Key Insights

The global Testing, Inspection, and Certification (TIC) market for the agriculture and food industry is poised for significant expansion. This growth is propelled by escalating consumer demand for safe, high-quality food, stringent regulatory frameworks for food safety and traceability, and the increasing integration of advanced technologies in agriculture. The market, valued at approximately $417.76 billion in the base year 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.6% through 2033. Key growth drivers include the imperative for rigorous testing due to foodborne illness prevalence, the expansion of global agricultural trade necessitating robust certification, and the adoption of precision agriculture technologies demanding accurate inspection. The market is segmented by service type (testing, inspection, certification) and sourcing (outsourced, in-house), with outsourcing being a prominent trend, especially for smaller enterprises. Geographically, North America and Europe currently lead, with the Asia-Pacific region showing rapid development. Challenges, including high testing costs, inconsistent regional protocols, and the need for continuous technological advancement, may temper growth.

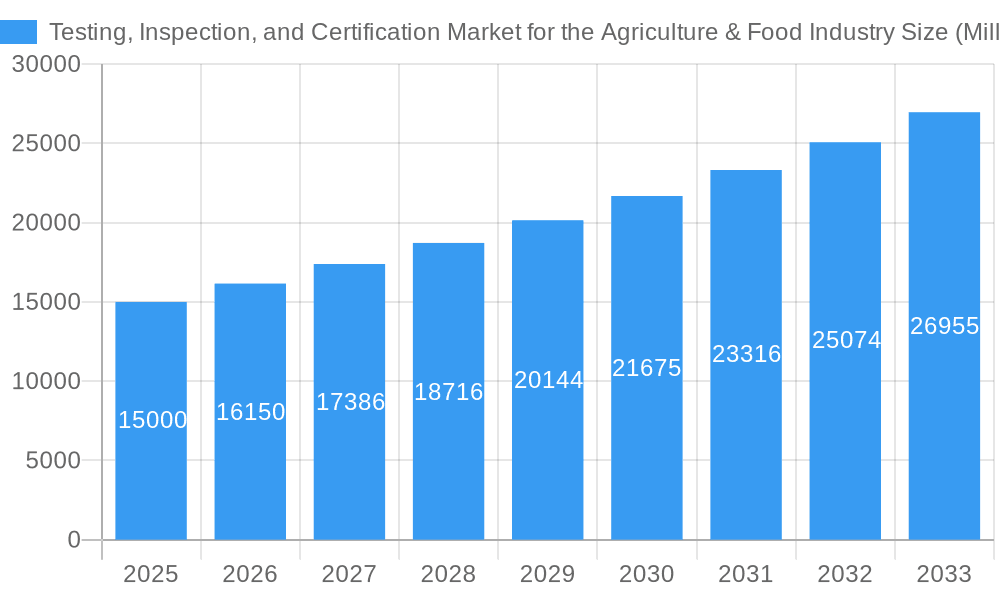

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market Size (In Billion)

Leading market participants, including Intertek Group Plc, SGS SA, and Bureau Veritas, are actively engaged in innovation and service expansion to meet industry demands. The competitive environment features both multinational corporations and specialized regional entities investing in R&D and strategic collaborations, mergers, and acquisitions to enhance capabilities and market reach. Emerging opportunities lie in blockchain for enhanced traceability and the development of rapid testing methodologies. Maintaining adherence to evolving international food safety standards remains a critical consideration. Future market trajectory will be influenced by ongoing technological innovation, dynamic regulatory environments, and evolving consumer preferences for supply chain transparency and sustainability.

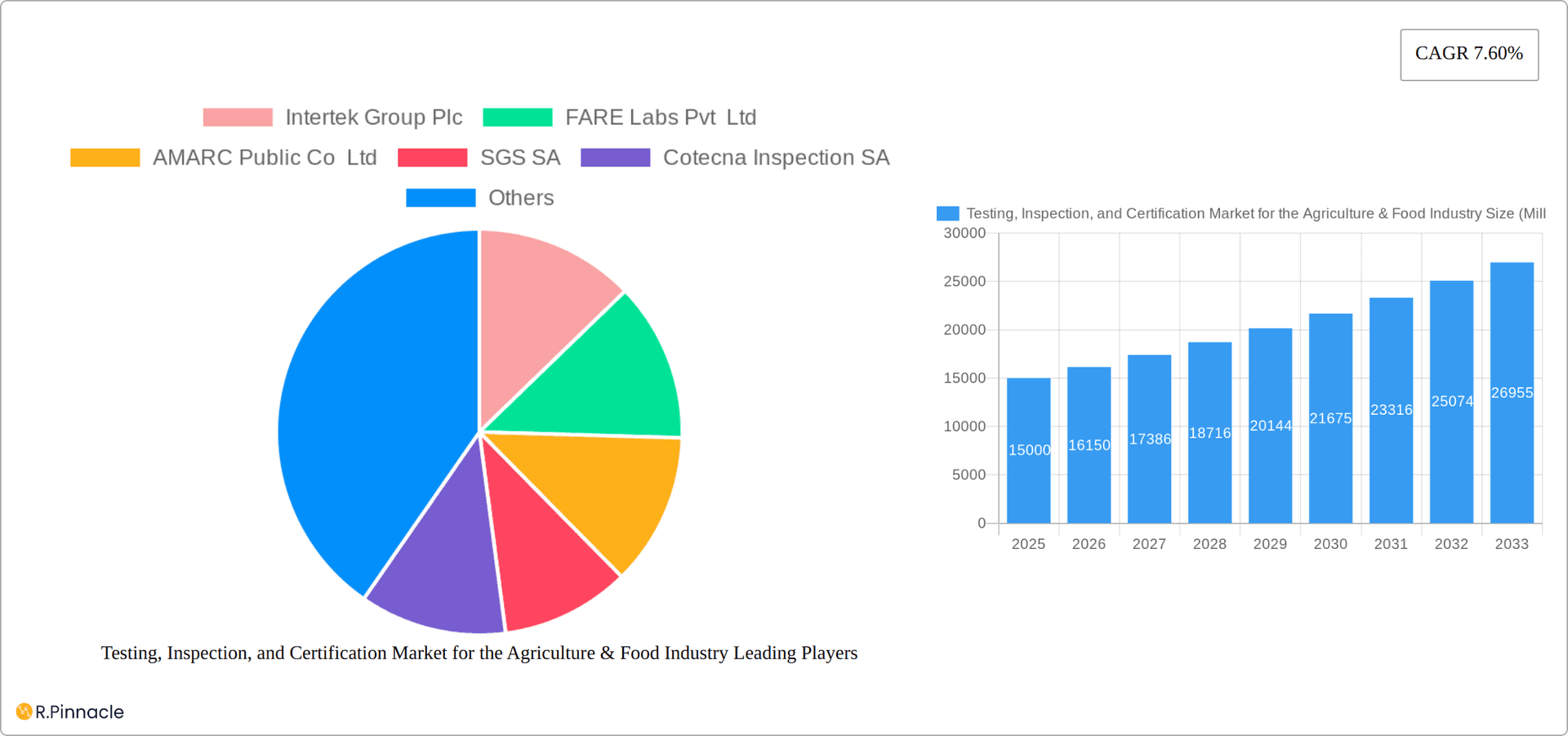

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Company Market Share

Testing, Inspection, and Certification Market for the Agriculture & Food Industry: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Testing, Inspection, and Certification (TIC) market within the agriculture and food industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This in-depth analysis leverages historical data from 2019-2024 to project future market trends and growth.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market Structure & Innovation Trends

The global Testing, Inspection, and Certification (TIC) market for the Agriculture & Food industry is characterized by a moderately consolidated structure, with a few prominent entities holding substantial market shares. Leading global players such as Intertek Group Plc, SGS SA, and Bureau Veritas collectively represent an estimated xx% of the market in 2025. Market share dynamics are in constant flux, influenced by strategic mergers and acquisitions (M&A) as well as organic expansion initiatives. While precise financial data for M&A transactions remains proprietary, recent deals have ranged from tens to hundreds of millions of dollars, underscoring the significant investment in consolidating services and broadening the scope of offerings within the sector.

Innovation is a critical driver in the TIC sector, propelled by several interconnected factors:

- Evolving Regulatory Landscape: The increasing stringency and global proliferation of regulations governing food safety, quality, and sustainability are compelling industry participants to invest in cutting-edge testing methodologies and advanced technological solutions. This necessitates continuous adaptation and the adoption of sophisticated analytical tools.

- Technological Integration: The seamless integration of automation, artificial intelligence (AI), and big data analytics is revolutionizing testing processes. These technologies are significantly enhancing accuracy, operational efficiency, and turnaround times. Emerging trends include the development of rapid pathogen detection systems and advanced data interpretation capabilities.

- Emergence of Novel Solutions: The development and adoption of alternative and disruptive testing methods and technologies are fostering a dynamic and competitive environment within the TIC sector. This includes innovations in molecular diagnostics, biosensors, and digital traceability solutions.

- Shifting Consumer Demands: A growing global appetite for safe, high-quality, and sustainably produced food products, particularly in emerging economies, is a significant catalyst for TIC market expansion. Consumers are increasingly discerning, demanding verifiable assurances of product integrity and ethical sourcing.

- Strategic M&A Activities: Significant merger and acquisition activities continue to reshape the market. These strategic moves enhance operational scale, expand service portfolios, and create more comprehensive solution offerings, allowing companies to cater to a wider range of client needs.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market Dynamics & Trends

The agriculture and food TIC market is experiencing robust growth, driven by a confluence of factors. Increasing consumer awareness of food safety and quality, stricter regulations, and the rising demand for sustainable agricultural practices are significantly impacting market expansion. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033).

Key growth drivers include:

- Stringent Food Safety Regulations: Governments worldwide are implementing stringent regulations to ensure food safety and quality, thereby increasing the demand for TIC services.

- Technological Disruptions: Advancements in technology such as rapid diagnostic tests and DNA sequencing are leading to more efficient and accurate testing solutions.

- Evolving Consumer Preferences: Consumers are increasingly demanding transparency and traceability in the food supply chain, pushing for more rigorous testing and certification.

- Competitive Dynamics: Increased competition among TIC providers is driving innovation and cost optimization, leading to better services for end-users.

- Market Penetration: The market penetration of TIC services is steadily increasing in developing economies as consumer awareness of food safety and quality grows.

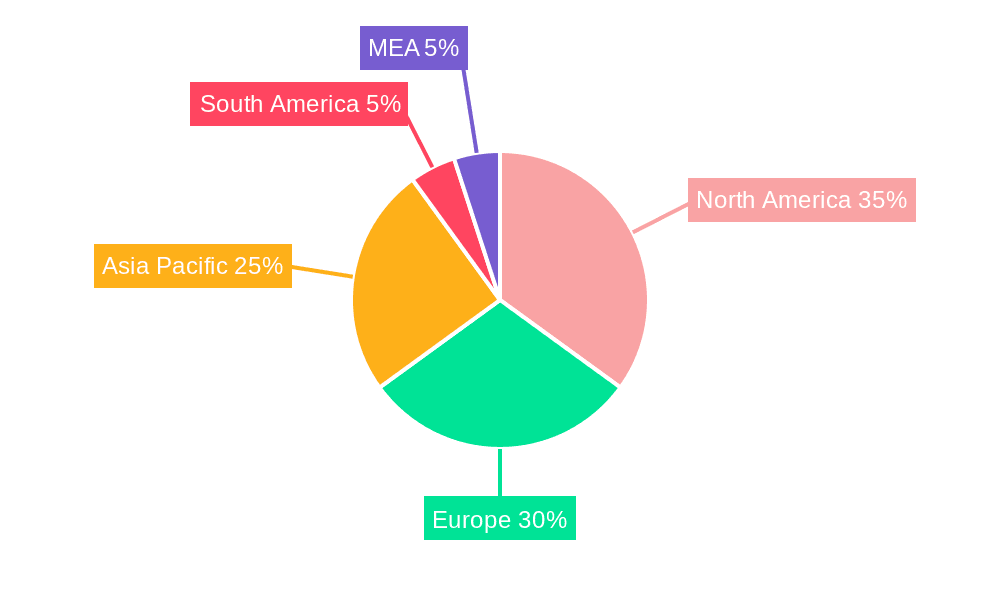

Dominant Regions & Segments in Testing, Inspection, and Certification Market for the Agriculture & Food Industry

- Leading Region: North America currently spearheads the market, driven by robust regulatory frameworks, advanced technological infrastructure, and a highly informed consumer base with elevated expectations for food safety. Europe and the Asia-Pacific region are also pivotal markets, exhibiting strong growth trajectories.

- Leading Segment (By Service Type): Testing and Inspection Services collectively command a larger market share compared to Certification Services. Within this, rapid pathogen testing represents a particularly high-growth sub-segment, reflecting the urgent need for swift and accurate detection of foodborne hazards.

- Leading Segment (By Sourcing Type): Outsourced testing and inspection services continue to dominate the market. This is largely attributable to the specialized expertise, advanced instrumentation, and comprehensive capabilities that external providers offer. However, there is a discernible trend of increasing in-house testing capabilities among larger corporations that aim for enhanced control over their production processes and quality assurance.

Key Drivers for Dominant Regions:

- North America: The region's market leadership is propelled by stringent and well-enforced food safety regulations, a consumer base that prioritizes safety and quality, and a strong foundation of technological innovation in analytical sciences.

- Europe: Europe's significant market contribution stems from its comprehensive and rigorous food safety standards, coupled with a mature and well-established ecosystem of TIC service providers.

- Asia-Pacific: Rapid economic expansion, rising disposable incomes, and evolving regulatory landscapes within the Asia-Pacific region are fueling substantial market growth. An increasing awareness of food safety concerns among consumers is also a key driver.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Product Innovations

Recent innovations encompass rapid diagnostic testing technologies, AI-powered data analytics for improved efficiency and accuracy, and the integration of blockchain technology for enhanced traceability and transparency within the food supply chain. These advancements are tailored to address the increasing demand for rapid, accurate, and reliable testing solutions, thus strengthening market competitiveness.

Report Scope & Segmentation Analysis

By Service Type:

- Testing and Inspection Services: This segment is the market's largest, with its growth trajectory projected to be significantly influenced by the escalating demand for efficient, accurate, and rapid food safety testing solutions. This includes physical, chemical, and microbiological analyses.

- Certification Services: This segment is experiencing steady growth as an increasing number of consumers actively seek out products bearing credible certifications. These certifications serve as verifiable assurances of adherence to specific quality, safety, and sustainability standards.

By Sourcing Type:

- Outsourced: This remains the dominant segment, driven by the inherent advantages of accessing specialized expertise, state-of-the-art technologies, and objective third-party validation. Continued growth is anticipated at a Compound Annual Growth Rate (CAGR) of xx%.

- In-House: While growth in in-house capabilities is moderate, it reflects a strategic investment by larger organizations to bolster their internal quality control and assurance mechanisms. Nevertheless, outsourcing is expected to retain its position as the more prevalent method for a majority of companies.

Key Drivers of Testing, Inspection, and Certification Market for the Agriculture & Food Industry Growth

The market's growth is significantly propelled by escalating consumer demand for food safety and quality, the implementation of stringent government regulations, advancements in testing technologies like rapid pathogen detection, and an increasing focus on sustainable agricultural practices. These factors collectively contribute to an expanding market and increased demand for testing, inspection, and certification services.

Challenges in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry Sector

The Testing, Inspection, and Certification sector for Agriculture & Food faces several hurdles. These include the inherently high costs associated with advanced testing methodologies, the persistent need for highly specialized technical expertise, and the dynamic nature of evolving food safety regulations that require continuous adaptation. Furthermore, disruptions within global supply chains can impact testing capacities, potentially leading to operational delays and increased expenses. The intensely competitive environment necessitates ongoing innovation, operational efficiency, and cost optimization to maintain a competitive edge.

Emerging Opportunities in Testing, Inspection, and Certification Market for the Agriculture & Food Industry

Emerging opportunities include the development of advanced testing technologies, such as rapid pathogen detection and DNA sequencing, coupled with the rising demand for traceability and transparency in food supply chains. Expansion into developing economies with rapidly growing food industries presents a significant opportunity for market growth.

Leading Players in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market

- Intertek Group Plc

- FARE Labs Pvt Ltd

- AMARC Public Co Ltd

- SGS SA

- Cotecna Inspection SA

- MISTRAS Group Inc

- AIM Control Inspection Group

- AsureQuality Limited

- Bureau Veritas

- Kiwa Ltd

- Applus+ Group

- TUV SUD

Key Developments in Testing, Inspection, and Certification Market for the Agriculture & Food Industry Industry

- March 2022: Bureau Veritas significantly bolstered its food safety testing capabilities in North America with the inauguration of its fifth Canadian Microbiology Laboratory. This strategic expansion directly addresses the escalating demand for rapid pathogen detection services, enhancing their capacity to serve a critical market need.

- January 2022: SGS announced a strategic partnership with Microsoft, aiming to leverage advanced data analytics and cloud solutions. This collaboration underscores the industry's commitment to embracing technological advancements to refine and elevate its TIC services, thereby improving efficiency and insight generation.

Future Outlook for Testing, Inspection, and Certification Market for the Agriculture & Food Industry Market

The future outlook for the agriculture and food TIC market remains highly promising, driven by continuous technological advancements, stricter regulations, and the rising consumer focus on food safety and sustainability. Strategic partnerships, acquisitions, and expansion into new markets will be key success factors in this growing sector. The market is poised for significant growth, driven by the factors highlighted throughout this report.

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. Sourcing Type

- 2.1. Outsourced

- 2.2. In-House

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East and Africa

Testing, Inspection, and Certification Market for the Agriculture & Food Industry Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market for the Agriculture & Food Industry

Testing, Inspection, and Certification Market for the Agriculture & Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Strict Regulations Imposed by the Government; Need for High Reliability and Compliance

- 3.3. Market Restrains

- 3.3.1. Lack of Common Global Standards and Industry Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Packaged Food to Drive the Demand for TIC Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.2.1. Outsourced

- 5.2.2. In-House

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.2.1. Outsourced

- 6.2.2. In-House

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.2.1. Outsourced

- 7.2.2. In-House

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.2.1. Outsourced

- 8.2.2. In-House

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.2.1. Outsourced

- 9.2.2. In-House

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 10.2.1. Outsourced

- 10.2.2. In-House

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FARE Labs Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMARC Public Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cotecna Inspection SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MISTRAS Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AIM Control Inspection Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AsureQuality Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kiwa Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Applus+ Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TUV SUD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 5: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 6: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 11: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 12: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 17: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 18: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 23: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 24: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 29: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 30: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 10: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 11: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 18: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 25: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 26: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Mexico Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 31: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 32: Global Testing, Inspection, and Certification Market for the Agriculture & Food Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

Key companies in the market include Intertek Group Plc, FARE Labs Pvt Ltd, AMARC Public Co Ltd, SGS SA, Cotecna Inspection SA, MISTRAS Group Inc , AIM Control Inspection Group, AsureQuality Limited, Bureau Veritas, Kiwa Ltd, Applus+ Group, TUV SUD.

3. What are the main segments of the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

The market segments include Service Type, Sourcing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Strict Regulations Imposed by the Government; Need for High Reliability and Compliance.

6. What are the notable trends driving market growth?

Increasing Consumption of Packaged Food to Drive the Demand for TIC Services.

7. Are there any restraints impacting market growth?

Lack of Common Global Standards and Industry Regulations.

8. Can you provide examples of recent developments in the market?

March 2022 - Bureau Veritas, a leading TIC service provider, opened its fifth Canadian Microbiology Laboratory in Winnipeg, Manitoba. The new laboratory will offer Rapid Pathogen testing (E.coli O157:H7, Salmonella & Listeria) and Indicators (Generic E.coli/Coliforms, Total Plate Count, Yeast & Mold). Expanding the company's food testing and certification business in Canada further enhanced its food safety and quality laboratory testing capabilities across the North American region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market for the Agriculture & Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market for the Agriculture & Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence