Key Insights

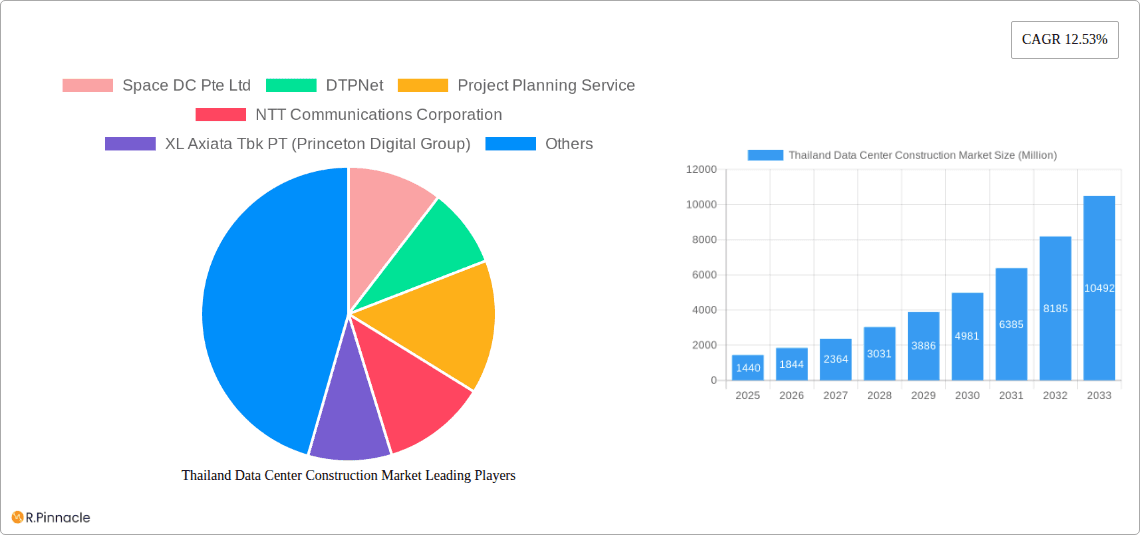

The Thailand Data Center Construction Market is poised for substantial growth, projected to reach 1.44 billion by 2025, driven by a remarkable CAGR of 27.78% through 2033. This robust expansion is fueled by a confluence of factors, including the escalating demand for digital services across various sectors such as IT and Telecommunications, Banking, Financial Services, and Insurance (BFSI), and Government. The rapid adoption of cloud computing, the proliferation of data-intensive applications like AI and IoT, and the increasing need for robust data storage and processing capabilities are primary accelerators. Furthermore, government initiatives aimed at digital transformation and fostering technological innovation are creating a fertile ground for data center development. The market segmentation reveals a strong emphasis on electrical infrastructure, with Power Distribution Solutions (PDU, transfer switches, switchgear) and Power Backup Solutions (UPS, generators) being critical components. Mechanical infrastructure, particularly advanced cooling systems like immersion and direct-to-chip cooling, is also gaining prominence to support higher power densities.

Thailand Data Center Construction Market Market Size (In Billion)

The market landscape is characterized by significant investments in Tier 3 and Tier 4 facilities, catering to enterprises with high availability and resilience requirements. The IT and Telecommunications sector is expected to be the largest end-user, followed by BFSI and Government entities, each demanding sophisticated and secure data center solutions. While the market presents immense opportunities, challenges such as rising construction costs, skilled labor shortages, and the need for sustainable and energy-efficient designs will need to be navigated. Leading players are actively involved in strategic partnerships, mergers, and acquisitions to expand their footprint and service offerings within the Thai market. The focus on service components within the construction process, from planning to maintenance, is also a growing trend, highlighting the holistic approach to data center development.

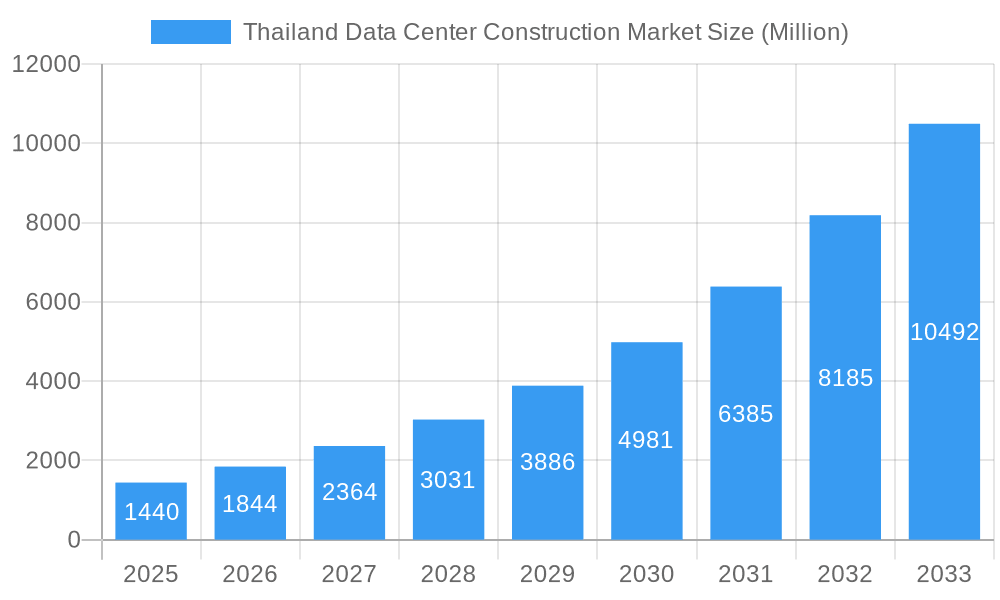

Thailand Data Center Construction Market Company Market Share

Gain unparalleled insights into the burgeoning Thailand Data Center Construction Market with this comprehensive report. Explore market dynamics, segmentation, innovation trends, and future outlook, essential for strategizing and capitalizing on opportunities. Our analysis covers the period from 2019 to 2033, with a deep dive into the base year 2025 and the forecast period 2025-2033, building upon historical data from 2019-2024. Discover actionable intelligence for stakeholders, including key players, investors, and infrastructure providers.

Thailand Data Center Construction Market Market Structure & Innovation Trends

The Thailand data center construction market exhibits a moderate to high level of concentration, with a mix of established global players and emerging local developers. Innovation is largely driven by the increasing demand for hyperscale facilities, the adoption of energy-efficient technologies, and the need for robust security infrastructure. Regulatory frameworks are evolving to support digital transformation initiatives, encouraging foreign investment while ensuring compliance with data localization and environmental standards. Key innovation drivers include advancements in cooling systems, power distribution solutions, and the integration of AI for operational efficiency. Product substitutes are limited, with advancements in modular construction and pre-fabricated components offering alternative approaches to traditional build-outs. End-user demographics are increasingly dominated by IT & Telecommunications, Banking, Financial Services, and Insurance sectors, seeking to leverage cloud computing and advanced analytics. Mergers and acquisitions (M&A) activities are a significant aspect of market structure, facilitating market consolidation and the expansion of capabilities. Notable M&A deal values in the broader Southeast Asian region, influencing Thailand's landscape, are estimated to be in the billions.

- Market Share Dynamics: Major players are vying for significant market share through strategic expansions and new builds.

- M&A Trends: Consolidation through acquisitions is expected to increase as companies seek to scale operations and acquire advanced technologies.

- Innovation Hubs: Bangkok and its surrounding regions are emerging as key innovation hubs for data center development.

- Regulatory Landscape: Government initiatives promoting digital economy growth are creating a favorable environment for construction.

Thailand Data Center Construction Market Market Dynamics & Trends

The Thailand data center construction market is experiencing robust growth, fueled by a confluence of escalating digital transformation initiatives, the burgeoning adoption of cloud services, and the increasing volume of data generated by businesses and consumers. The Thai government's Thailand 4.0 economic strategy actively promotes the development of digital infrastructure, providing a significant impetus for data center expansion. This proactive policy environment, coupled with substantial foreign direct investment, is driving the demand for advanced, high-capacity data center facilities. Technological disruptions, such as the widespread adoption of 5G networks, the expansion of Internet of Things (IoT) deployments, and the growing reliance on Artificial Intelligence (AI) and Machine Learning (ML) applications, are creating a persistent need for more localized and sophisticated data processing and storage capabilities. Consumer preferences are shifting towards seamless digital experiences, demanding lower latency and higher reliability, which directly translates into a need for geographically distributed and efficiently constructed data centers. Competitive dynamics are intensifying, with both international hyperscale operators and local enterprises investing heavily in building new facilities and expanding existing ones. The market penetration of advanced data center solutions is rapidly increasing, with a notable trend towards Tier 3 and Tier 4 certified facilities designed to meet stringent uptime and performance requirements. The projected Compound Annual Growth Rate (CAGR) for the market is robust, estimated to be in the high single digits to low double digits over the forecast period. This growth is intrinsically linked to the increasing digital dependency across all sectors, from BFSI and IT to healthcare and government.

Dominant Regions & Segments in Thailand Data Center Construction Market

The dominant regions in the Thailand Data Center Construction Market are primarily concentrated around Bangkok and its adjacent industrial and economic zones, benefiting from established infrastructure, access to skilled labor, and proximity to major business hubs. The IT and Telecommunications segment stands out as the leading end-user, driven by the insatiable demand for cloud computing, mobile data services, and digital transformation initiatives from telecommunication providers and IT service companies.

Key drivers for this dominance include:

- Economic Policies: Government initiatives like Thailand 4.0 and digital economy promotion policies directly encourage investment in IT infrastructure, including data centers.

- Infrastructure Development: Proximity to reliable power grids, high-speed network connectivity (fiber optic networks), and transportation links is crucial, making established economic zones highly attractive.

- Digitalization Push: The rapid adoption of digital services across all sectors necessitates the expansion of data storage and processing capabilities.

Within the infrastructure segments, Electrical Infrastructure, particularly Power Distribution Solution encompassing PDU - Basic & Smart - Metered & Switched solutions, Transfer Switches (Static, Automatic (ATS)), and Switchgear (Low-Voltage, Medium-Voltage), plays a pivotal role. The reliability and efficiency of power delivery are paramount for data center operations, driving significant investment in these components. Following closely is Mechanical Infrastructure, with Cooling Systems such as In-Row and In-Rack Cooling being critical for managing the heat generated by high-density computing. The General Construction segment also represents a substantial portion of the market, involving the planning, design, and physical build-out of these complex facilities.

- Tier Type Dominance: While Tier 2 and Tier 3 data centers are prevalent, there is a growing demand for Tier 4 facilities driven by the stringent uptime requirements of financial institutions and large enterprises.

- BFSI Sector Growth: The Banking, Financial Services, and Insurance sector is a significant and growing end-user, requiring high levels of security and availability, contributing to the demand for advanced data center designs.

- Healthcare's Digital Transformation: The healthcare sector is increasingly investing in digital health records and telemedicine, boosting demand for secure and reliable data center solutions.

- Government and Defense: These sectors have specific needs for secure and resilient data storage, often requiring highly customized and compliant data center constructions.

Thailand Data Center Construction Market Product Innovations

Product innovations in the Thailand data center construction market are focused on enhancing efficiency, sustainability, and performance. Advancements in Cooling Systems, such as the increasing adoption of Immersion Cooling and Direct-To-Chip Cooling technologies, are enabling higher compute densities while significantly reducing energy consumption compared to traditional air-cooling methods. In the Electrical Infrastructure domain, smart PDUs with advanced metering and remote management capabilities are gaining traction, offering greater control and visibility over power distribution. The development of more efficient UPS (Uninterruptible Power Supply) and generator systems ensures higher reliability and reduced environmental impact. These innovations provide data center operators with competitive advantages through reduced operational costs, improved uptime, and enhanced sustainability credentials. The market is witnessing a growing demand for modular and pre-fabricated data center solutions that can be deployed faster and more cost-effectively.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Thailand Data Center Construction Market across its key segments, providing comprehensive insights into market size, growth projections, and competitive dynamics. The analysis encompasses Infrastructure, broken down into Electrical Infrastructure and Mechanical Infrastructure.

Within Electrical Infrastructure, detailed segmentation includes:

- Power Distribution Solution: Covering PDU - Basic & Smart - Metered & Switched solutions, Transfer Switches (Static, Automatic (ATS)), Switchgear (Low-Voltage, Medium-Voltage), Power Panels and Components, and Other Power Distribution Solutions.

- Power Backup Solutions: Including UPS and Generators.

- Service offerings related to electrical infrastructure.

Mechanical Infrastructure is segmented into:

- Cooling Systems: Featuring Immersion Cooling, Direct-To-Chip Cooling, Rear Door Heat Exchanger, In-Row and In-Rack Cooling.

- Racks.

- Other Mechanical Infrastructure.

The market is further segmented by General Construction, encompassing the overall building and site development. Tier Type segmentation includes Tier 2 and 2, Tier 3, and Tier 4 facilities, each catering to different reliability and availability needs. The End User segmentation covers Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, and Other End Users. Growth projections for these segments are driven by the increasing demand for digital services and the continuous need for reliable and scalable data storage and processing infrastructure.

Key Drivers of Thailand Data Center Construction Market Growth

The Thailand Data Center Construction Market is propelled by a robust set of drivers, fundamentally linked to the nation's digital transformation agenda and its strategic economic policies.

- Government Initiatives: Thailand 4.0 and the National Digital Economy and Society Development Plan are creating a fertile ground for investment in advanced digital infrastructure, including data centers.

- Increasing Cloud Adoption: Businesses across all sectors are migrating to cloud-based solutions, demanding more localized and scalable data center capacity.

- Explosion of Data: The proliferation of IoT devices, big data analytics, and digital content consumption is generating an unprecedented volume of data requiring robust storage and processing.

- Foreign Direct Investment (FDI): Favorable investment policies and economic stability are attracting significant FDI from global technology companies and infrastructure investors.

- Technological Advancements: The rollout of 5G networks and the growing demand for edge computing are spurring the development of new data center facilities.

Challenges in the Thailand Data Center Construction Market Sector

Despite the strong growth trajectory, the Thailand data center construction market faces several challenges that can impede its full potential.

- High Upfront Capital Investment: The substantial financial outlay required for land acquisition, construction, and advanced technological integration presents a significant barrier for some investors.

- Skilled Labor Shortage: A lack of specialized engineers and technicians for data center design, construction, and ongoing operation can lead to project delays and increased costs.

- Regulatory Hurdles and Permitting: Navigating complex local regulations, obtaining necessary permits, and adhering to evolving environmental standards can be time-consuming and bureaucratic.

- Power Supply Reliability and Cost: Ensuring a consistent and affordable supply of electricity, especially for high-density facilities, remains a critical concern.

- Supply Chain Disruptions: Global supply chain issues for critical components like specialized cooling equipment and networking hardware can impact project timelines and costs.

Emerging Opportunities in Thailand Data Center Construction Market

The Thailand data center construction market is ripe with emerging opportunities for growth and innovation.

- Edge Data Centers: The expansion of 5G and IoT applications is creating a demand for smaller, distributed edge data centers closer to end-users, reducing latency and improving performance.

- Green Data Centers: Increasing global focus on sustainability is driving demand for eco-friendly data centers utilizing renewable energy sources, efficient cooling technologies, and waste heat recovery systems.

- Hyperscale Facility Expansion: Major cloud providers are increasingly looking to establish or expand their presence in Thailand, fueling the need for large-scale hyperscale data center developments.

- Colocation Services Growth: As businesses outsource their IT infrastructure, the demand for colocation facilities offering shared space, power, and cooling is expected to rise.

- Data Sovereignty and Localization: Evolving data privacy regulations may lead to increased demand for on-shore data center facilities to comply with data localization requirements.

Leading Players in the Thailand Data Center Construction Market Market

- Space DC Pte Ltd

- DTPNet

- Project Planning Service

- NTT Communications Corporation

- XL Axiata Tbk PT (Princeton Digital Group)

- Equinix Inc

- Telkomsigma

- GTN Data Center

- TAKNET Systems (Thailand ) Co Ltd

- Arup Group

- Lintasarta

- PT DCI Indonesia (DCI)

- Biznet Networks

- JupiterDC

- PT Faasri Utama Sakti

- Gulf Energy Development Public Company Limited

- Delta Electronics (Thailand)

- Indosat Tbk PT

Key Developments in Thailand Data Center Construction Market Industry

- February 2023: Singapore Telecom Limited (Singtel), Gulf Energy Development PLC (Gulf), and Advanced Info Services PLC (AIS) established a joint venture to build a 20 MW capacity data center in Thailand by 2025. This facility will be operated by GSA Data Center Company Limited (GSA), aiming to meet the large-scale data center requirements of cloud players in the country.

Future Outlook for Thailand Data Center Construction Market Market

The future outlook for the Thailand data center construction market is exceptionally bright, poised for sustained and robust growth. The ongoing digital transformation, coupled with increasing adoption of advanced technologies like AI and IoT, will continue to drive demand for sophisticated and scalable data center infrastructure. Government support for the digital economy and attractive investment incentives are expected to draw further domestic and international investment, leading to the construction of new facilities and the expansion of existing ones. The market's trajectory will also be shaped by the increasing emphasis on sustainability, pushing for the development of greener and more energy-efficient data centers. Strategic opportunities lie in catering to the burgeoning demand for hyperscale facilities, edge computing solutions, and secure colocation services. Collaboration between technology providers, construction firms, and energy utilities will be crucial to overcome challenges and capitalize on the immense potential of this dynamic market. The market is projected to witness significant investment in advanced cooling technologies and robust power backup solutions to ensure high availability and operational resilience.

Thailand Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Distribution Solutions

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Distribution Solutions

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 2 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 2 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Thailand Data Center Construction Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Construction Market Regional Market Share

Geographic Coverage of Thailand Data Center Construction Market

Thailand Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 9.1 Migration to Cloud by large businesses9.2 Established 'Mobile-First' Landscape Since the Recent Past

- 3.3. Market Restrains

- 3.3.1. 10.1 Shortage of Skilled Professionals Presenting a Challenge for Several Contractors

- 3.4. Market Trends

- 3.4.1. Tier 3 is the Largest Tier Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Distribution Solutions

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Distribution Solutions

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 2 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 2 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space DC Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DTPNet

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Project Planning Service

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NTT Communications Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XL Axiata Tbk PT (Princeton Digital Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Equinix Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telkomsigma

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GTN Data Center

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TAKNET Systems (Thailand ) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arup Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lintasarta

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT DCI Indonesia (DCI)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Biznet Networks

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JupiterDC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PT Faasri Utama Sakti

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Gulf Energy Development Public Company Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Delta Electronics (Thailand)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Indosat Tbk PT

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Space DC Pte Ltd

List of Figures

- Figure 1: Thailand Data Center Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 2: Thailand Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 3: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 4: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 5: Thailand Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Thailand Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 7: Thailand Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 8: Thailand Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 9: Thailand Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 10: Thailand Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 11: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 12: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 2 and 2 2020 & 2033

- Table 13: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 3 2020 & 2033

- Table 14: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 4 2020 & 2033

- Table 15: Thailand Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Thailand Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 17: Thailand Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 18: Thailand Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 19: Thailand Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 20: Thailand Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 21: Thailand Data Center Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 22: Thailand Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 23: Thailand Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 24: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 25: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 26: Thailand Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 27: Thailand Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 28: Thailand Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 29: Thailand Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 30: Thailand Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 31: Thailand Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 32: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 33: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 2 and 2 2020 & 2033

- Table 34: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 3 2020 & 2033

- Table 35: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 4 2020 & 2033

- Table 36: Thailand Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 37: Thailand Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 38: Thailand Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 39: Thailand Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 40: Thailand Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 41: Thailand Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 42: Thailand Data Center Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Construction Market?

The projected CAGR is approximately 27.78%.

2. Which companies are prominent players in the Thailand Data Center Construction Market?

Key companies in the market include Space DC Pte Ltd, DTPNet, Project Planning Service, NTT Communications Corporation, XL Axiata Tbk PT (Princeton Digital Group), Equinix Inc, Telkomsigma, GTN Data Center, TAKNET Systems (Thailand ) Co Ltd, Arup Group, Lintasarta, PT DCI Indonesia (DCI), Biznet Networks, JupiterDC, PT Faasri Utama Sakti, Gulf Energy Development Public Company Limited, Delta Electronics (Thailand), Indosat Tbk PT.

3. What are the main segments of the Thailand Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 2 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

9.1 Migration to Cloud by large businesses9.2 Established 'Mobile-First' Landscape Since the Recent Past.

6. What are the notable trends driving market growth?

Tier 3 is the Largest Tier Type.

7. Are there any restraints impacting market growth?

10.1 Shortage of Skilled Professionals Presenting a Challenge for Several Contractors.

8. Can you provide examples of recent developments in the market?

February 2023:Singapore Telecom Limited (Singtel), Gulf Energy Development PLC (Gulf), and Advanced Info Services PLC (AIS), established a joint venture to build a 20 MW capacity data center in Thailand by 2025. This facility will be operated by GSA Data Center Company Limited (GSA). The company aims to match the large-scale data center requirements of cloud players in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence