Key Insights

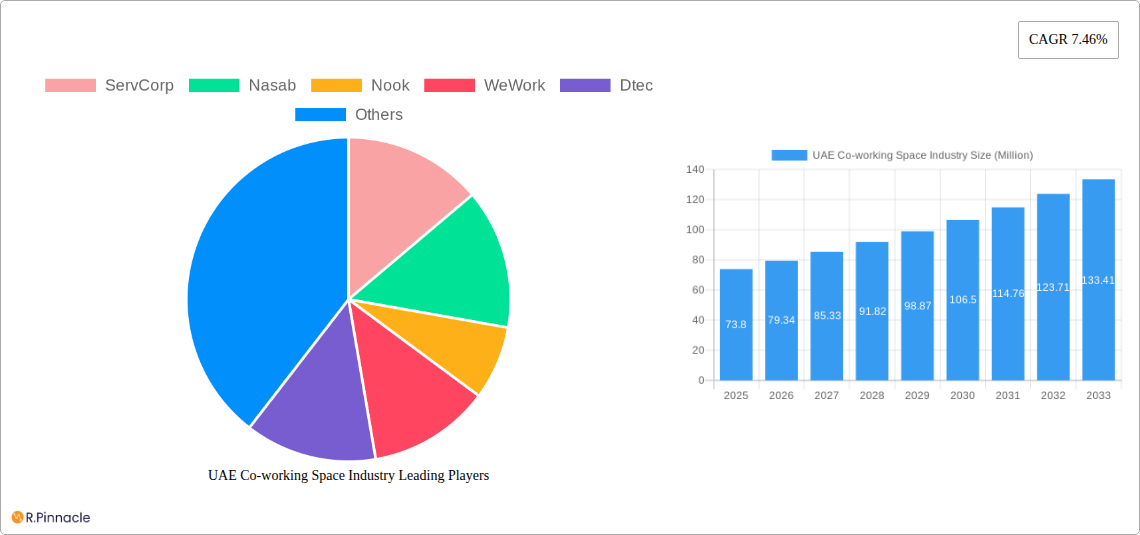

The UAE co-working space industry, valued at $73.80 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.46% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing number of startups and small to medium-sized enterprises (SMEs) in the UAE seeking flexible and cost-effective workspace solutions is a significant factor. Furthermore, the nation's burgeoning technology sector, particularly in IT and ITES, and the growth of the BFSI (Banking, Financial Services, and Insurance) industry, are creating a high demand for co-working spaces. The preference for collaborative work environments and the need for agile workspaces among large corporations are also contributing to this growth. Expansion of existing co-working chains and entry of new players are further stimulating market competition and enhancing service offerings. While the industry faces potential restraints such as fluctuating real estate prices and competition from traditional office spaces, the overall positive economic outlook of the UAE and the growing adoption of flexible work models suggest a promising future for the co-working sector.

The competitive landscape is characterized by a mix of international players like Regus and WeWork, alongside local operators like AstroLabs and LetsWork. This diverse range of providers caters to a variety of needs and budgets. Segmentation analysis reveals significant opportunities within the IT and ITES application segment, driven by the rapid digital transformation in the UAE. Similarly, the expanding BFSI sector promises considerable growth potential for co-working spaces tailored to their specific requirements. While SMEs currently constitute a large portion of the user base, large-scale corporations are increasingly adopting co-working spaces for specific teams or projects, contributing to the overall market expansion. The future trajectory suggests that continued innovation in space design, amenities, and service offerings will be crucial for companies to maintain a competitive edge in this dynamic market.

UAE Co-working Space Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UAE co-working space industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, and future opportunities within this rapidly evolving sector. Expect detailed segmentation analysis, competitive landscaping, and key player profiles. The report leverages extensive data analysis to forecast market size and growth trends, providing actionable intelligence for informed business strategies.

UAE Co-working Space Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UAE co-working space market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The historical period (2019-2024) and the forecast period (2025-2033) are analyzed to understand the evolution of the market.

Market Concentration: The UAE co-working space market exhibits a moderately concentrated structure with key players such as WeWork, Regus, Servcorp, and others holding significant market share. However, the presence of numerous smaller players and new entrants indicates a dynamic competitive environment. We estimate the top 5 players hold approximately xx% of the market share in 2025.

Innovation Drivers: Technological advancements (e.g., smart building technologies, flexible workspace solutions) and changing workplace preferences are driving innovation. The adoption of sustainable practices and flexible lease terms are also significant drivers.

Regulatory Framework: The UAE's supportive regulatory environment, including streamlined business setup procedures and flexible visa policies, fosters industry growth. Specific regulations concerning building codes, safety, and licensing are also considered.

Product Substitutes: Traditional office spaces and virtual offices remain substitutes, but the increasing demand for flexible and collaborative work environments positions co-working spaces favorably.

End-User Demographics: The market caters primarily to SMEs and large corporations, with a growing segment of freelancers and entrepreneurs. The report analyzes demographic shifts and their influence on demand.

M&A Activities: The UAE has witnessed several significant M&A activities in the co-working space sector in recent years, with deal values totaling approximately $xx Million in the historical period (2019-2024). Future M&A activity is expected to consolidate the market further.

UAE Co-working Space Industry Market Dynamics & Trends

This section explores the key market dynamics influencing the growth and trajectory of the UAE co-working space industry. The Compound Annual Growth Rate (CAGR) and market penetration are analyzed for the forecast period (2025-2033).

The UAE co-working space market is experiencing robust growth driven by factors such as a burgeoning entrepreneurial ecosystem, the increasing adoption of flexible work models, and the government's focus on economic diversification. Technological disruptions, such as the integration of smart building technologies and virtual reality solutions, are reshaping the industry. Consumer preferences are shifting towards spaces that offer a blend of functionality, community, and sustainability. The competitive landscape remains dynamic, with existing players expanding their footprint and new entrants entering the market. The market penetration rate is projected to increase from xx% in 2025 to xx% by 2033, driven by increasing adoption across various industry segments. The CAGR for the forecast period is estimated at xx%.

Dominant Regions & Segments in UAE Co-working Space Industry

This section identifies the dominant regions and segments within the UAE co-working space industry, considering business type (new spaces, expansions, chains), application (IT & ITES, legal, BFSI, consulting, other services), and end-user (SMEs, large corporations).

Dominant Regions: Dubai and Abu Dhabi are the leading regions, owing to their robust economies, established infrastructure, and high concentration of businesses.

- Key Drivers:

- Dubai: Strong economic growth, favorable business environment, and a large expat population.

- Abu Dhabi: Government initiatives promoting diversification, strategic investments in infrastructure, and growing business activity.

Dominant Segments:

By Business Type: Chains dominate the market due to their established brand recognition, economies of scale, and wider network. Expansions by existing players also contribute significantly to market growth.

By Application: The IT & ITES sector is the largest consumer of co-working spaces, driven by the increasing number of tech startups and the demand for flexible work arrangements.

By End-User: SMEs form the largest end-user segment, drawn to the cost-effectiveness and flexibility offered by co-working spaces. However, large-scale corporations are also increasingly adopting co-working solutions for specific teams or projects.

UAE Co-working Space Industry Product Innovations

The UAE co-working space market is witnessing significant product innovations, driven by technological advancements and evolving customer needs. Smart building technologies, including integrated IoT systems, are enhancing operational efficiency and user experience. Flexible workspace configurations, tailored to diverse business needs, are gaining popularity. The integration of virtual and augmented reality is also emerging as a key area of innovation, promising enhanced collaboration and productivity. These innovations cater to the demand for seamless connectivity, personalized work environments, and sustainable practices.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the UAE co-working space market, segmented by business type (New Spaces, Expansions, Chains), application (IT and ITES, Legal Services, BFSI, Consulting, Other Services), and end-user (SMEs, Large-scale Corporations). Each segment's growth projection, market size (in Millions of USD), and competitive dynamics are analyzed for both the historical and forecast periods. For example, the IT and ITES segment is projected to experience significant growth, driven by the thriving tech industry and the increasing demand for flexible workspaces. Similarly, the SME segment is expected to remain a dominant end-user category, while large corporations are adopting co-working solutions for specific projects or teams.

Key Drivers of UAE Co-working Space Industry Growth

The growth of the UAE co-working space industry is propelled by several key factors. The government's initiatives to diversify the economy and attract foreign investment create a favorable business environment. Technological advancements, such as smart building technology and enhanced connectivity, enhance productivity and user experience. The increasing preference for flexible work arrangements among businesses of all sizes and the rising number of freelancers and entrepreneurs are further boosting demand.

Challenges in the UAE Co-working Space Industry Sector

Despite strong growth potential, the UAE co-working space industry faces challenges. High real estate costs and intense competition can impact profitability. Maintaining a balance between affordability and providing premium services is crucial. The industry also faces challenges related to attracting and retaining top talent within a competitive job market. These factors can influence the overall growth trajectory of the sector.

Emerging Opportunities in UAE Co-working Space Industry

The UAE co-working space market presents several promising opportunities. The expansion into underserved regions and niche sectors holds potential. Focusing on sustainability and incorporating green building practices can attract environmentally conscious businesses. The incorporation of advanced technologies, such as AI-powered solutions for workspace management, presents significant growth potential.

Leading Players in the UAE Co-working Space Industry Market

Key Developments in UAE Co-working Space Industry

- 2022 Q3: WeWork expands its presence in Dubai with a new location in Business Bay.

- 2023 Q1: Regus launches a new flexible workspace concept focusing on sustainability.

- 2024 Q2: A major M&A deal involving two prominent co-working space providers is announced. (Further details need to be added based on available data)

Future Outlook for UAE Co-working Space Industry Market

The UAE co-working space industry is poised for sustained growth, driven by continued economic expansion, technological advancements, and a growing preference for flexible work arrangements. Strategic partnerships, expansion into new markets, and the adoption of innovative technologies will shape the future landscape. The market's potential is significant, particularly in emerging sectors and regions. The industry’s long-term outlook remains optimistic with ongoing efforts to create a more dynamic and supportive business ecosystem.

UAE Co-working Space Industry Segmentation

-

1. Business Type

- 1.1. New Spaces

- 1.2. Expansions

- 1.3. Chains

-

2. Application

- 2.1. Information Technology (IT and ITES)

- 2.2. Legal Services

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Services

-

3. End User

- 3.1. Small to Medium-sized Enterprises (SMEs)

- 3.2. Large-scale Corporations

-

4. Geography

- 4.1. Dubai

- 4.2. Abu Dhabi

- 4.3. Sharjah

- 4.4. Other Cities

UAE Co-working Space Industry Segmentation By Geography

- 1. Dubai

- 2. Abu Dhabi

- 3. Sharjah

- 4. Other Cities

UAE Co-working Space Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Remote and Hybrid Work Model

- 3.3. Market Restrains

- 3.3.1. Lack of Privacy

- 3.4. Market Trends

- 3.4.1. Increase in the Millennial Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UAE Co-working Space Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business Type

- 5.1.1. New Spaces

- 5.1.2. Expansions

- 5.1.3. Chains

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Legal Services

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Small to Medium-sized Enterprises (SMEs)

- 5.3.2. Large-scale Corporations

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Dubai

- 5.4.2. Abu Dhabi

- 5.4.3. Sharjah

- 5.4.4. Other Cities

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Dubai

- 5.5.2. Abu Dhabi

- 5.5.3. Sharjah

- 5.5.4. Other Cities

- 5.1. Market Analysis, Insights and Forecast - by Business Type

- 6. Dubai UAE Co-working Space Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Business Type

- 6.1.1. New Spaces

- 6.1.2. Expansions

- 6.1.3. Chains

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. Legal Services

- 6.2.3. BFSI (Banking, Financial Services, and Insurance)

- 6.2.4. Consulting

- 6.2.5. Other Services

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Small to Medium-sized Enterprises (SMEs)

- 6.3.2. Large-scale Corporations

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Dubai

- 6.4.2. Abu Dhabi

- 6.4.3. Sharjah

- 6.4.4. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Business Type

- 7. Abu Dhabi UAE Co-working Space Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Business Type

- 7.1.1. New Spaces

- 7.1.2. Expansions

- 7.1.3. Chains

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. Legal Services

- 7.2.3. BFSI (Banking, Financial Services, and Insurance)

- 7.2.4. Consulting

- 7.2.5. Other Services

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Small to Medium-sized Enterprises (SMEs)

- 7.3.2. Large-scale Corporations

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Dubai

- 7.4.2. Abu Dhabi

- 7.4.3. Sharjah

- 7.4.4. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Business Type

- 8. Sharjah UAE Co-working Space Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Business Type

- 8.1.1. New Spaces

- 8.1.2. Expansions

- 8.1.3. Chains

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. Legal Services

- 8.2.3. BFSI (Banking, Financial Services, and Insurance)

- 8.2.4. Consulting

- 8.2.5. Other Services

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Small to Medium-sized Enterprises (SMEs)

- 8.3.2. Large-scale Corporations

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Dubai

- 8.4.2. Abu Dhabi

- 8.4.3. Sharjah

- 8.4.4. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Business Type

- 9. Other Cities UAE Co-working Space Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Business Type

- 9.1.1. New Spaces

- 9.1.2. Expansions

- 9.1.3. Chains

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Information Technology (IT and ITES)

- 9.2.2. Legal Services

- 9.2.3. BFSI (Banking, Financial Services, and Insurance)

- 9.2.4. Consulting

- 9.2.5. Other Services

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Small to Medium-sized Enterprises (SMEs)

- 9.3.2. Large-scale Corporations

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Dubai

- 9.4.2. Abu Dhabi

- 9.4.3. Sharjah

- 9.4.4. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Business Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ServCorp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nasab

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nook

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 WeWork

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dtec

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GlassQube**List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AstroLabs

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Regus

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 WitWork

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LetsWork

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ServCorp

List of Figures

- Figure 1: UAE Co-working Space Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UAE Co-working Space Industry Share (%) by Company 2024

List of Tables

- Table 1: UAE Co-working Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UAE Co-working Space Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 3: UAE Co-working Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: UAE Co-working Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: UAE Co-working Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: UAE Co-working Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: UAE Co-working Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: UAE Co-working Space Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 9: UAE Co-working Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: UAE Co-working Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 11: UAE Co-working Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: UAE Co-working Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: UAE Co-working Space Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 14: UAE Co-working Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: UAE Co-working Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 16: UAE Co-working Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: UAE Co-working Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: UAE Co-working Space Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 19: UAE Co-working Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: UAE Co-working Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: UAE Co-working Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: UAE Co-working Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: UAE Co-working Space Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 24: UAE Co-working Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: UAE Co-working Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 26: UAE Co-working Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: UAE Co-working Space Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Co-working Space Industry?

The projected CAGR is approximately 7.46%.

2. Which companies are prominent players in the UAE Co-working Space Industry?

Key companies in the market include ServCorp, Nasab, Nook, WeWork, Dtec, GlassQube**List Not Exhaustive, AstroLabs, Regus, WitWork, LetsWork.

3. What are the main segments of the UAE Co-working Space Industry?

The market segments include Business Type, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Remote and Hybrid Work Model.

6. What are the notable trends driving market growth?

Increase in the Millennial Population.

7. Are there any restraints impacting market growth?

Lack of Privacy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Co-working Space Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Co-working Space Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Co-working Space Industry?

To stay informed about further developments, trends, and reports in the UAE Co-working Space Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence