Key Insights

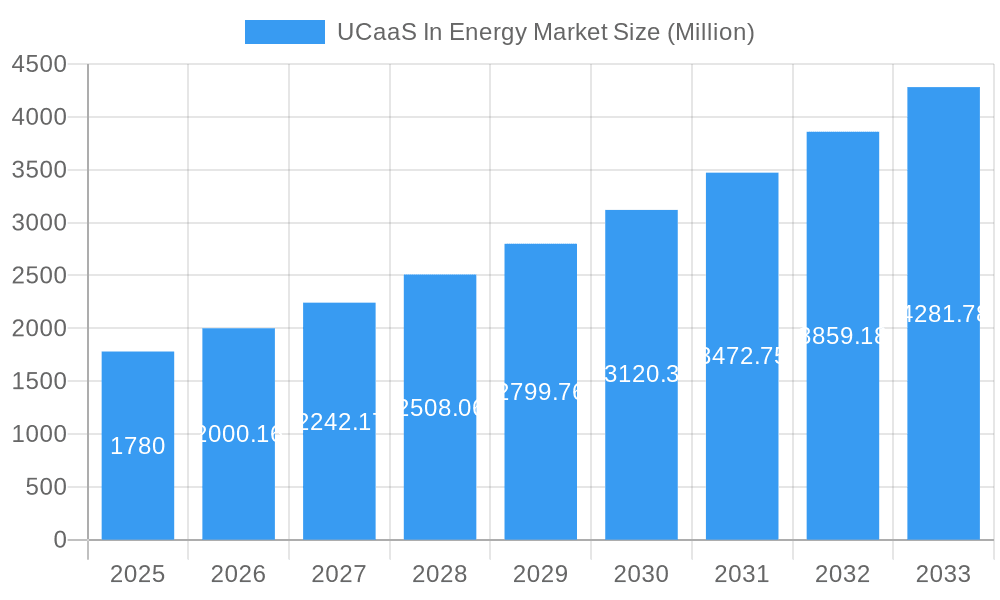

The Unified Communications as a Service (UCaaS) in the Energy market is poised for substantial growth, with a current estimated market size of $1.78 billion in 2025. This robust expansion is driven by a compelling Compound Annual Growth Rate (CAGR) of 12.08% projected throughout the forecast period of 2025-2033. The energy sector's increasing reliance on digital transformation, coupled with the need for enhanced operational efficiency and seamless collaboration, are key accelerators for UCaaS adoption. As energy companies navigate complex operations, from remote asset management to critical communication during emergencies, UCaaS solutions offer the agility and scalability required to meet these demands. The inherent need for secure, reliable, and integrated communication tools across geographically dispersed teams and diverse operational environments positions UCaaS as an indispensable technology for the modern energy landscape. Furthermore, the growing adoption of cloud-based infrastructure across the energy value chain underpins the migration towards flexible and cost-effective UCaaS offerings.

UCaaS In Energy Market Market Size (In Billion)

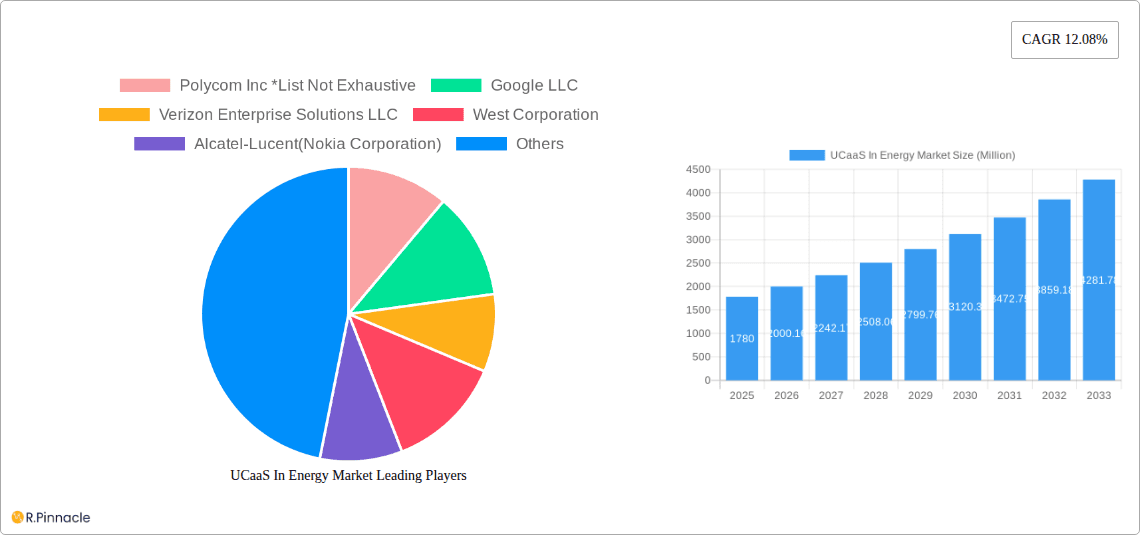

The market is segmented across various service categories, with Telephony, Collaboration, Unified Messaging, and Conferencing forming the core offerings, supplemented by Other Services. The deployment models are predominantly leaning towards Hybrid and Public cloud solutions, reflecting a strategic balance between control and flexibility, though Private cloud deployments also retain significance, particularly for sensitive operations. Large Enterprises are the primary adopters, driven by the complexity of their operations and the sheer scale of their communication needs, but Small and Medium Enterprises (SMEs) are increasingly recognizing the benefits of UCaaS for cost savings and enhanced productivity. Key industry players like Cisco Systems Inc., Microsoft Corporation, and Google LLC are actively innovating and competing, alongside specialized providers such as Polycom Inc. and Verizon Enterprise Solutions LLC, to capture market share. Geographical growth is expected to be significant across all regions, with North America and Europe currently leading adoption, while Asia and other emerging markets are anticipated to witness accelerated growth in the coming years due to their burgeoning energy sectors and increasing digital infrastructure investments.

UCaaS In Energy Market Company Market Share

Unleash Operational Efficiency: The Definitive UCaaS in Energy Market Report (2019-2033)

Gain a competitive edge with our in-depth analysis of the Unified Communications-as-a-Service (UCaaS) market tailored specifically for the dynamic energy sector. This comprehensive report, covering the historical period of 2019-2024 and a forecast period of 2025-2033, provides critical insights into market structure, dynamics, segmentation, and future growth opportunities. Discover how leading energy companies are leveraging UCaaS solutions to enhance collaboration, streamline operations, and drive digital transformation. Our analysis delves into key segments like Telephony, Collaboration, Unified Messaging, and Conferencing, across Public, Private, and Hybrid deployment models, and for Small & Medium Enterprises and Large Enterprises. With a base year of 2025 and an estimated year of 2025, this report is your essential guide to navigating the evolving UCaaS landscape in the energy industry, projecting a market size of xx Million by 2033.

UCaaS In Energy Market Market Structure & Innovation Trends

The UCaaS in Energy market exhibits a xx Million market size in the base year of 2025, with a projected growth trajectory that indicates an increasingly competitive yet consolidated landscape by 2033. Innovation drivers are primarily fueled by the energy sector's critical need for reliable, secure, and scalable communication solutions that can support remote operations, complex project management, and real-time data exchange. Regulatory frameworks, particularly those concerning data security and operational continuity, play a significant role in shaping deployment strategies and vendor choices.

- Market Concentration: While several key players dominate, there is room for specialized UCaaS providers to carve out niches within the energy sector, particularly focusing on niche communication requirements for exploration, production, and distribution.

- Innovation Drivers:

- Demand for seamless integration with Operational Technology (OT) and Information Technology (IT) systems.

- Need for enhanced cybersecurity and data privacy features.

- Adoption of AI-powered communication tools for intelligent analytics and automation.

- Growth in remote work and distributed workforce models.

- Regulatory Frameworks: Strict adherence to data sovereignty, industry-specific compliance (e.g., NERC CIP), and communication reliability standards.

- Product Substitutes: While traditional on-premise solutions exist, their declining flexibility and higher maintenance costs are increasingly making UCaaS the preferred alternative.

- End-User Demographics: A mix of field operations personnel requiring ruggedized and mobile solutions, and office-based teams demanding advanced collaboration tools.

- M&A Activities: Expect continued consolidation as larger UCaaS providers acquire specialized energy-focused communication companies to expand their service offerings and market reach. Recent M&A deals have collectively amounted to xx Million, indicating strategic investments in this sector.

UCaaS In Energy Market Market Dynamics & Trends

The UCaaS in Energy market is experiencing a robust growth phase, driven by the imperative for enhanced operational efficiency, improved safety, and cost optimization within this critical global industry. The market size, projected to reach xx Million by 2033, is being shaped by a confluence of technological advancements, evolving operational demands, and a heightened focus on sustainability and resource management. The increasing adoption of remote monitoring, predictive maintenance, and distributed energy resources necessitates communication platforms that can facilitate real-time information flow and seamless collaboration among geographically dispersed teams.

Technological disruptions are playing a pivotal role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into UCaaS platforms is enabling intelligent automation of communication workflows, advanced analytics for operational insights, and personalized user experiences. Furthermore, the proliferation of mobile devices and the demand for BYOD (Bring Your Own Device) policies are pushing vendors to develop user-friendly, secure, and cross-platform compatible UCaaS solutions. The energy sector, historically a laggard in digital adoption, is now accelerating its transformation, recognizing UCaaS not just as a communication tool but as a strategic enabler of its digital roadmap.

Consumer preferences within the energy market are shifting towards solutions that offer scalability, flexibility, and predictable cost structures. Cloud-based UCaaS solutions provide these advantages, allowing energy companies to adapt quickly to changing market conditions and project requirements without significant upfront capital expenditure. The competitive dynamics are intensifying, with established telecommunications giants and specialized UCaaS providers vying for market share. Key players are focusing on developing industry-specific functionalities, such as integration with SCADA systems, IoT platforms, and specialized field service management tools. The market penetration of UCaaS in the energy sector, currently at approximately xx%, is poised for significant expansion as more organizations realize the tangible benefits of unified communications in terms of productivity, safety, and operational resilience. The compound annual growth rate (CAGR) for the UCaaS in Energy market is estimated to be around xx% over the forecast period, reflecting its strong growth potential.

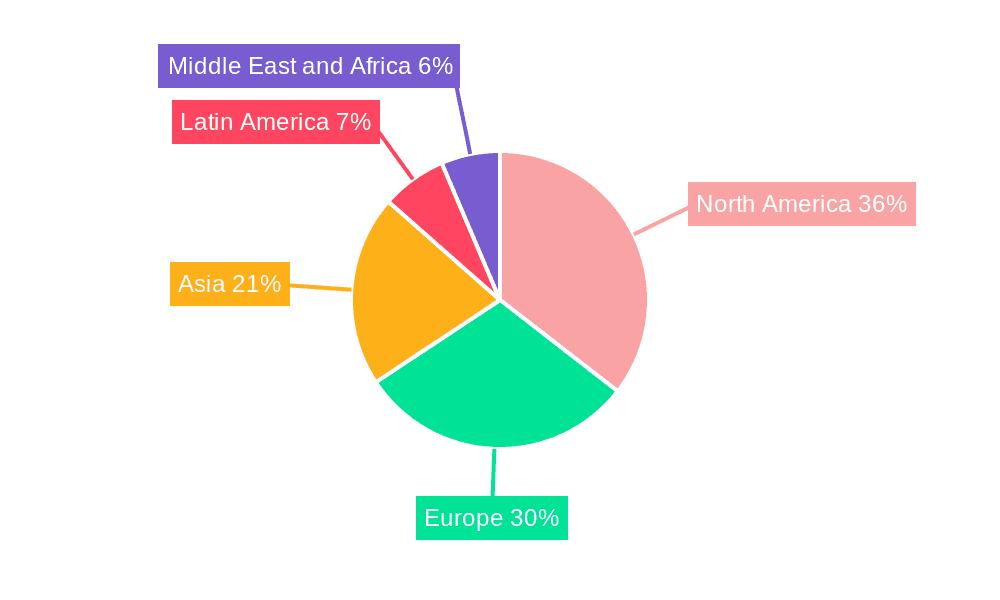

Dominant Regions & Segments in UCaaS In Energy Market

The UCaaS in Energy market exhibits distinct regional dominance and segment preferences, driven by economic policies, infrastructure development, and the specific operational needs of the energy sector in different geographies. North America currently leads the market, propelled by a mature digital infrastructure, significant investments in energy technology, and a strong regulatory push for modernization and cybersecurity. The United States, in particular, with its vast energy production and distribution networks, is a key market.

Component Dominance:

- Telephony: Remains a foundational component, with a strong demand for reliable voice communication, especially in remote field operations. Energy companies require advanced features like high-definition voice, call routing, and integration with existing PBX systems.

- Collaboration: This segment is experiencing rapid growth, driven by the need for seamless interaction among project teams, engineers, and remote workers. Features such as instant messaging, presence indication, and file sharing are becoming indispensable.

- Unified Messaging: The consolidation of voicemail, email, and fax into a single inbox is crucial for improving communication efficiency and ensuring no critical messages are missed, especially in time-sensitive energy operations.

- Conferencing: Essential for virtual meetings, technical reviews, and stakeholder engagements across dispersed locations. High-quality video conferencing with advanced features like screen sharing and recording is highly valued.

- Other Services: This encompasses a range of value-added services like contact center solutions, business process automation, and API integrations, which are increasingly sought after by energy firms for optimizing customer service and operational workflows.

Deployment Model Dominance:

- Hybrid Model: Dominates due to the energy sector's unique blend of on-premise operational infrastructure and the increasing adoption of cloud services. This model offers flexibility, allowing companies to host sensitive data on-premise while leveraging the scalability and cost-effectiveness of public cloud for other applications.

- Public Model: Gaining traction as cybersecurity concerns are addressed and as energy companies seek greater agility and reduced IT overhead.

- Private Model: Still relevant for organizations with stringent security and compliance requirements, though often at a higher cost.

Enterprise Size Dominance:

- Large Enterprise: Represents the largest market share. Large energy corporations have the resources and the operational complexity to benefit significantly from comprehensive UCaaS solutions that can be deployed across their extensive global operations.

- Small & Medium Enterprise (SME): While individually smaller, the collective demand from SMEs in the energy supply chain is growing. These businesses are increasingly adopting UCaaS for cost-effective communication and to compete with larger players.

Key drivers for regional dominance include government incentives for digital transformation, the presence of major energy hubs, and the development of robust telecommunications infrastructure. Economic policies that encourage investment in technology and a favorable regulatory environment for cloud adoption also contribute to market growth in leading regions.

UCaaS In Energy Market Product Innovations

Product innovations in the UCaaS for Energy market are focused on enhancing operational resilience, security, and real-time data accessibility for a demanding industry. Leading vendors are introducing AI-powered features for intelligent call routing, predictive maintenance alerts integrated with communication workflows, and advanced cybersecurity protocols tailored to protect critical energy infrastructure. The integration of UCaaS with IoT devices and SCADA systems allows for seamless communication between physical assets and operational teams, enabling proactive issue resolution and optimized performance.

These innovations offer significant competitive advantages by improving field worker productivity through mobile-first UCaaS applications, facilitating secure collaboration on sensitive projects, and providing unified platforms for disparate communication channels. Market fit is achieved by addressing the specific pain points of the energy sector, such as the need for robust communication in remote or hazardous environments and compliance with stringent industry regulations.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the UCaaS in Energy market, focusing on key segmentation parameters to provide granular insights. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033.

Component Segmentation:

- Telephony: Expected to grow at a CAGR of xx%, driven by the fundamental need for reliable voice communication in field operations. Market size projected to reach xx Million by 2033.

- Collaboration: Forecasted to exhibit the highest growth rate at xx%, fueled by the increasing adoption of remote work and complex project management. Market size estimated at xx Million by 2033.

- Unified Messaging: Projected to grow at xx%, offering essential consolidation of communication channels. Market size anticipated to be xx Million by 2033.

- Conferencing: Expected to grow at xx%, supporting global collaboration and stakeholder engagement. Market size projected to reach xx Million by 2033.

- Other Services: Anticipated to grow at xx%, encompassing a range of value-added solutions crucial for operational optimization. Market size estimated at xx Million by 2033.

Deployment Model Segmentation:

- Hybrid Model: Dominating with a projected CAGR of xx%, offering flexibility and security. Market size estimated at xx Million by 2033.

- Public Model: Experiencing rapid adoption at xx% CAGR, driven by scalability and cost-effectiveness. Market size projected to reach xx Million by 2033.

- Private Model: Expected to grow at xx%, catering to specific high-security needs. Market size anticipated to be xx Million by 2033.

Enterprise Size Segmentation:

- Large Enterprise: Expected to maintain its leading position with a CAGR of xx%, due to extensive operational needs. Market size projected to reach xx Million by 2033.

- Small & Medium Enterprise (SME): Showing significant growth at xx% CAGR, as these businesses increasingly leverage UCaaS for competitive advantage. Market size estimated at xx Million by 2033.

Key Drivers of UCaaS In Energy Market Growth

The growth of the UCaaS in Energy market is propelled by a multifaceted set of drivers, fundamentally aimed at enhancing operational efficiency, safety, and agility. The increasing digitization of the energy sector, from exploration and production to distribution and grid management, necessitates robust and flexible communication solutions. Technological advancements are a significant catalyst, with the integration of AI, IoT, and advanced analytics enabling smarter, more responsive communication systems.

The growing adoption of remote work and distributed teams, accelerated by recent global events, mandates UCaaS platforms that can facilitate seamless collaboration regardless of geographical location. Furthermore, the energy industry's focus on improving worker safety in hazardous environments drives the demand for reliable communication tools that can ensure prompt alerts and efficient coordination during emergencies. Economic factors, such as the pursuit of cost optimization and the shift from CapEx to OpEx models, also favor the adoption of subscription-based UCaaS solutions. Regulatory mandates pushing for enhanced cybersecurity and data integrity further bolster the demand for secure, cloud-based communication platforms.

Challenges in the UCaaS In Energy Market Sector

Despite the promising growth, the UCaaS in Energy market faces several significant challenges that can impede widespread adoption and market penetration. Regulatory hurdles, particularly concerning data sovereignty and compliance with industry-specific security standards like NERC CIP, require UCaaS providers to offer highly customized and secure solutions, which can increase implementation complexity and costs. The integration of UCaaS with legacy operational technology (OT) systems and existing IT infrastructure presents a considerable technical challenge, often requiring bespoke integration efforts.

Supply chain issues, though less direct for software-based services, can indirectly impact hardware availability for end-user devices or specialized communication equipment used in field operations. Competitive pressures from established telecommunications providers and new market entrants are intense, driving down margins and requiring continuous innovation. Furthermore, the inherent resistance to change within a traditionally conservative industry like energy can slow down the adoption of new technologies. Quantifiable impacts include extended sales cycles and increased integration costs, estimated to be xx% higher for complex energy deployments compared to other industries.

Emerging Opportunities in UCaaS In Energy Market

The UCaaS in Energy market is ripe with emerging opportunities driven by evolving industry needs and technological advancements. The increasing adoption of renewable energy sources and smart grid technologies creates a demand for enhanced communication infrastructure that can support distributed energy resources and real-time data exchange. The growing emphasis on sustainability and environmental, social, and governance (ESG) initiatives presents an opportunity for UCaaS providers to offer solutions that enhance remote monitoring, reduce travel requirements, and improve operational transparency.

The expansion of IoT in the energy sector opens doors for UCaaS platforms to integrate with sensor data, enabling proactive maintenance and predictive analytics. Furthermore, the digitalization of the workforce, particularly the need for efficient communication with field service technicians and remote workers, offers a substantial market for mobile-first UCaaS solutions. Emerging markets in developing economies, with their rapidly expanding energy infrastructure, also represent significant untapped potential.

Leading Players in the UCaaS In Energy Market Market

- Polycom Inc

- Google LLC

- Verizon Enterprise Solutions LLC

- West Corporation

- Alcatel-Lucent(Nokia Corporation)

- Cisco Systems Inc

- Microsoft Corporation

- International Business Machines Corporation

- Avaya Inc

- BT Group plc

Key Developments in UCaaS In Energy Market Industry

- May 2023: Access4, a leading Unified Communication-as-a-Service (UCaaS) provider, has unveiled a new SMS service, demonstrating its commitment to enhancing partner network growth and bolstering customer retention. This development strengthens UCaaS offerings with expanded messaging capabilities, crucial for field communications in the energy sector.

- August 2022: Avaya introduced Avaya Spaces, an all-in-one video collaboration app designed for the modern digital workplace. This innovative release incorporates a dynamic 61-participant "concert" style HD video layout to cater to diverse meeting scenarios. Avaya Spaces also features modernized collaboration controls to accommodate various use cases, as well as intelligent moderation tools such as smart mute, host control of participant cameras and microphones, and a "raise hand" feature, enabling effective session management. This enhances virtual collaboration for energy companies managing complex projects and dispersed teams.

Future Outlook for UCaaS In Energy Market Market

The future outlook for the UCaaS in Energy market is exceptionally positive, fueled by the sustained digital transformation within the energy sector. Key growth accelerators include the increasing reliance on cloud-native solutions for enhanced scalability and agility, the pervasive integration of Artificial Intelligence (AI) for intelligent automation and predictive insights within communication workflows, and the expansion of 5G networks enabling richer, real-time data transmission for field operations.

Strategic opportunities lie in developing specialized UCaaS solutions that directly address the unique challenges of various energy sub-sectors, such as oil and gas exploration, renewable energy management, and utility grid operations. The growing demand for robust cybersecurity features and compliance with evolving regulations will continue to drive innovation and market differentiation. Furthermore, the global push towards energy transition and sustainability will necessitate communication platforms that can facilitate collaboration on new energy infrastructure and smart grid technologies, positioning UCaaS as an indispensable tool for the future of the energy industry. The market is projected to see substantial growth, with an estimated market size of xx Million by 2033.

UCaaS In Energy Market Segmentation

-

1. Component

- 1.1. Telephony

- 1.2. Collaboration

- 1.3. Unified Messaging

- 1.4. Conferencing

- 1.5. Other Services

-

2. Deployment Model

- 2.1. Private

- 2.2. Public

- 2.3. Hybrid Model

-

3. Enterprise Size

- 3.1. Large Enterprise

- 3.2. Small & Medium Enterprise

UCaaS In Energy Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

UCaaS In Energy Market Regional Market Share

Geographic Coverage of UCaaS In Energy Market

UCaaS In Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Cloud Based Ecosystem will Act as a Driver; Improvement of Communication Technology

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns will Remain a Challenge to the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Proliferation of Cloud Based Ecosystem to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UCaaS In Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Telephony

- 5.1.2. Collaboration

- 5.1.3. Unified Messaging

- 5.1.4. Conferencing

- 5.1.5. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. Private

- 5.2.2. Public

- 5.2.3. Hybrid Model

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large Enterprise

- 5.3.2. Small & Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America UCaaS In Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Telephony

- 6.1.2. Collaboration

- 6.1.3. Unified Messaging

- 6.1.4. Conferencing

- 6.1.5. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. Private

- 6.2.2. Public

- 6.2.3. Hybrid Model

- 6.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.3.1. Large Enterprise

- 6.3.2. Small & Medium Enterprise

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe UCaaS In Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Telephony

- 7.1.2. Collaboration

- 7.1.3. Unified Messaging

- 7.1.4. Conferencing

- 7.1.5. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. Private

- 7.2.2. Public

- 7.2.3. Hybrid Model

- 7.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.3.1. Large Enterprise

- 7.3.2. Small & Medium Enterprise

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia UCaaS In Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Telephony

- 8.1.2. Collaboration

- 8.1.3. Unified Messaging

- 8.1.4. Conferencing

- 8.1.5. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. Private

- 8.2.2. Public

- 8.2.3. Hybrid Model

- 8.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.3.1. Large Enterprise

- 8.3.2. Small & Medium Enterprise

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America UCaaS In Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Telephony

- 9.1.2. Collaboration

- 9.1.3. Unified Messaging

- 9.1.4. Conferencing

- 9.1.5. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. Private

- 9.2.2. Public

- 9.2.3. Hybrid Model

- 9.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.3.1. Large Enterprise

- 9.3.2. Small & Medium Enterprise

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa UCaaS In Energy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Telephony

- 10.1.2. Collaboration

- 10.1.3. Unified Messaging

- 10.1.4. Conferencing

- 10.1.5. Other Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. Private

- 10.2.2. Public

- 10.2.3. Hybrid Model

- 10.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.3.1. Large Enterprise

- 10.3.2. Small & Medium Enterprise

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Polycom Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Google LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Verizon Enterprise Solutions LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 West Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alcatel-Lucent(Nokia Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Business Machines Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avaya Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BT Group plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Polycom Inc *List Not Exhaustive

List of Figures

- Figure 1: Global UCaaS In Energy Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UCaaS In Energy Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America UCaaS In Energy Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America UCaaS In Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 5: North America UCaaS In Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 6: North America UCaaS In Energy Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 7: North America UCaaS In Energy Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 8: North America UCaaS In Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UCaaS In Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UCaaS In Energy Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe UCaaS In Energy Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe UCaaS In Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 13: Europe UCaaS In Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 14: Europe UCaaS In Energy Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 15: Europe UCaaS In Energy Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 16: Europe UCaaS In Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe UCaaS In Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia UCaaS In Energy Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia UCaaS In Energy Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia UCaaS In Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 21: Asia UCaaS In Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 22: Asia UCaaS In Energy Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 23: Asia UCaaS In Energy Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 24: Asia UCaaS In Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia UCaaS In Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America UCaaS In Energy Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America UCaaS In Energy Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America UCaaS In Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 29: Latin America UCaaS In Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 30: Latin America UCaaS In Energy Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 31: Latin America UCaaS In Energy Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 32: Latin America UCaaS In Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America UCaaS In Energy Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa UCaaS In Energy Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa UCaaS In Energy Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa UCaaS In Energy Market Revenue (Million), by Deployment Model 2025 & 2033

- Figure 37: Middle East and Africa UCaaS In Energy Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 38: Middle East and Africa UCaaS In Energy Market Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 39: Middle East and Africa UCaaS In Energy Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 40: Middle East and Africa UCaaS In Energy Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa UCaaS In Energy Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UCaaS In Energy Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global UCaaS In Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 3: Global UCaaS In Energy Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 4: Global UCaaS In Energy Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UCaaS In Energy Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global UCaaS In Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 7: Global UCaaS In Energy Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 8: Global UCaaS In Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global UCaaS In Energy Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global UCaaS In Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 11: Global UCaaS In Energy Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 12: Global UCaaS In Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global UCaaS In Energy Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global UCaaS In Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 15: Global UCaaS In Energy Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 16: Global UCaaS In Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global UCaaS In Energy Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global UCaaS In Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 19: Global UCaaS In Energy Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 20: Global UCaaS In Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global UCaaS In Energy Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global UCaaS In Energy Market Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 23: Global UCaaS In Energy Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 24: Global UCaaS In Energy Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UCaaS In Energy Market?

The projected CAGR is approximately 12.08%.

2. Which companies are prominent players in the UCaaS In Energy Market?

Key companies in the market include Polycom Inc *List Not Exhaustive, Google LLC, Verizon Enterprise Solutions LLC, West Corporation, Alcatel-Lucent(Nokia Corporation), Cisco Systems Inc, Microsoft Corporation, International Business Machines Corporation, Avaya Inc, BT Group plc.

3. What are the main segments of the UCaaS In Energy Market?

The market segments include Component, Deployment Model, Enterprise Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Cloud Based Ecosystem will Act as a Driver; Improvement of Communication Technology.

6. What are the notable trends driving market growth?

Proliferation of Cloud Based Ecosystem to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Data Security Concerns will Remain a Challenge to the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Access4, a leading Unified Communication-as-a-Service (UCaaS) provider, has unveiled a new SMS service, demonstrating its commitment to enhancing partner network growth and bolstering customer retention.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UCaaS In Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UCaaS In Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UCaaS In Energy Market?

To stay informed about further developments, trends, and reports in the UCaaS In Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence