Key Insights

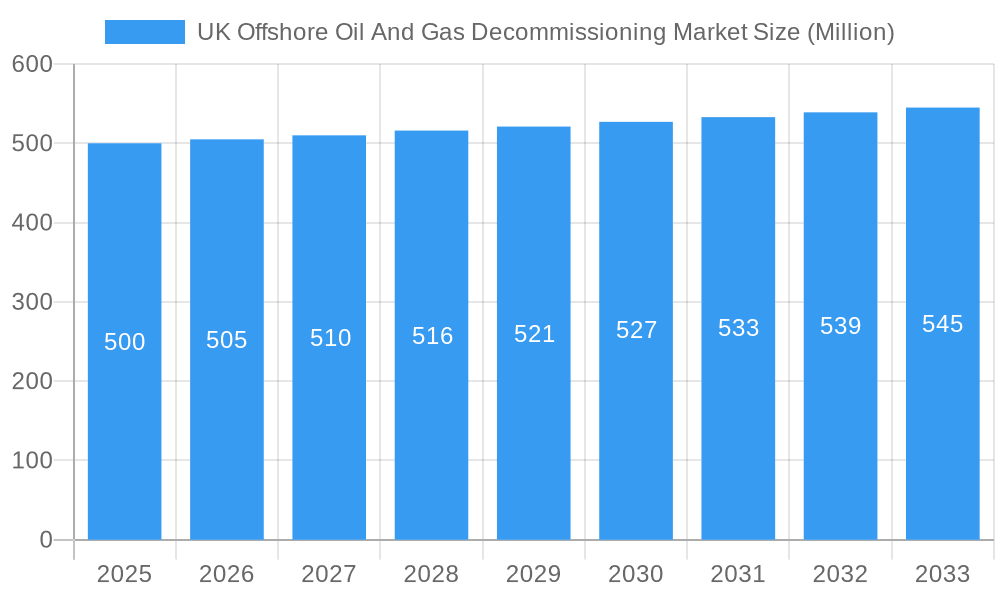

The UK offshore oil and gas decommissioning market is poised for significant expansion, driven by maturing fields and evolving environmental mandates. The market, valued at £11.1 billion in the base year 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. Key growth drivers include the substantial number of aging offshore assets requiring decommissioning, stringent environmental regulations promoting responsible asset retirement, and technological advancements enabling more efficient and cost-effective solutions. Plugging and Abandonment (P&A) and pipeline decommissioning are leading segments, with the oil and gas sector as the primary end-user. Prominent companies such as Veolia Environnement S.A., John Lawrie Group Ltd., AF Gruppen ASA, Ramboll Group A/S, Perenco SA, and Derrick Services (UK) Ltd. are key contributors through their specialized capabilities.

UK Offshore Oil And Gas Decommissioning Market Market Size (In Billion)

Focused on the United Kingdom, the market presents considerable opportunities across England, Wales, Scotland, and Northern Ireland. The forecast period of 2025-2033 offers a strategic window for market participants. While competition is expected to increase, challenges such as high capital investment, operational complexities, and the demand for specialized expertise persist. Success in this market will depend on effective cost management, innovation adoption, and stringent regulatory compliance.

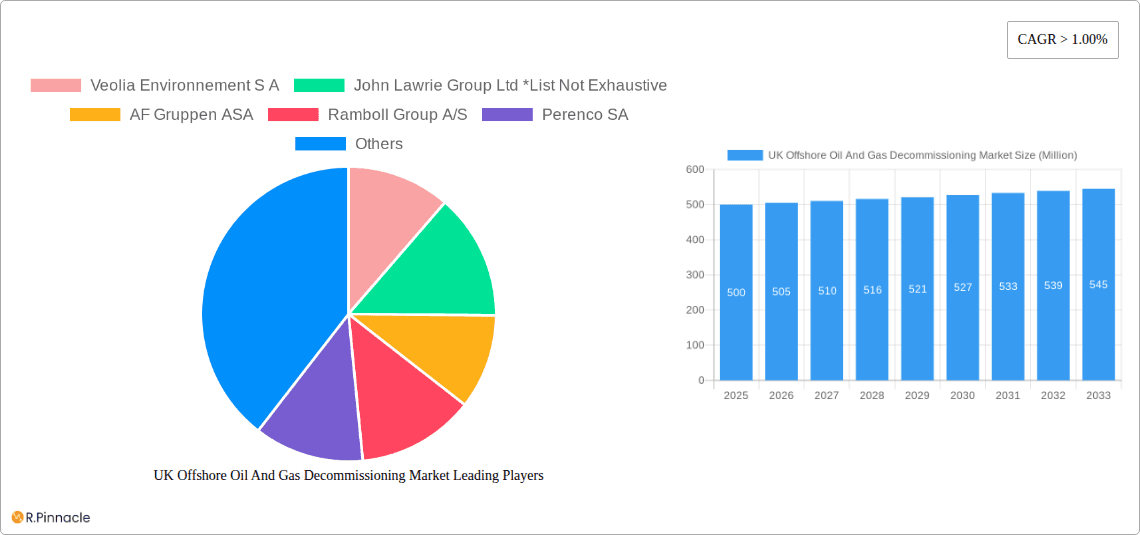

UK Offshore Oil And Gas Decommissioning Market Company Market Share

UK Offshore Oil and Gas Decommissioning Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK offshore oil and gas decommissioning market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive market research to forecast future trends and identify lucrative opportunities. The report includes detailed segmentation by type (Plugging and Abandonment (P&A), Pipeline Decommissioning) and end-user (Oil Industry, Gas Industry), highlighting key players such as Veolia Environnement S A, John Lawrie Group Ltd, AF Gruppen ASA, Ramboll Group A/S, Perenco SA, and Derrick Services (UK) Ltd. (Note: This list is not exhaustive).

UK Offshore Oil And Gas Decommissioning Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UK offshore oil and gas decommissioning market. We examine market concentration, identifying key players and their respective market shares (exact figures will be provided in the full report). We explore innovation drivers, including technological advancements in decommissioning techniques and regulatory pressures pushing for environmentally responsible practices. The regulatory framework governing decommissioning activities, including permitting and environmental compliance, is examined in detail. The report also explores the potential impact of product substitutes and discusses M&A activity within the sector, including deal values and their implications for market consolidation. End-user demographics, focusing on the evolving needs of the oil and gas industry, are analyzed to provide a comprehensive view of the market structure and future trends. Analysis of market share dynamics and future projections based on identified trends are included, contributing to a clear understanding of the overall market structure.

UK Offshore Oil And Gas Decommissioning Market Market Dynamics & Trends

The UK offshore oil and gas decommissioning market is poised for significant expansion, driven by a confluence of evolving industry dynamics and emerging trends. Our analysis projects a robust Compound Annual Growth Rate (CAGR) of approximately [Insert specific CAGR]% for the forecast period spanning 2025-2033. This projection is underpinned by a comprehensive evaluation of historical market performance from 2019-2024 and the identification of key growth catalysts. Paramount among these drivers is the escalating number of aging offshore assets reaching their end-of-life, necessitating substantial decommissioning efforts. Furthermore, increasingly stringent environmental regulations globally and within the UK are compelling operators to undertake these complex operations. Simultaneously, continuous technological advancements are paving the way for more efficient, cost-effective, and environmentally sound decommissioning methodologies.

Technological disruptions are at the forefront of market transformation. The integration of advanced robotics, artificial intelligence (AI), and sophisticated data analytics is revolutionizing decommissioning operations. These innovations are not only enhancing efficiency and reducing operational risks but also contributing to significant cost savings, thereby accelerating market penetration. The report meticulously assesses the impact of these technological shifts on market dynamics and potential efficiency gains.

Beyond technological advancements, the report delves into evolving consumer preferences, defined as end-user needs. These needs are increasingly focused on sustainable practices, minimizing environmental impact, and maximizing the recovery of valuable materials. The competitive landscape is characterized by strategic maneuvering among market players, with a strong emphasis on technological innovation, cost leadership, and strategic market expansion. We also critically examine the inherent challenges to market growth, including potential logistical bottlenecks, regulatory complexities, and the availability of skilled personnel, and provide actionable insights into effective mitigation strategies.

Dominant Regions & Segments in UK Offshore Oil And Gas Decommissioning Market

The UK's North Sea region unequivocally stands as the epicenter of offshore oil and gas decommissioning activities. This dominance is directly attributable to the region's extensive history of hydrocarbon exploration and production, which has resulted in a high concentration of aging and mature oil and gas infrastructure. The sheer volume of platforms, subsea structures, and associated pipelines requiring decommissioning in the North Sea is the primary engine driving market growth and activity.

Key Drivers for North Sea Dominance:

- Concentration of Aging Infrastructure: The North Sea harbors a vast legacy of decades-old oil and gas fields, many of which are now reaching the end of their productive lives and require comprehensive decommissioning.

- Stringent Environmental Regulations: The UK has implemented some of the world's most robust environmental regulations governing offshore activities, compelling operators to prioritize responsible decommissioning to mitigate ecological impact.

- Government Incentives and Support: The UK government actively supports decommissioning efforts through various fiscal incentives and initiatives, recognizing its importance for environmental protection and the transition to a low-carbon economy.

- Well-Established Decommissioning Ecosystem: The region boasts a mature and sophisticated ecosystem of specialized service providers, experienced personnel, and advanced infrastructure tailored to the complexities of offshore decommissioning.

Segment Analysis:

- Plugging and Abandonment (P&A): This segment is projected to command the largest market share. The immense number of wells that need to be permanently plugged and abandoned due to depletion or cessation of production is a significant driver. The full report provides detailed projections of market sizes and a thorough analysis of the competitive landscapes within this crucial segment.

- Pipeline Decommissioning: The extensive network of subsea pipelines traversing the North Sea presents substantial opportunities for decommissioning service providers. The report extensively discusses the transformative impact of technological innovation on the efficiency and cost-effectiveness of pipeline removal and decommissioning.

- End-users: Both the Oil Industry and the Gas Industry are the primary end-users in this market. Their demand for decommissioning services is intrinsically linked to regulatory compliance mandates, strategic asset portfolio management, and the ongoing transition towards cleaner energy sources.

UK Offshore Oil And Gas Decommissioning Market Product Innovations

The UK offshore oil and gas decommissioning market is experiencing a dynamic period of innovation, with a relentless focus on enhancing operational efficiency, minimizing environmental footprints, and optimizing cost-effectiveness. Recent advancements have introduced a suite of sophisticated technologies and methodologies designed to tackle the complex challenges of offshore asset retirement. These innovations include the widespread adoption of advanced autonomous and semi-autonomous robotics, highly capable Remotely Operated Vehicles (ROVs) equipped with cutting-edge manipulator arms and sensor technology, and the development of specialized, purpose-built decommissioning equipment. These technological leaps are collectively elevating the efficacy and safety of decommissioning operations, thereby stimulating a heightened market demand for advanced and integrated solutions.

Consequently, the competitive advantage within the market is progressively shifting towards companies that can demonstrably offer pioneering, sustainable, and economically viable decommissioning solutions. This includes advancements in waste management techniques, in-situ recycling, and the development of novel techniques for asset removal and disposal that minimize surface disruption and environmental impact.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the UK offshore oil and gas decommissioning market, covering the historical period from 2019 to 2033. The year 2025 serves as the base year for our detailed market assessments, with projections extending through the forecast period of 2025-2033. The market has been meticulously segmented to provide granular insights into its various facets. Key segmentation includes:

- By Type:

- Plugging and Abandonment (P&A)

- Pipeline Decommissioning

- Offshore Structure Decommissioning (including platforms, subsea structures, etc.)

- Well Decommissioning (beyond P&A, including integrity checks and remediation)

- By End-User:

- Oil Industry (National Oil Companies, Independent Oil Companies, International Oil Companies)

- Gas Industry (National Gas Companies, Independent Gas Producers)

- Service Providers & Contractors

For each segment, the report provides detailed projections of market size and value (expressed in Millions of USD/GBP), alongside a thorough analysis of prevailing competitive dynamics, key growth drivers, and potential challenges. This granular segmentation ensures a holistic understanding of the market's intricate structure and future trajectory.

Key Drivers of UK Offshore Oil And Gas Decommissioning Market Growth

The market is driven by several factors including: the aging infrastructure of the North Sea oil and gas fields necessitating decommissioning, increasingly stringent environmental regulations pushing for responsible decommissioning practices, and technological advancements in decommissioning techniques leading to increased efficiency and cost reduction. Government policies and incentives for sustainable decommissioning also contribute to market expansion.

Challenges in the UK Offshore Oil And Gas Decommissioning Market Sector

Challenges include the high cost associated with decommissioning operations, complexities involved in decommissioning aging infrastructure, supply chain constraints in securing specialized equipment and skilled labor, and potential regulatory hurdles and uncertainties. These factors can cause delays and cost overruns, impacting the overall market growth.

Emerging Opportunities in UK Offshore Oil And Gas Decommissioning Market

Emerging opportunities exist in developing innovative and sustainable decommissioning technologies, expanding into new geographical areas, leveraging digitalization and data analytics for improved efficiency and cost optimization, and exploring new business models focused on recycling and repurposing decommissioned materials.

Leading Players in the UK Offshore Oil And Gas Decommissioning Market Market

- Veolia Environnement S A

- John Lawrie Group Ltd

- AF Gruppen ASA

- Ramboll Group A/S

- Perenco SA

- Derrick Services (UK) Ltd

Key Developments in UK Offshore Oil And Gas Decommissioning Market Industry

- November 2022: A landmark research report by Offshore Energies UK (OEUK) highlighted the immense scale of decommissioning required in the North Sea, identifying over 2,000 abandoned oil and gas wells. This research underscored the substantial economic opportunity, estimating the market value at approximately EUR 20 billion, significantly influencing forward-looking market projections and strategic planning within the industry.

- September 2022: A pivotal three-year collaborative research agreement was forged between the UK's Nuclear Decommissioning Authority (NDA) and the National Decommissioning Centre (NDC). This strategic alliance aims to foster invaluable knowledge exchange and technological cross-pollination between the nuclear and oil and gas decommissioning sectors. The collaboration holds significant promise for the development of innovative, cross-industry solutions that could enhance safety, efficiency, and cost-effectiveness in both fields.

- Ongoing: Continuous investment in advanced marine technology and robotics by major oil and gas operators and specialized decommissioning service companies. This includes the development of AI-powered monitoring systems for asset integrity and the use of autonomous underwater vehicles (AUVs) for detailed site surveys and intervention operations, further driving efficiency and reducing human intervention in hazardous environments.

- Emerging Trend: Increased focus on circular economy principles within decommissioning. This involves exploring opportunities for material reuse, recycling, and repurposing of decommissioned assets and infrastructure, aligning with broader sustainability goals and potentially creating new revenue streams within the market.

Future Outlook for UK Offshore Oil And Gas Decommissioning Market Market

The UK offshore oil and gas decommissioning market is poised for significant growth, driven by a large backlog of decommissioning projects, increasingly stringent environmental regulations, and technological innovation. Strategic opportunities exist for companies that can offer cost-effective, sustainable, and technologically advanced decommissioning solutions. The market’s future potential is significant, given the substantial number of aging assets requiring decommissioning in the coming decades.

UK Offshore Oil And Gas Decommissioning Market Segmentation

- 1. Shallow Water

- 2. Deepwater and Ultra-Deep Water

UK Offshore Oil And Gas Decommissioning Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Offshore Oil And Gas Decommissioning Market Regional Market Share

Geographic Coverage of UK Offshore Oil And Gas Decommissioning Market

UK Offshore Oil And Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies in Developing Solar Energy4.; Abundant Solar Resources Across the Country

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Conventional Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Decommissioning Projects to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Shallow Water

- 5.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Shallow Water

- 6. North America UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Shallow Water

- 6.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 6.1. Market Analysis, Insights and Forecast - by Shallow Water

- 7. South America UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Shallow Water

- 7.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 7.1. Market Analysis, Insights and Forecast - by Shallow Water

- 8. Europe UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Shallow Water

- 8.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 8.1. Market Analysis, Insights and Forecast - by Shallow Water

- 9. Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Shallow Water

- 9.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 9.1. Market Analysis, Insights and Forecast - by Shallow Water

- 10. Asia Pacific UK Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Shallow Water

- 10.2. Market Analysis, Insights and Forecast - by Deepwater and Ultra-Deep Water

- 10.1. Market Analysis, Insights and Forecast - by Shallow Water

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Veolia Environnement S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 John Lawrie Group Ltd *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AF Gruppen ASA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ramboll Group A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Perenco SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Derrick Services (UK) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Veolia Environnement S A

List of Figures

- Figure 1: Global UK Offshore Oil And Gas Decommissioning Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global UK Offshore Oil And Gas Decommissioning Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 4: North America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 5: North America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 6: North America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 7: North America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 8: North America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 9: North America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 10: North America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 11: North America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 16: South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 17: South America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 18: South America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 19: South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 20: South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 21: South America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 22: South America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 23: South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 24: South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 25: South America UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 28: Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 29: Europe UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 30: Europe UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 31: Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 32: Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 33: Europe UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 34: Europe UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 35: Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 40: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 41: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 42: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 43: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 44: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 45: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 46: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 47: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Shallow Water 2025 & 2033

- Figure 52: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Shallow Water 2025 & 2033

- Figure 53: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Shallow Water 2025 & 2033

- Figure 54: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Shallow Water 2025 & 2033

- Figure 55: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 56: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 57: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 58: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Deepwater and Ultra-Deep Water 2025 & 2033

- Figure 59: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 2: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 3: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 4: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 5: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 8: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 9: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 10: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 11: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 20: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 21: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 22: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 23: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 32: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 33: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 34: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 35: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 56: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 57: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 58: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 59: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Shallow Water 2020 & 2033

- Table 74: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Shallow Water 2020 & 2033

- Table 75: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 76: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Deepwater and Ultra-Deep Water 2020 & 2033

- Table 77: Global UK Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global UK Offshore Oil And Gas Decommissioning Market Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific UK Offshore Oil And Gas Decommissioning Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific UK Offshore Oil And Gas Decommissioning Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Offshore Oil And Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the UK Offshore Oil And Gas Decommissioning Market?

Key companies in the market include Veolia Environnement S A, John Lawrie Group Ltd *List Not Exhaustive, AF Gruppen ASA, Ramboll Group A/S, Perenco SA, Derrick Services (UK) Ltd.

3. What are the main segments of the UK Offshore Oil And Gas Decommissioning Market?

The market segments include Shallow Water, Deepwater and Ultra-Deep Water.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies in Developing Solar Energy4.; Abundant Solar Resources Across the Country.

6. What are the notable trends driving market growth?

Increasing Decommissioning Projects to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Conventional Energy Sources.

8. Can you provide examples of recent developments in the market?

November 2022: there were more than 2,000 abandoned oil and gas wells in the North Sea begin, The high number of abandoned wells is expected to lead to an increase in activity as operations worth EUR 20 billion are decommissioned and shut down. The research was conducted by industry group Offshore Energies UK (OEUK), formerly Oil & Gas UK, which provides fresh insight into petroleum decommissioning efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Offshore Oil And Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Offshore Oil And Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Offshore Oil And Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the UK Offshore Oil And Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence