Key Insights

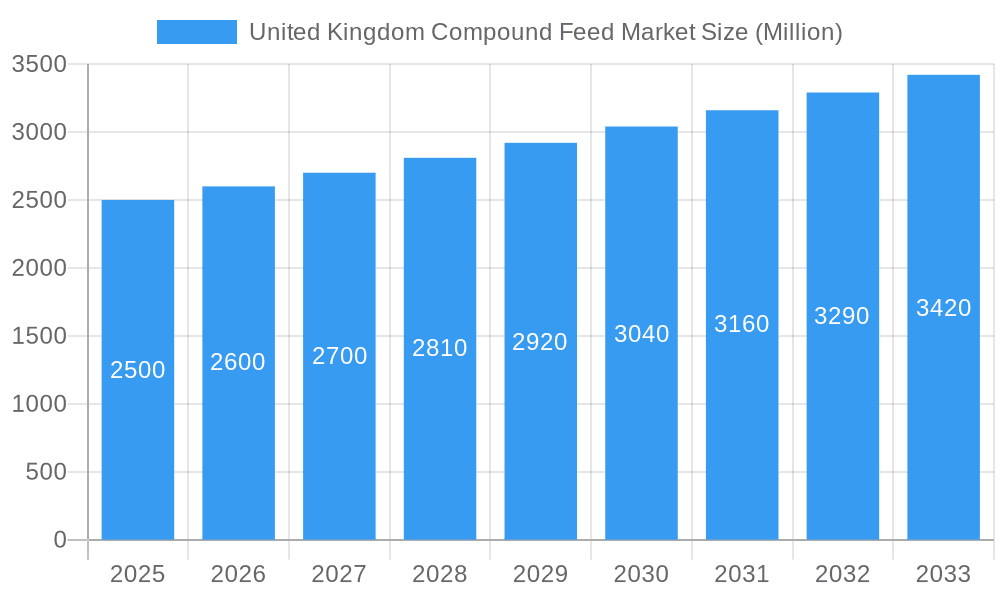

The United Kingdom compound feed market demonstrates robust growth potential, aligning with global expansion trends. Projections indicate a Compound Annual Growth Rate (CAGR) of 3.9%, driven by escalating demand for animal protein, increased livestock farming intensity, and technological advancements in feed formulations enhancing animal health and productivity. Key market segments include ruminant and poultry feeds, with cereals and cakes & meals forming the primary ingredient categories. Prominent industry players, including ABN, Land O Lakes Purina, and Cargill Inc., are expected to maintain market dominance through established distribution networks and strong brand recognition. However, rising feed costs due to volatile commodity prices and stringent feed composition regulations present significant market restraints. Opportunities for future growth lie in developing specialized feed formulations that address specific animal nutritional needs and sustainability imperatives. Intense competition exists between multinational corporations and regional entities. The market's trajectory will be influenced by government policies on animal welfare and sustainable agriculture, consumer demand for ethically produced meat, and ongoing innovations in feed technology. The UK compound feed market, valued at approximately 14.16 million in the base year 2024, is navigating a landscape where cost-effectiveness must be balanced with sustainability and ethical sourcing. Investment in research and development for efficient, environmentally friendly feed solutions is anticipated, alongside the adoption of alternative feed additives to combat antibiotic resistance. Regional market dynamics within the UK will likely vary based on distinct livestock farming practices and economic conditions. Future analyses should prioritize UK-specific data, accounting for the long-term implications of Brexit on trade and supply chains. Continuous monitoring of legislative changes and consumer trends impacting the entire food production and consumption ecosystem is crucial for navigating this evolving market.

United Kingdom Compound Feed Market Market Size (In Million)

United Kingdom Compound Feed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Kingdom compound feed market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. We utilize a robust methodology incorporating historical data (2019-2024), estimations for 2025, and projections for the future. This report is crucial for understanding market dynamics, identifying lucrative opportunities, and navigating the challenges within this vital sector.

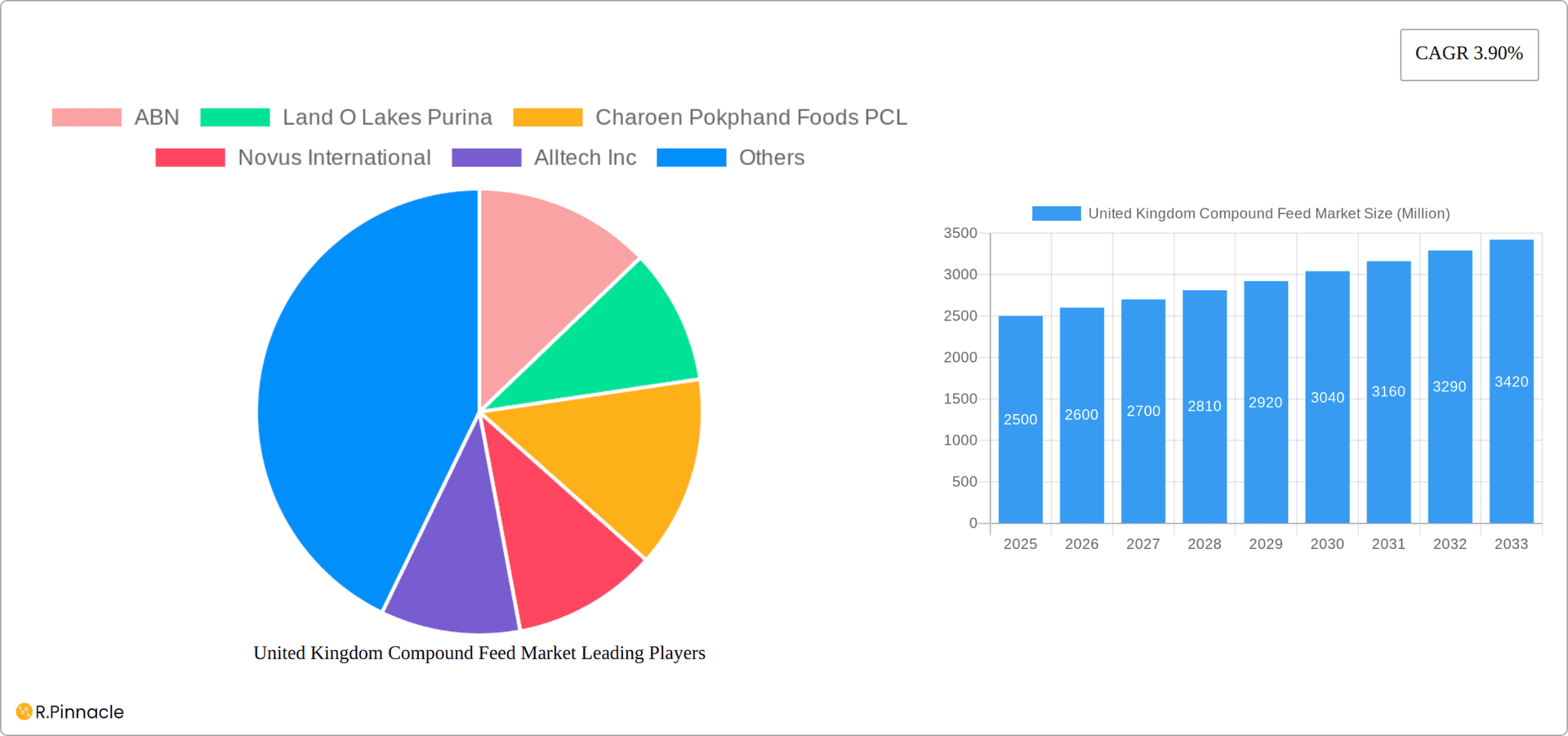

United Kingdom Compound Feed Market Company Market Share

United Kingdom Compound Feed Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UK compound feed market, examining market concentration, innovation drivers, and regulatory influences. We delve into the impact of mergers and acquisitions (M&A) activity, assessing deal values and their consequences on market share distribution. The report also explores product substitution trends and evolving end-user demographics.

Market Concentration: The UK compound feed market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% of the market share in 2025. This concentration is expected to shift slightly by 2033 due to ongoing M&A activity and the emergence of new players.

Innovation Drivers: Key drivers of innovation include the increasing demand for sustainable and efficient feed solutions, coupled with advancements in feed formulation and nutritional technology. Regulations promoting animal welfare and environmental sustainability are further stimulating innovation.

Regulatory Framework: The regulatory environment plays a significant role, impacting ingredient sourcing, feed safety standards, and environmental compliance. Stringent regulations are driving the adoption of sustainable practices and improved feed quality control.

M&A Activity: The past five years have witnessed significant M&A activity, with notable deals including [insert example deals with values if available, otherwise state "several significant deals involving xx Million in investment"]. These acquisitions have reshaped the competitive landscape and influenced market share dynamics.

Product Substitutes: The market faces pressure from substitute products, such as alternative protein sources and specialized feed additives. The extent of their impact varies across segments, with poultry feed showing the highest susceptibility.

United Kingdom Compound Feed Market Dynamics & Trends

This section examines the key factors driving market growth, including technological advancements, evolving consumer preferences, and shifts in competitive dynamics. The report provides insights into compound annual growth rates (CAGR) and market penetration rates for various segments.

The UK compound feed market is experiencing steady growth driven by factors such as increasing livestock population, rising demand for animal protein, and the growing adoption of technologically advanced feed solutions. The CAGR for the forecast period (2025-2033) is estimated at xx%, reflecting robust growth potential. Technological disruptions, such as precision feeding technologies and data-driven farm management, are improving efficiency and enhancing feed utilization. Consumer preferences for sustainably produced animal products are also impacting the market, favoring feed solutions that minimize environmental impact and enhance animal welfare. Intense competition among established players and the emergence of new entrants are creating dynamic market conditions, with pricing strategies and product differentiation playing pivotal roles. Market penetration of specialized feed additives and functional feed ingredients is gradually increasing, driven by health and productivity improvements.

Dominant Regions & Segments in United Kingdom Compound Feed Market

This section identifies the leading regions and segments within the UK compound feed market, examining the drivers of their dominance. It provides a detailed analysis of market share, growth rates, and key factors contributing to their success.

Animal Type:

- Poultry: The poultry segment dominates the market, driven by high demand for poultry meat and eggs, coupled with efficient poultry farming practices.

- Swine: The swine segment represents a significant portion of the market, though its growth may be influenced by evolving consumer preferences and changing farming practices.

- Ruminants: The ruminant segment demonstrates moderate growth, influenced by factors like livestock production patterns and feed efficiency advancements.

- Other Animal Types: This segment exhibits relatively slower growth, driven by the specific needs of different animal species.

Ingredient:

- Cereals: Cereals constitute a substantial portion of compound feed, owing to their availability and cost-effectiveness.

- Cakes & Meals: This segment plays a significant role, offering versatile ingredients suitable for various animal types.

- By-products: By-products offer cost-effective solutions, contributing substantially to the overall feed composition.

- Supplements: Supplements are becoming increasingly important, catering to specific nutritional requirements and enhancing animal performance.

The dominance of specific segments is influenced by factors such as government policies that support livestock production, the level of technological advancement in specific animal farming sectors, and consumer demand for specific animal products. Further details and quantitative data on market shares for each segment are presented in the full report.

United Kingdom Compound Feed Market Product Innovations

Recent product innovations focus on enhancing feed efficiency, improving animal health, and minimizing environmental impact. This includes the development of novel feed formulations incorporating advanced nutritional components and the implementation of precision feeding technologies. These developments cater to the growing demand for sustainable and high-performance animal feed solutions. The market is also witnessing the introduction of innovative feed additives designed to enhance nutrient digestibility, improve animal immunity, and reduce greenhouse gas emissions.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the UK compound feed market based on animal type (ruminants, poultry, swine, other animal types) and ingredient type (cereals, cakes & meals, by-products, supplements). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. For example, the poultry segment is expected to witness robust growth, driven by rising consumer demand and advancements in poultry farming techniques. Similarly, the cereals ingredient segment dominates due to its cost-effectiveness and wide availability. Detailed market size and growth projections for each segment are presented in the full report.

Key Drivers of United Kingdom Compound Feed Market Growth

Growth in the UK compound feed market is fueled by several factors. The expanding livestock population and rising demand for animal protein are key drivers. Government initiatives supporting livestock farming, coupled with technological advancements in feed formulation and delivery systems, further contribute to market expansion. Increasing focus on animal health and welfare is also a crucial factor, leading to greater demand for specialized and high-quality feed solutions.

Challenges in the United Kingdom Compound Feed Market Sector

The UK compound feed market navigates a complex landscape, presenting several significant challenges. Volatile global commodity prices for key ingredients like grains and protein meals exert considerable pressure on production costs. Supply chain vulnerabilities, exacerbated by geopolitical events and logistical hurdles, can lead to ingredient shortages and increased lead times. The sector is also characterized by intense competition among established players and emerging enterprises, driving a need for innovation and efficiency to maintain market share. Furthermore, stringent regulatory frameworks governing feed safety, traceability, and environmental sustainability, including emissions reduction targets for agriculture, impose significant compliance burdens and necessitate ongoing investment in technological upgrades. These combined factors contribute to elevated operational expenses and can create a precarious balance for market stability. Public and industry-wide concerns regarding the environmental footprint of livestock farming, encompassing land use, water consumption, and greenhouse gas emissions, are also driving a demand for more sustainable feed solutions, presenting both a challenge and an opportunity for the sector.

Emerging Opportunities in United Kingdom Compound Feed Market

Emerging opportunities lie in the growing demand for sustainable and traceable feed solutions. The development of innovative feed additives that enhance animal health and reduce environmental impact presents significant potential. Further opportunities exist in the application of precision feeding technologies and data-driven farm management systems, optimizing feed utilization and enhancing profitability. Increased focus on alternative protein sources and insect-based feed ingredients also presents emerging opportunities.

Leading Players in the United Kingdom Compound Feed Market Market

- ABN

- Land O Lakes Purina

- Charoen Pokphand Foods PCL

- Novus International

- Alltech Inc

- Wens Group

- Archer Daniels Midland

- Nutreco N

- Midland Feeds

- Cargill Inc

- Kent

- New Hope Group

- ForFarmer N V

Key Developments in United Kingdom Compound Feed Market Industry

- January 2023: Launch of a new sustainable feed solution by [Company Name], focusing on reduced environmental impact and improved nutrient utilization, aiming to meet growing demand for eco-friendly livestock production.

- June 2022: Acquisition of [Company A] by [Company B] for £xx Million, a strategic move to consolidate market presence, expand product portfolios, and leverage synergistic operational efficiencies within the UK compound feed sector.

- October 2021: Introduction of a novel feed additive by [Company Name] designed to significantly enhance poultry gut health and immune response, contributing to improved animal welfare and reduced antibiotic reliance in broiler and layer operations.

- March 2023: Significant investment by [Industry Body/Research Institute] in developing advanced precision feeding technologies to optimize nutrient delivery and minimize waste, fostering greater efficiency and sustainability across various livestock sectors.

- November 2022: Several leading feed manufacturers announced ambitious targets for reducing their carbon footprint by incorporating alternative protein sources and renewable energy in their production processes, responding to increasing pressure from consumers and regulators.

Future Outlook for United Kingdom Compound Feed Market Market

The UK compound feed market is projected for robust and sustained growth, propelled by a confluence of powerful drivers. The persistent global demand for animal protein, a staple in the UK diet, will continue to underpin the need for high-quality compound feeds. Concurrent advancements in feed technology, including the development of novel ingredients, precision nutrition, and smart farming integration, are set to enhance feed efficiency, animal performance, and overall sustainability. A heightened emphasis on animal health and welfare, driven by both consumer expectations and legislative frameworks, will further stimulate the market for specialized and high-performance feed formulations. Growing consumer awareness and preference for sustainably produced food products are creating a significant market pull for feed solutions that contribute to a reduced environmental impact throughout the livestock value chain. Strategic collaborations, mergers, and acquisitions are expected to continue shaping the competitive landscape, enabling companies to scale operations and enhance their product offerings. Furthermore, substantial investments in cutting-edge research and development will be pivotal in unlocking innovative solutions for challenges such as antibiotic resistance, climate change mitigation, and resource optimization, collectively shaping a dynamic and forward-looking UK compound feed market.

United Kingdom Compound Feed Market Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

- 2.4. Supplements

United Kingdom Compound Feed Market Segmentation By Geography

- 1. United Kingdom

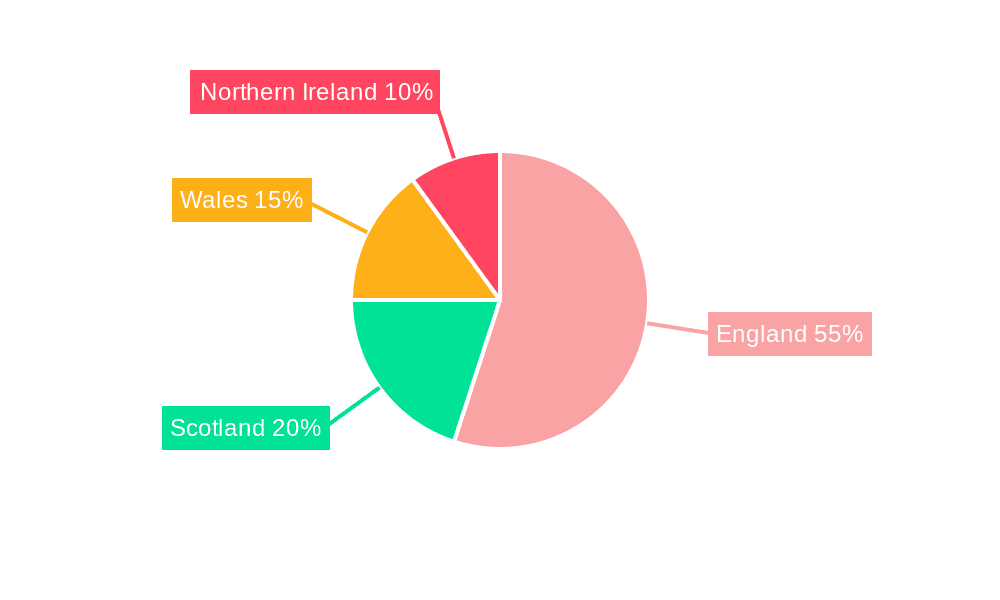

United Kingdom Compound Feed Market Regional Market Share

Geographic Coverage of United Kingdom Compound Feed Market

United Kingdom Compound Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Animal Sourced Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABN

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Land O Lakes Purina

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Charoen Pokphand Foods PCL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novus International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alltech Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wens Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nutreco N

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midland Feeds

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kent

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 New Hope Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ForFarmer N V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 ABN

List of Figures

- Figure 1: United Kingdom Compound Feed Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Compound Feed Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Compound Feed Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 2: United Kingdom Compound Feed Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 3: United Kingdom Compound Feed Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Compound Feed Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 5: United Kingdom Compound Feed Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 6: United Kingdom Compound Feed Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Compound Feed Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the United Kingdom Compound Feed Market?

Key companies in the market include ABN, Land O Lakes Purina, Charoen Pokphand Foods PCL, Novus International, Alltech Inc, Wens Group, Archer Daniels Midland, Nutreco N, Midland Feeds, Cargill Inc, Kent, New Hope Group, ForFarmer N V.

3. What are the main segments of the United Kingdom Compound Feed Market?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.16 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for Animal Sourced Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Compound Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Compound Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Compound Feed Market?

To stay informed about further developments, trends, and reports in the United Kingdom Compound Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence