Key Insights

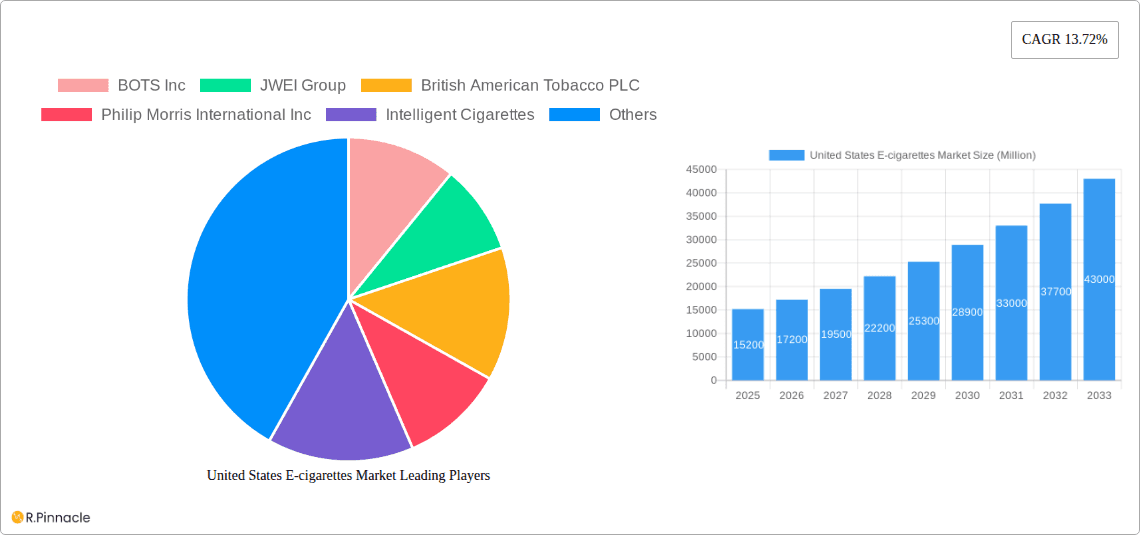

The United States e-cigarette market, a significant segment of the global market, is experiencing robust growth, driven by factors such as increasing awareness of vaping as a smoking cessation tool and the appeal of diverse product offerings. The market's 2025 value is estimated to be $15.2 billion (assuming the US holds approximately 44% of the global market based on regional data prevalence), projecting a significant expansion throughout the forecast period of 2025-2033. This growth is fueled by the introduction of innovative product types like personalized vaporizers and the expansion of distribution channels, including both offline retail and the rapidly growing online market. The popularity of automatic e-cigarettes also contributes significantly to market expansion, driven by ease of use and convenience. However, regulatory challenges and ongoing health concerns surrounding vaping present significant restraints, necessitating careful consideration of compliance and public perception for sustained growth. Market segmentation, driven by product type (completely disposable, rechargeable, personalized) and battery mode (automatic, manual), enables targeted marketing strategies and contributes to the market’s dynamism. Leading companies such as Juul Labs Inc., NJOY Inc., and Philip Morris International Inc. continue to shape market trends through product innovation and aggressive marketing. Future market trajectory hinges on the effective management of regulatory hurdles and the ongoing evolution of consumer preferences. Continuous innovation in product design and functionality, coupled with responsible marketing practices, will be crucial for sustained growth in the years ahead.

United States E-cigarettes Market Market Size (In Billion)

The competitive landscape is fiercely contested, with established tobacco companies and emerging vaping technology firms vying for market dominance. The constant evolution of vaping technology introduces new product innovations, forcing companies to adapt and innovate continually to stay ahead. The high CAGR of 13.72% reflects the rapid pace of market evolution and highlights the potential for continued substantial growth. Regional differences in regulations and consumer preferences will influence the growth trajectory of different segments of the market, necessitating regionally tailored strategies for optimal market penetration. Careful attention to consumer safety and responsible marketing are essential for long-term success within the evolving regulatory landscape, ensuring the sustainable growth of the United States e-cigarette market.

United States E-cigarettes Market Company Market Share

United States E-cigarettes Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States e-cigarettes market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The market is segmented by product type (Completely Disposable Model, Rechargeable but Disposable Cartomizer, Personalized Vaporizer), battery mode (Automatic E-cigarettes, Manual E-cigarettes), and distribution channel (Offline Retail, Online Retail). Key players analyzed include BOTS Inc, JWEI Group, British American Tobacco PLC, Philip Morris International Inc, Intelligent Cigarettes, Nicoventures Trading Limited, Japan Tobacco Inc, NJOY Inc, Imperial Brands PLC, and Juul Labs Inc. This report will equip you with the knowledge to navigate the complexities of this dynamic market.

United States E-cigarettes Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US e-cigarette market, highlighting market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market exhibits a moderately concentrated structure with key players holding significant market shares, although the exact figures vary by segment. Innovation is driven by the need for enhanced user experience, safer alternatives to traditional cigarettes, and evolving consumer preferences. Stringent regulatory frameworks, including FDA regulations, significantly impact market dynamics and product development. The emergence of alternative nicotine delivery systems, such as nicotine pouches, creates competitive pressure. The market is primarily driven by young adult and adult smokers seeking alternatives to traditional cigarettes. M&A activities are prevalent, with deals valuing xx Million shaping market consolidation and competitive positioning.

- Market Share: Dominant players hold between xx% and xx% market share.

- M&A Deal Values: Recent acquisitions average xx Million, reflecting a high level of consolidation.

- Regulatory Framework: FDA regulations significantly impact product development and marketing.

- Key Substitutes: Nicotine pouches and heated tobacco products are significant substitutes.

United States E-cigarettes Market Dynamics & Trends

The US e-cigarette market is characterized by dynamic growth, driven by factors such as increasing awareness of the health risks associated with traditional smoking, growing adoption of vaping as a smoking cessation method, and the appeal of diverse flavors and product designs. Technological disruptions, such as advancements in battery technology and e-liquid formulations, continuously reshape the market landscape. Consumer preferences are shifting towards more convenient and personalized vaping experiences, driving demand for disposable and pod-based systems. Intense competition among established players and new entrants, coupled with fluctuating consumer sentiment and regulatory changes, contribute to market volatility. The CAGR for the forecast period is estimated at xx%, with market penetration expected to reach xx% by 2033.

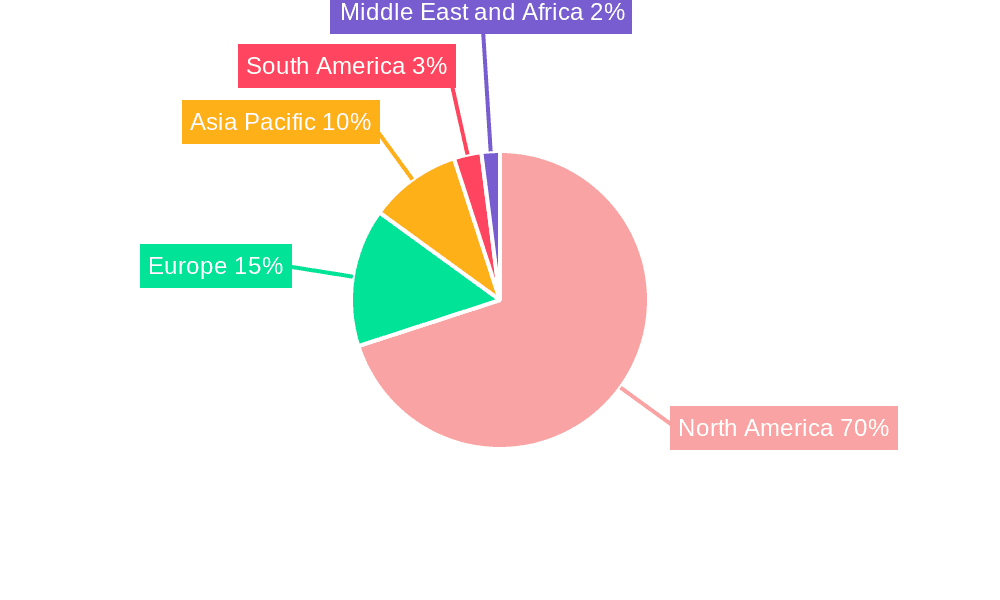

Dominant Regions & Segments in United States E-cigarettes Market

The US e-cigarette market displays regional variations in adoption and growth. While national-level data is crucial, specific regions may exhibit higher or lower consumption rates. Similarly, the market is highly segmented by product type and distribution channel.

Dominant Segment Analysis:

- Product Type: Completely Disposable Models currently hold the largest market share, driven by convenience and affordability. Personalized Vaporizers are projected to exhibit strong growth driven by customization options.

- Battery Mode: Automatic e-cigarettes are more popular due to ease of use, while Manual e-cigarettes appeal to more experienced users.

- Distribution Channel: Offline retail remains dominant due to consumer preference for immediate product access, but online retail is gaining traction.

Key Drivers (By Segment):

- Completely Disposable Models: Convenience, affordability, and ease of use.

- Rechargeable but Disposable Cartomizers: Balance between convenience and cost-effectiveness.

- Personalized Vaporizers: Customization options, advanced features, and potential for community building.

- Automatic E-cigarettes: Simplicity and ease of use, particularly for beginners.

- Manual E-cigarettes: Control over vaping experience and customizable settings.

- Offline Retail: Established infrastructure, immediate product availability, and direct consumer interaction.

- Online Retail: Convenience, competitive pricing, and wider product selection.

United States E-cigarettes Market Product Innovations

The landscape of United States e-cigarette product innovations is characterized by a relentless pursuit of enhanced user experience and safety. Manufacturers are pushing the boundaries of battery technology, focusing on longer-lasting power, faster charging, and improved temperature control for a more consistent vaping experience. Significant advancements are also seen in enhanced flavor delivery systems, moving beyond basic flavors to sophisticated blends and customizable options that cater to a diverse palate. The integration of more sophisticated user interfaces, including intuitive app connectivity and customizable settings, empowers users with greater control and personalization. The development of robust closed-system pods continues to be a key innovation, prioritizing user safety through pre-filled, tamper-evident cartridges that ensure consistency and reduce the risk of leaks or misuse. Concurrently, advancements in e-liquid formulations are a cornerstone of innovation, addressing growing consumer demand for a wider spectrum of flavors, including artisanal and beverage-inspired options, alongside precise nicotine strengths and even nicotine-free alternatives. These collective innovations are not only meeting but also shaping evolving consumer preferences, significantly boosting the user experience and the overall market appeal of e-cigarettes.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the US e-cigarette market, segmented by product type (Completely Disposable Model, Rechargeable but Disposable Cartomizer, Personalized Vaporizer), battery mode (Automatic E-cigarettes, Manual E-cigarettes), and distribution channel (Offline Retail, Online Retail). Each segment’s analysis includes market size, growth projections, and competitive dynamics, providing a holistic view of market dynamics. For example, the Completely Disposable Model segment is expected to grow at xx% CAGR, while the Online Retail segment will see xx% growth due to increased e-commerce penetration.

Key Drivers of United States E-cigarettes Market Growth

The robust growth of the US e-cigarette market is underpinned by a confluence of powerful drivers. A significant contributor is the increasing prevalence and effectiveness of smoking cessation initiatives, where e-cigarettes are increasingly recognized as a less harmful alternative for individuals seeking to quit traditional tobacco products. This is amplified by the rising awareness of the severe health risks associated with traditional cigarettes, prompting a greater migration towards vaping as a harm reduction strategy. The emergence of innovative and aesthetically appealing product designs also plays a crucial role, attracting new demographics and maintaining interest among existing users. Furthermore, continuous technological advancements, particularly in areas like extended battery life, rapid charging capabilities, and sophisticated flavor delivery mechanisms, directly enhance the user experience and drive adoption. Coupled with these product-centric factors, favorable economic conditions and increasing disposable incomes among key consumer segments provide the financial capacity for market expansion and product adoption.

Challenges in the United States E-cigarettes Market Sector

The US e-cigarette market faces challenges including stringent regulations from the FDA, concerns over the long-term health effects of vaping, and intense competition among numerous market players. Supply chain disruptions can also impact market stability, while fluctuating consumer confidence poses ongoing risks. These factors collectively influence market growth and profitability.

Emerging Opportunities in United States E-cigarettes Market

The United States e-cigarette market is ripe with emerging opportunities for growth and innovation. A primary avenue lies in the development of advanced nicotine delivery systems that offer more precise control over nicotine absorption and satisfaction, potentially catering to a broader range of user needs. The creation of novel e-liquid formulations, moving towards premium, natural ingredients and highly personalized flavor profiles, presents a significant opportunity to differentiate brands and capture discerning consumers. Expansion into new market segments, particularly those focusing on wellness-oriented vaping (e.g., with added vitamins or botanical extracts) and further solidifying the harm reduction narrative, can unlock substantial untapped potential. Moreover, the integration of cutting-edge technological advancements such as sophisticated sensor technologies for real-time monitoring of usage and health indicators, and the development of truly personalized vaping experiences through AI-driven recommendations and customizable device settings, are poised to redefine the market and drive future growth.

Leading Players in the United States E-cigarettes Market Market

- BOTS Inc

- JWEI Group

- British American Tobacco PLC (British American Tobacco PLC)

- Philip Morris International Inc (Philip Morris International Inc)

- Intelligent Cigarettes

- Nicoventures Trading Limited

- Japan Tobacco Inc (Japan Tobacco Inc)

- NJOY Inc

- Imperial Brands PLC (Imperial Brands PLC)

- Juul Labs Inc

Key Developments in United States E-cigarettes Market Industry

- November 2022: R.J. Reynolds Tobacco Company patents a composite tobacco-containing material for "smokeless" tobacco consumption, potentially impacting the e-cigarette market through the introduction of new product forms.

- November 2022: Philip Morris acquires 93% of Swedish Match, aiming to expand into the US market for reduced-risk products, including e-cigarettes, intensifying competition.

- June 2022: Japan Tobacco Inc. publishes a patent application for a flavor inhaler smoking system, signaling innovation in flavor delivery and potentially opening up new market segments.

Future Outlook for United States E-cigarettes Market Market

The future outlook for the United States e-cigarette market remains decidedly positive, projecting continued expansion driven by a dynamic interplay of factors. The market is expected to be significantly propelled by ongoing technological advancements, leading to devices that are not only more efficient and user-friendly but also incorporate enhanced safety features. Shifting consumer preferences towards potentially less harmful alternatives to traditional smoking will continue to fuel demand. The inherent potential for innovative product development, especially in areas like advanced nicotine salts, complex flavor profiles, and sophisticated device functionalities, will keep the market vibrant. A projected increase in investment in research and development will be instrumental in the creation of demonstrably safer and more effective vaping products, addressing regulatory concerns and consumer anxieties. Furthermore, the market landscape will likely be shaped by strategic consolidations through strategic partnerships and acquisitions, fostering an environment of accelerated innovation and intensified competition, ultimately benefiting consumers with a wider array of choices and improved product offerings.

United States E-cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarettes

- 2.2. Manual E-cigarettes

-

3. Distribution Channel

- 3.1. Offline Retail

- 3.2. Online Retail

United States E-cigarettes Market Segmentation By Geography

- 1. United States

United States E-cigarettes Market Regional Market Share

Geographic Coverage of United States E-cigarettes Market

United States E-cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Increasing Health Concern Among Smoking Population Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States E-cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarettes

- 5.2.2. Manual E-cigarettes

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail

- 5.3.2. Online Retail

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BOTS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JWEI Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 British American Tobacco PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Philip Morris International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intelligent Cigarettes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nicoventures Trading Limited*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Japan Tobacco Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NJOY Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Imperial Brands PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Juul Labs Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BOTS Inc

List of Figures

- Figure 1: United States E-cigarettes Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States E-cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 3: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States E-cigarettes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 7: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States E-cigarettes Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States E-cigarettes Market?

The projected CAGR is approximately 13.72%.

2. Which companies are prominent players in the United States E-cigarettes Market?

Key companies in the market include BOTS Inc, JWEI Group, British American Tobacco PLC, Philip Morris International Inc, Intelligent Cigarettes, Nicoventures Trading Limited*List Not Exhaustive, Japan Tobacco Inc, NJOY Inc, Imperial Brands PLC, Juul Labs Inc.

3. What are the main segments of the United States E-cigarettes Market?

The market segments include Product Type, Battery Mode, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Increasing Health Concern Among Smoking Population Drives the Market.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: A patent for composite tobacco-containing materials from R.J. Reynolds Tobacco Company shows that tobacco can be consumed in a reportedly "smokeless" form. The use of smokeless tobacco products often involves placing processed tobacco or a formulation containing tobacco in the user's mouth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States E-cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States E-cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States E-cigarettes Market?

To stay informed about further developments, trends, and reports in the United States E-cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence