Key Insights

The United States heparin market, a significant segment of the global anticoagulant market, is projected to experience robust growth over the forecast period (2025-2033). Driven by an aging population, increasing prevalence of cardiovascular diseases (including atrial fibrillation, heart attacks, and strokes), and a rise in deep vein thrombosis (DVT) cases, the demand for heparin products is expected to remain strong. The market is segmented by product type (unfractionated heparin, low molecular weight heparin (LMWH), and ultra-low molecular weight heparin (ULMWH)), source (bovine and porcine), and application. While unfractionated heparin historically dominated the market, the shift towards LMWH and ULMWH is evident due to their improved safety profiles and ease of administration. This trend is expected to continue, albeit at a moderated pace, given the established use of unfractionated heparin in specific clinical settings. Furthermore, ongoing research and development efforts focused on improving the efficacy and safety of heparin products, as well as the development of biosimilars, will further shape the market landscape. Competition among major pharmaceutical companies, including those listed such as Bayer, Merck, and Sanofi, will remain intense, with a focus on innovation and market penetration.

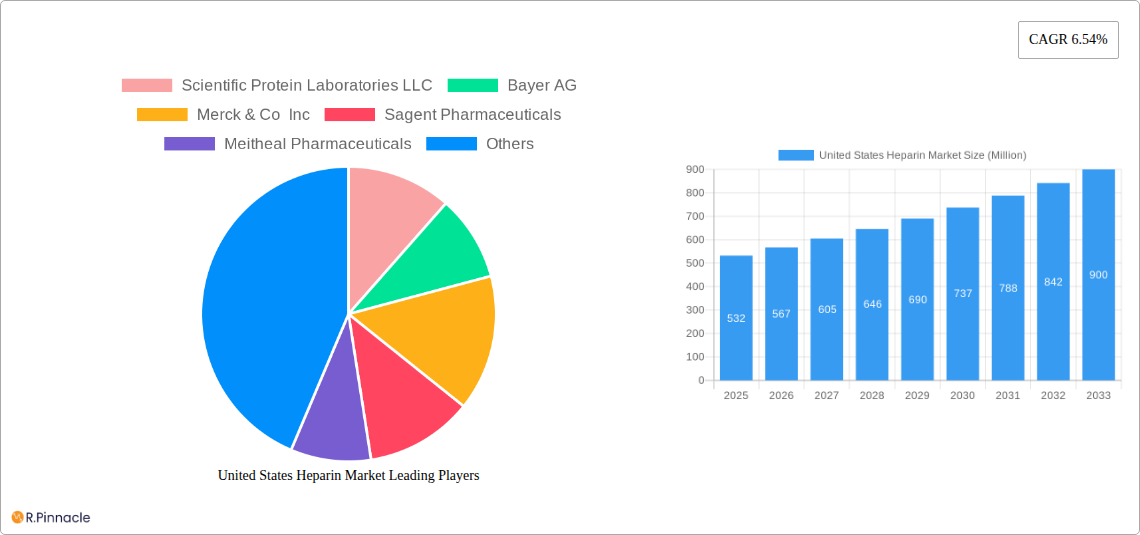

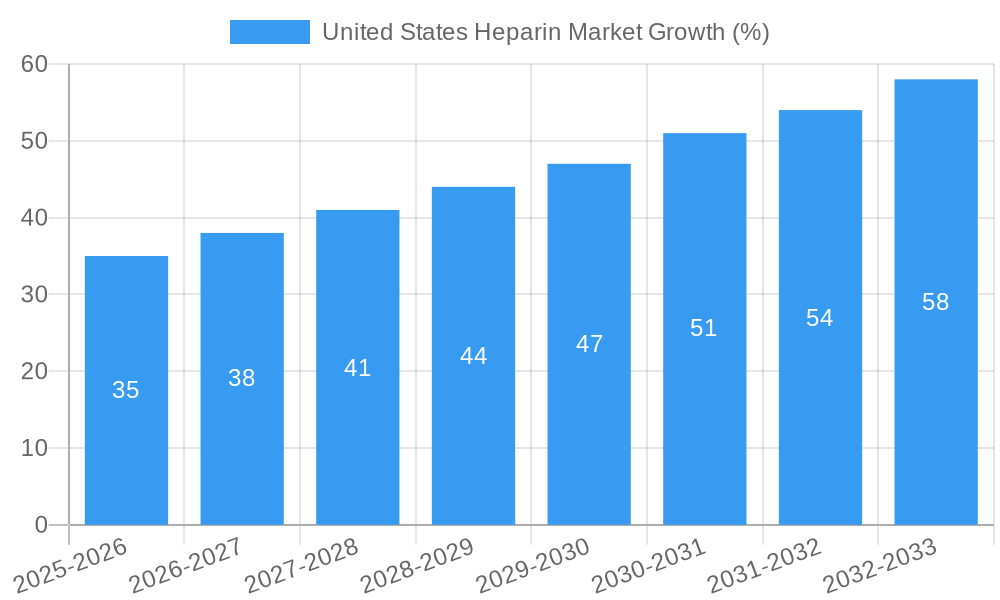

The substantial market size of the US heparin market contributes significantly to the overall global revenue. Considering the provided global market size of $1.33 billion in 2025 and a CAGR of 6.54%, and acknowledging the US's prominent role in global healthcare spending, a reasonable estimate for the US market share in 2025 would be around 40%, resulting in a US market value of approximately $532 million. Applying the same CAGR, we can project future market sizes. The presence of established players alongside emerging companies indicates a dynamic market with opportunities for both consolidation and innovation. Regulatory approvals and pricing pressures will continue to be important factors influencing market growth. However, potential supply chain disruptions and fluctuations in raw material costs present challenges to consistent growth.

United States Heparin Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United States Heparin market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for navigating this crucial sector of the healthcare industry.

Keywords: United States Heparin Market, Heparin Market, Unfractionated Heparin, Low Molecular Weight Heparin (LMWH), Ultra-Low Molecular Weight Heparin (ULMWH), Bovine Heparin, Porcine Heparin, Atrial Fibrillation, Stroke, Deep Vein Thrombosis (DVT), Anticoagulant, Pharmaceutical Market, Market Analysis, Market Research, Market Forecast, Market Size, CAGR, Scientific Protein Laboratories LLC, Bayer AG, Merck & Co Inc, Sagent Pharmaceuticals, Meitheal Pharmaceuticals, B Braun Melsungen AG, Baxter International Inc.

United States Heparin Market Structure & Innovation Trends

The United States Heparin market exhibits a moderately consolidated structure with several key players holding significant market share. Competition is intense, driven by continuous innovation in product formulation, delivery systems, and therapeutic applications. The market is influenced by stringent regulatory frameworks from the FDA, necessitating significant investment in research and development. Product substitution is limited due to the specialized nature of heparin, although newer anticoagulants represent a competitive threat. The end-user demographic is largely comprised of hospitals, clinics, and healthcare providers treating cardiovascular diseases and thrombosis. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share (2024).

- Innovation Drivers: Development of novel formulations (e.g., ULMWH), improved delivery systems (pre-filled syringes), and expansion into new therapeutic areas.

- Regulatory Framework: Stringent FDA regulations drive high R&D investment and stringent quality control.

- Product Substitutes: Limited direct substitution, but competition from newer oral anticoagulants like rivaroxaban.

- M&A Activity: Moderate activity with deal values ranging from xx Million to xx Million (2019-2024).

United States Heparin Market Dynamics & Trends

The United States Heparin market is experiencing steady growth, driven primarily by the increasing prevalence of cardiovascular diseases and thrombotic disorders. Technological advancements leading to safer and more effective heparin products, along with a growing elderly population with higher susceptibility to such conditions, contribute to market expansion. Consumer preferences are shifting towards more convenient and safer administration methods, fueling demand for pre-filled syringes and other advanced delivery systems. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants with innovative products.

The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration of ULMWH is increasing due to its improved safety profile. The market is also influenced by pricing pressures and evolving reimbursement policies.

Dominant Regions & Segments in United States Heparin Market

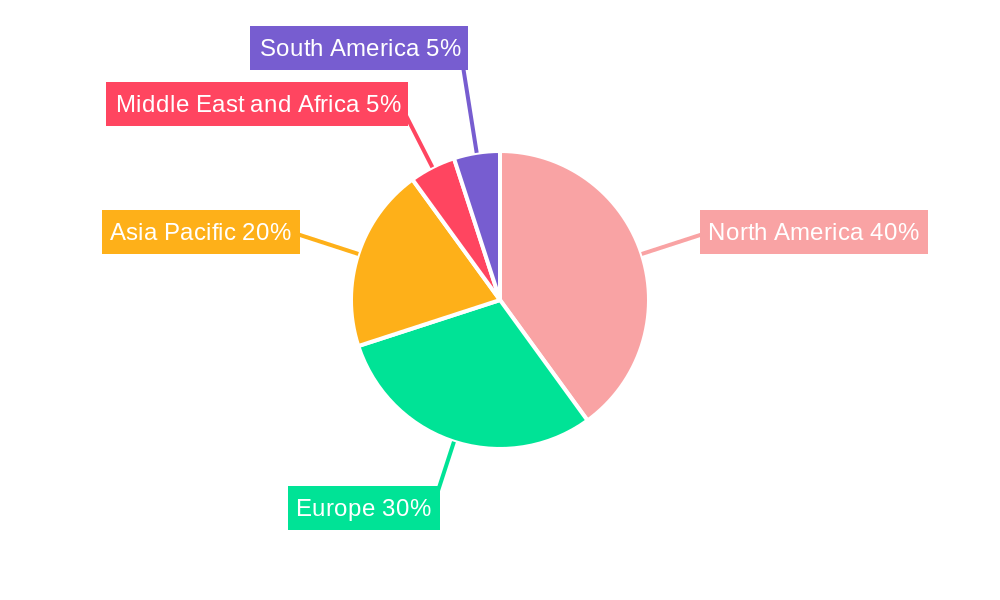

The United States Heparin market shows strong regional variation, with xx being the leading region due to factors such as high prevalence of cardiovascular diseases and advanced healthcare infrastructure.

By Product:

- Low Molecular Weight Heparin (LMWH): Dominates the market due to improved efficacy and reduced risk of bleeding compared to unfractionated heparin.

- Unfractionated Heparin: Retains market share in specific applications where LMWH is not suitable.

- Ultra-Low Molecular Weight Heparin (ULMWH): Shows significant growth potential driven by improved safety profiles and convenience.

By Source:

- Porcine: Remains the dominant source due to its consistent quality and availability.

- Bovine: Holds a smaller market share due to concerns about immunogenicity.

By Application:

Deep Vein Thrombosis (DVT): Represents a significant portion of the market driven by the high incidence of DVT.

Atrial Fibrillation and Heart Attack: Growing segment due to increased prevalence of these conditions.

Stroke: A substantial market segment considering the prevalence of stroke.

Key Drivers (Regional): High prevalence of cardiovascular diseases, robust healthcare infrastructure, and high healthcare expenditure.

United States Heparin Market Product Innovations

Recent product innovations include the development of pre-filled syringes with safety needles, enhancing ease of use and reducing needle-stick injuries. Improved formulations with enhanced purity and reduced immunogenicity are also gaining traction. The market is witnessing a trend toward targeted drug delivery and personalized medicine approaches to heparin therapy. These innovations are improving patient outcomes and expanding the market potential.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the United States Heparin market, segmented by product (Unfractionated Heparin, LMWH, ULMWH), source (Bovine, Porcine), and application (Atrial Fibrillation and Heart Attack, Stroke, DVT, Others). Each segment is thoroughly analyzed, providing detailed growth projections, market size estimates, and competitive landscape assessments for the forecast period (2025-2033).

Key Drivers of United States Heparin Market Growth

The growth of the United States Heparin market is driven by the increasing prevalence of cardiovascular diseases, the rising geriatric population, and the growing adoption of advanced medical technologies. Furthermore, government initiatives promoting preventative healthcare and improvements in healthcare infrastructure contribute to market expansion. The development and approval of innovative heparin formulations also fuels market growth.

Challenges in the United States Heparin Market Sector

The United States Heparin market faces challenges such as stringent regulatory requirements, price competition from generic drugs, and the potential for supply chain disruptions. Furthermore, the emergence of new anticoagulant therapies poses a competitive challenge, demanding ongoing innovation to retain market share. Stringent quality control measures significantly affect production costs.

Emerging Opportunities in United States Heparin Market

Significant opportunities exist in developing novel heparin formulations with enhanced efficacy and safety profiles. Expansion into new therapeutic areas and geographic markets also offers substantial potential. The growing adoption of personalized medicine and targeted drug delivery systems presents opportunities for market expansion.

Leading Players in the United States Heparin Market

- Scientific Protein Laboratories LLC

- Bayer AG

- Merck & Co Inc

- Sagent Pharmaceuticals

- Meitheal Pharmaceuticals

- Nanjing King-Friend Biochemical Pharmaceutical

- Shenzhen Hepalink

- B Braun Melsungen AG

- Baxter International Inc

- Leo Pharma A/S

- Amphastar Pharmaceuticals

- Mylan N V

- Sanofi S A

- Pfizer Inc

Key Developments in United States Heparin Market Industry

- June 2021: Bayer's partner, Janssen Research & Development, LLC, submitted an NDA to the USFDA for Xarelto (rivaroxaban) in pediatric patients for VTE treatment.

- April 2021: B. Braun Medical Inc. launched its Heparin Sodium Injection, USP, a pre-filled syringe with an attached safety needle.

Future Outlook for United States Heparin Market

The United States Heparin market is poised for continued growth, driven by advancements in formulation and delivery, coupled with the increasing prevalence of cardiovascular diseases. Strategic partnerships, investments in R&D, and expansion into emerging therapeutic applications will further shape the market's future landscape. The development of biosimilars and innovative drug delivery systems will further transform the market.

United States Heparin Market Segmentation

-

1. Product

- 1.1. Unfractionated Heparin

- 1.2. Low Molecular Weight Heparin (LMWH)

- 1.3. Ultra-Low Molecular Weight Heparin (ULMWH)

-

2. Source

- 2.1. Bovine

- 2.2. Porcine

-

3. Application

- 3.1. Atrial Fibrillation and Heart Attack

- 3.2. Stroke

- 3.3. Deep Vein Thrombosis (DVT)

- 3.4. Others

United States Heparin Market Segmentation By Geography

- 1. United States

United States Heparin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Chronic Diseases; Rise in Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Side Effects of Heparin

- 3.4. Market Trends

- 3.4.1. Deep Vein Thrombosis (DVT) is expected to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Heparin Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Unfractionated Heparin

- 5.1.2. Low Molecular Weight Heparin (LMWH)

- 5.1.3. Ultra-Low Molecular Weight Heparin (ULMWH)

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Bovine

- 5.2.2. Porcine

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Atrial Fibrillation and Heart Attack

- 5.3.2. Stroke

- 5.3.3. Deep Vein Thrombosis (DVT)

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America United States Heparin Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe United States Heparin Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Italy

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific United States Heparin Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 South Korea

- 8.1.6 Rest of Asia Pacific

- 9. Middle East and Africa United States Heparin Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 GCC

- 9.1.2 South Africa

- 9.1.3 Rest of Middle East and Africa

- 10. South America United States Heparin Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Brazil

- 10.1.2 Argentina

- 10.1.3 Rest of South America

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Scientific Protein Laboratories LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sagent Pharmaceuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Meitheal Pharmaceuticals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nanjing King-Friend Biochemical Pharmaceutical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shenzhen Hepalink*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baxter International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Leo Pharma A/S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amphastar Pharmaceuticals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mylan N V

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sanofi S A

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pfizer Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Scientific Protein Laboratories LLC

List of Figures

- Figure 1: United States Heparin Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Heparin Market Share (%) by Company 2024

List of Tables

- Table 1: United States Heparin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Heparin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: United States Heparin Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: United States Heparin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: United States Heparin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Heparin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Heparin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Heparin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States Heparin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States Heparin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America United States Heparin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United States Heparin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 33: United States Heparin Market Revenue Million Forecast, by Source 2019 & 2032

- Table 34: United States Heparin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: United States Heparin Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Heparin Market?

The projected CAGR is approximately 6.54%.

2. Which companies are prominent players in the United States Heparin Market?

Key companies in the market include Scientific Protein Laboratories LLC, Bayer AG, Merck & Co Inc, Sagent Pharmaceuticals, Meitheal Pharmaceuticals, Nanjing King-Friend Biochemical Pharmaceutical, Shenzhen Hepalink*List Not Exhaustive, B Braun Melsungen AG, Baxter International Inc, Leo Pharma A/S, Amphastar Pharmaceuticals, Mylan N V, Sanofi S A, Pfizer Inc.

3. What are the main segments of the United States Heparin Market?

The market segments include Product, Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Chronic Diseases; Rise in Geriatric Population.

6. What are the notable trends driving market growth?

Deep Vein Thrombosis (DVT) is expected to dominate the market.

7. Are there any restraints impacting market growth?

Side Effects of Heparin.

8. Can you provide examples of recent developments in the market?

In June 2021, Bayers development partner, Janssen Research & Development, LLC has submitted a New Drug Application (NDA) to the United States Food and Drug Administration (USFDA) for the use of the oral anticoagulant Xarelto (rivaroxaban) in pediatric patients for the treatment of venous thromboembolism (VTE) and reduction in the risk of recurrent VTE in pediatric patients from birth to less than 18 years of age after at least 5 days of initial parenteral anticoagulant treatment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Heparin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Heparin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Heparin Market?

To stay informed about further developments, trends, and reports in the United States Heparin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence