Key Insights

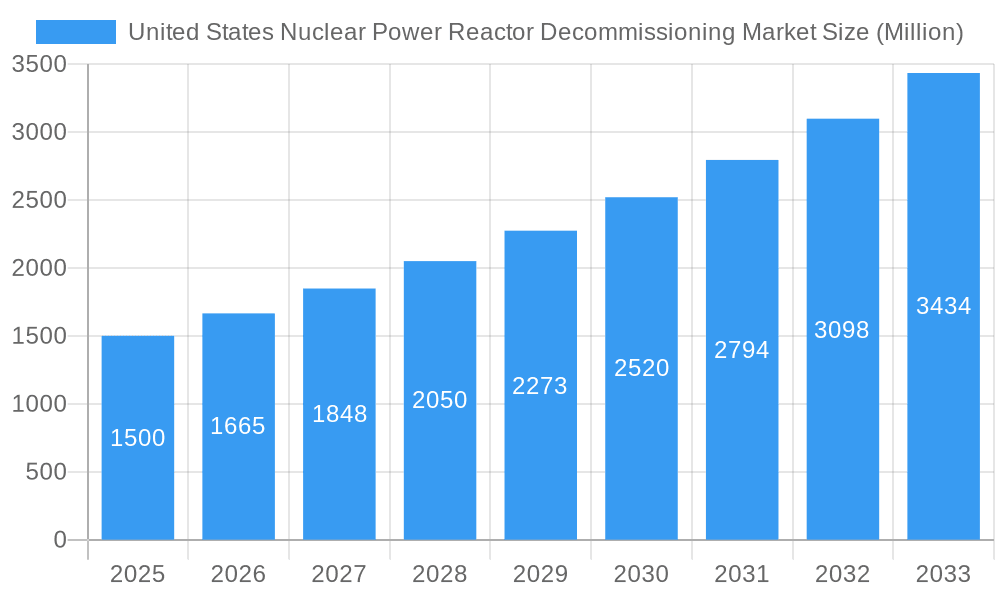

The United States Nuclear Power Reactor Decommissioning market is poised for significant expansion. Driven by an aging fleet of nuclear power plants and increasing regulatory mandates for safe and efficient decommissioning, the market is projected to reach $12.26 billion by 2025. This market is expected to experience a Compound Annual Growth Rate (CAGR) of 12.07% from 2025 to 2033. Key growth catalysts include the large number of reactors approaching end-of-life, stringent environmental regulations, and the adoption of advanced decommissioning technologies and waste management strategies. Competitive dynamics among established and emerging service providers further stimulate market growth. Despite challenges related to high costs and radioactive waste management, the market outlook remains highly positive.

United States Nuclear Power Reactor Decommissioning Market Market Size (In Billion)

Market segmentation highlights the dominance of Pressurized Water Reactors (PWRs) in decommissioning projects, reflecting their widespread deployment. Commercial power reactors represent the primary application segment. The capacity segment is characterized by a substantial share in the 100-1000 MW range, aligning with typical reactor sizes. Regional analysis confirms the United States as the primary market for these activities. Future growth will be propelled by technological innovation, evolving regulatory landscapes, and the successful execution of current and upcoming decommissioning initiatives.

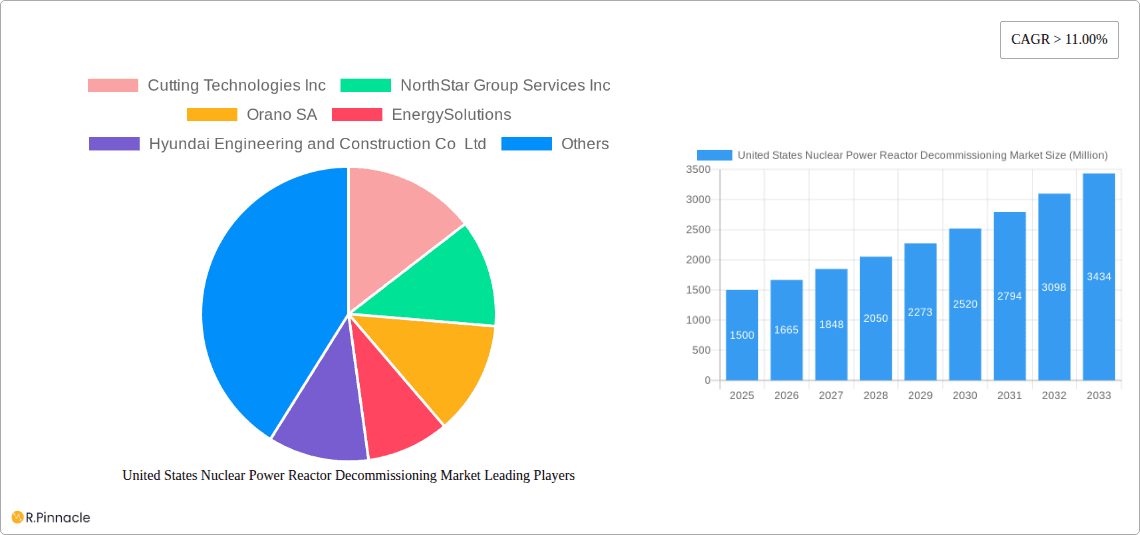

United States Nuclear Power Reactor Decommissioning Market Company Market Share

United States Nuclear Power Reactor Decommissioning Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States nuclear power reactor decommissioning market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, and future growth prospects. The market is segmented by reactor type (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas-cooled Reactor, Liquid Metal Fast Breeder Reactor, Other Reactor Types), application (Commercial Power Reactor, Prototype Power Reactor, Research Reactor), and capacity (Below 100 MW, 100-1000 MW, Above 1000 MW). The report’s findings are supported by rigorous data analysis and projections, providing a clear understanding of this vital and evolving sector. The total market size is projected to reach xx Million by 2033.

United States Nuclear Power Reactor Decommissioning Market Structure & Innovation Trends

The US nuclear power reactor decommissioning market is characterized by a moderately concentrated structure, with several major players commanding significant market share. While precise market share figures for individual companies remain proprietary, key players like Holtec International, NorthStar Group Services Inc, Orano SA, EnergySolutions, and Hyundai Engineering and Construction Co Ltd hold prominent positions. Market concentration is influenced by factors such as specialized expertise, regulatory compliance, and the high capital investment required for decommissioning projects. Furthermore, the market witnesses considerable M&A activity, with deal values varying significantly depending on the scale and complexity of the acquired assets or projects. Recent deals such as the Hyundai Engineering & Construction and Holtec partnership for the Indian Point decommissioning project illustrate this trend. The market is driven by innovations in decommissioning technologies, including advancements in robotics, remote handling systems, and waste management solutions. Regulatory frameworks, while stringent, are evolving to encourage innovation and streamline the decommissioning process. Product substitutes are limited due to the highly specialized nature of nuclear decommissioning, and end-user demographics comprise primarily nuclear power plant operators and government agencies.

United States Nuclear Power Reactor Decommissioning Market Market Dynamics & Trends

The US nuclear power reactor decommissioning market is experiencing robust growth, driven by the aging nuclear power plant fleet and the mandatory decommissioning requirements following plant closures. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements offering more efficient and cost-effective decommissioning methods. Technological disruptions, such as the development of advanced robotics and AI-driven automation, are streamlining processes and reducing decommissioning timelines. Consumer preferences, predominantly among plant operators and regulatory bodies, are shifting toward sustainable and environmentally responsible decommissioning practices. Competitive dynamics are intense, with companies vying for market share through technological innovation, cost optimization, and strategic partnerships. Market penetration of advanced decommissioning technologies is gradually increasing, although the adoption rate is influenced by factors such as cost considerations and regulatory approvals.

Dominant Regions & Segments in United States Nuclear Power Reactor Decommissioning Market

-

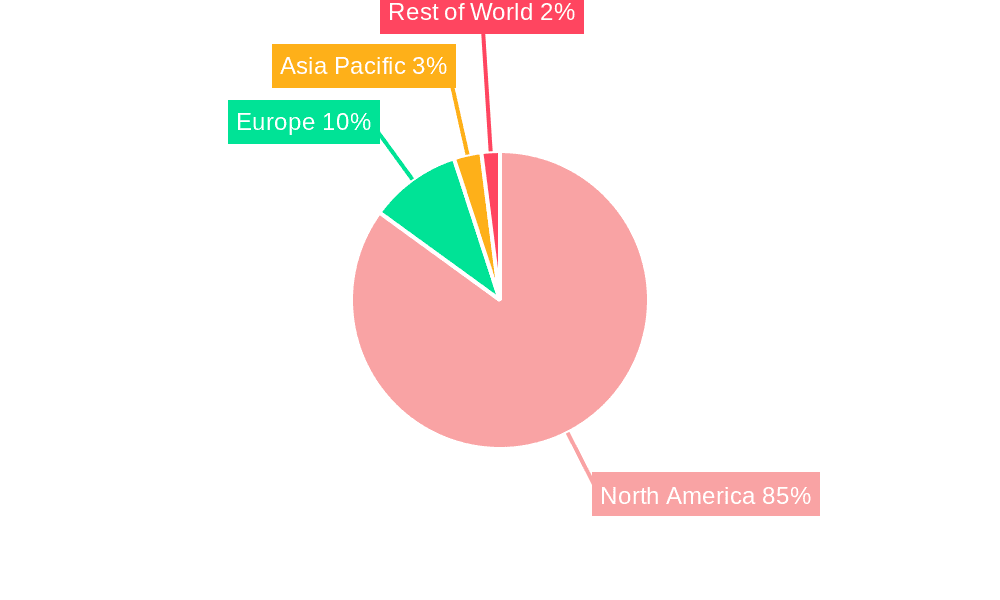

Dominant Region: The Northeast region continues to lead the United States nuclear power reactor decommissioning market. This dominance is attributed to the presence of a significant number of older nuclear power plants that have reached or are approaching the end of their operational lifecycles. As the nation's nuclear fleet ages, other regions are increasingly anticipating substantial growth in decommissioning activities as more facilities become eligible for retirement and subsequent dismantling.

-

Dominant Reactor Type: Pressurized Water Reactors (PWRs) represent the largest and most dominant segment within the decommissioning market. This prevalence directly reflects the historical construction and operational landscape of the US nuclear power industry, where PWRs have consistently comprised the majority of the operating fleet.

-

Dominant Application: The decommissioning of Commercial Power Reactors stands as the largest and most significant segment. This is a direct consequence of the substantial number of commercial nuclear facilities that are currently undergoing or are slated for decommissioning, underscoring their central role in the overall market dynamics.

-

Dominant Capacity: The market share is currently largest within the 100-1000 MW capacity range. This segment aligns with the typical operational size of many commercial nuclear power plants in the United States, indicating that reactors of this specific output capacity are the most frequently encountered for decommissioning projects.

Key Drivers:

-

Economic Policies & Regulatory Frameworks: Supportive government incentives, evolving decommissioning regulations, and clear policy directives play a crucial role in fostering responsible and timely plant closures and dismantling processes.

-

Infrastructure Development: The continuous development and expansion of specialized infrastructure for the safe interim storage of spent nuclear fuel and the long-term management of radioactive waste are critical enablers of efficient decommissioning.

-

Technological Advancements: Innovations in areas such as advanced robotics, remote handling technologies, sophisticated decontamination methods, and efficient waste processing and characterization are significantly improving the safety, speed, and cost-effectiveness of decommissioning operations.

-

Aging Nuclear Fleet: The inherent aging of the existing US nuclear power plant fleet, with a growing number of reactors reaching their planned operational lifespans, serves as a primary and persistent driver for increased decommissioning activities.

The current landscape of dominant segments and regions is dynamic and subject to change. As the decommissioning lifecycle of the US nuclear fleet progresses, shifts in market leadership are anticipated. Key factors influencing these future dynamics include evolving regulatory requirements, breakthroughs in decommissioning technologies, strategic decisions by plant operators, and the overall pace of nuclear plant retirements across the country.

United States Nuclear Power Reactor Decommissioning Market Product Innovations

Recent innovations focus on enhancing safety, efficiency, and cost-effectiveness of decommissioning. This includes advanced robotics for handling radioactive materials in hazardous environments, improved waste processing technologies minimizing waste volume, and the development of innovative spent fuel storage solutions. These innovations are enhancing the competitiveness of firms in the market and reducing the overall time and cost associated with decommissioning. The market is seeing a trend towards modular and standardized decommissioning solutions to reduce project complexity and costs.

Report Scope & Segmentation Analysis

This comprehensive report meticulously analyzes the United States nuclear power reactor decommissioning market by dissecting it into various crucial segments. This granular approach provides deep insights into the specific characteristics, challenges, and opportunities within each area of the market.

Reactor Type: The market is segmented based on reactor types, encompassing Pressurized Water Reactors (PWR), Pressurized Heavy Water Reactors (PHWR), Boiling Water Reactors (BWR), High-Temperature Gas-Cooled Reactors (HTGR), Liquid Metal Fast Breeder Reactors (LMFBR), and other less prevalent types. The growth trajectory and market share of each reactor type segment are intrinsically linked to the number of operational plants of that specific design nearing decommissioning and the unique technical complexities and regulatory considerations associated with their dismantling.

Application: The decommissioning market is further segmented by the application of the reactors, including commercial power reactors, prototype reactors, and research reactors. Commercial reactors currently constitute the most substantial segment due to their sheer volume and widespread deployment across the nation.

Capacity: The market segmentation by reactor capacity includes categories such as below 100 MW, 100-1000 MW, and above 1000 MW. The 100-1000 MW segment is presently dominant, reflecting the typical operational output of a significant portion of the commercial nuclear reactor fleet in the US.

Within each of these segments, the report provides in-depth analysis of market size, projected growth rates, key influencing factors, and the competitive landscape, offering a holistic view of the decommissioning market.

Key Drivers of United States Nuclear Power Reactor Decommissioning Market Growth

The market's growth is fueled by several key factors. The aging US nuclear power plant fleet necessitates a large number of decommissioning projects in the coming years. Government regulations mandating safe and efficient decommissioning practices are driving market expansion. Furthermore, technological advancements in robotics, automation, and waste management are improving the efficiency and cost-effectiveness of decommissioning processes, stimulating further market growth. Finally, increasing public awareness of nuclear safety and environmental responsibility contributes to the market's expansion.

Challenges in the United States Nuclear Power Reactor Decommissioning Market Sector

The US nuclear power reactor decommissioning market faces significant challenges. Stringent regulatory compliance requirements and the high cost of decommissioning projects pose major hurdles. Supply chain issues, particularly concerning specialized equipment and materials, can lead to project delays and cost overruns. Furthermore, intense competition among decommissioning companies can impact profitability margins. The long timeframe for project completion also presents financial and logistical challenges.

Emerging Opportunities in United States Nuclear Power Reactor Decommissioning Market

The United States nuclear power reactor decommissioning market is a fertile ground for emerging opportunities, driven by innovation and evolving industry needs. The development and widespread adoption of cutting-edge technologies, such as AI-powered automation and advanced robotics, present significant opportunities to enhance operational efficiency, minimize human exposure to radiation, and ultimately reduce decommissioning costs. Furthermore, the increasing global emphasis on safe and sustainable nuclear decommissioning practices is opening doors for companies specializing in environmentally responsible solutions, including advanced waste management and remediation techniques. The inherent challenges associated with decommissioning older reactors, particularly those with legacy waste, are also spurring innovation, creating unique opportunities for the development and deployment of novel technologies and specialized processes designed to tackle these complex issues effectively.

Leading Players in the United States Nuclear Power Reactor Decommissioning Market Market

- Cutting Technologies Inc

- NorthStar Group Services Inc

- Orano SA

- EnergySolutions

- Hyundai Engineering and Construction Co Ltd

- Holtec International

- AECOM

- Manafort Brothers Incorporated

Key Developments in United States Nuclear Power Reactor Decommissioning Market Industry

- May 2022: Entergy Corporation initiated the decommissioning of its Palisades nuclear plant (800 MW), highlighting the ongoing decommissioning activities in the market.

- March 2022: Hyundai Engineering & Construction and Holtec's collaboration on the Indian Point Energy Center decommissioning project showcases strategic partnerships driving market growth and innovation.

Future Outlook for United States Nuclear Power Reactor Decommissioning Market Market

The future of the US nuclear power reactor decommissioning market looks promising, driven by the continued aging of the nuclear power plant fleet and the growing demand for safe and efficient decommissioning solutions. Technological advancements will continue to drive cost reductions and improved efficiency. Strategic partnerships and M&A activities will shape the market landscape. The long-term growth prospects are strong, presenting significant opportunities for companies with innovative technologies and a strong understanding of the regulatory environment.

United States Nuclear Power Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. High-temperature Gas-cooled Reactor

- 1.5. Liquid Metal Fast Breeder Reactor

- 1.6. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. 100-1000 MW

- 3.3. Above 1000 MW

United States Nuclear Power Reactor Decommissioning Market Segmentation By Geography

- 1. United States

United States Nuclear Power Reactor Decommissioning Market Regional Market Share

Geographic Coverage of United States Nuclear Power Reactor Decommissioning Market

United States Nuclear Power Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Electricity Demand from Manufacturing

- 3.2.2 Construction

- 3.2.3 and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing Out of Coal-based Power Plants

- 3.4. Market Trends

- 3.4.1. Commercial Power Reactor Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. High-temperature Gas-cooled Reactor

- 5.1.5. Liquid Metal Fast Breeder Reactor

- 5.1.6. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. 100-1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cutting Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NorthStar Group Services Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orano SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergySolutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Engineering and Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Holtec

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Holtec International *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AECOM

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Manafort Brothers Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cutting Technologies Inc

List of Figures

- Figure 1: United States Nuclear Power Reactor Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Nuclear Power Reactor Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: United States Nuclear Power Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Nuclear Power Reactor Decommissioning Market?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the United States Nuclear Power Reactor Decommissioning Market?

Key companies in the market include Cutting Technologies Inc, NorthStar Group Services Inc, Orano SA, EnergySolutions, Hyundai Engineering and Construction Co Ltd, Holtec, Holtec International *List Not Exhaustive, AECOM, Manafort Brothers Incorporated.

3. What are the main segments of the United States Nuclear Power Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.26 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand from Manufacturing. Construction. and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation.

6. What are the notable trends driving market growth?

Commercial Power Reactor Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Phasing Out of Coal-based Power Plants.

8. Can you provide examples of recent developments in the market?

May 2022: Entergy Corporation shut down its Palisades nuclear plant on Lake Michigan. The nuclear power plant had an 800 MW power generation capacity. The fuel was removed from the reactor's vessel and placed in the spent fuel pool to cool. After the cooling process, the fuel will be transported to the secured independent spent fuel storage facility on station property. Furthermore, the company aims to complete the decommissioning of the nuclear plant by 2041.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Nuclear Power Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Nuclear Power Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Nuclear Power Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the United States Nuclear Power Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence