Key Insights

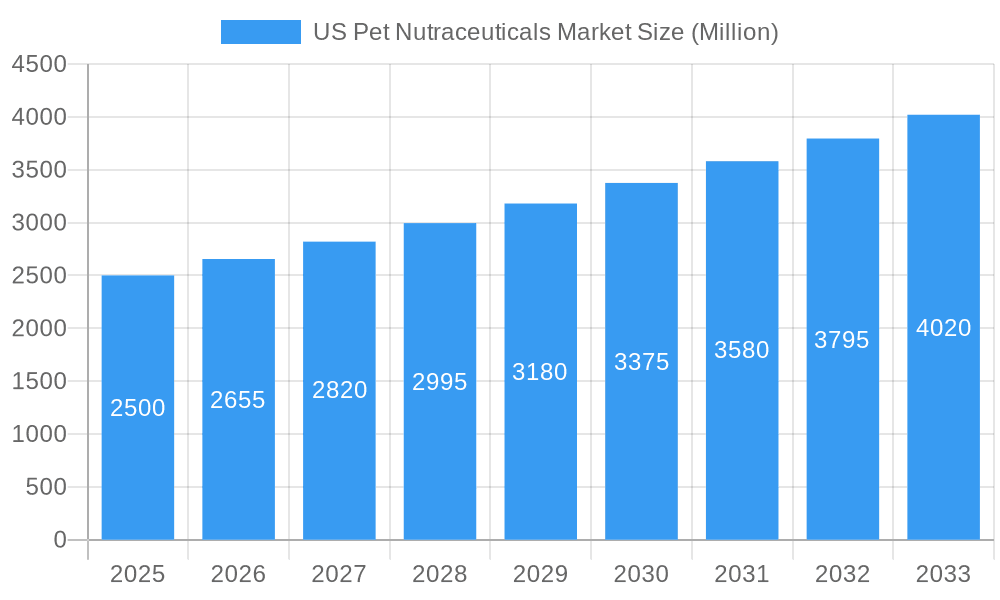

The U.S. pet nutraceuticals market is exhibiting substantial growth, propelled by escalating pet ownership, increased pet humanization, and heightened awareness of preventative pet healthcare. The market, valued at $2.08 billion in 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.86% from 2025 to 2033. Key growth drivers include rising disposable incomes enabling greater investment in premium pet products, the expanding reach of online retail offering convenient access to diverse nutraceutical options, and the growing demand for supplementary health solutions to address prevalent pet chronic conditions such as arthritis and allergies. The availability of specialized nutraceuticals tailored for specific breeds and health concerns further stimulates market expansion.

US Pet Nutraceuticals Market Market Size (In Billion)

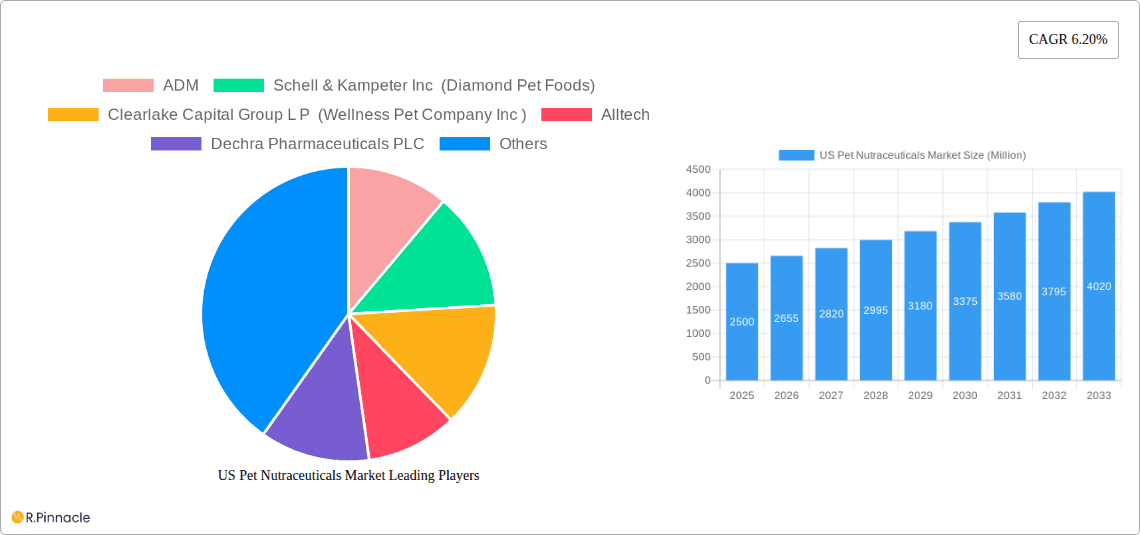

The market is segmented by product type (Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, Other Nutraceuticals), pet type (Cats, Dogs, Other Pets), and distribution channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). Competitive forces are intense, with leading companies such as ADM, Schell & Kampeter Inc, Clearlake Capital Group, and Alltech actively pursuing product innovation and portfolio expansion to meet evolving consumer needs.

US Pet Nutraceuticals Market Company Market Share

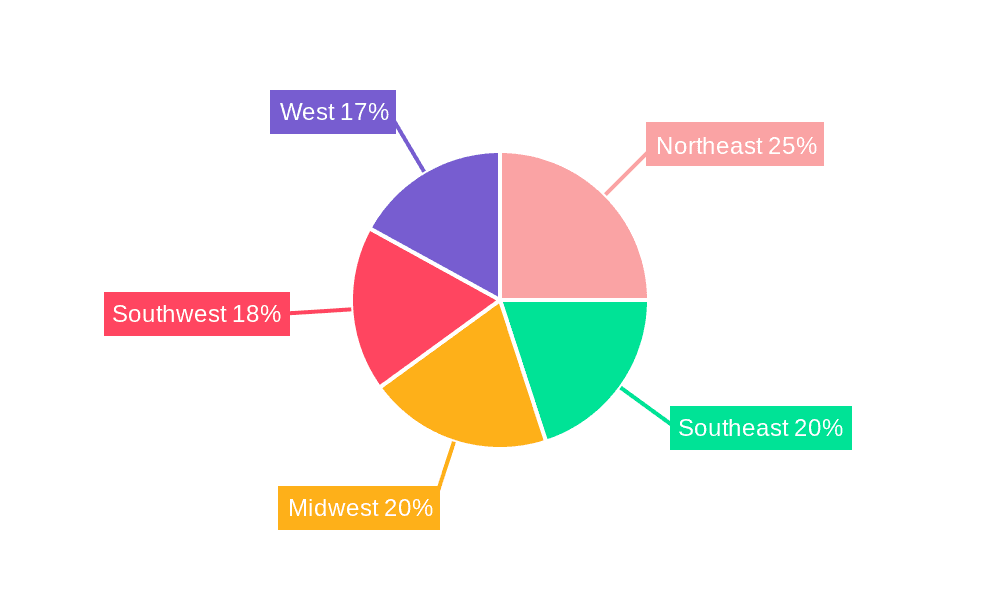

Regional market dynamics within the U.S. are varied, with areas like the Northeast and West potentially demonstrating accelerated growth due to higher pet ownership rates and greater consumer focus on pet well-being. The market's future trajectory will be influenced by continued pet humanization trends, ongoing product advancements, evolving regulatory landscapes, and potential economic shifts. Nevertheless, the underlying drivers of increased pet adoption and a sustained desire for enhanced pet health suggest a positive long-term growth outlook for the U.S. pet nutraceuticals market.

This comprehensive analysis delves into the U.S. Pet Nutraceuticals Market, providing critical insights for industry stakeholders, investors, and strategic planners. Spanning the period from 2019 to 2033, with a 2025 base year and a 2025-2033 forecast period, this report details market structure, dynamics, key participants, and future projections. The market is projected to reach significant valuation by 2033, demonstrating a robust CAGR during the forecast period.

US Pet Nutraceuticals Market Market Structure & Innovation Trends

The US pet nutraceuticals market is characterized by a dynamic and evolving competitive landscape. While dominated by a few key players such as ADM, Mars Incorporated, and Nestle (Purina), who hold substantial market share, the market also provides fertile ground for agile, specialized companies. These smaller entities are effectively leveraging innovation and a focus on niche offerings to carve out significant market presence. The consolidated market share of the top 5 players is estimated at approximately xx%.

Market Concentration: The industry presents a hybrid structure, blending the extensive reach of large multinational corporations with the focused agility of smaller, specialized businesses. This dynamic fosters intense competition while simultaneously creating ample opportunities for niche players to identify and capitalize on specific market needs and unmet demands.

Innovation Drivers: The primary catalysts for innovation stem from the accelerating trend of pet humanization, a profound shift where pets are increasingly viewed as integral family members. Coupled with this is a growing consumer awareness regarding pet health and wellness, driving demand for advanced nutritional solutions. Furthermore, ongoing advancements in veterinary nutrition science are enabling the development of sophisticated nutraceuticals precisely engineered to address a wide spectrum of pet health concerns, from joint health and digestive issues to immune support and cognitive function.

Regulatory Frameworks: Navigating the regulatory environment is paramount for success. The U.S. Food and Drug Administration (FDA) sets stringent regulations concerning pet food and supplements. Compliance with these guidelines, alongside a commitment to transparency in product development, ingredient sourcing, and marketing claims, is critical for building consumer trust and ensuring market acceptance.

Product Substitutes: While traditional, complete pet foods remain a primary source of nutrition, they also represent a significant substitute for specialized nutraceuticals. However, the unique value proposition of nutraceuticals lies in their targeted health benefits, offering customized solutions beyond the scope of standard pet food formulations. This differentiation is key to their market penetration.

End-User Demographics: The core consumer base for pet nutraceuticals comprises dedicated pet owners who place a high priority on their pets' health and overall well-being. These consumers are typically willing to invest in premium products and specialized services that promise tangible health improvements for their companions. This demographic is expanding, fueled by increasing pet ownership rates and a growing segment of the population with higher disposable incomes.

M&A Activities: The US pet nutraceuticals market has been a hotbed for mergers and acquisitions in recent years. This activity underscores a trend towards industry consolidation and strategic expansion by both established players and private equity firms. Deal values have ranged significantly, from xx Million to xx Million, highlighting robust investor confidence and strategic interest in this growing sector. A notable example is Clearlake Capital Group's acquisition of Wellness Pet Company, signaling significant investment and consolidation within the premium pet food and supplement space.

US Pet Nutraceuticals Market Market Dynamics & Trends

The US pet nutraceuticals market is currently experiencing a period of robust and sustained growth. This expansion is propelled by a confluence of significant factors. The deeply ingrained trend of pet humanization, where pets are increasingly integrated into family structures, directly translates into a heightened demand for high-quality, specialized nutritional supplements. Simultaneously, a heightened consumer awareness regarding pet health and proactive wellness is further fueling this demand. Technological advancements, particularly in the rapidly evolving fields of probiotics, prebiotics, and personalized nutrition solutions, are not only driving product innovation but also widening the market's scope and reach. The current market penetration of pet nutraceuticals is estimated at approximately xx%, indicating substantial untapped potential and considerable room for future growth.

Market Growth Drivers: The primary engines of market growth include a steady increase in pet ownership across the nation, rising disposable incomes allowing for greater discretionary spending on pets, and a growing consumer inclination towards preventative pet healthcare strategies. The pervasive and influential trend of pet humanization continues to be a significant overarching factor driving consumer willingness to invest in their pets' health and well-being.

Technological Disruptions: Cutting-edge advancements in scientific disciplines such as genomics, microbiome research, and the development of precision nutrition are actively reshaping product formulations, efficacy expectations, and the overall consumer experience within the pet nutraceuticals sector. These innovations are paving the way for more targeted and effective health solutions.

Consumer Preferences: Modern pet owners are increasingly prioritizing products that align with their own values and lifestyle choices. This translates into a strong preference for pet nutraceuticals that are natural, organic, and sustainably sourced. Furthermore, a demand for transparency and traceability throughout the supply chain, from raw ingredient sourcing to final product, is gaining significant traction among consumers.

Competitive Dynamics: The market is characterized by a highly competitive environment, featuring a mix of well-established industry titans and dynamic, emerging companies. To achieve success and stand out in this crowded marketplace, companies must focus on distinct product differentiation, continuous innovation in formulation and delivery, and the implementation of compelling and effective marketing strategies that resonate with health-conscious pet owners.

Dominant Regions & Segments in US Pet Nutraceuticals Market

The US pet nutraceuticals market exhibits a geographically diverse landscape, with distinct regional variations in growth trajectories and segment dominance. Understanding these nuances is crucial for strategic market engagement.

Leading Regions: States such as California, Florida, and Texas stand out as leading regional markets. This prominence is attributed to a combination of factors, including high pet ownership rates, substantial consumer spending capacity dedicated to pet care, and the presence of robust pet healthcare infrastructure, including a high density of veterinary clinics and specialized pet service providers.

Dominant Segments:

- Sub-Product: Currently, Vitamins and Minerals, Probiotics, and Omega-3 Fatty Acids command the largest market shares. This dominance is driven by persistent and strong consumer demand for supplements that actively support critical health areas such as joint mobility, digestive health, immune system function, and overall vitality.

- Pets: Dogs and cats remain the primary focus for the vast majority of pet nutraceutical products. However, there is a noticeable and growing market segment for nutraceuticals catering to the specific health needs of other pet species, indicating a diversification of the market.

- Distribution Channel: Specialty pet stores and online retail platforms are experiencing significant and accelerated growth. This trend reflects the evolving purchasing behaviors of consumers, who increasingly value convenience, product variety, and expert advice often found in these channels. Supermarkets and hypermarkets also continue to represent a substantial and important sales channel for pet nutraceuticals.

Key Drivers (using bullet points):

- Economic Factors: An upward trend in disposable incomes across various demographics, coupled with a strong willingness among pet owners to allocate significant financial resources towards their pets' health and well-being.

- Infrastructure: The presence of well-established and accessible veterinary networks and a diverse pet retail infrastructure in key regions, facilitating easier access to products and professional guidance.

- Consumer Awareness: A marked increase in consumer education and awareness regarding the profound benefits of proactive pet nutrition and preventative healthcare strategies for enhancing pet longevity and quality of life.

US Pet Nutraceuticals Market Product Innovations

Recent product innovations focus on specialized formulations targeting specific health conditions, such as joint pain, allergies, and cognitive decline. The integration of advanced technologies, like precision nutrition based on genetic information, is driving the development of customized pet nutraceutical solutions, reflecting increasing demand for personalized pet care. Products emphasize natural ingredients, enhanced bioavailability, and improved palatability.

Report Scope & Segmentation Analysis

This comprehensive report delves into a detailed segmentation analysis of the US pet nutraceuticals market. It provides granular insights across a variety of critical parameters, enabling a deeper understanding of market dynamics and opportunities.

Sub-Product: The market is segmented by sub-product categories including Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, and Other Nutraceuticals. Detailed growth projections and current market sizes are meticulously provided for each segment, accompanied by a thorough competitive analysis to identify key players and their strategies within each niche.

Pets: Segmentation by pet type encompasses Dogs, Cats, and Other Pets. The growth trajectory for each of these segments is rigorously analyzed, taking into account underlying pet population demographics and evolving consumer spending patterns specific to each animal category.

Distribution Channel: An in-depth analysis covers distribution channels such as Convenience Stores, Online Channels, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels. Growth projections and market size estimations for each channel are presented, offering a clear view of how evolving consumer behavior and prevailing industry trends are shaping purchasing habits and channel preferences.

Key Drivers of US Pet Nutraceuticals Market Growth

Several factors drive the growth of the US pet nutraceuticals market. The increasing humanization of pets leads to increased spending on their health and well-being. Rising consumer awareness of the benefits of preventative healthcare and functional foods fuels demand for high-quality supplements. Technological advancements in areas such as personalized nutrition and microbiome research drive product innovation and market expansion. Finally, supportive regulatory frameworks enhance market stability and growth.

Challenges in the US Pet Nutraceuticals Market Sector

Despite the significant growth potential, the US pet nutraceuticals market faces several challenges. Stringent regulatory requirements for pet food and supplements can increase compliance costs and slow product launches. Supply chain disruptions can impact ingredient availability and pricing. Intense competition among numerous established and emerging players puts pressure on pricing and margins. Inconsistent consumer understanding of the benefits of nutraceuticals requires strong educational initiatives to enhance market penetration.

Emerging Opportunities in US Pet Nutraceuticals Market

The US pet nutraceuticals market presents several emerging opportunities. Growing interest in personalized pet nutrition and precision medicine using genomics creates opportunities for customized supplement formulations. The expansion of the market into new pet species beyond dogs and cats presents significant untapped potential. Innovative product formats and delivery systems, such as functional chews and topical applications, could boost market growth. Finally, sustainable sourcing of ingredients and eco-friendly packaging are growing areas of opportunity.

Leading Players in the US Pet Nutraceuticals Market Market

- ADM

- Schell & Kampeter Inc (Diamond Pet Foods)

- Clearlake Capital Group L P (Wellness Pet Company Inc )

- Alltech

- Dechra Pharmaceuticals PLC

- Vetoquinol

- Mars Incorporated

- Nestle (Purina)

- Nutramax Laboratories Inc

- Virba

Key Developments in US Pet Nutraceuticals Market Industry

- January 2023: Wellness Pet Company Inc. launched a new range of dog supplements focusing on daily health benefits. This reflects the growing consumer preference for proactive pet healthcare.

- January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes. This collaboration highlights the growing importance of precision medicine and personalized nutrition in pet care.

- February 2023: ADM opened a new probiotics and postbiotics production facility in Spain, expanding its capacity to supply these supplements globally, including North America. This expansion reflects growing consumer demand for gut health products.

Future Outlook for US Pet Nutraceuticals Market Market

The future outlook for the US pet nutraceuticals market is exceptionally positive and poised for continued expansion. This optimistic forecast is underpinned by several fundamental growth drivers. The ongoing increase in pet ownership, coupled with a sustained rise in disposable incomes, will inevitably translate into greater demand for premium pet products, including advanced nutraceuticals. Furthermore, significant advancements in pet nutrition science, particularly in the burgeoning fields of personalized nutrition and precision medicine for pets, are set to fuel continuous product innovation and further market expansion. The escalating consumer awareness regarding the profound benefits of proactive and preventative pet healthcare will act as a powerful catalyst, propelling market growth. Consequently, companies that prioritize product innovation, demonstrate a commitment to sustainable sourcing practices, and excel at building strong, trusted brands are exceptionally well-positioned to capitalize on the immense opportunities that lie ahead in this thriving market.

US Pet Nutraceuticals Market Segmentation

-

1. Sub Product

- 1.1. Milk Bioactives

- 1.2. Omega-3 Fatty Acids

- 1.3. Probiotics

- 1.4. Proteins and Peptides

- 1.5. Vitamins and Minerals

- 1.6. Other Nutraceuticals

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

US Pet Nutraceuticals Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Pet Nutraceuticals Market Regional Market Share

Geographic Coverage of US Pet Nutraceuticals Market

US Pet Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Pet Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Milk Bioactives

- 5.1.2. Omega-3 Fatty Acids

- 5.1.3. Probiotics

- 5.1.4. Proteins and Peptides

- 5.1.5. Vitamins and Minerals

- 5.1.6. Other Nutraceuticals

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. North America US Pet Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 6.1.1. Milk Bioactives

- 6.1.2. Omega-3 Fatty Acids

- 6.1.3. Probiotics

- 6.1.4. Proteins and Peptides

- 6.1.5. Vitamins and Minerals

- 6.1.6. Other Nutraceuticals

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 7. South America US Pet Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 7.1.1. Milk Bioactives

- 7.1.2. Omega-3 Fatty Acids

- 7.1.3. Probiotics

- 7.1.4. Proteins and Peptides

- 7.1.5. Vitamins and Minerals

- 7.1.6. Other Nutraceuticals

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 8. Europe US Pet Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 8.1.1. Milk Bioactives

- 8.1.2. Omega-3 Fatty Acids

- 8.1.3. Probiotics

- 8.1.4. Proteins and Peptides

- 8.1.5. Vitamins and Minerals

- 8.1.6. Other Nutraceuticals

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 9. Middle East & Africa US Pet Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 9.1.1. Milk Bioactives

- 9.1.2. Omega-3 Fatty Acids

- 9.1.3. Probiotics

- 9.1.4. Proteins and Peptides

- 9.1.5. Vitamins and Minerals

- 9.1.6. Other Nutraceuticals

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 10. Asia Pacific US Pet Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 10.1.1. Milk Bioactives

- 10.1.2. Omega-3 Fatty Acids

- 10.1.3. Probiotics

- 10.1.4. Proteins and Peptides

- 10.1.5. Vitamins and Minerals

- 10.1.6. Other Nutraceuticals

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schell & Kampeter Inc (Diamond Pet Foods)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alltech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dechra Pharmaceuticals PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vetoquinol

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mars Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nestle (Purina)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nutramax Laboratories Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virba

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global US Pet Nutraceuticals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Pet Nutraceuticals Market Revenue (billion), by Sub Product 2025 & 2033

- Figure 3: North America US Pet Nutraceuticals Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 4: North America US Pet Nutraceuticals Market Revenue (billion), by Pets 2025 & 2033

- Figure 5: North America US Pet Nutraceuticals Market Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America US Pet Nutraceuticals Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America US Pet Nutraceuticals Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America US Pet Nutraceuticals Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Pet Nutraceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Pet Nutraceuticals Market Revenue (billion), by Sub Product 2025 & 2033

- Figure 11: South America US Pet Nutraceuticals Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 12: South America US Pet Nutraceuticals Market Revenue (billion), by Pets 2025 & 2033

- Figure 13: South America US Pet Nutraceuticals Market Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America US Pet Nutraceuticals Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: South America US Pet Nutraceuticals Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America US Pet Nutraceuticals Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Pet Nutraceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Pet Nutraceuticals Market Revenue (billion), by Sub Product 2025 & 2033

- Figure 19: Europe US Pet Nutraceuticals Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 20: Europe US Pet Nutraceuticals Market Revenue (billion), by Pets 2025 & 2033

- Figure 21: Europe US Pet Nutraceuticals Market Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe US Pet Nutraceuticals Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Europe US Pet Nutraceuticals Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe US Pet Nutraceuticals Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Pet Nutraceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Pet Nutraceuticals Market Revenue (billion), by Sub Product 2025 & 2033

- Figure 27: Middle East & Africa US Pet Nutraceuticals Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 28: Middle East & Africa US Pet Nutraceuticals Market Revenue (billion), by Pets 2025 & 2033

- Figure 29: Middle East & Africa US Pet Nutraceuticals Market Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa US Pet Nutraceuticals Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa US Pet Nutraceuticals Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa US Pet Nutraceuticals Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Pet Nutraceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Pet Nutraceuticals Market Revenue (billion), by Sub Product 2025 & 2033

- Figure 35: Asia Pacific US Pet Nutraceuticals Market Revenue Share (%), by Sub Product 2025 & 2033

- Figure 36: Asia Pacific US Pet Nutraceuticals Market Revenue (billion), by Pets 2025 & 2033

- Figure 37: Asia Pacific US Pet Nutraceuticals Market Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific US Pet Nutraceuticals Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific US Pet Nutraceuticals Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific US Pet Nutraceuticals Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Pet Nutraceuticals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 2: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 3: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 6: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 7: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 13: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 14: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 20: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 21: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 33: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 34: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 43: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 44: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global US Pet Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Pet Nutraceuticals Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Pet Nutraceuticals Market?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the US Pet Nutraceuticals Market?

Key companies in the market include ADM, Schell & Kampeter Inc (Diamond Pet Foods), Clearlake Capital Group L P (Wellness Pet Company Inc ), Alltech, Dechra Pharmaceuticals PLC, Vetoquinol, Mars Incorporated, Nestle (Purina), Nutramax Laboratories Inc, Virba.

3. What are the main segments of the US Pet Nutraceuticals Market?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: ADM opened its new probiotics and postbiotics production facility in Spain. The facility will supply these supplements to North America, EMEA, and Asia-Pacific.January 2023: Wellness Pet Company Inc., a subsidiary of Clearlake Capital Group LP, launched a fresh range of supplements designed for dogs, which prioritize providing daily health advantages to promote overall well-being. These products help meet the proactive approach of pet parents for long-term health and well-being.January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes to advance preventive pet care. It is aimed at developing more effective precision medicines and diets that lead to scientific breakthroughs for the future of pet health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Pet Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Pet Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Pet Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the US Pet Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence