Key Insights

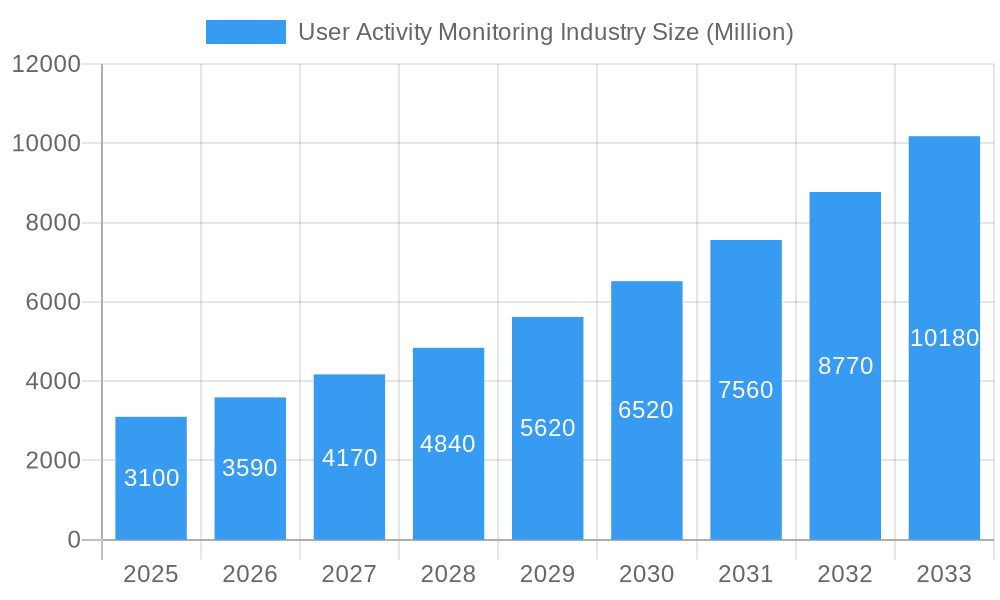

The User Activity Monitoring (UAM) industry is poised for significant expansion, projected to reach $3.1 billion in 2025. This robust growth is fueled by a compelling CAGR of 16.5% over the forecast period of 2025-2033. The increasing sophistication of cyber threats, coupled with the rising need for regulatory compliance across various sectors, are primary drivers propelling market adoption. Businesses are increasingly recognizing the critical role of UAM solutions in safeguarding sensitive data, detecting insider threats, and ensuring operational integrity. The demand for comprehensive visibility into user actions, from system and application monitoring to network and database activity, is escalating. Furthermore, the widespread implementation of remote work models has amplified the need for continuous monitoring to maintain security and productivity, making UAM an indispensable tool for modern enterprises.

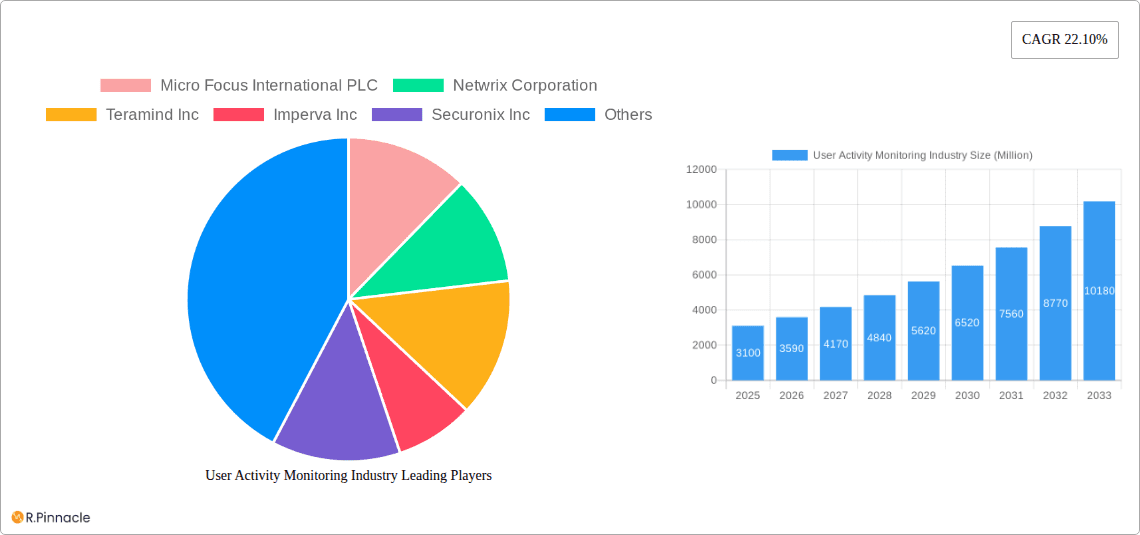

User Activity Monitoring Industry Market Size (In Billion)

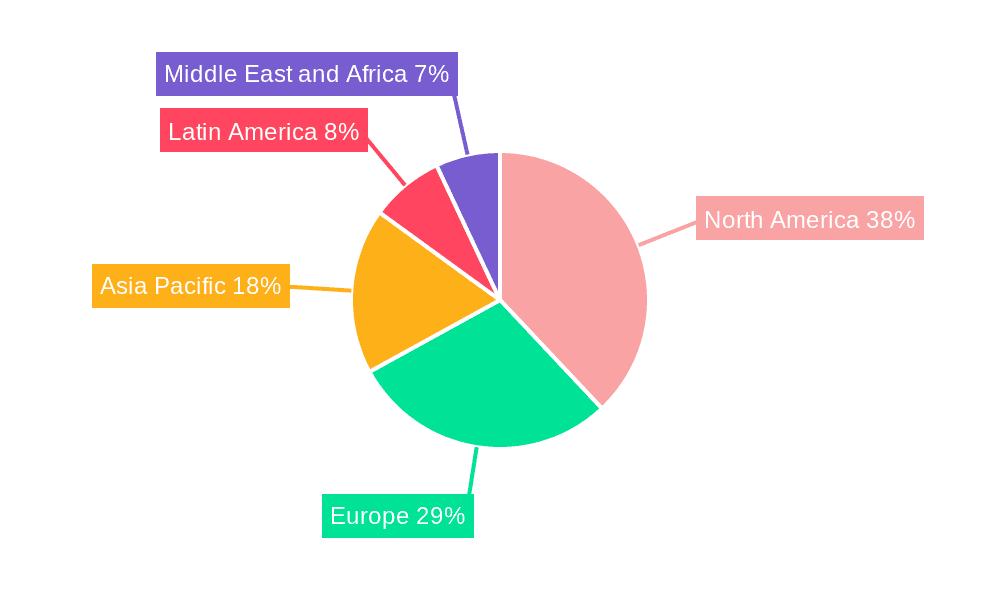

The UAM market is characterized by a diverse range of applications, including system, application, file, network, and database monitoring, catering to a broad spectrum of end-user industries such as BFSI, Retail, IT & Telecom, Healthcare, and Manufacturing. Small and Medium Enterprises (SMEs) and Large Enterprises alike are investing in these solutions to bolster their security postures. Emerging trends like the integration of AI and machine learning for anomaly detection, real-time threat intelligence, and advanced analytics are further enhancing the efficacy of UAM platforms. While the market exhibits strong growth, potential restraints could include the complexity of integration with existing IT infrastructures and concerns around employee privacy, necessitating a balanced approach to implementation. The North America region is anticipated to lead the market share, followed by Europe and the Asia Pacific, driven by early adoption and stringent regulatory frameworks.

User Activity Monitoring Industry Company Market Share

This comprehensive report, "User Activity Monitoring Industry: Market Size, Share, Growth, Trends, and Forecast to 2033," offers an in-depth analysis of the burgeoning user activity monitoring (UAM) market. Navigating the complexities of data security and compliance, this study delves into the strategic landscape, market dynamics, and future trajectory of UAM solutions. With a study period spanning from 2019 to 2033 and a base year of 2025, this report provides unparalleled foresight into a market projected to reach billions in valuation.

User Activity Monitoring Industry Market Structure & Innovation Trends

The user activity monitoring industry is characterized by a dynamic market structure, driven by continuous innovation and evolving regulatory landscapes. Market concentration is moderate, with key players like Splunk Inc., Micro Focus International PLC, and Imperva Inc. holding significant market share. Innovation is primarily fueled by the increasing sophistication of cyber threats and the growing need for robust data protection. Regulatory frameworks, such as GDPR and CCPA, are compelling organizations to adopt stringent UAM solutions, thereby influencing product development and market expansion. While direct product substitutes are limited, the rise of integrated security platforms poses a competitive challenge. End-user demographics reveal a strong demand across all enterprise sizes, with a particular surge in adoption by Large Enterprises and Small & Medium Enterprises seeking to enhance their cybersecurity posture. Mergers and acquisitions (M&A) activity is a key trend, with cybersecurity ventures investing billions in innovative UAM technologies, exemplified by CyberArk Software Ltd.'s USD 30 million investment fund. The overall market value in the base year of 2025 is projected to be in the billions, with substantial M&A deal values contributing to market consolidation and growth.

User Activity Monitoring Industry Market Dynamics & Trends

The user activity monitoring (UAM) industry is experiencing robust growth, propelled by a confluence of escalating cybersecurity threats, stringent regulatory mandates, and the increasing complexity of IT infrastructures. The primary growth driver remains the escalating need for organizations to detect and prevent insider threats, data breaches, and compliance violations. As digital transformation accelerates, organizations are generating and storing vast amounts of sensitive data, making effective monitoring of user activities paramount. The market penetration of UAM solutions is steadily increasing across various sectors, driven by the realization that proactive monitoring is more cost-effective than reactive breach response. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) into UAM platforms, are enhancing anomaly detection capabilities and reducing false positives. This allows for more sophisticated identification of suspicious behavior patterns that might otherwise go unnoticed. Consumer preferences are shifting towards user-friendly, scalable, and cloud-native UAM solutions that offer seamless integration with existing security stacks. The competitive dynamics are intensifying, with established players continuously innovating and new entrants offering specialized solutions. The compound annual growth rate (CAGR) for the UAM market is projected to be XX% during the forecast period, indicating significant expansion. The market is also witnessing a rise in demand for real-time monitoring and analytics, enabling swift incident response. Furthermore, the increasing adoption of remote work models necessitates advanced UAM capabilities to ensure endpoint security and user accountability, irrespective of location. This trend is expected to further accelerate market growth in the coming years, pushing the market value into the billions.

Dominant Regions & Segments in User Activity Monitoring Industry

The user activity monitoring (UAM) industry's dominance is spread across key regions and segments, each exhibiting unique growth drivers and adoption patterns.

- Leading Region: North America currently holds the leading position in the UAM market, driven by a mature cybersecurity landscape, stringent data protection regulations, and a high concentration of large enterprises investing heavily in advanced security solutions. The economic policies in the region foster significant R&D investment in cybersecurity technologies.

- Leading Country: The United States, within North America, is a significant contributor to the market's growth, with a strong presence of major UAM vendors and a high demand from the BFSI and IT & Telecom sectors.

- Dominant Application Segment: System Monitoring and Application Monitoring are witnessing the highest adoption rates. This dominance is attributed to the critical need for visibility into system performance, security events, and application usage to prevent disruptions and unauthorized access.

- System Monitoring: Essential for tracking user actions on operating systems, servers, and endpoints, crucial for identifying malicious activities and policy violations.

- Application Monitoring: Focuses on user interactions within specific software applications, vital for compliance and data integrity in sectors like BFSI.

- Dominant Enterprise Segment: Large Enterprises represent the largest segment of the UAM market. This is due to their complex IT environments, larger employee bases, and the significant financial and reputational risks associated with data breaches. They possess the resources to invest in comprehensive UAM solutions to meet stringent compliance requirements and protect sensitive data.

- Dominant End-user Industry: The BFSI (Banking, Financial Services, and Insurance) sector is the leading end-user industry for UAM solutions. This dominance is driven by the highly sensitive nature of financial data, strict regulatory oversight (e.g., SOX, PCI DSS), and the critical need to prevent fraud, insider trading, and data theft.

- BFSI: High transaction volumes and the presence of sensitive customer data necessitate robust monitoring for compliance and security.

- IT & Telecom: Rapid technological advancements and a vast digital infrastructure create significant security vulnerabilities, driving UAM adoption.

- Healthcare: Growing concerns over patient data privacy (HIPAA compliance) and the increasing digitalization of health records are fueling demand for UAM solutions.

- Manufacturing: The rise of Industrial IoT (IIoT) and the need to protect intellectual property and operational technology (OT) are increasing the relevance of UAM.

The projected market size for UAM solutions in these dominant segments is expected to reach billions by 2033, with consistent growth fueled by evolving threats and regulatory pressures.

User Activity Monitoring Industry Product Innovations

Product innovations in the user activity monitoring (UAM) industry are sharply focused on enhancing detection capabilities and streamlining compliance. The integration of AI and ML for advanced anomaly detection is a key trend, enabling platforms to identify subtle deviations from normal user behavior with greater accuracy. Cloud-native UAM solutions are gaining traction, offering scalability and ease of deployment for enterprises of all sizes. Innovations in data visualization and reporting provide clearer, more actionable insights for security teams. Competitive advantages are being forged through features like real-time threat intelligence integration, automated incident response workflows, and user-friendly interfaces that reduce the learning curve for security personnel. The trend towards unified security platforms, offering comprehensive visibility across endpoints, applications, and networks, is also shaping product development, aiming to simplify security management and improve overall effectiveness.

Report Scope & Segmentation Analysis

This report meticulously analyzes the User Activity Monitoring (UAM) industry, segmented across critical dimensions to provide granular insights into market dynamics and growth trajectories.

- Application Segmentation: The market is segmented into System Monitoring, Application Monitoring, File Monitoring, Network Monitoring, and Database Monitoring. System and Application Monitoring are projected to dominate in terms of market share and growth due to their foundational role in security and compliance.

- Enterprise Segmentation: The analysis covers Small & Medium Enterprises (SMEs) and Large Enterprises. Large Enterprises are expected to continue holding the larger market share due to their complex needs and higher security budgets, while SMEs represent a significant growth opportunity as UAM becomes more accessible.

- End-user Industry Segmentation: Key end-user industries analyzed include BFSI, Retail, IT & Telecom, Healthcare, Manufacturing, and Other End-user Industries. The BFSI sector is anticipated to lead in adoption and market value, followed closely by IT & Telecom and Healthcare, driven by regulatory compliance and data sensitivity.

Each segment is analyzed for its current market size, projected growth, and competitive landscape, with an estimated market valuation in the billions.

Key Drivers of User Activity Monitoring Industry Growth

The user activity monitoring (UAM) industry's growth is primarily driven by escalating cybersecurity threats, including sophisticated ransomware attacks and insider threats, compelling organizations to enhance their threat detection and response capabilities. The increasing stringency of global data privacy regulations, such as GDPR and CCPA, mandates robust user activity monitoring for compliance, directly fueling market expansion. The growing adoption of cloud computing and remote work models, while offering flexibility, introduces new security vulnerabilities that UAM solutions are designed to address. Furthermore, the increasing volume and complexity of digital data necessitate advanced tools to track access and usage. The proactive identification of suspicious activities and potential breaches through UAM minimizes potential financial losses and reputational damage, making it a critical investment for businesses of all sizes.

Challenges in the User Activity Monitoring Industry Sector

Despite its robust growth, the user activity monitoring (UAM) industry faces several challenges. A significant barrier is the potential for user privacy concerns and the ethical implications of constant monitoring, which can lead to employee resistance and legal challenges if not handled transparently. The complexity and sheer volume of data generated by UAM systems can overwhelm IT security teams, requiring substantial investment in skilled personnel and advanced analytics tools. Integration with existing, often disparate, IT infrastructure can also be a hurdle, leading to implementation delays and increased costs. Furthermore, the competitive landscape is intense, with many vendors offering similar solutions, making it difficult for potential buyers to differentiate and choose the most suitable platform. The evolving nature of cyber threats requires continuous adaptation and updates to UAM solutions, demanding ongoing R&D investment from vendors.

Emerging Opportunities in User Activity Monitoring Industry

Emerging opportunities within the User Activity Monitoring (UAM) industry are significant and diverse. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and advanced anomaly detection presents a substantial growth avenue, enabling more proactive threat identification. The increasing demand for UAM solutions in operational technology (OT) environments within the manufacturing sector, driven by the Industrial Internet of Things (IIoT), offers a new frontier for market expansion. As remote work continues to be prevalent, the need for comprehensive endpoint monitoring and secure remote access solutions will further drive demand. The growing emphasis on data governance and compliance across all industries provides fertile ground for UAM vendors to offer solutions that not only enhance security but also simplify regulatory adherence. Furthermore, the development of user-friendly, cloud-based UAM platforms catering to SMEs is opening up previously underserved markets.

Leading Players in the User Activity Monitoring Industry Market

- Micro Focus International PLC

- Netwrix Corporation

- Teramind Inc

- Imperva Inc

- Securonix Inc

- LogRhythm Inc

- Centrify Corporation

- CyberArk Software Ltd

- Ezwim B V

- Splunk Inc

- Forcepoint

Key Developments in User Activity Monitoring Industry Industry

- July 2022: Imperva Inc announced Imperva Data Security Fabric (DSF) which provides data-centric protection and compliance for enterprise data lakes built on Amazon Web Services (AWS). Imperva reinforced its commitment to securing data and all paths to it by allowing AWS customers to secure their data with one comprehensive platform, leveraging a unified security model across Amazon Aurora, Amazon Redshift, Amazon Relational Database Service (Amazon RDS), Amazon DynamoDB, Amazon Athena, and AWS CloudFormation without requiring any changes to their existing data infrastructure. This development significantly enhances cloud data security offerings.

- May 2022: CyberArk Software Ltd announced the launch of CyberArk Ventures USD 30 million global investment fund designed to empower the next generation of disruptors to solve complex security challenges with innovative technology. CyberArk Ventures provides portfolio companies with go-to-market support, access to CyberArk technology and CyberArk Labs research, engagement with CyberArk leadership, and networking opportunities with prospective partners and customers. This initiative fosters innovation within the broader cybersecurity ecosystem, including UAM.

Future Outlook for User Activity Monitoring Industry Market

The future outlook for the User Activity Monitoring (UAM) industry is exceptionally strong, projected to grow into the billions over the forecast period. Key growth accelerators include the relentless evolution of cyber threats, necessitating increasingly sophisticated monitoring tools. The ongoing digital transformation across all sectors, coupled with the sustained prevalence of remote work, will continue to drive demand for comprehensive UAM solutions that ensure visibility and security across distributed environments. Strategic opportunities lie in the deeper integration of AI and machine learning for predictive threat intelligence and automated remediation, offering a significant competitive edge. Furthermore, the expanding regulatory landscape globally will continue to mandate compliance, making UAM a non-negotiable investment for organizations. The market's future success will also depend on vendors' ability to offer scalable, cloud-native, and user-friendly solutions that cater to the diverse needs of both large enterprises and SMEs, solidifying UAM's position as a cornerstone of modern cybersecurity strategies.

User Activity Monitoring Industry Segmentation

-

1. Application

- 1.1. System Monitoring

- 1.2. Application Monitoring

- 1.3. File Monitoring

- 1.4. Network Monitoring

- 1.5. Database Monitoring

-

2. Enterprise

- 2.1. Small & Medium Enterprises

- 2.2. Large Enterprises

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT & Telecom

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Other End-user Industries

User Activity Monitoring Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

User Activity Monitoring Industry Regional Market Share

Geographic Coverage of User Activity Monitoring Industry

User Activity Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need Among Organizations to Optimize Employee Productivity; Need for Enhanced Control Over Employees and Third-Party Vendors in Enterprises

- 3.3. Market Restrains

- 3.3.1. High Cost of Innovation for Developing Robust UAM Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Need Among Organizations to Optimize Employee Productivity to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global User Activity Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. System Monitoring

- 5.1.2. Application Monitoring

- 5.1.3. File Monitoring

- 5.1.4. Network Monitoring

- 5.1.5. Database Monitoring

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small & Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT & Telecom

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America User Activity Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. System Monitoring

- 6.1.2. Application Monitoring

- 6.1.3. File Monitoring

- 6.1.4. Network Monitoring

- 6.1.5. Database Monitoring

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Small & Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Retail

- 6.3.3. IT & Telecom

- 6.3.4. Healthcare

- 6.3.5. Manufacturing

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe User Activity Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. System Monitoring

- 7.1.2. Application Monitoring

- 7.1.3. File Monitoring

- 7.1.4. Network Monitoring

- 7.1.5. Database Monitoring

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Small & Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Retail

- 7.3.3. IT & Telecom

- 7.3.4. Healthcare

- 7.3.5. Manufacturing

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific User Activity Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. System Monitoring

- 8.1.2. Application Monitoring

- 8.1.3. File Monitoring

- 8.1.4. Network Monitoring

- 8.1.5. Database Monitoring

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Small & Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Retail

- 8.3.3. IT & Telecom

- 8.3.4. Healthcare

- 8.3.5. Manufacturing

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America User Activity Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. System Monitoring

- 9.1.2. Application Monitoring

- 9.1.3. File Monitoring

- 9.1.4. Network Monitoring

- 9.1.5. Database Monitoring

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Small & Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Retail

- 9.3.3. IT & Telecom

- 9.3.4. Healthcare

- 9.3.5. Manufacturing

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa User Activity Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. System Monitoring

- 10.1.2. Application Monitoring

- 10.1.3. File Monitoring

- 10.1.4. Network Monitoring

- 10.1.5. Database Monitoring

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Small & Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Retail

- 10.3.3. IT & Telecom

- 10.3.4. Healthcare

- 10.3.5. Manufacturing

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Micro Focus International PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Netwrix Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teramind Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Imperva Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Securonix Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LogRhythm Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Centrify Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CyberArk Software Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ezwim B V *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Splunk Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Forcepoint

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Micro Focus International PLC

List of Figures

- Figure 1: Global User Activity Monitoring Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America User Activity Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America User Activity Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America User Activity Monitoring Industry Revenue (undefined), by Enterprise 2025 & 2033

- Figure 5: North America User Activity Monitoring Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America User Activity Monitoring Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America User Activity Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America User Activity Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe User Activity Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe User Activity Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe User Activity Monitoring Industry Revenue (undefined), by Enterprise 2025 & 2033

- Figure 13: Europe User Activity Monitoring Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 14: Europe User Activity Monitoring Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Europe User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe User Activity Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe User Activity Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific User Activity Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific User Activity Monitoring Industry Revenue (undefined), by Enterprise 2025 & 2033

- Figure 21: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 22: Asia Pacific User Activity Monitoring Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific User Activity Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America User Activity Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 27: Latin America User Activity Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Latin America User Activity Monitoring Industry Revenue (undefined), by Enterprise 2025 & 2033

- Figure 29: Latin America User Activity Monitoring Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 30: Latin America User Activity Monitoring Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Latin America User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America User Activity Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America User Activity Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa User Activity Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 35: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa User Activity Monitoring Industry Revenue (undefined), by Enterprise 2025 & 2033

- Figure 37: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Enterprise 2025 & 2033

- Figure 38: Middle East and Africa User Activity Monitoring Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa User Activity Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global User Activity Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global User Activity Monitoring Industry Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 3: Global User Activity Monitoring Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global User Activity Monitoring Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global User Activity Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global User Activity Monitoring Industry Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 7: Global User Activity Monitoring Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global User Activity Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global User Activity Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global User Activity Monitoring Industry Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 11: Global User Activity Monitoring Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global User Activity Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global User Activity Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global User Activity Monitoring Industry Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 15: Global User Activity Monitoring Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global User Activity Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global User Activity Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global User Activity Monitoring Industry Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 19: Global User Activity Monitoring Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global User Activity Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global User Activity Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global User Activity Monitoring Industry Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 23: Global User Activity Monitoring Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global User Activity Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the User Activity Monitoring Industry?

The projected CAGR is approximately 16.5%.

2. Which companies are prominent players in the User Activity Monitoring Industry?

Key companies in the market include Micro Focus International PLC, Netwrix Corporation, Teramind Inc, Imperva Inc, Securonix Inc, LogRhythm Inc, Centrify Corporation, CyberArk Software Ltd, Ezwim B V *List Not Exhaustive, Splunk Inc, Forcepoint.

3. What are the main segments of the User Activity Monitoring Industry?

The market segments include Application, Enterprise, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need Among Organizations to Optimize Employee Productivity; Need for Enhanced Control Over Employees and Third-Party Vendors in Enterprises.

6. What are the notable trends driving market growth?

Increasing Need Among Organizations to Optimize Employee Productivity to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Innovation for Developing Robust UAM Solutions.

8. Can you provide examples of recent developments in the market?

July 2022: Imperva Inc announced Imperva Data Security Fabric (DSF) which provides data-centric protection and compliance for enterprise data lakes built on Amazon Web Services (AWS). Imperva reinforced its commitment to securing data and all paths to it by allowing AWS customers to secure their data with one comprehensive platform, leveraging a unified security model across Amazon Aurora, Amazon Redshift, Amazon Relational Database Service (Amazon RDS), Amazon DynamoDB, Amazon Athena, and AWS CloudFormation without requiring any changes to their existing data infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "User Activity Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the User Activity Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the User Activity Monitoring Industry?

To stay informed about further developments, trends, and reports in the User Activity Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence