Key Insights

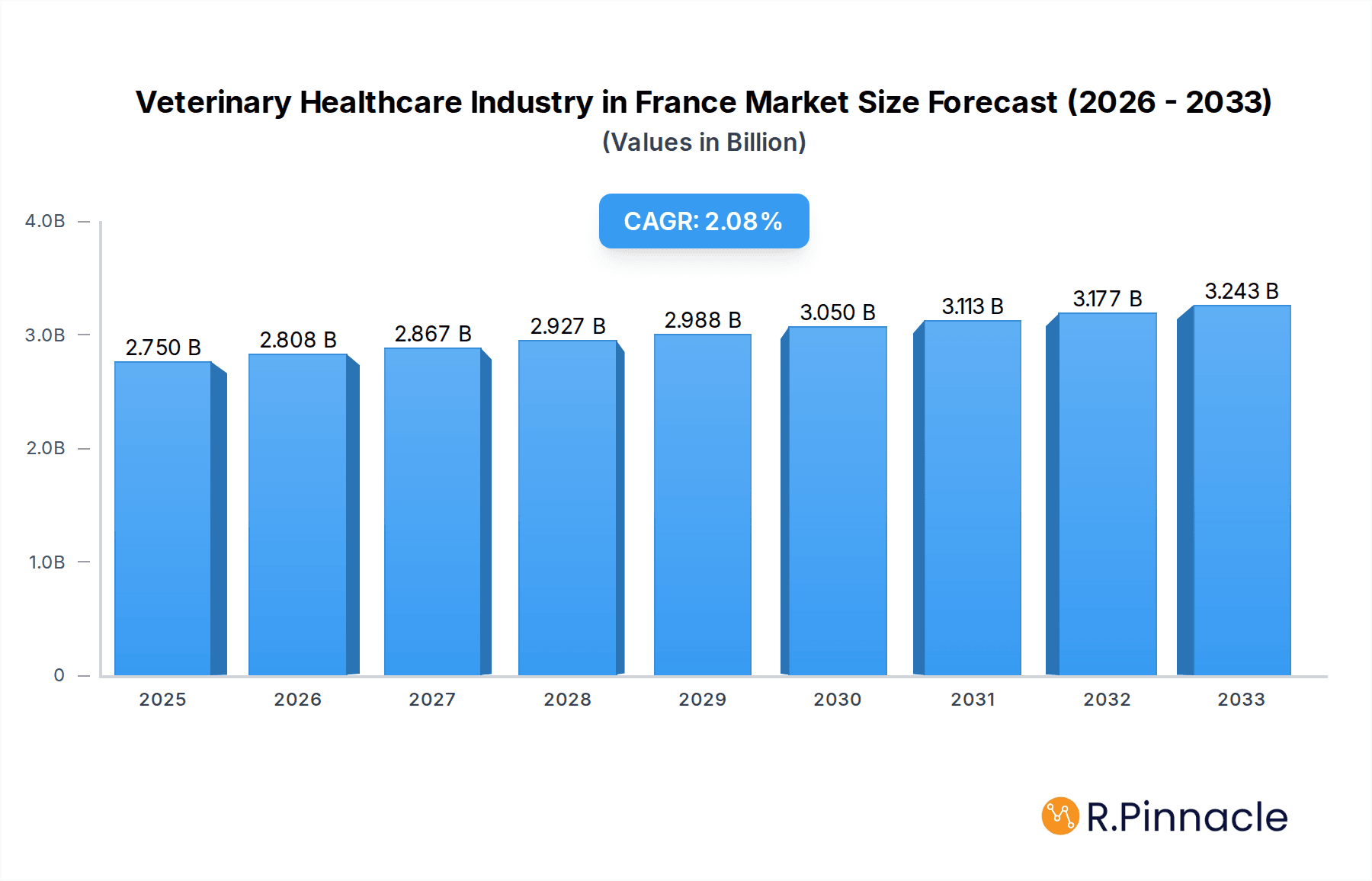

The French veterinary healthcare market is poised for steady growth, driven by increasing pet ownership and a rising focus on companion animal well-being. With a market size of an estimated €2.75 billion in 2025, the industry is projected to expand at a Compound Annual Growth Rate (CAGR) of 2.1% through 2033. This growth is fueled by advancements in veterinary diagnostics, a broader range of therapeutic options including vaccines and anti-infectives, and the increasing demand for specialized treatments. The "humanization of pets" trend, where animals are increasingly considered integral family members, is a significant catalyst, leading owners to invest more in preventative care, advanced medical procedures, and higher-quality feed additives. Furthermore, the growing recognition of zoonotic diseases and the importance of animal health for public health are contributing to a more robust veterinary sector.

Veterinary Healthcare Industry in France Market Size (In Billion)

The market's expansion is supported by significant investments in research and development by leading companies, fostering innovation in both pharmaceuticals and diagnostic technologies. Key growth segments include advanced immunodiagnostic tests and molecular diagnostics, offering more precise and early detection of diseases in animals. While the market enjoys strong drivers, potential restraints include economic downturns that might impact discretionary spending on pet care and regulatory hurdles for new product approvals. However, the overarching trend of increased spending on animal health, coupled with a proactive approach to disease prevention and management, suggests a resilient and growing French veterinary healthcare landscape. The competitive environment features established players like Ceva Animal Health, Elanco, and Zoetis, all actively contributing to market dynamism and product innovation.

Veterinary Healthcare Industry in France Company Market Share

This comprehensive report offers an in-depth analysis of the Veterinary Healthcare Industry in France, a rapidly evolving sector driven by increasing pet ownership, advancements in animal medicine, and a growing focus on animal welfare. Spanning from 2019 to 2033, with a base year of 2025, this report provides actionable insights for industry professionals, investors, and stakeholders.

Veterinary Healthcare Industry in France Market Structure & Innovation Trends

The Veterinary Healthcare Industry in France exhibits a moderately concentrated market structure, with key players like Boehringer Ingelheim International GmbH, Merck & Co Inc, Elanco, and Zoetis Inc holding significant market share. Innovation in this sector is primarily driven by veterinary pharmaceuticals, veterinary diagnostics, and the increasing demand for advanced animal health products. Regulatory frameworks, such as stringent approval processes for veterinary medicines and a growing emphasis on food safety for livestock, shape market entry and product development. Product substitutes, while present in the form of generic medications and traditional remedies, are increasingly being outpaced by innovative, science-backed solutions. End-user demographics are shifting towards a more pet-centric society, with a growing willingness to invest in premium pet care products and preventative healthcare. Merger and acquisition (M&A) activities are notable, with deal values estimated to be in the billions, signaling consolidation and strategic expansion within the French animal health market. The market share of top companies is projected to remain substantial, though niche players are emerging with specialized offerings.

Veterinary Healthcare Industry in France Market Dynamics & Trends

The Veterinary Healthcare Industry in France is poised for robust growth, driven by several dynamic factors. A primary market growth driver is the escalating humanization of pets, leading to increased expenditure on veterinary services and advanced animal treatments. This trend is further amplified by rising disposable incomes and a greater awareness of the therapeutic benefits of specialized veterinary drugs and canine and feline healthcare. Technological disruptions are revolutionizing the sector, with innovations in veterinary diagnostics, such as AI-powered imaging and rapid point-of-care testing, enhancing diagnostic accuracy and treatment efficacy. The adoption of telemedicine and digital health platforms is also gaining traction, improving accessibility to veterinary advice and animal disease management. Consumer preferences are increasingly leaning towards preventative healthcare, wellness products, and sustainable animal nutrition. This shift is stimulating demand for vaccines, parasiticides, and nutraceuticals for animals. The competitive dynamics within the French animal health market are characterized by a blend of established multinational corporations and agile local innovators. Market penetration of advanced veterinary technologies is steadily increasing, fueled by veterinary professional education and increased affordability of cutting-edge solutions. The compound annual growth rate (CAGR) for the forecast period is estimated to be between 6-8 billion, reflecting sustained expansion.

Dominant Regions & Segments in Veterinary Healthcare Industry in France

Within the Veterinary Healthcare Industry in France, the Dogs and Cats segment demonstrates significant dominance, fueled by the nation's high pet ownership rates and a strong cultural affinity for companion animals. This segment accounts for a substantial portion of the veterinary diagnostics and veterinary therapeutics markets. Key drivers for this dominance include increased consumer spending on premium pet food, specialized pet healthcare products, and advanced veterinary treatments for age-related conditions and chronic diseases.

Product Segmentation:

- Therapeutics: Within therapeutics, Vaccines and Parasiticides are leading categories, driven by preventative healthcare mandates and the need to manage common animal health issues. Anti-infectives also hold a strong position due to ongoing concerns about zoonotic diseases and bacterial infections.

- Diagnostics: Immunodiagnostic Tests and Diagnostic Imaging are spearheading the diagnostics segment, enabling early detection and precise diagnosis of animal ailments.

Animal Type Segmentation:

- Dogs and Cats: As mentioned, this segment is the largest revenue generator, with a growing demand for personalized veterinary medicine and specialized diets.

- Poultry and Ruminants: These segments remain crucial, particularly for the agricultural sector, with ongoing demand for medical feed additives and veterinary pharmaceuticals to ensure animal productivity and food safety.

The economic policies supporting the agricultural sector and the continuous research and development in animal pharmaceuticals contribute to the sustained growth of these segments. Infrastructure development in rural areas also plays a role in ensuring access to veterinary care for livestock. The market size for the veterinary healthcare industry in France is projected to exceed 50 billion by 2025.

Veterinary Healthcare Industry in France Product Innovations

Product innovations in the Veterinary Healthcare Industry in France are transforming animal care. Advancements in veterinary pharmaceuticals, particularly in the development of targeted therapies for chronic conditions like arthritis and cancer in pets, are improving quality of life. The diagnostic landscape is being revolutionized by molecular diagnostics and advanced clinical chemistry analyzers, offering faster and more accurate disease identification. Furthermore, the integration of AI in diagnostic imaging provides unprecedented insights for veterinarians. These innovations offer significant competitive advantages by addressing unmet medical needs and enhancing treatment outcomes, aligning with market demands for more effective and personalized animal health solutions.

Report Scope & Segmentation Analysis

This report delves into the intricate segmentation of the Veterinary Healthcare Industry in France. The Product segmentation covers Therapeutics, including Vaccines, Parasiticides, Anti-infectives, Medical Feed Additives, and Other Therapeutics. It also encompasses Diagnostics, comprising Immunodiagnostic Tests, Molecular diagnostics, Diagnostic Imaging, Clinical Chemistry, and Other Diagnostics. The Animal Type segmentation spans Dogs and Cats, Horses, Ruminants, Swine, Poultry, and Other Animals. Growth projections indicate a steady upward trend across all segments, with Dogs and Cats leading in market size and value. Competitive dynamics are shaped by the introduction of novel veterinary drugs and advanced diagnostic tools, fostering a dynamic market environment with projected market sizes exceeding 10 billion for key segments by 2033.

Key Drivers of Veterinary Healthcare Industry in France Growth

The Veterinary Healthcare Industry in France is propelled by several key drivers. Technological advancements in veterinary diagnostics and the development of novel animal health products are crucial. The increasing trend of pet humanization, leading to higher spending on companion animal care, and a growing awareness of zoonotic diseases are significant economic factors. Furthermore, supportive government initiatives and favorable regulatory frameworks for animal pharmaceuticals and veterinary services contribute to market expansion. The demand for premium veterinary nutrition and preventative healthcare solutions also fuels growth.

Challenges in the Veterinary Healthcare Industry in France Sector

Despite robust growth, the Veterinary Healthcare Industry in France faces several challenges. Regulatory hurdles related to the approval of new veterinary drugs and animal health technologies can cause delays. Supply chain disruptions, particularly for specialized veterinary pharmaceuticals, can impact product availability. Intense competition from both established players and emerging biotech firms can pressure pricing and profitability. Furthermore, the rising cost of advanced veterinary treatments and diagnostic services can be a barrier for some pet owners and livestock producers, impacting market penetration in lower-income demographics.

Emerging Opportunities in Veterinary Healthcare Industry in France

The Veterinary Healthcare Industry in France presents numerous emerging opportunities. The growing demand for personalized veterinary medicine and tailored animal health solutions offers significant potential. The expansion of telemedicine and digital health platforms for animal care is a rapidly growing niche. Furthermore, the increasing focus on sustainable animal agriculture and the development of novel feed additives and biologicals present new market avenues. The rising interest in exotic pet healthcare also opens up specialized market segments for innovative veterinary products.

Leading Players in the Veterinary Healthcare Industry in France Market

- Boehringer Ingelheim International GmbH

- Merck & Co Inc

- Elanco

- Zoetis Inc

- Ceva Animal Health Inc

- IDEXX Laboratories

- Vetoquinol

Key Developments in Veterinary Healthcare Industry in France Industry

- January 2022: TheraVet announced the signing of a distribution agreement for BIOCERA-VET-BS and BIOCERA-VET-OSA with one of the leading distributors of animal health products in France.

- Undisclosed Date (Recent): Bactana Corp announced that they have signed a distribution agreement with France-based ArcaNatura SAS to launch Bactana's first commercial product, Pawsni Glucose Control, shown to significantly reduce diabetic and prediabetic blood markers in multiple placebo-controlled mouse trials without causing undesirable hypoglycemic side effects.

Future Outlook for Veterinary Healthcare Industry in France Market

The future outlook for the Veterinary Healthcare Industry in France is exceptionally promising, with sustained growth projected through 2033. Key growth accelerators include the continued innovation in veterinary therapeutics and diagnostics, the expanding pet humanization trend, and increasing adoption of digital health solutions. Strategic opportunities lie in leveraging advancements in biotechnology for novel animal vaccines and treatments, enhancing accessibility to specialized veterinary care, and capitalizing on the growing demand for preventative and wellness-focused animal health products. The market is expected to witness further consolidation and the emergence of new specialized players, driving increased investment and technological sophistication. The overall market value is anticipated to reach upwards of 70 billion by 2033.

Veterinary Healthcare Industry in France Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

Veterinary Healthcare Industry in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Veterinary Healthcare Industry in France Regional Market Share

Geographic Coverage of Veterinary Healthcare Industry in France

Veterinary Healthcare Industry in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advanced Technology Leading to Innovations in Animal Healthcare; Risk of Emerging Zoonosis

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure and Funding; Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. Vaccines is expected to lead the France Veterinary Healthcare Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Healthcare Industry in France Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Veterinary Healthcare Industry in France Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti-infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. By Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.1. By Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs and Cats

- 6.2.2. Horses

- 6.2.3. Ruminants

- 6.2.4. Swine

- 6.2.5. Poultry

- 6.2.6. Other Animals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Veterinary Healthcare Industry in France Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti-infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. By Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.1. By Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs and Cats

- 7.2.2. Horses

- 7.2.3. Ruminants

- 7.2.4. Swine

- 7.2.5. Poultry

- 7.2.6. Other Animals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Veterinary Healthcare Industry in France Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti-infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. By Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.1. By Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs and Cats

- 8.2.2. Horses

- 8.2.3. Ruminants

- 8.2.4. Swine

- 8.2.5. Poultry

- 8.2.6. Other Animals

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Veterinary Healthcare Industry in France Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Therapeutics

- 9.1.1.1. Vaccines

- 9.1.1.2. Parasiticides

- 9.1.1.3. Anti-infectives

- 9.1.1.4. Medical Feed Additives

- 9.1.1.5. Other Therapeutics

- 9.1.2. By Diagnostics

- 9.1.2.1. Immunodiagnostic Tests

- 9.1.2.2. Molecular diagnostics

- 9.1.2.3. Diagnostic Imaging

- 9.1.2.4. Clinical Chemistry

- 9.1.2.5. Other Diagnostics

- 9.1.1. By Therapeutics

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs and Cats

- 9.2.2. Horses

- 9.2.3. Ruminants

- 9.2.4. Swine

- 9.2.5. Poultry

- 9.2.6. Other Animals

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Veterinary Healthcare Industry in France Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Therapeutics

- 10.1.1.1. Vaccines

- 10.1.1.2. Parasiticides

- 10.1.1.3. Anti-infectives

- 10.1.1.4. Medical Feed Additives

- 10.1.1.5. Other Therapeutics

- 10.1.2. By Diagnostics

- 10.1.2.1. Immunodiagnostic Tests

- 10.1.2.2. Molecular diagnostics

- 10.1.2.3. Diagnostic Imaging

- 10.1.2.4. Clinical Chemistry

- 10.1.2.5. Other Diagnostics

- 10.1.1. By Therapeutics

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs and Cats

- 10.2.2. Horses

- 10.2.3. Ruminants

- 10.2.4. Swine

- 10.2.5. Poultry

- 10.2.6. Other Animals

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ceva Animal Health Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elanco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zoetis Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Boehringer Ingelheim International GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck & Co Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IDEXX Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vetoquinol

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Ceva Animal Health Inc

List of Figures

- Figure 1: Global Veterinary Healthcare Industry in France Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Healthcare Industry in France Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Veterinary Healthcare Industry in France Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Veterinary Healthcare Industry in France Revenue (billion), by Animal Type 2025 & 2033

- Figure 5: North America Veterinary Healthcare Industry in France Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Veterinary Healthcare Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Veterinary Healthcare Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Veterinary Healthcare Industry in France Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Veterinary Healthcare Industry in France Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Veterinary Healthcare Industry in France Revenue (billion), by Animal Type 2025 & 2033

- Figure 11: South America Veterinary Healthcare Industry in France Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: South America Veterinary Healthcare Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Veterinary Healthcare Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Veterinary Healthcare Industry in France Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Veterinary Healthcare Industry in France Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Veterinary Healthcare Industry in France Revenue (billion), by Animal Type 2025 & 2033

- Figure 17: Europe Veterinary Healthcare Industry in France Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Europe Veterinary Healthcare Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Veterinary Healthcare Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Veterinary Healthcare Industry in France Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Veterinary Healthcare Industry in France Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Veterinary Healthcare Industry in France Revenue (billion), by Animal Type 2025 & 2033

- Figure 23: Middle East & Africa Veterinary Healthcare Industry in France Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East & Africa Veterinary Healthcare Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Veterinary Healthcare Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Veterinary Healthcare Industry in France Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Veterinary Healthcare Industry in France Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Veterinary Healthcare Industry in France Revenue (billion), by Animal Type 2025 & 2033

- Figure 29: Asia Pacific Veterinary Healthcare Industry in France Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Asia Pacific Veterinary Healthcare Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Veterinary Healthcare Industry in France Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 6: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 12: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 18: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 30: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 39: Global Veterinary Healthcare Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Veterinary Healthcare Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Healthcare Industry in France?

The projected CAGR is approximately 2.1%.

2. Which companies are prominent players in the Veterinary Healthcare Industry in France?

Key companies in the market include Ceva Animal Health Inc, Elanco, Zoetis Inc *List Not Exhaustive, Boehringer Ingelheim International GmbH, Merck & Co Inc, IDEXX Laboratories, Vetoquinol.

3. What are the main segments of the Veterinary Healthcare Industry in France?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Advanced Technology Leading to Innovations in Animal Healthcare; Risk of Emerging Zoonosis.

6. What are the notable trends driving market growth?

Vaccines is expected to lead the France Veterinary Healthcare Market.

7. Are there any restraints impacting market growth?

Lack of Infrastructure and Funding; Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

In January 2022, TheraVet announced the signing of a distribution agreement for BIOCERA-VET-BS and BIOCERA-VET-OSA with one of the leading distributors of animal health products in France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Healthcare Industry in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Healthcare Industry in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Healthcare Industry in France?

To stay informed about further developments, trends, and reports in the Veterinary Healthcare Industry in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence