Key Insights

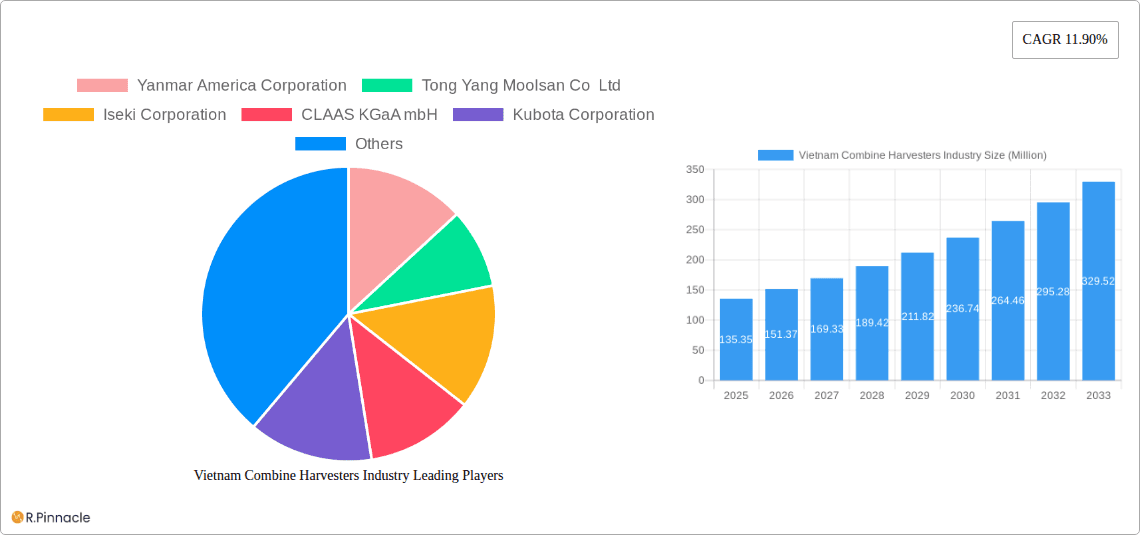

The Vietnam combine harvester market, valued at $135.35 million in 2025, is projected to experience robust growth, driven by increasing rice and other grain production, government initiatives promoting agricultural modernization, and a rising demand for efficient harvesting techniques. The compound annual growth rate (CAGR) of 11.90% from 2019 to 2024 suggests a strong upward trajectory, expected to continue through 2033. Key market segments include Tractor-on-Top (TOT) combine harvesters, wheeled-type combine harvesters, and track-type combine harvesters, each catering to specific farming needs and land conditions prevalent in Vietnam. The market is competitive, with both international players like Yanmar, CLAAS, Kubota, and CNH Industrial, and domestic manufacturers such as Truong Hai Auto Corporation (THACO) and Vietnam Agrotech Co Ltd vying for market share. Growth is further fueled by the expanding adoption of advanced technologies, including GPS-guided systems and improved engine efficiency, enhancing productivity and reducing operational costs. While challenges remain, such as the initial high investment cost for advanced harvesters and the need for skilled operators, the overall market outlook for combine harvesters in Vietnam remains positive, indicating a promising future for agricultural mechanization in the country.

Vietnam Combine Harvesters Industry Market Size (In Million)

The continued expansion of the Vietnamese agricultural sector, coupled with government support for mechanized farming, will be pivotal in driving market growth. Factors such as increasing labor costs and the need to improve harvesting efficiency are further accelerating the adoption of combine harvesters. While the initial capital expenditure might present a barrier for some small-scale farmers, financing schemes and leasing options are expected to mitigate this constraint, enabling wider access to modern harvesting technology. Future growth will be influenced by technological advancements leading to more fuel-efficient and versatile models, as well as the development of robust after-sales services and maintenance networks. The segment of wheeled-type combine harvesters is likely to witness significant growth due to its suitability for diverse terrain and ease of operation. Competition among manufacturers is anticipated to remain intense, fostering innovation and price competitiveness benefiting farmers.

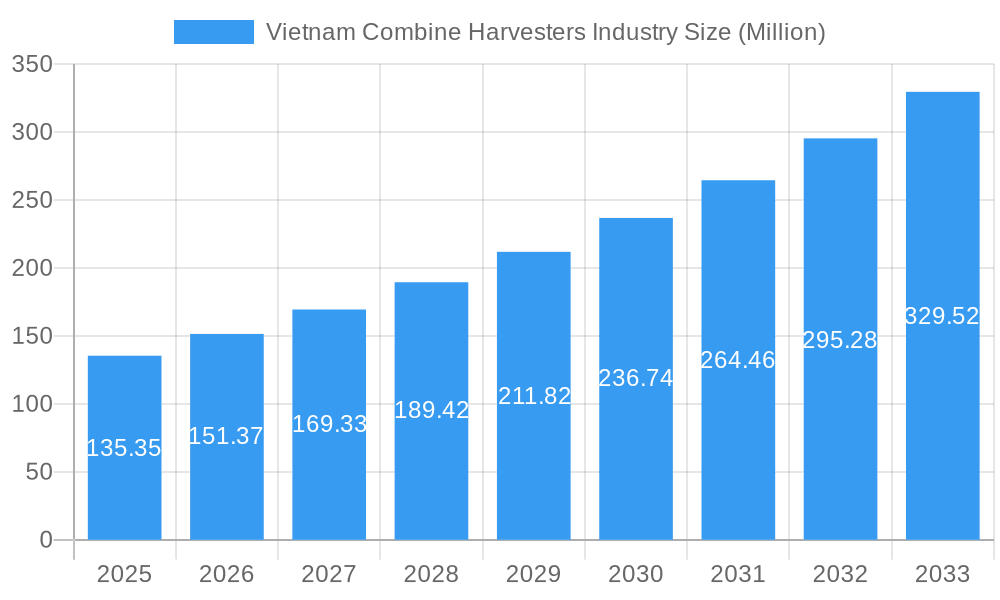

Vietnam Combine Harvesters Industry Company Market Share

This comprehensive report provides a detailed analysis of the Vietnam combine harvesters industry, offering invaluable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. It leverages extensive market research and data analysis to present a clear picture of the current market landscape and future growth trajectory. This report covers a market valued at $XX Million in 2025 and projects substantial growth to $XX Million by 2033.

Vietnam Combine Harvesters Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Vietnam combine harvesters market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report reveals a moderately concentrated market with key players like Kubota Corporation, CLAAS KGaA mbH, and Iseki Corporation holding significant market share. The combined market share of the top 5 players is estimated at XX%.

- Market Concentration: The report quantifies market concentration using metrics like the Herfindahl-Hirschman Index (HHI).

- Innovation Drivers: The analysis explores factors driving innovation, including government incentives for technological upgrades and the growing demand for higher efficiency and productivity.

- Regulatory Framework: The impact of government regulations on import/export and emission standards is assessed.

- Product Substitutes: The report evaluates potential substitutes and their impact on market dynamics.

- End-User Demographics: The report details the demographics of end-users, focusing on farm sizes and technological adoption rates.

- M&A Activities: The report identifies significant M&A activities within the industry during the historical period (2019-2024), estimating deal values at $XX Million in total. For example, there may have been consolidation among smaller domestic players.

Vietnam Combine Harvesters Industry Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The Vietnam combine harvesters market is projected to experience a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), driven primarily by factors like increasing agricultural production, government support for mechanization, and rising disposable incomes among farmers.

The report analyzes technological disruptions such as the adoption of precision farming technologies, autonomous systems, and improved fuel efficiency. Changing consumer preferences toward higher-capacity machines with advanced features also contribute to market growth. Competitive dynamics are explored, highlighting strategies employed by leading players to gain market share and technological leadership. Market penetration of advanced combine harvester types is assessed, indicating a shift towards more sophisticated equipment.

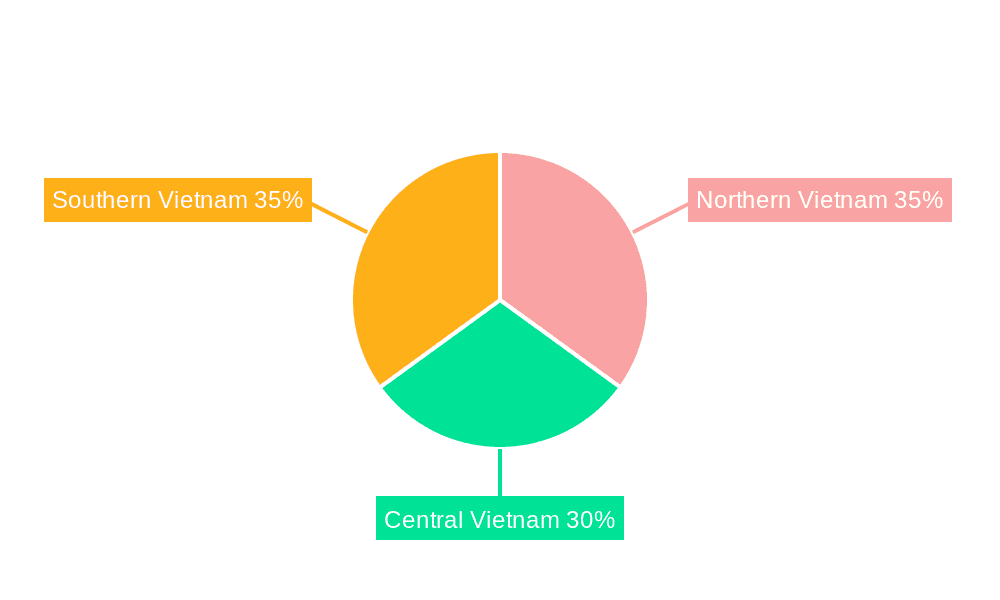

Dominant Regions & Segments in Vietnam Combine Harvesters Industry

This section identifies the leading regions and segments within the Vietnam combine harvester market. The analysis considers factors like agricultural output, infrastructure, and government policies to understand regional variations in market growth.

Leading Region: The Mekong Delta region is likely to be the dominant region due to its extensive rice cultivation. Key drivers include:

- Favorable government policies supporting agricultural modernization.

- Well-established agricultural infrastructure.

- High rice production volumes.

Dominant Segments:

- Wheeled-Type Combine Harvesters: This segment holds the largest market share due to its versatility and cost-effectiveness.

- Tractor-on-Top (TOT) Combine Harvesters: This segment is expected to witness significant growth due to its adaptability to varied terrains.

- Track-Type Combine Harvesters: This segment may see slower growth owing to higher initial investment costs.

The report provides a granular analysis of each segment’s market size, growth projections, and competitive landscape, revealing market leaders and emerging players in each segment.

Vietnam Combine Harvesters Industry Product Innovations

Recent years have witnessed significant product innovations in the Vietnam combine harvester market. Manufacturers are focusing on developing machines with improved fuel efficiency, higher harvesting capacity, enhanced precision, and reduced environmental impact. Technological advancements like GPS-guided systems, automated harvesting, and improved threshing mechanisms are gaining traction, boosting productivity and reducing operational costs. These innovations are crucial for addressing the needs of farmers and for enhancing the overall competitiveness of the Vietnamese agricultural sector.

Report Scope & Segmentation Analysis

This report comprehensively segments the Vietnam combine harvesters market by harvester type: Tractor-on-Top (TOT) Combine Harvesters, Wheeled-Type Combine Harvesters, and Track-Type Combine Harvesters. Each segment's market size, growth rate, and competitive dynamics are thoroughly analyzed, providing granular insights into the market's structure. The report projects substantial growth for all segments, with wheeled-type harvesters maintaining a dominant market share throughout the forecast period. Competitive dynamics vary across segments, with different players specializing in specific harvester types.

Key Drivers of Vietnam Combine Harvesters Industry Growth

The growth of the Vietnam combine harvesters industry is fueled by several key factors:

- Government support for agricultural mechanization: Policies aimed at modernizing agriculture are driving demand for advanced machinery.

- Rising agricultural production: Increased demand for food grains is boosting the need for efficient harvesting equipment.

- Improved infrastructure: Better roads and transportation networks facilitate the movement of harvesters and harvested crops.

- Technological advancements: Innovations in combine harvester technology are leading to higher efficiency and productivity.

Challenges in the Vietnam Combine Harvesters Industry Sector

The Vietnam combine harvesters industry faces several challenges:

- High initial investment costs: The price of advanced combine harvesters can be prohibitive for smallholder farmers.

- Limited access to financing: Farmers may struggle to secure loans to purchase expensive equipment.

- Maintenance and repair costs: Maintaining and repairing sophisticated machines can be costly.

- Skill gap among operators: A shortage of skilled operators can limit the efficient utilization of advanced harvesters.

Emerging Opportunities in Vietnam Combine Harvesters Industry

Despite challenges, several emerging opportunities exist for growth:

- Growing demand for precision farming technologies: Farmers are increasingly adopting technologies like GPS-guided systems for optimized harvesting.

- Expansion into new geographical areas: Opportunities exist to expand the market to less developed agricultural regions.

- Development of customized solutions: Tailoring combine harvesters to suit specific crops and farming practices can enhance market penetration.

- Focus on sustainable agriculture: Environmentally friendly harvesting practices are becoming increasingly important.

Leading Players in the Vietnam Combine Harvesters Industry Market

- Yanmar America Corporation

- Tong Yang Moolsan Co Ltd

- Iseki Corporation

- CLAAS KGaA mbH

- Kubota Corporation

- Vietnam Engine and Agricultural Machinery Corporation

- CNH Industrial

- Truong Hai Auto Corporation (THACO)

- ShanDong Huaxin Machinery Co Ltd

- Vietnam Agrotech Co Ltd

Key Developments in Vietnam Combine Harvesters Industry

- 2022 Q3: Kubota launched a new series of high-efficiency combine harvesters.

- 2021 Q4: A significant merger occurred between two domestic combine harvester manufacturers, increasing market concentration.

- 2020 Q1: The government introduced subsidies for farmers purchasing energy-efficient combine harvesters.

- (Add further key developments as available)

Future Outlook for Vietnam Combine Harvesters Industry Market

The Vietnam combine harvesters market is poised for robust growth over the next decade. Continued government support for agricultural modernization, rising agricultural output, and technological advancements will be key growth accelerators. Strategic partnerships between manufacturers and farmers, focused on providing affordable financing and training, will be crucial in expanding market penetration. The focus on sustainable and precision agriculture will further shape the industry's future, creating opportunities for innovation and investment.

Vietnam Combine Harvesters Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Combine Harvesters Industry Segmentation By Geography

- 1. Vietnam

Vietnam Combine Harvesters Industry Regional Market Share

Geographic Coverage of Vietnam Combine Harvesters Industry

Vietnam Combine Harvesters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Skilled Labor Shortage; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center

- 3.4. Market Trends

- 3.4.1. Shortage of Seasonal Agricultural Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Combine Harvesters Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yanmar America Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tong Yang Moolsan Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iseki Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CLAAS KGaA mbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kubota Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vietnam Engine and Agricultural Machinery Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CNH Industrial

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Truong Hai Auto Corporation (THACO)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ShanDong Huaxin Machinery Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vietnam Agrotech Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Yanmar America Corporation

List of Figures

- Figure 1: Vietnam Combine Harvesters Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Combine Harvesters Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Vietnam Combine Harvesters Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Combine Harvesters Industry?

The projected CAGR is approximately 11.90%.

2. Which companies are prominent players in the Vietnam Combine Harvesters Industry?

Key companies in the market include Yanmar America Corporation, Tong Yang Moolsan Co Ltd, Iseki Corporation, CLAAS KGaA mbH, Kubota Corporation, Vietnam Engine and Agricultural Machinery Corporation, CNH Industrial, Truong Hai Auto Corporation (THACO), ShanDong Huaxin Machinery Co Ltd, Vietnam Agrotech Co Ltd.

3. What are the main segments of the Vietnam Combine Harvesters Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 135.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Skilled Labor Shortage; Favorable Government Policies.

6. What are the notable trends driving market growth?

Shortage of Seasonal Agricultural Labor.

7. Are there any restraints impacting market growth?

Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Combine Harvesters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Combine Harvesters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Combine Harvesters Industry?

To stay informed about further developments, trends, and reports in the Vietnam Combine Harvesters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence