Key Insights

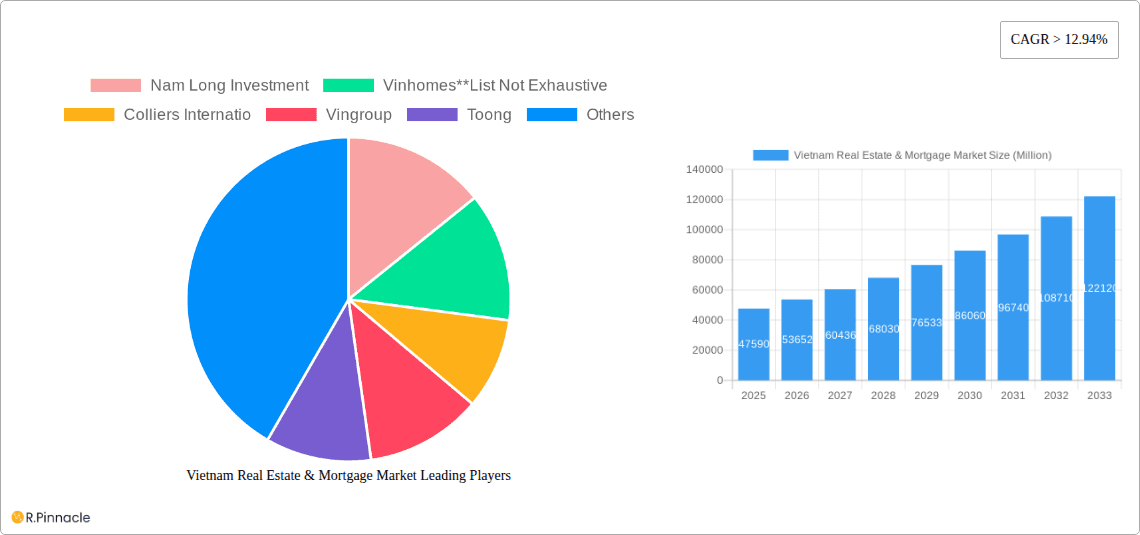

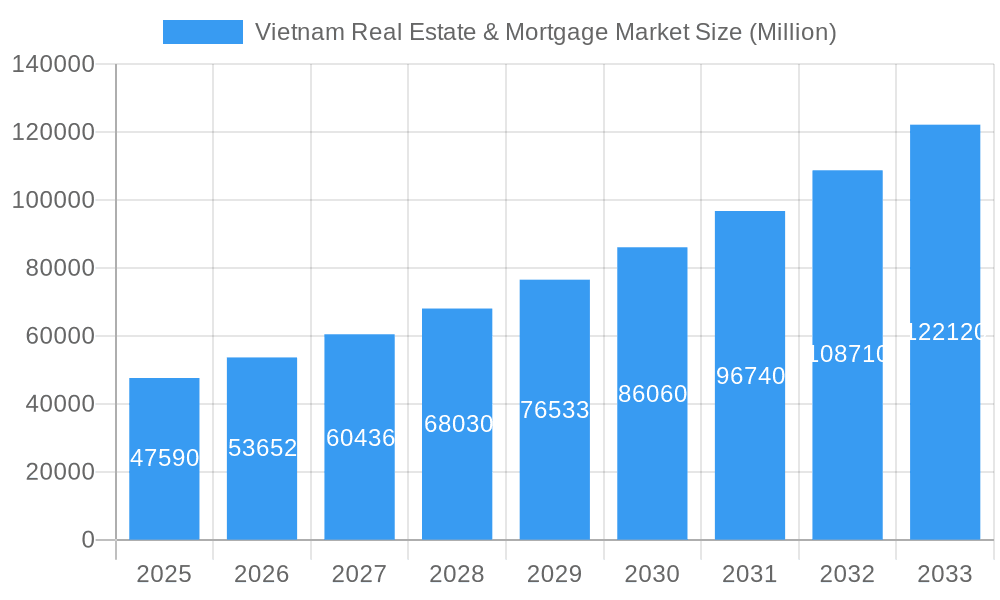

The Vietnam real estate and mortgage market exhibits robust growth potential, projected to reach a market size of $47.59 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 12.94% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, rapid urbanization and a burgeoning middle class are increasing demand for housing across all segments – residential, retail, logistics/industrial, hospitality, and office spaces. The preference for premium and luxury properties is rising, reflecting increasing disposable incomes and a shift towards higher living standards. Secondly, government initiatives aimed at improving infrastructure and streamlining real estate regulations are further stimulating market activity. Strategic investments in key cities like Ho Chi Minh City, Hanoi, Da Nang, and Quang Ninh are attracting both domestic and international developers. However, challenges such as fluctuating interest rates, potential oversupply in certain segments, and land acquisition complexities act as restraints. The competitive landscape is dominated by major players like Vingroup, Vinhomes, Nam Long Investment, and others, who are strategically expanding their portfolios and adopting innovative construction and financing models to cater to evolving market demands.

Vietnam Real Estate & Mortgage Market Market Size (In Billion)

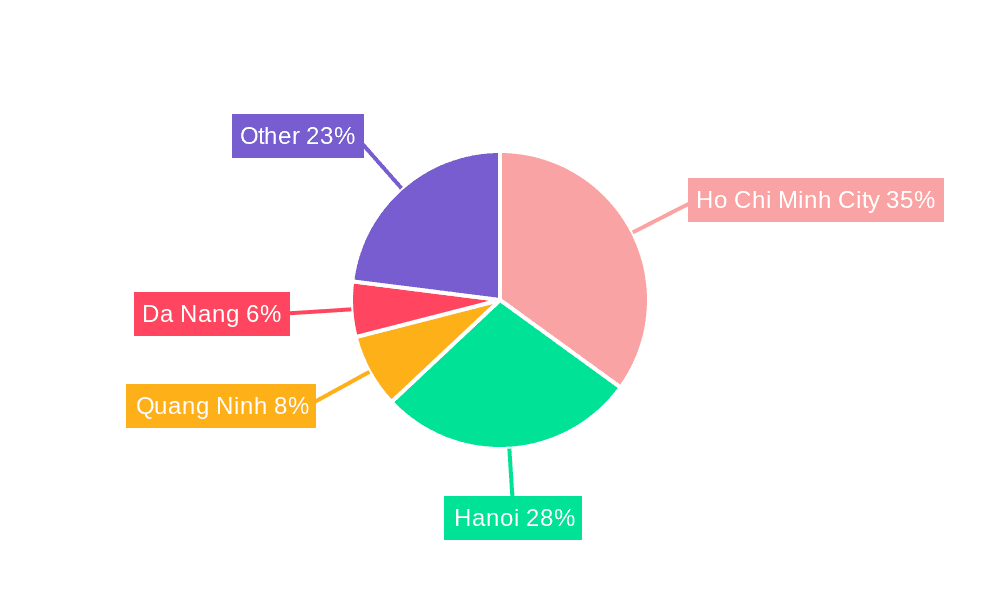

The market segmentation reveals diverse opportunities. The residential segment, encompassing premium, luxury, and affordable housing options, dominates the market share. The commercial sector, including retail, logistics/industrial, and hospitality, is also experiencing significant growth, driven by increasing foreign direct investment and tourism. Geographical distribution shows that Ho Chi Minh City and Hanoi remain the primary growth hubs, reflecting their economic significance. However, secondary cities like Da Nang and Quang Ninh are also witnessing increasing activity, attracting developers and investors seeking growth opportunities beyond the major metropolitan areas. The mortgage market's expansion is closely linked to real estate growth, with increased lending activity supporting property purchases and development projects. Therefore, a positive outlook for the Vietnam real estate market translates into strong growth potential for the mortgage sector, as well.

Vietnam Real Estate & Mortgage Market Company Market Share

Vietnam Real Estate & Mortgage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of Vietnam's dynamic real estate and mortgage market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and incorporates the latest market developments to deliver actionable intelligence. The report explores key segments, dominant players, and emerging trends, providing a 360-degree view of this rapidly evolving market. Key players such as Nam Long Investment, Vinhomes, Colliers International, Vingroup, Toong, Dat Xanh Group, Hung Thinh Real Estate Business Investment Corporation, Sun Group, FLC Group, Phat Dat Corporation, and Novaland Group are analyzed for their market positioning and contributions. Significant investments, such as Foxconn's USD 300 million expansion and Novaland's USD 250 million financing, are examined for their impact on market dynamics.

Vietnam Real Estate & Mortgage Market Structure & Innovation Trends

This section analyzes the competitive landscape, regulatory environment, and innovation drivers within Vietnam's real estate and mortgage market. We delve into market concentration, examining the market share of key players like Vinhomes and Novaland. The report explores the impact of M&A activities, including the USD 250 million investment in Novaland by Warburg Pincus, and their influence on market consolidation and innovation. Regulatory frameworks and their effects on market access and development are also examined. Furthermore, we analyze product substitutes, end-user demographics, and emerging technological trends shaping the market. The report also includes metrics such as market share held by major players and the total value of M&A deals concluded during the study period.

- Market Concentration: Analysis of market share held by top players (e.g., Vinhomes, Novaland). xx% market share for Vinhomes in 2024, xx% for Novaland.

- Innovation Drivers: Focus on technological advancements, government policies supporting sustainable development, and changing consumer preferences.

- Regulatory Framework: Assessment of the impact of building codes, zoning regulations, and mortgage lending policies on market growth.

- M&A Activity: Examination of recent mergers and acquisitions, including deal values and their influence on market dynamics. (e.g., Novaland's USD 250 million financing).

- Product Substitutes: Analysis of alternative investment options and their impact on the real estate market.

- End-User Demographics: Analysis of the changing needs and preferences of different demographics within the market.

Vietnam Real Estate & Mortgage Market Market Dynamics & Trends

This section provides a detailed analysis of the factors driving the growth of Vietnam's real estate and mortgage market. We examine key growth drivers, including rapid urbanization, rising disposable incomes, and increasing foreign direct investment. Technological disruptions, such as PropTech innovations, and their impact on market efficiency and customer experience are explored. The report also investigates evolving consumer preferences, including the demand for sustainable housing and smart homes, and analyzes the competitive dynamics shaping market strategies. Key metrics such as CAGR and market penetration rates for various segments are included.

Dominant Regions & Segments in Vietnam Real Estate & Mortgage Market

This section identifies the leading regions and segments within Vietnam's real estate market. Detailed analysis is provided for Ho Chi Minh City, Hanoi, Quang Ninh, and Da Nang, considering factors like economic growth, infrastructure development, and government policies. The analysis also covers segments by type (Residential, Retail, Logistics/Industrial, Hospitality, Office) and by value (Premium, Luxury, Affordable).

- By Key Cities:

- Ho Chi Minh City: Dominance driven by strong economic activity, high population density, and robust infrastructure.

- Hanoi: Growth fueled by government initiatives, increasing foreign investment, and expanding infrastructure.

- Quang Ninh: Growth driven by tourism, industrial development (Foxconn investment), and infrastructure improvements.

- Da Nang: Development spurred by tourism, industrial parks, and improved connectivity.

- By Type: Analysis of growth drivers within each segment (Residential, Retail, Logistics/Industrial, Hospitality, Office). Residential remains the largest segment.

- By Value: Analysis of the market size and growth potential for Premium, Luxury, and Affordable housing.

Vietnam Real Estate & Mortgage Market Product Innovations

This section summarizes recent product developments, highlighting innovative applications and competitive advantages. We focus on technological trends such as the integration of smart home technology and the use of big data analytics in property valuation and market forecasting. The market fit and adaptability of these innovations are evaluated in relation to consumer demand and market needs.

Report Scope & Segmentation Analysis

This report segments the Vietnamese real estate and mortgage market by type (Residential, Retail, Logistics/Industrial, Hospitality, Office), value (Premium, Luxury, Affordable), and key cities (Ho Chi Minh City, Hanoi, Quang Ninh, Da Nang). Each segment is analyzed individually, detailing growth projections, market sizes, and competitive dynamics. For example, the residential segment is further broken down by property type (apartments, villas, townhouses) and location (urban vs. suburban).

Key Drivers of Vietnam Real Estate & Mortgage Market Growth

Several key factors are driving the growth of Vietnam's real estate and mortgage market. These include robust economic growth, government policies promoting real estate development, and increasing urbanization. Foreign direct investment plays a significant role, as seen with Foxconn's investments in Quang Ninh. Technological advancements, particularly in construction and property management, further enhance market efficiency and attractiveness.

Challenges in the Vietnam Real Estate & Mortgage Market Sector

The Vietnam real estate market faces challenges including land scarcity in major cities, regulatory complexities, and infrastructure limitations in certain areas. Supply chain disruptions and fluctuating material costs impact development costs and timelines. Competition among developers can lead to price wars and reduced profit margins. These factors exert pressure on market growth and stability.

Emerging Opportunities in Vietnam Real Estate & Mortgage Market

The market presents several opportunities. Growth in e-commerce is driving demand for logistics and warehousing space. The rise of the middle class fuels demand for affordable and mid-range housing. Tourism-related development in key cities presents opportunities in hospitality and retail. Government initiatives promoting sustainable development create opportunities for eco-friendly projects.

Key Developments in Vietnam Real Estate & Mortgage Market Industry

- June 2023: Foxconn approved for USD 246 million investment in two new projects in Quang Ninh. This signals continued foreign investment in Vietnam's manufacturing sector, boosting related real estate demand.

- February 2023: Foxconn's USD 300 million expansion, including a USD 62.5 million lease for 111 acres in Bac Giang province, significantly impacts industrial real estate. This long-term lease (until 2057) demonstrates confidence in the Vietnamese market.

- June 2022: Novaland secures USD 250 million financing from Warburg Pincus, strengthening its position and potentially influencing market consolidation.

Future Outlook for Vietnam Real Estate & Mortgage Market Market

The Vietnamese real estate market is poised for continued growth, driven by strong economic fundamentals, urbanization, and increasing foreign investment. Strategic opportunities exist in developing sustainable and technologically advanced projects that cater to the evolving needs of a growing middle class. The government's continued focus on infrastructure development further enhances market potential.

Vietnam Real Estate & Mortgage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Retail

- 1.3. Logistics/Industrial

- 1.4. Hospitality

- 1.5. Office

-

2. Value

- 2.1. Premium

- 2.2. Luxury

- 2.3. Affordable

-

3. Key Cities

- 3.1. Ho Chi Minh City

- 3.2. Hanoi

- 3.3. Quang Ninh

- 3.4. Da Nang

Vietnam Real Estate & Mortgage Market Segmentation By Geography

- 1. Vietnam

Vietnam Real Estate & Mortgage Market Regional Market Share

Geographic Coverage of Vietnam Real Estate & Mortgage Market

Vietnam Real Estate & Mortgage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 12.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ho Chi Minh City and Hanoi were experiencing rapid urban expansion; Streamlined Real Estate Lending Service

- 3.3. Market Restrains

- 3.3.1. Declining property values as a result of volatile housing markets

- 3.4. Market Trends

- 3.4.1. Increased Population and Urbanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Real Estate & Mortgage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Retail

- 5.1.3. Logistics/Industrial

- 5.1.4. Hospitality

- 5.1.5. Office

- 5.2. Market Analysis, Insights and Forecast - by Value

- 5.2.1. Premium

- 5.2.2. Luxury

- 5.2.3. Affordable

- 5.3. Market Analysis, Insights and Forecast - by Key Cities

- 5.3.1. Ho Chi Minh City

- 5.3.2. Hanoi

- 5.3.3. Quang Ninh

- 5.3.4. Da Nang

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nam Long Investment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vinhomes**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colliers Internatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vingroup

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toong

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dat Xanh Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hung Thinh Real Estate Business Investment Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sun Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FLC Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phat Dat Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novaland Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Nam Long Investment

List of Figures

- Figure 1: Vietnam Real Estate & Mortgage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Real Estate & Mortgage Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Value 2020 & 2033

- Table 3: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 4: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Value 2020 & 2033

- Table 7: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 8: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Real Estate & Mortgage Market?

The projected CAGR is approximately > 12.94%.

2. Which companies are prominent players in the Vietnam Real Estate & Mortgage Market?

Key companies in the market include Nam Long Investment, Vinhomes**List Not Exhaustive, Colliers Internatio, Vingroup, Toong, Dat Xanh Group, Hung Thinh Real Estate Business Investment Corporation, Sun Group, FLC Group, Phat Dat Corporation, Novaland Group.

3. What are the main segments of the Vietnam Real Estate & Mortgage Market?

The market segments include Type, Value, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Ho Chi Minh City and Hanoi were experiencing rapid urban expansion; Streamlined Real Estate Lending Service.

6. What are the notable trends driving market growth?

Increased Population and Urbanization.

7. Are there any restraints impacting market growth?

Declining property values as a result of volatile housing markets.

8. Can you provide examples of recent developments in the market?

February 2023: Foxconn announced an investment of USD 300 million to expand its manufacturing facility in North Vietnam. Now, the supplier is leasing a new site in the Quang Chau Industrial Park in Bac Giang province, east of Hanoi. A South China Morning Post report reveals that Foxconn has signed a lease with Saigon-Bac Giang Industrial Park Corp for a plot of 111 acres for approximately USD 62.5 million. The lease will run until February 2057.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Real Estate & Mortgage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Real Estate & Mortgage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Real Estate & Mortgage Market?

To stay informed about further developments, trends, and reports in the Vietnam Real Estate & Mortgage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence