Key Insights

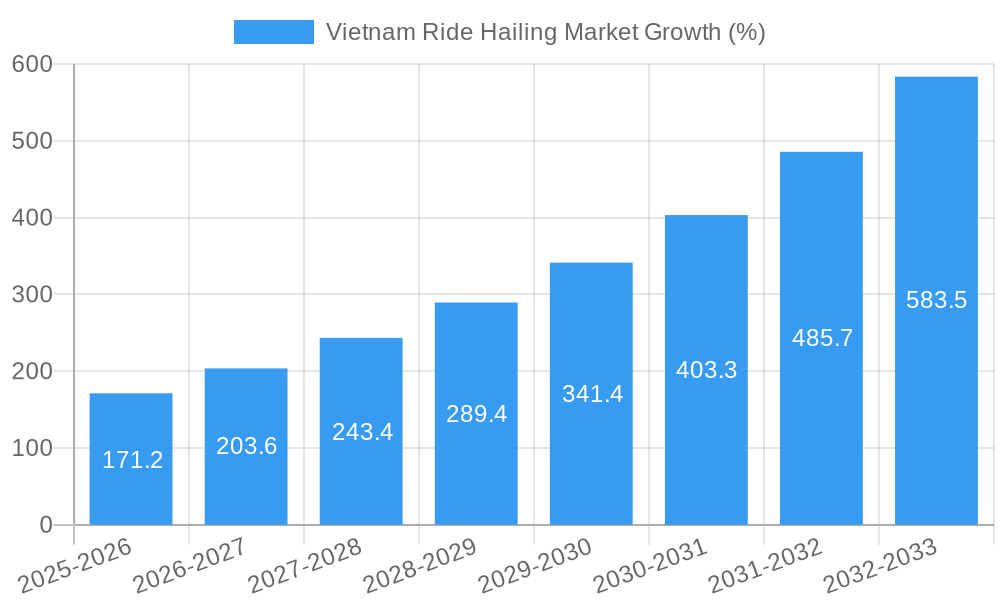

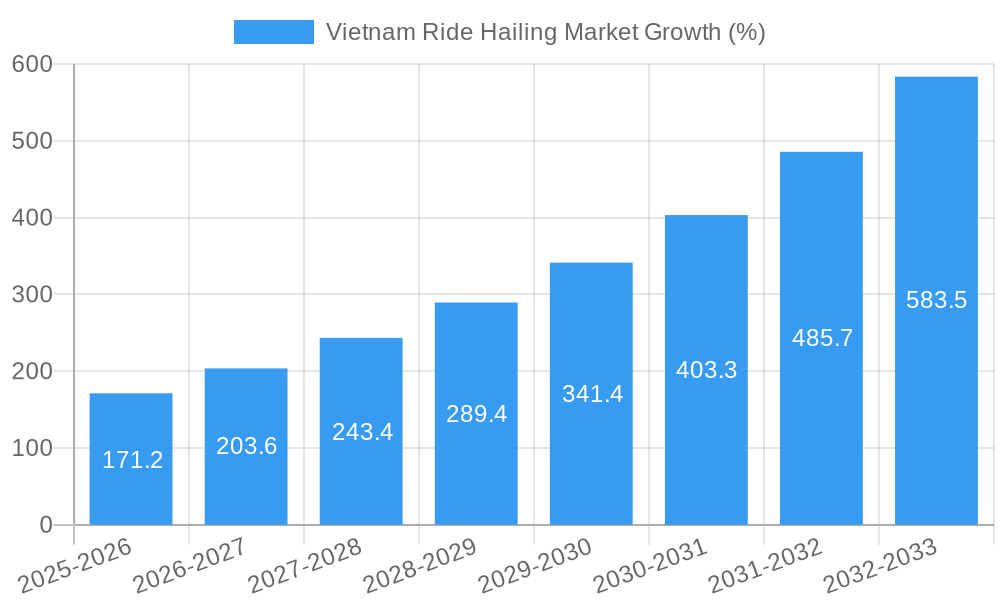

The Vietnam ride-hailing market, valued at $880 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 19.5% from 2025 to 2033. This surge is driven primarily by increasing smartphone penetration, rising urbanization, and a growing preference for convenient and affordable transportation options among Vietnam's young and increasingly affluent population. The market is segmented by vehicle type (passenger cars and motorcycles), propulsion type (ICE and electric), and geographical region, with major cities like Hanoi and Ho Chi Minh City leading in market share. The dominance of motorcycle taxis reflects the unique urban landscape and cost-sensitive nature of the market. However, the increasing adoption of electric vehicles, supported by government initiatives promoting sustainable transportation, is poised to significantly reshape the market landscape in the coming years. Competition is fierce, with established players like Grab, Gojek (now GoViet), and local companies like Vinasun vying for market dominance. Regulatory changes and infrastructure development will play crucial roles in shaping the future growth trajectory. The increasing popularity of delivery services integrated with ride-hailing platforms further contributes to the overall market expansion.

The continued expansion of the ride-hailing sector in Vietnam is heavily reliant on several factors. Firstly, improving infrastructure, particularly in less developed regions, will facilitate easier navigation and expansion beyond major urban centers. Secondly, technological advancements such as improved app functionality, enhanced payment gateways, and driver management systems will enhance the user experience. Thirdly, government policies promoting sustainable transportation, along with incentives for electric vehicle adoption, will significantly influence the shift towards greener transportation options. Finally, addressing concerns related to driver welfare, safety regulations, and fair pricing will be crucial for the sustainable growth and positive perception of the ride-hailing industry in Vietnam.

Vietnam Ride-Hailing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam ride-hailing market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategic planners seeking to understand the market's dynamics, growth potential, and competitive landscape. With a focus on key players like Grab, Gojek, and Vinasun, the report leverages robust data and analysis to deliver actionable intelligence. The report's base year is 2025, with estimations for 2025 and forecasts extending to 2033.

Vietnam Ride-Hailing Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Vietnamese ride-hailing market. The market structure is characterized by a mix of established players and emerging entrants, leading to intense competition.

- Market Concentration: The market exhibits a moderately concentrated structure, with Grab and Gojek holding significant market share, although precise figures vary by region and segment. Vinasun and Mai Linh also maintain substantial presence.

- Innovation Drivers: Technological advancements, such as the integration of AI and electric vehicles, are driving innovation. The adoption of cashless payments and in-app features also enhance the user experience and market competitiveness.

- Regulatory Framework: The government's policies regarding ride-hailing services significantly impact market operations. Recent regulations regarding licensing, safety standards, and pricing have shaped market dynamics.

- Product Substitutes: Traditional taxi services and personal vehicles remain viable alternatives. The rise of motorbike taxis presents a distinct competitive segment, heavily prevalent in Vietnam.

- End-User Demographics: The market caters to a broad demographic, ranging from young professionals to older individuals, although usage patterns may vary based on age, location, and income levels.

- M&A Activities: While specific M&A deal values remain unavailable (xx Million USD), the sector has witnessed several acquisitions and mergers in recent years, reflecting the drive for consolidation and expansion within the market.

Vietnam Ride-Hailing Market Dynamics & Trends

The Vietnam ride-hailing market demonstrates substantial growth potential fueled by several key drivers. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), driven by increasing smartphone penetration, rising urbanization, and a growing middle class with disposable income.

Technological advancements, such as the introduction of electric vehicles and improved navigation systems, continue to disrupt the market. Consumer preferences shift towards more convenient, affordable, and safe ride-hailing services. Competitive dynamics are characterized by fierce price wars, innovative service offerings, and expansion strategies into new regions and demographics. Market penetration for ride-hailing services continues to rise, surpassing xx% in major urban areas and showing potential for significant growth in other provinces.

Dominant Regions & Segments in Vietnam Ride-Hailing Market

Hanoi and Ho Chi Minh City represent the most dominant regions within the Vietnamese ride-hailing market, primarily driven by high population density, robust infrastructure, and increased demand for convenient transportation options.

Key Drivers:

- High Population Density: Concentrated populations in these cities create a large pool of potential users.

- Developed Infrastructure: Established road networks facilitate efficient transportation.

- High Smartphone Penetration: Digital adoption enables easy access to ride-hailing apps.

- Economic Activity: High economic activity generates strong demand for transportation services.

Dominant Segments:

- By Vehicle Type: Passenger cars hold a larger market share than motorcycles due to capacity and preference for comfort. However, motorcycles remain a significant segment, particularly for shorter distances and in congested areas.

- By Propulsion Type: Internal Combustion Engine (ICE) vehicles currently dominate, but Electric Vehicles (EV) are experiencing rapid growth, driven by government initiatives and increased environmental awareness. This segment is expected to see significant shifts in market share in the coming years.

- By Province: Besides Hanoi and Ho Chi Minh City, Binh Duong, Dong Nai, and Ba Ria-Vung Tau are experiencing significant growth due to industrial expansion and increased commuting needs.

Detailed dominance analysis reveals that Grab and Gojek, with their wider range of services and robust technological infrastructure, hold a competitive advantage in the major cities and are rapidly expanding into other provinces.

Vietnam Ride-Hailing Market Product Innovations

Recent innovations include the integration of advanced features such as real-time tracking, cashless payments, ride-sharing options, and enhanced safety measures. The introduction of electric vehicles is gaining momentum, aligning with global sustainability initiatives. These innovations are designed to improve user experience, cater to growing consumer preferences, and enhance competitive positioning. Market fit is influenced by factors such as affordability, convenience, and reliability.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Vietnam ride-hailing market, segmented by key factors to offer granular insights into its diverse landscape. The segmentation considers:

- Vehicle Type: Passenger cars and motorcycles, reflecting the distinct preferences and transportation needs across different regions and user demographics. The report analyzes the market share and growth trajectory of each vehicle type, highlighting the ongoing shift in consumer preference and its impact on the overall market.

- Propulsion Type: Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs), capturing the evolving technological landscape and the increasing adoption of sustainable transportation solutions. The analysis explores the growth potential of the EV segment, considering factors such as government incentives, charging infrastructure development, and consumer adoption rates.

- Province: A detailed breakdown across key provinces including Hanoi, Ho Chi Minh City, Binh Duong, Dong Nai, Ba Ria-Vung Tau, Hai Phong, Quang Ninh, Bac Ninh, Thanh Hoa, Nghe An, and other provinces. This geographical segmentation allows for a nuanced understanding of regional variations in market size, growth rates, competitive intensity, and consumer behavior. The report analyzes the factors driving growth in specific regions and the challenges faced in others.

Growth projections and market size estimations are provided for each segment, revealing significant variations across the market. The report highlights the substantial growth potential of the electric vehicle segment and the continued dominance of the motorcycle segment, particularly in less densely populated urban areas. Furthermore, a detailed competitive analysis within each segment reveals varying levels of market concentration, technological advancements, and the strategic approaches employed by different players.

Key Drivers of Vietnam Ride-Hailing Market Growth

Several factors propel growth in the Vietnam ride-hailing market. Rising urbanization and increasing disposable incomes fuel demand. Technological advancements, particularly in mobile technology and app development, enhance convenience and user experience. Government initiatives promoting technological innovation and sustainable transportation further stimulate market expansion.

Challenges in the Vietnam Ride-Hailing Market Sector

The market faces challenges like stringent regulations, competition from traditional taxis and motorbike taxis, and fluctuating fuel prices. Traffic congestion in major cities creates operational inefficiencies. Maintaining driver safety and security is also a significant concern. These factors impact profitability and operational efficiency for ride-hailing companies.

Emerging Opportunities in Vietnam Ride-Hailing Market

Emerging opportunities lie in the expansion into less-developed provinces, the growing adoption of electric vehicles, and the integration of innovative technologies like AI and machine learning. The development of specialized services, such as delivery and logistics solutions, expands market potential. Catering to evolving consumer preferences and addressing safety concerns also presents valuable avenues for growth.

Leading Players in the Vietnam Ride-Hailing Market

- Van Thong E-commerce Joint Stock Company

- FastGo Vietnam JSC

- Lozi Vietnam Joint Stock Company

- Vinasun Corporation

- Be Group JSC

- Viettel Post (MyGo)

- GrabTaxi Holdings Inc

- Xanh SM (GSM)

- Gojek Vietnam (GoViet)

- Mai Linh Corporation

Key Developments in Vietnam Ride-Hailing Market Industry

- June 2023: VinFast launched the VF 3, a mini electric car, impacting the EV segment.

- October 2023: Gojek expanded into Binh Duong and Dong Nai provinces, increasing competition.

- January 2024: Mai Linh expanded services in Hanoi, Da Nang, and Dong Nai, strengthening its market position.

- March 2024: Xanh SM Laos expanded its electric taxi service to Savannakhet Province, demonstrating the growth potential of electric ride-hailing.

Future Outlook for Vietnam Ride-Hailing Market

The Vietnam ride-hailing market exhibits significant long-term growth potential driven by continued urbanization, rising incomes, and technological innovation. The increasing adoption of electric vehicles presents a key opportunity. Strategic partnerships and investments in technology will be crucial for maintaining a competitive edge. The market is poised for further consolidation and expansion, with opportunities for both established players and new entrants.

Vietnam Ride Hailing Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Motorcycles

-

2. Propulsion Type

- 2.1. Internal Combustion Engine (ICE)

- 2.2. Electric

-

3. Province

- 3.1. Hanoi

- 3.2. Ho Chi Minh

- 3.3. Binh Duong

- 3.4. Dong Nai

- 3.5. Ba Ria-Vung Tau

- 3.6. Hai Phong

- 3.7. Quang Ninh

- 3.8. Bac Ninh

- 3.9. Thanh Hoa

- 3.10. Nghe An

- 3.11. Other Provinces

Vietnam Ride Hailing Market Segmentation By Geography

- 1. Vietnam

Vietnam Ride Hailing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Provide Long-term Momentum in Market; Increased Internet and Smartphone Penetration to Drive Market Demand

- 3.3. Market Restrains

- 3.3.1. High Purchase and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Passenger Cars will Continue to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Ride Hailing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Motorcycles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Internal Combustion Engine (ICE)

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Province

- 5.3.1. Hanoi

- 5.3.2. Ho Chi Minh

- 5.3.3. Binh Duong

- 5.3.4. Dong Nai

- 5.3.5. Ba Ria-Vung Tau

- 5.3.6. Hai Phong

- 5.3.7. Quang Ninh

- 5.3.8. Bac Ninh

- 5.3.9. Thanh Hoa

- 5.3.10. Nghe An

- 5.3.11. Other Provinces

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Van Thong E-commerce Joint Stock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FastGo Vietnam JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lozi Vietnam Joint Stock Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vinasun Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Be Group JSC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viettel Post (MyGo)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GrabTaxi Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Xanh SM (GSM)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GoJek Vietnam (GoViet)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mai Linh Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Van Thong E-commerce Joint Stock Company

List of Figures

- Figure 1: Vietnam Ride Hailing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Ride Hailing Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Ride Hailing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Ride Hailing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Vietnam Ride Hailing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Vietnam Ride Hailing Market Revenue Million Forecast, by Province 2019 & 2032

- Table 5: Vietnam Ride Hailing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Ride Hailing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Ride Hailing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Vietnam Ride Hailing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 9: Vietnam Ride Hailing Market Revenue Million Forecast, by Province 2019 & 2032

- Table 10: Vietnam Ride Hailing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Ride Hailing Market?

The projected CAGR is approximately 19.50%.

2. Which companies are prominent players in the Vietnam Ride Hailing Market?

Key companies in the market include Van Thong E-commerce Joint Stock Company, FastGo Vietnam JSC, Lozi Vietnam Joint Stock Company*List Not Exhaustive, Vinasun Corporation, Be Group JSC, Viettel Post (MyGo), GrabTaxi Holdings Inc, Xanh SM (GSM), GoJek Vietnam (GoViet), Mai Linh Corporation.

3. What are the main segments of the Vietnam Ride Hailing Market?

The market segments include Vehicle Type, Propulsion Type, Province.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Provide Long-term Momentum in Market; Increased Internet and Smartphone Penetration to Drive Market Demand.

6. What are the notable trends driving market growth?

Passenger Cars will Continue to be the Largest Segment.

7. Are there any restraints impacting market growth?

High Purchase and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

March 2024: Following successful launches in Vientiane and the tourist town of Vang Vieng, Xanh SM Laos officially expanded its electric taxi service to Savannakhet Province. This marks Xanh SM’s next step in brand development and the company’s continued commitment toward promoting electric vehicles and environmental protection worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Ride Hailing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Ride Hailing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Ride Hailing Market?

To stay informed about further developments, trends, and reports in the Vietnam Ride Hailing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence