Key Insights

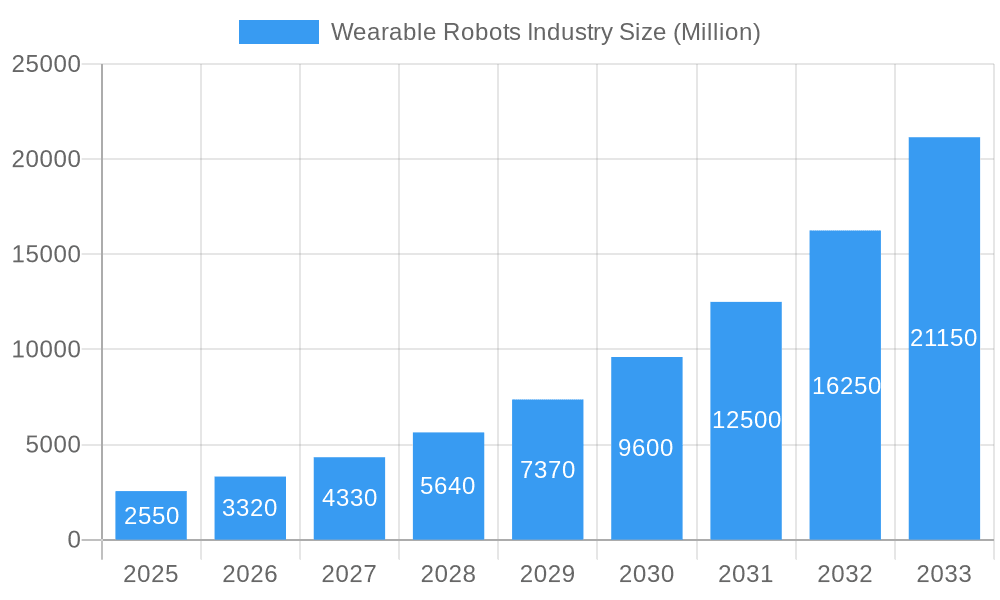

The global Wearable Robots Industry is poised for explosive growth, with a current market size of USD 2.55 Billion and a projected Compound Annual Growth Rate (CAGR) of 32.05% from 2025 to 2033. This remarkable expansion is fueled by several compelling drivers. Advancements in robotics, artificial intelligence, and sensor technology are enabling the development of more sophisticated and user-friendly wearable robots. The increasing demand for enhanced human capabilities in industrial settings, particularly in manufacturing and logistics, for tasks involving heavy lifting and repetitive motions, is a significant growth catalyst. Furthermore, the aging global population and the rising prevalence of mobility impairments are driving the adoption of exoskeletons in healthcare for rehabilitation, assistance, and improved quality of life. The military and defense sector also represents a key area of growth, with wearable robots being explored for soldier augmentation, load carrying, and enhanced combat capabilities.

Wearable Robots Industry Market Size (In Billion)

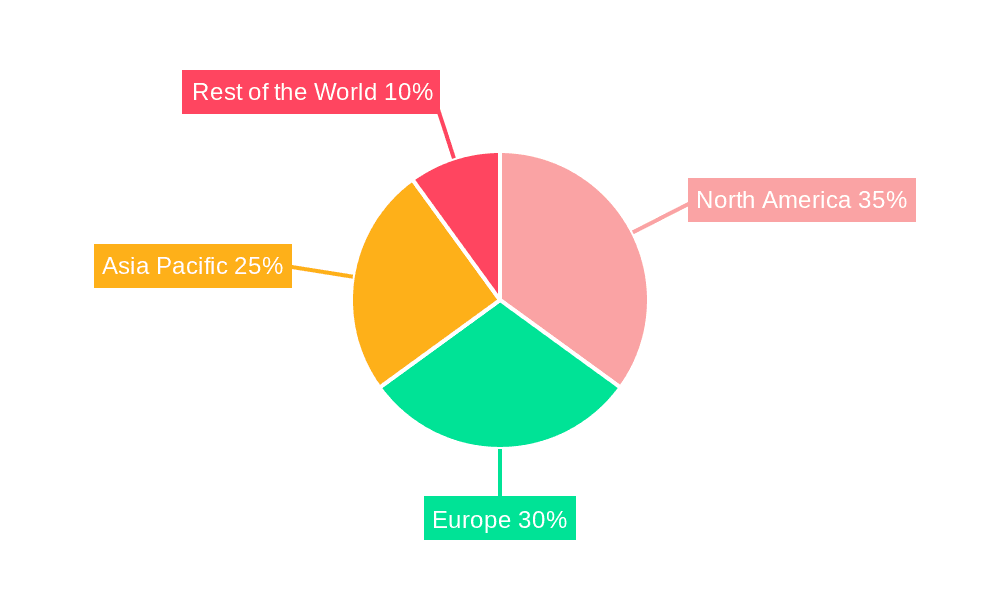

The industry's trajectory is further shaped by key trends such as the miniaturization and increased affordability of wearable robot components, leading to wider accessibility. The integration of advanced AI for adaptive control and intuitive human-robot interaction is transforming user experience and operational efficiency. However, certain restraints could temper this growth, including the high initial cost of some advanced systems and the need for extensive training and user acceptance. Regulatory hurdles and ethical considerations surrounding the widespread deployment of human augmentation technologies also warrant attention. Geographically, North America and Europe are expected to lead the market due to strong R&D investments and established healthcare and industrial infrastructure. Asia Pacific is anticipated to witness the fastest growth, driven by a burgeoning manufacturing sector and increasing healthcare expenditure. Key players like Lockheed Martin Corporation, Ekso Bionics Holdings Inc., and ReWalk Robotics Inc. are at the forefront, innovating and expanding the market landscape across various segments, including powered and passive exoskeletons tailored for healthcare, military, industrial, and other end-user applications.

Wearable Robots Industry Company Market Share

Unlock the potential of the burgeoning Wearable Robots industry with this comprehensive market analysis. Spanning from 2019 to 2033, with a deep dive into the Base Year 2025 and an extensive Forecast Period of 2025–2033, this report delivers critical insights into the forces shaping robotic exoskeletons and human augmentation.

This report is meticulously crafted for industry professionals, researchers, investors, and stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape of wearable robotics. Leverage high-ranking keywords like "wearable robots," "exoskeletons," "robotics industry," "human augmentation," "rehabilitation robots," "industrial exoskeletons," "military robots," and "healthcare robotics" to boost your strategic advantage.

Wearable Robots Industry Market Structure & Innovation Trends

The Wearable Robots industry is characterized by a dynamic market structure with a moderate level of concentration. Leading players are investing heavily in research and development, driven by innovation in sensor technology, artificial intelligence, and battery efficiency. Regulatory frameworks are evolving to ensure safety and efficacy, particularly in healthcare and industrial applications. Product substitutes, such as advanced prosthetics and physical therapy, exist but are increasingly being complemented or surpassed by the capabilities of advanced exoskeletons. End-user demographics are broadening, encompassing individuals with mobility impairments, military personnel, industrial workers, and those seeking performance enhancement. Mergers and acquisitions are anticipated to play a significant role in consolidating market share and fostering technological advancements. We project M&A deal values to reach in the range of several hundred million USD annually. Market share distribution currently sees a significant portion held by companies specializing in powered exoskeletons for healthcare applications, estimated at 60% of the total market.

Wearable Robots Industry Market Dynamics & Trends

The Wearable Robots industry is poised for remarkable growth, driven by a confluence of technological advancements, increasing demand for human augmentation, and a growing awareness of the benefits of robotic assistance across various sectors. The market penetration of wearable robots is steadily increasing, particularly within the healthcare segment for rehabilitation and assistive purposes, and in industrial settings to enhance worker productivity and safety. Technological disruptions, including advancements in AI-powered control systems, miniaturization of components, and improved power efficiency, are key enablers of this expansion. Consumer preferences are shifting towards more intuitive, adaptable, and user-friendly robotic solutions. Competitive dynamics are intensifying, with established players and emerging startups vying for market dominance through product innovation and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the wearable robots market is projected to be robust, estimated at approximately 20% over the forecast period (2025–2033). This growth is fueled by the continuous evolution of powered exoskeletons and the expanding applications of passive exoskeletons in specific use cases. The increasing adoption in industrial environments, driven by the need for ergonomic support and injury prevention, is a significant trend, alongside the established demand in military and defense for enhanced soldier capabilities.

Dominant Regions & Segments in Wearable Robots Industry

North America currently stands as the dominant region in the Wearable Robots industry, largely propelled by robust government funding for military and defense applications, a strong healthcare infrastructure, and a high concentration of leading research institutions and technology companies. The United States, in particular, is a powerhouse, driven by significant investment in advanced robotics and a proactive approach to integrating these technologies into critical sectors.

- Type: Powered Exoskeletons: This segment is expected to continue its dominance, accounting for over 70% of the total market share. The ability of powered exoskeletons to provide active assistance and enhance mobility makes them indispensable in rehabilitation, military, and advanced industrial applications. Growth is fueled by continuous improvements in battery life, motor efficiency, and AI-driven control algorithms.

- End-user Industry: Healthcare: The healthcare sector is the largest and fastest-growing end-user industry. Its dominance is attributed to the increasing prevalence of neurological disorders, aging populations requiring assistive devices, and the growing demand for advanced rehabilitation solutions. The development of user-friendly and effective rehabilitation exoskeletons for stroke recovery, spinal cord injuries, and general mobility assistance is a key driver. Economic policies supporting healthcare innovation and reimbursement for robotic therapies further bolster this segment.

- End-user Industry: Military and Defense: This sector remains a significant consumer of wearable robots, particularly powered exoskeletons designed to enhance soldier endurance, strength, and load-carrying capacity. Government procurement policies and ongoing geopolitical developments are key drivers.

- End-user Industry: Industrial: The industrial segment is witnessing substantial growth, driven by the need for worker safety, ergonomic support, and increased productivity. Companies are adopting exoskeletons to reduce musculoskeletal injuries and improve efficiency in manufacturing, logistics, and construction. Favorable economic conditions and investments in workplace safety initiatives are key enablers.

Wearable Robots Industry Product Innovations

Product innovations in the Wearable Robots industry are primarily focused on enhancing user experience, improving functionality, and expanding application scope. Advancements in materials science are leading to lighter, more durable, and more comfortable exoskeleton designs. The integration of sophisticated AI and machine learning algorithms allows for more intuitive and responsive control, adapting to individual user movements and needs. Key applications include assisting individuals with mobility impairments in healthcare, augmenting soldier capabilities in defense, and providing ergonomic support to industrial workers. Competitive advantages are being gained through features like modular design, wireless connectivity, and predictive maintenance capabilities, making these robotic systems more practical and cost-effective for widespread adoption.

Report Scope & Segmentation Analysis

This report segments the Wearable Robots market by Type and End-user Industry. The Type segmentation includes:

- Powered Exoskeletons: These are robotic suits that actively assist the user's movements through powered actuators. Projections indicate significant growth, driven by advancements in motor technology and AI, with an estimated market size of over $10 Million by 2025 and projected to reach over $20 Million by 2033.

- Passive Exoskeletons: These devices provide structural support and assist movement through mechanical means without powered actuators. While smaller in market share, they offer cost-effective solutions for specific industrial and assistive tasks, with steady growth expected.

The End-user Industry segmentation includes:

- Healthcare: This segment is expected to dominate, with substantial growth driven by the increasing demand for rehabilitation and assistive technologies for neurological and mobility-related conditions. Market size is estimated to be over $8 Million in 2025 and projected to exceed $15 Million by 2033.

- Military and Defense: This segment sees consistent demand for exoskeletons to enhance soldier performance and reduce fatigue. Market size is estimated at over $5 Million in 2025 and projected to reach over $9 Million by 2033.

- Industrial: This segment is experiencing rapid expansion due to the focus on worker safety and productivity. Market size is estimated at over $4 Million in 2025 and projected to exceed $8 Million by 2033.

- Other End-user Industries: This includes emerging applications in sports, entertainment, and personal use, with nascent but promising growth potential.

Key Drivers of Wearable Robots Industry Growth

The growth of the Wearable Robots industry is propelled by several interconnected factors. Technologically, advancements in artificial intelligence, robotics, sensor technology, and battery efficiency are enabling the development of more sophisticated, versatile, and user-friendly exoskeletons. Economically, increasing healthcare expenditure, coupled with a growing emphasis on worker safety and productivity in industrial sectors, creates a strong demand for assistive and augmentative robotic solutions. Regulatory frameworks, while still evolving, are becoming more supportive of innovative medical devices and industrial safety technologies, further accelerating adoption. For example, the increasing need for rehabilitation solutions for a growing aging population and individuals with spinal cord injuries is a significant economic and demographic driver.

Challenges in the Wearable Robots Industry Sector

Despite its promising trajectory, the Wearable Robots industry faces several challenges. High manufacturing costs for advanced exoskeletons can limit widespread adoption, particularly in cost-sensitive markets. Regulatory hurdles, though evolving, can still pose a barrier to entry, requiring extensive testing and approval processes. Supply chain complexities for specialized components can impact production timelines and costs. Competitive pressures from established players and new entrants necessitate continuous innovation and cost optimization. Quantifiable impacts include potential delays in market penetration due to lengthy approval processes, estimated to add 1-2 years to product launch cycles for novel devices, and increased R&D expenditure, accounting for approximately 15-20% of revenue for leading companies.

Emerging Opportunities in Wearable Robots Industry

Emerging opportunities in the Wearable Robots industry lie in several key areas. The expansion of applications beyond traditional healthcare and military uses into consumer markets, such as personal mobility assistance and fitness enhancement, presents significant growth potential. Advances in miniaturization and material science are paving the way for lighter, more aesthetically pleasing, and less obtrusive wearable robotic devices. The increasing integration of IoT and cloud-based data analytics offers opportunities for remote monitoring, personalized training, and predictive maintenance, further enhancing the value proposition of wearable robots. Furthermore, the development of collaborative robots that work alongside humans, rather than solely augmenting them, opens new avenues for human-robot interaction and efficiency gains in various industries.

Leading Players in the Wearable Robots Industry Market

- Lockheed Martin Corporation

- Hocoma AG (DIH International Ltd)

- Sarcos Corporation

- Ekso Bionics Holdings Inc

- Technaid S L

- Cyberdyne Inc

- Skelex

- ATOUN Inc

- Honda Motor Co Ltd

- ReWalk Robotics Inc

Key Developments in Wearable Robots Industry Industry

- November 2021: Rewalk Robotics Ltd received a 'Breakthrough Designation' from the FDA for its ReBoot, battery-powered orthotic exo-suit, designed to assist ambulatory functions in individuals with reduced ankle function related to neurological injuries, such as stroke. It is intended for home and community use.

- March 2021: DIH International Limited, the parent company of Hocomo, partnered with Reha technology to distribute the rehabilitation robotics products developed by the latter in Switzerland, Germany, and the United States. The products are end-effector-based gait therapy devices for lower extremities rehabilitation.

Future Outlook for Wearable Robots Industry Market

The future outlook for the Wearable Robots industry is exceptionally bright, characterized by sustained growth and expanding adoption across diverse sectors. Continued innovation in AI, miniaturization, and power management will lead to more intuitive, comfortable, and affordable robotic solutions. The healthcare sector will remain a primary growth engine, with an increasing focus on home-based rehabilitation and assistive technologies for an aging global population. The industrial sector will see further integration of exoskeletons for ergonomic support and injury prevention, enhancing worker well-being and productivity. Emerging markets in developing economies and the consumer sector present significant untapped potential. Strategic partnerships, coupled with a favorable regulatory environment, will be crucial for realizing the full market potential and solidifying the role of wearable robots in augmenting human capabilities.

Wearable Robots Industry Segmentation

-

1. Type

- 1.1. Powered Exoskeletons

- 1.2. Passive Exoskeletons

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Military and Defense

- 2.3. Industrial

- 2.4. Other End-user Industries

Wearable Robots Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Wearable Robots Industry Regional Market Share

Geographic Coverage of Wearable Robots Industry

Wearable Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Robotic Rehabilitation in Healthcare Industry; Growing Investment in the Development of the Exoskeleton Technology

- 3.3. Market Restrains

- 3.3.1. High Cost of the Equipment

- 3.4. Market Trends

- 3.4.1. Healthcare is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powered Exoskeletons

- 5.1.2. Passive Exoskeletons

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Military and Defense

- 5.2.3. Industrial

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powered Exoskeletons

- 6.1.2. Passive Exoskeletons

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Healthcare

- 6.2.2. Military and Defense

- 6.2.3. Industrial

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powered Exoskeletons

- 7.1.2. Passive Exoskeletons

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Healthcare

- 7.2.2. Military and Defense

- 7.2.3. Industrial

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powered Exoskeletons

- 8.1.2. Passive Exoskeletons

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Healthcare

- 8.2.2. Military and Defense

- 8.2.3. Industrial

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powered Exoskeletons

- 9.1.2. Passive Exoskeletons

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Healthcare

- 9.2.2. Military and Defense

- 9.2.3. Industrial

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lockheed Martin Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hocoma AG (DIH International Ltd )

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sarcos Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ekso Bionics Holdings Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Technaid S L

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cyberdyne Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Skelex

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ATOUN Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Honda Motor Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ReWalk Robotics Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Global Wearable Robots Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Wearable Robots Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Robots Industry?

The projected CAGR is approximately 32.05%.

2. Which companies are prominent players in the Wearable Robots Industry?

Key companies in the market include Lockheed Martin Corporation, Hocoma AG (DIH International Ltd ), Sarcos Corporation, Ekso Bionics Holdings Inc, Technaid S L, Cyberdyne Inc, Skelex, ATOUN Inc, Honda Motor Co Ltd, ReWalk Robotics Inc.

3. What are the main segments of the Wearable Robots Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Robotic Rehabilitation in Healthcare Industry; Growing Investment in the Development of the Exoskeleton Technology.

6. What are the notable trends driving market growth?

Healthcare is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

High Cost of the Equipment.

8. Can you provide examples of recent developments in the market?

November 2021 - Rewalk Robotics Ltd received a 'Breakthrough Designation' from the FDA for its ReBoot, battery-powered orthotic exo-suit, designed to assist ambulatory functions in individuals with reduced ankle function related to neurological injuries, such as stroke. It is intended for home and community use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Robots Industry?

To stay informed about further developments, trends, and reports in the Wearable Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence