Key Insights

The global Wireless Flow Sensors market is poised for substantial expansion, projected to reach $27.18 billion by 2025, driven by an impressive compound annual growth rate (CAGR) of 20.6%. This robust growth is fueled by the escalating demand for real-time data acquisition and remote monitoring across a diverse range of industries, including water and wastewater management, chemicals and petrochemicals, and power generation. The inherent benefits of wireless technology, such as reduced installation costs, enhanced flexibility, and improved operational efficiency, are critical enablers. Furthermore, the increasing adoption of the Industrial Internet of Things (IIoT) and smart manufacturing initiatives are creating significant opportunities for wireless flow sensors to integrate seamlessly into automated systems. The continuous advancement in sensor technologies, miniaturization, and improved battery life are also contributing to the market's upward trajectory, making these solutions more accessible and reliable for various applications.

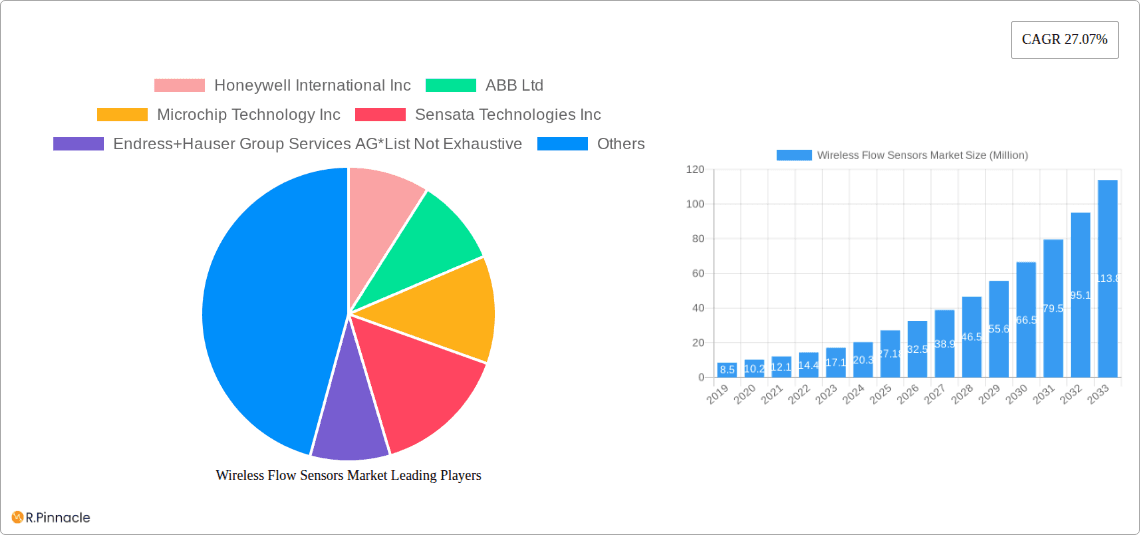

Wireless Flow Sensors Market Market Size (In Million)

The market is witnessing significant innovation and adoption of various technologies, including Bluetooth, ZigBee, RFID, Wi-Fi, and WLAN, each offering distinct advantages for specific deployment scenarios. The growing emphasis on process optimization, stringent regulatory compliance, and the need for predictive maintenance are further stimulating the demand for accurate and reliable wireless flow measurement. While the market exhibits immense potential, certain factors such as initial implementation costs in legacy systems and cybersecurity concerns associated with wireless data transmission could pose minor challenges. However, the overwhelming advantages in terms of operational efficiency, cost savings, and enhanced safety are expected to propel the market's continued dominance. Leading companies like Honeywell International Inc., ABB Ltd., and Siemens AG are at the forefront of this innovation, investing heavily in research and development to offer advanced solutions that cater to the evolving needs of industries worldwide. The market's segmented growth across various applications and technologies underscores its dynamic nature and widespread applicability.

Wireless Flow Sensors Market Company Market Share

This in-depth report provides a granular analysis of the global Wireless Flow Sensors market, projecting its trajectory from 2019 to 2033. With a base year of 2025, the study delves into market dynamics, technological advancements, regional dominance, and key player strategies. The market is poised for significant expansion, driven by increasing demand for real-time data, operational efficiency, and the proliferation of IoT in industrial settings. We forecast the market to reach $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033).

Wireless Flow Sensors Market Market Structure & Innovation Trends

The Wireless Flow Sensors market exhibits a moderately consolidated structure, characterized by the presence of several global players and a growing number of niche innovators. Market concentration is influenced by proprietary technology, strong distribution networks, and the ability to integrate seamlessly with existing industrial automation systems. Innovation is primarily driven by the demand for enhanced accuracy, reduced installation costs, improved data security, and the integration of advanced analytics. Key innovation drivers include miniaturization, energy efficiency for battery-powered sensors, and the development of robust wireless protocols capable of withstanding harsh industrial environments.

- Market Concentration: Dominated by established players with substantial R&D investments and broad product portfolios.

- Innovation Drivers:

- Demand for real-time, accurate flow data.

- Reduction in cabling and installation complexity.

- Integration with IoT platforms and cloud analytics.

- Development of energy-efficient wireless technologies.

- Enhanced diagnostic and predictive maintenance capabilities.

- Regulatory Frameworks: Adherence to industrial safety standards (e.g., ATEX, IECEx) and wireless communication regulations (e.g., FCC, CE) are crucial.

- Product Substitutes: Traditional wired flow sensors and less sophisticated mechanical flow meters still represent a segment of the market, particularly in cost-sensitive applications or environments where wireless implementation is challenging.

- End-User Demographics: Primarily large industrial enterprises across sectors such as water and wastewater, chemicals and petrochemicals, power generation, and food & beverage. Small and medium-sized enterprises (SMEs) are increasingly adopting these technologies due to falling costs and ease of deployment.

- M&A Activities: Moderate M&A activity is observed as larger companies seek to acquire innovative technologies or expand their market reach. Deal values are expected to range from $XX million to $XXX million for strategic acquisitions.

Wireless Flow Sensors Market Market Dynamics & Trends

The Wireless Flow Sensors market is experiencing robust growth, propelled by a confluence of powerful market dynamics and evolving technological trends. The fundamental driver of this expansion is the pervasive shift towards smart manufacturing and Industry 4.0 principles, where real-time data acquisition and analysis are paramount for optimizing operational efficiency, reducing costs, and ensuring process reliability. The increasing adoption of the Internet of Things (IoT) across various industrial verticals has created a fertile ground for wireless flow sensors, enabling them to transmit critical flow data wirelessly to central monitoring systems, cloud platforms, or mobile devices. This seamless connectivity empowers industries to achieve unprecedented levels of process visibility and control.

Technological disruptions are continuously reshaping the market landscape. The ongoing development and refinement of wireless communication protocols such as Bluetooth Low Energy (BLE), ZigBee, Wi-Fi, and LoRaWAN are making wireless deployments more reliable, secure, and energy-efficient. This is particularly critical for battery-powered sensors, extending their operational life and reducing maintenance overheads. Furthermore, advancements in sensor materials and microelectronics are leading to more accurate, durable, and cost-effective wireless flow sensor solutions. The integration of AI and machine learning algorithms with flow sensor data is enabling predictive maintenance, anomaly detection, and advanced process optimization, moving beyond simple data collection to intelligent insights.

Consumer preferences are increasingly leaning towards solutions that offer ease of installation, minimal disruption to existing infrastructure, and lower total cost of ownership. Wireless flow sensors excel in these aspects by eliminating the need for extensive cabling, thereby reducing installation time and labor costs. The ability to remotely monitor and diagnose sensor performance also contributes to greater operational convenience and reduced downtime. The growing awareness of water scarcity and the stringent regulations surrounding water management are significantly boosting the demand for wireless flow sensors in the water and wastewater treatment sectors. Similarly, the chemical and petrochemical industries are leveraging these sensors for enhanced safety, precise process control, and compliance with environmental regulations.

The competitive dynamics within the market are characterized by intense innovation, strategic partnerships, and a focus on expanding product portfolios to cater to diverse application needs. Companies are investing heavily in R&D to develop next-generation wireless flow sensors that offer higher accuracy, wider measurement ranges, and superior performance in challenging environments. The market penetration of wireless flow sensors, while growing rapidly, still has significant headroom, particularly in legacy industrial facilities undergoing modernization. The CAGR for the Wireless Flow Sensors market is estimated to be robust, projecting significant growth in market penetration over the forecast period.

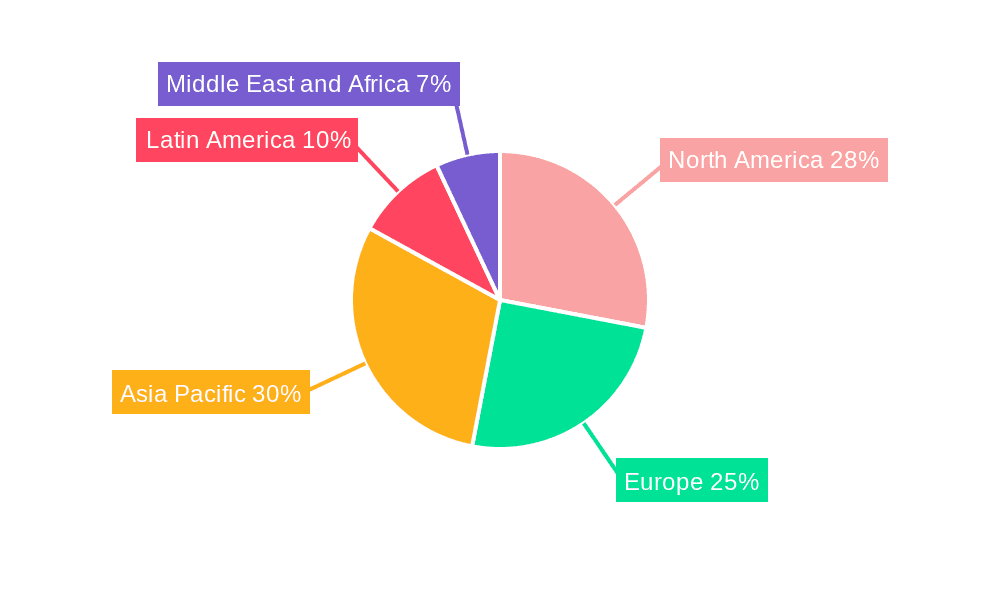

Dominant Regions & Segments in Wireless Flow Sensors Market

North America and Europe currently stand as the dominant regions in the Wireless Flow Sensors market, driven by their well-established industrial infrastructure, high adoption rates of advanced automation technologies, and stringent regulatory frameworks that mandate efficient resource management. The significant presence of key players headquartered in these regions, coupled with substantial investments in research and development, further solidifies their leadership. Economic policies that encourage industrial digitization and sustainability initiatives play a crucial role in accelerating the adoption of wireless flow sensing solutions.

Within the technological segmentation, Wi-Fi and WLAN are emerging as dominant technologies. This dominance is attributed to their widespread availability, high data transfer rates, and the increasing integration of Wi-Fi capabilities in industrial automation equipment and control systems. The ability to leverage existing network infrastructure makes Wi-Fi a cost-effective and convenient choice for many applications.

- Key Drivers for Wi-Fi/WLAN Dominance:

- Ubiquitous availability and familiarity.

- High bandwidth for real-time data transmission.

- Seamless integration with existing IT and OT networks.

- Growing support from device manufacturers and cloud platforms.

- Enables remote access and configuration for diagnostics.

In terms of applications, the Water and Wastewater sector represents a significant and rapidly growing segment for wireless flow sensors. The critical need for accurate monitoring of water distribution, leak detection, treatment process control, and compliance with environmental discharge regulations makes wireless solutions indispensable. The increasing focus on water conservation, smart city initiatives, and the aging infrastructure in many municipalities are further fueling demand.

- Key Drivers for Water and Wastewater Dominance:

- Essential for accurate resource management and conservation.

- Critical for regulatory compliance and environmental protection.

- Enables early leak detection, reducing water loss.

- Facilitates optimized treatment processes for efficiency.

- Supports smart city infrastructure development.

The Chemicals and Petrochemicals sector also exhibits strong demand, driven by the imperative for precision in process control, safety, and the prevention of hazardous leaks. Wireless sensors allow for monitoring in potentially explosive or corrosive environments where wired installations might be challenging or hazardous. The Power Generation sector relies on wireless flow sensors for efficient fuel monitoring, steam flow measurement, and optimizing plant operations for maximum energy output and minimal emissions.

Wireless Flow Sensors Market Product Innovations

Recent product innovations in the Wireless Flow Sensors market focus on enhancing connectivity, accuracy, and user-friendliness. Companies are developing sensors with integrated wireless modules supporting multiple protocols like Bluetooth, Wi-Fi, and proprietary low-power networks, offering flexibility in deployment. Advanced diagnostic features, remote configuration capabilities via mobile applications, and improved battery life are key competitive advantages. For instance, the integration of Wi-Fi connectivity in Coriolis transmitters enables easy on-site configuration and diagnostics, providing valuable process insights and ensuring total flow measurement confidence. This trend emphasizes smart, connected devices that contribute to greater operational efficiency and reduced maintenance needs.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Wireless Flow Sensors market across various technological and application segments. The Technology segmentation includes Bluetooth, ZigBee, RFID, Wi-Fi, WLAN, and EnOcean. Each technology offers unique benefits in terms of range, power consumption, and data throughput, catering to specific application requirements. The Application segmentation covers Water and Wastewater, Chemicals and Petrochemicals, Power Generation, and Other Applications (including Food & Beverage, Oil & Gas, and Manufacturing). Market size and growth projections are provided for each segment, with detailed analysis of competitive dynamics, key market drivers, and emerging opportunities within each.

Key Drivers of Wireless Flow Sensors Market Growth

The Wireless Flow Sensors market is propelled by several key drivers:

- Industry 4.0 and IoT Adoption: The widespread integration of IoT devices and the push towards smart manufacturing necessitate real-time data from field devices, including flow sensors.

- Demand for Operational Efficiency: Wireless sensors reduce installation costs, minimize downtime, and provide data for process optimization, leading to significant cost savings.

- Enhanced Accuracy and Reliability: Advancements in sensor technology and wireless communication ensure more precise flow measurements, crucial for critical processes.

- Environmental Regulations and Sustainability: Stringent regulations concerning water management, emissions, and resource conservation drive the adoption of accurate monitoring systems.

- Safety Concerns in Hazardous Environments: Wireless sensors eliminate the need for cabling in potentially explosive or corrosive areas, improving worker safety.

Challenges in the Wireless Flow Sensors Market Sector

Despite the robust growth, the Wireless Flow Sensors market faces several challenges:

- Cybersecurity Concerns: Ensuring the security of data transmitted wirelessly from industrial sensors is paramount to prevent unauthorized access or manipulation.

- Interoperability and Standardization: A lack of universal standards across different wireless technologies and platforms can hinder seamless integration.

- Battery Life and Maintenance: For battery-powered sensors, managing battery life and replacement schedules can be a logistical challenge, especially in remote or hard-to-reach locations.

- Environmental Interference: Harsh industrial environments with electromagnetic interference or physical obstructions can impact wireless signal strength and reliability.

- Initial Investment Costs: While installation costs are lower, the initial purchase price of sophisticated wireless flow sensors can still be a barrier for some smaller enterprises.

Emerging Opportunities in Wireless Flow Sensors Market

Emerging opportunities in the Wireless Flow Sensors market are diverse and promising:

- Predictive Maintenance and AI Integration: Leveraging sensor data with AI for predictive maintenance offers significant value, preventing failures and optimizing asset management.

- Smart Water Management Solutions: The growing global focus on water scarcity and efficient water usage presents a vast opportunity for wireless flow sensors in municipal and industrial water systems.

- Expansion into New Verticals: Applications in sectors like pharmaceutical manufacturing, food and beverage processing, and HVAC systems are becoming more prominent.

- Development of Low-Power, Long-Range Technologies: Continued innovation in technologies like LoRaWAN and NB-IoT will enable deployments in remote or challenging locations with extended battery life.

- Augmented Reality (AR) Integration: Combining wireless sensor data with AR for remote diagnostics and maintenance training offers enhanced operational support.

Leading Players in the Wireless Flow Sensors Market Market

- Honeywell International Inc

- ABB Ltd

- Microchip Technology Inc

- Sensata Technologies Inc

- Endress+Hauser Group Services AG

- Emerson Electric Co

- NXP Semiconductors

- Siemens AG

- Texas Instruments Incorporated

- Panasonic Corporation

- AW-Lake

Key Developments in Wireless Flow Sensors Market Industry

- September 2022: Wireless technology enabled intelligent field device configuration and diagnostics options for process automation-related mobile applications. Emerson Electric Co's Micro Motion Model 5700 Advanced, Field-Mount, or Truck-Mount Coriolis Transmitter with Wi-Fi connectivity ensures total flow measurement confidence, valuable process insight, and greater operational efficiency. It now has an option for configuration via a Wi-Fi connection. The Wi-Fi option turns the 5700 transmitters into an access point, enabling easy connections with an SSID and WPA2 password.

- July 2021: Endress+Hauser Group Services AG launched its new Proline 10. Promag and Promassflow sensors can be combined with four different Proline 10 transmitters as a compact version. With two status LEDs, these flow sensors can be operated with the SmartBlue app via Bluetooth. These flowmeters cover several basic applications in various industries. The Proline Promag electromagnetic flowmeters are suited for conductive liquids and volume measurement of water and corrosive liquids.

Future Outlook for Wireless Flow Sensors Market Market

The future outlook for the Wireless Flow Sensors market is exceptionally bright, characterized by sustained growth and technological evolution. The increasing digitalization of industries worldwide, coupled with the relentless pursuit of operational efficiency and sustainability, will continue to fuel demand. Advancements in AI, edge computing, and 5G technology are expected to unlock new possibilities for data analytics and real-time control, further solidifying the position of wireless flow sensors as indispensable components of modern industrial infrastructure. Strategic opportunities lie in developing integrated solutions that offer end-to-end process monitoring and optimization, catering to the growing demand for smart, autonomous systems. The market is anticipated to witness further consolidation and innovation as key players strive to capture market share and address emerging application needs.

Wireless Flow Sensors Market Segmentation

-

1. Technology

- 1.1. Bluetooth

- 1.2. ZigBee

- 1.3. RFID

- 1.4. Wi-Fi

- 1.5. WLAN

- 1.6. EnOcean

-

2. Application

- 2.1. Water and Wastewater

- 2.2. Chemicals and Petrochemicals

- 2.3. Power Generation

- 2.4. Other Applications

Wireless Flow Sensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Wireless Flow Sensors Market Regional Market Share

Geographic Coverage of Wireless Flow Sensors Market

Wireless Flow Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Application of Temperature Sensors in Industries; Increasing Demand for Temperature Sensors in Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Wireless Technologies to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Bluetooth

- 5.1.2. ZigBee

- 5.1.3. RFID

- 5.1.4. Wi-Fi

- 5.1.5. WLAN

- 5.1.6. EnOcean

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water and Wastewater

- 5.2.2. Chemicals and Petrochemicals

- 5.2.3. Power Generation

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Bluetooth

- 6.1.2. ZigBee

- 6.1.3. RFID

- 6.1.4. Wi-Fi

- 6.1.5. WLAN

- 6.1.6. EnOcean

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water and Wastewater

- 6.2.2. Chemicals and Petrochemicals

- 6.2.3. Power Generation

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Bluetooth

- 7.1.2. ZigBee

- 7.1.3. RFID

- 7.1.4. Wi-Fi

- 7.1.5. WLAN

- 7.1.6. EnOcean

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water and Wastewater

- 7.2.2. Chemicals and Petrochemicals

- 7.2.3. Power Generation

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Bluetooth

- 8.1.2. ZigBee

- 8.1.3. RFID

- 8.1.4. Wi-Fi

- 8.1.5. WLAN

- 8.1.6. EnOcean

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water and Wastewater

- 8.2.2. Chemicals and Petrochemicals

- 8.2.3. Power Generation

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Bluetooth

- 9.1.2. ZigBee

- 9.1.3. RFID

- 9.1.4. Wi-Fi

- 9.1.5. WLAN

- 9.1.6. EnOcean

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water and Wastewater

- 9.2.2. Chemicals and Petrochemicals

- 9.2.3. Power Generation

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Bluetooth

- 10.1.2. ZigBee

- 10.1.3. RFID

- 10.1.4. Wi-Fi

- 10.1.5. WLAN

- 10.1.6. EnOcean

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water and Wastewater

- 10.2.2. Chemicals and Petrochemicals

- 10.2.3. Power Generation

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microchip Technology Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sensata Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Endress+Hauser Group Services AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emerson Electric Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AW-Lake

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Wireless Flow Sensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 3: North America Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 9: Europe Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 15: Asia Pacific Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Latin America Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Latin America Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 11: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 17: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Flow Sensors Market?

The projected CAGR is approximately 20.6%.

2. Which companies are prominent players in the Wireless Flow Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Microchip Technology Inc, Sensata Technologies Inc, Endress+Hauser Group Services AG*List Not Exhaustive, Emerson Electric Co, NXP Semiconductors, Siemens AG, Texas Instruments Incorporated, Panasonic Corporation, AW-Lake.

3. What are the main segments of the Wireless Flow Sensors Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Application of Temperature Sensors in Industries; Increasing Demand for Temperature Sensors in Consumer Electronics.

6. What are the notable trends driving market growth?

Increasing Adoption of Wireless Technologies to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

September 2022: Wireless technology enabled intelligent field device configuration and diagnostics options for process automation-related mobile applications. Emerson Electric Co's Micro Motion Model 5700 Advanced, Field-Mount, or Truck-Mount Coriolis Transmitter with Wi-Fi connectivity ensures total flow measurement confidence, valuable process insight, and greater operational efficiency. It now has an option for configuration via a Wi-Fi connection. The Wi-Fi option turns the 5700 transmitters into an access point, enabling easy connections with an SSID and WPA2 password.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Flow Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Flow Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Flow Sensors Market?

To stay informed about further developments, trends, and reports in the Wireless Flow Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence