Key Insights

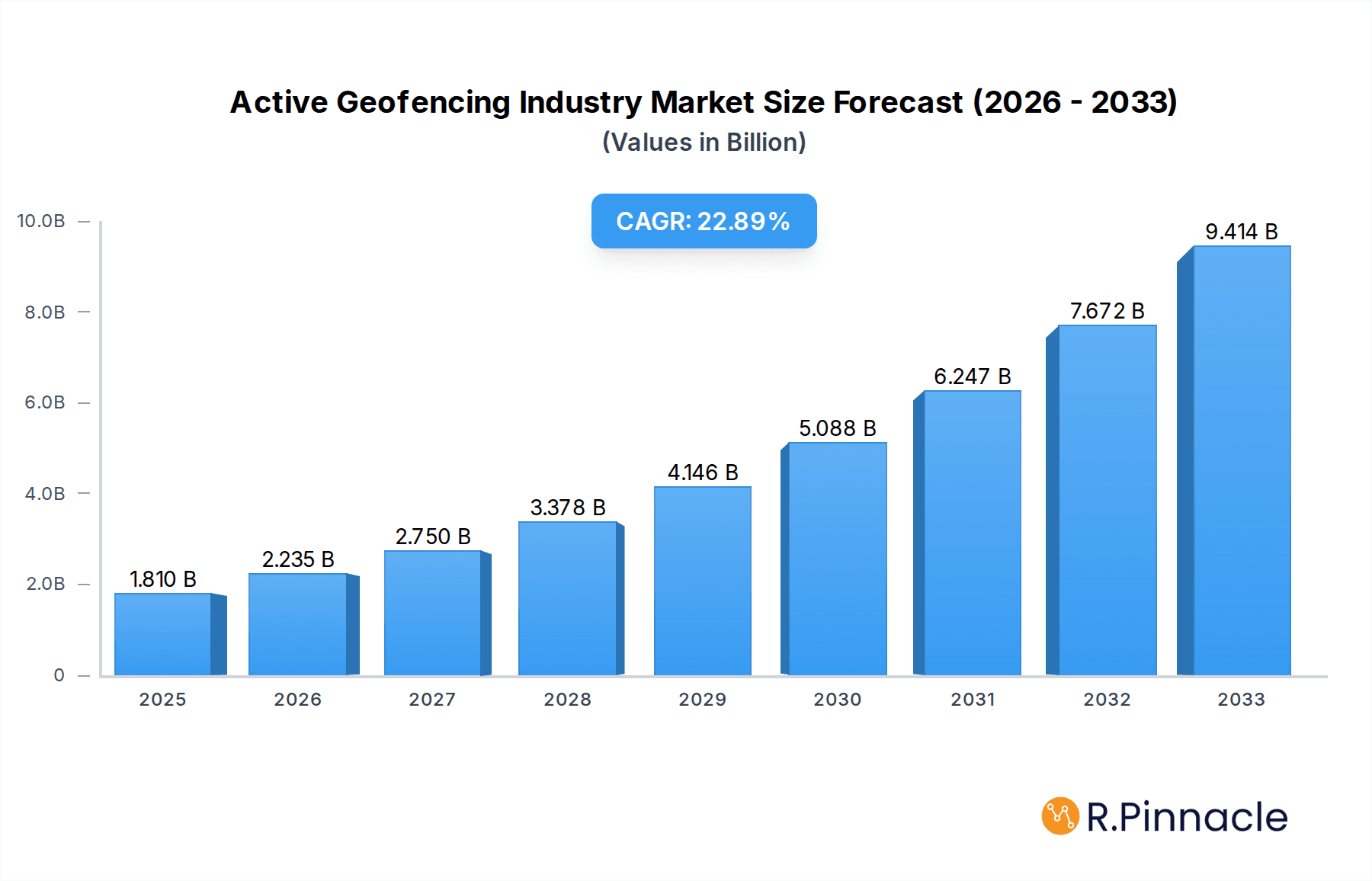

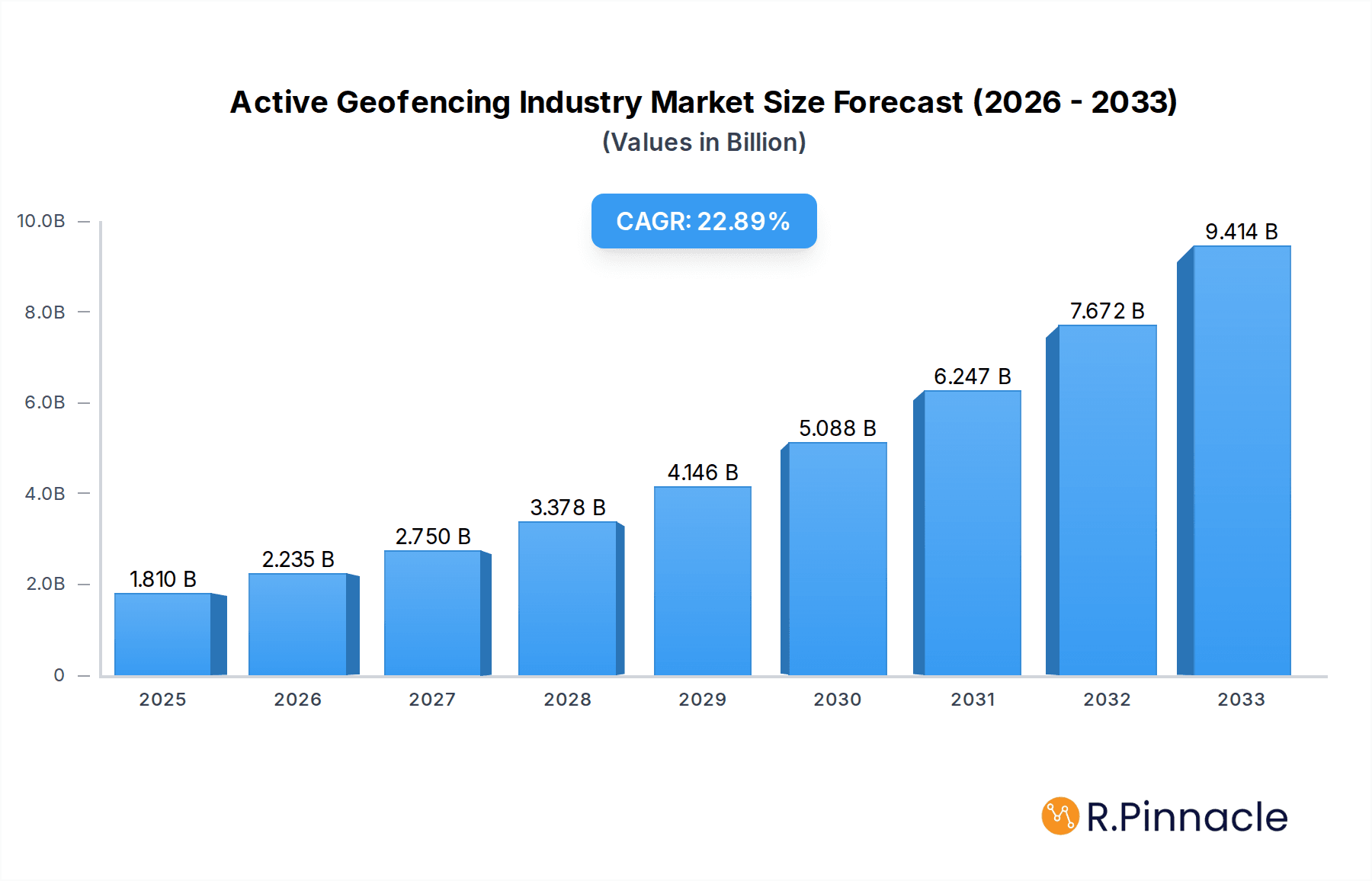

The Active Geofencing Industry is poised for remarkable expansion, with a current market size estimated at $1.81 billion and projected to grow at a CAGR of 23.23% through 2033. This significant growth is propelled by a confluence of factors, primarily the increasing demand for location-aware applications and services across diverse sectors. Key drivers include the burgeoning adoption of the Internet of Things (IoT), the continuous evolution of mobile technology, and the escalating need for precise location-based data for enhanced customer engagement, operational efficiency, and security. The industry's ability to deliver contextualized experiences and automate actions based on user location is a fundamental catalyst for this upward trajectory. Furthermore, the growing sophistication of location intelligence platforms, coupled with advancements in data analytics, enables businesses to derive actionable insights from geofencing data, further solidifying its market position.

Active Geofencing Industry Market Size (In Billion)

The active geofencing market is experiencing dynamic shifts, with a strong emphasis on enhancing user privacy and data security alongside technological advancements. Small and medium-scale businesses are increasingly leveraging geofencing solutions to compete with larger enterprises, creating a diverse and competitive market landscape. The Banking, Financial Services, and Insurance (BFSI) sector, along with Retail and Healthcare, are at the forefront of geofencing adoption due to its potential for personalized marketing, fraud detection, and streamlined customer service. While the market is driven by innovation and widespread adoption, challenges such as data accuracy in dense urban environments and evolving regulatory landscapes around data privacy present areas for strategic focus. Companies are actively investing in research and development to overcome these hurdles, ensuring the continued robust growth and widespread applicability of active geofencing technologies.

Active Geofencing Industry Company Market Share

Active Geofencing Industry Market: Comprehensive Analysis and Future Projections (2019–2033)

Dive deep into the rapidly evolving active geofencing market with this in-depth report. Covering the historical period of 2019–2024, the base year of 2025, and a comprehensive forecast period through 2033, this analysis provides invaluable insights for industry professionals. Explore the intricate market structure, key growth drivers, dominant regions, product innovations, and the strategic landscape of leading players like ESRI, Verve Inc, Infillion Inc (GIMBLE), IBM Corporation, Google LLC, SZ DJI Technology Co, Samsung Electronics Co, LocationSmart, Microsoft Corporation, Radar Labs Inc, Bluedot Innovation Pty Ltd, Apple Inc, and more. Understand the impact of groundbreaking developments, such as McDonald's expanding its geofencing-enabled mobile order pilot and Radar Labs Inc.'s innovative Routr Matching API. This report is essential for stakeholders seeking to capitalize on the significant opportunities within the location-based services (LBS) and proximity marketing sectors.

Active Geofencing Industry Market Structure & Innovation Trends

The active geofencing industry exhibits a dynamic market structure characterized by moderate concentration, with key players like ESRI, Google LLC, and Microsoft Corporation holding significant market share. Innovation is primarily driven by advancements in GPS technology, IoT integration, and AI-powered analytics, enabling more precise and responsive geofencing solutions. Regulatory frameworks are evolving to address data privacy concerns, influencing how businesses deploy geofencing for customer engagement and operational efficiency. The threat of product substitutes remains low due to the specialized nature of geofencing, though advancements in general location-based analytics could pose indirect competition. End-user demographics span across various sectors, with a notable focus on retail, transportation and logistics, and BFSI for personalized offers and operational streamlining. Mergers and acquisitions (M&A) activity is present, with notable deal values in the hundreds of millions of dollars, as companies seek to consolidate market presence and acquire innovative technologies. The estimated market share of leading entities in specific segments is expected to reach over 30% within their respective niches.

Active Geofencing Industry Market Dynamics & Trends

The active geofencing market is poised for substantial growth, driven by an escalating demand for hyper-personalized customer experiences and enhanced operational efficiencies. The Compound Annual Growth Rate (CAGR) is projected to be a robust 15% to 20% over the forecast period. Technological disruptions, including the widespread adoption of 5G, improved battery life in mobile devices, and the proliferation of IoT sensors, are enabling more accurate and real-time geofencing capabilities. Consumer preferences are shifting towards personalized offers and timely notifications, which geofencing effectively delivers. For instance, in the retail sector, consumers increasingly expect location-aware promotions and services. Competitive dynamics are intensifying as more companies recognize the strategic advantage of location intelligence. Market penetration for small-scale and medium-scale businesses is rapidly increasing, democratizing access to sophisticated geofencing solutions that were once exclusive to large enterprises. The ability to trigger actions based on precise user location is transforming marketing, logistics, and security protocols across industries, with an estimated 40% increase in adoption among targeted sectors by 2027. The integration of geofencing with augmented reality (AR) and virtual reality (VR) technologies is also emerging as a significant trend, creating new avenues for immersive customer engagement and training simulations in sectors like defense and industrial manufacturing.

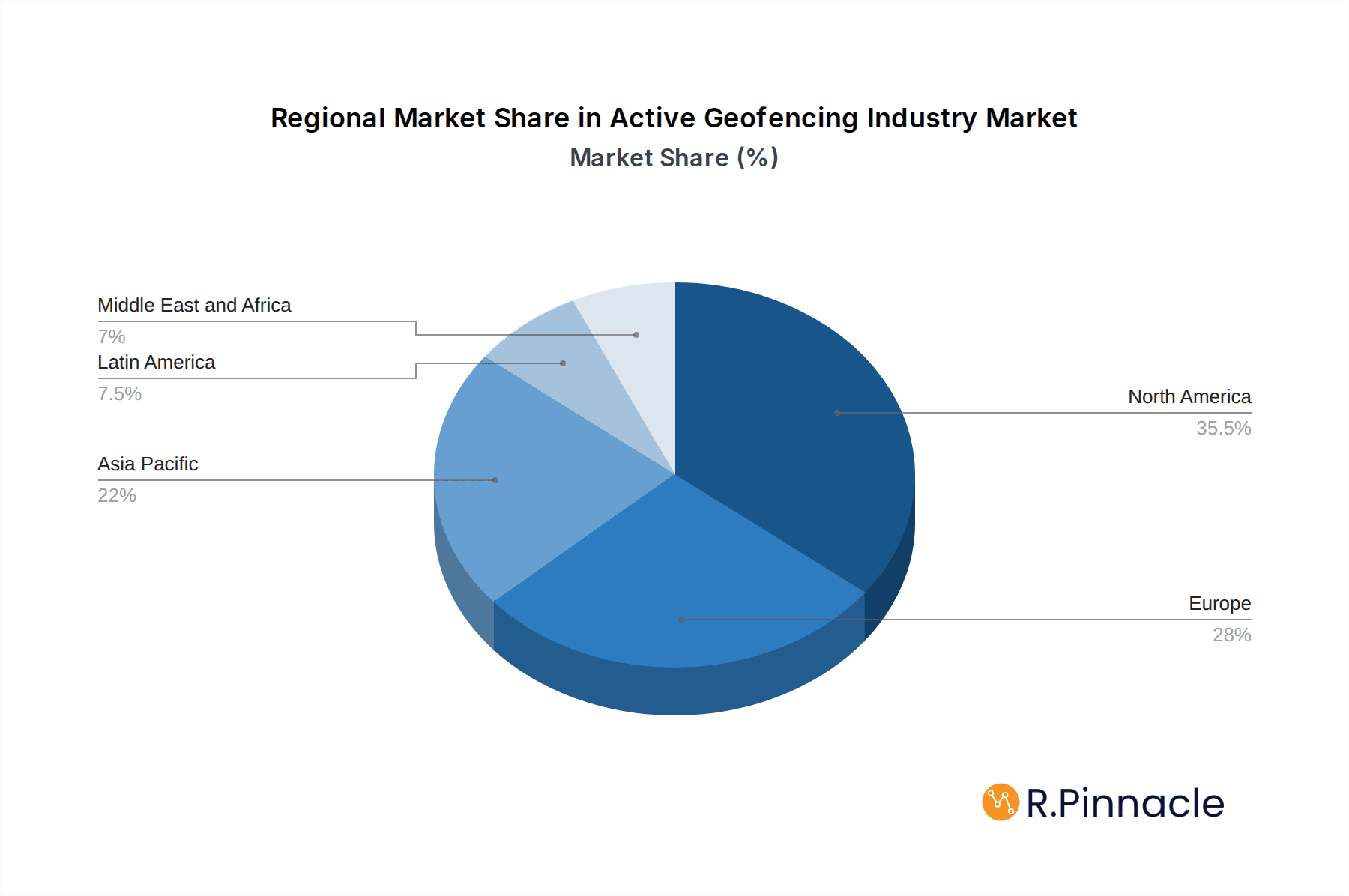

Dominant Regions & Segments in Active Geofencing Industry

North America, particularly the United States, is currently the dominant region in the active geofencing market, driven by early adoption of advanced technologies and a strong presence of key industry players. The retail sector stands out as a leading end-user industry, leveraging geofencing for personalized marketing campaigns, loyalty programs, and in-store analytics, with an estimated market size of over $2 Billion by 2027.

- North America Dominance: High smartphone penetration, a robust digital advertising ecosystem, and significant investment in location-based services contribute to its leadership. Economic policies that encourage innovation and data utilization further bolster this dominance.

- Retail Sector Leadership:

- Personalized Offers: Retailers use geofencing to send targeted discounts and promotions to shoppers as they enter or approach a store, increasing conversion rates.

- Inventory Management: Real-time location tracking of assets and personnel within retail environments can optimize stock levels and prevent loss.

- Customer Analytics: Understanding customer movement patterns within and around stores provides valuable insights for store layout optimization and marketing strategy.

- Transportation and Logistics: This segment is a strong contender, utilizing geofencing for efficient route optimization, delivery confirmations, and real-time fleet tracking, with an estimated market penetration of over 35% among logistics firms.

- Last-Mile Delivery: Geofencing alerts drivers when they are near a delivery location, enabling timely notifications to recipients.

- Fleet Management: Optimizing routes and monitoring driver behavior for improved safety and fuel efficiency.

- Warehouse Operations: Streamlining the movement of goods within large distribution centers.

- Banking, Financial Services, and Insurance (BFSI): Geofencing is employed for fraud detection, branch proximity marketing, and personalized financial advice, with a projected market contribution of over $1 Billion by 2028.

- Fraud Prevention: Detecting unusual transaction locations that deviate from a user's typical geographic patterns.

- Customer Service: Alerting customers to nearby branch services or personalized financial advisory sessions.

- Large-Scale Businesses: These enterprises currently represent the largest market share due to their extensive resources and complex operational needs, but small-scale and medium-scale businesses are rapidly adopting geofencing solutions, driven by the availability of affordable SaaS platforms, with their market share projected to grow by over 25% in the coming years.

- Scalability: Large organizations can implement comprehensive geofencing strategies across multiple locations and user groups.

- Integration: Seamless integration with existing CRM and ERP systems enhances data utilization.

Active Geofencing Industry Product Innovations

Recent product innovations in the active geofencing industry focus on enhanced accuracy, reduced battery consumption, and seamless integration with existing platforms. Companies are developing AI-driven geofencing that can predict user movement patterns, leading to proactive alerts and more efficient resource allocation. The development of geofencing APIs that can distinguish between pedestrian, cycling, and driving movements offers significant advantages for transportation and logistics companies. Furthermore, innovations in privacy-preserving geofencing techniques are crucial for user adoption in sensitive sectors like healthcare. These advancements collectively enhance the competitive advantage of solutions by offering greater precision, improved user experience, and broader application potential.

Report Scope & Segmentation Analysis

This report meticulously segments the active geofencing industry to provide a granular understanding of market dynamics. The segmentation covers:

- Organization Size: This analysis breaks down the market into Small-Scale and Medium-Scale Businesses and Large-Scale Businesses, detailing their distinct adoption rates, investment capacities, and specific use cases. Large enterprises currently dominate in terms of investment, but smaller businesses are showing rapid growth, projected to contribute over 30% of new market entrants by 2028.

- End-user Industry: The report offers deep dives into the Banking, Financial Services, and Insurance (BFSI), Retail, Defense, Government, and Military, Healthcare, Industrial Manufacturing, Transportation and Logistics, and Other End-user Industries. Each segment is analyzed for its unique adoption drivers, market size, and competitive landscape. For instance, the Retail segment is estimated to reach a market size of over $2 Billion by 2027, driven by personalized marketing.

Key Drivers of Active Geofencing Industry Growth

The active geofencing industry is experiencing robust growth driven by several interconnected factors. The increasing proliferation of smartphones and wearable devices provides a vast user base for location-based services. Advancements in GPS accuracy and the rollout of 5G networks are enabling real-time, precise geofencing capabilities. Furthermore, businesses across sectors are recognizing the significant ROI derived from personalized marketing, improved operational efficiency in logistics, and enhanced security protocols, leading to widespread adoption. For example, the McDonald's Ready on Arrival pilot expansion highlights the success of geofencing in enhancing customer experience and operational flow in the QSR industry, a trend expected to be replicated in other service-oriented businesses. The demand for hyper-location data to understand customer behavior and optimize business processes is a fundamental driver.

Challenges in the Active Geofencing Industry Sector

Despite its immense potential, the active geofencing industry faces several challenges. Privacy concerns and the need for user consent for location data collection remain significant hurdles, necessitating robust data anonymization and transparent data usage policies. Regulatory landscapes, while evolving, can be fragmented and complex across different regions, impacting global deployment. The accuracy of geofencing can be affected by environmental factors like indoor environments or dense urban canyons, leading to occasional inaccuracies. Furthermore, the cost of implementing and maintaining sophisticated geofencing solutions can be a barrier for some smaller organizations, although the decreasing cost of SaaS platforms is mitigating this. Competitive pressures and the need for continuous innovation to stay ahead of technological advancements also present ongoing challenges.

Emerging Opportunities in Active Geofencing Industry

Emerging opportunities in the active geofencing industry lie in the integration of geofencing with other cutting-edge technologies. The fusion of geofencing with Augmented Reality (AR) presents novel ways for consumers to interact with their surroundings, offering immersive experiences in retail, tourism, and gaming. The expansion of the Internet of Things (IoT) ecosystem provides a wealth of new data points and devices that can be incorporated into geofencing strategies, enabling more sophisticated automation and control in industrial settings. The growing demand for hyper-local advertising and personalized services continues to fuel innovation, particularly in segments like healthcare for appointment reminders and adherence tracking, and in urban planning for optimizing public services. The development of advanced analytics and AI will further unlock predictive capabilities, allowing businesses to anticipate customer needs and optimize operations proactively, leading to an estimated 25% growth in these niche applications by 2030.

Leading Players in the Active Geofencing Industry Market

- ESRI

- Verve Inc

- Infillion Inc (GIMBLE)

- IBM Corporation

- Google LLC

- SZ DJI Technology Co

- Samsung Electronics Co

- LocationSmart

- Microsoft Corporation

- Radar Labs Inc

- Bluedot Innovation Pty Ltd

- Apple Inc

Key Developments in Active Geofencing Industry Industry

- December 2023: McDonald’s announced the expansion of its Ready on Arrival pilot, which uses geofencing to alert employees when a mobile order customer is nearing the restaurant, aiming for deployment in its top six markets by 2025. This development significantly enhances operational efficiency and customer satisfaction in the quick-service restaurant sector.

- July 2023: Radar Labs Inc. unveiled the newest addition to its Maps Platform, the Routr Matching API. This innovation addresses the challenge of imprecise location data from mobile devices and GPS units, which often makes tracing driving or walking paths and calculating mileage difficult. The Routr Matching API, part of Radar Labs' comprehensive Maps Platform and Geofencing platform, promises more accurate location-based services for a variety of applications.

Future Outlook for Active Geofencing Industry Market

The future outlook for the active geofencing industry is exceptionally bright, fueled by accelerating technological advancements and an ever-increasing demand for location-aware solutions. The continued expansion of 5G networks, the proliferation of IoT devices, and advancements in AI will empower more sophisticated and precise geofencing applications. We anticipate a significant surge in adoption across small-scale and medium-scale businesses, driven by accessible and cost-effective SaaS solutions. Strategic opportunities will arise from deeper integration with emerging technologies like AR/VR, creating immersive customer experiences. Furthermore, the evolving privacy landscape will drive innovation in secure and transparent geofencing practices, ensuring sustained user trust and market growth. The market is projected to reach over $30 Billion by 2030, demonstrating its substantial future potential.

Active Geofencing Industry Segmentation

-

1. Organization Size

- 1.1. Small-Scale and Medium-Scale Businesses

- 1.2. Large-Scale Businesses

-

2. End-user Industry

- 2.1. Banking, Financial Services, and Insurance

- 2.2. Retail

- 2.3. Defense, Government, and Military

- 2.4. Healthcare

- 2.5. Industrial Manufacturing

- 2.6. Transportation and Logistics

- 2.7. Other End-user Industries

Active Geofencing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active Geofencing Industry Regional Market Share

Geographic Coverage of Active Geofencing Industry

Active Geofencing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Use of Spatial Data and Improved Real-time Location Technology; Higher Adoption of Location-based Application among Consumers

- 3.3. Market Restrains

- 3.3.1. Rising Awareness Regarding Safety and Security among Consumers of Location Tracking

- 3.4. Market Trends

- 3.4.1. Retail Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active Geofencing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small-Scale and Medium-Scale Businesses

- 5.1.2. Large-Scale Businesses

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Banking, Financial Services, and Insurance

- 5.2.2. Retail

- 5.2.3. Defense, Government, and Military

- 5.2.4. Healthcare

- 5.2.5. Industrial Manufacturing

- 5.2.6. Transportation and Logistics

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America Active Geofencing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Small-Scale and Medium-Scale Businesses

- 6.1.2. Large-Scale Businesses

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Banking, Financial Services, and Insurance

- 6.2.2. Retail

- 6.2.3. Defense, Government, and Military

- 6.2.4. Healthcare

- 6.2.5. Industrial Manufacturing

- 6.2.6. Transportation and Logistics

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe Active Geofencing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Small-Scale and Medium-Scale Businesses

- 7.1.2. Large-Scale Businesses

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Banking, Financial Services, and Insurance

- 7.2.2. Retail

- 7.2.3. Defense, Government, and Military

- 7.2.4. Healthcare

- 7.2.5. Industrial Manufacturing

- 7.2.6. Transportation and Logistics

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia Pacific Active Geofencing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Small-Scale and Medium-Scale Businesses

- 8.1.2. Large-Scale Businesses

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Banking, Financial Services, and Insurance

- 8.2.2. Retail

- 8.2.3. Defense, Government, and Military

- 8.2.4. Healthcare

- 8.2.5. Industrial Manufacturing

- 8.2.6. Transportation and Logistics

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Latin America Active Geofencing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Small-Scale and Medium-Scale Businesses

- 9.1.2. Large-Scale Businesses

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Banking, Financial Services, and Insurance

- 9.2.2. Retail

- 9.2.3. Defense, Government, and Military

- 9.2.4. Healthcare

- 9.2.5. Industrial Manufacturing

- 9.2.6. Transportation and Logistics

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Middle East and Africa Active Geofencing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Small-Scale and Medium-Scale Businesses

- 10.1.2. Large-Scale Businesses

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Banking, Financial Services, and Insurance

- 10.2.2. Retail

- 10.2.3. Defense, Government, and Military

- 10.2.4. Healthcare

- 10.2.5. Industrial Manufacturing

- 10.2.6. Transportation and Logistics

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ESRI

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Verve Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infillion Inc (GIMBLE)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SZ DJI Technology Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Electronics Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LocationSmart

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Microsoft Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Radar Labs Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bluedot Innovation Pty Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Apple Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ESRI

List of Figures

- Figure 1: Global Active Geofencing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Active Geofencing Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 3: North America Active Geofencing Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 4: North America Active Geofencing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Active Geofencing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Active Geofencing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Active Geofencing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Active Geofencing Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 9: Europe Active Geofencing Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: Europe Active Geofencing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Active Geofencing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Active Geofencing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Active Geofencing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Active Geofencing Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 15: Asia Pacific Active Geofencing Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 16: Asia Pacific Active Geofencing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Active Geofencing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Active Geofencing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Active Geofencing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Active Geofencing Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Latin America Active Geofencing Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Latin America Active Geofencing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Active Geofencing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Active Geofencing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Active Geofencing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Active Geofencing Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 27: Middle East and Africa Active Geofencing Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Middle East and Africa Active Geofencing Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Active Geofencing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Active Geofencing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Active Geofencing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Active Geofencing Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 2: Global Active Geofencing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Active Geofencing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Active Geofencing Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 5: Global Active Geofencing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Active Geofencing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Active Geofencing Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 8: Global Active Geofencing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Active Geofencing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Active Geofencing Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 11: Global Active Geofencing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Active Geofencing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Active Geofencing Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 14: Global Active Geofencing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Active Geofencing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Active Geofencing Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 17: Global Active Geofencing Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Active Geofencing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active Geofencing Industry?

The projected CAGR is approximately 23.23%.

2. Which companies are prominent players in the Active Geofencing Industry?

Key companies in the market include ESRI, Verve Inc, Infillion Inc (GIMBLE), IBM Corporation, Google LLC, SZ DJI Technology Co, Samsung Electronics Co, LocationSmart, Microsoft Corporation, Radar Labs Inc, Bluedot Innovation Pty Ltd, Apple Inc.

3. What are the main segments of the Active Geofencing Industry?

The market segments include Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Use of Spatial Data and Improved Real-time Location Technology; Higher Adoption of Location-based Application among Consumers.

6. What are the notable trends driving market growth?

Retail Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Rising Awareness Regarding Safety and Security among Consumers of Location Tracking.

8. Can you provide examples of recent developments in the market?

December 2023 : McDonald’s has announced the expanding its Ready on Arrival pilot which uses geofencing to alert employees when a mobile order customer is nearing the restaurant so they can get the customer’s food ready to its top six markets by 2025

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active Geofencing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active Geofencing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active Geofencing Industry?

To stay informed about further developments, trends, and reports in the Active Geofencing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence