Key Insights

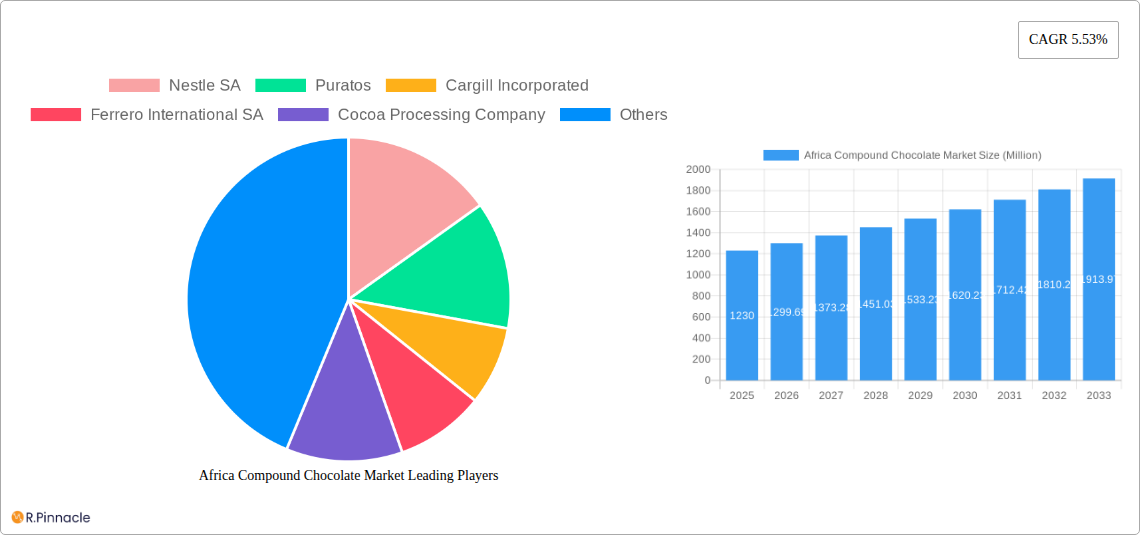

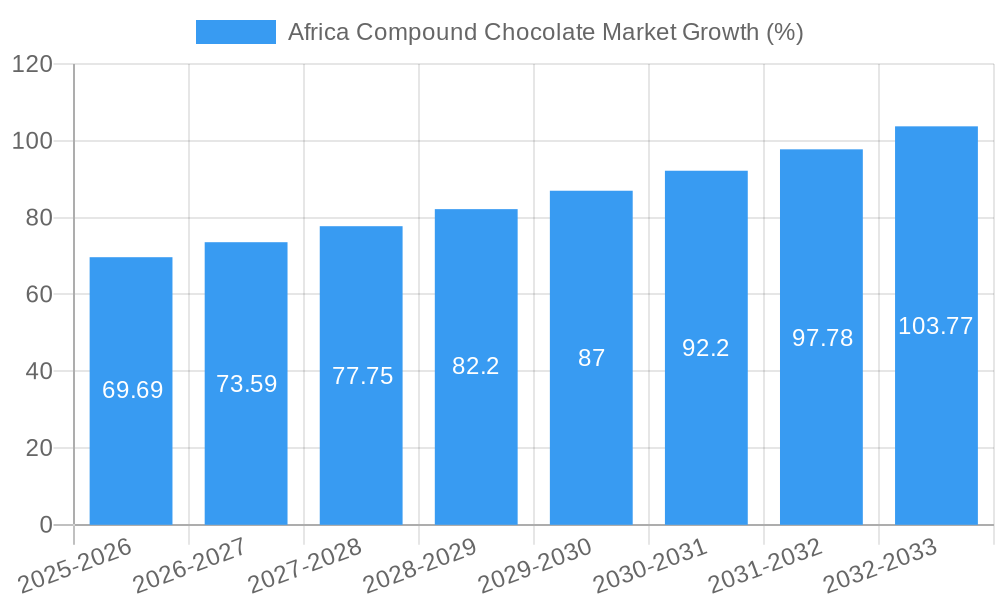

The Africa compound chocolate market, valued at $1.23 billion in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing urbanization, and a burgeoning demand for convenient and indulgent food products. The market's Compound Annual Growth Rate (CAGR) of 5.53% from 2025 to 2033 signifies a significant expansion opportunity. Key drivers include the growing popularity of chocolate confectionery, bakery products, and frozen desserts, particularly among younger demographics. The preference for dark chocolate, reflecting health-conscious trends, is also contributing to market growth. While the market is segmented by chocolate type (dark, milk, white), form (chips, slabs, coatings), and application (bakery, confectionery, beverages), the bakery and confectionery segments are expected to dominate due to high chocolate consumption in these sectors. Leading players like Nestle, Ferrero, and Barry Callebaut are leveraging strategic partnerships and product innovations to cater to evolving consumer preferences. However, challenges like fluctuating cocoa prices and potential supply chain disruptions in certain African regions could pose restraints on market growth. Nonetheless, the overall outlook for the African compound chocolate market remains positive, presenting significant potential for both established players and new entrants.

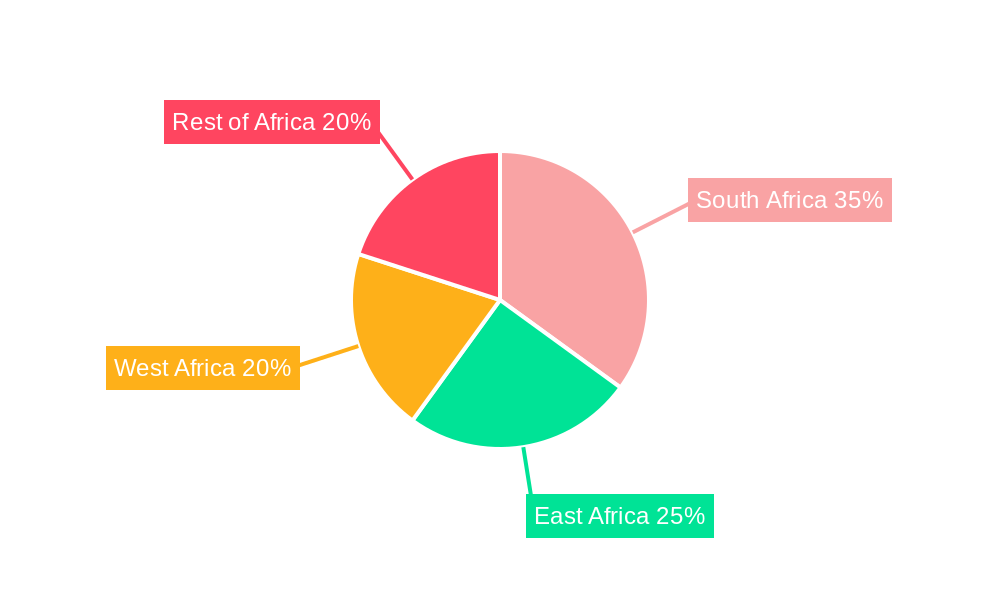

The regional variations within Africa are significant. South Africa, due to its advanced economy and higher per capita income, is likely to be a major contributor to market growth. Other regions such as East Africa (Kenya, Uganda, Tanzania) are witnessing increasing consumption of chocolate, driven by rising middle-class populations and westernization of diets. The market's success will depend on factors such as infrastructure development, effective distribution channels, and targeted marketing strategies to address diverse consumer segments. Further research into specific regional preferences and cultural factors could offer opportunities for tailoring product offerings and marketing campaigns for maximum impact. The forecast period indicates substantial market expansion, providing attractive investment prospects for businesses operating within or looking to enter the African compound chocolate market.

Africa Compound Chocolate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Africa compound chocolate market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025). Expect detailed segmentation analysis, competitive landscape assessment, and growth projections, all backed by robust data and market intelligence. The report is structured to deliver actionable insights, helping you navigate the complexities of this dynamic market.

Africa Compound Chocolate Market Structure & Innovation Trends

This section analyzes the competitive landscape of the African compound chocolate market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. We delve into the dynamics of mergers and acquisitions (M&A), assessing their impact on market share and overall industry structure. Key players like Nestle SA, Puratos, Cargill Incorporated, Ferrero International SA, Cocoa Processing Company, The Barry Callebaut Group, Lindt & Sprungli AG, The Bühler Holding AG, Fuji Oil Holdings Inc., and Mondelez International are examined in detail.

- Market Concentration: The market exhibits a [XX]% concentration ratio, indicating [description of concentration – e.g., a moderately consolidated market with a few dominant players].

- Innovation Drivers: Growing consumer demand for premium and specialized chocolate, coupled with technological advancements in processing and flavor development, are key innovation drivers.

- Regulatory Frameworks: [Analysis of relevant regulations impacting the market, e.g., food safety standards, labeling requirements]. This includes an assessment of potential impact on market growth.

- Product Substitutes: [Discussion of substitute products and their market impact, e.g., confectionery items using alternative sweeteners].

- End-User Demographics: Analysis of consumer preferences and purchasing behaviors across various demographics, including age, income, and location.

- M&A Activities: [Analysis of significant M&A deals in the past five years, including deal values and their strategic implications for market players. Example: Mention the Barry Callebaut acquisition of Attelli SARL assets in Morocco.]. We will analyze the market share changes resulting from these activities.

Africa Compound Chocolate Market Dynamics & Trends

This section explores the key factors driving market growth, including technological disruptions, evolving consumer preferences, and the competitive dynamics amongst key players. We will analyze the Compound Annual Growth Rate (CAGR) and market penetration rate across various segments. The analysis includes a comprehensive assessment of market size and growth projections. A detailed account of the impact of changing consumer preferences, including demand for healthier options and ethical sourcing, will also be included. The report will also examine the impact of any technological disruptions on production methods and supply chains. This section will explore these dynamics in detail, providing a 360-degree view of market evolution. [XX Million] in market value is projected by [Year]. The CAGR is estimated at [XX%] during the forecast period.

Dominant Regions & Segments in Africa Compound Chocolate Market

This section identifies the leading regions and segments within the African compound chocolate market. We will analyze factors such as economic policies, infrastructure development, and consumer demand to understand the reasons behind the dominance of specific regions or segments.

Dominant Regions: [Analysis of leading regions based on market share and growth potential, including specific countries].

Dominant Segments:

- Type: [Analysis of the market share of Dark, Milk, and White chocolate, highlighting the fastest-growing segment and the drivers behind its growth].

- Form: [Analysis of market share of Chocolate Chips/Drops/Chunks, Chocolate Slabs, Chocolate Coatings, and Other Types, focusing on the factors driving growth in each segment].

- Application: [Analysis of market share across Bakery, Confectionery, Frozen Desserts & Ice Cream, Beverages, Cereals, and Others, identifying the leading application and growth drivers].

Key Drivers (Examples):

- Economic growth and rising disposable incomes.

- Expanding retail infrastructure and increased availability of chocolate products.

- Growing adoption of Westernized food consumption patterns.

- Government initiatives supporting the food processing industry.

Africa Compound Chocolate Market Product Innovations

Recent product developments focus on creating healthier options with reduced sugar content, exploring unique flavors tailored to local preferences, and utilizing sustainable sourcing practices. Technological advancements, including improved processing techniques and packaging innovations, are enhancing product quality and shelf life. These innovations are crucial for companies to gain a competitive edge in a market with increasing consumer demands.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Africa compound chocolate market based on type (Dark, Milk, White), form (Chips/Drops/Chunks, Slabs, Coatings, Others), and application (Bakery, Confectionery, Frozen Desserts & Ice Cream, Beverages, Cereals, Others). Each segment’s growth projections, market size, and competitive dynamics will be thoroughly examined, allowing for a comprehensive understanding of market opportunities and challenges. [Provide growth projections and market sizes (in Millions) for each segment].

Key Drivers of Africa Compound Chocolate Market Growth

Several factors contribute to the market's growth. Rising disposable incomes and urbanization are increasing chocolate consumption. The burgeoning food processing and confectionery industries are also key drivers. Moreover, the growing popularity of Westernized diets and changing consumer preferences contribute to the market's expansion.

Challenges in the Africa Compound Chocolate Market Sector

Challenges include price volatility of raw materials (cocoa beans), fluctuating exchange rates, and potential supply chain disruptions. Competition from international and regional brands poses a significant challenge for local players. Furthermore, regulatory hurdles and infrastructural limitations in certain regions impact market growth. [Quantifiable impacts of these challenges should be included, for example, potential impact on production costs or market access].

Emerging Opportunities in Africa Compound Chocolate Market

Emerging opportunities include expanding into underserved regions, introducing innovative product formats, and focusing on health-conscious and ethically sourced chocolate. The growth of e-commerce and online retail channels presents further opportunities.

Leading Players in the Africa Compound Chocolate Market Market

- Nestle SA

- Puratos

- Cargill Incorporated

- Ferrero International SA

- Cocoa Processing Company

- The Barry Callebaut Group

- Lindt & Sprungli AG

- The Bühler Holding AG

- Fuji Oil Holdings Inc

- Mondelez International

Key Developments in Africa Compound Chocolate Market Industry

- November 2022: Barry Callebaut establishes a production unit in Morocco after acquiring Attelli SARL's assets.

- October 2022: Puratos launches So'Choc Cacao Trace, a fermented cacao chocolate.

- October 2022: Barry Callebaut introduces its second-generation chocolate, applicable in various food products.

Future Outlook for Africa Compound Chocolate Market Market

The Africa compound chocolate market shows strong growth potential, driven by rising incomes, urbanization, and evolving consumer preferences. Strategic partnerships, product diversification, and tapping into emerging markets will be key for success. The market is expected to witness significant expansion over the forecast period, presenting lucrative opportunities for established and emerging players alike.

Africa Compound Chocolate Market Segmentation

-

1. Type

- 1.1. Dark Chocolate

- 1.2. Milk Chocolate

- 1.3. White Chocolate

-

2. Form

- 2.1. Chocolate Chips/Drops/Chunk

- 2.2. Chocolate Slab

- 2.3. Chocolate Coatings

- 2.4. Other Types

-

3. Application

- 3.1. Bakery

- 3.2. Confectionery

- 3.3. Frozen Desserts and Ice-Cream

- 3.4. Beverages

- 3.5. Cereals

- 3.6. Others

Africa Compound Chocolate Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Compound Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand for Chocolate in Various Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dark Chocolate

- 5.1.2. Milk Chocolate

- 5.1.3. White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Chocolate Chips/Drops/Chunk

- 5.2.2. Chocolate Slab

- 5.2.3. Chocolate Coatings

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Confectionery

- 5.3.3. Frozen Desserts and Ice-Cream

- 5.3.4. Beverages

- 5.3.5. Cereals

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Compound Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nestle SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Puratos

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cargill Incorporated

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ferrero International SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cocoa Processing Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 The Barry Callebaut Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Lindt & Sprungli AG*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Bühler Holding AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fuji Oil Holdings Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Mondelez International

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nestle SA

List of Figures

- Figure 1: Africa Compound Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Compound Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Compound Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Compound Chocolate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Compound Chocolate Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Africa Compound Chocolate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Africa Compound Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Compound Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Compound Chocolate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Africa Compound Chocolate Market Revenue Million Forecast, by Form 2019 & 2032

- Table 15: Africa Compound Chocolate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Africa Compound Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Compound Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Compound Chocolate Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Africa Compound Chocolate Market?

Key companies in the market include Nestle SA, Puratos, Cargill Incorporated, Ferrero International SA, Cocoa Processing Company, The Barry Callebaut Group, Lindt & Sprungli AG*List Not Exhaustive, The Bühler Holding AG, Fuji Oil Holdings Inc, Mondelez International.

3. What are the main segments of the Africa Compound Chocolate Market?

The market segments include Type, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Growing Demand for Chocolate in Various Applications.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

In November 2022, Barry Callebaut announced a long-term agreement with Attelli SARL, a distributor and confectionery manufacturer based in Casablanca, Morocco. Under this agreement, the company took over the manufacturing assets of Attelli and established a production unit in Morocco.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Compound Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Compound Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Compound Chocolate Market?

To stay informed about further developments, trends, and reports in the Africa Compound Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence