Key Insights

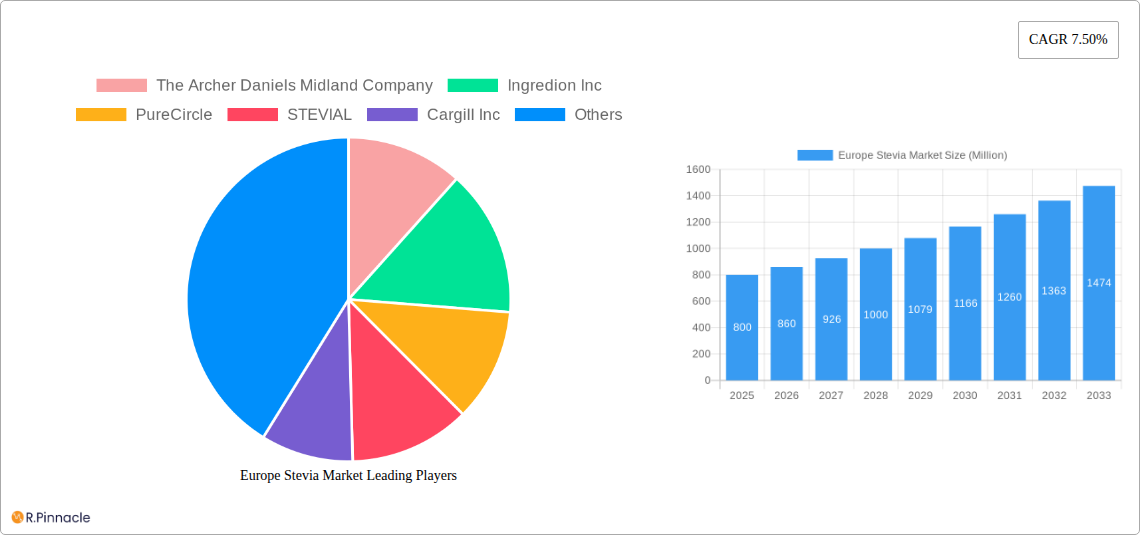

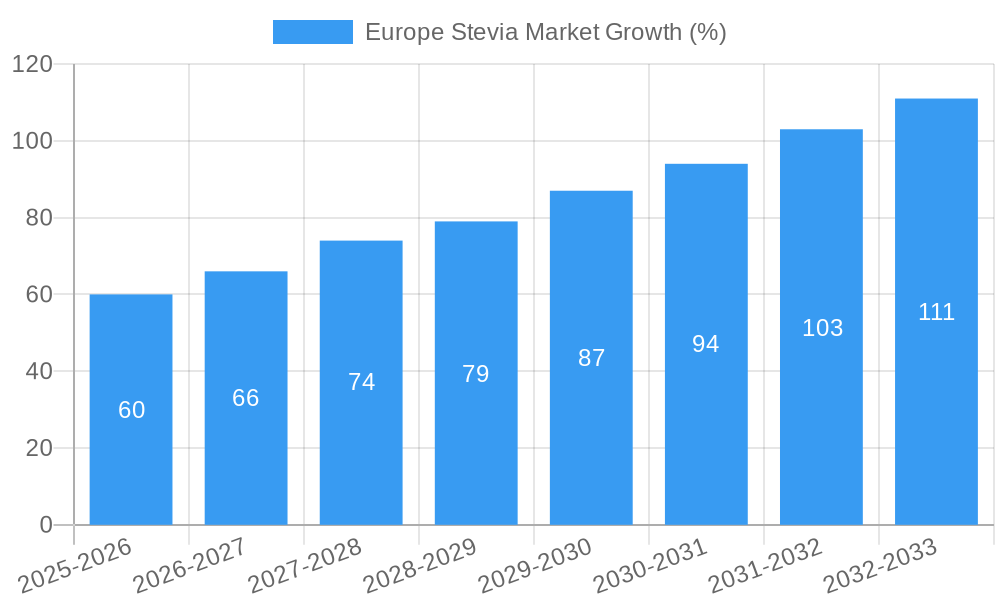

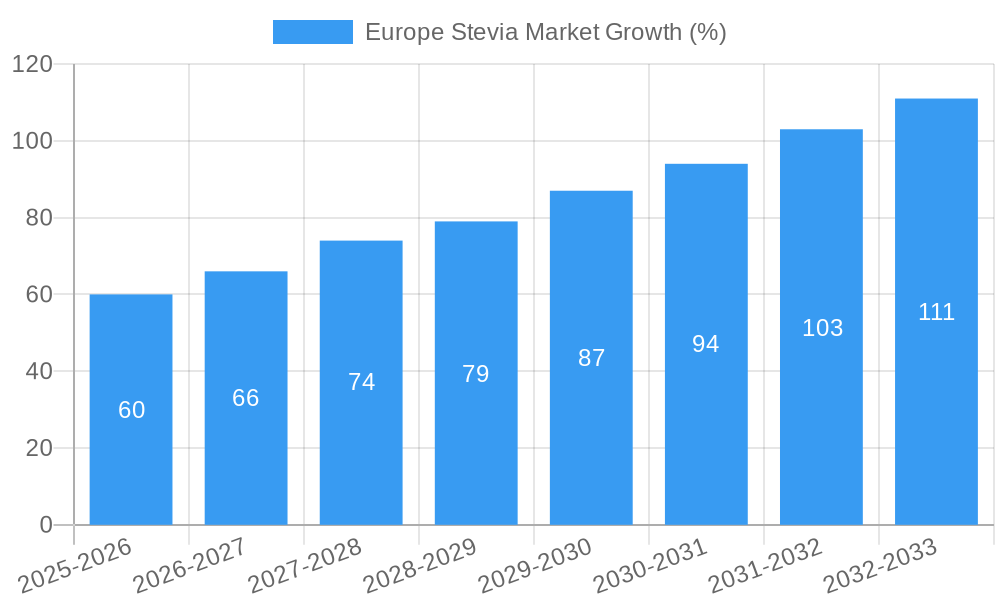

The European stevia market, valued at approximately €800 million in 2025, is projected to experience robust growth, driven by increasing consumer demand for natural and low-calorie sweeteners. This surge is fueled by growing health consciousness, particularly concerning sugar reduction in diets, and the rising prevalence of diabetes and obesity across Europe. The liquid form of stevia dominates the market, owing to its ease of use in various applications. Bakery and beverage segments are key contributors to market revenue, followed by dairy food products and dietary supplements. Germany, France, and the UK represent the largest national markets within Europe, reflecting high consumer awareness and adoption of stevia-based products in these regions. However, the market faces challenges such as the relatively higher price of stevia compared to conventional sweeteners and potential concerns about its aftertaste, which manufacturers are actively addressing through technological advancements in stevia extraction and formulation. The increasing availability of stevia in various forms (liquid, powder, leaf) and its growing use in diverse product categories are poised to propel market expansion over the forecast period (2025-2033). Key players such as Archer Daniels Midland, Ingredion Inc., and PureCircle are heavily investing in research and development to enhance stevia's quality and broaden its applications.

The projected CAGR of 7.50% indicates a significant expansion in the European stevia market through 2033, reaching an estimated value exceeding €1.5 billion. This growth will be supported by the continued development of innovative stevia-based products, supportive regulatory frameworks, and rising consumer preference for clean-label ingredients. Furthermore, strategic partnerships between stevia producers and food and beverage companies will facilitate wider adoption and distribution. However, potential regulatory changes and fluctuations in raw material prices could present challenges to consistent market growth. Continued market penetration in less-developed European markets, along with advancements in overcoming stevia's perceived taste limitations, will be critical factors determining the market's trajectory.

Europe Stevia Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Stevia Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, segmentation, competitive landscape, and future growth potential. The study leverages extensive primary and secondary research to deliver actionable intelligence on this rapidly evolving market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Europe Stevia Market Market Structure & Innovation Trends

The Europe stevia market is characterized by a moderately concentrated landscape, with key players such as The Archer Daniels Midland Company, Ingredion Inc, PureCircle, STEVIAL, Cargill Inc, Tereos S A, GLG LIFE TECH CORP, and Tate & Lyle holding significant market share. Market concentration is estimated at xx%, driven by the presence of large multinational corporations with established distribution networks and advanced processing capabilities. Innovation is largely fueled by consumer demand for natural and healthier sweeteners, leading to continuous advancements in stevia extraction and processing techniques. Regulatory frameworks, particularly those concerning food additives and labeling, significantly influence market dynamics. Substitute sweeteners, such as sucralose and aspartame, exert competitive pressure, although stevia's natural origin provides a key differentiator. The market is witnessing increased M&A activity, such as the acquisition of PureCircle by Ingredion Inc in 2020, valued at xx Million, showcasing industry consolidation and expansion strategies. This activity significantly influences market share distribution and competitive dynamics. The end-user demographics are shifting towards health-conscious consumers, particularly millennials and Gen Z, propelling the growth of stevia-based products.

Europe Stevia Market Market Dynamics & Trends

The Europe stevia market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Key growth drivers include the rising consumer preference for natural sweeteners, increasing health awareness, and the growing demand for sugar-free and low-calorie products in various food and beverage applications. Technological advancements in stevia extraction and purification are improving taste profiles and reducing production costs. This is leading to higher market penetration across various segments. Changing consumer preferences, with a surge in demand for healthier alternatives to traditional sugar, are boosting market growth. Competitive dynamics are intense, with major players investing heavily in R&D, strategic partnerships, and capacity expansions to maintain their market share. Market penetration in specific segments, like beverages, is high, surpassing xx%, whereas penetration in others, like confectionery, remains relatively lower, at approximately xx%.

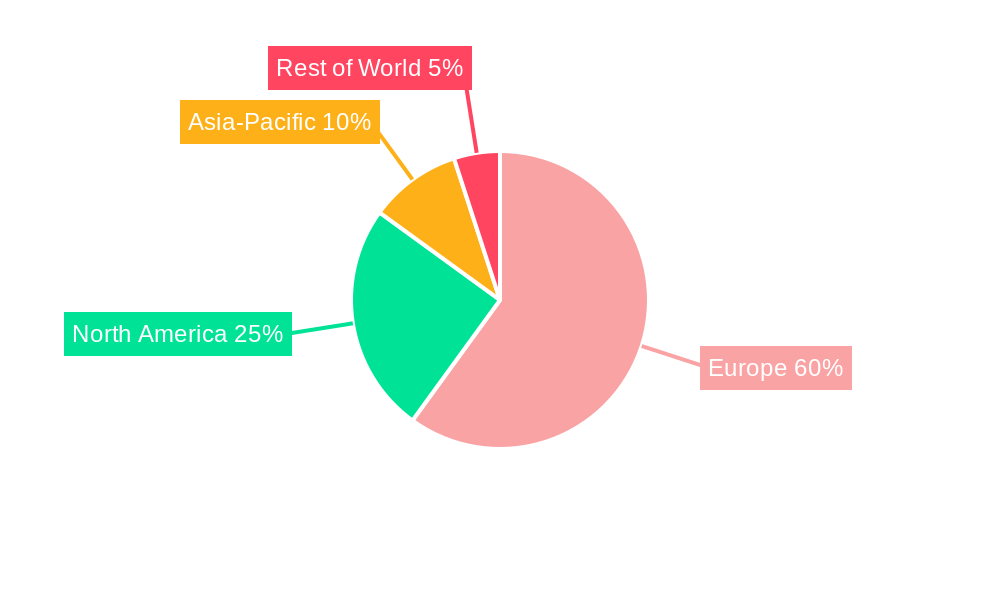

Dominant Regions & Segments in Europe Stevia Market

The report identifies [Name of Country/Region] as the dominant region within the Europe stevia market, accounting for xx% of the total market value in 2025. This dominance is attributed to several key factors:

- Strong consumer preference for natural sweeteners: A significant proportion of consumers in this region actively seek out natural alternatives to traditional sugar.

- Favorable regulatory environment: Clear and supportive regulations related to stevia use in food and beverages facilitate market growth.

- Robust food and beverage industry: A well-established food and beverage manufacturing base provides ample opportunities for stevia integration.

- Extensive distribution network: Efficient distribution channels ensure widespread availability of stevia-based products.

In terms of segments, the Beverages application segment currently holds the largest market share due to high consumer demand and the suitability of stevia in various beverage formulations. The Powder form of stevia is currently the leading segment in the market due to its convenience and ease of use in various food applications.

Europe Stevia Market Product Innovations

Recent innovations in the Europe stevia market focus on enhancing the taste profile of stevia sweeteners to address lingering aftertaste issues. This involves blending stevia with other natural sweeteners or employing advanced extraction and purification methods. New applications are continually emerging, extending beyond traditional uses to encompass novel food and beverage products, personal care items, and even pharmaceutical applications. Companies are leveraging technological advancements in biotechnology and extraction to gain a competitive edge, offering superior quality and cost-effective stevia-based solutions.

Report Scope & Segmentation Analysis

The report segments the Europe stevia market based on form (Liquid, Powder, Leaf) and application (Bakery, Dairy Food Products, Beverages, Dietary Supplements, Confectionery, Others). Each segment's growth trajectory, market size, and competitive dynamics are analyzed in detail. The Powder segment is expected to show substantial growth driven by ease of use and versatility, while the Liquid segment is expected to remain a major player due to its prevalence in beverages. Similarly, the Beverages segment is projected to dominate applications due to the increasing consumption of sugar-reduced drinks. Within each segment, the competitive landscape varies, highlighting the key players and their strategies.

Key Drivers of Europe Stevia Market Growth

The Europe stevia market's growth is driven by several factors, including the rising health consciousness among consumers, leading to increased demand for natural and low-calorie sweeteners. Government regulations promoting healthier food choices also contribute significantly. Furthermore, technological advancements in stevia extraction and processing are reducing costs and improving product quality, which positively impact market expansion. Finally, increasing product innovation, such as the development of novel stevia-based products for diverse applications, fuels market growth.

Challenges in the Europe Stevia Market Sector

Challenges within the Europe stevia market include potential supply chain disruptions and fluctuations in raw material costs due to stevia's reliance on agricultural production. Furthermore, competitive pressure from established sugar and other artificial sweeteners presents an ongoing challenge. Regulatory hurdles concerning labeling and approval processes can also slow down market growth. The fluctuating price of stevia also influences the profitability of the market.

Emerging Opportunities in Europe Stevia Market

Significant opportunities lie in expanding stevia applications into new food and beverage categories, such as functional foods and ready-to-drink beverages. Developing innovative stevia-based products with improved taste profiles and addressing concerns about aftertaste are key opportunities for market expansion. Furthermore, exploring new markets within Europe and expanding into niche segments, such as personalized nutrition, offer further growth potential.

Leading Players in the Europe Stevia Market Market

- The Archer Daniels Midland Company

- Ingredion Inc

- PureCircle

- STEVIAL

- Cargill Inc

- Tereos S A

- GLG LIFE TECH CORP

- Tate & Lyle

Key Developments in Europe Stevia Market Industry

- 2020: Acquisition of PureCircle by Ingredion Inc.

- 2021: Launch of Tate & Lyle's Optimizer Stevia.

- 2022: Investment in stevia production facilities by The Archer Daniels Midland Company and Cargill Inc.

Future Outlook for Europe Stevia Market Market

The future of the Europe stevia market looks promising, driven by sustained consumer demand for natural sweeteners and continuous innovation in product development. Strategic partnerships, mergers and acquisitions, and expansion into new applications will shape the market landscape. The market is poised for significant growth, fueled by these factors and the increasing health-consciousness of consumers.

Europe Stevia Market Segmentation

-

1. Form

- 1.1. Liquid

- 1.2. Powder

- 1.3. Leaf

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Food Products

- 2.3. Beverages

- 2.4. Dietary Supplements

- 2.5. Confectionery

- 2.6. Others

Europe Stevia Market Segmentation By Geography

-

1. Europe

- 1.1. Spain

- 1.2. United Kingdom

- 1.3. Germany

- 1.4. France

- 1.5. Italy

- 1.6. Russia

- 1.7. Rest of Europe

Europe Stevia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand For Plant Based Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Liquid

- 5.1.2. Powder

- 5.1.3. Leaf

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Food Products

- 5.2.3. Beverages

- 5.2.4. Dietary Supplements

- 5.2.5. Confectionery

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Stevia Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Archer Daniels Midland Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ingredion Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PureCircle

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 STEVIAL

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cargill Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tereos S A

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 GLG LIFE TECH CORP

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Tate & Lyle

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 The Archer Daniels Midland Company

List of Figures

- Figure 1: Europe Stevia Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Stevia Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Stevia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Stevia Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Europe Stevia Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Stevia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Stevia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Stevia Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Europe Stevia Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Stevia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Spain Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Stevia Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Europe Stevia Market?

Key companies in the market include The Archer Daniels Midland Company, Ingredion Inc, PureCircle, STEVIAL, Cargill Inc, Tereos S A, GLG LIFE TECH CORP, Tate & Lyle.

3. What are the main segments of the Europe Stevia Market?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Growing Demand For Plant Based Ingredients.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of PureCircle by Ingredion Inc in 2020 2. Launch of Tate & Lyle's new stevia-based sweetener, Optimizer Stevia, in 2021 3. Investment in stevia production facilities by The Archer Daniels Midland Company and Cargill Inc in 2022

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Stevia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Stevia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Stevia Market?

To stay informed about further developments, trends, and reports in the Europe Stevia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence