Key Insights

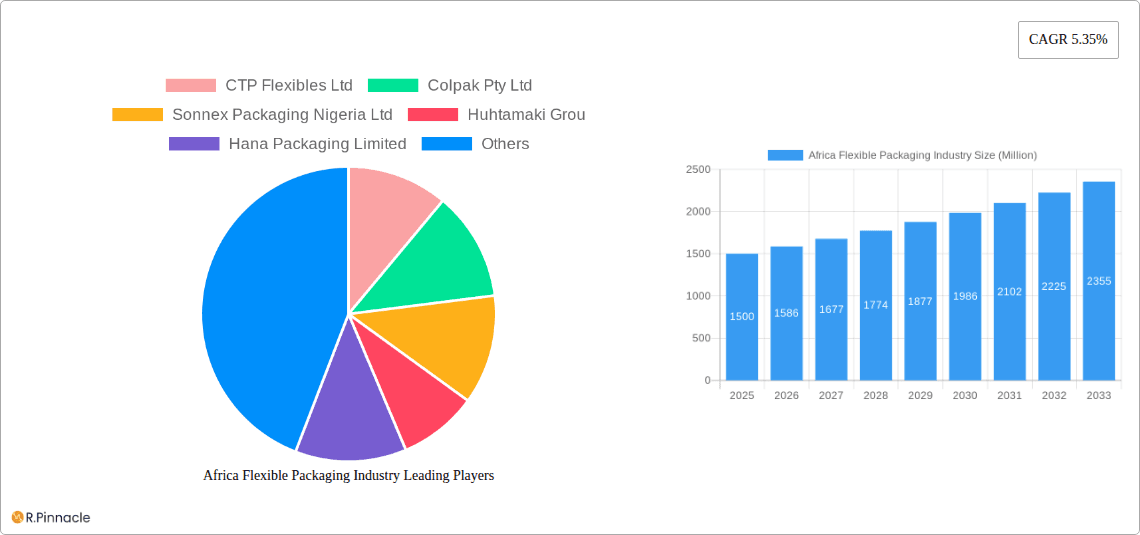

The African flexible packaging market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning food and beverage sector, particularly within processed foods and ready-to-eat meals, necessitates increased packaging solutions. A rising middle class with greater disposable income is driving demand for convenient, packaged goods. Furthermore, the cosmetic and pharmaceutical industries are experiencing growth, creating additional demand for flexible packaging. Increased investments in retail infrastructure and the adoption of e-commerce are further accelerating market growth. While challenges exist, such as infrastructural limitations in certain regions and the fluctuating cost of raw materials like plastic and aluminum, the overall market outlook remains positive due to consistent economic development across many African nations.

Africa Flexible Packaging Industry Market Size (In Billion)

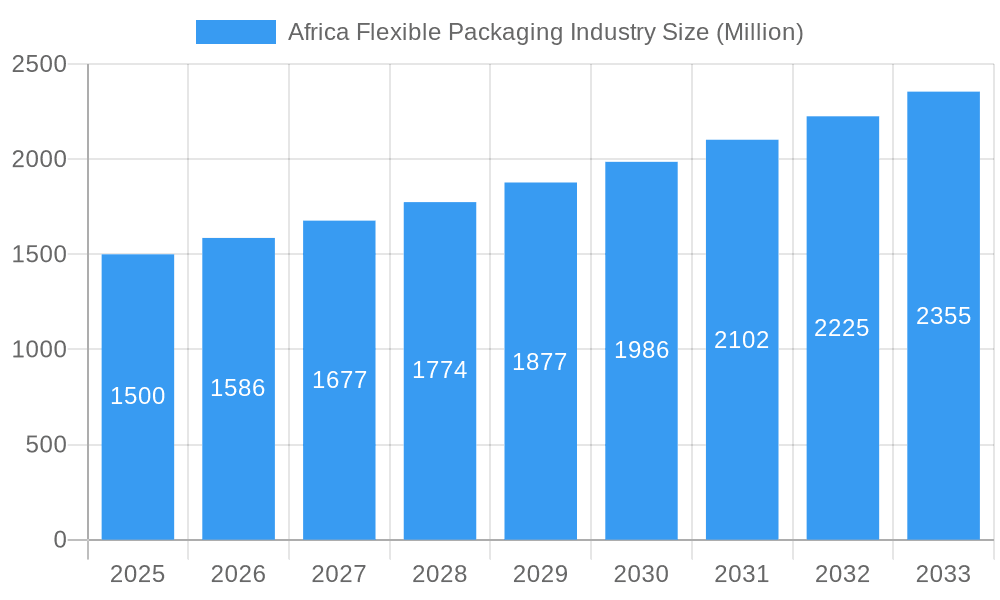

Growth is expected to be particularly strong in key markets like South Africa, Nigeria, Egypt, and Kenya, which possess established manufacturing capabilities and sizable consumer bases. Segmentation analysis reveals strong demand across various packaging types, including bags, pouches, wraps and films, with plastic currently dominating the materials segment due to its cost-effectiveness. However, an increasing awareness of sustainability is driving growth within the paper and potentially biodegradable material segments. The competitive landscape includes both local players and multinational corporations, with companies like CTP Flexibles Ltd, Colpak Pty Ltd, and Huhtamaki Group contributing significantly to the market's dynamism. The market's future trajectory will likely involve further diversification of materials used, increased focus on sustainable packaging options, and enhanced supply chain efficiency to meet the rising demand across diverse end-use sectors.

Africa Flexible Packaging Industry Company Market Share

Africa Flexible Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa flexible packaging industry, covering market size, growth drivers, challenges, opportunities, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This in-depth analysis is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market.

Africa Flexible Packaging Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and key market trends within the African flexible packaging industry. The market is characterized by a mix of multinational corporations and local players, with varying degrees of market concentration across different countries. Key players such as CTP Flexibles Ltd, Colpak Pty Ltd, Sonnex Packaging Nigeria Ltd, Huhtamaki Group, Hana Packaging Limited, PrimePak Industries Nigeria Ltd, Constantia Afripack Flexibles Ltd, and Aristocrat Industries Ltd, hold significant market share, although precise figures remain unavailable for a definitive market share breakdown (xx%).

The industry witnesses continuous innovation driven by factors such as increasing demand for sustainable packaging solutions (e.g., biodegradable materials), advancements in printing technologies (e.g., HD flexo printing), and evolving consumer preferences. Regulatory frameworks related to food safety and environmental protection are also shaping industry practices. The presence of substitute materials like rigid packaging influences market dynamics. Recent M&A activities, although not fully quantified, contribute to market consolidation. The total value of M&A deals in the period 2019-2024 is estimated at $xx Million. End-user demographics, particularly growth in the food and beverage sector, particularly in urban areas, fuels the growth of this industry.

- Market Concentration: Moderately fragmented, with a few dominant players.

- Innovation Drivers: Sustainable packaging, advanced printing, consumer demand.

- Regulatory Frameworks: Food safety, environmental regulations.

- Product Substitutes: Rigid packaging materials.

- M&A Activity: Moderate level of consolidation, with $xx Million in deal value (2019-2024).

Africa Flexible Packaging Industry Market Dynamics & Trends

The Africa flexible packaging market exhibits robust growth, driven by several key factors. Rising disposable incomes, particularly in urban centers, contribute to increased consumption of packaged goods. The expanding food and beverage sector, fueled by population growth and urbanization, is a significant driver, leading to higher demand for flexible packaging solutions. Technological advancements in packaging materials and printing techniques further enhance market growth. Consumer preferences for convenience and attractive packaging also play a crucial role. Competitive dynamics, including pricing strategies and product differentiation, influence market shares. The industry is witnessing a gradual shift towards sustainable and eco-friendly packaging, creating new opportunities for innovation and growth. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, with market penetration expected to reach xx% by 2033.

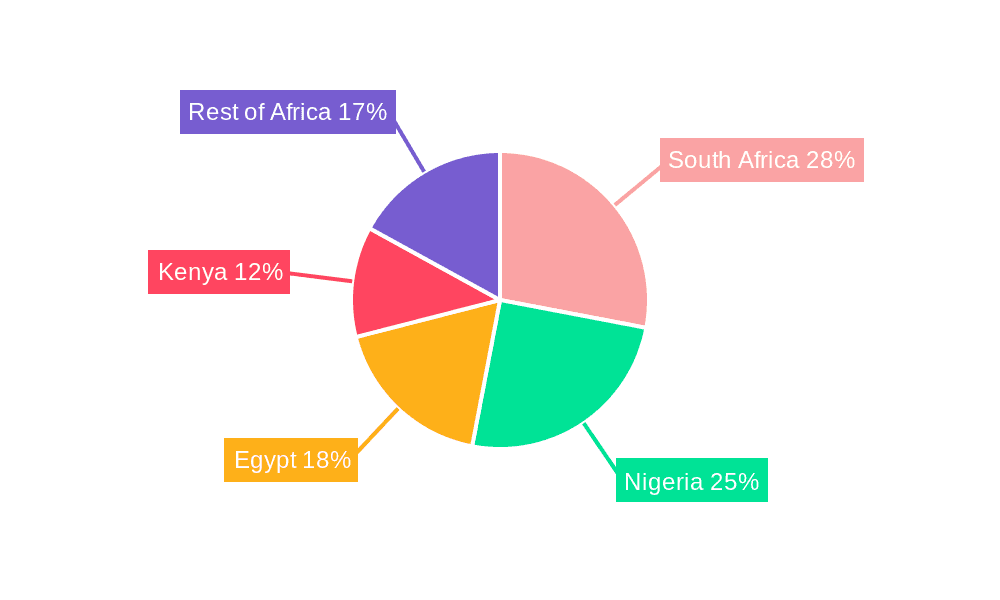

Dominant Regions & Segments in Africa Flexible Packaging Industry

The Africa flexible packaging market shows significant variations in dominance across regions and segments. South Africa, Nigeria, and Egypt collectively represent the largest market share, driven by their substantial populations, established manufacturing sectors, and relatively higher disposable incomes. Kenya and Morocco are also experiencing notable growth. The "Rest of Africa" segment exhibits high growth potential due to expanding economies and rising consumer spending.

By Material: Plastic dominates the market due to its versatility and affordability. However, growth in demand for sustainable alternatives like paper-based and bio-based materials is observed. Aluminum foil occupies a niche market, predominantly used in high-value food and beverage products.

By Product: Bags and pouches represent the largest segments, reflecting their widespread use across various industries. Wraps and films cater to a growing segment of the market. The "Other Products" category includes specialized packaging materials.

By End-User: The food and beverage sector remains the leading end-user, with substantial growth observed in the beauty & personal care, and home care sectors. The pharmaceutical industry also demands specialized flexible packaging.

- Key Drivers (South Africa): Strong manufacturing base, developed infrastructure, established retail networks.

- Key Drivers (Nigeria): Large population, growing middle class, expanding consumer goods market.

- Key Drivers (Egypt): Significant agricultural production, expanding tourism sector.

Africa Flexible Packaging Industry Product Innovations

The Africa flexible packaging industry continuously introduces innovative products, such as stand-up pouches with improved barrier properties, retort pouches for extended shelf life, and flexible packaging with enhanced graphics for improved brand appeal. These developments focus on meeting evolving consumer preferences for convenient, sustainable, and aesthetically pleasing packaging solutions. Technological advancements in materials science and printing techniques drive these innovations. The market sees a growing adoption of sustainable and recyclable materials, addressing environmental concerns.

Report Scope & Segmentation Analysis

This report segments the African flexible packaging market by material (plastic, paper, aluminum foil), product (bags, pouches, wraps & films, other products), end-user (food, beverage, beauty & personal care, home care, pharmaceutical), and country (South Africa, Nigeria, Egypt, Morocco, Kenya, Rest of Africa). Each segment presents a unique market size, growth projection, and competitive landscape. For example, the plastic segment is projected to maintain a substantial market share due to its cost-effectiveness. Meanwhile, the paper-based segment is projected for significant growth due to growing environmental awareness. Similar analyses apply to other segmentations, providing a comprehensive market view. The market size is expected to reach $xx Million by 2033.

Key Drivers of Africa Flexible Packaging Industry Growth

Several key factors drive the growth of the Africa flexible packaging industry. These include the growing consumer base fueled by population growth and urbanization, the rising demand for packaged foods and beverages, and a rapid increase in disposable income. Technological advances, like improved barrier properties and sustainable materials, stimulate innovation. Government initiatives promoting local manufacturing and investment in infrastructure further accelerate this growth. The expanding retail sector supports this trend with the development of sophisticated supply chains.

Challenges in the Africa Flexible Packaging Industry Sector

Challenges faced by the African flexible packaging industry include fluctuations in raw material prices, infrastructure limitations affecting logistics and distribution, and uneven access to advanced technologies. Competition from both international and regional players affects market dynamics. Regulatory compliance and enforcement vary across countries, creating complexities for manufacturers. These factors can potentially constrain market growth if not properly addressed. For instance, inconsistent energy supply across the region can impact manufacturing output.

Emerging Opportunities in Africa Flexible Packaging Industry

Growing demand for sustainable and eco-friendly packaging presents a significant opportunity. The increasing adoption of e-commerce creates opportunities for specialized packaging solutions for online deliveries. Moreover, the rising demand for convenient packaging formats like stand-up pouches and retort pouches unlocks significant market potential. Further, the expansion of the middle class across several African countries opens new avenues for innovative and high-value flexible packaging solutions.

Leading Players in the Africa Flexible Packaging Industry Market

- CTP Flexibles Ltd

- Colpak Pty Ltd

- Sonnex Packaging Nigeria Ltd

- Huhtamaki Group

- Hana Packaging Limited

- PrimePak Industries Nigeria Ltd

- Constantia Afripack Flexibles Ltd

- Aristocrat Industries Ltd

Key Developments in Africa Flexible Packaging Industry

- 2022 Q4: Huhtamaki Group announced expansion of its manufacturing capacity in South Africa.

- 2023 Q1: Introduction of a new biodegradable packaging material by Colpak Pty Ltd.

- 2023 Q2: Sonnex Packaging Nigeria Ltd invested in a new high-speed printing press. (Further developments require more information.)

Future Outlook for Africa Flexible Packaging Market

The Africa flexible packaging market is poised for continued growth, driven by sustained consumer demand, economic development, and technological advancements. Strategic investments in infrastructure and sustainable packaging solutions will be critical for long-term success. The industry is expected to experience a period of consolidation, with larger players acquiring smaller companies. The market is expected to continue its expansion in the coming years, offering significant opportunities for both established and new market entrants.

Africa Flexible Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Aluminium Foil

-

2. Product

- 2.1. Bags

- 2.2. Pouches

- 2.3. Wraps and Films

- 2.4. Other Products

-

3. End User

- 3.1. Food

- 3.2. Beverage

- 3.3. Beauty and Personal Care

- 3.4. Home Care

- 3.5. Pharmaceutical

- 3.6. Other End User

Africa Flexible Packaging Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Flexible Packaging Industry Regional Market Share

Geographic Coverage of Africa Flexible Packaging Industry

Africa Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increased Demand for Convenient Packaging; Longer shelf life and changing lifestyle of people

- 3.3. Market Restrains

- 3.3.1. Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Pouches are Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Aluminium Foil

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Bags

- 5.2.2. Pouches

- 5.2.3. Wraps and Films

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Beauty and Personal Care

- 5.3.4. Home Care

- 5.3.5. Pharmaceutical

- 5.3.6. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CTP Flexibles Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colpak Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonnex Packaging Nigeria Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hana Packaging Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PrimePak Industries Nigeria Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Constantia Afripack Flexibles Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aristocrat Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 CTP Flexibles Ltd

List of Figures

- Figure 1: Africa Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Flexible Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Africa Flexible Packaging Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Africa Flexible Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Africa Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Africa Flexible Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Africa Flexible Packaging Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Africa Flexible Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Africa Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Africa Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Egypt Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Kenya Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ethiopia Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Morocco Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Ghana Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Algeria Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Tanzania Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ivory Coast Africa Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Flexible Packaging Industry?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the Africa Flexible Packaging Industry?

Key companies in the market include CTP Flexibles Ltd, Colpak Pty Ltd, Sonnex Packaging Nigeria Ltd, Huhtamaki Grou, Hana Packaging Limited, PrimePak Industries Nigeria Ltd, Constantia Afripack Flexibles Ltd, Aristocrat Industries Ltd.

3. What are the main segments of the Africa Flexible Packaging Industry?

The market segments include Material, Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Increased Demand for Convenient Packaging; Longer shelf life and changing lifestyle of people.

6. What are the notable trends driving market growth?

Pouches are Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the Africa Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence