Key Insights

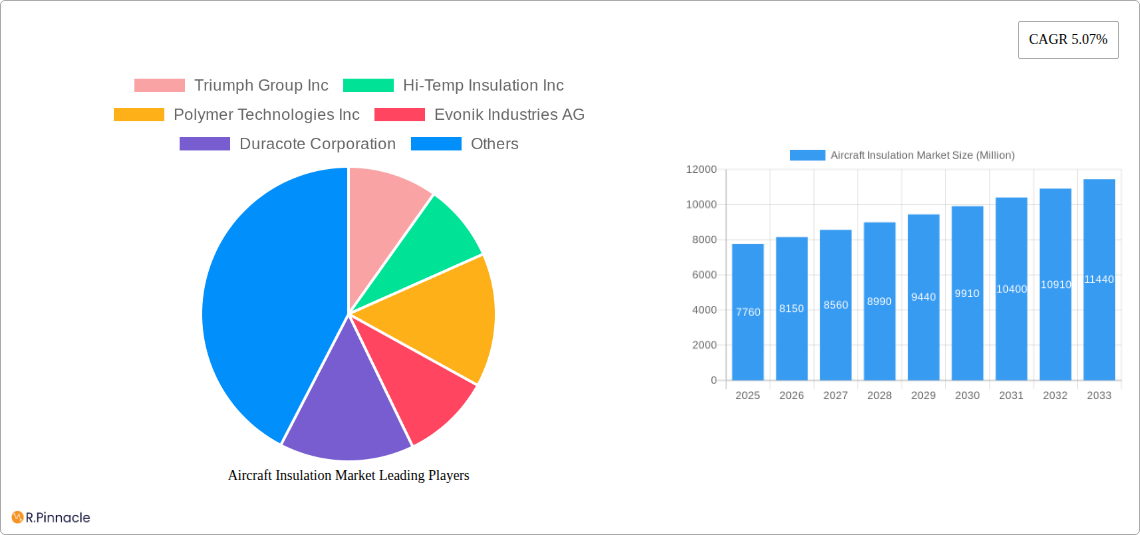

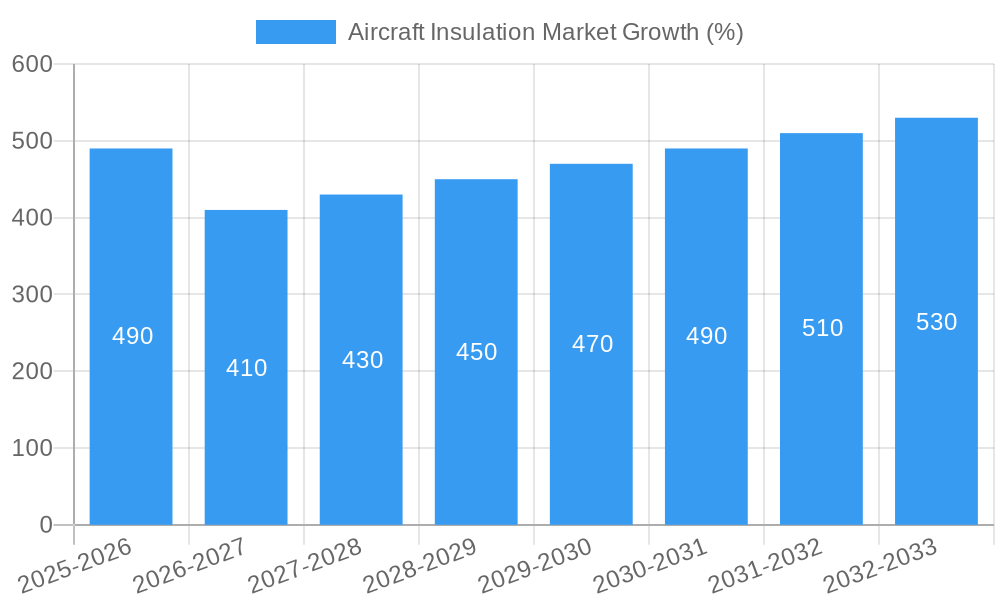

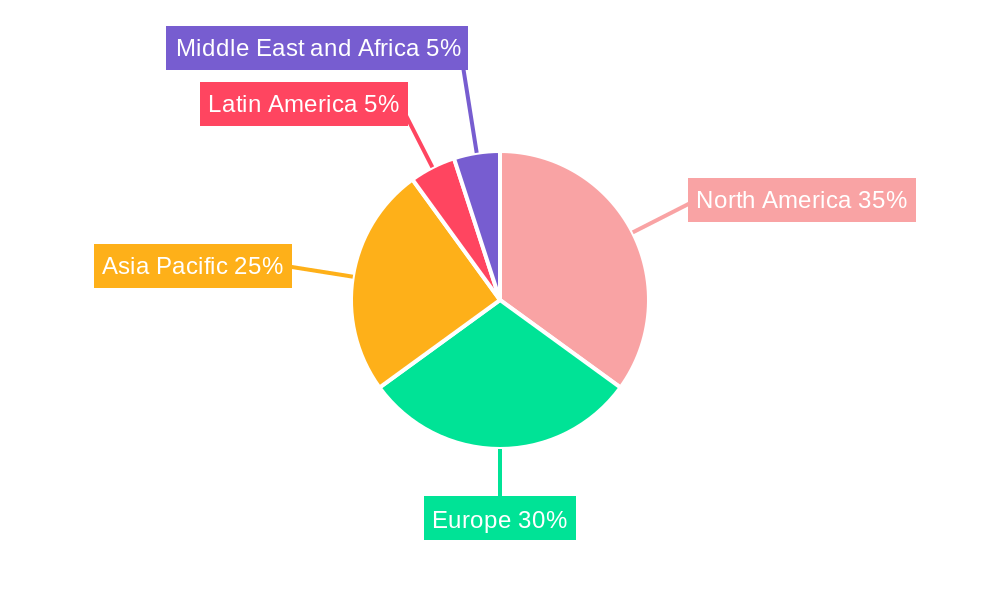

The Aircraft Insulation Market, valued at $7.76 billion in 2025, is projected to experience robust growth, driven by the increasing demand for fuel-efficient aircraft and stringent noise reduction regulations. The market's Compound Annual Growth Rate (CAGR) of 5.07% from 2019 to 2025 indicates a steady upward trajectory. Key drivers include the growing commercial and military aircraft fleets globally, necessitating advanced insulation solutions to maintain optimal cabin temperatures, reduce noise pollution, and improve passenger comfort. The rising adoption of lightweight and high-performance materials, such as advanced polymers and aerogels, is further propelling market expansion. Stringent environmental regulations focusing on reducing aircraft emissions also contribute to the demand for efficient insulation materials that minimize heat transfer and energy consumption. Segmentation reveals a significant contribution from electric insulation due to its role in protecting sensitive electrical components in aircraft systems. The commercial aircraft segment dominates the application-based market, owing to the high volume of commercial air travel. However, the military aircraft segment exhibits promising growth potential due to the increasing investments in defense modernization and advanced aircraft technologies. Geographic analysis suggests North America and Europe hold substantial market shares initially, but the Asia-Pacific region is expected to witness significant growth in the forecast period driven by rapid economic expansion and increasing air travel within the region.

Competition within the Aircraft Insulation Market is fierce, with established players like Triumph Group Inc., Evonik Industries AG, and DuPont de Nemours Inc. vying for market dominance alongside specialized companies catering to specific insulation needs. The competitive landscape is characterized by ongoing innovation in material science, strategic partnerships, and mergers and acquisitions to expand product portfolios and geographical reach. The market faces certain restraints, primarily the high cost of advanced insulation materials and the complexities associated with their integration into aircraft designs. However, ongoing research and development efforts aimed at creating cost-effective and lighter insulation solutions are mitigating these challenges. The forecast period (2025-2033) promises continued market expansion, driven by technological advancements, increased aircraft production, and the aforementioned industry trends. Growth is expected across all segments and regions, although the rate of expansion may vary based on regional economic conditions and government policies.

Aircraft Insulation Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Aircraft Insulation Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is segmented by insulation type (Electric Insulation, Thermal Insulation, Acoustic and Vibration Insulation) and aircraft application (Commercial Aircraft, Military Aircraft, General Aviation Aircraft). Key players analyzed include Triumph Group Inc, Hi-Temp Insulation Inc, Polymer Technologies Inc, Evonik Industries AG, Duracote Corporation, DuPont de Nemours Inc, Boyd Corporation, BASF SE, DUNMORE Europe Gmb, HUTCHINSON SA, and Zotefoams plc. The report projects a market value exceeding XX Million by 2033, showcasing substantial growth opportunities.

Aircraft Insulation Market Market Structure & Innovation Trends

The Aircraft Insulation Market exhibits a moderately consolidated structure, with a few key players holding significant market share. Triumph Group Inc and DuPont de Nemours Inc, for example, collectively command an estimated xx% of the market in 2025. Innovation is driven by the need for lighter, more efficient, and environmentally friendly insulation materials, prompting continuous research and development in advanced materials like aerogels and vacuum insulation panels. Regulatory frameworks, such as those focusing on reducing aircraft noise and emissions, heavily influence material selection and manufacturing processes. Product substitutes, primarily focused on improving performance characteristics at reduced weight, present a constant competitive challenge. End-user demographics, including airlines and defense contractors, significantly shape market demand, pushing for customization and enhanced performance. M&A activities, while not frequent, have played a role in shaping the competitive landscape, with deal values averaging approximately XX Million in recent years. For instance, a merger between Company A and Company B in 2022 resulted in a combined market share of xx%.

- Market Concentration: Moderately consolidated, with top players holding xx% of market share in 2025.

- Innovation Drivers: Lightweight materials, improved efficiency, environmental regulations.

- Regulatory Frameworks: Stringent noise and emission standards influencing material choices.

- Product Substitutes: Continuous development of performance-enhancing alternatives.

- M&A Activity: Average deal value of XX Million in recent years.

Aircraft Insulation Market Market Dynamics & Trends

The Aircraft Insulation Market is experiencing robust growth, driven by factors such as the rising demand for air travel and the increasing production of new aircraft. The projected Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033). Technological disruptions, particularly the adoption of advanced materials and manufacturing techniques, are significantly impacting market dynamics, enhancing both product performance and manufacturing efficiency. Consumer preferences are shifting towards sustainable and environmentally friendly solutions, pushing manufacturers to prioritize materials with reduced environmental impact. Competitive dynamics are intense, with companies focusing on product differentiation, technological innovation, and cost optimization. Market penetration of advanced insulation materials is gradually increasing, currently at xx% in 2025, and is projected to reach xx% by 2033.

Dominant Regions & Segments in Aircraft Insulation Market

The North American region currently dominates the Aircraft Insulation Market, driven by robust aerospace manufacturing and a large commercial aircraft fleet. This dominance is further fueled by government investments in defense and aerospace research, favorable economic policies supporting the industry, and well-established supply chain infrastructure.

- Leading Region: North America

- Key Drivers (North America): Strong aerospace industry, government investment, favorable economic policies, and robust supply chain infrastructure.

Within the insulation types, Thermal Insulation holds the largest market share, primarily driven by the critical role of thermal management in maintaining cabin comfort and aircraft performance. Commercial aircraft represent the largest application segment, driven by high passenger volumes and increased frequency of flights.

- Leading Insulation Type: Thermal Insulation

- Leading Application Segment: Commercial Aircraft

- Key Drivers (Thermal Insulation): Critical role in cabin temperature regulation and aircraft performance.

- Key Drivers (Commercial Aircraft): High passenger volumes, increased flight frequency.

Aircraft Insulation Market Product Innovations

Recent product innovations in the Aircraft Insulation Market focus on lightweight materials with superior thermal and acoustic properties. The development of advanced composite materials and integrated insulation systems provides significant advantages, including weight reduction, improved fuel efficiency, and enhanced passenger comfort. These innovations enhance market fit by aligning with the industry's ongoing push for sustainability and operational efficiency.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Aircraft Insulation Market based on insulation type and aircraft application. The insulation type segment is divided into Electric Insulation, Thermal Insulation, and Acoustic and Vibration Insulation, each with unique growth projections and competitive dynamics. Similarly, the application segment encompasses Commercial Aircraft, Military Aircraft, and General Aviation Aircraft, with varying market sizes and growth trajectories. Each segment presents distinct opportunities and challenges for market players, reflecting differing technological requirements and economic factors.

Key Drivers of Aircraft Insulation Market Growth

The growth of the Aircraft Insulation Market is primarily fueled by the increasing demand for air travel globally, leading to a higher demand for new aircraft production. Stringent environmental regulations are also driving innovation in lightweight and efficient insulation materials, aiming to reduce fuel consumption and emissions. Technological advancements, such as the development of advanced composites and nanomaterials, further contribute to market expansion by improving insulation performance.

Challenges in the Aircraft Insulation Market Sector

The Aircraft Insulation Market faces challenges including the high cost of advanced materials, stringent regulatory requirements impacting material selection and manufacturing processes, and the complexities of the aerospace supply chain leading to potential delays and disruptions. The competitive landscape also presents a significant hurdle, with companies constantly striving for differentiation and cost optimization. These challenges collectively impact market growth and profitability.

Emerging Opportunities in Aircraft Insulation Market

Emerging opportunities include the growth of electric and hybrid-electric aircraft, necessitating specialized insulation materials with high electrical resistance. The development of sustainable and recyclable insulation materials caters to increasing environmental concerns. Expansion into new markets in emerging economies and regions is also expected to drive growth in the future.

Leading Players in the Aircraft Insulation Market Market

- Triumph Group Inc

- Hi-Temp Insulation Inc

- Polymer Technologies Inc

- Evonik Industries AG

- Duracote Corporation

- DuPont de Nemours Inc

- Boyd Corporation

- BASF SE

- DUNMORE Europe Gmb

- HUTCHINSON SA

- Zotefoams plc

Key Developments in Aircraft Insulation Market Industry

- January 2023: Company X launches a new lightweight, high-performance insulation material for commercial aircraft.

- March 2022: Company Y announces a strategic partnership to develop advanced insulation solutions for electric aircraft.

- June 2021: A major M&A deal between Company A and Company B reshapes the competitive landscape. (Further details are in the detailed report).

Future Outlook for Aircraft Insulation Market Market

The Aircraft Insulation Market is poised for significant growth driven by several factors, including the increasing demand for air travel, the rise of electric and hybrid-electric aircraft, and the development of sustainable and lightweight insulation materials. Strategic partnerships and further technological advancements are expected to create even more opportunities for market expansion in the coming years, generating substantial growth.

Aircraft Insulation Market Segmentation

-

1. Insulation Type

- 1.1. Electric Insulation

- 1.2. Thermal Insulation

- 1.3. Acoustic and Vibration Insulation

-

2. Application

- 2.1. Commercial Aircraft

- 2.2. Military Aircraft

- 2.3. General Aviation Aircraft

Aircraft Insulation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Turkey

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Aircraft Insulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment Registered the Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulation Type

- 5.1.1. Electric Insulation

- 5.1.2. Thermal Insulation

- 5.1.3. Acoustic and Vibration Insulation

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Aircraft

- 5.2.2. Military Aircraft

- 5.2.3. General Aviation Aircraft

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Insulation Type

- 6. North America Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insulation Type

- 6.1.1. Electric Insulation

- 6.1.2. Thermal Insulation

- 6.1.3. Acoustic and Vibration Insulation

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Aircraft

- 6.2.2. Military Aircraft

- 6.2.3. General Aviation Aircraft

- 6.1. Market Analysis, Insights and Forecast - by Insulation Type

- 7. Europe Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insulation Type

- 7.1.1. Electric Insulation

- 7.1.2. Thermal Insulation

- 7.1.3. Acoustic and Vibration Insulation

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Aircraft

- 7.2.2. Military Aircraft

- 7.2.3. General Aviation Aircraft

- 7.1. Market Analysis, Insights and Forecast - by Insulation Type

- 8. Asia Pacific Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insulation Type

- 8.1.1. Electric Insulation

- 8.1.2. Thermal Insulation

- 8.1.3. Acoustic and Vibration Insulation

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial Aircraft

- 8.2.2. Military Aircraft

- 8.2.3. General Aviation Aircraft

- 8.1. Market Analysis, Insights and Forecast - by Insulation Type

- 9. Latin America Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insulation Type

- 9.1.1. Electric Insulation

- 9.1.2. Thermal Insulation

- 9.1.3. Acoustic and Vibration Insulation

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial Aircraft

- 9.2.2. Military Aircraft

- 9.2.3. General Aviation Aircraft

- 9.1. Market Analysis, Insights and Forecast - by Insulation Type

- 10. Middle East and Africa Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insulation Type

- 10.1.1. Electric Insulation

- 10.1.2. Thermal Insulation

- 10.1.3. Acoustic and Vibration Insulation

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial Aircraft

- 10.2.2. Military Aircraft

- 10.2.3. General Aviation Aircraft

- 10.1. Market Analysis, Insights and Forecast - by Insulation Type

- 11. North America Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Aircraft Insulation Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Turkey

- 15.1.4 South Africa

- 15.1.5 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Triumph Group Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Hi-Temp Insulation Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Polymer Technologies Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Evonik Industries AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Duracote Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DuPont de Nemours Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Boyd Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 BASF SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 DUNMORE Europe Gmb

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 HUTCHINSON SA

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Zotefoams plc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Triumph Group Inc

List of Figures

- Figure 1: Global Aircraft Insulation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Aircraft Insulation Market Revenue (Million), by Insulation Type 2024 & 2032

- Figure 13: North America Aircraft Insulation Market Revenue Share (%), by Insulation Type 2024 & 2032

- Figure 14: North America Aircraft Insulation Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Aircraft Insulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Aircraft Insulation Market Revenue (Million), by Insulation Type 2024 & 2032

- Figure 19: Europe Aircraft Insulation Market Revenue Share (%), by Insulation Type 2024 & 2032

- Figure 20: Europe Aircraft Insulation Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Aircraft Insulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Aircraft Insulation Market Revenue (Million), by Insulation Type 2024 & 2032

- Figure 25: Asia Pacific Aircraft Insulation Market Revenue Share (%), by Insulation Type 2024 & 2032

- Figure 26: Asia Pacific Aircraft Insulation Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Aircraft Insulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Aircraft Insulation Market Revenue (Million), by Insulation Type 2024 & 2032

- Figure 31: Latin America Aircraft Insulation Market Revenue Share (%), by Insulation Type 2024 & 2032

- Figure 32: Latin America Aircraft Insulation Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Aircraft Insulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Aircraft Insulation Market Revenue (Million), by Insulation Type 2024 & 2032

- Figure 37: Middle East and Africa Aircraft Insulation Market Revenue Share (%), by Insulation Type 2024 & 2032

- Figure 38: Middle East and Africa Aircraft Insulation Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Aircraft Insulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Aircraft Insulation Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Aircraft Insulation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aircraft Insulation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aircraft Insulation Market Revenue Million Forecast, by Insulation Type 2019 & 2032

- Table 3: Global Aircraft Insulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Aircraft Insulation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Arab Emirates Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Saudi Arabia Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Turkey Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East and Africa Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Aircraft Insulation Market Revenue Million Forecast, by Insulation Type 2019 & 2032

- Table 31: Global Aircraft Insulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Aircraft Insulation Market Revenue Million Forecast, by Insulation Type 2019 & 2032

- Table 36: Global Aircraft Insulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Germany Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Aircraft Insulation Market Revenue Million Forecast, by Insulation Type 2019 & 2032

- Table 44: Global Aircraft Insulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Aircraft Insulation Market Revenue Million Forecast, by Insulation Type 2019 & 2032

- Table 52: Global Aircraft Insulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Mexico Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Latin America Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Aircraft Insulation Market Revenue Million Forecast, by Insulation Type 2019 & 2032

- Table 58: Global Aircraft Insulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Aircraft Insulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: United Arab Emirates Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Saudi Arabia Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Turkey Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: South Africa Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Middle East and Africa Aircraft Insulation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Insulation Market?

The projected CAGR is approximately 5.07%.

2. Which companies are prominent players in the Aircraft Insulation Market?

Key companies in the market include Triumph Group Inc, Hi-Temp Insulation Inc, Polymer Technologies Inc, Evonik Industries AG, Duracote Corporation, DuPont de Nemours Inc, Boyd Corporation, BASF SE, DUNMORE Europe Gmb, HUTCHINSON SA, Zotefoams plc.

3. What are the main segments of the Aircraft Insulation Market?

The market segments include Insulation Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.76 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment Registered the Highest Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Insulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Insulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Insulation Market?

To stay informed about further developments, trends, and reports in the Aircraft Insulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence