Key Insights

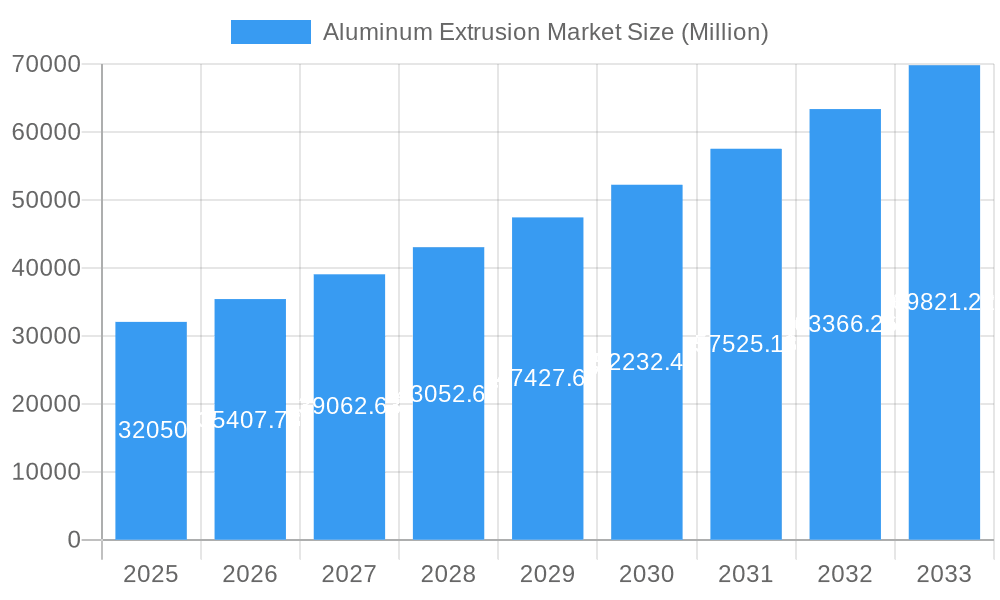

The global aluminum extrusion market, valued at $32.05 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 10.55% from 2025 to 2033. This expansion is fueled by several key factors. The automotive industry's increasing adoption of lightweight materials to enhance fuel efficiency and performance significantly boosts demand for aluminum extrusions in passenger cars, light commercial vehicles, and buses. Furthermore, the construction sector's growing preference for durable and aesthetically pleasing aluminum profiles for windows, doors, and facades contributes substantially to market growth. Technological advancements in extrusion processes, leading to improved precision, strength, and surface finishes, further stimulate market expansion. Finally, the rising demand for energy-efficient building materials and the increasing popularity of customized aluminum products are creating new opportunities for growth.

Aluminum Extrusion Market Market Size (In Billion)

However, the market faces certain challenges. Fluctuations in aluminum prices, a key raw material, pose a significant risk to profitability. Geopolitical instability and supply chain disruptions can also impact production and delivery timelines. Furthermore, competition from alternative materials like steel and plastics, particularly in price-sensitive segments, necessitates continuous innovation and cost optimization strategies for aluminum extrusion manufacturers. Despite these restraints, the long-term outlook for the aluminum extrusion market remains positive, particularly in regions experiencing rapid industrialization and infrastructure development, such as Asia-Pacific. The market segmentation by application (passenger cars, light commercial vehicles, medium and heavy-duty commercial vehicles, buses) and type (body structure, interiors, exteriors, other types) allows for a nuanced understanding of market dynamics and offers manufacturers opportunities to tailor their products to specific needs.

Aluminum Extrusion Market Company Market Share

Aluminum Extrusion Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Aluminum Extrusion Market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this study delves into market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for informed decision-making.

Aluminum Extrusion Market Market Structure & Innovation Trends

The aluminum extrusion market exhibits a moderately concentrated structure, with several major players holding significant market share. Omnimax International, Kobelco Aluminum Products & Extrusions Inc, Norsk Hydro ASA, Kaiser Aluminum Corp, Walter Klein GmbH & Co KG, BENTELER International, SMS Schimmer, Constellium SE, Innoval Technology, Novelis Inc, and Bonnell Aluminum Extrusion Company are key players driving innovation and competition. Market share distribution varies across regions and segments, with ongoing M&A activity reshaping the competitive landscape. In 2024, the top 5 players collectively held approximately xx% of the global market share. Recent M&A deals have totaled an estimated xx Million, primarily focused on expanding geographic reach and technological capabilities. Innovation is driven by lightweighting trends in the automotive and construction sectors, necessitating advanced alloys and extrusion techniques. Stringent environmental regulations are also shaping the market, pushing for more sustainable aluminum production and recycling practices. Product substitutes, such as other lightweight materials (e.g., carbon fiber), pose a competitive challenge, although aluminum extrusion maintains its dominance due to cost-effectiveness and recyclability. End-user demographics are shifting towards industries seeking higher performance and sustainability, impacting material selection and design.

Aluminum Extrusion Market Market Dynamics & Trends

The global aluminum extrusion market is experiencing robust growth, driven by the increasing demand from the automotive industry, particularly for electric vehicles (EVs). The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by factors such as rising vehicle production, the growing preference for lightweight vehicles to improve fuel efficiency, and stringent government regulations promoting fuel economy and emissions reduction. Technological advancements, such as the development of high-strength alloys and improved extrusion processes, further enhance the market's growth potential. The market penetration of aluminum extrusions in various sectors, such as construction and transportation, is steadily increasing, owing to its versatility, strength-to-weight ratio, and recyclability. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and mergers & acquisitions, leading to consolidation and increased efficiency. Consumer preferences for sustainable and eco-friendly products further boost the demand for recycled aluminum extrusions.

Dominant Regions & Segments in Aluminum Extrusion Market

The automotive sector is the dominant end-use segment for aluminum extrusions, particularly in passenger cars and light commercial vehicles. Within this segment, applications such as body structures and exteriors are experiencing significant growth due to the increasing demand for lightweighting and improved fuel efficiency.

- Key Drivers for Passenger Cars: Stringent fuel economy standards, rising vehicle production, and advancements in automotive design.

- Key Drivers for Light Commercial Vehicles: Growing e-commerce and last-mile delivery services increasing demand for vans and trucks.

- Key Drivers for Medium and Heavy-duty Commercial Vehicles: Increased focus on fuel efficiency and payload capacity.

- Key Drivers for Buses: Adoption of lightweight materials for enhanced fuel efficiency and passenger safety.

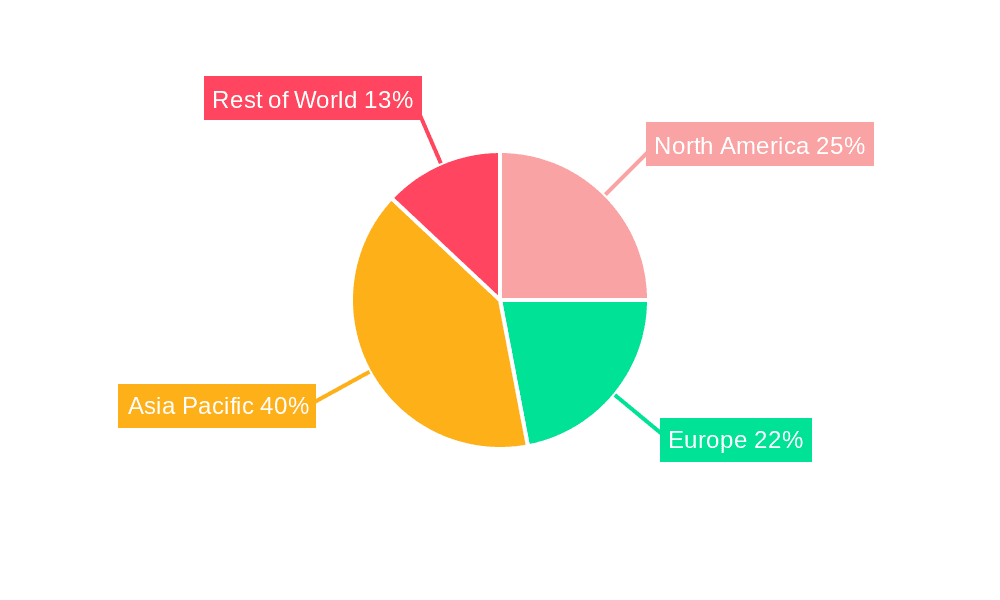

Geographically, Asia Pacific is the leading region, driven by rapid industrialization and urbanization in countries like China and India. Europe and North America also hold significant market share. The dominance of these regions is attributed to the well-established automotive industry and robust infrastructure.

Aluminum Extrusion Market Product Innovations

The aluminum extrusion market is experiencing a wave of innovation, with a strong emphasis on developing high-performance alloys. Key advancements include the creation of alloys with superior strength-to-weight ratios, enhanced corrosion resistance for greater durability, and improved formability to facilitate intricate designs and complex manufacturing processes. These cutting-edge materials are specifically engineered to meet the evolving demands of critical sectors such as the automotive industry (especially in the context of electric vehicles), the rapidly expanding construction sector, and the aerospace industry. Furthermore, manufacturers are actively investing in and adopting advanced extrusion technologies. This includes the pioneering development of multi-material extrusion, which allows for the integration of different aluminum alloys or even other materials within a single extrusion profile, thereby unlocking new levels of performance, functionality, and design possibilities. The introduction of specialized alloys, such as Alba's '6060.HE', exemplifies a commitment to delivering bespoke solutions precisely tailored to the unique requirements of individual customers. This dedication to targeted innovation, coupled with continuous improvements in extrusion processes and manufacturing efficiency, is a pivotal factor in driving market differentiation, enhancing product value, and fostering increased competitiveness among industry players.

Report Scope & Segmentation Analysis

This comprehensive report provides an in-depth analysis of the aluminum extrusion market, meticulously segmented to offer a clear understanding of its diverse landscape. The market is categorized based on its primary applications, including: Passenger Cars, Light Commercial Vehicles, Medium and Heavy-duty Commercial Vehicles, and Buses. Additionally, segmentation is performed by product type, encompassing: Body Structure, Interiors, Exteriors, and Other Types of extrusions. For each identified segment, the report rigorously analyzes growth trends, evaluating key metrics such as market size, projected Compound Annual Growth Rate (CAGR), and prevailing competitive dynamics. For instance, the passenger car segment is anticipated to experience substantial growth, largely propelled by the imperative for lightweighting in vehicle design to enhance fuel efficiency and reduce environmental impact. Similarly, the body structure segment is expected to maintain a dominant position within the market due to the extensive and ongoing utilization of aluminum extrusions in critical automotive components like chassis, frames, and other load-bearing structural elements. Growth projections for each specific segment are carefully presented, taking into account a multitude of influencing factors including industry-specific trends, evolving technological advancements, and prevailing economic conditions. A thorough examination of the competitive landscape within each segment is also a core component of this analysis, focusing on critical aspects such as market share distribution, the pace of innovation, strategic collaborations, and market entry strategies.

Key Drivers of Aluminum Extrusion Market Growth

The robust and sustained growth of the aluminum extrusion market is primarily propelled by a confluence of powerful and interconnected factors. Foremost among these is the escalating global demand for lightweight vehicle solutions. As regulatory pressures increase and consumer awareness grows regarding fuel efficiency and environmental sustainability, automakers are increasingly turning to aluminum extrusions to reduce vehicle weight, thereby directly contributing to lower fuel consumption and diminished emissions. Secondly, significant advancements in aluminum alloy development and sophisticated extrusion technologies are continuously enabling the creation of products that are not only lighter but also demonstrably stronger, more durable, and exceptionally versatile, opening up new application possibilities across various industries. Finally, supportive government policies and evolving regulatory frameworks across numerous regions worldwide are actively promoting and incentivizing the adoption of sustainable materials, including aluminum extrusions, in sectors ranging from construction and transportation to renewable energy infrastructure, further bolstering market expansion.

Challenges in the Aluminum Extrusion Market Sector

The aluminum extrusion market faces challenges, including fluctuating raw material prices (aluminum), supply chain disruptions, and intense competition from substitute materials such as steel and plastics. Additionally, stringent environmental regulations and the increasing cost of energy can impact production costs and profitability. These factors can cause price volatility and affect market growth to varying degrees, especially in certain geographical regions. The impact of these challenges can be quantified through cost analysis and supply chain assessments.

Emerging Opportunities in Aluminum Extrusion Market

Emerging opportunities lie in the growing demand for aluminum extrusions in renewable energy applications (solar panels, wind turbines) and the construction industry. The rise of electric vehicles and the focus on sustainable transportation present significant potential for market expansion. Technological advancements in areas such as additive manufacturing and customized extrusion solutions offer new growth avenues. Further exploration of new alloys with superior properties and enhanced recyclability will be vital for future market penetration and growth.

Leading Players in the Aluminum Extrusion Market Market

- Omnimax International

- Kobelco Aluminum Products & Extrusions Inc

- Norsk Hydro ASA

- Kaiser Aluminum Corp

- Walter Klein GmbH & Co KG

- BENTELER International

- SMS Schimmer

- Constellium SE

- Innoval Technology

- Novelis Inc

- Bonnell Aluminum Extrusion Company

Key Developments in Aluminum Extrusion Market Industry

- August 2023: Hydro, a leading aluminum and energy company, announced a significant investment of NOK 67 Million (approximately EUR 6 Million) to upgrade its extrusion facility in Lucé, France. This strategic investment is focused on enhancing equipment, modernizing infrastructure, and fostering the professional development of its workforce, aiming to boost production efficiency and product quality.

- August 2023: Aluminium Bahrain (Alba), one of the world's largest aluminum producers, successfully launched its innovative '6060.HE' alloy. This new alloy is specifically designed and marketed to meet the precise requirements of extruder clients, offering enhanced properties for specialized applications.

- August 2022: Norsk Hydro ASA made a substantial investment of NOK 300 Million to establish a new, state-of-the-art 6000-ton extrusion press at its facility in Tonder, Denmark. This strategic expansion is particularly geared towards serving the growing demands of the automotive and electric vehicle (EV) markets, enabling the production of larger and more complex aluminum components.

Future Outlook for Aluminum Extrusion Market Market

The future trajectory of the aluminum extrusion market appears exceptionally promising, underpinned by sustained and accelerating growth across key sectors. The automotive industry, in particular, is a major driver, with the ongoing global transition towards electric vehicles (EVs) and the continuous pursuit of lightweighting strategies creating unprecedented demand for advanced aluminum solutions. Concurrently, the construction sector's increasing emphasis on sustainable building practices and the demand for durable, energy-efficient materials further fuel market expansion. Continuous advancements in aluminum alloy technology, coupled with refinements in extrusion processes, are set to unlock an even wider array of applications for aluminum extrusions, pushing the boundaries of what is possible in product design and manufacturing. Strategic partnerships, collaborative research and development initiatives, and targeted investments in emerging technologies will play a pivotal role in shaping the market's future landscape and driving competitive advantage. The market is well-positioned for significant growth, with particular optimism for expansion in emerging economies that are experiencing rapid infrastructural development and burgeoning manufacturing sectors.

Aluminum Extrusion Market Segmentation

-

1. Type

- 1.1. Body Structure

- 1.2. Interiors

- 1.3. Exteriors

- 1.4. Other Types

-

2. Application

- 2.1. Passenger Cars

- 2.2. Light Commercial Vehicles

- 2.3. Medium and Heavy-duty Commercial Vehicles

- 2.4. Buses

Aluminum Extrusion Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Aluminum Extrusion Market Regional Market Share

Geographic Coverage of Aluminum Extrusion Market

Aluminum Extrusion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Electric Vehicles Fueling the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices Anticipate to Restrain the Market's Growth

- 3.4. Market Trends

- 3.4.1. Passenger Cars are Fueling the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aluminum Extrusion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Body Structure

- 5.1.2. Interiors

- 5.1.3. Exteriors

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Cars

- 5.2.2. Light Commercial Vehicles

- 5.2.3. Medium and Heavy-duty Commercial Vehicles

- 5.2.4. Buses

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aluminum Extrusion Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Body Structure

- 6.1.2. Interiors

- 6.1.3. Exteriors

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Cars

- 6.2.2. Light Commercial Vehicles

- 6.2.3. Medium and Heavy-duty Commercial Vehicles

- 6.2.4. Buses

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Aluminum Extrusion Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Body Structure

- 7.1.2. Interiors

- 7.1.3. Exteriors

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Cars

- 7.2.2. Light Commercial Vehicles

- 7.2.3. Medium and Heavy-duty Commercial Vehicles

- 7.2.4. Buses

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Aluminum Extrusion Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Body Structure

- 8.1.2. Interiors

- 8.1.3. Exteriors

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Cars

- 8.2.2. Light Commercial Vehicles

- 8.2.3. Medium and Heavy-duty Commercial Vehicles

- 8.2.4. Buses

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Aluminum Extrusion Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Body Structure

- 9.1.2. Interiors

- 9.1.3. Exteriors

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Cars

- 9.2.2. Light Commercial Vehicles

- 9.2.3. Medium and Heavy-duty Commercial Vehicles

- 9.2.4. Buses

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Omnimax International

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kobelco Aluminum Products & Extrusions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Norsk Hydro ASA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kaiser Aluminum Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Walter Klein GmbH & Co KG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BENTELER Internationa

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SMS Schimmer

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Constellium SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Innoval Technology

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Novelis Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bonnell Aluminum Extrusion Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Omnimax International

List of Figures

- Figure 1: Global Aluminum Extrusion Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aluminum Extrusion Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Aluminum Extrusion Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Aluminum Extrusion Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Aluminum Extrusion Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Aluminum Extrusion Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aluminum Extrusion Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aluminum Extrusion Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Aluminum Extrusion Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Aluminum Extrusion Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Aluminum Extrusion Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Aluminum Extrusion Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aluminum Extrusion Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aluminum Extrusion Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Aluminum Extrusion Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Aluminum Extrusion Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Aluminum Extrusion Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Aluminum Extrusion Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aluminum Extrusion Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Aluminum Extrusion Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Aluminum Extrusion Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Aluminum Extrusion Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Aluminum Extrusion Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Aluminum Extrusion Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Aluminum Extrusion Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aluminum Extrusion Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aluminum Extrusion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Aluminum Extrusion Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aluminum Extrusion Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Aluminum Extrusion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Aluminum Extrusion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Aluminum Extrusion Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Aluminum Extrusion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Aluminum Extrusion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Aluminum Extrusion Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Aluminum Extrusion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Aluminum Extrusion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Aluminum Extrusion Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Aluminum Extrusion Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Aluminum Extrusion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Aluminum Extrusion Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aluminum Extrusion Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the Aluminum Extrusion Market?

Key companies in the market include Omnimax International, Kobelco Aluminum Products & Extrusions Inc, Norsk Hydro ASA, Kaiser Aluminum Corp, Walter Klein GmbH & Co KG, BENTELER Internationa, SMS Schimmer, Constellium SE, Innoval Technology, Novelis Inc, Bonnell Aluminum Extrusion Company.

3. What are the main segments of the Aluminum Extrusion Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Electric Vehicles Fueling the Market's Growth.

6. What are the notable trends driving market growth?

Passenger Cars are Fueling the Market's Growth.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices Anticipate to Restrain the Market's Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Hydro declared an investment of NOK 67 million (approximately EUR 6 million) to enhance its aluminum extrusion facility in Lucé, France. This investment was earmarked not only for the modernization of the plant's equipment, buildings, and infrastructure but also for initiating a new program dedicated to employee development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aluminum Extrusion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aluminum Extrusion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aluminum Extrusion Market?

To stay informed about further developments, trends, and reports in the Aluminum Extrusion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence