Key Insights

The Americas aircraft lighting market, valued at $307.87 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 9.03% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for advanced aircraft lighting systems, particularly LED-based solutions, is a significant driver. LED lighting offers superior energy efficiency, longer lifespan, and enhanced brightness compared to traditional technologies, making it increasingly attractive to aircraft manufacturers and operators. Secondly, stringent safety regulations regarding aircraft illumination, coupled with a growing emphasis on passenger comfort and enhanced aesthetics, are further boosting market growth. The integration of smart lighting technologies, which allow for dynamic control and personalized illumination settings, represents a significant emerging trend. Finally, the steady growth in both commercial and general aviation sectors within the Americas is providing a favorable backdrop for expanding market opportunities. Specific growth within the commercial sector is anticipated to outpace that of the general aviation segment, driven by larger fleet modernization programs and investments in enhancing passenger experience.

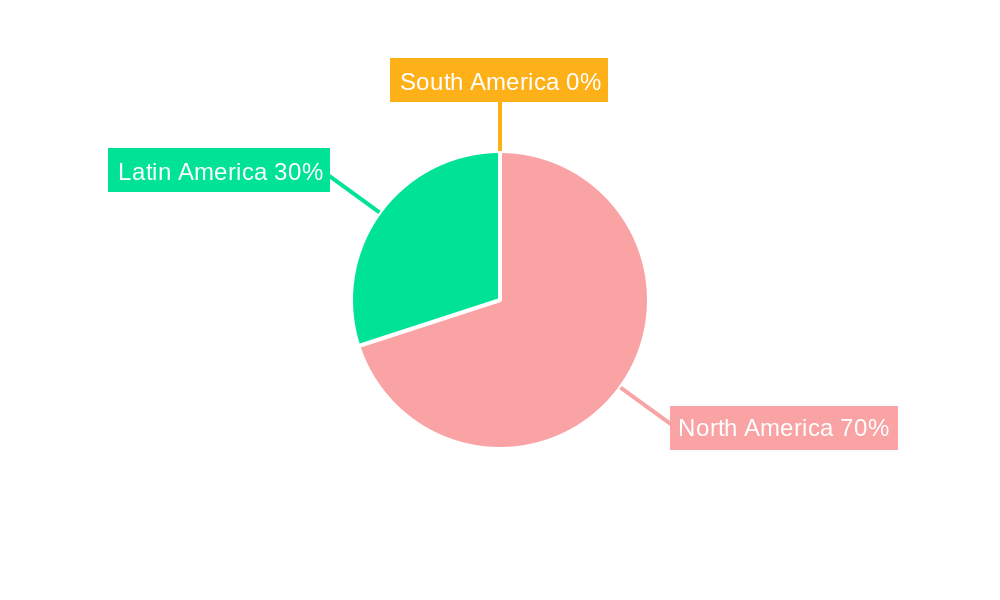

However, challenges exist. The high initial investment cost associated with advanced lighting systems, particularly for smaller operators, could act as a restraint. Furthermore, potential supply chain disruptions and the availability of skilled labor for installation and maintenance could impact market expansion. Market segmentation reveals significant opportunity within both interior and exterior lighting applications across commercial and general aviation aircraft. The United States and Canada dominate the North American market, while Brazil and Mexico are key players in the Latin American segment, each exhibiting unique growth trajectories based on their respective aviation industries. Leading companies like Astronics Corporation, Safran, and Honeywell International Inc. are actively shaping the competitive landscape through innovation and strategic partnerships. The forecast period indicates continued expansion, with substantial growth anticipated across various segments and geographical locations.

Americas Aircraft Lighting Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Americas aircraft lighting market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market dynamics and future growth trajectories. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Americas Aircraft Lighting Market Structure & Innovation Trends

This section analyzes the competitive landscape, encompassing market concentration, key innovation drivers, regulatory influences, and significant M&A activities within the Americas aircraft lighting market. The market exhibits a moderately concentrated structure, with key players like Astronics Corporation, Safran, and Honeywell International Inc. holding significant market share. However, several smaller, specialized companies contribute to market innovation.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: Advancements in LED technology, the rising demand for energy-efficient lighting solutions, and stringent safety regulations are driving innovation.

- Regulatory Framework: FAA and other regional aviation authorities' regulations significantly impact product design and safety standards.

- Product Substitutes: While limited, alternative lighting technologies are emerging, creating subtle competitive pressure.

- End-User Demographics: The market is primarily driven by commercial airlines and general aviation aircraft operators.

- M&A Activities: The past five years have witnessed xx M&A deals valued at approximately xx Million, primarily focused on expanding product portfolios and technological capabilities. Notable examples include [mention specific M&A deals if available, otherwise state "Data unavailable"].

Americas Aircraft Lighting Market Dynamics & Trends

This section delves into the factors influencing market growth, including technological advancements, consumer preferences, and competitive strategies. The market's expansion is fueled by several key drivers:

- Growth Drivers: The increasing global air passenger traffic, coupled with the modernization of existing aircraft fleets and the delivery of new aircraft, is a major driver. Furthermore, the increasing focus on enhancing passenger experience and improved safety features stimulates market growth.

- Technological Disruptions: The adoption of LED lighting is revolutionizing the industry, offering energy efficiency, improved lifespan, and design flexibility. Smart lighting systems incorporating features like dimming and customizable illumination are gaining traction.

- Consumer Preferences: Airlines are prioritizing passenger comfort and brand image, leading to the increased adoption of sophisticated lighting solutions. This includes mood lighting, personalized cabin lighting, and exterior lighting designs that enhance brand recognition.

- Competitive Dynamics: The market is witnessing intensified competition, driven by both established players and emerging innovative companies. This competition is fostering technological advancements and price reductions, benefiting end-users.

Dominant Regions & Segments in Americas Aircraft Lighting Market

This section identifies the leading regions and segments within the Americas aircraft lighting market.

Dominant Region: The United States is the leading market in the Americas, driven by a large commercial aviation sector and robust general aviation activity. Key factors include a strong manufacturing base, significant R&D investments, and supportive government policies.

Dominant Lighting Type: The Exterior Light segment is expected to hold a larger market share compared to the Interior Light segment, primarily due to stringent regulatory requirements for external aircraft lighting.

Dominant Application: The Commercial Aircraft segment dominates the market due to the higher number of aircraft and the larger scale of operations compared to General Aviation.

Key Drivers for the United States:

- Large fleet of commercial and general aviation aircraft

- High rate of aircraft modernization and new aircraft deliveries.

- Significant investment in aerospace R&D.

- Stringent safety regulations promoting the adoption of advanced lighting technologies.

Americas Aircraft Lighting Market Product Innovations

Recent years have witnessed significant product innovations in aircraft lighting, focusing on energy efficiency, enhanced safety features, and improved design aesthetics. LED technology dominates, offering lighter weight, longer lifespan, and energy savings compared to traditional lighting solutions. Smart lighting systems with dimming capabilities and customizable color options are gaining popularity. This allows for tailored cabin atmospheres enhancing passenger comfort and airline branding.

Report Scope & Segmentation Analysis

This report segments the Americas aircraft lighting market based on Lighting Type (Interior Light, Exterior Light) and Application (Commercial Aircraft, General Aviation Aircraft).

Lighting Type:

- Interior Light: This segment is experiencing steady growth driven by the increasing demand for enhanced passenger comfort and personalized cabin ambiance. Market size in 2025 is estimated at xx Million.

- Exterior Light: This segment is characterized by strict safety regulations, driving the adoption of advanced technologies. Market size in 2025 is estimated at xx Million.

Application:

- Commercial Aircraft: This segment holds the largest market share due to the sheer volume of aircraft and stringent safety standards. Market size in 2025 is estimated at xx Million.

- General Aviation Aircraft: This segment exhibits moderate growth, driven by increasing leisure and business aviation activities. Market size in 2025 is estimated at xx Million.

Key Drivers of Americas Aircraft Lighting Market Growth

Several factors contribute to the growth of the Americas aircraft lighting market. Technological advancements in LED technology, offering energy efficiency and enhanced safety, are a primary driver. Stringent safety regulations imposed by aviation authorities necessitate the adoption of advanced lighting systems. Lastly, the continuous growth of the commercial aviation sector and increased air passenger traffic are key factors driving demand.

Challenges in the Americas Aircraft Lighting Market Sector

The Americas aircraft lighting market faces challenges including the high initial investment cost of advanced lighting systems, the potential for supply chain disruptions affecting component availability, and intense competition among established and emerging players. These factors can impact market growth and profitability.

Emerging Opportunities in Americas Aircraft Lighting Market

Emerging opportunities include the growing adoption of smart lighting systems and the potential for integration with other aircraft systems. The rising demand for improved cabin ambiance and brand customization among airlines presents significant opportunities. Moreover, technological advancements in areas like augmented reality (AR) and holographic projection open new avenues for innovative lighting applications.

Leading Players in the Americas Aircraft Lighting Market Market

- Astronics Corporation

- Safran

- Honeywell International Inc

- Collins Aerospace (RTX Corporation)

- Whelen Engineering Inc

- Diehl Stiftung & Co KG

- Heads Up Technologies Inc

- Soderberg Manufacturing Company Inc

- Bruce Aerospace Inc

- STG Aerospace Limited

- Oxley Group

- Precise Flight Inc

Key Developments in Americas Aircraft Lighting Market Industry

- 2022 Q4: Astronics Corporation launched a new line of LED cabin lighting systems.

- 2023 Q1: Safran acquired a smaller lighting technology company, expanding its product portfolio.

- 2023 Q2: Honeywell International Inc. announced a partnership to develop next-generation smart lighting solutions. [Add more key developments with dates as available]

Future Outlook for Americas Aircraft Lighting Market Market

The future of the Americas aircraft lighting market is bright, driven by continued growth in air travel, technological advancements, and the increasing focus on passenger experience. Opportunities exist in developing energy-efficient, smart, and customizable lighting solutions. Strategic partnerships and acquisitions will likely shape the market landscape in the coming years.

Americas Aircraft Lighting Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Americas Aircraft Lighting Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Aircraft Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Commercial Aircraft Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Aircraft Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Latin America Americas Aircraft Lighting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Mexico

- 6.1.2 Brazil

- 7. North America Americas Aircraft Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United States

- 7.1.2 Canada

- 7.1.3 Mexico

- 8. South America Americas Aircraft Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Brazil

- 8.1.2 Argentina

- 8.1.3 Rest of South America

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Astronics Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Safran

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Honeywell International Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Collins Aerospace (RTX Corporation)

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Whelen Engineering Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Diehl Stiftung & Co KG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Heads Up Technologies Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Soderberg Manufacturing Company Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bruce Aerospace Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 STG Aerospace Limited

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Oxley Group

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Precise Flight Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Astronics Corporation

List of Figures

- Figure 1: Americas Aircraft Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Americas Aircraft Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Americas Aircraft Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Americas Aircraft Lighting Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Americas Aircraft Lighting Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Americas Aircraft Lighting Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Americas Aircraft Lighting Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Americas Aircraft Lighting Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Americas Aircraft Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Americas Aircraft Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Mexico Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Brazil Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Americas Aircraft Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Americas Aircraft Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Americas Aircraft Lighting Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 20: Americas Aircraft Lighting Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Americas Aircraft Lighting Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Americas Aircraft Lighting Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Americas Aircraft Lighting Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 24: Americas Aircraft Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Mexico Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Chile Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Colombia Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru Americas Aircraft Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Aircraft Lighting Market?

The projected CAGR is approximately 9.03%.

2. Which companies are prominent players in the Americas Aircraft Lighting Market?

Key companies in the market include Astronics Corporation, Safran, Honeywell International Inc, Collins Aerospace (RTX Corporation), Whelen Engineering Inc, Diehl Stiftung & Co KG, Heads Up Technologies Inc, Soderberg Manufacturing Company Inc, Bruce Aerospace Inc, STG Aerospace Limited, Oxley Group, Precise Flight Inc.

3. What are the main segments of the Americas Aircraft Lighting Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.87 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Commercial Aircraft Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Aircraft Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Aircraft Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Aircraft Lighting Market?

To stay informed about further developments, trends, and reports in the Americas Aircraft Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence