Key Insights

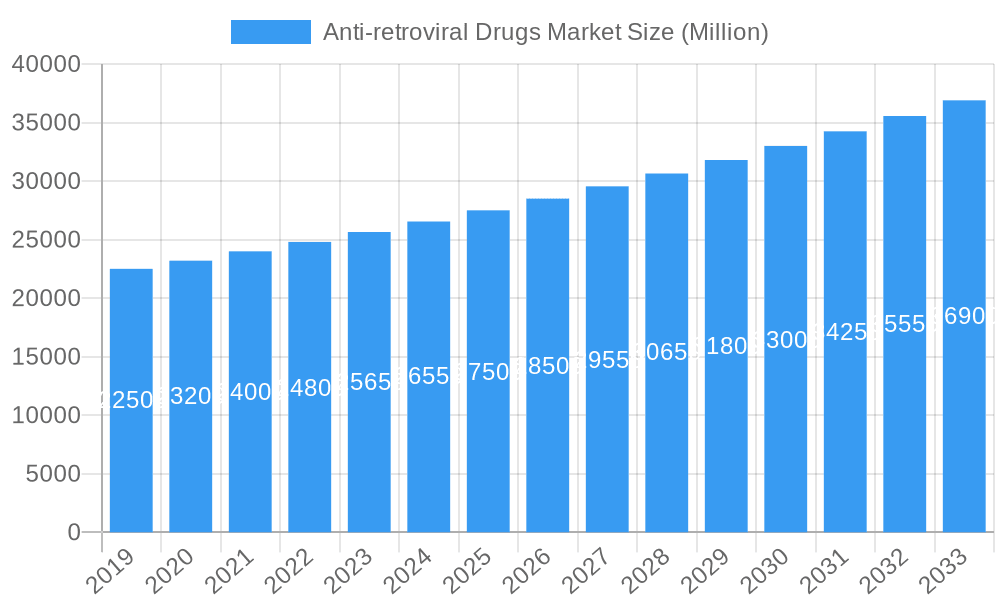

The global Anti-retroviral Drugs Market is projected to reach $30.44 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This significant growth is driven by the increasing global prevalence of HIV/AIDS, advancements in antiretroviral therapies, and expanded treatment access. Rising awareness and screening initiatives contribute to a larger diagnosed patient pool, while novel drug formulations enhance patient adherence. Government and non-profit initiatives further support treatment accessibility, particularly in low and middle-income countries.

Anti-retroviral Drugs Market Market Size (In Billion)

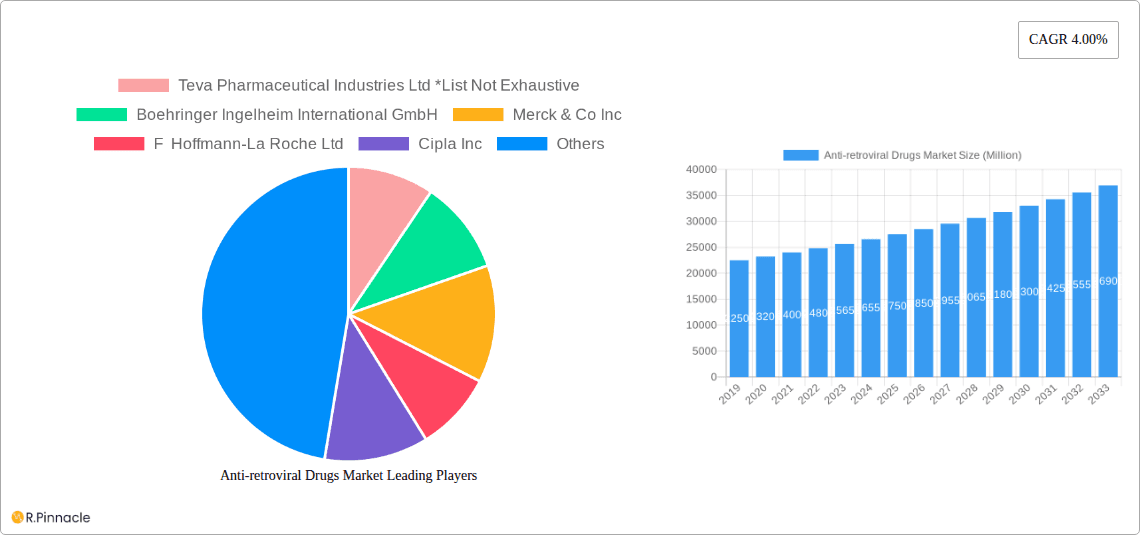

The anti-retroviral drugs market features a competitive landscape with key players like Gilead Sciences, ViiV Healthcare, Merck & Co., and AbbVie Inc. Trends include a preference for combination therapies for improved efficacy and reduced resistance, and the rise of integrase inhibitors as first-line treatments. Challenges include the high cost of advanced drugs and the emergence of drug resistance, necessitating ongoing research and development. Market segmentation highlights a focus on multi-class combination products and integrase inhibitors, reflecting evolving HIV treatment paradigms.

Anti-retroviral Drugs Market Company Market Share

This report offers a critical analysis of the anti-retroviral drugs market. Designed for industry professionals, this analysis uses high-ranking keywords and actionable insights for navigating HIV treatment complexities. Covering 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, the report provides historical trends, current dynamics, and future projections. Gain a competitive edge with granular segmentation, identification of key growth drivers, and an assessment of emerging opportunities and challenges in the HIV treatment market.

Anti-retroviral Drugs Market Market Structure & Innovation Trends

The anti-retroviral drugs market exhibits a moderate to high level of concentration, driven by a few dominant players holding significant market share. Innovation remains a key differentiator, with continuous research and development focused on improving efficacy, reducing side effects, and enhancing patient adherence. Regulatory frameworks, overseen by bodies like the FDA and EMA, play a crucial role in drug approval and market access, impacting product launches and market penetration. While direct product substitutes are limited due to the specific nature of HIV treatment, therapeutic alternatives and advancements in prevention methods can influence demand. End-user demographics are primarily driven by the global prevalence of HIV/AIDS, with a growing emphasis on long-term management and quality of life for affected individuals. Mergers and Acquisitions (M&A) activities, while not pervasive, have occurred to consolidate portfolios and gain access to promising drug pipelines. For instance, an M&A deal value of approximately $5 Billion in 2023 saw a large pharmaceutical entity acquire a biotech firm with novel integrase inhibitor technology, signaling strategic consolidation. The market share of the top five players is estimated to be around 60% in the base year 2025.

Anti-retroviral Drugs Market Market Dynamics & Trends

The anti-retroviral drugs market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033, reaching an estimated market size of $45 Billion by 2033. This growth is underpinned by several dynamic forces. Increased global awareness, enhanced diagnostic capabilities, and expanding access to healthcare services in low- and middle-income countries are driving market penetration. Technological disruptions, particularly in the development of novel drug delivery systems and combination therapies, are revolutionizing HIV treatment paradigms. The shift towards long-acting injectables and less frequent dosing regimens caters to evolving consumer preferences for convenience and improved adherence, thereby reducing the burden of daily pill intake. Competitive dynamics are characterized by intense R&D investment, patent expirations leading to generic competition, and strategic partnerships aimed at accelerating drug development and market access. Pharmaceutical companies are increasingly focusing on developing drugs that address drug resistance and improve the overall tolerability profile. The prevalence of HIV remains a significant public health concern, necessitating continued innovation and accessibility to effective anti-retroviral therapies (ART). The increasing focus on Undetectable = Untransmittable (U=U) messaging is also contributing to a greater demand for effective treatments that maintain viral suppression. Furthermore, the development of pre-exposure prophylaxis (PrEP) and post-exposure prophylaxis (PEP) drugs represents a growing sub-segment within the broader HIV prevention market, indirectly influencing the demand for ART by contributing to a comprehensive HIV management strategy. The projected market size for multi-class combination products alone is expected to reach $18 Billion by 2033, highlighting the dominance of these integrated treatment solutions.

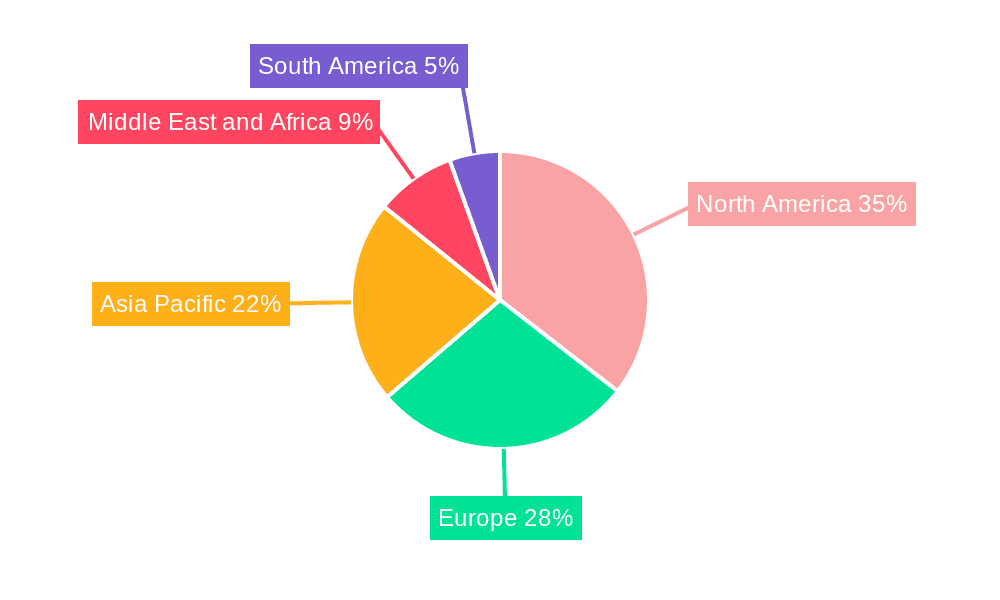

Dominant Regions & Segments in Anti-retroviral Drugs Market

North America currently dominates the anti-retroviral drugs market, accounting for an estimated 35% of the global market share in 2025. This dominance is attributed to robust healthcare infrastructure, high disposable incomes, strong government funding for HIV/AIDS research and treatment programs, and a high prevalence of advanced diagnostic and treatment facilities. The United States, in particular, is a key market within this region, driven by extensive clinical trials and early adoption of innovative therapies.

Key Drivers of Regional Dominance in North America:

- Advanced Healthcare Infrastructure: Widespread availability of specialized clinics and healthcare professionals equipped to manage HIV/AIDS.

- Government Funding and Research Initiatives: Significant investment in HIV research and access programs by agencies like the National Institutes of Health (NIH).

- High Patient Awareness and Adherence: Greater patient education and support systems contributing to consistent treatment adherence.

- Early Adoption of Novel Therapies: A receptive market for new drug classes and formulations, including long-acting injectables.

Within the Drug Class segmentation, Multi-class Combination Products represent the most dominant segment, capturing an estimated 45% market share in 2025. This is due to their efficacy in preventing drug resistance and simplifying treatment regimens.

Key Drivers of Dominance for Multi-class Combination Products:

- Enhanced Efficacy: Combining multiple drug classes targets different stages of the HIV replication cycle, leading to superior viral suppression.

- Reduced Drug Resistance: The multi-pronged attack significantly lowers the probability of HIV developing resistance to the therapy.

- Improved Patient Adherence: Single-pill regimens simplify daily routines, leading to better long-term compliance.

- Streamlined Treatment Protocols: Easier management for healthcare providers and reduced pill burden for patients.

Other significant segments include Integrase Inhibitors, which are rapidly gaining market share due to their favorable efficacy and safety profiles, and Nucleos(t)ide Reverse Transcriptase Inhibitors (NRTIs), which form the backbone of many ART regimens. The Protease Inhibitors segment, while still crucial, faces increasing competition from newer drug classes. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) and Other Drug Classes constitute smaller but important segments, offering alternative treatment options and niche applications. The market size for Integrase Inhibitors is projected to reach $9 Billion by 2033.

Anti-retroviral Drugs Market Product Innovations

Product innovation in the anti-retroviral drugs market is intensely focused on enhancing patient outcomes and simplifying treatment. Key trends include the development of long-acting injectable formulations, offering less frequent dosing and improved convenience, such as Gilead's Sunlenca (Lenacapavir). Advancements in fixed-dose combinations continue to streamline treatment regimens, reducing pill burden and improving adherence. Furthermore, research into novel drug targets and mechanisms of action aims to overcome drug resistance and improve the tolerability profile of therapies. These innovations are crucial for the long-term management of HIV, enabling patients to live healthier, more fulfilling lives.

Report Scope & Segmentation Analysis

This report meticulously analyzes the anti-retroviral drugs market across various critical segments. The segmentation includes:

- Protease Inhibitors: A mature segment, providing vital treatment options and contributing an estimated $3 Billion to the market in 2025.

- Integrase Inhibitors: A rapidly growing segment, expected to reach $9 Billion by 2033, driven by superior efficacy and safety.

- Multi-class Combination Products: The dominant segment, projected to achieve $18 Billion by 2033, offering simplified and highly effective treatment regimens.

- Nucleoside/Nucleotide Reverse Transcriptase Inhibitors (NRTIs): Core components of many ART regimens, contributing an estimated $7 Billion in 2025.

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs): Offering alternative treatment pathways, with a projected market size of $4 Billion by 2033.

- Other Drug Class: Encompassing newer and specialized therapies, this segment is expected to grow significantly, reaching $4 Billion by 2033.

The competitive landscape within each segment is dynamic, with ongoing research and development efforts shaping market shares.

Key Drivers of Anti-retroviral Drugs Market Growth

The growth of the anti-retroviral drugs market is propelled by several key factors. Increasing global prevalence of HIV/AIDS, coupled with enhanced access to diagnostics and treatment in developing nations, significantly expands the patient pool. Advances in R&D are continuously yielding more effective, tolerable, and convenient treatment options, such as long-acting injectables, which improve patient adherence. Government initiatives and non-governmental organization support for HIV/AIDS awareness and treatment programs further fuel market expansion. Additionally, the growing focus on long-term management and improving the quality of life for individuals living with HIV drives demand for innovative ART.

Challenges in the Anti-retroviral Drugs Market Sector

Despite robust growth, the anti-retroviral drugs market faces several challenges. The development of drug resistance remains a persistent concern, necessitating continuous innovation in drug design. High drug development costs and lengthy regulatory approval processes can pose significant barriers to market entry for new therapies. Patent expiries leading to generic competition can impact the revenue streams of innovator companies. Furthermore, ensuring equitable access to affordable ART in low-resource settings remains a global challenge, despite international efforts. Pricing pressures from payers and healthcare systems also contribute to the complexities of market dynamics.

Emerging Opportunities in Anti-retroviral Drugs Market

The anti-retroviral drugs market presents several emerging opportunities. The development of cure strategies for HIV, while a long-term goal, represents a significant potential paradigm shift. Advances in personalized medicine, tailoring treatment regimens based on individual genetic profiles and viral characteristics, offer opportunities for improved outcomes. The growing market for pre-exposure prophylaxis (PrEP) and post-exposure prophylaxis (PEP) for HIV prevention presents a complementary growth area. Furthermore, exploring new markets in regions with a high burden of HIV but limited access to advanced treatments offers substantial untapped potential. The integration of digital health solutions for patient monitoring and adherence support is another promising avenue.

Leading Players in the Anti-retroviral Drugs Market Market

- Teva Pharmaceutical Industries Ltd

- Boehringer Ingelheim International GmbH

- Merck & Co Inc

- F Hoffmann-La Roche Ltd

- Cipla Inc

- Johnson and Johnson

- Viatris Inc (Mylan Inc )

- AbbVie Inc

- GlaxoSmithKline plc (ViiV Healthcare)

- Gilead Sciences Inc

- Bristol-Myers Squibb Company

- Pfizer Inc

Key Developments in Anti-retroviral Drugs Market Industry

- September 2022: Merck reported initiating a new phase 3 clinical trial evaluating once-daily oral islatravir for HIV-1 infection.

- August 2022: Gilead received the global regulatory approval of Sunlenca (Lenacapavir), the twice-yearly HIV treatment option.

Future Outlook for Anti-retroviral Drugs Market Market

The future outlook for the anti-retroviral drugs market is highly positive, driven by an ongoing commitment to innovation and expanding access to care. The continued development of novel drug classes, long-acting formulations, and potential cure strategies will shape the therapeutic landscape. Increased global collaboration and government support are expected to improve access to ART, particularly in underserved regions. The market will likely witness further consolidation through strategic partnerships and acquisitions, optimizing R&D efforts and market reach. The focus will remain on achieving sustained viral suppression, improving patient quality of life, and ultimately striving towards an HIV-free future. The projected market size of $45 Billion by 2033 underscores the significant growth and strategic importance of this sector.

Anti-retroviral Drugs Market Segmentation

-

1. Drug Class

- 1.1. Protease Inhibitors

- 1.2. Integrase Inhibitors

- 1.3. Multi-class Combination Products

- 1.4. Nucleosi

- 1.5. Non-Nucl

- 1.6. Other Drug Class

Anti-retroviral Drugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Anti-retroviral Drugs Market Regional Market Share

Geographic Coverage of Anti-retroviral Drugs Market

Anti-retroviral Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of HIV; Increasing Investment in R&D; Increase in Availability of Novel Drugs with Better Efficacy

- 3.3. Market Restrains

- 3.3.1. Side Effects of Drugs

- 3.4. Market Trends

- 3.4.1. Multi-class Combination Product Segment is Expected to Register a Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti-retroviral Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Protease Inhibitors

- 5.1.2. Integrase Inhibitors

- 5.1.3. Multi-class Combination Products

- 5.1.4. Nucleosi

- 5.1.5. Non-Nucl

- 5.1.6. Other Drug Class

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Anti-retroviral Drugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Protease Inhibitors

- 6.1.2. Integrase Inhibitors

- 6.1.3. Multi-class Combination Products

- 6.1.4. Nucleosi

- 6.1.5. Non-Nucl

- 6.1.6. Other Drug Class

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Anti-retroviral Drugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Protease Inhibitors

- 7.1.2. Integrase Inhibitors

- 7.1.3. Multi-class Combination Products

- 7.1.4. Nucleosi

- 7.1.5. Non-Nucl

- 7.1.6. Other Drug Class

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Anti-retroviral Drugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Protease Inhibitors

- 8.1.2. Integrase Inhibitors

- 8.1.3. Multi-class Combination Products

- 8.1.4. Nucleosi

- 8.1.5. Non-Nucl

- 8.1.6. Other Drug Class

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Anti-retroviral Drugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Protease Inhibitors

- 9.1.2. Integrase Inhibitors

- 9.1.3. Multi-class Combination Products

- 9.1.4. Nucleosi

- 9.1.5. Non-Nucl

- 9.1.6. Other Drug Class

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Anti-retroviral Drugs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Protease Inhibitors

- 10.1.2. Integrase Inhibitors

- 10.1.3. Multi-class Combination Products

- 10.1.4. Nucleosi

- 10.1.5. Non-Nucl

- 10.1.6. Other Drug Class

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Teva Pharmaceutical Industries Ltd *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Boehringer Ingelheim International GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cipla Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Johnson and Johnson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Viatris Inc (Mylan Inc )

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AbbVie Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GlaxoSmithKline plc (ViiV Healthcare)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gilead Sciences Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bristol-Myers Squibb Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Teva Pharmaceutical Industries Ltd *List Not Exhaustive

List of Figures

- Figure 1: Global Anti-retroviral Drugs Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Anti-retroviral Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 3: North America Anti-retroviral Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 4: North America Anti-retroviral Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Anti-retroviral Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Anti-retroviral Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 7: Europe Anti-retroviral Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 8: Europe Anti-retroviral Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Anti-retroviral Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Anti-retroviral Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 11: Asia Pacific Anti-retroviral Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 12: Asia Pacific Anti-retroviral Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Anti-retroviral Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Anti-retroviral Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 15: Middle East and Africa Anti-retroviral Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 16: Middle East and Africa Anti-retroviral Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East and Africa Anti-retroviral Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Anti-retroviral Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 19: South America Anti-retroviral Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 20: South America Anti-retroviral Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Anti-retroviral Drugs Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 2: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 4: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 9: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 17: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 25: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: GCC Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: South Africa Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 30: Global Anti-retroviral Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Anti-retroviral Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-retroviral Drugs Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Anti-retroviral Drugs Market?

Key companies in the market include Teva Pharmaceutical Industries Ltd *List Not Exhaustive, Boehringer Ingelheim International GmbH, Merck & Co Inc, F Hoffmann-La Roche Ltd, Cipla Inc, Johnson and Johnson, Viatris Inc (Mylan Inc ), AbbVie Inc, GlaxoSmithKline plc (ViiV Healthcare), Gilead Sciences Inc, Bristol-Myers Squibb Company, Pfizer Inc.

3. What are the main segments of the Anti-retroviral Drugs Market?

The market segments include Drug Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of HIV; Increasing Investment in R&D; Increase in Availability of Novel Drugs with Better Efficacy.

6. What are the notable trends driving market growth?

Multi-class Combination Product Segment is Expected to Register a Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Side Effects of Drugs.

8. Can you provide examples of recent developments in the market?

In September 2022, Merck reported initiating a new phase 3 clinical trial evaluating once-daily oral islatravir for HIV-1 infection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti-retroviral Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti-retroviral Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti-retroviral Drugs Market?

To stay informed about further developments, trends, and reports in the Anti-retroviral Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence