Key Insights

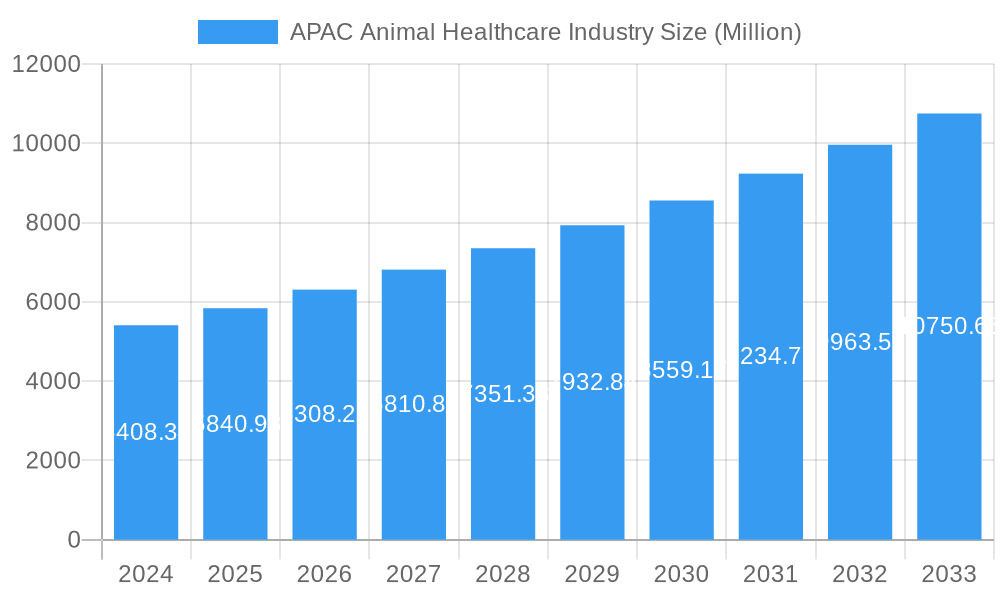

The APAC Animal Healthcare Industry is poised for substantial growth, currently valued at an estimated $5408.36 million in 2024. This expansion is driven by a confluence of factors, including rising pet ownership, increasing disposable incomes, and a growing awareness among consumers about the importance of animal well-being and disease prevention. The market is experiencing a robust CAGR of 8%, projected to continue its upward trajectory throughout the forecast period of 2025-2033. Key therapeutic segments like vaccines and anti-infectives are anticipated to lead the market, supported by advancements in veterinary medicine and the continuous need for disease control in both companion and livestock animals. The diagnostics sector is also seeing significant evolution, with molecular diagnostics and immunodiagnostic tests gaining traction due to their accuracy and speed in disease detection.

APAC Animal Healthcare Industry Market Size (In Billion)

The market's growth is further propelled by favorable government initiatives promoting animal health and safety, particularly in livestock for food security. Emerging economies within the APAC region, such as China and India, are emerging as major growth hubs due to their expanding middle class and increasing expenditure on pets. While the market demonstrates strong potential, certain restraints, such as the high cost of advanced veterinary treatments and diagnostic procedures, may pose challenges. However, the proactive approach of leading companies like Zoetis, Elanco, and Merck & Co. Inc. in introducing innovative products and expanding their market reach is expected to mitigate these concerns. The focus on preventative care and the development of more accessible healthcare solutions will be crucial for sustained market expansion in the coming years.

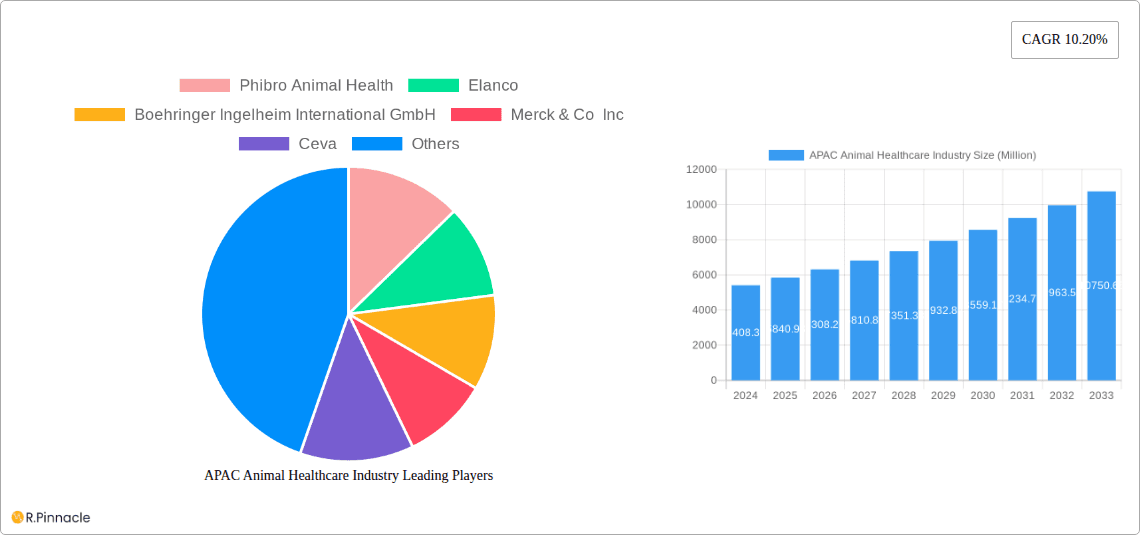

APAC Animal Healthcare Industry Company Market Share

APAC Animal Healthcare Industry Market Analysis Report 2024-2033

Gain critical insights into the dynamic APAC Animal Healthcare Industry with our comprehensive market analysis report. Covering the historical period (2019-2024) and projecting growth through 2033, this report provides actionable intelligence for industry professionals, investors, and stakeholders. We delve deep into market dynamics, regional dominance, product innovations, and key growth drivers, utilizing high-ranking keywords for maximum visibility.

APAC Animal Healthcare Industry Market Structure & Innovation Trends

The APAC animal healthcare market exhibits a moderately concentrated structure, with a few leading global players dominating significant market share. Innovation is a key driver, fueled by increasing pet humanization and the growing demand for advanced animal health solutions. Regulatory frameworks, while evolving, vary across countries, impacting product approvals and market access. Substitutes for conventional treatments are emerging, particularly in the form of preventive care and novel therapies. End-user demographics are shifting, with a growing middle class in emerging economies driving demand for both companion animal and livestock healthcare. Mergers and acquisitions (M&A) activities are prominent, with notable deals contributing to market consolidation. For instance, the acquisition of xx by xx for an estimated $500 million in 2023 signifies the ongoing M&A trend. Market share for key players like Zoetis and Boehringer Ingelheim International GmbH often exceeds 15% within specific therapeutic areas.

- Market Concentration: Dominated by a few global leaders, with increasing participation from regional players.

- Innovation Drivers: Pet humanization, demand for preventive care, and advancements in biotechnology.

- Regulatory Frameworks: Evolving and fragmented across the APAC region.

- Product Substitutes: Rise of natural remedies, advanced diagnostics, and personalized treatment plans.

- End-User Demographics: Growing pet ownership, increased disposable income, and greater awareness of animal welfare.

- M&A Activities: Strategic acquisitions and partnerships to expand product portfolios and market reach.

APAC Animal Healthcare Industry Market Dynamics & Trends

The APAC animal healthcare market is poised for robust growth, driven by several interconnected factors. A significant catalyst is the increasing adoption of pets across the region, transforming animals into integral family members. This “pet humanization” trend fuels consumer willingness to invest more in their pets' well-being, encompassing everything from premium food to advanced veterinary care and preventive treatments. Furthermore, the escalating demand for high-quality protein sources in developing economies directly translates to a greater need for effective livestock health management. This includes disease prevention, treatment, and enhanced productivity through improved animal husbandry practices.

Technological advancements are also profoundly shaping the market. The integration of digital health solutions, such as telemedicine, wearable devices for pet monitoring, and AI-powered diagnostic tools, is enhancing the accessibility and precision of veterinary services. Molecular diagnostics and advanced imaging techniques are becoming more prevalent, enabling earlier and more accurate disease detection. This technological disruption is not only improving patient outcomes but also creating new market opportunities for innovative companies.

Consumer preferences are evolving towards preventive care and natural or holistic health solutions. Owners are increasingly seeking to prevent illnesses rather than merely treat them, leading to higher demand for vaccines, nutritional supplements, and regular health check-ups. This shift is creating a market for companies offering proactive health management strategies.

The competitive landscape is dynamic, characterized by both intense competition among established global players and the emergence of nimble local companies. Strategic collaborations, partnerships, and mergers and acquisitions are common strategies employed to gain market share, expand product portfolios, and access new geographical territories. The CAGR for the APAC animal healthcare market is projected to be approximately 7.5% during the forecast period, indicating a healthy expansion trajectory. Market penetration for advanced veterinary services is steadily increasing, especially in urban centers.

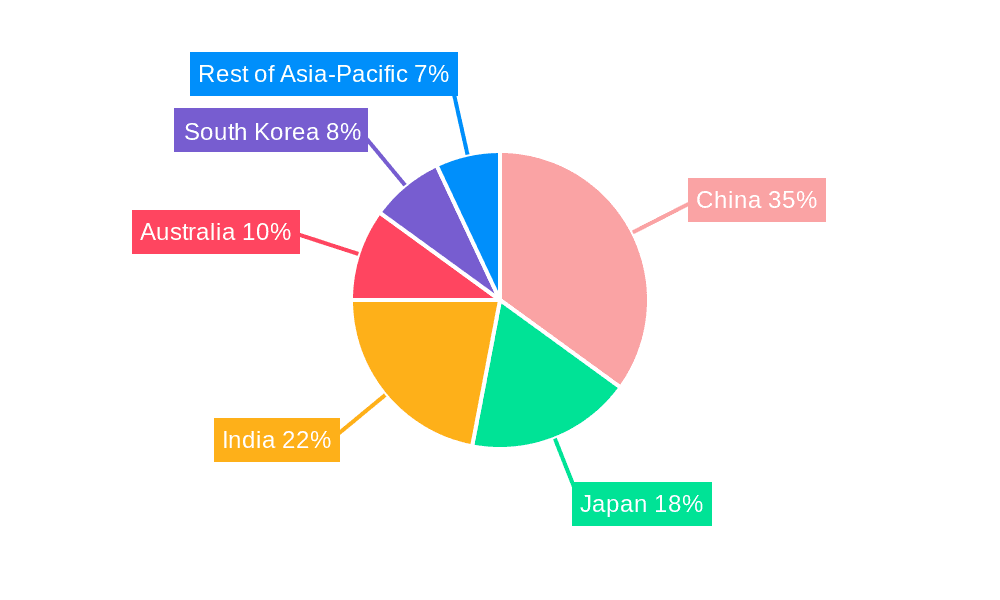

Dominant Regions & Segments in APAC Animal Healthcare Industry

The APAC Animal Healthcare Industry is experiencing significant growth and evolution, with China and India emerging as dominant regions, driven by their vast populations, burgeoning middle class, and increasing pet ownership alongside substantial livestock sectors. China, in particular, leads in terms of market size, propelled by rapid urbanization and a cultural shift towards viewing pets as family members. The "Rest of Asia-Pacific" region, encompassing countries like Southeast Asian nations, also presents considerable growth potential due to improving economic conditions and rising disposable incomes.

Within product segments, Therapeutics, specifically Vaccines and Anti-infectives, command a substantial market share. The increasing prevalence of zoonotic diseases and the need to protect both livestock and companion animals from infectious agents drive the demand for these products. The Medical Feed Additives segment is also critical, especially for the livestock industry, contributing to animal growth, health, and feed efficiency.

In the Diagnostics segment, Immunodiagnostic Tests and Molecular Diagnostics are experiencing rapid expansion. These advanced diagnostic tools allow for early detection and accurate identification of diseases, leading to more effective treatment strategies and improved animal welfare. The growing sophistication of veterinary practices necessitates these advanced diagnostic capabilities.

When considering Animal Type, Dogs and Cats represent the largest and fastest-growing segments within the companion animal market, directly linked to the pet humanization trend. However, the Livestock segment, encompassing cattle, poultry, and swine, remains crucial for food security and economic stability in the region, driving significant demand for a broad range of healthcare products and services.

Key drivers of dominance in these regions and segments include:

- Economic Policies: Government initiatives supporting agricultural productivity and animal welfare directly impact the livestock segment. Favorable economic conditions in urban areas boost disposable income for pet care.

- Infrastructure Development: Improved veterinary infrastructure, including advanced clinics and diagnostic laboratories, supports the growth of high-value animal healthcare services.

- Regulatory Support: Harmonization of regulations and increased government focus on animal disease control and food safety encourage market growth.

- Technological Adoption: The willingness of veterinary professionals and animal owners to adopt new technologies, from advanced diagnostics to telemedicine, fuels segment expansion.

- Consumer Awareness: Rising awareness about animal health, welfare, and the human-animal bond is a primary driver for both companion and livestock animal healthcare markets.

APAC Animal Healthcare Industry Product Innovations

Recent product innovations in the APAC animal healthcare industry are significantly enhancing disease prevention and treatment. Advancements in vaccine technology are leading to more effective and longer-lasting immunizations, particularly for livestock against prevalent diseases. In diagnostics, the development of rapid point-of-care testing kits for common infections and genetic predispositions is empowering veterinarians with swift and accurate diagnoses. Furthermore, the exploration of novel therapeutic agents, including biologics and gene therapies, is opening new avenues for treating chronic and complex conditions in both pets and production animals. These innovations are driven by a focus on improving animal welfare, enhancing food safety, and meeting the growing demand for specialized veterinary care across the region.

Report Scope & Segmentation Analysis

This report meticulously analyzes the APAC Animal Healthcare Industry across its diverse segments. The Product segmentation includes Therapeutics (Vaccines, Parasiticides, Anti-infectives, Medical Feed Additives, Other Therapeutics) and Diagnostics (Immunodiagnostic Tests, Molecular Diagnostics, Diagnostic Imaging, Clinical Chemistry, Other Diagnostics). The Animal Type segmentation covers Dogs, Cats, Horses, and Other Animals, reflecting the dual focus on companion animals and livestock. Geographically, the report examines China, Japan, India, Australia, South Korea, and the Rest of Asia-Pacific, providing granular insights into regional market dynamics. Growth projections indicate that the Diagnostics segment, particularly Molecular Diagnostics, is expected to witness the highest CAGR, driven by technological advancements. The companion animal segments for Dogs and Cats are anticipated to see substantial market size expansion, fueled by increasing pet ownership and spending.

Key Drivers of APAC Animal Healthcare Industry Growth

The APAC animal healthcare industry is propelled by a confluence of powerful growth drivers. The pervasive trend of pet humanization is a primary accelerant, leading to increased consumer spending on veterinary services, preventive care, and specialized treatments for companion animals. Concurrently, the growing global demand for protein-rich foods fuels the expansion of the livestock healthcare sector, emphasizing disease prevention, improved animal welfare, and enhanced productivity. Technological advancements, including the adoption of digital health solutions and advanced diagnostics, are not only improving the quality of care but also expanding market reach. Furthermore, rising disposable incomes, coupled with greater awareness of animal health and welfare, are creating a fertile ground for market expansion.

Challenges in the APAC Animal Healthcare Industry Sector

Despite its promising growth, the APAC animal healthcare industry faces several significant challenges. Regulatory hurdles and fragmented approval processes across different countries can impede market entry and product launch timelines. Limited veterinary infrastructure and a shortage of skilled professionals in some developing economies can restrict access to advanced healthcare services. Supply chain disruptions, particularly for specialized pharmaceuticals and equipment, can impact product availability and pricing. Price sensitivity and affordability concerns for certain treatments, especially in lower-income demographics, also pose a restraint. Finally, increasing competition from both global giants and local players necessitates continuous innovation and strategic market positioning.

Emerging Opportunities in APAC Animal Healthcare Industry

The APAC animal healthcare industry is brimming with emerging opportunities. The burgeoning companion animal market, fueled by increasing pet ownership, presents a significant avenue for growth in specialized veterinary services, premium pet food, and advanced therapeutic products. The rising demand for preventive healthcare and wellness solutions, including nutritional supplements and advanced diagnostics, is another key opportunity. The expansion of telemedicine and digital health platforms for veterinary care offers the potential to improve accessibility and efficiency across the region. Furthermore, the growing focus on food safety and sustainable livestock production creates opportunities for innovative solutions in disease management and herd health. Emerging markets within Southeast Asia and India represent untapped potential for market penetration.

Leading Players in the APAC Animal Healthcare Industry Market

- Phibro Animal Health

- Elanco

- Boehringer Ingelheim International GmbH

- Merck & Co Inc

- Ceva

- Zoetis

- CVS Group PLC

- IDEXX Laboratories

- Vetoquinol

- Virbac

- Mars Inc

- Idexx laboratories

Key Developments in APAC Animal Healthcare Industry Industry

- May 2022: The Central Government of India implemented the Livestock Health and Disease Control Schemes with a budget of Rs 525 crores to control economically essential livestock diseases and undertake related functions.

- March 2022: Hacarus Inc. launched its ECG platform in collaboration with DS Pharma Animal Health, enabling measurement and analysis of dogs' heart conditions for early detection of cardiac disease.

Future Outlook for APAC Animal Healthcare Industry Market

The future outlook for the APAC animal healthcare industry is exceptionally positive, driven by sustained growth accelerators. The increasing adoption of pets and the escalating demand for quality protein sources will continue to fuel expansion in both companion animal and livestock segments. Technological advancements, particularly in diagnostics and digital health, will enhance the delivery of veterinary services and create new market niches. Strategic investments in research and development, coupled with potential mergers and acquisitions, will shape a competitive yet collaborative landscape. The growing awareness of animal welfare and the potential for market penetration in emerging economies within the APAC region present significant strategic opportunities for companies aiming for long-term success.

APAC Animal Healthcare Industry Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs

- 2.2. Cats

- 2.3. Horses

- 2.4. Other Animals

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia-Pacific

APAC Animal Healthcare Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

APAC Animal Healthcare Industry Regional Market Share

Geographic Coverage of APAC Animal Healthcare Industry

APAC Animal Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of the Disease; Increasing Product Launches for Animal Healthcare; Technological Advancements in the Field of Drug Discovery and Development

- 3.3. Market Restrains

- 3.3.1. Increasing Cost of Veterinary Services Couple with the Lack of Infrastructure and Funding; Use of Counterfeit Medicines

- 3.4. Market Trends

- 3.4.1. Vaccines Segment is Expected to Dominate the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs

- 5.2.2. Cats

- 5.2.3. Horses

- 5.2.4. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti-infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. By Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular Diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.1. By Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs

- 6.2.2. Cats

- 6.2.3. Horses

- 6.2.4. Other Animals

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. South Korea

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti-infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. By Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular Diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.1. By Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs

- 7.2.2. Cats

- 7.2.3. Horses

- 7.2.4. Other Animals

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. South Korea

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti-infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. By Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular Diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.1. By Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs

- 8.2.2. Cats

- 8.2.3. Horses

- 8.2.4. Other Animals

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. South Korea

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Therapeutics

- 9.1.1.1. Vaccines

- 9.1.1.2. Parasiticides

- 9.1.1.3. Anti-infectives

- 9.1.1.4. Medical Feed Additives

- 9.1.1.5. Other Therapeutics

- 9.1.2. By Diagnostics

- 9.1.2.1. Immunodiagnostic Tests

- 9.1.2.2. Molecular Diagnostics

- 9.1.2.3. Diagnostic Imaging

- 9.1.2.4. Clinical Chemistry

- 9.1.2.5. Other Diagnostics

- 9.1.1. By Therapeutics

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs

- 9.2.2. Cats

- 9.2.3. Horses

- 9.2.4. Other Animals

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Therapeutics

- 10.1.1.1. Vaccines

- 10.1.1.2. Parasiticides

- 10.1.1.3. Anti-infectives

- 10.1.1.4. Medical Feed Additives

- 10.1.1.5. Other Therapeutics

- 10.1.2. By Diagnostics

- 10.1.2.1. Immunodiagnostic Tests

- 10.1.2.2. Molecular Diagnostics

- 10.1.2.3. Diagnostic Imaging

- 10.1.2.4. Clinical Chemistry

- 10.1.2.5. Other Diagnostics

- 10.1.1. By Therapeutics

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs

- 10.2.2. Cats

- 10.2.3. Horses

- 10.2.4. Other Animals

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. South Korea

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific APAC Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. By Therapeutics

- 11.1.1.1. Vaccines

- 11.1.1.2. Parasiticides

- 11.1.1.3. Anti-infectives

- 11.1.1.4. Medical Feed Additives

- 11.1.1.5. Other Therapeutics

- 11.1.2. By Diagnostics

- 11.1.2.1. Immunodiagnostic Tests

- 11.1.2.2. Molecular Diagnostics

- 11.1.2.3. Diagnostic Imaging

- 11.1.2.4. Clinical Chemistry

- 11.1.2.5. Other Diagnostics

- 11.1.1. By Therapeutics

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Dogs

- 11.2.2. Cats

- 11.2.3. Horses

- 11.2.4. Other Animals

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. Australia

- 11.3.5. South Korea

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Phibro Animal Health

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Elanco

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Boehringer Ingelheim International GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Merck & Co Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ceva

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Zoetis

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CVS Group PLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 IDEXX Laboratories

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Vetoquinol

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Virbac

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Mars Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Idexx laboratories

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Phibro Animal Health

List of Figures

- Figure 1: Global APAC Animal Healthcare Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China APAC Animal Healthcare Industry Revenue (undefined), by Product 2025 & 2033

- Figure 3: China APAC Animal Healthcare Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: China APAC Animal Healthcare Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 5: China APAC Animal Healthcare Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: China APAC Animal Healthcare Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China APAC Animal Healthcare Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Animal Healthcare Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: China APAC Animal Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Japan APAC Animal Healthcare Industry Revenue (undefined), by Product 2025 & 2033

- Figure 11: Japan APAC Animal Healthcare Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Japan APAC Animal Healthcare Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 13: Japan APAC Animal Healthcare Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 14: Japan APAC Animal Healthcare Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Japan APAC Animal Healthcare Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Japan APAC Animal Healthcare Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Japan APAC Animal Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: India APAC Animal Healthcare Industry Revenue (undefined), by Product 2025 & 2033

- Figure 19: India APAC Animal Healthcare Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: India APAC Animal Healthcare Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 21: India APAC Animal Healthcare Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: India APAC Animal Healthcare Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 23: India APAC Animal Healthcare Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: India APAC Animal Healthcare Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: India APAC Animal Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia APAC Animal Healthcare Industry Revenue (undefined), by Product 2025 & 2033

- Figure 27: Australia APAC Animal Healthcare Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Australia APAC Animal Healthcare Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 29: Australia APAC Animal Healthcare Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Australia APAC Animal Healthcare Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Australia APAC Animal Healthcare Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Australia APAC Animal Healthcare Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Australia APAC Animal Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South Korea APAC Animal Healthcare Industry Revenue (undefined), by Product 2025 & 2033

- Figure 35: South Korea APAC Animal Healthcare Industry Revenue Share (%), by Product 2025 & 2033

- Figure 36: South Korea APAC Animal Healthcare Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 37: South Korea APAC Animal Healthcare Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 38: South Korea APAC Animal Healthcare Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: South Korea APAC Animal Healthcare Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: South Korea APAC Animal Healthcare Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: South Korea APAC Animal Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue (undefined), by Product 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue Share (%), by Product 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Animal Healthcare Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 14: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 22: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 23: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 26: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 27: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Animal Healthcare Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the APAC Animal Healthcare Industry?

Key companies in the market include Phibro Animal Health, Elanco, Boehringer Ingelheim International GmbH, Merck & Co Inc, Ceva, Zoetis, CVS Group PLC, IDEXX Laboratories, Vetoquinol, Virbac, Mars Inc, Idexx laboratories.

3. What are the main segments of the APAC Animal Healthcare Industry?

The market segments include Product, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of the Disease; Increasing Product Launches for Animal Healthcare; Technological Advancements in the Field of Drug Discovery and Development.

6. What are the notable trends driving market growth?

Vaccines Segment is Expected to Dominate the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Cost of Veterinary Services Couple with the Lack of Infrastructure and Funding; Use of Counterfeit Medicines.

8. Can you provide examples of recent developments in the market?

In May 2022, to control the economically essential livestock diseases and to undertake the necessary functions related to animal health in the country, the Central Government of India implemented the Livestock Health and Disease Control Schemes with a budget of Rs 525 crores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Animal Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Animal Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Animal Healthcare Industry?

To stay informed about further developments, trends, and reports in the APAC Animal Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence