Key Insights

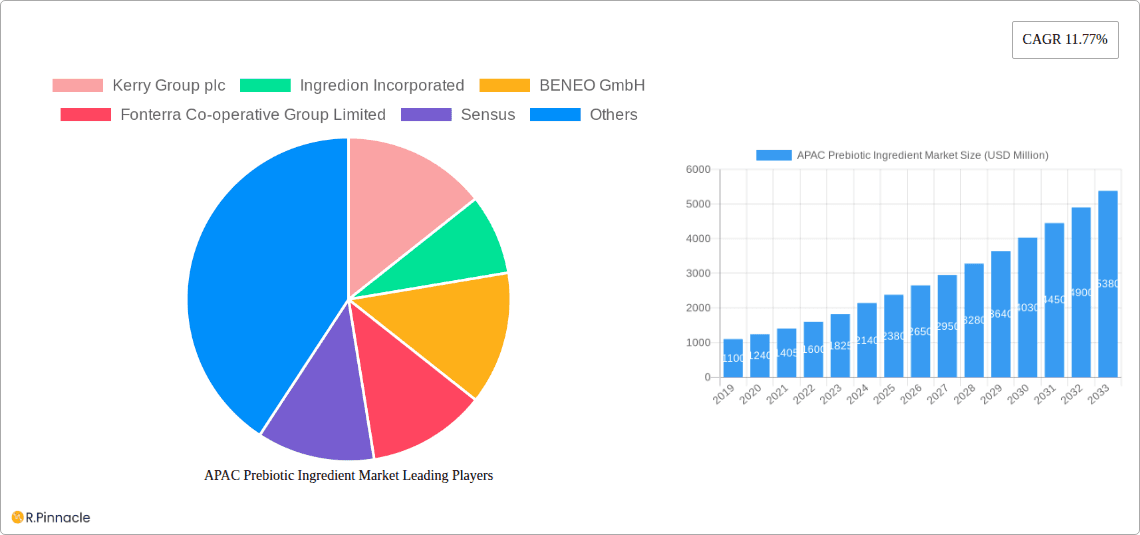

The APAC Prebiotic Ingredient Market is poised for substantial growth, reaching an estimated USD 2.14 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 11.77% through to 2033. This robust expansion is primarily fueled by increasing consumer awareness regarding gut health and the associated benefits of prebiotics in improving digestion, immunity, and overall well-being. The rising prevalence of chronic diseases and the growing demand for functional foods and beverages are further accelerating market adoption. Key drivers include the expanding infant formula segment, driven by a focus on early childhood nutrition and the incorporation of prebiotics for digestive health, and the burgeoning dietary supplements sector, as consumers actively seek to fortify their diets with ingredients that support a healthy microbiome. Additionally, the fortification of everyday food and beverage products with prebiotic ingredients is becoming a significant trend, making these beneficial compounds more accessible to a wider population.

APAC Prebiotic Ingredient Market Market Size (In Billion)

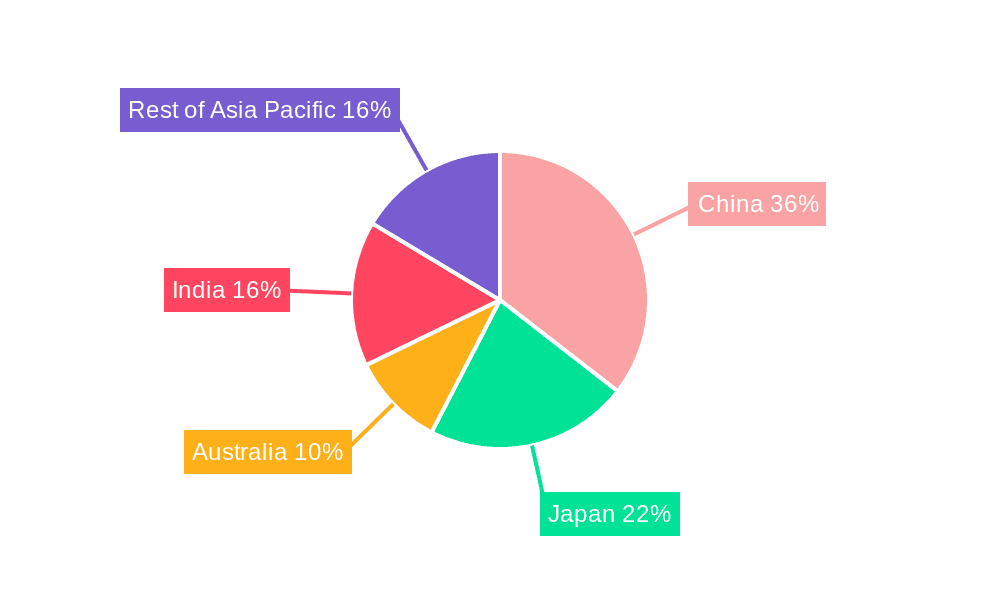

The market is characterized by a dynamic segmentation across various prebiotic types, with Inulin, Fructo-oligosaccharides (FOS), and Galacto-oligosaccharides (GOS) leading the charge due to their well-established efficacy and widespread applications. Geographically, China and Japan are anticipated to dominate the APAC region, owing to their advanced economies, high disposable incomes, and a strong cultural inclination towards health and wellness products. India presents a rapidly growing market with immense potential, driven by a growing middle class and increasing health consciousness. While the market exhibits strong growth potential, it faces certain restraints, including the fluctuating raw material costs for prebiotic ingredient production and the need for greater consumer education to fully grasp the nuances of prebiotic benefits versus probiotics. Nonetheless, the continuous innovation in product development, coupled with strategic collaborations and investments by key players, is expected to overcome these challenges and sustain the upward trajectory of the APAC Prebiotic Ingredient Market.

APAC Prebiotic Ingredient Market Company Market Share

APAC Prebiotic Ingredient Market: Comprehensive Market Analysis and Future Projections (2019-2033)

Unlock unparalleled insights into the booming APAC Prebiotic Ingredient Market with our in-depth report. Covering a critical study period from 2019 to 2033, with a base and estimated year of 2025, this report provides a granular analysis of market dynamics, key players, and future growth trajectories. Dive deep into market segmentation by type (Inulin, FOS, GOS, others), application (infant formula, fortified foods, dietary supplements, animal feed, and others), and geography (China, Japan, Australia, India, Rest of Asia Pacific). Forecasted to reach $XX billion by 2033, this market presents a significant opportunity for stakeholders. Our research leverages advanced analytics and industry expertise to deliver actionable intelligence for strategic decision-making.

APAC Prebiotic Ingredient Market Market Structure & Innovation Trends

The APAC Prebiotic Ingredient Market exhibits a XX% market concentration, with leading players like Kerry Group plc, Ingredion Incorporated, and BENEO GmbH holding significant market share, estimated at XX% collectively. Innovation is primarily driven by increasing consumer awareness of gut health benefits, leading to extensive research and development in novel prebiotic sources and enhanced delivery systems. Regulatory frameworks, particularly in countries like China and Japan, are evolving to support functional food ingredients, influencing product development and market entry strategies. Product substitutes, such as probiotics and synbiotics, pose a competitive threat, but the distinct mechanisms of prebiotics continue to drive demand. End-user demographics show a strong preference for natural and scientifically-backed ingredients, particularly among health-conscious millennials and aging populations seeking to bolster their immune systems. Mergers and acquisitions (M&A) activities are moderate, with recent deals valued at an estimated $XX million, primarily focused on consolidating supply chains and acquiring specialized ingredient technologies.

APAC Prebiotic Ingredient Market Market Dynamics & Trends

The APAC Prebiotic Ingredient Market is poised for robust expansion, driven by an escalating global demand for health and wellness products, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This significant growth is underpinned by a confluence of factors, including a rising middle class across the Asia Pacific region with increased disposable income and a growing propensity to invest in preventative healthcare. Consumers are increasingly informed about the intricate relationship between gut microbiota and overall well-being, fueling a surge in the consumption of functional foods and dietary supplements enriched with prebiotic ingredients. This heightened consumer consciousness is a primary growth catalyst, pushing manufacturers to innovate and diversify their product portfolios.

Technological advancements are playing a pivotal role in shaping market dynamics. Innovations in extraction and purification techniques are leading to the development of more effective and bioavailable prebiotic ingredients. For instance, advancements in enzymatic synthesis have improved the production efficiency and purity of FOS (Fructo-oligosaccharide) and GOS (Galacto-oligosaccharide), making them more accessible and cost-effective. Furthermore, research into novel prebiotic fibers derived from indigenous sources, such as specific plant extracts, is expanding the ingredient landscape.

Competitive dynamics are intensifying as both established multinational corporations and agile local players vie for market dominance. Strategic collaborations, partnerships, and acquisitions are becoming increasingly common as companies seek to expand their geographical reach, enhance their product offerings, and secure proprietary technologies. The market penetration of prebiotic ingredients is steadily increasing across various applications, from infant nutrition to animal feed, reflecting their broad applicability and recognized health benefits. The competitive landscape is characterized by a focus on product differentiation through scientific validation, claims substantiation, and the development of unique prebiotic blends tailored to specific health outcomes. The overall market penetration is estimated to reach XX% by 2033.

Dominant Regions & Segments in APAC Prebiotic Ingredient Market

China stands as the dominant region in the APAC Prebiotic Ingredient Market, driven by its massive population, escalating consumer awareness regarding health and wellness, and supportive government initiatives promoting the food and beverage industry's innovation in functional ingredients. The country's robust economic growth and rising disposable incomes have empowered consumers to prioritize healthier food choices, directly translating into substantial demand for prebiotic ingredients, particularly in infant formula and fortified food and beverage applications. Government policies aimed at enhancing food safety standards and encouraging domestic production of high-value ingredients further bolster China's market leadership.

Within the Type segmentation, Inulin is the leading segment, accounting for an estimated XX% of the market share. Its widespread availability from sources like chicory root and its proven efficacy in promoting digestive health have cemented its dominance. However, FOS and GOS are experiencing rapid growth, driven by their specific benefits in infant nutrition and their potential for targeted gut health modulation.

In terms of Application, Infant Formula represents the largest and fastest-growing segment, projected to reach $XX billion by 2025. The increasing emphasis on early childhood nutrition and the scientific understanding of the gut microbiome's role in infant development are key drivers. Fortified Food and Beverage and Dietary Supplements are also significant segments, reflecting the broader consumer trend towards incorporating prebiotics into daily diets for preventive health. The Animal Feed segment, though smaller, is also showing promising growth due to the recognition of prebiotics' role in improving animal gut health and reducing antibiotic reliance.

Japan and India are also key growth markets, characterized by their distinct consumer preferences and rapidly evolving food industries. Japan's mature market demonstrates a strong demand for high-quality, scientifically validated functional ingredients, while India's burgeoning middle class is increasingly adopting health-conscious lifestyles. The Rest of Asia Pacific region, encompassing Southeast Asian nations, presents significant untapped potential, with growing economies and a rising awareness of health and wellness trends.

APAC Prebiotic Ingredient Market Product Innovations

Product innovations in the APAC Prebiotic Ingredient Market are centered on enhancing bioavailability, targeting specific health benefits, and diversifying sourcing. Companies are developing novel formulations of Inulin, FOS, and GOS with improved solubility and prebiotic efficacy. Innovations include synbiotic combinations and synergistic blends designed to optimize gut microbiota balance for specific health outcomes, such as immune support or digestive regularity. Competitive advantages are being built through advanced extraction technologies that yield highly pure and functional prebiotic ingredients, coupled with robust scientific backing and clear health claims. Emerging trends also involve the exploration of prebiotics derived from underutilized agricultural by-products and the development of encapsulated prebiotic ingredients for enhanced stability and controlled release in various food matrices.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the APAC Prebiotic Ingredient Market, segmented by Type into Inulin, FOS (Fructo-oligosaccharide), GOS (Galacto-oligosaccharide), and Other Ingredients. The Application segment covers Infant Formula, Fortified Food and Beverage, Dietary Supplements, Animal Feed, and Other Applications. Geographically, the market is segmented into China, Japan, Australia, India, and the Rest of Asia Pacific. Growth projections indicate a significant CAGR of XX% for the forecast period. The market size for the Infant Formula segment is projected to reach $XX billion by 2025, showcasing its dominance. Competitive dynamics within each segment are characterized by innovation in product formulations and strategic market penetration efforts by key players.

Key Drivers of APAC Prebiotic Ingredient Market Growth

The APAC Prebiotic Ingredient Market is propelled by several interconnected growth drivers. Increasing consumer awareness of gut health and its impact on overall well-being is a primary catalyst. This is further amplified by the rising prevalence of lifestyle diseases such as obesity and diabetes, leading consumers to actively seek preventive healthcare solutions like prebiotic-rich foods and supplements. Supportive government policies and initiatives promoting functional foods and ingredients in countries like China and Japan are also instrumental. Technological advancements in ingredient processing and extraction technologies are enhancing the efficacy and cost-effectiveness of prebiotic production. Finally, the expanding middle class and growing disposable incomes across the region enable greater consumer spending on health-focused products.

Challenges in the APAC Prebiotic Ingredient Market Sector

Despite its growth potential, the APAC Prebiotic Ingredient Market faces several challenges. Stringent and evolving regulatory frameworks across different countries can create hurdles for new product introductions and market access. Supply chain complexities and volatility in the availability of raw materials can impact production costs and consistency. Intense competition from established players and new entrants necessitates continuous innovation and competitive pricing strategies. Consumer education and awareness gaps regarding the specific benefits and optimal usage of different prebiotic types can limit market penetration. Furthermore, high production costs for certain specialized prebiotic ingredients can affect affordability and accessibility.

Emerging Opportunities in APAC Prebiotic Ingredient Market

Emerging opportunities in the APAC Prebiotic Ingredient Market are abundant, driven by evolving consumer demands and technological advancements. The growing demand for plant-based and natural ingredients presents an opportunity to explore novel prebiotic sources from fruits, vegetables, and agricultural by-products. The increasing adoption of prebiotics in animal nutrition to enhance livestock health and reduce antibiotic use is a significant growth avenue. Furthermore, personalized nutrition trends are creating a demand for targeted prebiotic formulations tailored to individual gut microbiome profiles. The expansion of e-commerce platforms also facilitates wider market reach and direct-to-consumer sales, particularly for dietary supplements.

Leading Players in the APAC Prebiotic Ingredient Market Market

- Kerry Group plc

- Ingredion Incorporated

- BENEO GmbH

- Fonterra Co-operative Group Limited

- Sensus

- Nexira SAS

- Royal FrieslandCampina

- Shandong Bailong Group Co

- Baolingbao Biology Co Ltd

Key Developments in APAC Prebiotic Ingredient Market Industry

- 2023: Kerry Group plc launched a new range of prebiotic ingredients optimized for dairy applications, enhancing gut health benefits in yogurts and fermented milk products.

- 2023: Ingredion Incorporated announced strategic investments in expanding its prebiotic fiber production capacity in Asia, catering to the growing regional demand.

- 2022: BENEO GmbH introduced a new GOS ingredient with enhanced solubility and prebiotic efficacy, targeting the infant nutrition market in China.

- 2022: Fonterra Co-operative Group Limited partnered with a leading Chinese infant formula manufacturer to incorporate its specialized prebiotic ingredients into premium product lines.

- 2021: Sensus unveiled new research on the synergistic effects of their inulin with other functional ingredients, highlighting its potential in fortified food applications.

- 2020: Nexira SAS expanded its portfolio of acacia-based prebiotic fibers, emphasizing their natural origin and gentle digestive properties.

Future Outlook for APAC Prebiotic Ingredient Market Market

The future outlook for the APAC Prebiotic Ingredient Market is exceptionally positive, projecting continued strong growth driven by an escalating global focus on preventative health and personalized nutrition. The market is expected to witness a significant surge in demand for novel prebiotic ingredients derived from sustainable and natural sources. Innovations in encapsulation technologies will enable more targeted delivery and enhanced efficacy in a wider array of food and beverage applications. The increasing R&D investment in understanding the complex gut-brain axis and its link to mental well-being will further fuel the development of specialized prebiotic formulations. Strategic collaborations between ingredient manufacturers, food producers, and research institutions will be crucial for unlocking new market opportunities and addressing emerging consumer health needs, solidifying prebiotics as a cornerstone of future health and wellness strategies.

APAC Prebiotic Ingredient Market Segmentation

-

1. Type

- 1.1. Inulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Other In

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

APAC Prebiotic Ingredient Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. Australia

- 4. India

- 5. Rest of Asia Pacific

APAC Prebiotic Ingredient Market Regional Market Share

Geographic Coverage of APAC Prebiotic Ingredient Market

APAC Prebiotic Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Prebiotics for Fortifying Food & Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Other In

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. Australia

- 5.3.4. India

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. Australia

- 5.4.4. India

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Other In

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. Australia

- 6.3.4. India

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Other In

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. Australia

- 7.3.4. India

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Australia APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Other In

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. Australia

- 8.3.4. India

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. India APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inulin

- 9.1.2. FOS (Fructo-oligosaccharide)

- 9.1.3. GOS (Galacto-oligosaccharide)

- 9.1.4. Other In

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infant Formula

- 9.2.2. Fortified Food and Beverage

- 9.2.3. Dietary Supplements

- 9.2.4. Animal Feed

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. Australia

- 9.3.4. India

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inulin

- 10.1.2. FOS (Fructo-oligosaccharide)

- 10.1.3. GOS (Galacto-oligosaccharide)

- 10.1.4. Other In

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infant Formula

- 10.2.2. Fortified Food and Beverage

- 10.2.3. Dietary Supplements

- 10.2.4. Animal Feed

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. Australia

- 10.3.4. India

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kerry Group plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ingredion Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BENEO GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fonterra Co-operative Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sensus

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nexira SAS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Royal FrieslandCampina

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Bailong Group Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baolingbao Biology Co Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kerry Group plc

List of Figures

- Figure 1: APAC Prebiotic Ingredient Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: APAC Prebiotic Ingredient Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Prebiotic Ingredient Market?

The projected CAGR is approximately 11.77%.

2. Which companies are prominent players in the APAC Prebiotic Ingredient Market?

Key companies in the market include Kerry Group plc, Ingredion Incorporated, BENEO GmbH, Fonterra Co-operative Group Limited, Sensus, Nexira SAS, Royal FrieslandCampina, Shandong Bailong Group Co, Baolingbao Biology Co Ltd *List Not Exhaustive.

3. What are the main segments of the APAC Prebiotic Ingredient Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Acquisitive Demand of Prebiotics for Fortifying Food & Beverages.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Prebiotic Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Prebiotic Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Prebiotic Ingredient Market?

To stay informed about further developments, trends, and reports in the APAC Prebiotic Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence