Key Insights

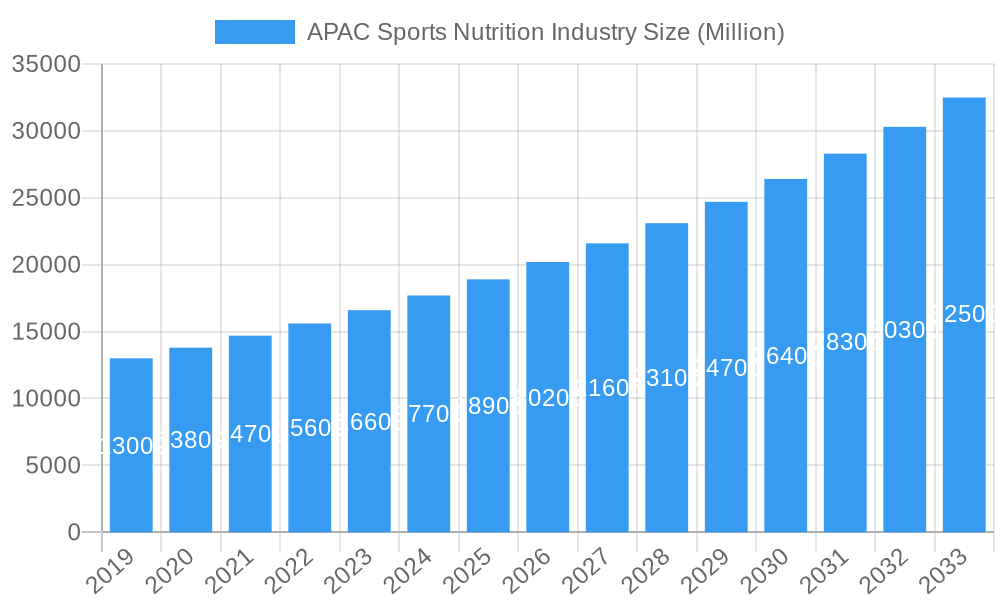

The APAC sports nutrition market is poised for significant expansion, projected to reach approximately $20,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.64% through 2033. This growth is primarily fueled by increasing health consciousness, a rising participation in sports and fitness activities across the region, and a growing demand for performance-enhancing and recovery products. Key market drivers include the expanding middle class with higher disposable incomes, greater awareness of the benefits of sports nutrition for both athletes and everyday fitness enthusiasts, and the influence of global fitness trends penetrating Asian markets. Furthermore, the proliferation of online retail channels and a greater focus on product innovation, including plant-based and natural ingredient formulations, are expected to propel market value. The distribution landscape is evolving, with a strong shift towards online sales and specialty stores, complementing traditional channels like supermarkets and convenience stores.

APAC Sports Nutrition Industry Market Size (In Billion)

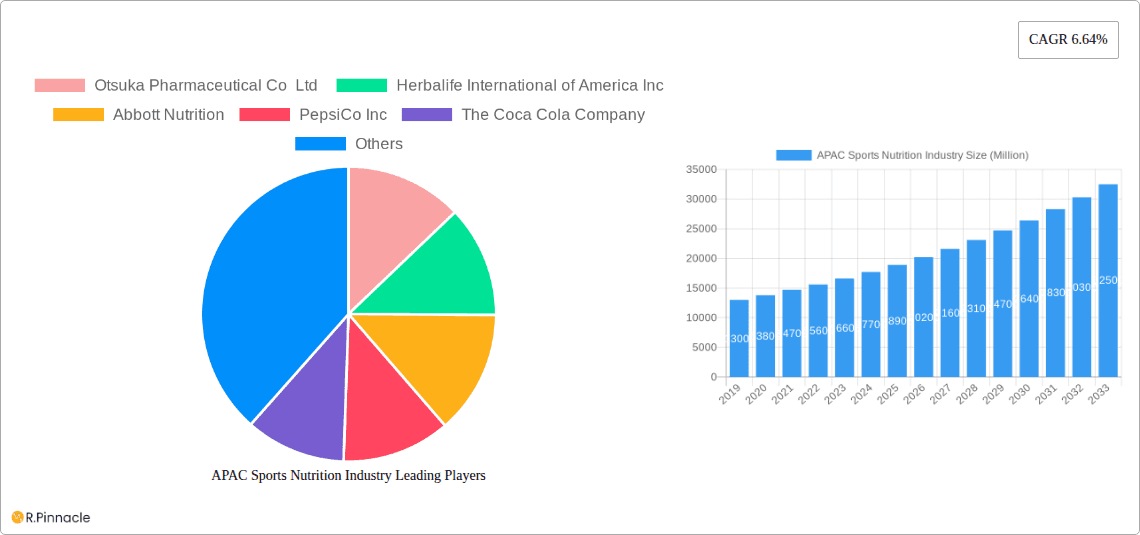

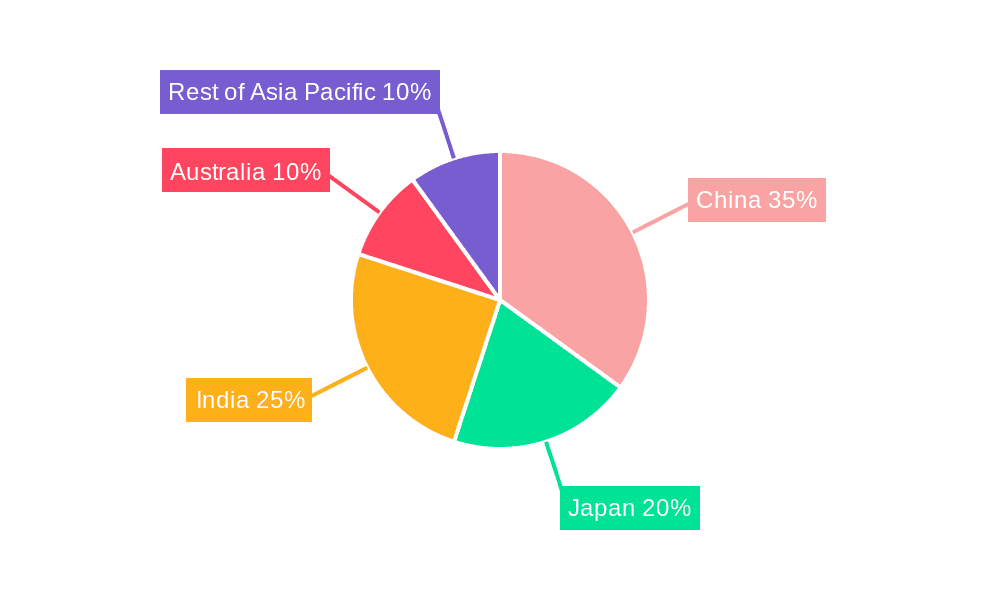

The market is segmented into various product types, including Sports Food, Sports Drinks, and Sports Supplements, each catering to specific nutritional needs and consumption occasions. Sports drinks are likely to maintain a dominant position due to their convenience and immediate hydration benefits, while sports supplements are anticipated to witness rapid growth driven by demand for targeted solutions like protein powders, BCAAs, and pre-workout formulas. Geographically, China and India are emerging as key growth engines, owing to their massive populations and burgeoning fitness culture. Japan and Australia, with their established sports and health-conscious demographics, will continue to be significant contributors. Rest of Asia-Pacific nations are also showing promising growth as awareness and accessibility increase. However, challenges such as regulatory hurdles in some countries and the need for greater consumer education regarding the efficacy and safety of certain supplements could temper growth. Key players like Otsuka Pharmaceutical, Herbalife, Abbott Nutrition, PepsiCo, and Coca-Cola are actively investing in product development and market penetration strategies to capitalize on this dynamic market.

APAC Sports Nutrition Industry Company Market Share

APAC Sports Nutrition Industry Market Analysis 2024-2033: Growth Drivers, Trends, and Competitive Landscape

Gain unparalleled insights into the dynamic APAC Sports Nutrition Industry with this comprehensive market report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market structure, key growth drivers, dominant regions, emerging opportunities, and the competitive landscape. Leveraging high-ranking keywords, this report is essential for industry professionals seeking to capitalize on the rapidly expanding Asia-Pacific sports nutrition market. Discover market segmentation, product innovations, regulatory frameworks, and strategic recommendations to navigate this lucrative sector. The market is projected to reach a valuation of over XX Million by 2033, with a CAGR of XX% during the forecast period.

APAC Sports Nutrition Industry Market Structure & Innovation Trends

The APAC sports nutrition market exhibits a moderately concentrated structure, with several multinational corporations alongside a growing number of regional and local players. Innovation is primarily driven by evolving consumer demand for personalized nutrition, plant-based alternatives, and functional ingredients that enhance performance and recovery. Regulatory frameworks across the APAC region are becoming more defined, with an increasing focus on product safety, labeling, and quality control, influenced by international standards. Product substitutes are emerging in the form of whole foods with inherent nutritional benefits, though specialized sports nutrition products offer targeted efficacy. End-user demographics are broadening beyond elite athletes to include fitness enthusiasts, casual exercisers, and even individuals seeking general wellness benefits, reflecting a growing health-conscious population. Mergers and acquisitions (M&A) activity is present, with larger players acquiring smaller, innovative brands to expand their product portfolios and market reach. For instance, recent M&A deals have focused on acquiring niche brands specializing in protein alternatives and personalized supplement formulations, with deal values estimated to be in the XX Million range. Key innovation drivers include R&D investments in novel ingredient formulations and delivery systems.

APAC Sports Nutrition Industry Market Dynamics & Trends

The APAC sports nutrition market is experiencing robust growth, fueled by a confluence of accelerating factors. A primary driver is the escalating health and wellness consciousness across the region, particularly in emerging economies like India and Southeast Asian nations. This is intrinsically linked to the increasing adoption of fitness-oriented lifestyles, with a surge in gym memberships, participation in sports activities, and a general preference for active living. Economic development and rising disposable incomes have empowered a larger segment of the population to invest in premium health products, including sports nutrition. Technological advancements are playing a significant role, with the development of innovative product formulations that cater to specific needs, such as enhanced hydration, muscle recovery, and sustained energy release. The proliferation of online retail channels has democratized access to a wide array of sports nutrition products, breaking down geographical barriers and offering consumers convenience and competitive pricing. Consumer preferences are shifting towards natural, organic, and plant-based ingredients, driven by a greater awareness of health and environmental sustainability. This trend is forcing established brands to diversify their offerings and is creating opportunities for specialized brands. The competitive dynamics are intensifying, with both global giants and nimble local players vying for market share. This includes strategies like product differentiation, aggressive marketing campaigns targeting specific demographic groups, and strategic partnerships. The market penetration of sports nutrition products is still relatively low in some segments compared to Western markets, indicating significant untapped potential for future growth. The overall market penetration is estimated to be around XX%, with projections to reach XX% by 2033. The CAGR for the APAC Sports Nutrition Industry is projected to be XX% from 2025 to 2033.

Dominant Regions & Segments in APAC Sports Nutrition Industry

The APAC Sports Nutrition Industry is characterized by significant regional variations and segment dominance.

Geography:

- China stands as the leading market, driven by its massive population, growing middle class, and increasing awareness of health and fitness. Government initiatives promoting sports participation and a rising disposable income further bolster China's dominance. The market size in China is estimated to be over XX Million. Key drivers include:

- Government support for sports and fitness.

- Rapid urbanization and increased disposable income.

- Growing influence of e-commerce for product accessibility.

- India is emerging as a high-growth region, fueled by a young population, a burgeoning fitness culture, and aggressive marketing by local and international brands. The increasing prevalence of lifestyle diseases also contributes to a greater focus on preventive health through nutrition. The market size in India is estimated to be over XX Million. Key drivers include:

- A young and rapidly growing population.

- Rising disposable incomes and a growing middle class.

- Aggressive marketing and brand proliferation.

- Australia boasts a mature sports nutrition market with high consumer awareness and a well-established fitness industry. The country's strong sporting culture and emphasis on outdoor activities contribute to consistent demand. The market size in Australia is estimated to be over XX Million. Key drivers include:

- A well-established fitness and sports culture.

- High disposable incomes and consumer willingness to spend on health.

- Robust regulatory environment ensuring product quality.

- Japan exhibits a unique market dynamic, with a focus on specialized and functional ingredients, catering to an aging population seeking health maintenance alongside athletic performance. The market size in Japan is estimated to be over XX Million. Key drivers include:

- Emphasis on premium and specialized functional ingredients.

- A health-conscious aging population.

- Advanced research and development in nutrition science.

- Rest of Asia-Pacific represents a diverse and rapidly expanding segment, with countries like South Korea, Southeast Asian nations (e.g., Singapore, Thailand, Malaysia, Indonesia), and Vietnam showing significant growth potential due to increasing urbanization, rising incomes, and a burgeoning fitness trend. The market size in this segment is estimated to be over XX Million. Key drivers include:

- Rapid economic development and increasing disposable incomes.

- Growing influence of global fitness trends.

- Untapped market potential and increasing product availability.

Product Type:

- Sports Drinks hold a dominant position, driven by their immediate hydration and energy replenishment benefits, appealing to a broad range of active individuals. The market size for Sports Drinks is estimated to be over XX Million.

- Sports Supplements are a rapidly growing segment, encompassing protein powders, pre-workouts, post-workouts, and vitamins, catering to specific performance and recovery needs. The market size for Sports Supplements is estimated to be over XX Million.

- Sports Food, including energy bars and gels, commands a significant share, offering convenient and portable nutrition solutions for athletes and active individuals. The market size for Sports Food is estimated to be over XX Million.

Distribution Channel:

- Online Stores are rapidly emerging as the leading distribution channel, offering unparalleled convenience, wider product selection, and competitive pricing. This channel is experiencing the fastest growth. The market size for Online Stores is estimated to be over XX Million.

- Specialty Stores continue to be a crucial channel for expert advice and a curated range of high-quality sports nutrition products, appealing to dedicated athletes and fitness enthusiasts. The market size for Specialty Stores is estimated to be over XX Million.

- Supermarkets/Hypermarkets offer broad accessibility and convenience, capturing a significant portion of the market, especially for mass-market sports drinks and basic supplements. The market size for Supermarkets/Hypermarkets is estimated to be over XX Million.

- Convenience Stores cater to impulse purchases and on-the-go consumption, particularly for sports drinks and energy bars. The market size for Convenience Stores is estimated to be over XX Million.

- Other Distribution Channels, including direct-to-consumer (DTC) models and fitness centers, are also contributing to market reach and engagement. The market size for Other Distribution Channels is estimated to be over XX Million.

APAC Sports Nutrition Industry Product Innovations

Product innovation in the APAC sports nutrition sector is characterized by a focus on enhanced efficacy, convenience, and clean ingredient profiles. Technological advancements are leading to the development of advanced delivery systems for improved bioavailability and faster absorption. There's a growing trend towards personalized nutrition solutions, with brands offering customized supplement blends based on individual dietary needs, fitness goals, and even genetic predispositions. Plant-based protein alternatives are gaining significant traction, meeting the rising demand for sustainable and ethically sourced products. Innovations in flavor profiles and textures are also crucial for consumer acceptance and repeat purchases. Competitive advantages are being built around unique ingredient combinations, scientific backing for product claims, and a strong brand narrative emphasizing purity and performance. The market fit is achieved by aligning product development with current consumer trends in health, wellness, and sustainability.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the APAC Sports Nutrition Industry, encompassing a detailed segmentation of the market. The analysis covers the following key segments:

Product Type: Sports Food, Sports Drinks, and Sports Supplements. Growth projections for each product type indicate robust expansion, with Sports Supplements expected to witness the highest CAGR due to increasing demand for specialized performance enhancement. Market sizes for each are estimated to be over XX Million, XX Million, and XX Million respectively for 2025.

Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Online Stores, along with Other Distribution Channels. The Online Stores segment is projected to dominate future growth due to its convenience and accessibility, with an estimated market size of over XX Million by 2025. Specialty Stores will continue to cater to a niche but dedicated customer base.

Geography: China, Japan, India, Australia, and the Rest of Asia-Pacific. China and India are identified as the largest and fastest-growing geographical markets respectively, with significant investment opportunities. The estimated market sizes for these regions in 2025 are: China (XX Million), Japan (XX Million), India (XX Million), Australia (XX Million), and Rest of Asia-Pacific (XX Million). Competitive dynamics within each geography are influenced by local market conditions, regulatory landscapes, and consumer preferences.

Key Drivers of APAC Sports Nutrition Industry Growth

The APAC Sports Nutrition Industry is propelled by several influential growth drivers. The increasing health and wellness awareness across the region is a fundamental catalyst, leading consumers to proactively invest in their physical well-being. This is complemented by a growing adoption of active lifestyles, with more individuals engaging in sports, fitness activities, and outdoor pursuits. Rising disposable incomes and economic development in many APAC nations have made premium health products, including sports nutrition, more accessible to a larger population segment. Technological advancements in product formulation and delivery systems are enabling the creation of more effective and targeted nutritional solutions. Furthermore, the expanding e-commerce landscape is democratizing access to a wide range of products, making them readily available to consumers across diverse geographical locations. Government initiatives promoting sports and physical activity in several countries are also contributing to market expansion.

Challenges in the APAC Sports Nutrition Industry Sector

Despite its promising growth, the APAC Sports Nutrition Industry faces several significant challenges. Regulatory fragmentation and evolving compliance standards across different countries can create hurdles for market entry and product standardization. Supply chain disruptions, particularly in the event of geopolitical instability or natural disasters, can impact the availability and cost of raw materials. Intense competition from both global brands and local players necessitates continuous innovation and aggressive marketing strategies. The lack of widespread consumer education in some developing markets regarding the benefits and appropriate usage of sports nutrition products can hinder market penetration. Counterfeit products and quality concerns in certain sub-regions also pose a threat to brand credibility and consumer trust. The high cost of some specialized ingredients and manufacturing processes can also translate into higher retail prices, limiting affordability for some consumer segments.

Emerging Opportunities in APAC Sports Nutrition Industry

The APAC Sports Nutrition Industry presents a wealth of emerging opportunities for astute businesses. The growing demand for plant-based and vegan sports nutrition products offers a significant avenue for product development and market differentiation. The increasing interest in personalized nutrition solutions, leveraging data analytics and AI, presents an opportunity to offer tailored supplement regimens and meal plans. Expansion into underserved geographical markets within Southeast Asia and Oceania, where health consciousness is rising and disposable incomes are growing, holds substantial potential. The development of functional foods and beverages that incorporate sports nutrition benefits, catering to everyday wellness rather than just elite performance, is another promising trend. Furthermore, strategic collaborations with fitness influencers, gyms, and sports organizations can enhance brand visibility and consumer engagement. The rise of sustainable and ethically sourced ingredients aligns with growing consumer preferences and can be a key differentiator.

Leading Players in the APAC Sports Nutrition Industry Market

- Otsuka Pharmaceutical Co Ltd

- Herbalife International of America Inc

- Abbott Nutrition

- PepsiCo Inc

- The Coca Cola Company

- Glanbia PLC

- Cliff Bar & Company

- Zywie Ventures Pvt Ltd

- Muscleblaze

- Healthkart

- General Nutrition Centers Inc

Key Developments in APAC Sports Nutrition Industry Industry

- April 2023: UK sports nutrition brand Genetic Nutrition launched its high-quality sports nutrition supplements in India. The brand's range of supplements includes protein powders, amino acids, and vitamins formulated using best-in-class ingredients for maximum effectiveness.

- September 2022: HRX, India's fitness brand, and OZiva partnered to launch a new sports & performance nutrition brand HRX Agame. The brand offers a variety of sports nutrition supplements like protein, pre and post-workout supplements, and vitamins.

- August 2022: The Coca-Cola Company brand Limca extended its product offering with the launch of Sports Drinks, Limca Sportz. The product is a glucose+electrolyte beverage that contains essential minerals for faster hydration.

Future Outlook for APAC Sports Nutrition Industry Market

The future outlook for the APAC Sports Nutrition Industry is exceptionally bright, marked by sustained growth and evolving consumer demands. The market is poised to witness continued expansion driven by the increasing integration of sports nutrition into mainstream wellness routines, moving beyond hardcore athletes to a broader consumer base. Innovations in product formulation, particularly in the realms of plant-based, personalized, and functional ingredients, will be key differentiators. The digital transformation of distribution channels, with e-commerce playing an ever-larger role, will further democratize access and drive sales. Strategic market entry and expansion into emerging economies within the APAC region will unlock significant untapped potential. Companies that can effectively navigate the complex regulatory landscapes, embrace sustainable practices, and demonstrate scientific credibility will be well-positioned to capture substantial market share and achieve long-term success in this dynamic and lucrative industry. The market is projected to exceed XX Million by 2033.

APAC Sports Nutrition Industry Segmentation

-

1. Product Type

- 1.1. Sports Food

- 1.2. Sports Drinks

- 1.3. Sports Supplements

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

APAC Sports Nutrition Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Sports Nutrition Industry Regional Market Share

Geographic Coverage of APAC Sports Nutrition Industry

APAC Sports Nutrition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Increasing Sports Participation to Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Sports Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sports Food

- 5.1.2. Sports Drinks

- 5.1.3. Sports Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Sports Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Sports Food

- 6.1.2. Sports Drinks

- 6.1.3. Sports Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan APAC Sports Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Sports Food

- 7.1.2. Sports Drinks

- 7.1.3. Sports Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India APAC Sports Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Sports Food

- 8.1.2. Sports Drinks

- 8.1.3. Sports Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia APAC Sports Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Sports Food

- 9.1.2. Sports Drinks

- 9.1.3. Sports Supplements

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific APAC Sports Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Sports Food

- 10.1.2. Sports Drinks

- 10.1.3. Sports Supplements

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Otsuka Pharmaceutical Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Herbalife International of America Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abbott Nutrition

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Coca Cola Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glanbia PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cliff Bar & Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zywie Ventures Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Muscleblaze

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Healthkart

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 General Nutrition Centers Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Otsuka Pharmaceutical Co Ltd

List of Figures

- Figure 1: Global APAC Sports Nutrition Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: China APAC Sports Nutrition Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: China APAC Sports Nutrition Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Sports Nutrition Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: China APAC Sports Nutrition Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: China APAC Sports Nutrition Industry Revenue (Million), by Geography 2025 & 2033

- Figure 7: China APAC Sports Nutrition Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Sports Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: China APAC Sports Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Japan APAC Sports Nutrition Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Japan APAC Sports Nutrition Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Japan APAC Sports Nutrition Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 13: Japan APAC Sports Nutrition Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Japan APAC Sports Nutrition Industry Revenue (Million), by Geography 2025 & 2033

- Figure 15: Japan APAC Sports Nutrition Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Japan APAC Sports Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Japan APAC Sports Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: India APAC Sports Nutrition Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: India APAC Sports Nutrition Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: India APAC Sports Nutrition Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: India APAC Sports Nutrition Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: India APAC Sports Nutrition Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: India APAC Sports Nutrition Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: India APAC Sports Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: India APAC Sports Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia APAC Sports Nutrition Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Australia APAC Sports Nutrition Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Australia APAC Sports Nutrition Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Australia APAC Sports Nutrition Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Australia APAC Sports Nutrition Industry Revenue (Million), by Geography 2025 & 2033

- Figure 31: Australia APAC Sports Nutrition Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Australia APAC Sports Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia APAC Sports Nutrition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue (Million), by Geography 2025 & 2033

- Figure 39: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific APAC Sports Nutrition Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Sports Nutrition Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Sports Nutrition Industry?

The projected CAGR is approximately 6.64%.

2. Which companies are prominent players in the APAC Sports Nutrition Industry?

Key companies in the market include Otsuka Pharmaceutical Co Ltd , Herbalife International of America Inc, Abbott Nutrition, PepsiCo Inc, The Coca Cola Company, Glanbia PLC, Cliff Bar & Company, Zywie Ventures Pvt Ltd, Muscleblaze, Healthkart, General Nutrition Centers Inc.

3. What are the main segments of the APAC Sports Nutrition Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Increasing Sports Participation to Boost Market Growth.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

April 2023: UK sports nutrition brand Genetic Nutrition launched its high-quality sports nutrition supplements in India. The brand's range of supplements includes protein powders, amino acids, and vitamins formulated using best-in-class ingredients for maximum effectiveness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Sports Nutrition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Sports Nutrition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Sports Nutrition Industry?

To stay informed about further developments, trends, and reports in the APAC Sports Nutrition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence