Key Insights

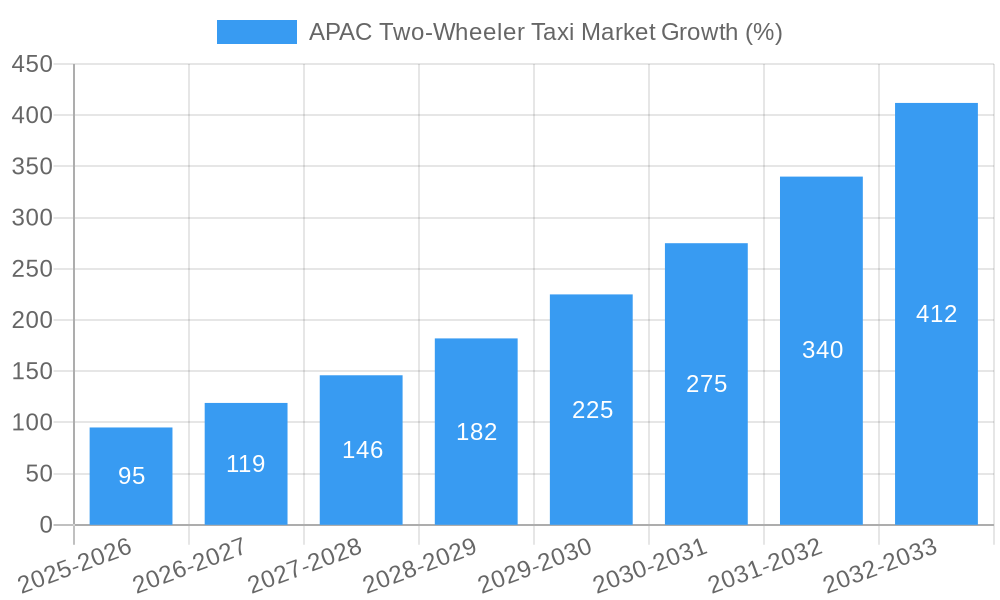

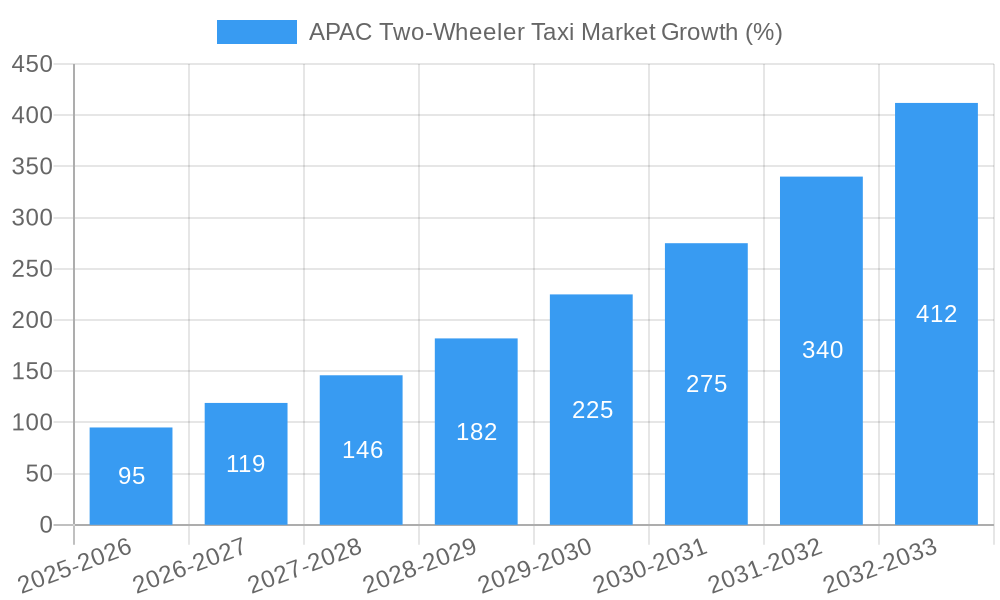

The Asia-Pacific (APAC) two-wheeler taxi market is experiencing robust growth, projected to reach a market size of $0.39 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 24.50% from 2025 to 2033. This surge is driven by several factors. Increasing urbanization and traffic congestion in major APAC cities are making two-wheeler taxis an attractive, faster, and more fuel-efficient alternative to traditional four-wheeled taxis. The rising disposable incomes, particularly amongst younger demographics, coupled with the convenience and affordability offered by ride-hailing apps, further fuel market expansion. The market's segmentation into "Pay as You Go" and "Subscription-Based" services caters to diverse user preferences and contributes to its expanding reach. India and China, with their vast populations and burgeoning economies, are expected to be key contributors to this growth, alongside other rapidly developing nations like Vietnam and Thailand. The presence of established players like Ola, Rapido, and Gojek, alongside emerging companies, fosters competition and innovation, driving service improvements and attracting a broader customer base. While regulatory hurdles and safety concerns might pose some challenges, the overall market outlook remains positive due to the strong underlying demand and ongoing technological advancements.

The market's growth trajectory indicates substantial potential for investors and stakeholders. While specific regional breakdowns for China, India, Japan, Thailand, and Vietnam are not provided, a logical estimation considering the market size and CAGR suggests a significant concentration of market share in India and China. These two nations' significant populations and rapid adoption of mobile technology present unparalleled opportunities. The diversification of service models, including the incorporation of electric two-wheelers, further enhances the market's sustainability and attractiveness. The competitive landscape suggests that companies focusing on technological innovation, efficient operational strategies, and customer-centric approaches will be best positioned to capture a significant share of this rapidly evolving market. The expansion of services beyond major cities into smaller towns and rural areas also presents a large untapped potential for future growth.

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) two-wheeler taxi market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, dominant segments, key players, and future growth prospects.

APAC Two-Wheeler Taxi Market Structure & Innovation Trends

The APAC two-wheeler taxi market is characterized by a dynamic interplay of established players and emerging startups. Market concentration is moderate, with a few dominant players like Uber Technologies Inc, ANI Technologies Pvt Ltd (OLA), and GrabTaxi Holdings Pte Ltd commanding significant market share, estimated at xx% collectively in 2025. However, smaller players like Madhatters Voyage Pvt Ltd and Roppen Transportation (Rapido) are increasingly challenging the incumbents, particularly in niche segments. Innovation is driven by technological advancements in electric vehicles, ride-hailing app functionalities, and subscription-based service models.

- Market Concentration: Moderate, with a few dominant players and many smaller competitors.

- Innovation Drivers: Electric vehicle technology, app-based services, subscription models.

- Regulatory Frameworks: Vary significantly across countries, impacting market entry and operations.

- Product Substitutes: Private vehicles, public transport, and other ride-sharing services.

- End-User Demographics: Primarily young professionals and urban residents seeking affordable and convenient transport.

- M&A Activities: Moderate level of M&A activity, with deal values estimated at xx Million in 2024. Consolidation is expected to continue as larger players seek to expand their market share.

APAC Two-Wheeler Taxi Market Dynamics & Trends

The APAC two-wheeler taxi market is experiencing robust growth, driven by several factors. Increasing urbanization, rising disposable incomes, and the proliferation of smartphones are fueling demand for convenient and affordable transportation. The market's CAGR is projected to be xx% during the forecast period (2025-2033), with market penetration steadily increasing across major APAC cities. Technological disruptions, such as the introduction of electric two-wheelers and improved navigation systems, are further enhancing market appeal. Competitive dynamics are intense, with players focusing on strategic partnerships, service differentiation, and technological innovation to gain a competitive edge. Consumer preferences are shifting towards safer, more reliable, and environmentally friendly options.

Dominant Regions & Segments in APAC Two-Wheeler Taxi Market

India and Southeast Asia are currently the dominant regions in the APAC two-wheeler taxi market, driven by high population density, favorable demographics, and supportive government initiatives. Within these regions, specific countries like India, Indonesia, and Vietnam are experiencing particularly rapid growth.

Dominant Segments:

- By Vehicle Type: Motorcycles currently hold the largest market share, due to affordability and wider availability. However, scooters are gaining traction due to their increased comfort and safety features.

- By Service Type: Pay-as-you-go services constitute the majority of the market. Subscription-based models are still relatively nascent but are expected to witness significant growth in the coming years.

Key Drivers:

- Economic Policies: Government incentives for electric vehicles and ride-sharing services.

- Infrastructure: Expanding road networks and improved urban planning.

- Technological Advancements: Innovation in electric vehicle technology, app development, and navigation systems.

APAC Two-Wheeler Taxi Market Product Innovations

The APAC two-wheeler taxi market is witnessing significant product innovations, focusing primarily on electric vehicles and enhanced safety features. Electric motorcycles and scooters are gaining popularity due to environmental concerns and government regulations. App-based services are also incorporating features like real-time tracking, cashless payments, and improved user interfaces to enhance customer experience. These innovations are improving market fit by catering to evolving consumer preferences for convenient, safe, and environmentally conscious transportation.

Report Scope & Segmentation Analysis

This report segments the APAC two-wheeler taxi market based on vehicle type (motorcycle, scooter) and service type (pay-as-you-go, subscription-based). Each segment offers unique growth opportunities and competitive dynamics. The motorcycle segment, currently larger, shows steady growth, while the scooter segment exhibits faster expansion due to increased appeal among a wider customer base. Pay-as-you-go dominates the service type segment due to its flexibility, while subscription models are anticipated to achieve considerable growth rates in the years to come.

Key Drivers of APAC Two-Wheeler Taxi Market Growth

Several factors drive the growth of the APAC two-wheeler taxi market. Rapid urbanization leads to increased commuting needs, while rising disposable incomes fuel demand for convenient transportation options. Government initiatives promoting electric mobility and supportive regulatory frameworks further boost market expansion. Technological advancements in ride-hailing apps and electric vehicles also contribute to market growth.

Challenges in the APAP Two-Wheeler Taxi Market Sector

The APAC two-wheeler taxi market faces several challenges. Stringent regulatory requirements and varying regulations across different countries create operational complexities. Concerns about driver safety and rider security remain, affecting market perception. The high initial investment costs associated with electric vehicle adoption can also be a barrier for some operators. Competitive pressures among existing players and new entrants further add complexity.

Emerging Opportunities in APAC Two-Wheeler Taxi Market

The APAC two-wheeler taxi market presents several emerging opportunities. Expansion into smaller cities and underserved areas offers significant untapped potential. Integrating advanced technologies like AI-powered route optimization and autonomous driving features can enhance efficiency and customer experience. The increasing focus on sustainable transportation opens avenues for eco-friendly two-wheeler solutions, particularly electric vehicles.

Leading Players in the APAC Two-Wheeler Taxi Market Market

- Madhatters Voyage Pvt Ltd

- Roppen Transportation (Rapido)

- Uber Technologies Inc

- Moped

- GOJEK Ltd

- GrabTaxi Holdings Pte Ltd

- ANI Technologies Pvt Ltd (OLA)

Key Developments in APAC Two-Wheeler Taxi Market Industry

- May 2022: The Thai government and UNEP launched a pilot project for electric motorcycle taxis using 50 electric motorcycles donated by TAILG. This initiative demonstrates the growing focus on sustainable transportation.

- May 2022: EGAT, Stallions, and TAILG partnered to introduce electric motorcycle taxis in Thailand, showcasing public-private collaboration in promoting eco-friendly mobility.

Future Outlook for APAC Two-Wheeler Taxi Market Market

The APAC two-wheeler taxi market exhibits significant growth potential. Continued urbanization, rising disposable incomes, and technological advancements will drive market expansion. The increasing adoption of electric vehicles and innovative service models will further shape market dynamics. Strategic partnerships and investments in technology will be crucial for players to maintain a competitive edge and capitalize on future opportunities. The market is poised for substantial growth, driven by its inherent affordability and convenience in a rapidly growing urban landscape.

APAC Two-Wheeler Taxi Market Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter

-

2. Service Type

- 2.1. Pay as You Go

- 2.2. Subscription-Based

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Thailand

- 3.5. Vietnam

- 3.6. Rest of Asia-Pacific

APAC Two-Wheeler Taxi Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Thailand

- 5. Vietnam

- 6. Rest of Asia Pacific

APAC Two-Wheeler Taxi Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Smartphone User and Internet Penetration Across the Region

- 3.3. Market Restrains

- 3.3.1. Increase in Traffic Problems

- 3.4. Market Trends

- 3.4.1. Increase in Smartphone and Internet Penetration Across the Region will Stimulate Pay as You Go Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Pay as You Go

- 5.2.2. Subscription-Based

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Thailand

- 5.3.5. Vietnam

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Thailand

- 5.4.5. Vietnam

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Motorcycle

- 6.1.2. Scooter

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Pay as You Go

- 6.2.2. Subscription-Based

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Thailand

- 6.3.5. Vietnam

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Motorcycle

- 7.1.2. Scooter

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Pay as You Go

- 7.2.2. Subscription-Based

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Thailand

- 7.3.5. Vietnam

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Japan APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Motorcycle

- 8.1.2. Scooter

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Pay as You Go

- 8.2.2. Subscription-Based

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Thailand

- 8.3.5. Vietnam

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Thailand APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Motorcycle

- 9.1.2. Scooter

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Pay as You Go

- 9.2.2. Subscription-Based

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Thailand

- 9.3.5. Vietnam

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Vietnam APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Motorcycle

- 10.1.2. Scooter

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Pay as You Go

- 10.2.2. Subscription-Based

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Thailand

- 10.3.5. Vietnam

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Rest of Asia Pacific APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Motorcycle

- 11.1.2. Scooter

- 11.2. Market Analysis, Insights and Forecast - by Service Type

- 11.2.1. Pay as You Go

- 11.2.2. Subscription-Based

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Thailand

- 11.3.5. Vietnam

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. China APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. India APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Japan APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Thailand APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Vietnam APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Rest of Asia Pacific APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Madhatters Voyage Pvt Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Roppen Transportation(Rapido)

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Uber Technologies Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Moped

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 GOJEK Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 GrabTaxi Holdings Pte Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 ANI Technologies Pvt Ltd (OLA)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.1 Madhatters Voyage Pvt Ltd

List of Figures

- Figure 1: Global APAC Two-Wheeler Taxi Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 3: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: India APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 5: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: China APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: China APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 17: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 18: China APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 19: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 20: China APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 21: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: India APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: India APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 25: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 26: India APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 27: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 28: India APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 29: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 33: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 34: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 35: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 36: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 41: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 42: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 43: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 44: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 47: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 48: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 49: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 50: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 51: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 52: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 55: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 56: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 57: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 58: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 59: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 60: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 23: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 24: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 31: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 32: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 36: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 40: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Two-Wheeler Taxi Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the APAC Two-Wheeler Taxi Market?

Key companies in the market include Madhatters Voyage Pvt Ltd, Roppen Transportation(Rapido), Uber Technologies Inc, Moped, GOJEK Ltd, GrabTaxi Holdings Pte Ltd, ANI Technologies Pvt Ltd (OLA).

3. What are the main segments of the APAC Two-Wheeler Taxi Market?

The market segments include Vehicle Type, Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Smartphone User and Internet Penetration Across the Region.

6. What are the notable trends driving market growth?

Increase in Smartphone and Internet Penetration Across the Region will Stimulate Pay as You Go Segment.

7. Are there any restraints impacting market growth?

Increase in Traffic Problems.

8. Can you provide examples of recent developments in the market?

May 2022: A significant milestone was achieved as the Thai government and the United Nations Environment Program (UNEP) jointly initiated a pilot project for electric motorcycle taxis in Thailand. In a remarkable collaboration, approximately fifty electric motorcycles generously donated by the Chinese company TAILG will be utilized as green motorcycle taxis, serving as both a research project and a demonstration of sustainable mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Two-Wheeler Taxi Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Two-Wheeler Taxi Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Two-Wheeler Taxi Market?

To stay informed about further developments, trends, and reports in the APAC Two-Wheeler Taxi Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence