Key Insights

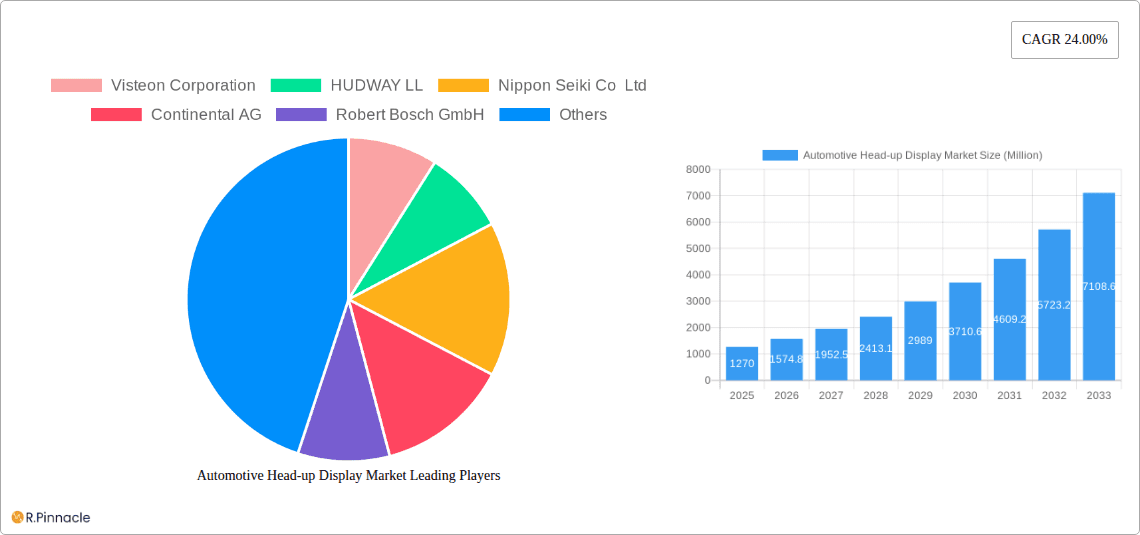

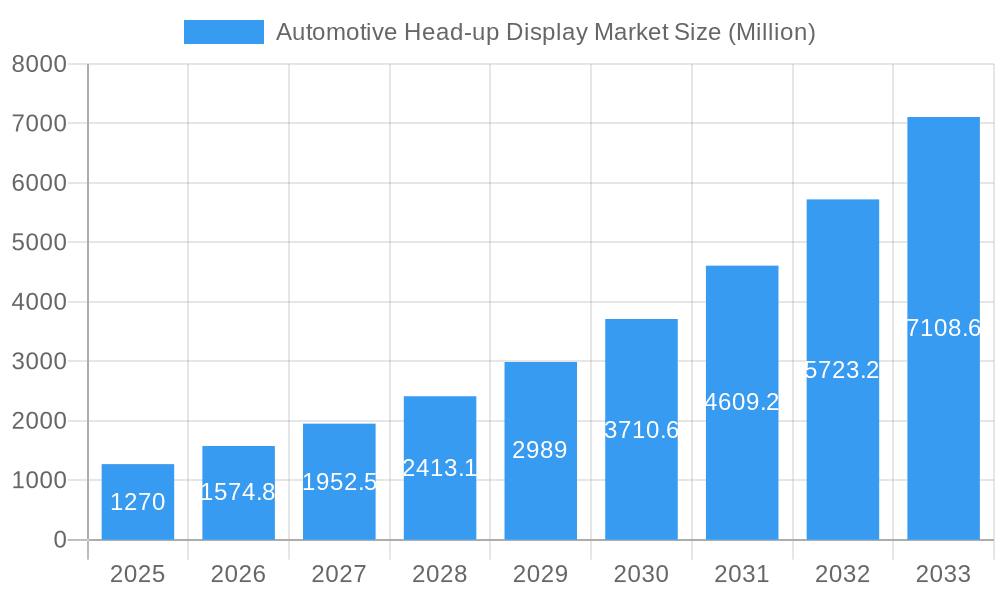

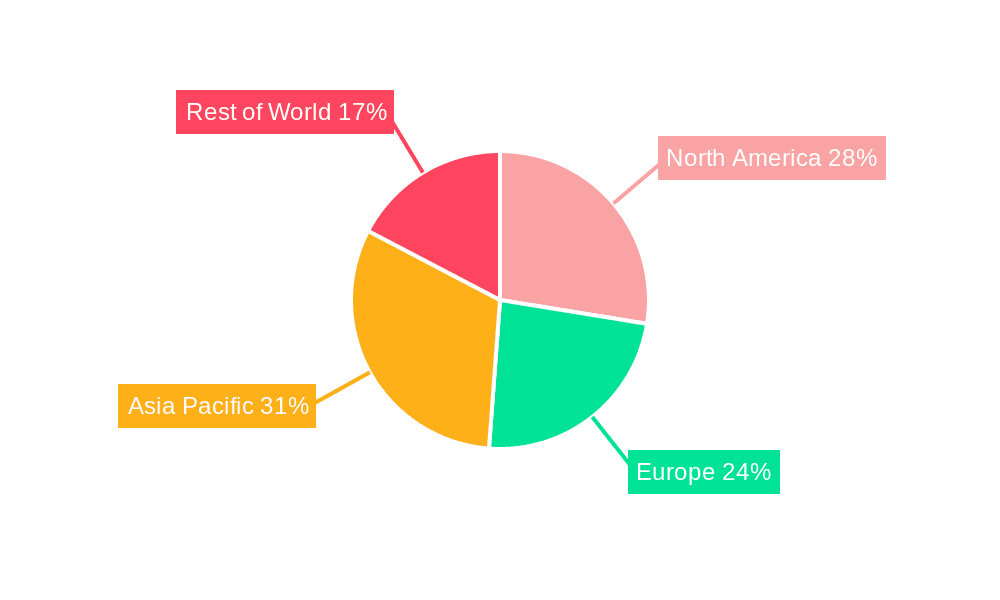

The Automotive Head-up Display (HUD) market is experiencing robust growth, projected to reach $1.27 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 24% from 2025 to 2033. This expansion is driven by increasing consumer demand for enhanced safety and driver convenience features, particularly in advanced driver-assistance systems (ADAS). The integration of HUD technology into vehicles improves driver focus by projecting critical information, such as speed and navigation directions, directly onto the windshield, minimizing distractions. Technological advancements, such as the development of augmented reality (AR) HUDs, which overlay digital information onto the real-world view, further fuel market growth. The adoption of HUDs is particularly strong in passenger cars, but commercial vehicles are also increasingly incorporating this technology to improve safety and efficiency for professional drivers. The market is geographically diverse, with North America and Europe representing significant market shares, driven by high vehicle ownership rates and strong adoption of advanced automotive technologies. However, the Asia-Pacific region is anticipated to experience substantial growth in the coming years due to rising disposable incomes and increasing vehicle production. Competition among key players such as Visteon Corporation, Continental AG, and Bosch is fierce, leading to continuous innovation and price optimization.

Automotive Head-up Display Market Market Size (In Billion)

The segment breakdown reveals a strong preference for windshield HUDs over combiner HUDs, reflecting the ease of integration and superior visibility provided by windshield projection. The passenger car segment dominates the market due to higher production volumes compared to commercial vehicles. However, the commercial vehicle segment shows significant potential for growth due to rising focus on safety regulations and driver assistance features in the logistics and transportation sectors. Restraints on market expansion could include the high initial cost of implementing HUD technology and potential challenges related to the system’s calibration and maintenance. Nevertheless, the long-term outlook for the automotive HUD market remains exceptionally positive, driven by ongoing technological advancements, increased consumer preference for advanced safety and convenience features, and the continuous expansion of the global automotive sector.

Automotive Head-up Display Market Company Market Share

Automotive Head-up Display Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Automotive Head-up Display market, offering invaluable insights for industry professionals, investors, and stakeholders. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, and includes key market segmentation, competitive landscape, and future growth projections. The report uses 2025 as the base year and estimated year.

Automotive Head-up Display Market Market Structure & Innovation Trends

The automotive head-up display (HUD) market is experiencing significant growth, driven by increasing demand for enhanced driver safety and convenience features. Market concentration is moderate, with several key players holding significant market share, including Visteon Corporation, Continental AG, Robert Bosch GmbH, and DENSO Corporation. These companies collectively hold an estimated xx% of the market share in 2025. However, the market also features numerous smaller players, particularly in the emerging AR-HUD segment.

Innovation is a key driver, with advancements in augmented reality (AR) technology, improved projection systems, and integration with advanced driver-assistance systems (ADAS) shaping market trends. Regulatory frameworks focused on driver safety are promoting HUD adoption, while factors like increasing vehicle production and rising consumer disposable incomes are fueling market expansion. Product substitutes, such as traditional instrument panels and infotainment systems, face competition from the enhanced functionality and improved driver experience offered by HUDs. Mergers and acquisitions (M&A) activities are anticipated to increase, with deal values projected to reach xx Million by 2033, driven by the need for technological advancement and market consolidation. End-user demographics are shifting towards younger drivers who value technology-driven safety features.

Automotive Head-up Display Market Market Dynamics & Trends

The global automotive head-up display market is expected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by several factors, including the increasing integration of ADAS features in vehicles, the rising demand for enhanced driver safety and convenience, and the growing adoption of electric and autonomous vehicles. Technological disruptions, such as the transition from basic HUDs to AR-HUDs, are further accelerating market expansion. Consumer preferences are shifting towards more advanced and feature-rich HUD systems with improved image quality and larger projection sizes. The market is witnessing increased competitive intensity, with both established players and new entrants vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. Market penetration is increasing steadily, particularly in developed regions like North America and Europe, but growth potential in emerging markets like Asia-Pacific is also significant.

Dominant Regions & Segments in Automotive Head-up Display Market

The automotive head-up display market is experiencing robust growth across various regions, with North America and Europe currently leading in terms of market size and adoption. However, the Asia-Pacific region is projected to witness the highest growth rate during the forecast period, driven by increasing vehicle production, rising disposable incomes, and supportive government policies.

- Leading Region: North America

- Key Drivers for North America: Strong automotive industry, high adoption of advanced technologies, stringent safety regulations.

- Leading Country: United States

- Key Drivers for Asia-Pacific: Rapid economic growth, increasing vehicle sales, and government initiatives to promote technological advancements in the automotive sector.

- Leading Segment (HUD Type): Windshield HUDs are dominant due to their larger projection area and better visibility.

- Leading Segment (Vehicle Type): Passenger cars currently dominate the market, but the commercial vehicle segment is expected to show considerable growth as technology matures and becomes more cost-effective.

Detailed dominance analysis reveals that the preference for Windshield HUDs is driven by their superior image quality and wider field of view compared to Combiner HUDs. The Passenger Car segment's dominance stems from the higher volume of passenger vehicle production compared to commercial vehicles. However, increasing automation and safety requirements in commercial vehicles are fueling the growth of HUD adoption in this segment.

Automotive Head-up Display Market Product Innovations

Recent product innovations in the automotive HUD market are focused on enhancing user experience and safety features. This includes the development of AR-HUDs, which overlay virtual images onto the real-world view through the windshield. These systems offer greater immersion and integration with ADAS features. Other innovations include larger projection sizes, improved image quality, and advanced connectivity features. The market is also witnessing a shift towards compact and cost-effective HUD systems suitable for integration into a broader range of vehicles. These innovations reflect the market's focus on enhancing driver safety and providing an improved user experience while maintaining cost-effectiveness and efficient manufacturing processes.

Report Scope & Segmentation Analysis

This report segments the automotive head-up display market based on HUD type and vehicle type.

HUD Type:

- Windshield HUD: This segment is characterized by its large market share, driven by superior image quality and driver experience. It's expected to grow at a CAGR of xx% during the forecast period, reaching a market size of xx Million by 2033. The competitive landscape is dominated by established automotive component suppliers.

- Combiner HUD: This segment presents promising growth opportunities, despite a smaller current market share. It offers a more compact solution, making it suitable for smaller vehicles. Its growth is expected to be faster than that of Windshield HUDs, with a CAGR of xx%.

Vehicle Type:

- Passenger Cars: This segment holds the largest market share due to high production volumes. It is projected to grow steadily with a CAGR of xx%, reaching xx Million by 2033. The segment's competitiveness is high, with numerous original equipment manufacturers (OEMs) and aftermarket players.

- Commercial Vehicles: This segment is expected to show significant growth due to the increasing integration of safety features in commercial vehicles. It is projected to achieve a CAGR of xx% during the forecast period.

Key Drivers of Automotive Head-up Display Market Growth

Several key factors are driving the growth of the automotive head-up display market:

- Technological advancements: Development of AR-HUD, improved image quality, and integration with ADAS.

- Increased focus on driver safety: Stringent safety regulations and consumer demand for safety features are major contributors.

- Rising demand for enhanced driver convenience: HUDs provide important information without distracting drivers from the road.

- Growing adoption of electric and autonomous vehicles: These vehicles often incorporate advanced driver-assistance systems that benefit from HUD integration.

Challenges in the Automotive Head-up Display Market Sector

The automotive head-up display market faces several challenges:

- High initial investment costs: Developing and implementing HUD technology requires significant upfront capital.

- Supply chain disruptions: The global supply chain disruptions have impacted component availability and pricing.

- Competitive pressure: Market saturation with established players and new entrants driving price wars.

- Regulatory hurdles: Meeting varied regional safety and emission standards increases production complexity. These challenges lead to an estimated xx Million loss in revenue by 2028 for a xx% segment of the market.

Emerging Opportunities in Automotive Head-up Display Market

The automotive HUD market presents several emerging opportunities:

- Expansion into emerging markets: Growing demand in developing economies presents a significant growth potential.

- Development of cost-effective HUD solutions: Lowering the production cost widens the market reach.

- Integration with advanced infotainment systems: Seamless integration enhances overall user experience.

- Focus on AR-HUD technology: Augmented reality technology offers significant advancements in safety and usability.

Leading Players in the Automotive Head-up Display Market Market

- Visteon Corporation

- HUDWAY LL

- Nippon Seiki Co Ltd

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Yazaki Corporation

- Pioneer Corporation

- Panasonic Corporation

Key Developments in Automotive Head-up Display Market Industry

- July 2022: TomTom's full-stack navigation solution integrated into Opel's new Astra, including a head-up display, highlights the growing integration of HUDs with advanced navigation systems.

- July 2022: Foryou Corporation and Huawei's collaboration on AR-HUD signifies the increasing focus on augmented reality technology in the HUD market.

- June 2022: Japan Display's commitment to strengthening its automotive display business, including HUDs, underscores the growing importance of this technology in the automotive industry.

- May 2022: Panasonic's 11.5-inch WS HUD adopted by Nissan Ariya showcases the ongoing trend of larger, more advanced HUD systems.

- December 2021: Karma Automotive and WayRay's integration of AR-HUD technology demonstrates the growing adoption of augmented reality features in high-end vehicles.

Future Outlook for Automotive Head-up Display Market Market

The future of the automotive head-up display market looks promising, with continuous growth fueled by technological innovations, increasing demand for advanced safety features, and the expansion into emerging markets. The shift towards AR-HUDs, along with the integration of advanced driver-assistance systems, will drive market expansion. Strategic partnerships and acquisitions are likely to reshape the competitive landscape, while the focus on cost-effective solutions will broaden market reach. Overall, the market is poised for continued strong growth, presenting significant opportunities for both established players and new entrants.

Automotive Head-up Display Market Segmentation

-

1. HUD Type

- 1.1. Windshield

- 1.2. Combiner

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Automotive Head-up Display Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Head-up Display Market Regional Market Share

Geographic Coverage of Automotive Head-up Display Market

Automotive Head-up Display Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Safety Features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With The Feature

- 3.4. Market Trends

- 3.4.1. Increased Adoption Rate of Windshield HUD to Occupy Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by HUD Type

- 5.1.1. Windshield

- 5.1.2. Combiner

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by HUD Type

- 6. North America Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by HUD Type

- 6.1.1. Windshield

- 6.1.2. Combiner

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by HUD Type

- 7. Europe Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by HUD Type

- 7.1.1. Windshield

- 7.1.2. Combiner

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by HUD Type

- 8. Asia Pacific Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by HUD Type

- 8.1.1. Windshield

- 8.1.2. Combiner

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by HUD Type

- 9. Rest of the World Automotive Head-up Display Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by HUD Type

- 9.1.1. Windshield

- 9.1.2. Combiner

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by HUD Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Visteon Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HUDWAY LL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nippon Seiki Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Continental AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DENSO Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Yazaki Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Pioneer Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Panasonic Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Visteon Corporation

List of Figures

- Figure 1: Global Automotive Head-up Display Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 3: North America Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 4: North America Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 9: Europe Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 10: Europe Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Head-up Display Market Revenue (Million), by HUD Type 2025 & 2033

- Figure 21: Rest of the World Automotive Head-up Display Market Revenue Share (%), by HUD Type 2025 & 2033

- Figure 22: Rest of the World Automotive Head-up Display Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Automotive Head-up Display Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Automotive Head-up Display Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Head-up Display Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 2: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Head-up Display Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 5: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 11: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 20: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Automotive Head-up Display Market Revenue Million Forecast, by HUD Type 2020 & 2033

- Table 28: Global Automotive Head-up Display Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Automotive Head-up Display Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: South America Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Middle East and Africa Automotive Head-up Display Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Head-up Display Market?

The projected CAGR is approximately 24.00%.

2. Which companies are prominent players in the Automotive Head-up Display Market?

Key companies in the market include Visteon Corporation, HUDWAY LL, Nippon Seiki Co Ltd, Continental AG, Robert Bosch GmbH, DENSO Corporation, Yazaki Corporation, Pioneer Corporation, Panasonic Corporation.

3. What are the main segments of the Automotive Head-up Display Market?

The market segments include HUD Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Safety Features in Vehicles.

6. What are the notable trends driving market growth?

Increased Adoption Rate of Windshield HUD to Occupy Significant Share in the Market.

7. Are there any restraints impacting market growth?

High Costs Associated With The Feature.

8. Can you provide examples of recent developments in the market?

July 2022: Tom Tom announced that Opel's new Astra features a new generation of TomTom's full-stack navigation solution, including over-the-air updates for fresh and accurate maps, highly convenient connected services, and new map-based advanced driver assistance system (ADAS) features for greater safety. TomTom's up-to-date map information and navigation guidance is available across the new Astra's next-generation Pure Panel digital cockpit screens, including the new head-up display. It is also accessible through easy-to-use voice control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Head-up Display Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Head-up Display Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Head-up Display Market?

To stay informed about further developments, trends, and reports in the Automotive Head-up Display Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence