Key Insights

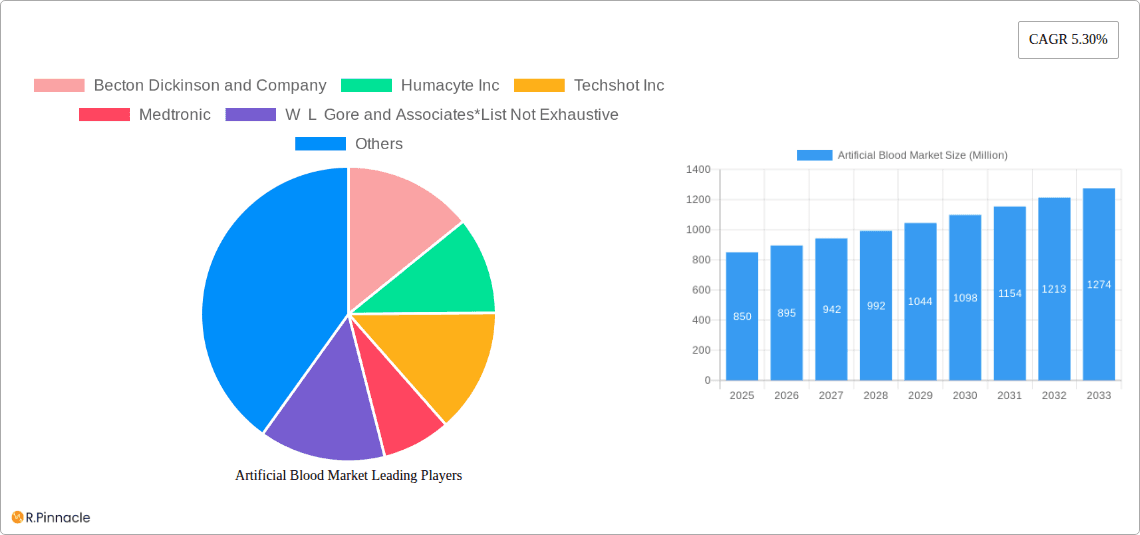

The global Artificial Blood Market is poised for robust growth, projected to reach an estimated XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.30% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing prevalence of chronic diseases such as aortic and peripheral artery diseases, coupled with the rising demand for effective solutions in hemodialysis. Technological advancements in polymer science, particularly the development of advanced polydioxanone and elastomer-based artificial blood products, are significantly enhancing efficacy and patient outcomes, thereby driving market adoption. Furthermore, the growing number of surgical procedures and the continuous need for blood substitutes in emergency situations are key market accelerators. The increasing investment in research and development by leading companies, including Becton Dickinson and Company, Medtronic, and Humacyte Inc., is also contributing to the innovation and availability of superior artificial blood solutions.

Artificial Blood Market Market Size (In Million)

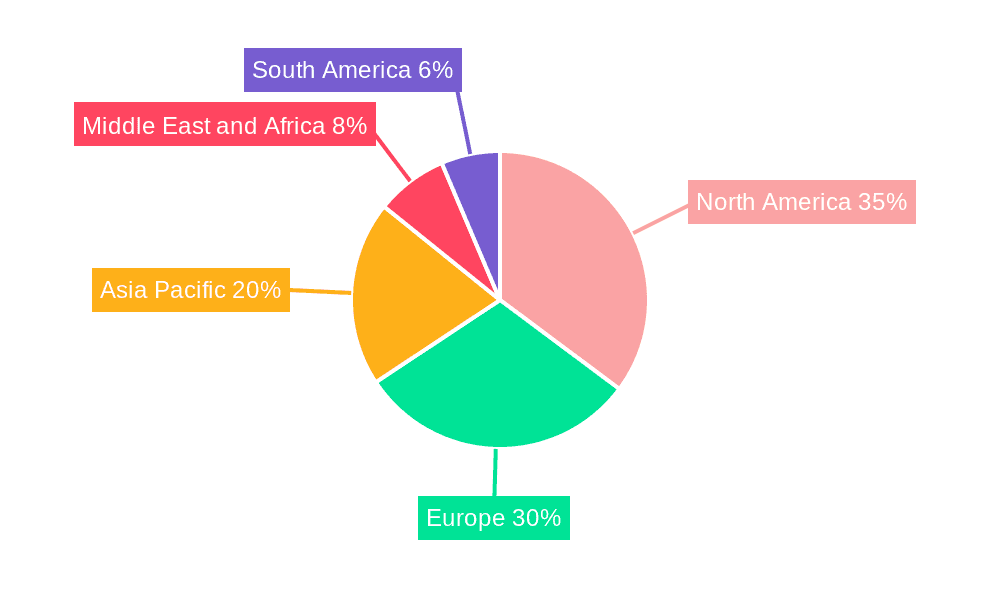

The market's growth trajectory is further supported by favorable healthcare policies and an increasing awareness among healthcare providers and patients regarding the benefits of artificial blood, such as reduced risks of transfusion-transmitted infections and a broader availability compared to human blood. While the market demonstrates strong potential, certain restraints such as high development costs and stringent regulatory approvals may pose challenges. However, the continuous innovation in material science and the expanding applications in trauma care and battlefield medicine are expected to offset these limitations. Geographically, North America and Europe are expected to lead the market due to advanced healthcare infrastructure and higher adoption rates of innovative medical technologies. The Asia Pacific region, with its large population and burgeoning healthcare sector, presents a significant growth opportunity. The competitive landscape is characterized by strategic collaborations and product launches aimed at expanding market reach and product portfolios.

Artificial Blood Market Company Market Share

This in-depth report provides a definitive analysis of the global Artificial Blood Market, meticulously detailing market structure, dynamics, key applications, polymer innovations, and future outlook. Leveraging advanced research methodologies and industry expertise, this report offers actionable insights for stakeholders aiming to capitalize on the burgeoning artificial blood sector. Our study encompasses a comprehensive review from 2019 to 2024 (historical period), with a base year of 2025 and a detailed forecast extending to 2033.

Artificial Blood Market Market Structure & Innovation Trends

The Artificial Blood Market exhibits a moderately concentrated structure, with key players like Becton Dickinson and Company, Humacyte Inc., and Medtronic leading innovation and market penetration. The market's growth is significantly propelled by continuous innovation in biomaterials and device engineering, aiming to replicate the oxygen-carrying capacity and physiological functions of natural blood. Regulatory frameworks, though stringent, are evolving to accommodate novel artificial blood technologies, particularly for life-saving applications in trauma care and chronic disease management. Product substitutes, primarily blood transfusions and oxygenators, face increasing competition from advanced artificial blood solutions that offer reduced risks of transfusion reactions and disease transmission. End-user demographics are expanding to include a wider patient population suffering from conditions like Aortic Disease, Peripheral Artery Disease, and those requiring Hemodialysis. Mergers and acquisitions (M&A) activity, while not dominant, are strategically focused on acquiring groundbreaking technologies and expanding market reach, with notable deal values in the hundreds of Million range. The market is characterized by a strong emphasis on R&D investment to overcome existing limitations and enhance biocompatibility and efficacy, further solidifying its innovative trajectory.

Artificial Blood Market Market Dynamics & Trends

The Artificial Blood Market is poised for remarkable expansion, driven by a confluence of critical factors that are reshaping healthcare delivery and patient outcomes. The increasing prevalence of cardiovascular diseases, including Aortic Disease and Peripheral Artery Disease, represents a primary growth catalyst. As these conditions necessitate advanced treatment modalities, the demand for innovative blood substitutes that can effectively improve oxygenation and circulation is surging. Furthermore, the growing aging population worldwide, coupled with a higher incidence of age-related ailments requiring robust circulatory support, significantly fuels market growth. Technological advancements are at the forefront of this expansion. Breakthroughs in nanotechnology, biomaterials science, and polymer engineering are enabling the development of artificial blood products with enhanced oxygen-carrying capacity, prolonged shelf-life, and superior biocompatibility, thereby minimizing adverse immune responses. The ongoing development of Hemodialysis technologies also indirectly contributes, as advancements in blood management and filtration systems create a synergistic environment for artificial blood innovations.

The competitive landscape is dynamic, characterized by significant investment in research and development by established medical device manufacturers and emerging biotech firms. These entities are vying to secure patents and gain regulatory approvals for novel artificial blood formulations and delivery systems. Consumer preferences are gradually shifting towards solutions that offer greater convenience and reduced risks compared to traditional blood transfusions. Artificial blood holds the promise of addressing blood shortages and eliminating the risk of bloodborne pathogen transmission, making it an increasingly attractive option for both patients and healthcare providers. The global healthcare expenditure, particularly in developed economies, is on an upward trajectory, allowing for greater adoption of advanced medical technologies like artificial blood. Government initiatives and funding for medical research also play a pivotal role in accelerating product development and market penetration. The pursuit of more efficient and effective treatments for critical conditions is a constant driver, pushing the boundaries of what is possible in blood substitute technology and ensuring sustained market growth. The estimated market penetration of artificial blood solutions, while currently niche, is projected to witness a significant increase in the forecast period. The Compound Annual Growth Rate (CAGR) for the Artificial Blood Market is anticipated to be robust, reflecting the transformative potential and expanding applications of these life-saving technologies.

Dominant Regions & Segments in Artificial Blood Market

The Artificial Blood Market is witnessing significant traction across various geographic regions and product segments. North America, particularly the United States, currently dominates the market, driven by high healthcare expenditure, advanced research infrastructure, and a robust regulatory framework that supports the approval of innovative medical technologies. The region's strong focus on cardiovascular health and the early adoption of cutting-edge medical treatments contribute to its leading position.

Key Drivers of Regional Dominance in North America:

- High Prevalence of Cardiovascular Diseases: A substantial patient pool suffering from Aortic Disease and Peripheral Artery Disease creates a constant demand for advanced circulatory support solutions.

- Advanced Healthcare Infrastructure: Well-established hospitals, specialized clinics, and extensive research institutions facilitate the development and adoption of novel artificial blood technologies.

- Favorable Regulatory Environment: The U.S. Food and Drug Administration (FDA) provides a pathway for the approval of innovative medical devices and therapies, encouraging investment in R&D.

- Significant R&D Investment: Pharmaceutical and medical device companies based in North America are at the forefront of developing next-generation artificial blood products.

In terms of applications, Aortic Disease and Peripheral Artery Disease are currently the most significant segments, owing to the critical need for improved blood flow and oxygenation in patients with these vascular conditions. The increasing incidence of these diseases, coupled with advancements in surgical techniques and the development of artificial blood products designed to enhance perfusion, are key factors driving their dominance.

Looking at the polymer segment, Elastomer and Polydioxanone are gaining prominence due to their biocompatibility, flexibility, and ability to withstand physiological stresses. These polymers are crucial in developing artificial blood vessels and oxygenators that mimic the natural elasticity and function of biological tissues. The continuous research into novel polymer formulations aims to improve drug delivery capabilities, hemocompatibility, and overall product lifespan.

Emerging economies, particularly in Asia-Pacific, are showing promising growth trajectories due to increasing healthcare investments, a rising burden of chronic diseases, and improving access to medical technologies. As these regions develop their healthcare systems, the adoption of artificial blood solutions is expected to accelerate. The focus on expanding applications for Hemodialysis is also a critical driver, as artificial blood technologies can potentially reduce complications associated with traditional dialysis procedures.

Artificial Blood Market Product Innovations

Product innovations in the artificial blood market are focused on developing highly biocompatible and effective oxygen carriers. Recent advancements include the development of nanoscale artificial red blood cells capable of superior oxygen transport and prolonged circulation times. These innovations address limitations of earlier generations, offering enhanced safety profiles and reduced immunogenicity. The competitive advantage lies in superior oxygen delivery efficiency, reduced risk of allergic reactions, and the potential for a longer shelf life compared to traditional blood products.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Artificial Blood Market across key segments.

Application Segment:

- Aortic Disease: This segment focuses on artificial blood solutions designed for the treatment of aortic aneurysms and dissections, aiming to restore normal blood flow and reduce complications. Growth is driven by an increasing prevalence of these conditions and the need for advanced surgical adjuncts.

- Peripheral Artery Disease: This segment addresses artificial blood used in managing blockages in the arteries of the limbs, improving circulation and preventing amputation. The rising incidence of PAD, especially in aging populations, fuels growth.

- Hemodialysis: This segment explores the use of artificial blood or related technologies to enhance or replace aspects of traditional hemodialysis, improving efficiency and patient outcomes.

Polymer Segment:

- Polydioxanone: A biodegradable synthetic polymer, it finds application in developing artificial vascular grafts and scaffolds, offering controlled degradation and integration with host tissues.

- Elastomer: These flexible polymers are crucial for creating artificial blood vessels and other compliant vascular devices that can withstand pulsatile blood flow.

- Polyethylene Terephthalate (PET): Commonly used in vascular prosthetics, PET offers durability and a proven track record in medical device applications.

- Others: This category includes a range of novel polymers and composite materials being explored for their unique properties in artificial blood applications.

Key Drivers of Artificial Blood Market Growth

The Artificial Blood Market is propelled by several key growth drivers. Technological advancements in biomaterials science, nanotechnology, and polymer engineering are enabling the creation of safer, more effective, and biocompatible artificial blood substitutes. The increasing global burden of cardiovascular diseases, including Aortic Disease and Peripheral Artery Disease, creates a substantial demand for innovative treatment options. Furthermore, rising healthcare expenditures and a growing focus on patient outcomes are fostering greater adoption of advanced medical technologies. Government initiatives and funding supporting research and development in the medical field also play a crucial role in accelerating innovation and market penetration. The potential to address blood shortages and reduce the risks associated with traditional transfusions is a significant economic and humanitarian driver.

Challenges in the Artificial Blood Market Sector

Despite its promising growth, the Artificial Blood Market faces several challenges. Stringent regulatory approvals by bodies like the FDA and EMA can be a lengthy and costly process, delaying market entry for new products. High research and development costs associated with creating sophisticated artificial blood technologies present a significant financial barrier. Ensuring long-term efficacy and safety in human trials remains a critical hurdle, with potential concerns regarding immunogenicity and biocompatibility. Limited market penetration and physician acceptance compared to established transfusion methods also pose a challenge. Furthermore, manufacturing complexities and the need for specialized facilities can lead to higher production costs, impacting affordability. The availability of compatible polymers and their cost-effective large-scale production are also crucial considerations for market expansion.

Emerging Opportunities in Artificial Blood Market

The Artificial Blood Market presents numerous emerging opportunities. The development of hemoglobin-based oxygen carriers (HBOCs) with improved safety profiles and longer shelf-lives offers a significant opportunity for therapeutic applications in trauma and emergency medicine. Personalized artificial blood solutions tailored to individual patient needs and genetic makeup are on the horizon, promising enhanced efficacy and reduced adverse reactions. The expanding applications in drug delivery systems and regenerative medicine, where artificial blood components can act as carriers or scaffolds, represent a novel growth avenue. Furthermore, the increasing demand for remote and point-of-care medical devices opens opportunities for portable artificial blood technologies. The growing prevalence of diseases in emerging markets presents a vast untapped potential for market expansion.

Leading Players in the Artificial Blood Market Market

- Becton Dickinson and Company

- Humacyte Inc.

- Techshot Inc.

- Medtronic

- W L Gore and Associates

- Cook Medical Incorporated

- LeMaitre Vascular Inc.

- B Braun Melsungen

- Terumo Medical Corporation

- Jotec GmbH

Key Developments in Artificial Blood Market Industry

- 2024: Advancements in nanoparticle-based oxygen carriers demonstrate enhanced efficacy in preclinical trials.

- 2023: Humacyte Inc. receives regulatory clearance for its bioengineered blood vessel for vascular access in hemodialysis.

- 2023: Research on biodegradable polymers for artificial vascular grafts shows promising results for tissue integration.

- 2022: Becton Dickinson and Company announces strategic partnerships to accelerate R&D in next-generation blood substitutes.

- 2021: Techshot Inc. showcases AI-driven development of advanced biomaterials for artificial blood applications.

- 2020: LeMaitre Vascular Inc. expands its product portfolio in peripheral vascular disease management, indirectly supporting the need for advanced circulatory solutions.

Future Outlook for Artificial Blood Market Market

The future outlook for the Artificial Blood Market is exceptionally bright, driven by relentless innovation and an ever-increasing unmet medical need. The ongoing advancements in biomaterials, nanotechnology, and bioengineering are poised to overcome existing limitations, leading to the development of highly sophisticated and safe artificial blood products. We anticipate significant growth acceleration due to the expanding therapeutic applications beyond simple oxygen carriers, including roles in targeted drug delivery, tissue engineering, and advanced diagnostic tools. The increasing global incidence of chronic diseases, coupled with a growing aging population, will continue to fuel demand. Strategic partnerships, strategic acquisitions, and sustained investment in R&D will be crucial for market players to capitalize on emerging opportunities. The gradual shift in regulatory landscapes towards faster approval pathways for life-saving technologies will further support market expansion, paving the way for widespread adoption of artificial blood solutions across various clinical settings and contributing significantly to global healthcare advancements.

Artificial Blood Market Segmentation

-

1. Application

- 1.1. Aortic Disease

- 1.2. Peripheral Artery Disease

- 1.3. Hemodialysis

-

2. Polymer

- 2.1. Polydioxanone

- 2.2. Elastomer

- 2.3. Polyethylene Terephthalate

- 2.4. Others

Artificial Blood Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Artificial Blood Market Regional Market Share

Geographic Coverage of Artificial Blood Market

Artificial Blood Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Prevalence of Aortic Diseases; Growing Adoption of Minimally Invasive Surgeries; Technoloigical Advancements in Development of Artificial Blood Vessels

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Transplants and Surgeries

- 3.4. Market Trends

- 3.4.1. Application in Aortic Disease is Expected to cover a Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Blood Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aortic Disease

- 5.1.2. Peripheral Artery Disease

- 5.1.3. Hemodialysis

- 5.2. Market Analysis, Insights and Forecast - by Polymer

- 5.2.1. Polydioxanone

- 5.2.2. Elastomer

- 5.2.3. Polyethylene Terephthalate

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Artificial Blood Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aortic Disease

- 6.1.2. Peripheral Artery Disease

- 6.1.3. Hemodialysis

- 6.2. Market Analysis, Insights and Forecast - by Polymer

- 6.2.1. Polydioxanone

- 6.2.2. Elastomer

- 6.2.3. Polyethylene Terephthalate

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Artificial Blood Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aortic Disease

- 7.1.2. Peripheral Artery Disease

- 7.1.3. Hemodialysis

- 7.2. Market Analysis, Insights and Forecast - by Polymer

- 7.2.1. Polydioxanone

- 7.2.2. Elastomer

- 7.2.3. Polyethylene Terephthalate

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Artificial Blood Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aortic Disease

- 8.1.2. Peripheral Artery Disease

- 8.1.3. Hemodialysis

- 8.2. Market Analysis, Insights and Forecast - by Polymer

- 8.2.1. Polydioxanone

- 8.2.2. Elastomer

- 8.2.3. Polyethylene Terephthalate

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Artificial Blood Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aortic Disease

- 9.1.2. Peripheral Artery Disease

- 9.1.3. Hemodialysis

- 9.2. Market Analysis, Insights and Forecast - by Polymer

- 9.2.1. Polydioxanone

- 9.2.2. Elastomer

- 9.2.3. Polyethylene Terephthalate

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Artificial Blood Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aortic Disease

- 10.1.2. Peripheral Artery Disease

- 10.1.3. Hemodialysis

- 10.2. Market Analysis, Insights and Forecast - by Polymer

- 10.2.1. Polydioxanone

- 10.2.2. Elastomer

- 10.2.3. Polyethylene Terephthalate

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Humacyte Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Techshot Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 W L Gore and Associates*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cook Medical Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LeMaitre Vascular Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terumo Medical Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jotec GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Artificial Blood Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Artificial Blood Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Artificial Blood Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Artificial Blood Market Revenue (undefined), by Polymer 2025 & 2033

- Figure 5: North America Artificial Blood Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 6: North America Artificial Blood Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Artificial Blood Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Artificial Blood Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Artificial Blood Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Artificial Blood Market Revenue (undefined), by Polymer 2025 & 2033

- Figure 11: Europe Artificial Blood Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 12: Europe Artificial Blood Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Artificial Blood Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Artificial Blood Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Artificial Blood Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Artificial Blood Market Revenue (undefined), by Polymer 2025 & 2033

- Figure 17: Asia Pacific Artificial Blood Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 18: Asia Pacific Artificial Blood Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Artificial Blood Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Artificial Blood Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East and Africa Artificial Blood Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East and Africa Artificial Blood Market Revenue (undefined), by Polymer 2025 & 2033

- Figure 23: Middle East and Africa Artificial Blood Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 24: Middle East and Africa Artificial Blood Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Artificial Blood Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Artificial Blood Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: South America Artificial Blood Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Artificial Blood Market Revenue (undefined), by Polymer 2025 & 2033

- Figure 29: South America Artificial Blood Market Revenue Share (%), by Polymer 2025 & 2033

- Figure 30: South America Artificial Blood Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Artificial Blood Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artificial Blood Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Artificial Blood Market Revenue undefined Forecast, by Polymer 2020 & 2033

- Table 3: Global Artificial Blood Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Artificial Blood Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Artificial Blood Market Revenue undefined Forecast, by Polymer 2020 & 2033

- Table 6: Global Artificial Blood Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Artificial Blood Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Artificial Blood Market Revenue undefined Forecast, by Polymer 2020 & 2033

- Table 12: Global Artificial Blood Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Artificial Blood Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Artificial Blood Market Revenue undefined Forecast, by Polymer 2020 & 2033

- Table 21: Global Artificial Blood Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Artificial Blood Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Artificial Blood Market Revenue undefined Forecast, by Polymer 2020 & 2033

- Table 30: Global Artificial Blood Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Artificial Blood Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Artificial Blood Market Revenue undefined Forecast, by Polymer 2020 & 2033

- Table 36: Global Artificial Blood Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Artificial Blood Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Blood Market?

The projected CAGR is approximately 16.89%.

2. Which companies are prominent players in the Artificial Blood Market?

Key companies in the market include Becton Dickinson and Company, Humacyte Inc, Techshot Inc, Medtronic, W L Gore and Associates*List Not Exhaustive, Cook Medical Incorporated, LeMaitre Vascular Inc, B Braun Melsungen, Terumo Medical Corporation, Jotec GmbH.

3. What are the main segments of the Artificial Blood Market?

The market segments include Application, Polymer.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Prevalence of Aortic Diseases; Growing Adoption of Minimally Invasive Surgeries; Technoloigical Advancements in Development of Artificial Blood Vessels.

6. What are the notable trends driving market growth?

Application in Aortic Disease is Expected to cover a Large Share of the Market.

7. Are there any restraints impacting market growth?

; High Cost Associated with Transplants and Surgeries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Blood Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Blood Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Blood Market?

To stay informed about further developments, trends, and reports in the Artificial Blood Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence