Key Insights

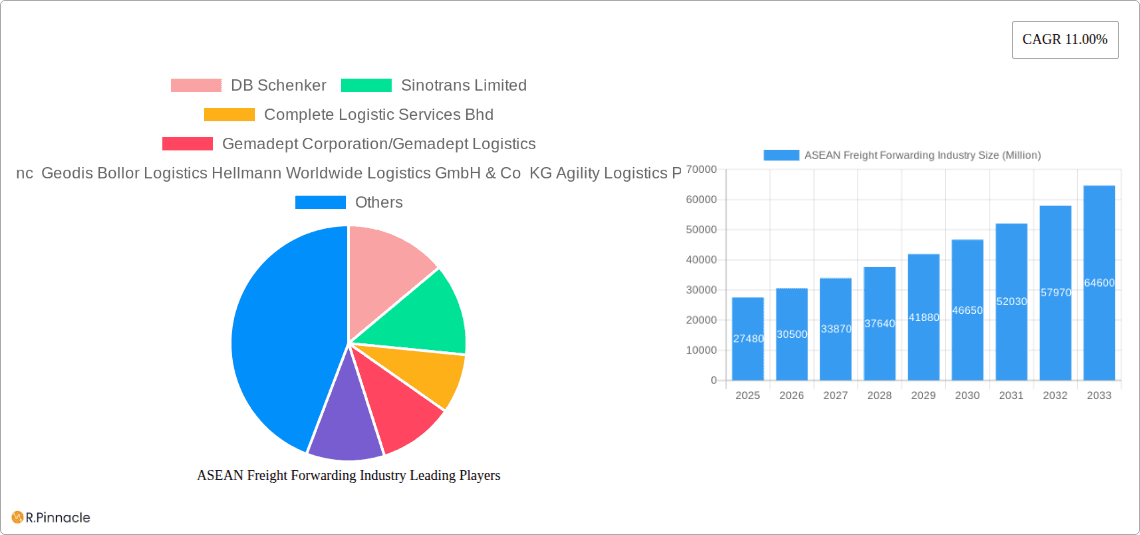

The ASEAN freight forwarding market, valued at $27.48 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. This surge is driven by several key factors. The region's burgeoning e-commerce sector fuels demand for efficient logistics solutions, particularly in air and sea freight forwarding. Furthermore, the increasing manufacturing and industrial activities across ASEAN nations, especially in sectors like automotive, oil & gas, and FMCG, necessitate robust freight forwarding services. Growth in warehousing and value-added services, including customs clearance and specialized packaging, further contributes to market expansion. While infrastructure limitations and geopolitical uncertainties pose challenges, ongoing investments in port infrastructure and improved regional connectivity are mitigating these restraints. The market's segmentation reveals a diverse landscape, with significant contributions from key countries like Singapore, Thailand, Malaysia, and Vietnam. The dominance of air and sea freight forwarding highlights the importance of international trade within the ASEAN bloc and beyond.

ASEAN Freight Forwarding Industry Market Size (In Billion)

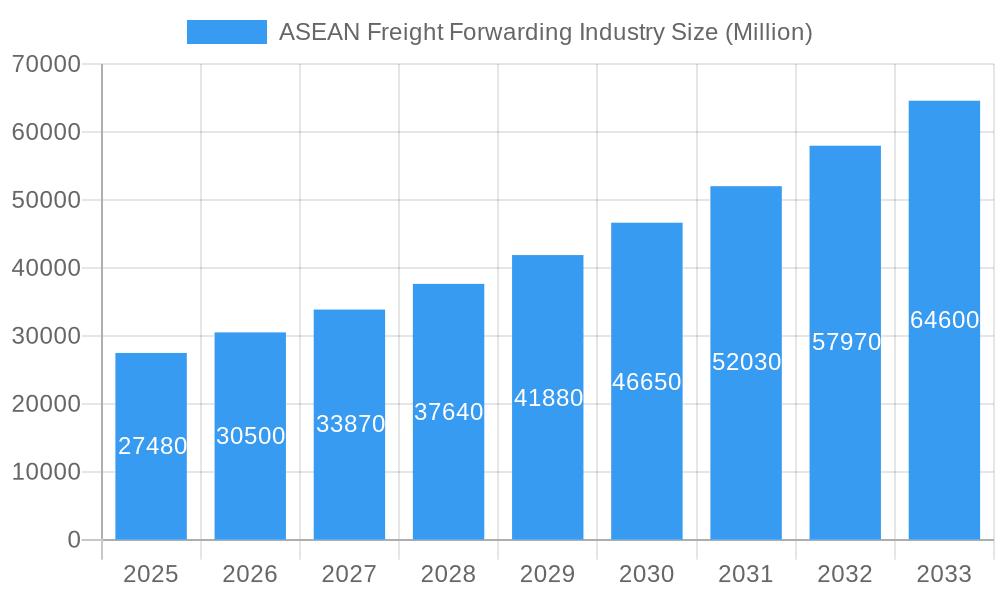

The competitive landscape is characterized by a mix of global giants like DHL, Kuehne + Nagel, and DSV, alongside regional players such as Gemadept and Kerry Logistics. This dynamic interplay fosters innovation and drives efficiency improvements. The expansion of e-commerce is transforming the industry, favoring companies with robust digital capabilities and technological integrations. Future growth hinges on continued investments in technology, optimized supply chain management, and adaptation to evolving consumer demands. The market's substantial growth potential attracts further investment and consolidation, paving the way for specialized service providers to emerge and cater to the niche needs of various industry segments. The ASEAN freight forwarding market is poised for continued expansion, driven by economic growth, technological advancements, and evolving logistical demands within the region.

ASEAN Freight Forwarding Industry Company Market Share

ASEAN Freight Forwarding Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN freight forwarding industry, offering invaluable insights for industry professionals, investors, and stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive data analysis to illuminate market dynamics, growth drivers, challenges, and opportunities within this dynamic sector. Discover key trends, competitive landscapes, and future projections to make informed strategic decisions. The total market value in 2025 is estimated at xx Million.

ASEAN Freight Forwarding Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the ASEAN freight forwarding market, examining market concentration, innovation drivers, and regulatory influences. The report delves into the impact of mergers and acquisitions (M&A) activities on market share distribution, highlighting significant deals and their implications.

- Market Concentration: The ASEAN freight forwarding market exhibits a moderately concentrated structure, with a few large multinational players like DB Schenker, Kuehne + Nagel, and DHL Global Forwarding holding significant market share. However, numerous regional players and smaller specialized firms contribute substantially to the overall market volume. The market share of the top 5 players in 2025 is estimated at xx%.

- Innovation Drivers: Technological advancements, particularly in digitalization and automation (e.g., blockchain for supply chain transparency, AI-powered route optimization), are key innovation drivers. Government initiatives promoting logistics infrastructure development and trade facilitation also significantly impact market innovation.

- Regulatory Frameworks: Varying regulatory environments across ASEAN countries create both challenges and opportunities. Harmonization efforts and regional trade agreements are influencing market dynamics, while individual country-specific regulations regarding customs procedures and licensing continue to shape market access.

- Product Substitutes: While the core freight forwarding service remains essential, the rise of e-commerce and direct-to-consumer models is presenting new challenges. Alternative delivery options and the emergence of technology-driven platforms are influencing market competition and consumer choices.

- End-User Demographics: The report details end-user industry segments across Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Construction, Distributive Trade (including FMCG), and Other End Users (Telecommunications, Pharmaceuticals etc.). Market share by end-user segment for 2025 will be analyzed in detail.

- M&A Activities: The report documents significant M&A transactions in the ASEAN freight forwarding sector during the historical period (2019-2024), analyzing deal values and their impact on market consolidation. The total value of M&A deals during this period is estimated at xx Million.

ASEAN Freight Forwarding Industry Market Dynamics & Trends

This section provides a deep dive into the market’s growth trajectory, dissecting growth drivers, technological disruptions, evolving consumer preferences, and competitive forces. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates are analyzed in detail.

The ASEAN freight forwarding market is experiencing robust growth, driven by factors such as increasing intra-ASEAN trade, expanding e-commerce activities, and the rising demand for efficient and reliable logistics solutions. Technological advancements, such as the adoption of digital platforms and automation technologies, are transforming operational efficiency and enhancing supply chain visibility. The preference for integrated logistics solutions that encompass freight transport, warehousing, and value-added services is further driving market growth. The highly competitive market environment compels players to constantly innovate, optimize their services, and leverage technology to gain a competitive edge. The projected CAGR for the forecast period (2025-2033) is xx%. Market penetration of technology-driven solutions is expected to reach xx% by 2033.

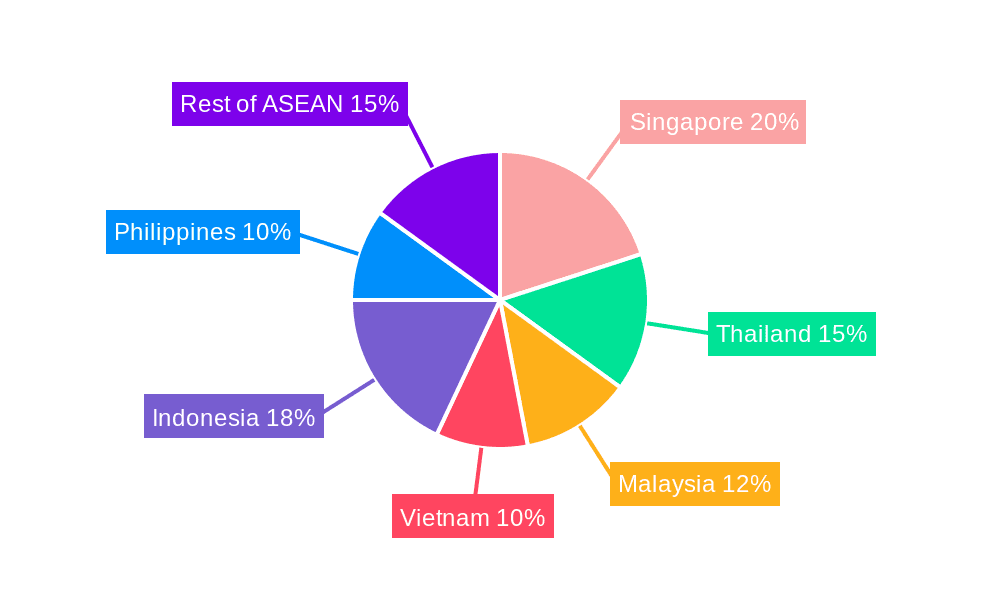

Dominant Regions & Segments in ASEAN Freight Forwarding Industry

This section identifies the leading regions, countries, and segments within the ASEAN freight forwarding market. A detailed analysis explores the factors driving the dominance of specific regions and segments.

- Leading Regions: Singapore consistently ranks as a leading hub due to its advanced infrastructure, strategic location, and pro-business policies. Other important regions include Thailand, Malaysia, and Vietnam, each demonstrating strong growth potential.

- Leading Countries: Singapore's robust infrastructure, established logistics network, and favorable regulatory environment solidify its position as a leading country. Thailand benefits from its strong manufacturing base and proximity to other ASEAN markets, while Malaysia's well-developed transportation network and strategic location provide an advantage. Indonesia, despite some infrastructural challenges, presents a massive market opportunity given its large population and expanding economy. Vietnam's rapid economic growth fuels substantial demand for freight forwarding services.

- Leading Segments (Mode of Transport): Sea freight forwarding remains the dominant mode of transport, reflecting the significant volume of seaborne trade within the ASEAN region and globally. Air freight forwarding is experiencing substantial growth driven by the time-sensitive nature of certain goods and the expansion of e-commerce.

- Leading Segments (Service): Freight transport constitutes the core service, but the increasing demand for integrated logistics solutions is driving the growth of value-added services, such as warehousing, customs clearance, and packaging. Warehousing is becoming increasingly sophisticated with specialized solutions for temperature-sensitive goods and high-value items.

- Leading End-User Segments: The Manufacturing and Automotive sector constitutes a large share of the freight forwarding market, driven by the region's robust manufacturing base. The distributive trade sector, especially FMCG, is another key driver, reflecting the growing consumer market in ASEAN.

Key drivers for leading regions and segments include:

- Economic Policies: Government incentives, infrastructure investments, and trade liberalization policies significantly influence market growth.

- Infrastructure Development: Investments in ports, airports, and road networks directly impact the efficiency and capacity of freight forwarding operations.

ASEAN Freight Forwarding Industry Product Innovations

The ASEAN freight forwarding industry is witnessing significant product innovation, particularly in technology-driven solutions. The adoption of digital platforms for cargo tracking, real-time visibility, and automated documentation processes is enhancing efficiency and transparency. The integration of blockchain technology is improving supply chain security and traceability. Innovative warehousing solutions, such as automated storage and retrieval systems, are optimizing space utilization and enhancing operational efficiency. These advancements are enhancing competitiveness and meeting the evolving demands of end-users.

Report Scope & Segmentation Analysis

This report comprehensively segments the ASEAN freight forwarding market based on mode of transport (Air Freight Forwarding, Sea Freight Forwarding), service type (Freight Transport, Warehousing, Value-added Services), country (Singapore, Thailand, Malaysia, Indonesia, Vietnam, Philippines, Rest of ASEAN), and end-user industry. Each segment's growth projections, market size, and competitive dynamics are analyzed in detail, providing a granular understanding of the market structure and future prospects.

Key Drivers of ASEAN Freight Forwarding Industry Growth

The ASEAN freight forwarding industry's growth is propelled by several factors: the increasing volume of intra-ASEAN trade fueled by regional economic integration initiatives like ASEAN Economic Community (AEC); the rapid expansion of e-commerce, increasing demand for faster and more reliable delivery services; the development of improved infrastructure, particularly ports and transportation networks; and the adoption of innovative technologies, leading to enhanced efficiency and transparency.

Challenges in the ASEAN Freight Forwarding Industry Sector

Challenges faced by the ASEAN freight forwarding industry include varying regulatory frameworks across countries, creating complexities in cross-border operations; the development and maintenance of reliable and efficient transportation infrastructure; intense competition among freight forwarders, driving down profit margins; and the increasing need to navigate evolving environmental regulations and sustainability concerns.

Emerging Opportunities in ASEAN Freight Forwarding Industry

Emerging opportunities include: the growing demand for specialized logistics solutions for temperature-sensitive goods and high-value products; the rise of e-commerce driving demand for last-mile delivery services; the increasing adoption of technology-driven solutions to improve supply chain visibility and efficiency; and the expansion into new and underserved markets within the ASEAN region.

Leading Players in the ASEAN Freight Forwarding Industry Market

- DB Schenker

- Sinotrans Limited

- Complete Logistic Services Bhd

- Gemadept Corporation/Gemadept Logistics

- C H Robinson

- Expeditors International

- United Parcel Service Inc

- Geodis

- Bolloré Logistics

- Hellmann Worldwide Logistics GmbH & Co KG

- Agility Logistics Pvt Ltd

- Advantage Logistics Co Ltd

- PT Cahaya Pundimas Indonusa

- Nippon Express Co Ltd

- DSV A/S

- Kuehne + Nagel International AG

- Freight Management Holdings Bhd

- CEVA Logistics

- Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd)

- PT Samudera 6

- 3 Other Companies (Key Information/Overview)

- TransOcean Holdings Bhd

- Deutsche Post DHL Group (DHL Global Forwarding)

- Kintetsu World Express Inc

- Kerry Logistics Network Limited

Key Developments in ASEAN Freight Forwarding Industry

- 2022 Q3: DHL Global Forwarding launched a new digital platform for real-time cargo tracking and visibility.

- 2023 Q1: Kuehne + Nagel invested in expanding its warehousing capacity in Singapore.

- 2023 Q4: A significant merger between two regional freight forwarding companies occurred, further consolidating the market. (Further details on specific mergers and acquisitions will be included in the full report).

Future Outlook for ASEAN Freight Forwarding Industry Market

The ASEAN freight forwarding market is poised for sustained growth, driven by strong economic expansion, increasing trade volumes, and technological advancements. The adoption of digital technologies, focus on sustainability, and the increasing need for specialized logistics solutions will shape future market dynamics. Companies that can successfully leverage technology, offer integrated solutions, and adapt to evolving regulatory environments are likely to experience strong growth and increased market share in the coming years.

ASEAN Freight Forwarding Industry Segmentation

-

1. Mode of Transport

- 1.1. Air Freight Forwarding

- 1.2. Sea Freight Forwarding

-

2. Service

- 2.1. Freight Transport

- 2.2. Warehousing

- 2.3. Value-ad

-

3. End User

- 3.1. Manufacturing and Automotive

- 3.2. Oil and Gas, Mining, and Quarrying

- 3.3. Agriculture, Fishing, and Forestry

- 3.4. Construction

- 3.5. Distribu

- 3.6. Other En

ASEAN Freight Forwarding Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Freight Forwarding Industry Regional Market Share

Geographic Coverage of ASEAN Freight Forwarding Industry

ASEAN Freight Forwarding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5.1 Drivers 5.2 Restraints 5.3 Opportunities 5.4 Porter's Five Forces Analysis 5.5 Industry Value Chain Analysis

- 3.3. Market Restrains

- 3.3.1. 5.1 Drivers 5.2 Restraints 5.3 Opportunities 5.4 Porter's Five Forces Analysis 5.5 Industry Value Chain Analysis

- 3.4. Market Trends

- 3.4.1. Sea Freight Forwarding to Achieve Significant Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Air Freight Forwarding

- 5.1.2. Sea Freight Forwarding

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Freight Transport

- 5.2.2. Warehousing

- 5.2.3. Value-ad

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Manufacturing and Automotive

- 5.3.2. Oil and Gas, Mining, and Quarrying

- 5.3.3. Agriculture, Fishing, and Forestry

- 5.3.4. Construction

- 5.3.5. Distribu

- 5.3.6. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. North America ASEAN Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.1.1. Air Freight Forwarding

- 6.1.2. Sea Freight Forwarding

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Freight Transport

- 6.2.2. Warehousing

- 6.2.3. Value-ad

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Manufacturing and Automotive

- 6.3.2. Oil and Gas, Mining, and Quarrying

- 6.3.3. Agriculture, Fishing, and Forestry

- 6.3.4. Construction

- 6.3.5. Distribu

- 6.3.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7. South America ASEAN Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.1.1. Air Freight Forwarding

- 7.1.2. Sea Freight Forwarding

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Freight Transport

- 7.2.2. Warehousing

- 7.2.3. Value-ad

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Manufacturing and Automotive

- 7.3.2. Oil and Gas, Mining, and Quarrying

- 7.3.3. Agriculture, Fishing, and Forestry

- 7.3.4. Construction

- 7.3.5. Distribu

- 7.3.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8. Europe ASEAN Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.1.1. Air Freight Forwarding

- 8.1.2. Sea Freight Forwarding

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Freight Transport

- 8.2.2. Warehousing

- 8.2.3. Value-ad

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Manufacturing and Automotive

- 8.3.2. Oil and Gas, Mining, and Quarrying

- 8.3.3. Agriculture, Fishing, and Forestry

- 8.3.4. Construction

- 8.3.5. Distribu

- 8.3.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9. Middle East & Africa ASEAN Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.1.1. Air Freight Forwarding

- 9.1.2. Sea Freight Forwarding

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Freight Transport

- 9.2.2. Warehousing

- 9.2.3. Value-ad

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Manufacturing and Automotive

- 9.3.2. Oil and Gas, Mining, and Quarrying

- 9.3.3. Agriculture, Fishing, and Forestry

- 9.3.4. Construction

- 9.3.5. Distribu

- 9.3.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10. Asia Pacific ASEAN Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.1.1. Air Freight Forwarding

- 10.1.2. Sea Freight Forwarding

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Freight Transport

- 10.2.2. Warehousing

- 10.2.3. Value-ad

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Manufacturing and Automotive

- 10.3.2. Oil and Gas, Mining, and Quarrying

- 10.3.3. Agriculture, Fishing, and Forestry

- 10.3.4. Construction

- 10.3.5. Distribu

- 10.3.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sinotrans Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Complete Logistic Services Bhd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gemadept Corporation/Gemadept Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C H Robinson Expeditors International United Parcel Service Inc Geodis Bollor Logistics Hellmann Worldwide Logistics GmbH & Co KG Agility Logistics Pvt Ltd Advantage Logistics Co Ltd and PT Cahaya Pundimas Indonusa

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nippon Express Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DSV A/S

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kuehne + Nagel International AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Freight Management Holdings Bhd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CEVA Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PT Samudera 6 3 Other Companies (Key Information/Overview)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TransOcean Holdings Bhd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Deutsche Post DHL Group (DHL Global Forwarding)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Kintetsu World Express Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kerry Logistics Network Limited

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Freight Forwarding Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Freight Forwarding Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 3: North America ASEAN Freight Forwarding Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 4: North America ASEAN Freight Forwarding Industry Revenue (Million), by Service 2025 & 2033

- Figure 5: North America ASEAN Freight Forwarding Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America ASEAN Freight Forwarding Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America ASEAN Freight Forwarding Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America ASEAN Freight Forwarding Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America ASEAN Freight Forwarding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America ASEAN Freight Forwarding Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 11: South America ASEAN Freight Forwarding Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 12: South America ASEAN Freight Forwarding Industry Revenue (Million), by Service 2025 & 2033

- Figure 13: South America ASEAN Freight Forwarding Industry Revenue Share (%), by Service 2025 & 2033

- Figure 14: South America ASEAN Freight Forwarding Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: South America ASEAN Freight Forwarding Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America ASEAN Freight Forwarding Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America ASEAN Freight Forwarding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe ASEAN Freight Forwarding Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 19: Europe ASEAN Freight Forwarding Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 20: Europe ASEAN Freight Forwarding Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Europe ASEAN Freight Forwarding Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Europe ASEAN Freight Forwarding Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe ASEAN Freight Forwarding Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe ASEAN Freight Forwarding Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe ASEAN Freight Forwarding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa ASEAN Freight Forwarding Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 27: Middle East & Africa ASEAN Freight Forwarding Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 28: Middle East & Africa ASEAN Freight Forwarding Industry Revenue (Million), by Service 2025 & 2033

- Figure 29: Middle East & Africa ASEAN Freight Forwarding Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East & Africa ASEAN Freight Forwarding Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa ASEAN Freight Forwarding Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa ASEAN Freight Forwarding Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa ASEAN Freight Forwarding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific ASEAN Freight Forwarding Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 35: Asia Pacific ASEAN Freight Forwarding Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 36: Asia Pacific ASEAN Freight Forwarding Industry Revenue (Million), by Service 2025 & 2033

- Figure 37: Asia Pacific ASEAN Freight Forwarding Industry Revenue Share (%), by Service 2025 & 2033

- Figure 38: Asia Pacific ASEAN Freight Forwarding Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific ASEAN Freight Forwarding Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific ASEAN Freight Forwarding Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific ASEAN Freight Forwarding Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 6: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 13: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 20: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 21: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 33: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 34: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 43: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 44: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global ASEAN Freight Forwarding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific ASEAN Freight Forwarding Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Freight Forwarding Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the ASEAN Freight Forwarding Industry?

Key companies in the market include DB Schenker, Sinotrans Limited, Complete Logistic Services Bhd, Gemadept Corporation/Gemadept Logistics, C H Robinson Expeditors International United Parcel Service Inc Geodis Bollor Logistics Hellmann Worldwide Logistics GmbH & Co KG Agility Logistics Pvt Ltd Advantage Logistics Co Ltd and PT Cahaya Pundimas Indonusa, Nippon Express Co Ltd, DSV A/S, Kuehne + Nagel International AG, Freight Management Holdings Bhd, CEVA Logistics, Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd), PT Samudera 6 3 Other Companies (Key Information/Overview), TransOcean Holdings Bhd, Deutsche Post DHL Group (DHL Global Forwarding), Kintetsu World Express Inc, Kerry Logistics Network Limited.

3. What are the main segments of the ASEAN Freight Forwarding Industry?

The market segments include Mode of Transport, Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.48 Million as of 2022.

5. What are some drivers contributing to market growth?

5.1 Drivers 5.2 Restraints 5.3 Opportunities 5.4 Porter's Five Forces Analysis 5.5 Industry Value Chain Analysis.

6. What are the notable trends driving market growth?

Sea Freight Forwarding to Achieve Significant Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

5.1 Drivers 5.2 Restraints 5.3 Opportunities 5.4 Porter's Five Forces Analysis 5.5 Industry Value Chain Analysis.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Freight Forwarding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Freight Forwarding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Freight Forwarding Industry?

To stay informed about further developments, trends, and reports in the ASEAN Freight Forwarding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence