Key Insights

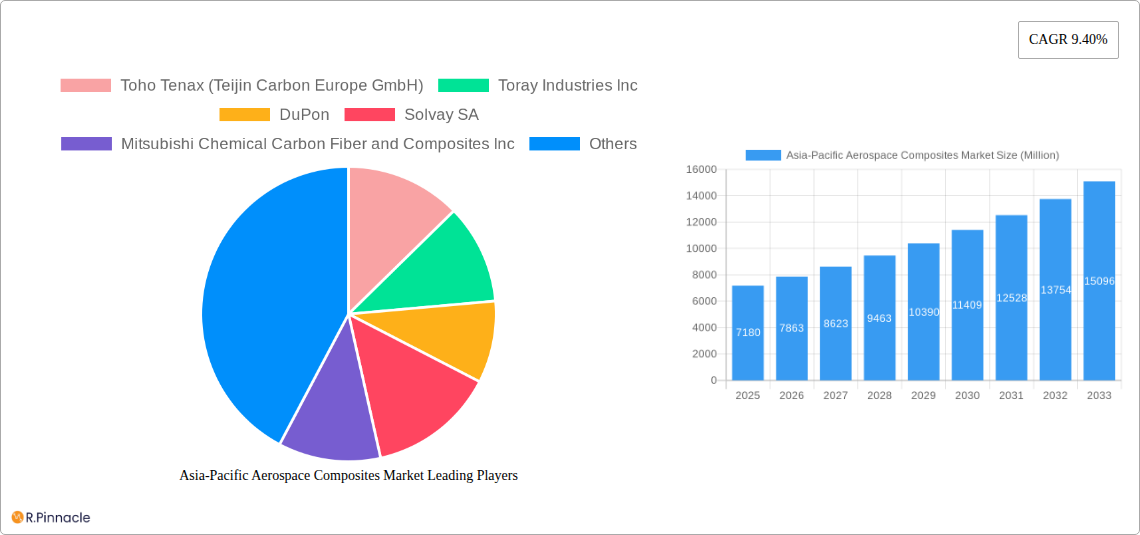

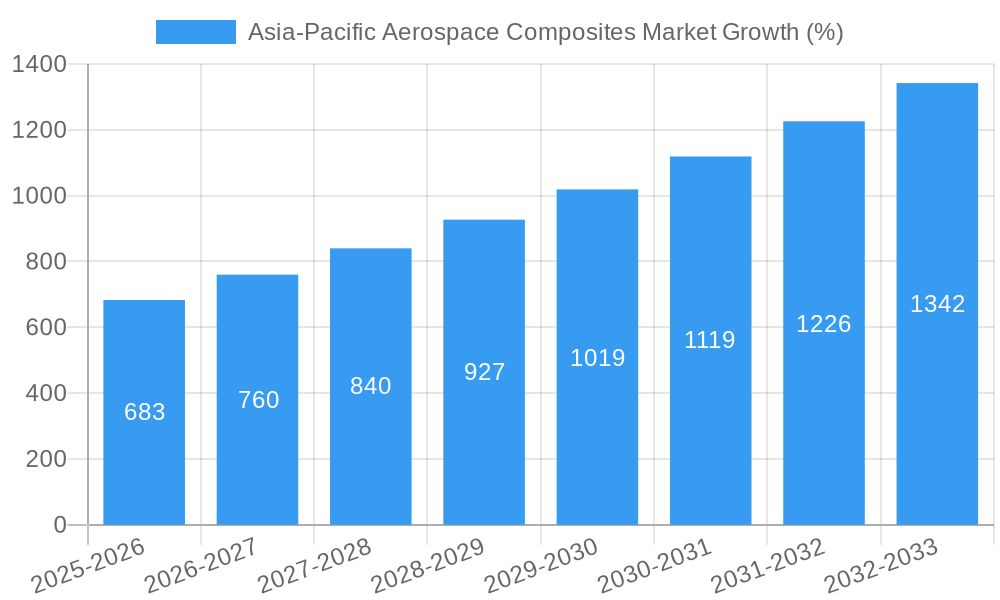

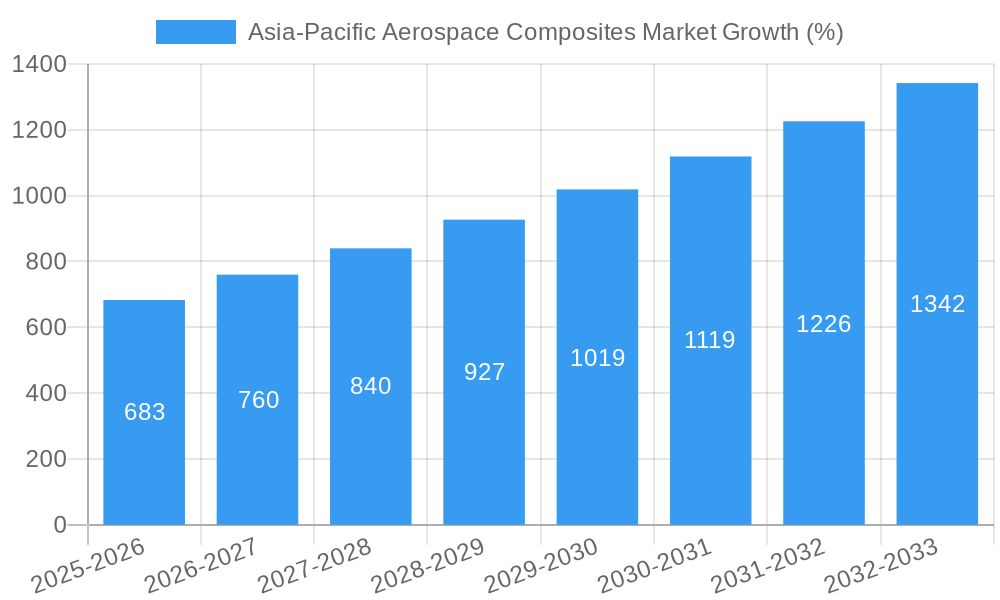

The Asia-Pacific aerospace composites market is experiencing robust growth, driven by increasing demand for lightweight and high-strength materials in the region's burgeoning aerospace industry. The market, valued at $7.18 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 9.40% from 2025 to 2033. This significant growth is fueled by several key factors. Firstly, the substantial investments in both commercial and military aircraft manufacturing across the Asia-Pacific region, particularly in countries like China, Japan, and India, are creating a high demand for advanced composite materials. Secondly, the rising adoption of fuel-efficient aircraft designs necessitates the use of lightweight composites, further boosting market demand. Furthermore, government initiatives promoting aerospace technology and manufacturing within the region are providing a favorable regulatory environment that stimulates growth. Finally, advancements in composite material technology, leading to improved performance characteristics and reduced manufacturing costs, are contributing to wider adoption across various aircraft segments, including commercial, military, and general aviation.

However, the market is not without its challenges. Supply chain disruptions, particularly concerning raw materials, can impact production timelines and costs. Moreover, the high initial investment required for composite manufacturing can act as a barrier to entry for smaller companies. Nevertheless, the long-term outlook for the Asia-Pacific aerospace composites market remains positive, driven by sustained growth in air travel, increasing military spending, and the ongoing technological advancements in composite materials. The major players in the market – including Toho Tenax, Toray Industries, DuPont, Solvay, Mitsubishi Chemical, Hexcel, SGL Carbon, and others – are well-positioned to capitalize on these trends and benefit from the market's expansion. Specific application segments like commercial aircraft are expected to dominate, given the substantial growth in air passenger traffic projected for the region.

Asia-Pacific Aerospace Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific aerospace composites market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth drivers, challenges, and emerging opportunities, equipping you with the knowledge needed to navigate this rapidly evolving sector. The report analyzes market trends, key players, and future projections, providing actionable data to inform your business strategy.

Asia-Pacific Aerospace Composites Market Market Structure & Innovation Trends

The Asia-Pacific aerospace composites market exhibits a moderately concentrated structure, with key players like Toho Tenax (Teijin Carbon Europe GmbH), Toray Industries Inc, DuPont, Solvay SA, and Hexcel Corporation holding significant market share. Estimates suggest these top five companies collectively account for approximately xx% of the market in 2025. Market concentration is influenced by factors such as technological advancements, economies of scale, and stringent regulatory frameworks. Innovation within the industry is driven by the demand for lighter, stronger, and more fuel-efficient aircraft, leading to significant R&D investments in advanced composite materials like carbon fiber reinforced polymers (CFRP) and high-performance thermoplastics.

The regulatory landscape plays a crucial role, with safety and certification standards impacting material selection and manufacturing processes. Product substitutes, such as traditional aluminum alloys, continue to exist, but their market share is gradually decreasing due to the superior performance characteristics of composites. The market is witnessing increased M&A activity, with deal values exceeding xx Million in the past five years, primarily driven by efforts to expand market reach, acquire technological expertise, and consolidate market share. End-user demographics, particularly within the commercial and military aircraft sectors, are largely responsible for shaping market demand, influenced by factors like passenger growth and defense budgets.

Asia-Pacific Aerospace Composites Market Market Dynamics & Trends

The Asia-Pacific aerospace composites market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The burgeoning air travel industry in the region is driving significant demand for new aircraft, leading to increased composite material usage. Technological advancements, such as the development of more durable and cost-effective manufacturing processes, further enhance market expansion. Consumer preferences increasingly favor fuel-efficient aircraft, stimulating the adoption of lighter weight composite materials. Intense competition among leading players fosters innovation and drives down prices, making composites more accessible. Market penetration is expected to reach approximately xx% by 2033, reflecting the growing dominance of composites in aerospace applications. The increasing adoption of advanced technologies like additive manufacturing (3D printing) for composite parts is also a key dynamic shaping the market.

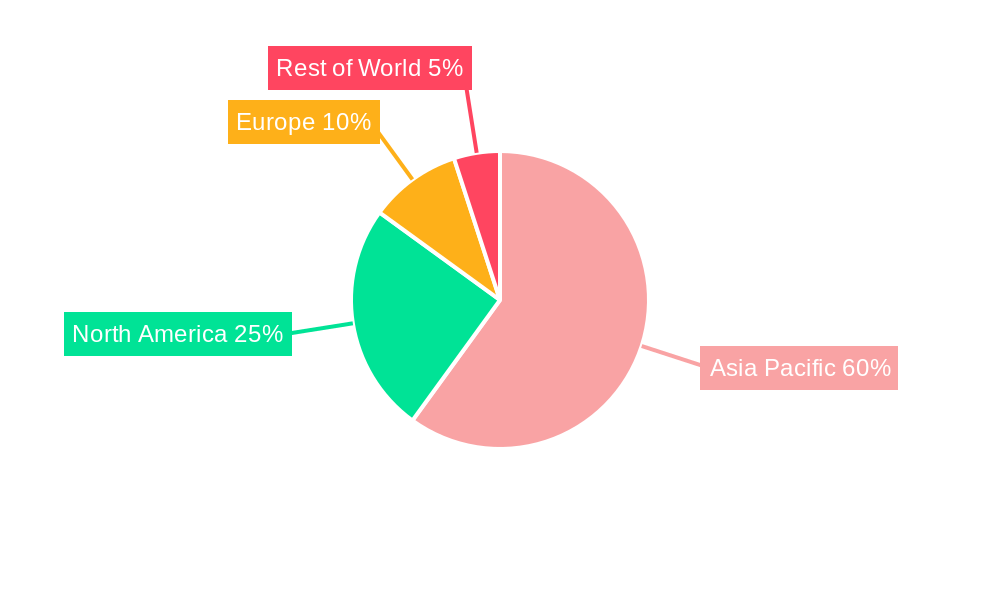

Dominant Regions & Segments in Asia-Pacific Aerospace Composites Market

China emerges as the dominant region in the Asia-Pacific aerospace composites market, driven by substantial investments in its domestic aviation industry, robust economic growth, and supportive government policies promoting technological advancements. Japan and South Korea also hold significant positions, fueled by their established aerospace manufacturing capabilities and strong technological prowess.

- Key Drivers for China:

- Government initiatives supporting indigenous aerospace development.

- Rapid expansion of domestic air travel.

- Increasing investment in military aviation.

- Development of advanced composite manufacturing capabilities.

The Commercial Aircraft segment constitutes the largest share of the market, followed by the Military Aircraft segment. This dominance is attributed to the high volume of commercial aircraft production and the increasing demand for advanced composite materials in military applications. While the General Aviation and Space segments currently hold smaller market shares, they are projected to witness significant growth driven by increasing demand and technological advancements. Detailed analysis reveals China's dominance extends across all application segments. The rapid economic growth and substantial investments in aerospace manufacturing within the country are major factors driving this trend.

Asia-Pacific Aerospace Composites Market Product Innovations

Recent product innovations focus on developing high-strength, lightweight composites with improved fatigue resistance and enhanced thermal properties. This includes advancements in carbon fiber prepreg materials, improved resin systems, and innovative manufacturing processes like automated fiber placement (AFP) and out-of-autoclave (OOA) curing. These advancements address key challenges like manufacturing cost and cycle time, making composite materials increasingly competitive against traditional metallic alloys. The market is also witnessing the emergence of hybrid composite structures, combining different materials to optimize performance characteristics.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific aerospace composites market by application:

Commercial Aircraft: This segment is characterized by high volume production, driving demand for cost-effective composite materials. Market size is projected to reach xx Million by 2033. Competitive dynamics are shaped by large-scale manufacturers of airframes and engines.

Military Aircraft: This segment focuses on high-performance materials with enhanced durability and strength. Market size is estimated at xx Million in 2025. Competitive dynamics are influenced by government procurement processes and defense budgets.

General Aviation Aircraft: This segment presents opportunities for lightweight, cost-effective composites. The market size is xx Million in 2025 and expected to grow. Competitive dynamics are determined by niche players specializing in general aviation aircraft.

Space: This segment demands materials with extreme temperature resistance and high strength-to-weight ratios. The market size is relatively small currently, but it holds significant growth potential. The competitive landscape is dominated by specialized companies involved in aerospace and defense.

Key Drivers of Asia-Pacific Aerospace Composites Market Growth

The growth of the Asia-Pacific aerospace composites market is propelled by several factors: the increasing demand for fuel-efficient aircraft, driven by rising fuel costs and environmental concerns; government initiatives promoting the adoption of advanced materials in aerospace manufacturing; and the continuous improvement of composite materials' performance characteristics. Technological advancements, such as the development of more efficient manufacturing processes and the introduction of novel materials, contribute significantly to market growth. Favorable economic conditions in the region and increasing investments in the aerospace industry further accelerate market expansion. Stringent regulatory frameworks emphasizing safety and environmental standards influence material selection and manufacturing processes.

Challenges in the Asia-Pacific Aerospace Composites Market Sector

The Asia-Pacific aerospace composites market faces several challenges. High initial material costs remain a barrier to wider adoption, particularly in price-sensitive segments. Complex manufacturing processes and the need for specialized expertise add to the overall cost. Supply chain disruptions can significantly impact production, especially given the global nature of the aerospace industry. Intense competition from established players and the emergence of new entrants create pressure on pricing and margins. Regulatory hurdles and stringent certification requirements add complexity to the manufacturing process. These factors influence market growth and profitability.

Emerging Opportunities in Asia-Pacific Aerospace Composites Market

Emerging opportunities exist in the development of next-generation composite materials with superior properties, including self-healing capabilities and improved recyclability. The growing adoption of additive manufacturing (3D printing) for creating complex composite parts opens up new possibilities. Expansion into niche segments, such as unmanned aerial vehicles (UAVs) and hypersonic aircraft, presents promising prospects. Focus on sustainable manufacturing practices and the utilization of recycled materials will also become increasingly important, leading to further opportunities.

Leading Players in the Asia-Pacific Aerospace Composites Market Market

- Toho Tenax (Teijin Carbon Europe GmbH)

- Toray Industries Inc

- DuPont

- Solvay SA

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Hexcel Corporation

- SGL Carbon SE

- Harbin Hafei Airbus Composite Manufacturing Centre Co Ltd

- TATA Advanced Materials Limited

- Korea Composites Inc

Key Developments in Asia-Pacific Aerospace Composites Market Industry

- January 2023: Toho Tenax announced a significant expansion of its carbon fiber production capacity in Japan.

- March 2022: Toray Industries Inc. launched a new high-performance carbon fiber prepreg material for aerospace applications.

- June 2021: A strategic partnership was formed between Hexcel and a major Chinese aerospace manufacturer.

Future Outlook for Asia-Pacific Aerospace Composites Market Market

The Asia-Pacific aerospace composites market is poised for sustained growth, driven by technological advancements, increasing demand for fuel-efficient aircraft, and supportive government policies. Strategic opportunities exist for companies to invest in R&D, expand production capacity, and explore new applications for composite materials. The focus on sustainable manufacturing practices and the development of recyclable composites will shape the future of the market. The market is expected to witness a significant increase in the adoption of advanced composite materials across various aerospace segments, creating promising growth opportunities for leading players and new entrants.

Asia-Pacific Aerospace Composites Market Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation Aircraft

- 1.4. Space

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Aerospace Composites Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South

-

2. Australia

- 2.1. Rest

Asia-Pacific Aerospace Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Aviation is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation Aircraft

- 5.1.4. Space

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Aircraft

- 6.1.2. Military Aircraft

- 6.1.3. General Aviation Aircraft

- 6.1.4. Space

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Asia-Pacific

- 6.2.1.1. China

- 6.2.1.2. India

- 6.2.1.3. Japan

- 6.2.1.4. South Korea

- 6.2.1.5. Australia

- 6.2.1.6. Rest of Asia-Pacific

- 6.2.1. Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Australia Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Aircraft

- 7.1.2. Military Aircraft

- 7.1.3. General Aviation Aircraft

- 7.1.4. Space

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Asia-Pacific

- 7.2.1.1. China

- 7.2.1.2. India

- 7.2.1.3. Japan

- 7.2.1.4. South Korea

- 7.2.1.5. Australia

- 7.2.1.6. Rest of Asia-Pacific

- 7.2.1. Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. China Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 9. Japan Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 10. India Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 11. South Korea Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 12. Taiwan Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 13. Australia Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Asia-Pacific Asia-Pacific Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Toho Tenax (Teijin Carbon Europe GmbH)

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Toray Industries Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 DuPon

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Solvay SA

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Mitsubishi Chemical Carbon Fiber and Composites Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Hexcel Corporation

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 SGL Carbon SE

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Harbin Hafei Airbus Composite Manufacturing Centre Co Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 TATA Advanced Materials Limited

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Korea Composites Inc

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Toho Tenax (Teijin Carbon Europe GmbH)

List of Figures

- Figure 1: Asia-Pacific Aerospace Composites Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Aerospace Composites Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Asia-Pacific Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Rest Asia-Pacific Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Aerospace Composites Market?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the Asia-Pacific Aerospace Composites Market?

Key companies in the market include Toho Tenax (Teijin Carbon Europe GmbH), Toray Industries Inc, DuPon, Solvay SA, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, SGL Carbon SE, Harbin Hafei Airbus Composite Manufacturing Centre Co Ltd, TATA Advanced Materials Limited, Korea Composites Inc.

3. What are the main segments of the Asia-Pacific Aerospace Composites Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.18 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Aviation is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Aerospace Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Aerospace Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Aerospace Composites Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Aerospace Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence