Key Insights

The Asia-Pacific ammonia market is experiencing robust growth, driven by the region's burgeoning fertilizer demand and expanding industrial applications. The period between 2019 and 2024 witnessed significant expansion, laying a strong foundation for continued expansion through 2033. While precise market size figures for previous years are unavailable, industry analysis suggests a considerable market size in 2025, exceeding several billion USD, reflecting the increasing importance of ammonia as a key agricultural input and in various industrial processes across the region. The significant growth is fueled by factors including rising agricultural production to meet the food security needs of a rapidly growing population, increasing industrialization leading to a higher demand for ammonia-based products in sectors such as manufacturing and textiles, and government initiatives promoting sustainable agricultural practices. However, fluctuating energy prices and environmental regulations related to ammonia production and usage pose challenges to consistent growth.

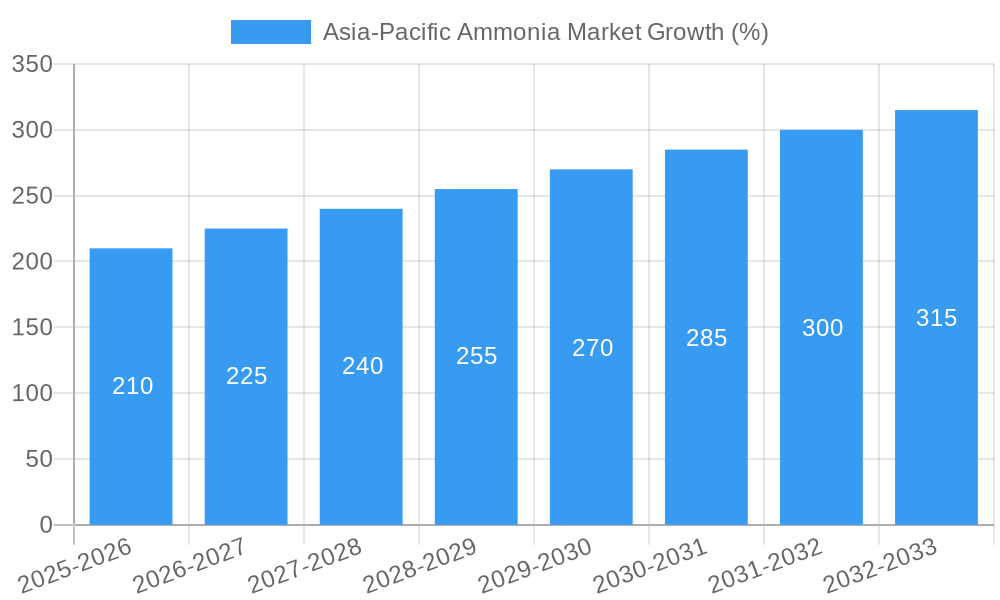

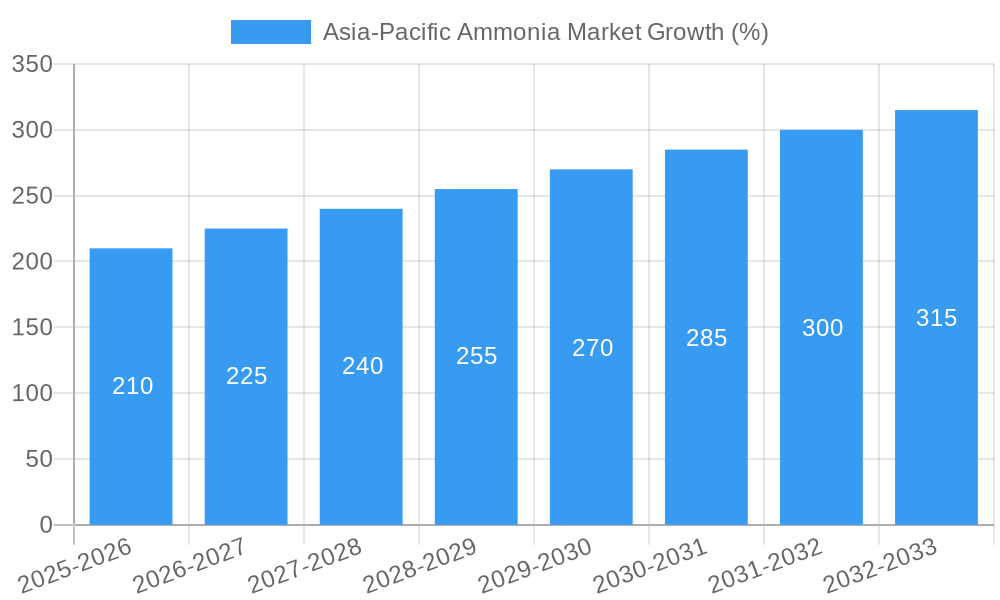

Looking ahead to the forecast period (2025-2033), the Asia-Pacific ammonia market is projected to maintain a healthy Compound Annual Growth Rate (CAGR), albeit potentially moderating slightly from the earlier period. Continued investment in fertilizer production infrastructure, coupled with technological advancements in ammonia synthesis and distribution, will contribute to this positive trajectory. The specific CAGR will depend on various factors, including global economic conditions, agricultural policies, and the pace of industrial growth within the region. Nevertheless, the overall outlook remains optimistic, projecting substantial market expansion throughout the forecast period, driven by the fundamental needs for food and industrial goods in a rapidly developing Asia-Pacific.

Asia-Pacific Ammonia Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Ammonia Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The study includes detailed segmentation analysis, competitive landscape assessment, and key development updates. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia-Pacific Ammonia Market Market Structure & Innovation Trends

This section analyzes the market structure of the Asia-Pacific Ammonia Market, focusing on concentration, innovation, regulations, substitutes, end-user demographics, and mergers & acquisitions (M&A). We examine market share distribution among key players like BASF SE, CF Industries Holdings Inc., and Yara, highlighting the competitive landscape. The report also delves into the influence of regulatory frameworks on market growth and the impact of technological innovations on product development and market penetration. M&A activities are analyzed, including deal values and their implications for market consolidation. Specific examples of innovative technologies and their market adoption rates are detailed, alongside an assessment of the impact of substitute products and changing end-user demographics. The report quantifies market concentration using the Herfindahl-Hirschman Index (HHI) and provides a breakdown of market share held by top players, along with a comprehensive analysis of recent M&A activities, including estimated deal values in Millions.

Asia-Pacific Ammonia Market Market Dynamics & Trends

This section explores the key factors driving market growth, including increasing demand from fertilizers, industrial applications, and the burgeoning green ammonia sector. We analyze technological disruptions like advancements in ammonia production processes and the rising adoption of renewable energy sources for ammonia synthesis. Consumer preferences, particularly the shift towards sustainable and environmentally friendly products, are examined, along with a detailed competitive analysis focusing on pricing strategies, product differentiation, and market penetration of key players. The analysis incorporates specific metrics, such as CAGR for different market segments, market penetration rates for new technologies, and the impact of evolving consumer preferences on market demand. Growth trends in various end-use industries and the impact of government policies and regulations are thoroughly investigated.

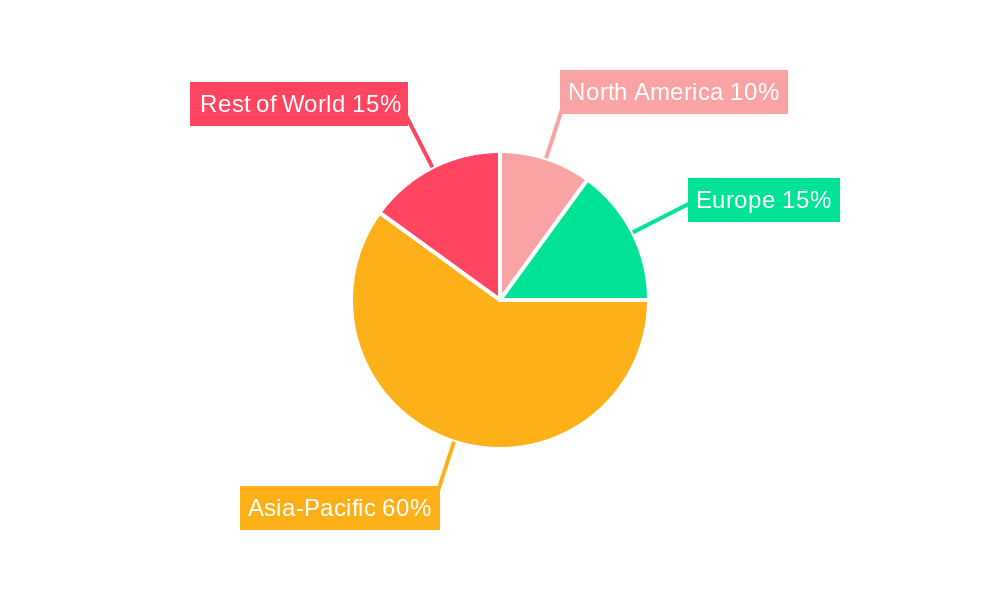

Dominant Regions & Segments in Asia-Pacific Ammonia Market

This section identifies the dominant regions and segments within the Asia-Pacific Ammonia Market. We analyze factors contributing to regional dominance, such as economic policies favoring fertilizer production, robust infrastructure supporting logistics, and established industrial bases. A detailed analysis of each leading region or country is provided, including:

- Key Drivers: Economic policies, infrastructure development, government support for agricultural sector.

- Market Size & Growth: Detailed analysis of past, current, and projected market size in Millions.

- Competitive Landscape: Assessment of major players and their market share in each region.

Asia-Pacific Ammonia Market Product Innovations

This section summarizes recent product developments and applications within the Asia-Pacific Ammonia market. It highlights technological advancements such as improved production efficiency, reduced energy consumption, and the emergence of green ammonia production methods. The competitive advantages offered by these innovations, including cost reductions, environmental benefits, and enhanced product performance, are discussed, along with an assessment of market fit and adoption rates.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Asia-Pacific Ammonia market. This includes segmentation by: [Specific segments will be detailed here based on available data - e.g., by application (fertilizers, industrial chemicals), by production method (conventional, green), by region (India, China, Australia etc.)]. Each segment's growth projections, market sizes in Millions, and competitive dynamics are analyzed in detail.

Key Drivers of Asia-Pacific Ammonia Market Growth

Several factors fuel the growth of the Asia-Pacific Ammonia Market. These include: increasing demand from the agricultural sector, driven by population growth and rising food consumption; industrial applications of ammonia in various sectors; government initiatives promoting sustainable agriculture and green technologies; and continuous technological advancements leading to improved production efficiency and cost reduction. The impact of these drivers is quantified wherever possible.

Challenges in the Asia-Pacific Ammonia Market Sector

The Asia-Pacific Ammonia Market faces several challenges. These include fluctuating raw material prices, stringent environmental regulations, intense competition among existing players, and potential supply chain disruptions. The report quantifies the impact of these challenges on market growth and profitability.

Emerging Opportunities in Asia-Pacific Ammonia Market

The Asia-Pacific Ammonia Market presents significant emerging opportunities. These include the growing demand for green ammonia as a sustainable alternative, the expansion of ammonia-based hydrogen technologies, and the exploration of new applications in sectors such as transportation and energy storage. The report explores the potential of these opportunities and their impact on future market growth.

Leading Players in the Asia-Pacific Ammonia Market Market

- BASF SE (BASF SE)

- CF Industries Holdings Inc. (CF Industries Holdings Inc.)

- Chambal Fertilizers and Chemicals Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- IFFCO

- Indorama Corporation

- National Fertilizers Limited

- Petroliam Nasional Berhad (PETRONAS) (PETRONAS)

- Pride-Chem Industries

- Rashtriya Chemicals and Fertilizers Limited

- SABIC (SABIC)

- Yara (Yara)

- List Not Exhaustive

Key Developments in Asia-Pacific Ammonia Market Industry

- October 2023: Gentari (Petronas) and AM Green partnered with GIC to invest USD 2 Billion in green ammonia production in India (5,000 kilotons annually by 2030). This significantly boosts the green ammonia segment.

- July 2024: Rashtriya Chemicals and Fertilizers Limited contracted Topsoe AS to revamp its ammonia plant in Thal, India, aiming for reduced energy consumption. This showcases efforts towards operational efficiency and sustainability.

Future Outlook for Asia-Pacific Ammonia Market Market

The Asia-Pacific Ammonia Market is poised for robust growth, driven by increasing demand, technological advancements, and supportive government policies. The rising adoption of green ammonia, coupled with the expansion of applications beyond fertilizers, will create significant opportunities for market players. Strategic partnerships, investments in research and development, and a focus on sustainability will be crucial for success in this dynamic market. The market is expected to experience sustained growth, driven by factors such as increasing agricultural needs, industrial demand, and the global push towards cleaner energy sources.

Asia-Pacific Ammonia Market Segmentation

-

1. Type

- 1.1. Liquid

- 1.2. Gas

-

2. End-user Industry

- 2.1. Agriculture

- 2.2. Textile

- 2.3. Mining

- 2.4. Pharmaceutical

- 2.5. Refrigeration

- 2.6. Other End-user Industries

Asia-Pacific Ammonia Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Ammonia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives

- 3.3. Market Restrains

- 3.3.1. Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives

- 3.4. Market Trends

- 3.4.1. Expanding Agricultural Industry Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Ammonia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Liquid

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Agriculture

- 5.2.2. Textile

- 5.2.3. Mining

- 5.2.4. Pharmaceutical

- 5.2.5. Refrigeration

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CF Industries Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chambal Fertilizers and Chemicals Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat Narmada Valley Fertilizers & Chemicals Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IFFCO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Indorama Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 National Fertilizers Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petroliam Nasional Berhad (PETRONAS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pride-Chem Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rashtriya Chemicals and Fertilizers Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SABIC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Yara*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: Asia-Pacific Ammonia Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Ammonia Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Ammonia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Ammonia Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Ammonia Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia-Pacific Ammonia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Ammonia Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Asia-Pacific Ammonia Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: Asia-Pacific Ammonia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: New Zealand Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Malaysia Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Thailand Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Vietnam Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Philippines Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Ammonia Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Asia-Pacific Ammonia Market?

Key companies in the market include BASF SE, CF Industries Holdings Inc, Chambal Fertilizers and Chemicals Limited, Gujarat Narmada Valley Fertilizers & Chemicals Limited, IFFCO, Indorama Corporation, National Fertilizers Limited, Petroliam Nasional Berhad (PETRONAS), Pride-Chem Industries, Rashtriya Chemicals and Fertilizers Limited, SABIC, Yara*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Ammonia Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives.

6. What are the notable trends driving market growth?

Expanding Agricultural Industry Driving Market Growth.

7. Are there any restraints impacting market growth?

Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives.

8. Can you provide examples of recent developments in the market?

July 2024: Rashtriya Chemicals and Fertilizers Limited approved a contract with Topsoe AS to revamp its ammonia plant in Thal, Maharashtra, India. The contract includes procuring a basic engineering design package and supplying proprietary equipment and catalysts. This project targets reducing the plant's specific energy consumption.October 2023: Gentari, the clean energy arm of Malaysia’s Petroliam Nasional Bhd (Petronas), and AM Green, a producer specializing in hydrogen and ammonia, signed agreements with Singapore's investment entity, GIC. Together, they committed a substantial USD 2 billion to a shared goal of producing 5,000 kilotons annually of green ammonia in India by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Ammonia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Ammonia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Ammonia Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Ammonia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence