Key Insights

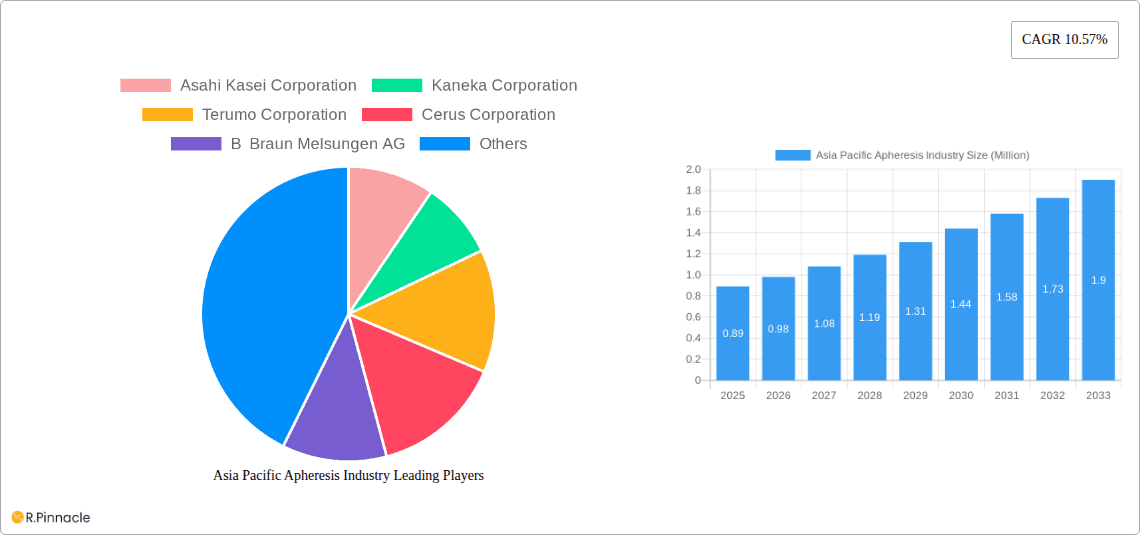

The Asia Pacific Apheresis market is poised for significant expansion, with a current valuation of USD 0.74 billion expected to surge in the coming years. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 10.57% projected from 2019 to 2033, indicating a dynamic and thriving industry. The market's expansion is primarily fueled by increasing awareness and diagnosis of chronic conditions, particularly renal disorders, which necessitate apheresis procedures for effective management. Advancements in apheresis technology, leading to more efficient and less invasive treatments, are further propelling market adoption. Additionally, the rising prevalence of hematological and autoimmune disorders, coupled with growing healthcare expenditures across the region, are creating substantial demand for apheresis services and associated products. The strategic focus of leading companies on expanding their product portfolios and enhancing their distribution networks within key Asian markets also contributes to this upward trajectory.

Asia Pacific Apheresis Industry Market Size (In Million)

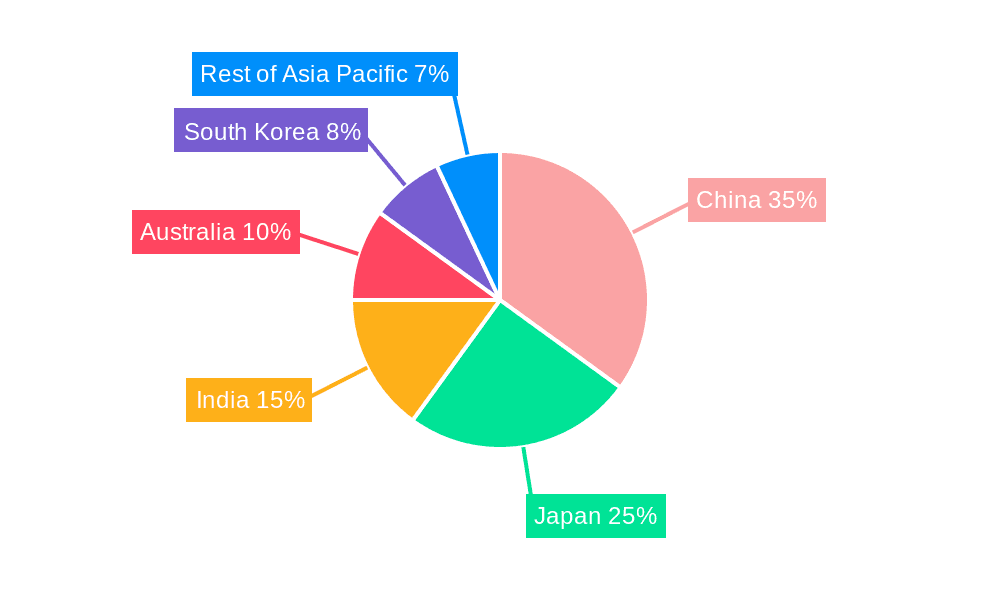

The apheresis market in Asia Pacific is characterized by a diverse range of applications and a competitive landscape. The 'Devices' segment is expected to lead revenue generation, driven by technological innovations and increasing adoption of sophisticated apheresis machines. Complementing this are the 'Disposables' which will see consistent demand due to the procedural nature of apheresis. Geographically, China, with its vast population and burgeoning healthcare infrastructure, is anticipated to be the largest market, followed by Japan and India, which are actively investing in advanced medical technologies. The 'Plasmapheresis' procedure segment is projected to dominate, reflecting its critical role in treating a wide array of conditions. Emerging trends include the development of point-of-care apheresis solutions and a growing interest in therapeutic apheresis for novel indications, all of which will shape the market's future trajectory and innovation within the Asia Pacific region.

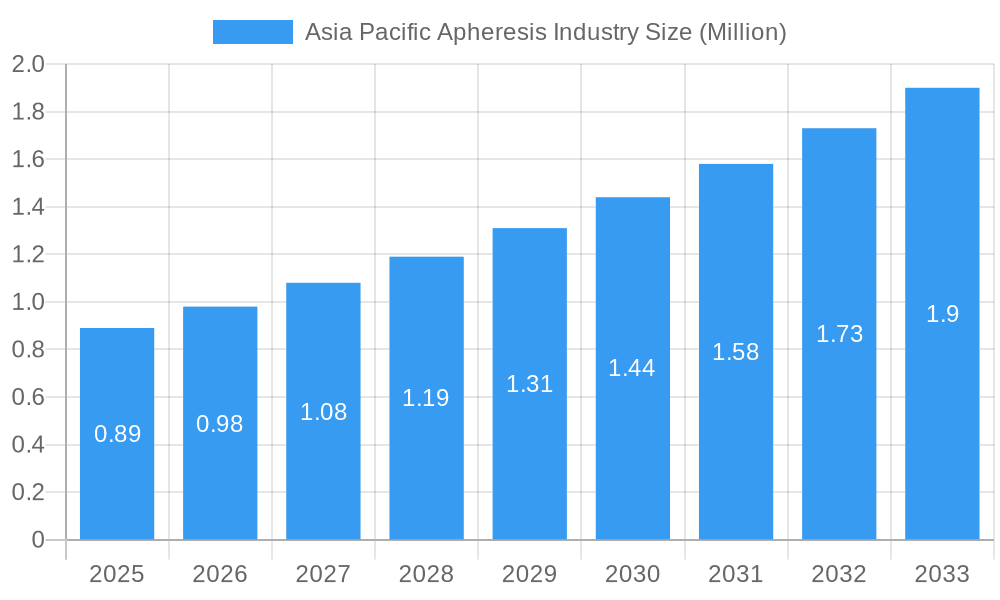

Asia Pacific Apheresis Industry Company Market Share

This in-depth report provides a detailed analysis of the Asia Pacific Apheresis Industry, a rapidly evolving sector critical for advanced medical treatments. Leveraging extensive data and expert insights, we explore market dynamics, key players, technological advancements, and future growth opportunities across the region. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, encompassing historical data from 2019–2024. Discover actionable intelligence for strategic decision-making in this vital healthcare market.

Asia Pacific Apheresis Industry Market Structure & Innovation Trends

The Asia Pacific Apheresis Industry exhibits a moderately concentrated market structure, with leading players like Asahi Kasei Corporation, Kaneka Corporation, and Terumo Corporation holding significant market shares. Innovation is a key driver, fueled by advancements in apheresis device technology and the development of novel disposable kits. Regulatory frameworks across countries like Japan and South Korea are becoming increasingly supportive of new therapeutic applications for apheresis, although variations exist. Product substitutes are limited given the highly specialized nature of apheresis procedures, primarily focusing on blood component separation. End-user demographics are shifting towards an aging population and a rising prevalence of chronic diseases, increasing the demand for apheresis therapies. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to expand their product portfolios and geographical reach. For instance, recent M&A deals in the broader medical device sector, though not specific to apheresis, have seen valuations in the range of hundreds of millions to billions of USD, indicating potential investment appetite. The market share of top players is estimated to be over 60%.

Asia Pacific Apheresis Industry Market Dynamics & Trends

The Asia Pacific Apheresis Industry is poised for robust growth, driven by an increasing prevalence of hematological and autoimmune disorders, coupled with a rising awareness of advanced therapeutic options. The adoption of sophisticated apheresis devices and disposables is accelerating, supported by improving healthcare infrastructure and increased disposable income in emerging economies within the region. Technological advancements, particularly in automation and precision of apheresis machines, are enhancing procedure efficiency and patient safety, thereby boosting market penetration. Consumer preferences are shifting towards minimally invasive and targeted therapies, with apheresis offering a unique solution for a range of conditions. Competitive dynamics are intensifying, with both established global players and emerging local manufacturers vying for market share. The projected Compound Annual Growth Rate (CAGR) for the Asia Pacific apheresis market is approximately 7.5% to 9.0% over the forecast period. Market penetration is currently estimated at around 30-40% for key indications, with significant room for expansion. The growing demand for specialized treatments like therapeutic plasma exchange and stem cell collection for transplants further propels market expansion. Furthermore, the increasing focus on personalized medicine and the development of targeted cellular therapies are creating new avenues for apheresis applications. The rising incidence of chronic diseases such as kidney disorders and cardiovascular conditions also necessitates the use of apheresis for managing specific complications and improving patient outcomes, contributing significantly to the market's upward trajectory.

Dominant Regions & Segments in Asia Pacific Apheresis Industry

China currently stands as the dominant region in the Asia Pacific Apheresis Industry, driven by its vast population, increasing healthcare expenditure, and growing adoption of advanced medical technologies. The country's strong economic policies and substantial investments in healthcare infrastructure have facilitated the widespread implementation of apheresis procedures.

- Key Drivers in China:

- High Prevalence of Chronic Diseases: A significant burden of renal disorders and hematological disorders necessitates the application of apheresis.

- Government Initiatives: Supportive government policies aimed at improving healthcare access and quality.

- Growing R&D Investments: Increased focus on developing and adopting innovative medical devices.

Japan follows closely, characterized by its advanced healthcare system, early adoption of innovative medical technologies, and a high concentration of elderly patients requiring specialized treatments. Its regulatory environment is well-established, and the market exhibits a mature demand for high-quality apheresis products.

- Key Drivers in Japan:

- Aging Population: A higher proportion of elderly individuals with age-related conditions often benefiting from apheresis.

- Technological Sophistication: Strong domestic manufacturing capabilities and a receptive market for advanced medical equipment.

- Robust Reimbursement Policies: Comprehensive healthcare coverage supporting complex medical procedures.

In terms of Product Segmentation, Devices hold a substantial market share due to the initial capital investment required for apheresis machines. However, the Disposables segment is experiencing rapid growth driven by the recurring need for consumables like blood tubing sets, collection bags, and filters, crucial for each apheresis procedure.

- Dominance of Devices: High initial cost and long lifespan make devices a significant market segment.

- Growth in Disposables: Increasing procedure volumes directly translate to higher demand for disposable components.

Within Indication Segmentation, Hematological Disorders and Renal Disorders are leading areas, reflecting the widespread use of apheresis in managing conditions like sickle cell disease, thalassemia, and certain kidney failure complications requiring plasma exchange.

- Prevalence of Hematological Disorders: A substantial patient base requires regular apheresis for treatment.

- Management of Renal Disorders: Therapeutic plasma exchange is a common intervention for various kidney diseases.

The Plasmapheresis Procedure dominates the market, being the most common form of apheresis used for a broad range of therapeutic applications, including the removal of harmful antibodies, toxins, and abnormal proteins from the blood.

- Versatility of Plasmapheresis: Applicable across a wide spectrum of diseases and conditions.

- Established Protocols: Well-defined clinical guidelines support its widespread use.

South Korea is also a significant contributor, demonstrating rapid growth due to its advanced healthcare infrastructure, high patient awareness, and strong focus on medical innovation.

- Key Drivers in South Korea:

- Advanced Medical Tourism: Attracting international patients for specialized treatments.

- Government Support for MedTech: Policies encouraging research and development in the medical technology sector.

Asia Pacific Apheresis Industry Product Innovations

Product innovations in the Asia Pacific Apheresis Industry are primarily focused on enhancing the efficiency, safety, and user-friendliness of apheresis devices and disposables. Companies are developing more compact and portable devices, enabling bedside procedures and improving patient comfort. Advancements in filtration technologies are leading to more precise and effective separation of blood components, while single-use disposables are designed to minimize contamination risks and streamline workflows. The integration of smart technologies for real-time monitoring and data logging is also a key trend, offering improved patient management and research capabilities. These innovations aim to reduce procedural times, minimize adverse events, and expand the therapeutic applications of apheresis.

Report Scope & Segmentation Analysis

The Asia Pacific Apheresis Industry report encompasses a comprehensive segmentation analysis. The Product segment is divided into Devices and Disposables, with Devices representing the capital expenditure and Disposables reflecting ongoing procedural costs. The Indication segment covers Renal Disorders, Hematological Disorders, Neurological Disorders, Autoimmune Disorders, and Other Indications, each representing distinct patient populations and treatment needs. The Procedure segment breaks down into Plasmapheresis, Plateletpheresis, Erythrocytapheresis, Leukapheresis, and Other Procedures, highlighting the various methods of blood component separation. Geographically, the market is analyzed across China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific, providing granular insights into regional market dynamics and growth projections.

Key Drivers of Asia Pacific Apheresis Industry Growth

The Asia Pacific Apheresis Industry is propelled by several key drivers. The increasing global incidence of chronic diseases such as hematological disorders, autoimmune diseases, and renal conditions directly fuels the demand for apheresis therapies. Technological advancements in apheresis devices, leading to enhanced precision, efficiency, and patient safety, are crucial accelerators. Furthermore, expanding healthcare infrastructure and rising per capita income in emerging economies within Asia Pacific are improving access to advanced medical treatments. Supportive government initiatives and favorable reimbursement policies in various countries are also playing a significant role in market growth. For example, increased government funding for chronic disease management programs in countries like India and China is directly impacting the demand for apheresis.

Challenges in the Asia Pacific Apheresis Industry Sector

Despite its growth, the Asia Pacific Apheresis Industry faces several challenges. High initial costs associated with apheresis devices can be a barrier to adoption, particularly for smaller healthcare facilities in developing regions. Stringent regulatory approval processes for new devices and consumables can lead to delayed market entry. The availability of skilled healthcare professionals trained in operating apheresis equipment and managing patient care also presents a constraint in some areas. Moreover, fluctuating raw material prices for disposables and complexities in supply chain management can impact profitability and product availability. The competitive landscape, while driving innovation, also poses challenges in terms of market share acquisition and pricing pressures.

Emerging Opportunities in Asia Pacific Apheresis Industry

Emerging opportunities in the Asia Pacific Apheresis Industry lie in the expanding therapeutic applications of apheresis beyond traditional uses. The growing focus on personalized medicine and cell-based therapies, such as CAR T-cell therapy, is creating new demand for apheresis in stem cell collection. The development of point-of-care apheresis devices that are more portable and cost-effective presents a significant opportunity for market penetration in remote or resource-limited areas. Furthermore, increasing research into the use of apheresis for managing novel or rare diseases, alongside greater patient and physician awareness, will unlock new market segments. The untapped potential in countries like India and Southeast Asian nations, with their large populations and growing healthcare needs, offers substantial growth avenues.

Leading Players in the Asia Pacific Apheresis Industry Market

- Asahi Kasei Corporation

- Kaneka Corporation

- Terumo Corporation

- Cerus Corporation

- B Braun Melsungen AG

- Fresenius SE & Co KGaA

Key Developments in Asia Pacific Apheresis Industry Industry

- 2023: Launch of next-generation apheresis devices with enhanced automation and user interface by Terumo Corporation, improving procedural efficiency.

- 2023: Asahi Kasei Corporation expanded its production capacity for apheresis disposables to meet growing regional demand, particularly in China and India.

- 2022: Cerus Corporation received regulatory approval in several Asia Pacific countries for its pathogen-inactivation technology for platelet and plasma products, enhancing safety.

- 2022: B Braun Melsungen AG introduced a new line of advanced apheresis filters designed for improved patient outcomes and reduced procedure times.

- 2021: Fresenius SE & Co KGaA partnered with a leading hospital group in South Korea to enhance apheresis services and training programs.

- 2020: Increased adoption of therapeutic plasma exchange for autoimmune disorders in India, driven by rising awareness and improved accessibility of treatment protocols.

Future Outlook for Asia Pacific Apheresis Industry Market

The future outlook for the Asia Pacific Apheresis Industry is highly promising, driven by sustained growth in the prevalence of chronic diseases and rapid technological advancements. The increasing adoption of personalized medicine and cell therapy will significantly boost the demand for specialized apheresis procedures. Investments in healthcare infrastructure and a growing emphasis on preventative and advanced care within the region will further accelerate market expansion. Companies that can innovate in terms of device miniaturization, cost-effectiveness, and enhanced disposables, while also navigating diverse regulatory landscapes, are best positioned for success. The growing disposable income and increasing health consciousness among consumers will continue to support the demand for high-quality apheresis treatments, making Asia Pacific a critical growth engine for the global apheresis market.

Asia Pacific Apheresis Industry Segmentation

-

1. Product

- 1.1. Devices

- 1.2. Disposables

-

2. Indication

- 2.1. Renal Disorders

- 2.2. Hematological Disorders

- 2.3. Neurological Disorders

- 2.4. Autoimmune Disorders

- 2.5. Other Indications

-

3. Procedure

- 3.1. Plasmapheresis

- 3.2. Plateletpheresis

- 3.3. Erythrocytapheresis

- 3.4. Leukapheresis

- 3.5. Other Procedures

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia Pacific

Asia Pacific Apheresis Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia Pacific Apheresis Industry Regional Market Share

Geographic Coverage of Asia Pacific Apheresis Industry

Asia Pacific Apheresis Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Disease Burden in Asia; Rise in Demand for Blood Components and Associated Safety; Technological Advancement in the Development of New Apheresis Techniques

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Cost Associated with Apheresis Procedures; Risk of Blood Contamination

- 3.4. Market Trends

- 3.4.1. Neurological Disorders is Expected to Grow with High CAGR in the Indication Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Devices

- 5.1.2. Disposables

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Renal Disorders

- 5.2.2. Hematological Disorders

- 5.2.3. Neurological Disorders

- 5.2.4. Autoimmune Disorders

- 5.2.5. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by Procedure

- 5.3.1. Plasmapheresis

- 5.3.2. Plateletpheresis

- 5.3.3. Erythrocytapheresis

- 5.3.4. Leukapheresis

- 5.3.5. Other Procedures

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Devices

- 6.1.2. Disposables

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Renal Disorders

- 6.2.2. Hematological Disorders

- 6.2.3. Neurological Disorders

- 6.2.4. Autoimmune Disorders

- 6.2.5. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by Procedure

- 6.3.1. Plasmapheresis

- 6.3.2. Plateletpheresis

- 6.3.3. Erythrocytapheresis

- 6.3.4. Leukapheresis

- 6.3.5. Other Procedures

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Devices

- 7.1.2. Disposables

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Renal Disorders

- 7.2.2. Hematological Disorders

- 7.2.3. Neurological Disorders

- 7.2.4. Autoimmune Disorders

- 7.2.5. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by Procedure

- 7.3.1. Plasmapheresis

- 7.3.2. Plateletpheresis

- 7.3.3. Erythrocytapheresis

- 7.3.4. Leukapheresis

- 7.3.5. Other Procedures

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Devices

- 8.1.2. Disposables

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Renal Disorders

- 8.2.2. Hematological Disorders

- 8.2.3. Neurological Disorders

- 8.2.4. Autoimmune Disorders

- 8.2.5. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by Procedure

- 8.3.1. Plasmapheresis

- 8.3.2. Plateletpheresis

- 8.3.3. Erythrocytapheresis

- 8.3.4. Leukapheresis

- 8.3.5. Other Procedures

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Devices

- 9.1.2. Disposables

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Renal Disorders

- 9.2.2. Hematological Disorders

- 9.2.3. Neurological Disorders

- 9.2.4. Autoimmune Disorders

- 9.2.5. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by Procedure

- 9.3.1. Plasmapheresis

- 9.3.2. Plateletpheresis

- 9.3.3. Erythrocytapheresis

- 9.3.4. Leukapheresis

- 9.3.5. Other Procedures

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Devices

- 10.1.2. Disposables

- 10.2. Market Analysis, Insights and Forecast - by Indication

- 10.2.1. Renal Disorders

- 10.2.2. Hematological Disorders

- 10.2.3. Neurological Disorders

- 10.2.4. Autoimmune Disorders

- 10.2.5. Other Indications

- 10.3. Market Analysis, Insights and Forecast - by Procedure

- 10.3.1. Plasmapheresis

- 10.3.2. Plateletpheresis

- 10.3.3. Erythrocytapheresis

- 10.3.4. Leukapheresis

- 10.3.5. Other Procedures

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia Pacific Apheresis Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Devices

- 11.1.2. Disposables

- 11.2. Market Analysis, Insights and Forecast - by Indication

- 11.2.1. Renal Disorders

- 11.2.2. Hematological Disorders

- 11.2.3. Neurological Disorders

- 11.2.4. Autoimmune Disorders

- 11.2.5. Other Indications

- 11.3. Market Analysis, Insights and Forecast - by Procedure

- 11.3.1. Plasmapheresis

- 11.3.2. Plateletpheresis

- 11.3.3. Erythrocytapheresis

- 11.3.4. Leukapheresis

- 11.3.5. Other Procedures

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Asahi Kasei Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kaneka Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Terumo Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cerus Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 B Braun Melsungen AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fresenius SE & Co KGaA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 Asahi Kasei Corporation

List of Figures

- Figure 1: Asia Pacific Apheresis Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Apheresis Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 4: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 5: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 6: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 7: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Asia Pacific Apheresis Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 13: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 14: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 15: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 16: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 17: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Asia Pacific Apheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 22: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 23: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 24: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 25: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 26: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 27: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Asia Pacific Apheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 32: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 33: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 34: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 35: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 36: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 37: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia Pacific Apheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 42: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 43: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 44: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 45: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 46: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 47: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Asia Pacific Apheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 52: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 53: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 54: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 55: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 56: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 57: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Asia Pacific Apheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Asia Pacific Apheresis Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 62: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 63: Asia Pacific Apheresis Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 64: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 65: Asia Pacific Apheresis Industry Revenue Million Forecast, by Procedure 2020 & 2033

- Table 66: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 67: Asia Pacific Apheresis Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 68: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Asia Pacific Apheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Asia Pacific Apheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Apheresis Industry?

The projected CAGR is approximately 10.57%.

2. Which companies are prominent players in the Asia Pacific Apheresis Industry?

Key companies in the market include Asahi Kasei Corporation, Kaneka Corporation, Terumo Corporation, Cerus Corporation, B Braun Melsungen AG, Fresenius SE & Co KGaA.

3. What are the main segments of the Asia Pacific Apheresis Industry?

The market segments include Product, Indication, Procedure, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.74 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Disease Burden in Asia; Rise in Demand for Blood Components and Associated Safety; Technological Advancement in the Development of New Apheresis Techniques.

6. What are the notable trends driving market growth?

Neurological Disorders is Expected to Grow with High CAGR in the Indication Segment.

7. Are there any restraints impacting market growth?

; High Capital Investment and Cost Associated with Apheresis Procedures; Risk of Blood Contamination.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Apheresis Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Apheresis Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Apheresis Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Apheresis Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence