Key Insights

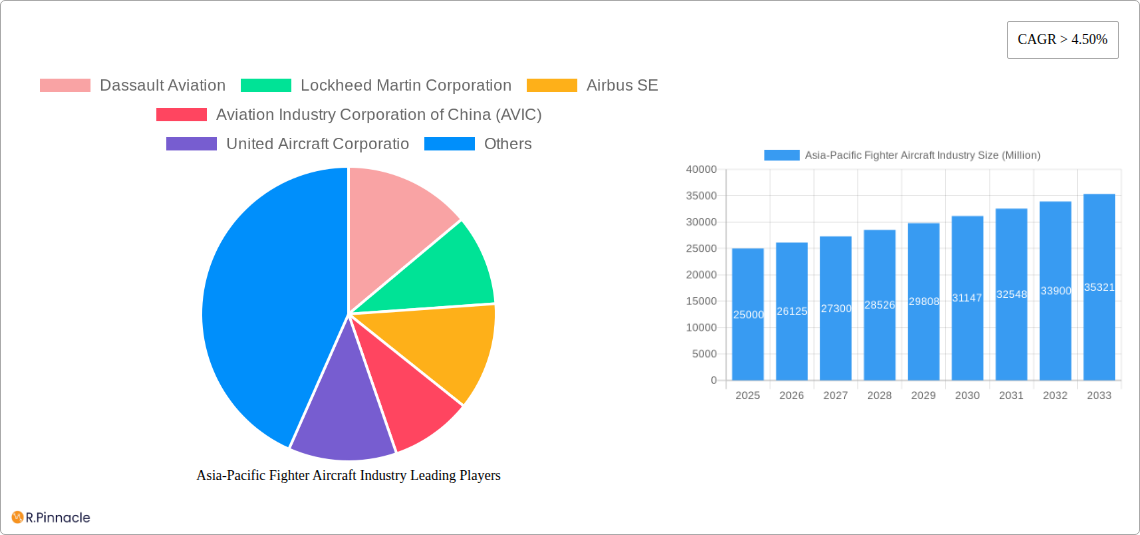

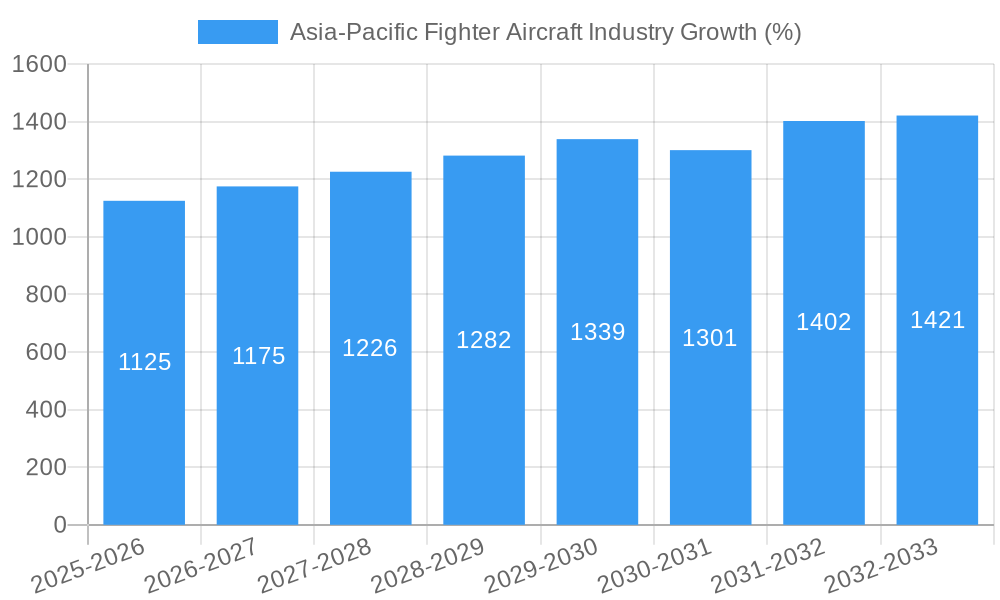

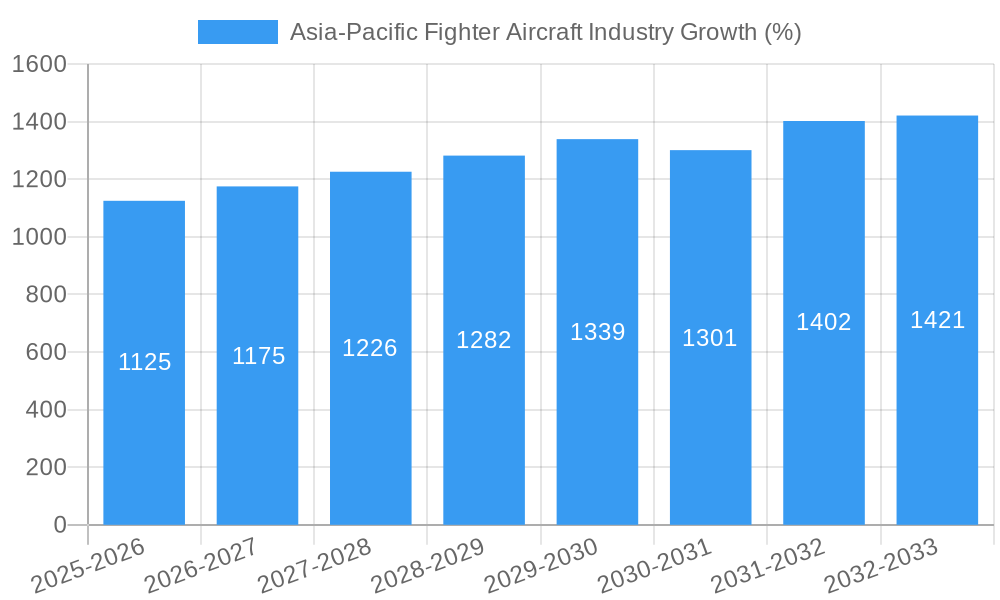

The Asia-Pacific fighter aircraft market is experiencing robust growth, driven by escalating geopolitical tensions, modernization of existing fleets, and increasing defense budgets across the region. The market, estimated at $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2025 to 2033. This growth is fueled by significant investments in advanced aerial combat capabilities by major players such as China, India, Japan, and South Korea. These nations are actively seeking to enhance their air power projection capabilities, leading to substantial procurement of both domestically produced and internationally sourced fighter aircraft. The demand is further spurred by technological advancements in areas like stealth technology, advanced sensors, and improved avionics, pushing nations to upgrade their aging fleets to maintain a competitive edge. The segment encompassing advanced technologies like short take-off and landing (STOL) and vertical take-off and landing (VTOL) capabilities is anticipated to witness particularly strong growth due to their strategic advantages in diverse terrains and operational scenarios prevalent in the Asia-Pacific region.

Several factors, however, could potentially restrain market growth. These include economic fluctuations impacting defense spending, technological limitations in specific areas like engine performance and materials science, and the complexities involved in international collaborations for co-development and procurement of advanced fighter aircraft. Despite these challenges, the overall market outlook remains positive, underpinned by continued geopolitical instability and the unwavering commitment of major Asia-Pacific nations to modernizing their air forces. The leading players, including Dassault Aviation, Lockheed Martin, Airbus SE, and AVIC, are strategically positioned to benefit from this expanding market, focusing on technological innovation and tailored solutions to meet the diverse requirements of their customers in the region. The competitive landscape is expected to remain intensely competitive as these companies vie for contracts and partnerships.

Asia-Pacific Fighter Aircraft Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Asia-Pacific fighter aircraft industry, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, technological advancements, and competitive landscapes to illuminate the future of this vital sector. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence, enabling informed strategic planning and investment decisions.

Asia-Pacific Fighter Aircraft Industry Market Structure & Innovation Trends

This section analyzes the market structure of the Asia-Pacific fighter aircraft industry, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The Asia-Pacific region exhibits a moderately concentrated market, with key players holding significant market share. The market share of the top five players is estimated at xx%. Innovation is driven by the need for advanced stealth technology, improved avionics, and enhanced maneuverability. Stringent regulatory frameworks govern the production and export of fighter aircraft, influencing market dynamics. The rising adoption of unmanned combat aerial vehicles (UCAVs) presents a key substitute. The primary end-users are national air forces, with evolving defense budgets significantly impacting demand. Significant M&A activity has been observed in the past five years, with total deal values estimated at $xx Million.

- Market Concentration: Top 5 players hold xx% market share (2025 estimate).

- Innovation Drivers: Stealth technology, advanced avionics, enhanced maneuverability.

- Regulatory Frameworks: Stringent export controls and safety standards.

- Product Substitutes: Increasing adoption of UCAVs.

- M&A Activity (2019-2024): Total deal value estimated at $xx Million.

Asia-Pacific Fighter Aircraft Industry Market Dynamics & Trends

The Asia-Pacific fighter aircraft market is experiencing robust growth, driven by increasing geopolitical tensions, modernization of existing fleets, and technological advancements. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%. Technological disruptions, such as the integration of artificial intelligence and advanced sensors, are transforming the industry. Consumer preferences (i.e., national air forces) are shifting towards multi-role fighters with enhanced capabilities. Intense competition among established players and the emergence of new entrants are shaping market dynamics. Market penetration of advanced technologies is expected to reach xx% by 2033.

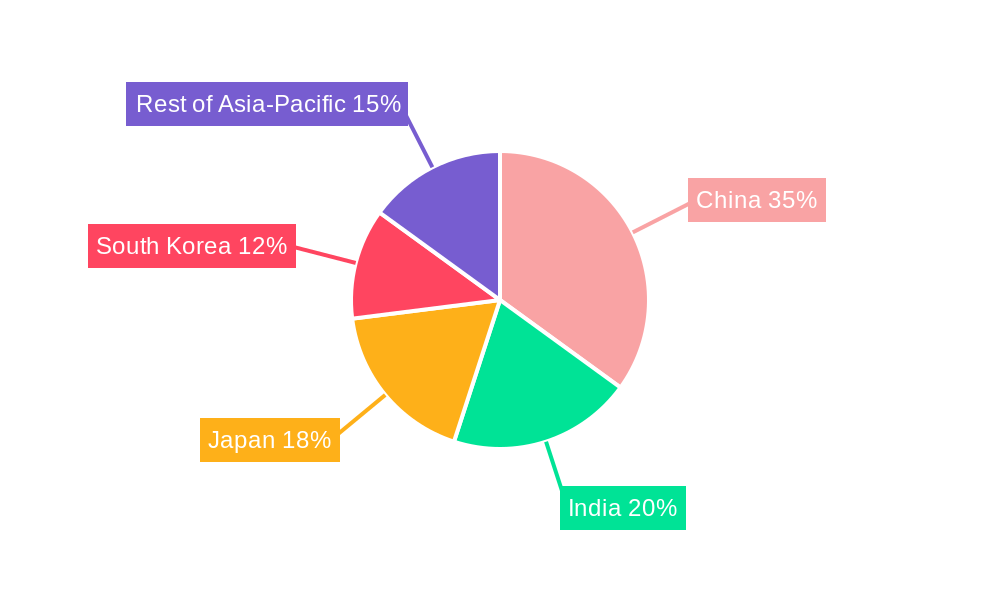

Dominant Regions & Segments in Asia-Pacific Fighter Aircraft Industry

The report identifies key regions and segments within the Asia-Pacific fighter aircraft market. India and China are currently dominant markets for fighter aircraft. The conventional take-off and landing (CTOL) segment holds the largest market share, owing to its established infrastructure and operational suitability.

- Key Drivers for Dominant Regions:

- India: Increasing defense budget and modernization of air force.

- China: Rapid economic growth and assertive foreign policy.

- Segment Dominance:

- CTOL: Largest market share due to established infrastructure.

- STOL: Growing niche market driven by operational flexibility needs.

- VTOL: Emerging segment with limited adoption due to technological maturity and cost factors. Growth is projected but slower than CTOL and STOL.

Asia-Pacific Fighter Aircraft Industry Product Innovations

Recent innovations focus on enhancing stealth capabilities, integrating advanced sensor systems, and improving pilot situational awareness. These advancements lead to improved combat effectiveness and survivability. Market fit is driven by the specific operational requirements of each air force, such as range, payload capacity, and electronic warfare capabilities.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific fighter aircraft market based on take-off and landing capabilities: Conventional Take-off and Landing (CTOL), Short Take-off and Landing (STOL), and Vertical Take-off and Landing (VTOL). Each segment’s growth projections, market size, and competitive dynamics are analyzed separately. The CTOL segment dominates the market, exhibiting robust growth due to its established infrastructure and widespread adoption. The STOL segment is a niche but growing market, driven by operational flexibility requirements. The VTOL segment remains nascent, constrained by technological maturity and cost considerations.

Key Drivers of Asia-Pacific Fighter Aircraft Industry Growth

The Asia-Pacific fighter aircraft market’s growth is fueled by several factors: increasing defense budgets across the region, modernization of aging fleets, technological advancements (e.g., fifth-generation fighter jets), and rising geopolitical tensions. Government policies prioritizing defense capabilities and partnerships between nations for joint development projects also contribute to this growth.

Challenges in the Asia-Pacific Fighter Aircraft Industry Sector

Key challenges facing the industry include high development and production costs, stringent regulatory compliance requirements, complex supply chains, and intense competition among established players and emerging entrants. These factors can lead to delays in project timelines and potential cost overruns, impacting profitability and market penetration.

Emerging Opportunities in Asia-Pacific Fighter Aircraft Industry

Emerging opportunities include the development of next-generation fighter aircraft incorporating AI, unmanned systems integration, and advanced materials. Growing demand for specialized capabilities, such as electronic warfare and aerial refueling, also creates significant market opportunities. Furthermore, collaborations and partnerships between countries are creating avenues for innovation and technology sharing.

Leading Players in the Asia-Pacific Fighter Aircraft Industry Market

- Dassault Aviation

- Lockheed Martin Corporation

- Airbus SE

- Aviation Industry Corporation of China (AVIC)

- United Aircraft Corporation

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Hindustan Aeronautics Limited

- Saab AB

- The Boeing Company

Key Developments in Asia-Pacific Fighter Aircraft Industry

- 2022-Q4: India places a large order for fighter aircraft from [Supplier Name].

- 2023-Q1: China unveils a new generation of stealth fighter jets.

- 2023-Q3: Joint development program commences between [Country A] and [Country B] for a next-generation fighter aircraft.

Future Outlook for Asia-Pacific Fighter Aircraft Industry Market

The Asia-Pacific fighter aircraft market is poised for continued growth, driven by increasing defense spending, technological advancements, and geopolitical dynamics. Strategic partnerships and collaborations will play a crucial role in shaping the industry's future, with a focus on innovation, affordability, and interoperability. The market is projected to reach $xx Million by 2033, presenting significant opportunities for industry players.

Asia-Pacific Fighter Aircraft Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Fighter Aircraft Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Fighter Aircraft Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Conventional Take-off and Landing is Projected to Grow with the Highest CAGR During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Dassault Aviation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Lockheed Martin Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Airbus SE

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aviation Industry Corporation of China (AVIC)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 United Aircraft Corporatio

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BAE Systems plc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kawasaki Heavy Industries Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hindustan Aeronautics Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Saab AB

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Boeing Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Dassault Aviation

List of Figures

- Figure 1: Asia-Pacific Fighter Aircraft Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Fighter Aircraft Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Fighter Aircraft Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Asia-Pacific Fighter Aircraft Industry?

Key companies in the market include Dassault Aviation, Lockheed Martin Corporation, Airbus SE, Aviation Industry Corporation of China (AVIC), United Aircraft Corporatio, BAE Systems plc, Kawasaki Heavy Industries Ltd, Hindustan Aeronautics Limited, Saab AB, The Boeing Company.

3. What are the main segments of the Asia-Pacific Fighter Aircraft Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Conventional Take-off and Landing is Projected to Grow with the Highest CAGR During Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Fighter Aircraft Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Fighter Aircraft Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Fighter Aircraft Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Fighter Aircraft Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence