Key Insights

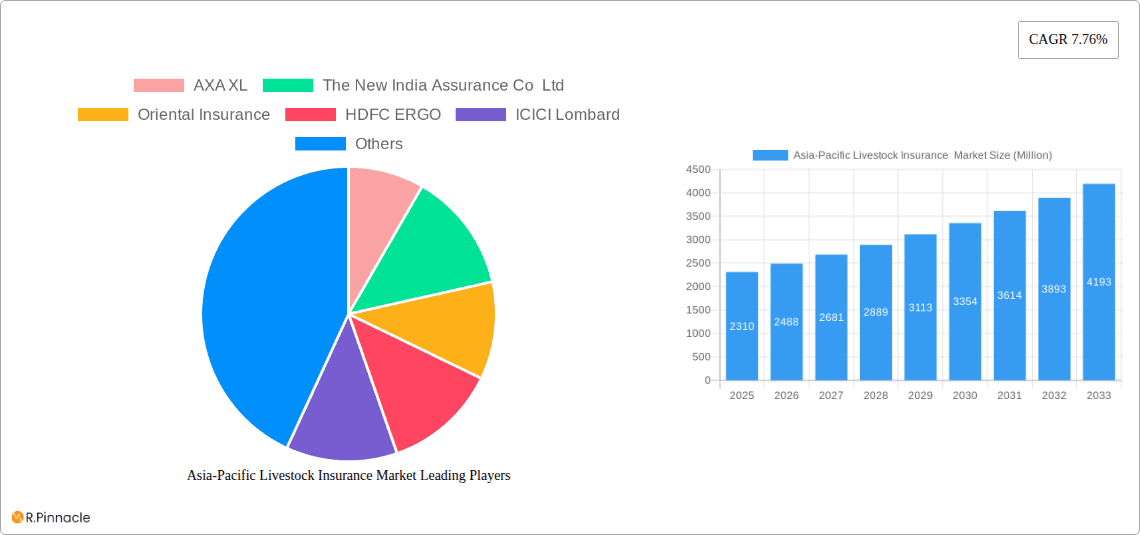

The Asia-Pacific livestock insurance market, valued at $2.31 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 7.76% from 2025 to 2033. This expansion is fueled by several key factors. Increasing awareness of the economic vulnerability of livestock farmers to disease outbreaks, climate change, and fluctuating market prices is driving demand for risk mitigation strategies. Government initiatives promoting agricultural insurance schemes across the region, coupled with the growing adoption of technology in insurance delivery (e.g., mobile-based claims processing and remote risk assessment), are further accelerating market growth. The increasing integration of livestock farming into supply chains also necessitates comprehensive insurance coverage to protect against potential losses, bolstering the market. Furthermore, the rising middle class and improving economic conditions in several Asia-Pacific nations contribute to enhanced consumer purchasing power, leading to greater adoption of livestock insurance products.

Asia-Pacific Livestock Insurance Market Market Size (In Billion)

However, the market faces some challenges. Limited insurance penetration in rural areas due to lack of awareness, infrastructure limitations, and difficulties in assessing risk accurately remain significant constraints. The complexity of livestock insurance products and the need for strong underwriting capabilities also pose hurdles to broader market adoption. Furthermore, fluctuating livestock prices and the unpredictable nature of weather patterns can impact claim payouts, presenting risks to insurers. Nevertheless, the long-term outlook for the Asia-Pacific livestock insurance market remains positive, given the ongoing efforts to improve agricultural infrastructure, financial inclusion, and technological innovation within the insurance sector. Key players like AXA XL, The New India Assurance Co Ltd, and others are strategically positioning themselves to capitalize on the emerging opportunities within this dynamic market.

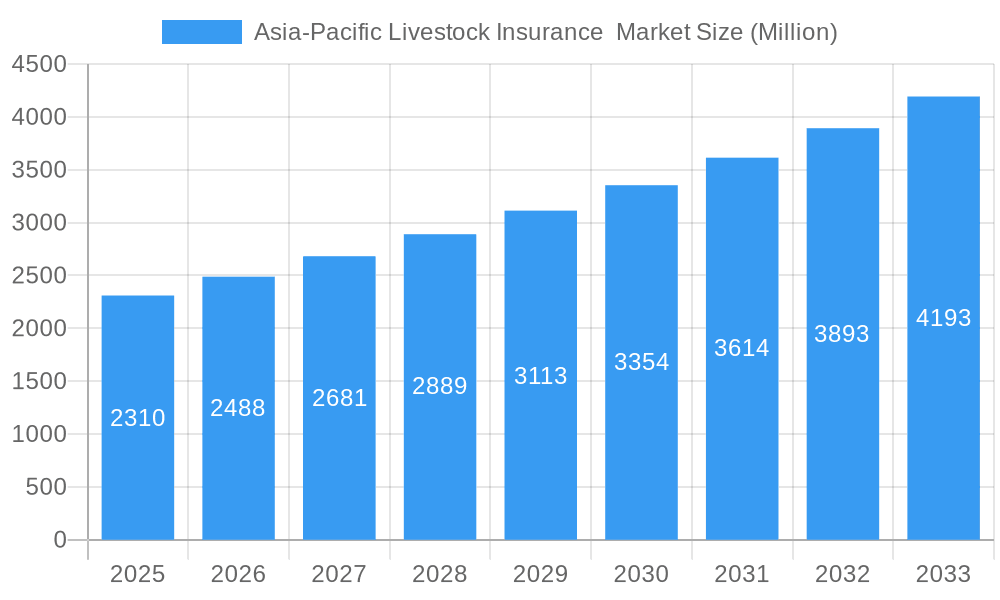

Asia-Pacific Livestock Insurance Market Company Market Share

Asia-Pacific Livestock Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific livestock insurance market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and emerging opportunities, providing a robust forecast for future market potential. The report leverages extensive data analysis and incorporates recent key industry developments to offer actionable intelligence.

Asia-Pacific Livestock Insurance Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Asia-Pacific livestock insurance market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of multinational insurance giants and regional players. Market share data reveals a fragmented landscape, with no single dominant player holding a majority stake. However, companies like AXA XL, Chubb, and Zurich Insurance PLC hold significant positions, benefiting from global expertise and extensive distribution networks. The average M&A deal value within the sector during the historical period (2019-2024) averaged approximately xx Million, primarily driven by strategic acquisitions aimed at expanding regional presence and product portfolios.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share.

- Innovation Drivers: Growing demand for risk mitigation, technological advancements (e.g., IoT, AI for risk assessment), and supportive government policies.

- Regulatory Frameworks: Vary across the region, impacting market penetration and product offerings. Harmonization efforts are underway in several countries.

- Product Substitutes: Traditional risk-sharing mechanisms among farmers and informal insurance arrangements. These present both competition and opportunities for formal insurance providers to tailor products to specific needs.

- End-User Demographics: Primarily smallholder farmers, with increasing engagement from larger livestock farming operations.

- M&A Activities: Strategic acquisitions focused on regional expansion and diversification of product portfolios. Average deal value: xx Million (2019-2024).

Asia-Pacific Livestock Insurance Market Dynamics & Trends

The Asia-Pacific livestock insurance market exhibits robust growth, driven by factors such as rising livestock populations, increasing awareness of risk management, and supportive government initiatives. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and it's projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This growth is further fueled by technological advancements, such as the implementation of innovative data analytics and parametric insurance products, allowing for more accurate risk assessment and faster claims processing. Consumer preferences are shifting toward comprehensive coverage that addresses various risks, including disease outbreaks, natural disasters, and theft. Competitive dynamics are characterized by price competition, product differentiation, and expansion strategies of existing players. Market penetration remains relatively low in some regions, offering significant untapped potential.

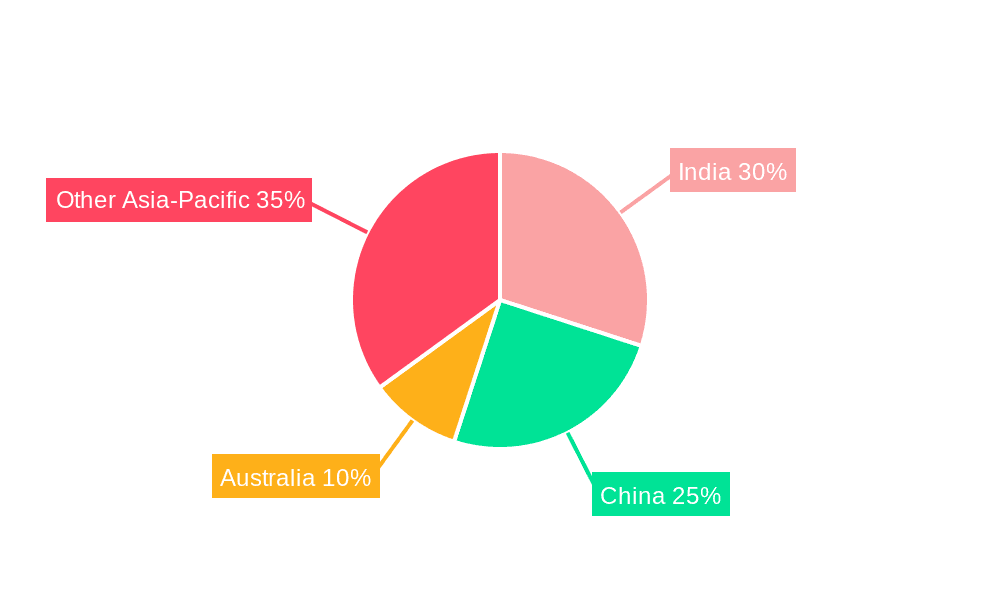

Dominant Regions & Segments in Asia-Pacific Livestock Insurance Market

India and China currently dominate the Asia-Pacific livestock insurance market, accounting for a combined xx% of the total market share in 2024.

India's dominance is driven by:

- Government Support: Initiatives like Pradhan Mantri Fasal Bima Yojana (PMFBY) have significantly boosted insurance penetration.

- Large Livestock Population: India possesses one of the world's largest livestock populations, creating substantial demand for insurance.

- Expanding Insurance Sector: The Indian insurance sector's rapid growth is contributing to market expansion.

China's dominance is driven by:

- Government Regulations: Stringent animal health regulations and increasing focus on food safety are fueling insurance adoption.

- Growing Middle Class: Increased disposable income is leading to greater adoption of insurance products.

- Technological Advancements: The integration of technology into agriculture and insurance sectors is accelerating market growth.

Other key regions include, but are not limited to, Australia, Bangladesh and Vietnam which demonstrate substantial growth potential driven by factors such as increasing livestock production and government efforts to promote agricultural insurance.

Asia-Pacific Livestock Insurance Market Product Innovations

Recent innovations in livestock insurance include parametric insurance products that utilize weather data and other objective parameters to trigger payouts, minimizing the reliance on traditional loss assessments. This leads to faster claims processing and improved customer satisfaction. The integration of technology, including Internet of Things (IoT) devices and AI-driven risk assessment models, is significantly enhancing the accuracy and efficiency of livestock insurance products. These innovations are enhancing the market fit by addressing long-standing challenges, like the difficulty in assessing losses in livestock insurance.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific livestock insurance market by livestock type (cattle, poultry, swine, etc.), insurance type (mortality, morbidity, theft, etc.), distribution channel (direct, brokers, etc.), and country. Each segment provides comprehensive analysis of market size, growth projections, and competitive dynamics. Growth projections vary across segments, reflecting differing adoption rates and market conditions. For example, the cattle insurance segment is projected to witness significant growth, fueled by large cattle populations and increasing awareness of risk. The competitive dynamics within each segment vary, with some segments experiencing intense competition while others demonstrate less intense competition.

Key Drivers of Asia-Pacific Livestock Insurance Market Growth

Several factors are driving the growth of the Asia-Pacific livestock insurance market. These include rising livestock populations, particularly in high-growth economies; increasing government support through subsidies and regulations aimed at promoting insurance adoption; technological advancements in risk assessment and claims processing, including the use of big data, AI, and IoT; and heightened awareness among farmers about the importance of risk management and the benefits of insurance coverage. The growing middle class in many Asian countries further enhances the market.

Challenges in the Asia-Pacific Livestock Insurance Market Sector

The Asia-Pacific livestock insurance market faces various challenges, including the high cost of insurance for smallholder farmers, data scarcity hindering precise risk assessment, inadequate infrastructure in rural areas for claim processing and payout, limited awareness among farmers about insurance benefits, and regulatory complexities varying across countries. These factors negatively impact market penetration, particularly in less developed regions. Furthermore, fraud and moral hazard pose significant risks that insurers must mitigate.

Emerging Opportunities in Asia-Pacific Livestock Insurance Market

Significant opportunities exist for growth in the Asia-Pacific livestock insurance market. This includes expanding coverage to underserved regions and livestock types, developing innovative insurance products tailored to the specific needs of different farming communities, leveraging technology to improve risk assessment and claims processing, and promoting financial literacy among farmers to enhance market penetration. Government initiatives and partnerships with other stakeholders can facilitate the penetration of livestock insurance into rural and underserved areas.

Leading Players in the Asia-Pacific Livestock Insurance Market

- AXA XL

- The New India Assurance Co Ltd

- Oriental Insurance

- HDFC ERGO

- ICICI Lombard

- Chubb

- QBE Insurance Group

- Zurich Insurance PLC

- Reliance General Insurance

- Royal Sundaram

Key Developments in Asia-Pacific Livestock Insurance Market Industry

- May 2024: Bangladesh launched an online cattle identification and registration system (BINLI), enhancing traceability and facilitating insurance adoption. This is expected to register 50,000 cattle by 2025.

- April 2023: The Agriculture Insurance Company of India Limited (AIC) expanded into livestock insurance with products like 'Saral Krishi Bima' and 'Sampoorna Pasudhan Kavach,' significantly increasing the reach of livestock insurance in India. 'Saral Krishi Bima' utilizes parametric insurance, offering quicker claims processing based on weather data.

Future Outlook for Asia-Pacific Livestock Insurance Market

The Asia-Pacific livestock insurance market is poised for significant growth in the coming years. Driven by technological advancements, increasing government support, and a growing awareness of risk management among farmers, the market is expected to witness sustained expansion. Strategic partnerships between insurers, technology providers, and government agencies will be key to accelerating market penetration and realizing the full potential of the market. The focus on innovative parametric products and increased access to insurance for smallholder farmers will be instrumental in shaping the future of this dynamic market.

Asia-Pacific Livestock Insurance Market Segmentation

-

1. Coverage

- 1.1. Mortality

- 1.2. Revenue

- 1.3. Other Types of Coverages

-

2. Animal Type

- 2.1. Bovine

- 2.2. Swine

- 2.3. Other Animal Types

-

3. Distribution

- 3.1. Direct Sales

- 3.2. Agent & Brokers

- 3.3. Bancassurance

- 3.4. Other Distribution Modes

Asia-Pacific Livestock Insurance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Livestock Insurance Market Regional Market Share

Geographic Coverage of Asia-Pacific Livestock Insurance Market

Asia-Pacific Livestock Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture

- 3.3. Market Restrains

- 3.3.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture

- 3.4. Market Trends

- 3.4.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Livestock Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Mortality

- 5.1.2. Revenue

- 5.1.3. Other Types of Coverages

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Bovine

- 5.2.2. Swine

- 5.2.3. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution

- 5.3.1. Direct Sales

- 5.3.2. Agent & Brokers

- 5.3.3. Bancassurance

- 5.3.4. Other Distribution Modes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AXA XL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The New India Assurance Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oriental Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HDFC ERGO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICICI Lombard

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QBE Insurance Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zurich Insurance PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reliance General Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Sundaram

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AXA XL

List of Figures

- Figure 1: Asia-Pacific Livestock Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Livestock Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 3: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 5: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 6: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Distribution 2020 & 2033

- Table 7: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 10: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 11: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 13: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 14: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Distribution 2020 & 2033

- Table 15: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Livestock Insurance Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the Asia-Pacific Livestock Insurance Market?

Key companies in the market include AXA XL, The New India Assurance Co Ltd, Oriental Insurance, HDFC ERGO, ICICI Lombard, Chubb, QBE Insurance Group, Zurich Insurance PLC, Reliance General Insurance, Royal Sundaram.

3. What are the main segments of the Asia-Pacific Livestock Insurance Market?

The market segments include Coverage, Animal Type, Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.31 Million as of 2022.

5. What are some drivers contributing to market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture.

6. What are the notable trends driving market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience.

7. Are there any restraints impacting market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture.

8. Can you provide examples of recent developments in the market?

May 2024: Bangladesh launched an online cattle identification and registration system. The system allows customers to access detailed information about their livestock via barcode scanning. By 2025, 50,000 cattle are expected to be registered, each tagged with a barcode. The Bangladesh Integrated Network for Livestock Information (BINLI) is led by the Department of Livestock Services under the Livestock and Dairy Development Project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Livestock Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Livestock Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Livestock Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Livestock Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence