Key Insights

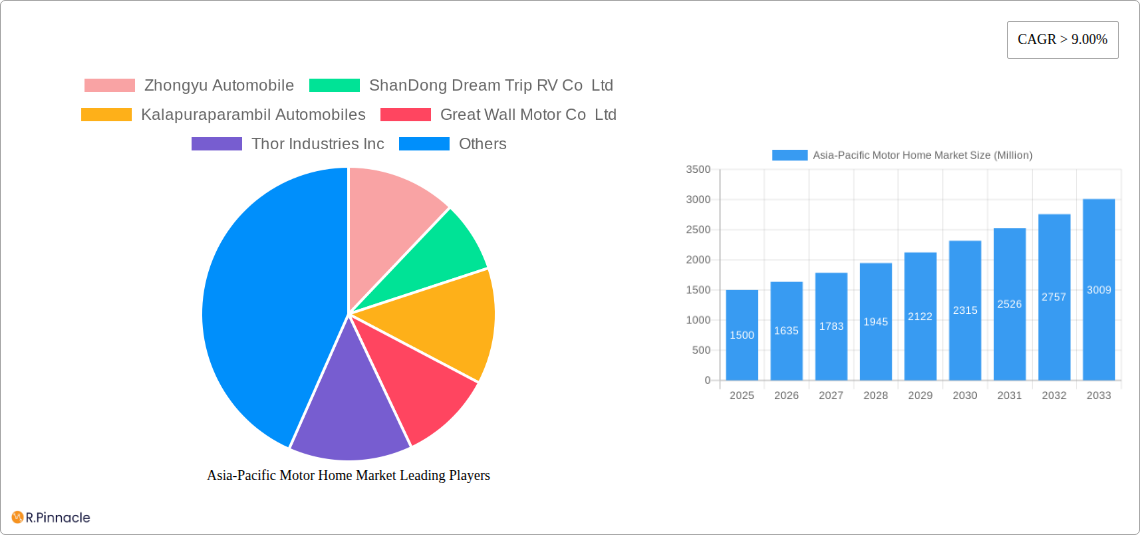

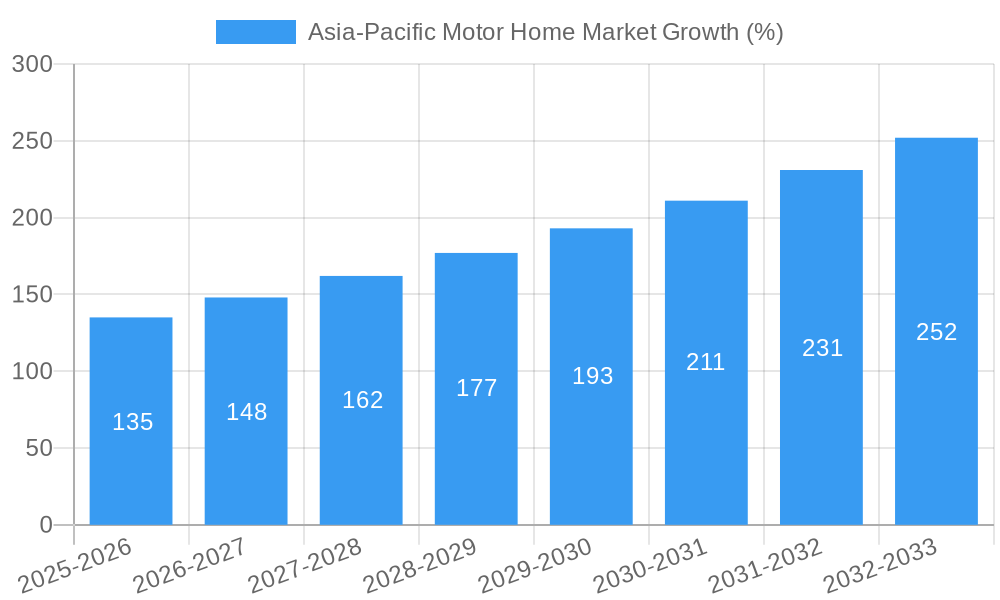

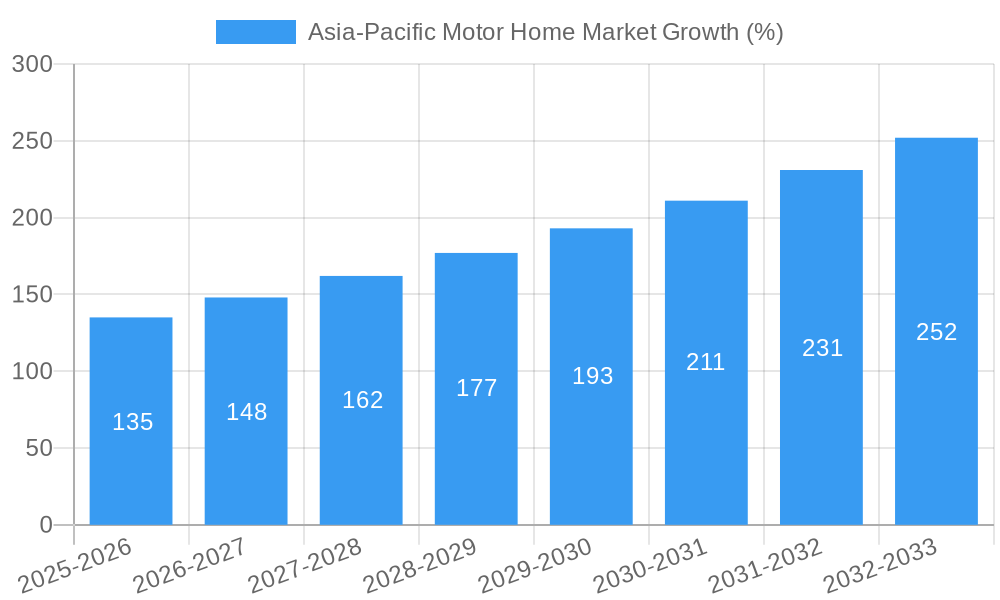

The Asia-Pacific motorhome market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and the provided CAGR), is experiencing robust growth, projected to exceed a CAGR of 9% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, particularly in rapidly developing economies like China and India, are fueling increased demand for leisure travel and recreational vehicles. A burgeoning middle class with a preference for experiential travel is further bolstering the market. Furthermore, supportive government initiatives promoting tourism and infrastructure development in several Asia-Pacific nations are creating a favorable environment for motorhome adoption. The increasing popularity of outdoor activities and glamping contributes significantly to this growth, attracting a wider demographic beyond traditional RVers. Segment-wise, Class B motorhomes are expected to maintain a strong market share due to their compact size and suitability for urban exploration and diverse terrains. Fleet owners, driven by the rise in organized RV tours and rental services, constitute a significant end-user segment, alongside direct buyers representing individual enthusiasts and families.

However, certain restraints are limiting market expansion. High initial purchase costs and ongoing maintenance expenses can be prohibitive for many potential buyers. Limited infrastructure for RV parking and services, especially outside major cities, poses a challenge. Stringent emission regulations and environmental concerns are also impacting the industry, necessitating the adoption of more sustainable technologies. Despite these challenges, the overall market outlook remains positive, with substantial growth anticipated across key countries like China, Japan, India, and South Korea. The competitive landscape is diverse, encompassing both established international players like Thor Industries Inc. and domestic manufacturers such as Zhongyu Automobile and Great Wall Motor Co Ltd, leading to innovation and varied product offerings catering to different segments and price points. The continuous evolution of motorhome designs, focusing on enhanced comfort, technology integration, and fuel efficiency, will be critical for sustained growth in the coming years.

Asia-Pacific Motor Home Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific motor home market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, segmentation, key players, and future growth potential. The market is projected to reach xx Million by 2033.

Asia-Pacific Motor Home Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Asia-Pacific motor home market. We examine market concentration, revealing the market share held by key players like Zhongyu Automobile, ShanDong Dream Trip RV Co Ltd, and Great Wall Motor Co Ltd. The report also details mergers and acquisitions (M&A) activities, including deal values where available, highlighting the strategic shifts in the industry. Innovation drivers such as the rising demand for recreational vehicles, technological advancements in motor home design and manufacturing, and supportive government policies are explored. The impact of regulatory frameworks and the availability of product substitutes are also considered, along with an analysis of end-user demographics and their evolving preferences. The report provides a comprehensive overview of the market structure and the forces driving innovation within the Asia-Pacific region.

Asia-Pacific Motor Home Market Dynamics & Trends

This section delves into the key market dynamics and trends influencing growth. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates for different segments. Growth drivers such as rising disposable incomes, increasing tourism, and the growing popularity of outdoor recreational activities are explored. Technological disruptions, including the integration of smart technologies and sustainable features in motor homes, are examined. The report also analyzes consumer preferences and their impact on market demand, alongside a detailed assessment of competitive dynamics, including pricing strategies, product differentiation, and marketing initiatives. This section provides a comprehensive understanding of the forces shaping the market's trajectory.

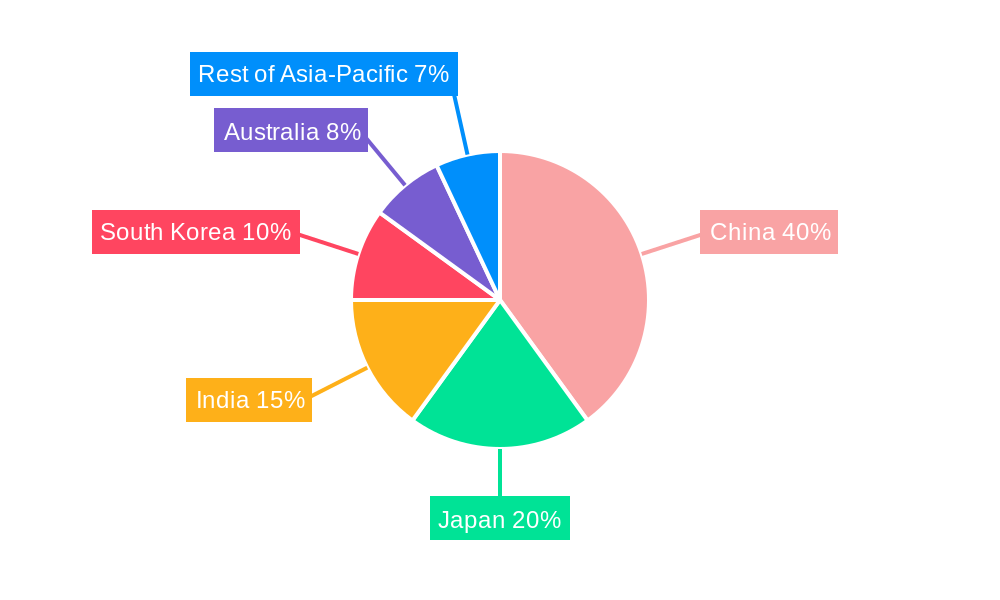

Dominant Regions & Segments in Asia-Pacific Motor Home Market

This section identifies the leading regions and segments within the Asia-Pacific motor home market. We analyze market dominance by country (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific) and by type (Class A, Class B, Class C) and end-user (Fleet Owners, Direct Buyers).

- Key Drivers:

- China: Strong economic growth, expanding middle class, supportive government policies.

- Japan: Well-developed infrastructure, high tourism rates, preference for high-quality RVs.

- Class A: Larger size, luxurious features, caters to high-end customers.

- Direct Buyers: Growing preference for personalized travel experiences.

The dominance analysis provides detailed insights into the factors contributing to the success of specific regions and segments, highlighting the opportunities and challenges in each area.

Asia-Pacific Motor Home Market Product Innovations

This section summarizes recent product developments, highlighting technological trends and market fit. The report examines advancements in materials, design, and technology, such as the incorporation of smart home features, improved fuel efficiency, and enhanced safety systems. Competitive advantages driven by innovation are analyzed, showcasing how companies are differentiating their products to meet evolving consumer demands.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Asia-Pacific motor home market across various parameters.

- By Type: Class A, Class B, and Class C motor homes, with detailed growth projections and market size estimations for each segment.

- By End User: Fleet owners and direct buyers, analyzing their respective market shares and growth trajectories.

- By Country: A granular analysis of market size and growth potential for each key country in the Asia-Pacific region, including China, Japan, India, South Korea, Australia, and the Rest of Asia-Pacific. Competitive dynamics within each segment and country are also explored.

Key Drivers of Asia-Pacific Motor Home Market Growth

The Asia-Pacific motor home market is propelled by several key factors. Technological advancements leading to enhanced features and comfort, coupled with rising disposable incomes and increasing tourism, are significant drivers. Favorable government regulations and infrastructure development further boost market expansion. The burgeoning middle class across several Asian countries significantly contributes to increased demand for leisure and recreational vehicles like motor homes.

Challenges in the Asia-Pacific Motor Home Market Sector

Despite its growth potential, the Asia-Pacific motor home market faces several challenges. Stringent regulatory frameworks in some countries may hinder market expansion. Supply chain disruptions and fluctuations in raw material prices pose significant challenges. Intense competition among established players and new entrants impacts profitability. Furthermore, the high initial investment cost associated with purchasing motor homes can restrict market penetration in price-sensitive segments.

Emerging Opportunities in Asia-Pacific Motor Home Market

Several emerging opportunities exist within the Asia-Pacific motor home market. The rise of eco-tourism and sustainable travel creates demand for environmentally friendly motor homes. Technological advancements in connectivity and autonomous driving offer exciting opportunities for innovation. Untapped markets in developing countries present significant growth potential. The growing popularity of customized and luxury motor homes also creates avenues for niche players.

Leading Players in the Asia-Pacific Motor Home Market Market

- Zhongyu Automobile

- ShanDong Dream Trip RV Co Ltd

- Kalapuraparambil Automobiles

- Great Wall Motor Co Ltd

- Thor Industries Inc

- JCBL PLA Motorhome

- Baoding Zhongjin Braun RV Manufacturing Co Ltd

- SAIC Motor

- Zhongtian Gaoke Special Vehicle Co Ltd

Key Developments in Asia-Pacific Motor Home Market Industry

- January 2023: Zhongyu Automobile launched a new line of eco-friendly motor homes.

- March 2024: Great Wall Motor Co Ltd partnered with a technology firm to integrate smart features into its motor homes.

- June 2024: A significant M&A deal involving two major players in the Indian market. (Further details on the deal are included in the full report)

Future Outlook for Asia-Pacific Motor Home Market Market

The Asia-Pacific motor home market is poised for significant growth in the coming years. Continued economic expansion, rising disposable incomes, and increased focus on leisure and recreation will fuel demand. Technological advancements and innovative product offerings will further drive market expansion. The focus on sustainable and eco-friendly options will shape future industry trends. Strategic partnerships and investments in infrastructure will support the market's continued growth trajectory.

Asia-Pacific Motor Home Market Segmentation

-

1. Type

- 1.1. Class A

- 1.2. Class B

- 1.3. Class C

-

2. End User

- 2.1. Fleet Owners

- 2.2. Direct Buyers

Asia-Pacific Motor Home Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Motor Home Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles

- 3.4. Market Trends

- 3.4.1. Used motorhome sales is anticipated to hinder the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Class A

- 5.1.2. Class B

- 5.1.3. Class C

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Fleet Owners

- 5.2.2. Direct Buyers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Zhongyu Automobile

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ShanDong Dream Trip RV Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Kalapuraparambil Automobiles

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Great Wall Motor Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Thor Industries Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 JCBL PLA Motorhome

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Baoding Zhongjin Braun RV Manufacturing Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 SAIC Motor

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Zhongtian Gaoke Special Vehicle Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Zhongyu Automobile

List of Figures

- Figure 1: Asia-Pacific Motor Home Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Motor Home Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Motor Home Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Motor Home Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Motor Home Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Asia-Pacific Motor Home Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Motor Home Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Motor Home Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia-Pacific Motor Home Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Asia-Pacific Motor Home Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Motor Home Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Motor Home Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Asia-Pacific Motor Home Market?

Key companies in the market include Zhongyu Automobile, ShanDong Dream Trip RV Co Ltd, Kalapuraparambil Automobiles, Great Wall Motor Co Ltd, Thor Industries Inc, JCBL PLA Motorhome, Baoding Zhongjin Braun RV Manufacturing Co Ltd, SAIC Motor, Zhongtian Gaoke Special Vehicle Co Ltd.

3. What are the main segments of the Asia-Pacific Motor Home Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth.

6. What are the notable trends driving market growth?

Used motorhome sales is anticipated to hinder the market growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Motor Home Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Motor Home Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Motor Home Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Motor Home Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence