Key Insights

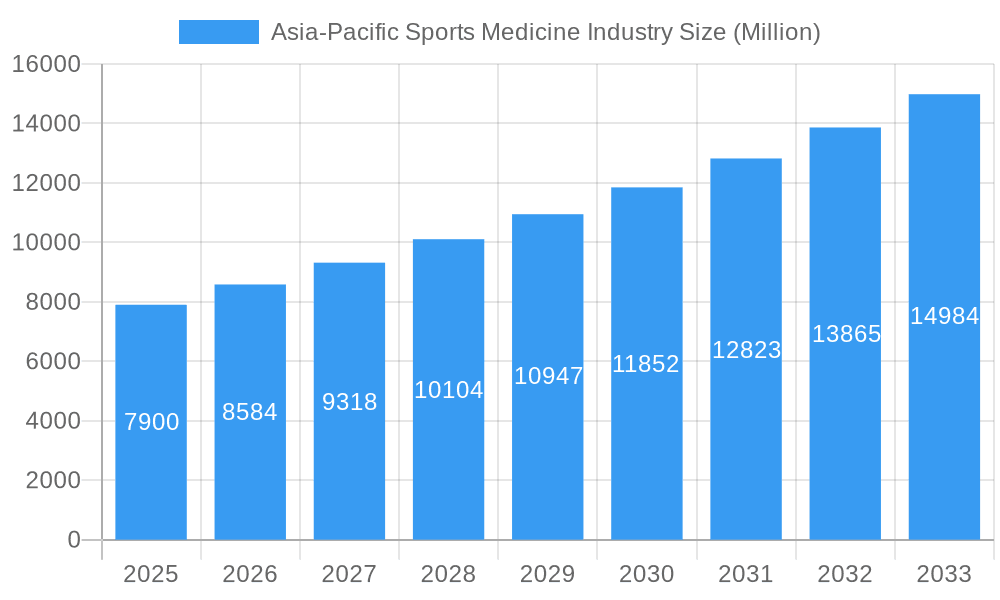

The Asia-Pacific sports medicine industry is poised for significant expansion, projected to reach a substantial market size of $7.9 billion in 2025. This robust growth is underpinned by an impressive Compound Annual Growth Rate (CAGR) of 8.7%, indicating a dynamic and rapidly evolving market. The surge in sports participation across the region, coupled with a heightened awareness of sports-related injuries and the importance of their effective management and prevention, are key drivers. Advances in medical technology, leading to more sophisticated implants, arthroscopy devices, and prosthetic solutions, are further fueling this expansion. Furthermore, the increasing adoption of orthobiologics and innovative bracing and taping solutions contributes to improved patient outcomes and faster recovery times, thus driving demand.

Asia-Pacific Sports Medicine Industry Market Size (In Billion)

The market segmentation reveals a strong demand across various product categories and applications. Implants and arthroscopy devices are expected to lead the product segment due to the prevalence of knee and shoulder injuries, which are common in both professional and amateur sports. The growing emphasis on non-invasive and minimally invasive treatments will also bolster the demand for arthroscopy devices. In terms of applications, knee injuries are anticipated to be the largest segment, followed by shoulder and ankle/foot injuries, reflecting global sports injury trends. Geographically, China and India are expected to be major contributors to market growth, driven by their large populations, increasing disposable incomes, and growing interest in sports and fitness activities. While the market benefits from these positive trends, potential restraints such as the high cost of advanced medical devices and limited healthcare infrastructure in some developing nations within the region could pose challenges.

Asia-Pacific Sports Medicine Industry Company Market Share

This in-depth report offers a definitive analysis of the Asia-Pacific Sports Medicine Industry, providing critical insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market structure, dynamics, key segments, product innovations, and future outlook. Leverage actionable data on market size, CAGR, and competitive landscapes to inform your strategic decisions.

Asia-Pacific Sports Medicine Industry Market Structure & Innovation Trends

The Asia-Pacific Sports Medicine Industry exhibits a moderately concentrated market structure, with a blend of global giants and emerging regional players. Innovation is a primary driver, fueled by advancements in biomaterials, minimally invasive surgical techniques, and personalized rehabilitation solutions. Regulatory frameworks, though evolving, are increasingly focused on ensuring product safety and efficacy, impacting market entry and product approvals. Product substitutes, such as conservative treatments and advanced physiotherapy, present a competitive challenge, necessitating continuous innovation in high-value sports medicine products. End-user demographics are shifting towards an aging population seeking to maintain active lifestyles and a younger, increasingly sports-conscious demographic prone to injuries. Mergers and acquisitions (M&A) activities are a key feature, with deal values in the billions of USD, as larger companies seek to expand their product portfolios and geographical reach. For instance, recent M&A activities have seen consolidated market share increase by an estimated 15% over the past three years, contributing to the overall market valuation which is projected to reach over $20 billion by 2025.

Asia-Pacific Sports Medicine Industry Market Dynamics & Trends

The Asia-Pacific Sports Medicine Industry is experiencing robust growth, propelled by a confluence of accelerating factors. The rising prevalence of sports-related injuries, driven by increased participation in both professional and recreational sports across the region, is a fundamental growth engine. This is further amplified by a growing awareness among athletes and the general population regarding the importance of timely and effective treatment and rehabilitation for sports injuries. Technological advancements are revolutionizing the sector, with innovations in arthroscopic surgery, advanced implant materials, and sophisticated prosthetic designs significantly improving patient outcomes and driving market penetration. The integration of digital health technologies, including wearable devices for injury prevention and remote patient monitoring for rehabilitation, is also gaining traction, enhancing the patient experience and treatment efficacy. Consumer preferences are increasingly leaning towards minimally invasive procedures and personalized treatment plans, pushing manufacturers to develop more sophisticated and tailored solutions. The competitive landscape is dynamic, characterized by intense R&D efforts, strategic collaborations, and a keen focus on market expansion into developing economies within the Asia-Pacific region. The market penetration of advanced sports medicine solutions is expected to climb from XX% to over 35% by 2033. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be between 8.5% and 9.5%. The market size is estimated to be $18.5 billion in 2025, with projected growth to exceed $35 billion by 2033.

Dominant Regions & Segments in Asia-Pacific Sports Medicine Industry

China stands out as the dominant region within the Asia-Pacific Sports Medicine Industry, driven by its vast population, rapidly growing middle class with increasing disposable income, and a government push towards promoting sports and physical fitness. Significant investments in healthcare infrastructure and a growing acceptance of advanced medical technologies further bolster China's leading position. India follows closely, exhibiting rapid growth fueled by a burgeoning sports culture, a substantial young population, and an increasing focus on sports injury management and rehabilitation.

Product Segment Dominance:

- Implants: Driven by the increasing incidence of joint replacement surgeries for sports-related degenerative conditions and trauma, particularly in knees and hips.

- Arthroscopy Devices: Essential for minimally invasive diagnosis and treatment of a wide range of sports injuries, this segment sees consistent demand due to improved patient recovery times.

- Braces, Bandages, and Tapes: These widely accessible and cost-effective products cater to a broad spectrum of sports injuries, from minor sprains to post-operative support, ensuring consistent market penetration.

Application Segment Dominance:

- Knee Injuries: The most prevalent category of sports injuries, encompassing ligament tears, meniscus damage, and patellofemoral pain syndrome, leading to sustained high demand for related treatments and devices.

- Shoulder Injuries: Common in overhead sports, shoulder injuries like rotator cuff tears and dislocations require advanced surgical and rehabilitative solutions, driving segment growth.

Geographical Dominance Breakdown:

- China: Leading market share due to massive population, economic growth, and government focus on sports. Economic policies encouraging healthcare spending and infrastructure development are key drivers.

- Japan: High market penetration due to an aging population seeking to maintain active lifestyles and advanced technological adoption in healthcare.

- India: Rapidly growing market driven by increasing sports participation, rising disposable incomes, and a developing healthcare ecosystem.

The Rest of Asia-Pacific, encompassing Southeast Asian nations and Oceania, presents significant untapped potential, characterized by growing awareness and improving healthcare access.

Asia-Pacific Sports Medicine Industry Product Innovations

Product innovation in the Asia-Pacific sports medicine market is characterized by the development of advanced biomaterials for implants, offering enhanced biocompatibility and longevity. Minimally invasive surgical tools and robotic-assisted surgery systems are transforming treatment protocols, reducing recovery times and improving precision. The rise of personalized orthobiologics, such as platelet-rich plasma (PRP) and stem cell therapies, is offering novel approaches to tissue regeneration. Furthermore, smart wearable devices integrated with AI are revolutionizing injury prevention and rehabilitation, providing real-time data and personalized feedback, thereby enhancing competitive advantages.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia-Pacific Sports Medicine Industry across key Product categories including Implants, Arthroscopy Devices, Prosthetic, Orthobiologics, Braces, Bandages and Tapes, and Other Products. The Application segment covers Knee Injuries, Shoulder Injuries, Ankle and Foot Injuries, Back and Spine Injuries, Elbow and Wrist Injuries, and Other Applications. Geographically, the analysis extends to China, Japan, India, Australia, South Korea, and the Rest of Asia-Pacific. Growth projections for each segment are detailed, with the Implants and Arthroscopy Devices segments expected to exhibit a CAGR of over 9% through 2033. Competitive dynamics within each segment are analyzed, highlighting the strategies of key players and the market share distribution. The estimated market size for the Implants segment alone is projected to reach over $7 billion by 2025.

Key Drivers of Asia-Pacific Sports Medicine Industry Growth

The Asia-Pacific Sports Medicine Industry's growth is propelled by several key factors. Firstly, the escalating prevalence of sports-related injuries, fueled by increased participation in athletic activities and a heightened focus on fitness. Secondly, rapid technological advancements, including minimally invasive surgical techniques, novel biomaterials for implants, and sophisticated rehabilitation devices, are enhancing treatment efficacy. Thirdly, rising disposable incomes and a growing middle class in emerging economies are leading to increased healthcare expenditure and a greater demand for advanced medical solutions. Fourthly, supportive government initiatives promoting sports and health awareness further catalyze market expansion.

Challenges in the Asia-Pacific Sports Medicine Industry Sector

Despite its growth trajectory, the Asia-Pacific Sports Medicine Industry faces several challenges. High costs associated with advanced technologies and treatments can be a barrier to widespread adoption, particularly in developing regions. Stringent and varied regulatory frameworks across different countries create complexity for market entry and product approvals. Supply chain disruptions, exacerbated by geopolitical factors and logistics issues, can impact product availability and lead times. Furthermore, a shortage of skilled orthopedic surgeons and sports medicine professionals in certain areas limits the delivery of advanced care.

Emerging Opportunities in Asia-Pacific Sports Medicine Industry

Emerging opportunities in the Asia-Pacific Sports Medicine Industry are significant. The growing demand for non-invasive and regenerative treatments presents a substantial market for orthobiologics and advanced physical therapy solutions. The expansion of telehealth and remote rehabilitation platforms offers a pathway to reach underserved populations and improve accessibility. The burgeoning e-commerce landscape provides new channels for distributing sports medicine products, especially braces and bandages. Furthermore, the increasing focus on sports tourism and wellness activities is creating niche markets for specialized sports injury prevention and management services.

Leading Players in the Asia-Pacific Sports Medicine Industry Market

- CONMED Corporation

- Smith & Nephew

- Arthrex Inc

- 3M company

- Wright Medical Group

- DJO Global Inc

- Medtronic PLC

- Vissco

- Johnson & Johnson

- Stryker Corporation

- Zimmer Biomet Holdings Inc

- DJO LLC

Key Developments in Asia-Pacific Sports Medicine Industry Industry

- October 2022: Vissco launched Vissco Next, a one-stop online platform for sports health and well-being in India, offering a wide range of orthopedic braces and pain recovery solutions.

- June 2022: Lonza Japan expanded UC-II knee claims, receiving approval from Japan's Consumer Affairs Agency for its product to support knee movements in activities such as climbing stairs and squatting, following positive clinical trial findings.

Future Outlook for Asia-Pacific Sports Medicine Industry Market

The future outlook for the Asia-Pacific Sports Medicine Industry is exceptionally promising, poised for sustained high growth. Key accelerators include the continued rise in sports participation and an aging population actively seeking to maintain mobility and quality of life. Technological innovations, particularly in AI-driven diagnostics, robotics, and personalized medicine, will further revolutionize treatment approaches. Strategic opportunities lie in expanding into underserved markets within Southeast Asia and the Pacific islands, leveraging digital health solutions for wider reach. The increasing investment in sports infrastructure and professional leagues across the region will also fuel demand for advanced sports medicine products and services. The market is projected to witness substantial growth, driven by innovation and increasing healthcare expenditure, reaching over $35 billion by 2033.

Asia-Pacific Sports Medicine Industry Segmentation

-

1. Product

- 1.1. Implants

- 1.2. Arthroscopy Devices

- 1.3. Prosthetic

- 1.4. Orthobiologics

- 1.5. Braces

- 1.6. Bandages and Tapes

- 1.7. Other Products

-

2. Application

- 2.1. Knee Injuries

- 2.2. Shoulder Injuries

- 2.3. Ankle and Foot Injuries

- 2.4. Back and Spine Injuries

- 2.5. Elbow and Wrist Injuries

- 2.6. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia-Pacific

Asia-Pacific Sports Medicine Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Sports Medicine Industry Regional Market Share

Geographic Coverage of Asia-Pacific Sports Medicine Industry

Asia-Pacific Sports Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Sports Injuries; Consistent Innovation of New Products and Treatment Modalities

- 3.3. Market Restrains

- 3.3.1. High Cost of Implants and Devices; Dearth of Proper Sports Ecosystem

- 3.4. Market Trends

- 3.4.1. Implants Segment is Expected to Grow at a Faster Pace in Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Implants

- 5.1.2. Arthroscopy Devices

- 5.1.3. Prosthetic

- 5.1.4. Orthobiologics

- 5.1.5. Braces

- 5.1.6. Bandages and Tapes

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Knee Injuries

- 5.2.2. Shoulder Injuries

- 5.2.3. Ankle and Foot Injuries

- 5.2.4. Back and Spine Injuries

- 5.2.5. Elbow and Wrist Injuries

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Implants

- 6.1.2. Arthroscopy Devices

- 6.1.3. Prosthetic

- 6.1.4. Orthobiologics

- 6.1.5. Braces

- 6.1.6. Bandages and Tapes

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Knee Injuries

- 6.2.2. Shoulder Injuries

- 6.2.3. Ankle and Foot Injuries

- 6.2.4. Back and Spine Injuries

- 6.2.5. Elbow and Wrist Injuries

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. South Korea

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Implants

- 7.1.2. Arthroscopy Devices

- 7.1.3. Prosthetic

- 7.1.4. Orthobiologics

- 7.1.5. Braces

- 7.1.6. Bandages and Tapes

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Knee Injuries

- 7.2.2. Shoulder Injuries

- 7.2.3. Ankle and Foot Injuries

- 7.2.4. Back and Spine Injuries

- 7.2.5. Elbow and Wrist Injuries

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. South Korea

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Implants

- 8.1.2. Arthroscopy Devices

- 8.1.3. Prosthetic

- 8.1.4. Orthobiologics

- 8.1.5. Braces

- 8.1.6. Bandages and Tapes

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Knee Injuries

- 8.2.2. Shoulder Injuries

- 8.2.3. Ankle and Foot Injuries

- 8.2.4. Back and Spine Injuries

- 8.2.5. Elbow and Wrist Injuries

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. South Korea

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Implants

- 9.1.2. Arthroscopy Devices

- 9.1.3. Prosthetic

- 9.1.4. Orthobiologics

- 9.1.5. Braces

- 9.1.6. Bandages and Tapes

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Knee Injuries

- 9.2.2. Shoulder Injuries

- 9.2.3. Ankle and Foot Injuries

- 9.2.4. Back and Spine Injuries

- 9.2.5. Elbow and Wrist Injuries

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Implants

- 10.1.2. Arthroscopy Devices

- 10.1.3. Prosthetic

- 10.1.4. Orthobiologics

- 10.1.5. Braces

- 10.1.6. Bandages and Tapes

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Knee Injuries

- 10.2.2. Shoulder Injuries

- 10.2.3. Ankle and Foot Injuries

- 10.2.4. Back and Spine Injuries

- 10.2.5. Elbow and Wrist Injuries

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. South Korea

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia-Pacific Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Implants

- 11.1.2. Arthroscopy Devices

- 11.1.3. Prosthetic

- 11.1.4. Orthobiologics

- 11.1.5. Braces

- 11.1.6. Bandages and Tapes

- 11.1.7. Other Products

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Knee Injuries

- 11.2.2. Shoulder Injuries

- 11.2.3. Ankle and Foot Injuries

- 11.2.4. Back and Spine Injuries

- 11.2.5. Elbow and Wrist Injuries

- 11.2.6. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. Australia

- 11.3.5. South Korea

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CONMED Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Smith & Nephew

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Arthrex Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 3M company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Wright Medical Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DJO Global Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Medtronic PLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vissco

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Johnson & Johnson

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Stryker Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Zimmer Biomet Holdings Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 DJO LLC

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 CONMED Corporation

List of Figures

- Figure 1: Asia-Pacific Sports Medicine Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Sports Medicine Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 3: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 11: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 19: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 26: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 27: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 29: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 34: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 35: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 37: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 42: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 43: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 45: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 50: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Product 2020 & 2033

- Table 51: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 52: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Application 2020 & 2033

- Table 53: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific Sports Medicine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific Sports Medicine Industry Volume Kg Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Sports Medicine Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Asia-Pacific Sports Medicine Industry?

Key companies in the market include CONMED Corporation, Smith & Nephew, Arthrex Inc, 3M company, Wright Medical Group, DJO Global Inc, Medtronic PLC, Vissco, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings Inc, DJO LLC.

3. What are the main segments of the Asia-Pacific Sports Medicine Industry?

The market segments include Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Sports Injuries; Consistent Innovation of New Products and Treatment Modalities.

6. What are the notable trends driving market growth?

Implants Segment is Expected to Grow at a Faster Pace in Market During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Implants and Devices; Dearth of Proper Sports Ecosystem.

8. Can you provide examples of recent developments in the market?

In October 2022, Vissco launched a one-stop online platform for sports health and well-being in India, Vissco Next. The company's website offers product categories ranging from orthopedic braces like back and knee support to pain recovery solutions like heating mats, cooling gels, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kg.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Sports Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Sports Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Sports Medicine Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Sports Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence