Key Insights

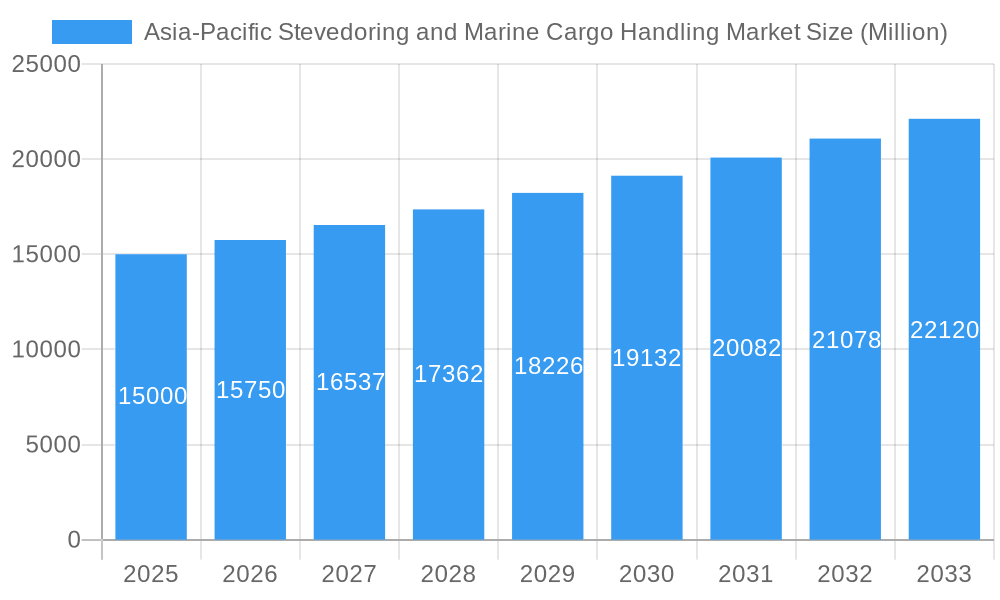

The Asia-Pacific stevedoring and marine cargo handling market is experiencing robust growth, driven by the region's expanding trade volumes, particularly within the burgeoning e-commerce sector and rising manufacturing activities in countries like China, India, and South Korea. A compound annual growth rate (CAGR) exceeding 5% indicates a significant upward trajectory projected through 2033. This expansion is fueled by increasing port infrastructure development, technological advancements in automation and container handling, and a growing demand for efficient and reliable logistics solutions. The market is segmented by type (stevedoring, cargo handling and transportation, others) and cargo type (bulk cargo, containerized cargo, other cargo), with containerized cargo currently dominating due to the globalization of trade and the popularity of standardized shipping. Key players like PSA International, China Merchants Port Holdings, and APM Terminals are strategically investing in advanced technologies and expanding their port operations to maintain a competitive edge. The Asia-Pacific region's diverse economic landscape and varying levels of port infrastructure present both opportunities and challenges for market participants. Growth is expected to be uneven across the region, with the most developed economies exhibiting steady growth and less developed nations potentially experiencing faster, though potentially volatile, expansion as their infrastructure improves and trade increases. The market faces potential restraints such as geopolitical instability, fluctuating fuel prices, and environmental regulations, but the overall outlook remains positive, suggesting continued substantial growth.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

The market's growth is further fueled by the increasing adoption of innovative technologies aimed at optimizing efficiency and reducing operational costs. Automation in port operations, such as the use of automated guided vehicles (AGVs) and remote-controlled cranes, is gradually improving throughput and minimizing human error. Furthermore, the integration of digital technologies such as blockchain and IoT are enhancing supply chain transparency and traceability, leading to improved operational efficiency and reduced delays. While competition amongst existing players remains intense, the significant market size and anticipated growth attract investments in port modernization and expansion. This creates opportunities for both established players and emerging companies to enter and compete effectively, particularly those specializing in innovative technologies and integrated logistics solutions. The market's future growth is largely contingent on maintaining positive regional trade relations, continued infrastructure investments, and adapting to evolving global trade patterns.

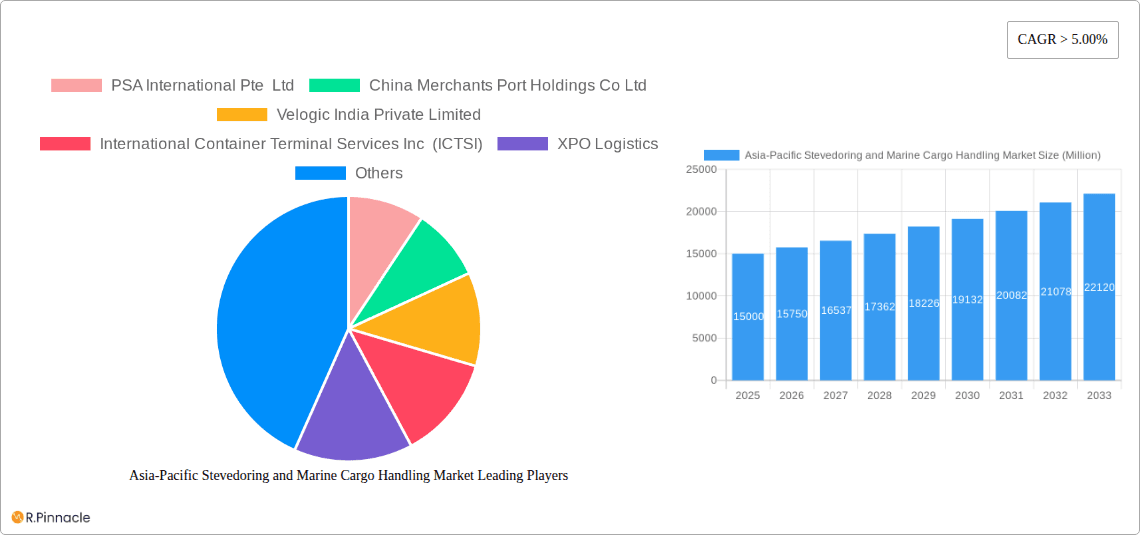

Asia-Pacific Stevedoring and Marine Cargo Handling Market Company Market Share

Asia-Pacific Stevedoring and Marine Cargo Handling Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific stevedoring and marine cargo handling market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete picture of the market's past performance, current state, and future potential. The report leverages rigorous data analysis and expert insights to present a clear and actionable overview of this dynamic market.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Market Structure & Innovation Trends

The Asia-Pacific stevedoring and marine cargo handling market is characterized by a moderately concentrated structure, with key players such as PSA International Pte Ltd, China Merchants Port Holdings Co Ltd, and APM Terminals holding significant market share. However, the market also features a substantial number of smaller, regional operators. The market share of the top 5 players is estimated at xx%, indicating a degree of competition and potential for further consolidation. Innovation is driven by increasing automation, digitalization, and the adoption of advanced technologies to enhance efficiency and reduce operational costs. Stringent regulatory frameworks focusing on safety, environmental protection, and operational standards shape market practices. Product substitutes are limited, primarily involving alternative transportation methods (e.g., rail, road) for certain cargo types. End-user demographics encompass a broad range of importers, exporters, and logistics providers across various industries. Significant M&A activity, such as Maersk's acquisition of LF Logistics, demonstrates the industry's ongoing consolidation and expansion. The estimated value of M&A deals in the past 5 years totals approximately xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Innovation Drivers: Automation, digitalization, advanced technologies.

- Regulatory Frameworks: Safety, environmental protection, operational standards.

- M&A Activity: Significant consolidation and expansion, with deals valued at approximately xx Million in the last 5 years.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Market Dynamics & Trends

The Asia-Pacific stevedoring and marine cargo handling market exhibits robust growth, driven by the region's expanding manufacturing sector, increasing e-commerce activities, and rising global trade volumes. Technological disruptions, such as the implementation of automated container terminals and advanced logistics software, are revolutionizing operational efficiency. Consumer preferences for faster and more reliable delivery services are pushing the industry toward increased automation and data-driven decision-making. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, particularly in specialized segments. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with a market penetration rate of xx% by 2033. This growth is further fueled by government initiatives promoting infrastructure development and trade facilitation within the region.

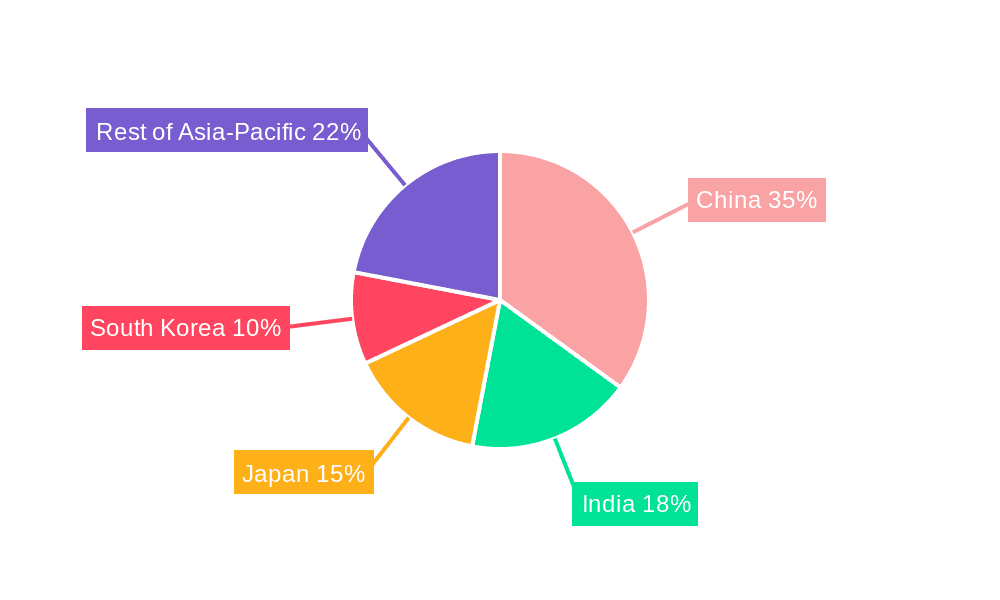

Dominant Regions & Segments in Asia-Pacific Stevedoring and Marine Cargo Handling Market

China and other East Asian nations currently dominate the Asia-Pacific stevedoring and marine cargo handling market. This dominance is primarily attributed to their established port infrastructure, significant manufacturing output, and robust export-oriented economies. Among the segments, containerized cargo handling currently holds the largest market share, driven by the growth of global container shipping.

Key Drivers of Regional Dominance (China):

- Extensive port infrastructure and capacity.

- Strong manufacturing base and export-oriented economy.

- Government support for port development and trade facilitation.

Key Drivers of Segment Dominance (Containerized Cargo):

- Increased global trade and container shipping volumes.

- Efficiency gains from containerization compared to bulk cargo handling.

- Technological advancements facilitating efficient container handling.

The stevedoring segment is also experiencing significant growth due to the increasing demand for efficient cargo handling services at ports.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Product Innovations

Recent product innovations center on automated guided vehicles (AGVs), automated stacking cranes, and advanced port management systems. These technologies aim to enhance efficiency, optimize cargo flow, and reduce operational costs. The integration of IoT sensors and AI-powered analytics provides real-time visibility and predictive capabilities for improved operational efficiency and reduced downtime. These innovations are finding wide market acceptance due to their demonstrable contribution to improved productivity and cost reduction.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific stevedoring and marine cargo handling market by type (Stevedoring, Cargo Handling and Transportation, Others) and by cargo type (Bulk Cargo, Containerized Cargo, Other Cargo). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. The containerized cargo segment is projected to experience the highest growth rate, driven by ongoing globalization and e-commerce expansion. The stevedoring segment will also see robust growth, reflecting the continuous demand for efficient cargo handling solutions. The "Others" segments encompass a range of specialized services and will exhibit moderate growth.

Key Drivers of Asia-Pacific Stevedoring and Marine Cargo Handling Market Growth

The growth of the Asia-Pacific stevedoring and marine cargo handling market is propelled by several key factors: the burgeoning e-commerce sector driving increased demand for efficient logistics solutions; government initiatives aimed at enhancing port infrastructure and trade facilitation; and technological advancements such as automation and digitization, leading to improved efficiency and cost reductions. Further expansion of manufacturing and industrial activity in the region will sustain growth.

Challenges in the Asia-Pacific Stevedoring and Marine Cargo Handling Market Sector

Significant challenges include increasing labor costs, stringent environmental regulations requiring significant investments in eco-friendly equipment, and infrastructure bottlenecks in some regions. Intense competition among established players and the emergence of new entrants also pose challenges. These factors combined can exert a significant impact on profitability and market share.

Emerging Opportunities in Asia-Pacific Stevedoring and Marine Cargo Handling Market

Emerging opportunities lie in the adoption of advanced technologies like blockchain for enhanced supply chain transparency and security, the development of specialized handling solutions for niche cargo types, and the expansion into new markets driven by increasing trade between Asia and other regions. Focus on sustainable practices and efficient resource management will attract investment and create new opportunities.

Leading Players in the Asia-Pacific Stevedoring and Marine Cargo Handling Market Market

- PSA International Pte Ltd

- China Merchants Port Holdings Co Ltd

- Velogic India Private Limited

- International Container Terminal Services Inc (ICTSI)

- XPO Logistics

- EUROKAI GmbH & Co KGaA

- Pacific Cargo Services

- APM Terminals

- Hutchison Port Holdings Trust

- Orissa Stevedores Limited

- A P Moller-Maersk

Key Developments in Asia-Pacific Stevedoring and Marine Cargo Handling Market Industry

- September 2022: MAERSK completed its acquisition of LF Logistics, expanding its warehousing capabilities and strengthening its presence in Asia-Pacific e-commerce.

- February 2022: A.P. Moller - Maersk announced the intended acquisition of Pilot Freight Services, bolstering its North American last-mile delivery capabilities.

Future Outlook for Asia-Pacific Stevedoring and Marine Cargo Handling Market Market

The Asia-Pacific stevedoring and marine cargo handling market is poised for continued growth, driven by robust trade volumes, technological advancements, and increasing e-commerce activities. Strategic investments in infrastructure development, the adoption of sustainable practices, and the integration of advanced technologies will be crucial for players to capitalize on the market’s immense potential. Focus on enhancing operational efficiency and delivering reliable, cost-effective solutions will be key to success in this competitive landscape.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo Handling and Transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Singapore

- 3.6. Rest of Asia-Pacific

Asia-Pacific Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Singapore

- 6. Rest of Asia Pacific

Asia-Pacific Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of Asia-Pacific Stevedoring and Marine Cargo Handling Market

Asia-Pacific Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Rising Container Handling Services are driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo Handling and Transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Singapore

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Singapore

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Stevedoring

- 6.1.2. Cargo Handling and Transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Bulk Cargo

- 6.2.2. Containerized Cargo

- 6.2.3. Other Cargo

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Singapore

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Stevedoring

- 7.1.2. Cargo Handling and Transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Bulk Cargo

- 7.2.2. Containerized Cargo

- 7.2.3. Other Cargo

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Singapore

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Stevedoring

- 8.1.2. Cargo Handling and Transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Bulk Cargo

- 8.2.2. Containerized Cargo

- 8.2.3. Other Cargo

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Singapore

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Stevedoring

- 9.1.2. Cargo Handling and Transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Bulk Cargo

- 9.2.2. Containerized Cargo

- 9.2.3. Other Cargo

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Singapore

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Singapore Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Stevedoring

- 10.1.2. Cargo Handling and Transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Bulk Cargo

- 10.2.2. Containerized Cargo

- 10.2.3. Other Cargo

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Singapore

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Stevedoring

- 11.1.2. Cargo Handling and Transportation

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Cargo Type

- 11.2.1. Bulk Cargo

- 11.2.2. Containerized Cargo

- 11.2.3. Other Cargo

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Australia

- 11.3.5. Singapore

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PSA International Pte Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 China Merchants Port Holdings Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Velogic India Private Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 International Container Terminal Services Inc (ICTSI)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 XPO Logistics

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 EUROKAI GmbH & Co KGaA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pacific Cargo Services**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 APM Terminals

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hutchison Port Holdings Trust

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Orissa Stevedores Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 A P Moller-Maersk

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 PSA International Pte Ltd

List of Figures

- Figure 1: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 7: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 11: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 15: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 19: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 23: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 27: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

Key companies in the market include PSA International Pte Ltd, China Merchants Port Holdings Co Ltd, Velogic India Private Limited, International Container Terminal Services Inc (ICTSI), XPO Logistics, EUROKAI GmbH & Co KGaA, Pacific Cargo Services**List Not Exhaustive, APM Terminals, Hutchison Port Holdings Trust, Orissa Stevedores Limited, A P Moller-Maersk.

3. What are the main segments of the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Rising Container Handling Services are driving the market.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

September 2022: MAERSK has completed its acquisition of LF Logistics, a contract logistics company with capabilities across e-commerce and inland transport in the Asia Pacific region. Having acquired the Hong Kong-based company, Maersk will add 223 warehouses to its existing portfolio, bringing the total number of warehouse facilities to 549 globally, spread across a total of 9.5 million square kilometres. With the addition of LF Logistics, Maersk gains unique and best in class capabilities to servicing the important and fast-growing consumer markets in Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence