Key Insights

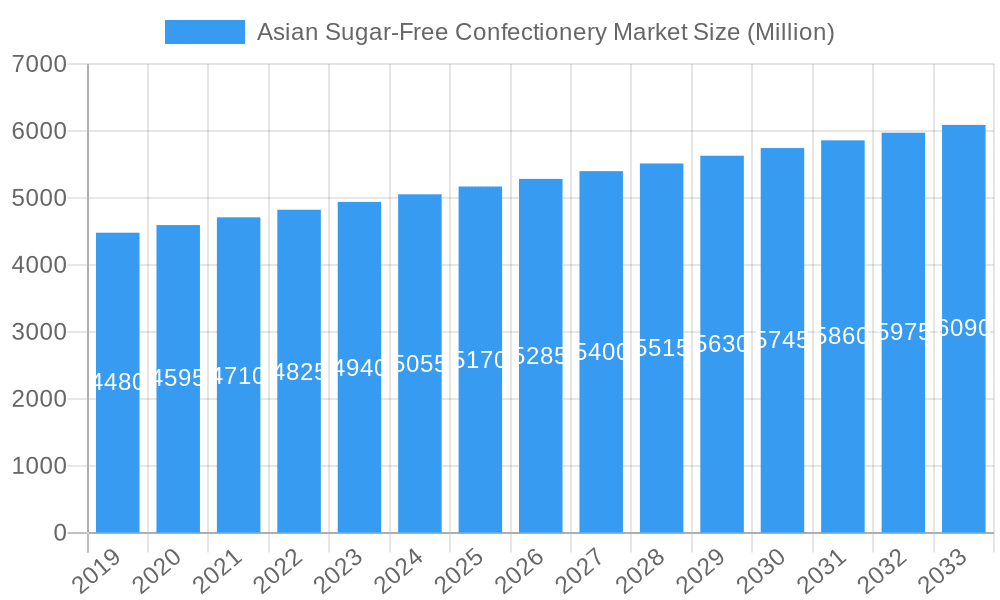

The Asian Sugar-Free Confectionery Market is projected for substantial growth, estimated to reach USD 4.07 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This expansion is driven by rising consumer health consciousness and the increasing prevalence of lifestyle diseases such as diabetes and obesity across the region. Consumers are actively seeking healthier alternatives to traditional sweets, boosting demand for sugar-free options. Product innovation by leading manufacturers, focusing on natural sweeteners, improved flavors, and diverse formats, further supports market growth. Increasing disposable incomes in emerging Asian economies, alongside a greater awareness of the benefits of reduced sugar intake, are creating significant opportunities for sugar-free confectionery. The market is segmented by product type, including sugar-free chocolate, gums, snack bars, and confectionery items like mints and gummies.

Asian Sugar-Free Confectionery Market Market Size (In Billion)

Distribution channels are adapting to consumer convenience, with online retail gaining prominence alongside traditional convenience stores and supermarkets. This multi-channel strategy enhances accessibility for the digitally engaged Asian consumer. Key players, including Nestlé SA, Mars Incorporated, and The Hershey Company, are investing in product development and market expansion within major Asian markets like China, Japan, and India. Key market drivers include heightened health awareness, demand for diabetic-friendly products, and the perceived advantages of reduced sugar consumption. Potential challenges may arise from the higher cost of sugar-free ingredients and consumer perceptions regarding taste and texture. However, ongoing research and development aimed at improving palatability and cost-effectiveness are expected to overcome these obstacles, reinforcing the upward trajectory of the Asian sugar-free confectionery market.

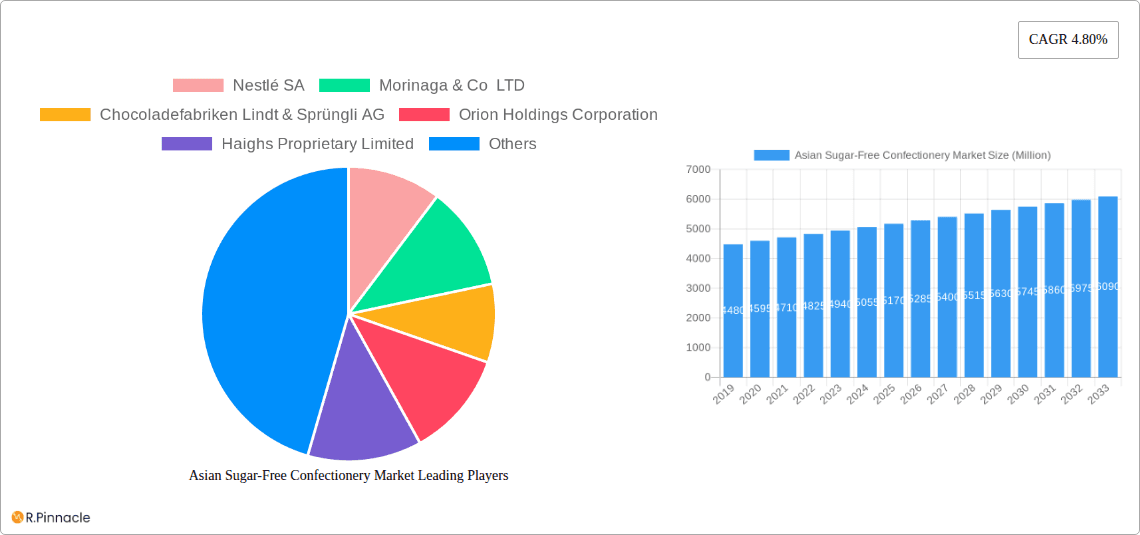

Asian Sugar-Free Confectionery Market Company Market Share

This report provides an in-depth analysis of the dynamic Asian sugar-free confectionery market, offering actionable insights. Focusing on sugar-free chocolates, gums, snack bars, and hard candies, this study examines market trends, growth drivers, competitive landscapes, and future projections. With a base year of 2025 and a forecast period extending to 2033, it explores key segments, dominant regions, and strategic developments shaping this rapidly evolving sector.

Asian Sugar-Free Confectionery Market Market Structure & Innovation Trends

The Asian sugar-free confectionery market exhibits a moderately consolidated structure, with key players like Nestlé SA, Mondelēz International Inc., and Lotte Corporation holding significant market share. Innovation remains a primary driver, fueled by escalating consumer demand for healthier indulgence options and advancements in sugar-alternative technologies. Regulatory frameworks, particularly concerning health claims and ingredient labeling, play a crucial role in shaping product development and market access. The threat of product substitutes, including functional foods and beverages offering similar health benefits, is a constant consideration. End-user demographics are increasingly skewing towards health-conscious millennials and Gen Z consumers, as well as individuals managing diabetes or seeking weight management solutions. Mergers and acquisitions (M&A) activities, while not yet at a frenzied pace, are anticipated to increase as larger players seek to consolidate their market position and acquire innovative smaller companies. For instance, strategic partnerships for ingredient sourcing or R&D could significantly impact market dynamics, with estimated M&A deal values in the range of several hundred million to over a billion dollars for significant acquisitions. The market concentration ratio (CR4) is estimated to be around 45% in the base year 2025, with opportunities for smaller players to carve out niche markets through specialized product offerings.

Asian Sugar-Free Confectionery Market Market Dynamics & Trends

The Asian sugar-free confectionery market is experiencing robust growth, propelled by a confluence of escalating health consciousness among consumers, a rising prevalence of lifestyle diseases such as diabetes, and a growing disposable income that allows for premiumization of food choices. The CAGR for this market is projected to be approximately 6.8% from 2025 to 2033, reflecting a significant upward trajectory. Technological disruptions are continuously reshaping the landscape, with advancements in natural sweeteners like stevia and erythritol offering improved taste profiles and wider application possibilities. Furthermore, the development of functional sugar-free confectionery, incorporating probiotics, vitamins, and other health-boosting ingredients, is gaining traction. Consumer preferences are rapidly shifting away from traditional high-sugar products towards options that align with wellness goals. This includes a strong demand for clear labeling of ingredients, transparency about sugar content, and a preference for products perceived as "natural" or "clean label." The competitive dynamics are intensifying, with both established multinational corporations and agile local players vying for market share. Market penetration for sugar-free options, currently estimated at around 25% in key urban centers by 2025, is expected to surge as availability and consumer acceptance broaden. The increasing awareness of the negative health impacts of excessive sugar consumption is a fundamental driver, leading consumers to actively seek alternatives. This shift is particularly pronounced in urban areas with higher access to information and exposure to global health trends. The development of sophisticated product formulations that mimic the taste and texture of traditional sugary confections without compromising on health benefits is a key trend. This includes advancements in dark chocolate formulations with a higher cocoa content and naturally occurring antioxidants, as well as sugar-free gums that offer long-lasting flavor and oral hygiene benefits. The demand for sugar-free snack bars, catering to busy lifestyles and fitness enthusiasts, is also a significant growth area, encompassing options like protein bars, cereal bars, and fruit & nut bars with reduced sugar content. The overall market size is projected to reach approximately USD 18.5 Billion by 2033.

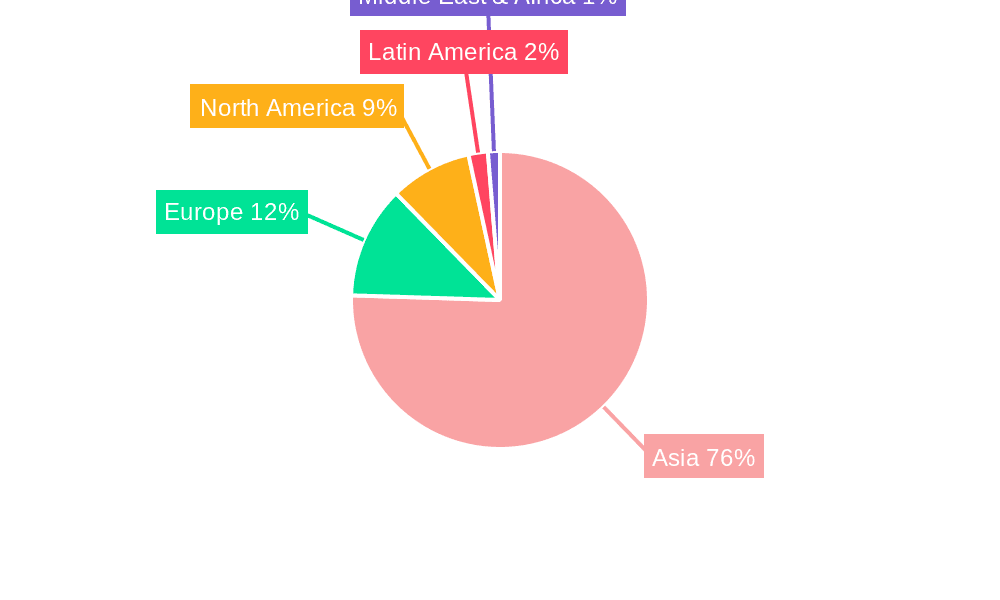

Dominant Regions & Segments in Asian Sugar-Free Confectionery Market

The Asian sugar-free confectionery market is largely dominated by Southeast Asia, driven by its burgeoning economies, increasing health awareness, and a youthful demographic. Within Southeast Asia, China stands out as the leading country market due to its massive population, rapid urbanization, and a growing middle class that is increasingly health-conscious and willing to spend on premium products. Economic policies promoting healthy lifestyles and investments in food technology research and development further bolster China's dominance.

Key Segment Dominance:

Confections:

- Chocolate: Dark Chocolate holds a commanding position within the sugar-free chocolate segment. Consumers are increasingly recognizing the health benefits associated with dark chocolate, such as its antioxidant properties, making it a preferred choice for sugar-free indulgence. The demand for milk and white chocolate alternatives with reduced sugar is also growing steadily.

- Gums: Sugar-free Chewing Gum is a significant segment, driven by its dual benefits of breath freshening and potential oral health advantages. The market is witnessing a rise in functional sugar-free gums incorporating vitamins or xylitol for enhanced dental care.

- Snack Bar: Protein Bars are experiencing explosive growth. This is largely attributed to the rising health and fitness trend, with consumers seeking convenient, on-the-go options that support their dietary goals. Cereal bars and fruit & nut bars also contribute significantly to this segment's expansion.

- Sugar Confectionery: Mints and Pastilles are leading sub-segments, offering a quick and convenient sugar-free refreshment. Gummies and jellies are also gaining popularity as healthier alternatives to traditional candies, especially among younger consumers.

Distribution Channel:

- Supermarket/Hypermarket: These channels remain the most dominant for sugar-free confectionery due to their wide reach, extensive product variety, and the ability to cater to a broad consumer base. Consumers often purchase these items as part of their regular grocery shopping.

- Online Retail Store: The online channel is rapidly gaining traction, driven by convenience, wider product selection, and competitive pricing. E-commerce platforms offer a significant avenue for specialized sugar-free brands to reach a wider audience.

Key Drivers of Dominance:

- Economic Policies: Government initiatives promoting healthier eating habits and the taxation of high-sugar products in certain countries contribute to the increased demand for sugar-free alternatives.

- Infrastructure: Well-developed retail infrastructure, including modern supermarkets and a robust online delivery network, facilitates the accessibility and widespread availability of sugar-free confectionery.

- Consumer Awareness: Increased media coverage and public health campaigns highlighting the detrimental effects of sugar consumption have significantly boosted consumer awareness and preference for sugar-free options.

- Rising Disposable Income: A growing middle class across Asia has more disposable income to spend on premium and health-oriented food products.

The market size for the dominant regions is estimated to contribute over 70% of the total Asian sugar-free confectionery market by 2025.

Asian Sugar-Free Confectionery Market Product Innovations

Product innovations in the Asian sugar-free confectionery market are characterized by a focus on natural sweeteners, enhanced functionality, and diverse flavor profiles. Companies are actively developing sugar-free chocolates with sophisticated flavor infusions, such as chili or fruit essences, to appeal to evolving palates. Sugar-free gums are being enhanced with functional ingredients like probiotics for gut health or breath-freshening agents. The snack bar category is witnessing the introduction of bars catering to specific dietary needs, including low-carb and keto-friendly options. These innovations aim to provide consumers with guilt-free indulgence, offering competitive advantages through improved taste, texture, and health benefits. Technological trends are enabling the creation of sugar-free products that closely mimic the sensory experience of their traditional counterparts, further driving market acceptance.

Report Scope & Segmentation Analysis

This report comprehensively covers the Asian sugar-free confectionery market across various segments.

Confections:

- Chocolate: This segment is further divided into Dark Chocolate, Milk Chocolate, and White Chocolate, all offered in sugar-free variants. Growth is driven by premiumization and health-conscious indulgence.

- Gums: Includes Bubble Gum and Chewing Gum. The Chewing Gum segment is dissected by sugar content into Sugar Chewing Gum and Sugar-free Chewing Gum. Demand for sugar-free variants is propelled by oral health and wellness trends.

- Snack Bar: Encompasses Cereal Bar, Fruit & Nut Bar, and Protein Bar. The Protein Bar sub-segment is a significant growth engine due to fitness trends.

- Sugar Confectionery: A broad category including Hard Candy, Lollipops, Mints, Pastilles, Gummies, and Jellies, Toffees and Nougats, and Others. Mints and pastilles are particularly strong performers in the sugar-free domain.

Distribution Channel:

- Convenience Store: Offers impulse purchases and on-the-go accessibility.

- Online Retail Store: Experiencing rapid growth due to convenience and wider selection.

- Supermarket/Hypermarket: Dominant channel for bulk purchases and everyday needs.

- Others: Includes specialized health food stores and pharmacies.

Growth projections for each segment indicate a robust expansion, with the Protein Bar and Sugar-free Chewing Gum segments expected to exhibit the highest Compound Annual Growth Rates (CAGR). Competitive dynamics vary across segments, with online retail expected to witness intensified competition.

Key Drivers of Asian Sugar-Free Confectionery Market Growth

The Asian sugar-free confectionery market is propelled by several key drivers. Rising health consciousness is paramount, with consumers actively seeking to reduce sugar intake due to concerns about obesity, diabetes, and overall well-being. Technological advancements in sweeteners, such as stevia and erythritol, have enabled the creation of palatable sugar-free products. Favorable government initiatives and regulations promoting healthier food choices and imposing taxes on sugary products also contribute significantly. Furthermore, the increasing prevalence of lifestyle diseases like diabetes creates a sustained demand for sugar-free alternatives. The growing disposable income in emerging Asian economies allows consumers to prioritize health-oriented purchases, driving market expansion. The convenience factor of sugar-free snack bars and confectionery for on-the-go consumption also plays a crucial role.

Challenges in the Asian Sugar-Free Confectionery Market Sector

Despite the promising growth, the Asian sugar-free confectionery market faces several challenges. High production costs associated with sugar substitutes and specialized manufacturing processes can lead to higher retail prices, potentially limiting mass market adoption. Consumer perception and taste preferences remain a hurdle, as some consumers still associate sugar-free products with inferior taste or texture compared to their traditional counterparts. Regulatory complexities and differing standards across various Asian countries can create compliance challenges for manufacturers. Supply chain disruptions for specific sugar-alternative ingredients, coupled with the need for stringent quality control, can impact product availability. Intense competitive pressure from both established players and emerging brands also poses a significant challenge, requiring continuous innovation and effective marketing strategies. The potential for negative publicity or consumer skepticism regarding the long-term health effects of certain artificial sweeteners can also impact market growth.

Emerging Opportunities in Asian Sugar-Free Confectionery Market

The Asian sugar-free confectionery market presents several emerging opportunities. The growing demand for functional sugar-free confectionery, incorporating ingredients like probiotics, vitamins, and natural energy boosters, offers a significant avenue for product differentiation. Expansion into untapped rural and semi-urban markets within Asia, where awareness of sugar-free benefits is growing, presents a substantial growth potential. Partnerships with healthcare providers and nutritionists can help build credibility and drive adoption among target consumer groups, particularly those managing chronic health conditions. The development of innovative and sustainable packaging solutions for sugar-free confectionery can appeal to environmentally conscious consumers. Furthermore, leveraging e-commerce platforms and digital marketing strategies to reach a wider audience and provide personalized product recommendations is a key opportunity for brand building and sales growth. The exploration of novel, plant-based sugar alternatives is also a promising area for innovation.

Leading Players in the Asian Sugar-Free Confectionery Market Market

- Nestlé SA

- Morinaga & Co LTD

- Chocoladefabriken Lindt & Sprüngli AG

- Orion Holdings Corporation

- Haighs Proprietary Limited

- Perfetti Van Melle BV

- General Mills Inc

- PepsiCo Inc

- Delfi Limited

- Ferrero International SA

- Mars Incorporated

- Lotte Corporation

- The Hershey Company

- Mondelēz International Inc

- Meiji Holdings Company Ltd

- Kellogg Company

Key Developments in Asian Sugar-Free Confectionery Market Industry

- May 2023: Nature Valley added a new level of flavor with its newest innovation, Nature Valley Savory Nut Crunch Bar, the first savory snack from the number one-selling bar brand. These bars will be available in three flavors: Everything Bagel, White Cheddar, and Smoky BBQ.

- May 2023: The Hershey Company expanded its business by establishing a new research and development center in Johor, Malaysia.

- April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.

Future Outlook for Asian Sugar-Free Confectionery Market Market

The future outlook for the Asian sugar-free confectionery market is exceptionally bright, driven by an enduring shift towards healthier lifestyle choices and sustained innovation. The market is poised for continued robust growth, fueled by increasing consumer awareness, advancements in sweetener technology, and expanding product portfolios catering to diverse dietary needs and preferences. Strategic investments in research and development, coupled with expansion into emerging markets and channels, will be crucial for players to capitalize on future opportunities. The market's trajectory indicates a strong potential for further premiumization and the integration of functional benefits, solidifying sugar-free confectionery as a mainstream and indispensable part of the Asian food landscape. Anticipated market size by 2033 is projected to reach approximately USD 18.5 Billion.

Asian Sugar-Free Confectionery Market Segmentation

-

1. Confections

-

1.1. Chocolate

-

1.1.1. By Confectionery Variant

- 1.1.1.1. Dark Chocolate

- 1.1.1.2. Milk and White Chocolate

-

1.1.1. By Confectionery Variant

-

1.2. Gums

- 1.2.1. Bubble Gum

-

1.2.2. Chewing Gum

-

1.2.2.1. By Sugar Content

- 1.2.2.1.1. Sugar Chewing Gum

- 1.2.2.1.2. Sugar-free Chewing Gum

-

1.2.2.1. By Sugar Content

-

1.3. Snack Bar

- 1.3.1. Cereal Bar

- 1.3.2. Fruit & Nut Bar

- 1.3.3. Protein Bar

-

1.4. Sugar Confectionery

- 1.4.1. Hard Candy

- 1.4.2. Lollipops

- 1.4.3. Mints

- 1.4.4. Pastilles, Gummies, and Jellies

- 1.4.5. Toffees and Nougats

- 1.4.6. Others

-

1.1. Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Asian Sugar-Free Confectionery Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Sugar-Free Confectionery Market Regional Market Share

Geographic Coverage of Asian Sugar-Free Confectionery Market

Asian Sugar-Free Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1 China is the leading market

- 3.4.2 followed by Japan

- 3.4.3 collectively accounting for more than 50% share of the region's confectionery market in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Sugar-Free Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 5.1.1. Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.1.1.1. Dark Chocolate

- 5.1.1.1.2. Milk and White Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.2. Gums

- 5.1.2.1. Bubble Gum

- 5.1.2.2. Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.2.2.1.1. Sugar Chewing Gum

- 5.1.2.2.1.2. Sugar-free Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.3. Snack Bar

- 5.1.3.1. Cereal Bar

- 5.1.3.2. Fruit & Nut Bar

- 5.1.3.3. Protein Bar

- 5.1.4. Sugar Confectionery

- 5.1.4.1. Hard Candy

- 5.1.4.2. Lollipops

- 5.1.4.3. Mints

- 5.1.4.4. Pastilles, Gummies, and Jellies

- 5.1.4.5. Toffees and Nougats

- 5.1.4.6. Others

- 5.1.1. Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morinaga & Co LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orion Holdings Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Haighs Proprietary Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Perfetti Van Melle BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Mills Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PepsiCo Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Delfi Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ferrero International SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mars Incorporated

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lotte Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 The Hershey Compan

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mondelēz International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Meiji Holdings Company Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Kellogg Company

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: Asian Sugar-Free Confectionery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asian Sugar-Free Confectionery Market Share (%) by Company 2025

List of Tables

- Table 1: Asian Sugar-Free Confectionery Market Revenue billion Forecast, by Confections 2020 & 2033

- Table 2: Asian Sugar-Free Confectionery Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asian Sugar-Free Confectionery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asian Sugar-Free Confectionery Market Revenue billion Forecast, by Confections 2020 & 2033

- Table 5: Asian Sugar-Free Confectionery Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asian Sugar-Free Confectionery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bangladesh Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Pakistan Asian Sugar-Free Confectionery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Sugar-Free Confectionery Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Asian Sugar-Free Confectionery Market?

Key companies in the market include Nestlé SA, Morinaga & Co LTD, Chocoladefabriken Lindt & Sprüngli AG, Orion Holdings Corporation, Haighs Proprietary Limited, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Delfi Limited, Ferrero International SA, Mars Incorporated, Lotte Corporation, The Hershey Compan, Mondelēz International Inc, Meiji Holdings Company Ltd, Kellogg Company.

3. What are the main segments of the Asian Sugar-Free Confectionery Market?

The market segments include Confections, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

China is the leading market. followed by Japan. collectively accounting for more than 50% share of the region's confectionery market in 2023.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

May 2023: Nature Valley added a new level of flavor with its newest innovation, Nature Valley Savory Nut Crunch Bar, the first savory snack from the number one-selling bar brand. These bars will be available in three flavors: Everything Bagel, White Cheddar, and Smoky BBQ.May 2023: The Hershey Company expanded its business by establishing a new research and development center in Johor, Malaysia.April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Sugar-Free Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Sugar-Free Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Sugar-Free Confectionery Market?

To stay informed about further developments, trends, and reports in the Asian Sugar-Free Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence