Key Insights

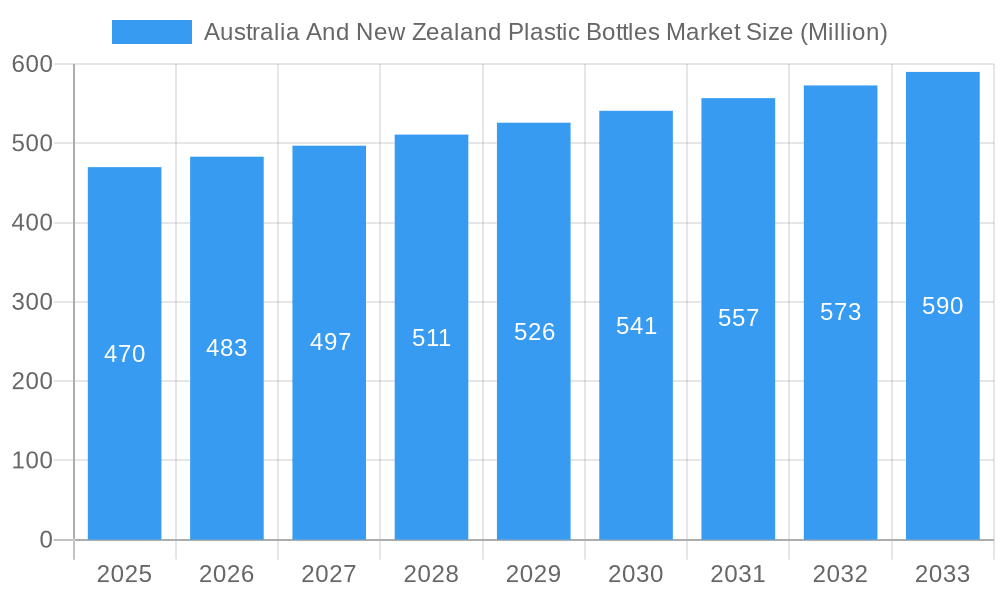

The Australia and New Zealand plastic bottles market, valued at $453.85 million in 2024, is projected to experience steady growth, driven primarily by the robust demand from the food and beverage, personal care, and pharmaceutical sectors. The 3.19% CAGR from 2019 to 2024 suggests a continued, albeit moderate, expansion through 2033. Growth is fueled by increasing consumer preference for convenience packaging, coupled with rising population and disposable incomes. However, increasing environmental concerns regarding plastic waste and stringent government regulations aimed at promoting sustainable alternatives represent significant headwinds. The market is characterized by a mix of established players, such as Visy Group and Pact Group, alongside smaller, regional manufacturers. Competition is likely to intensify as both established companies and emerging players seek to innovate in materials (e.g., recycled PET), packaging designs (e.g., lighter-weight bottles), and manufacturing processes (e.g., improved efficiency). The market’s segmentation likely reflects variations in bottle types (e.g., PET, HDPE), applications, and distribution channels. A deeper dive into regional data (currently unavailable) would illuminate potential variations in market dynamics between Australia and New Zealand, potentially highlighting differences in consumer behavior, regulatory environments, and competitive landscapes. The forecast period of 2025-2033 will likely see a continued focus on sustainability and the adoption of more eco-friendly packaging solutions, potentially impacting market growth and player strategies.

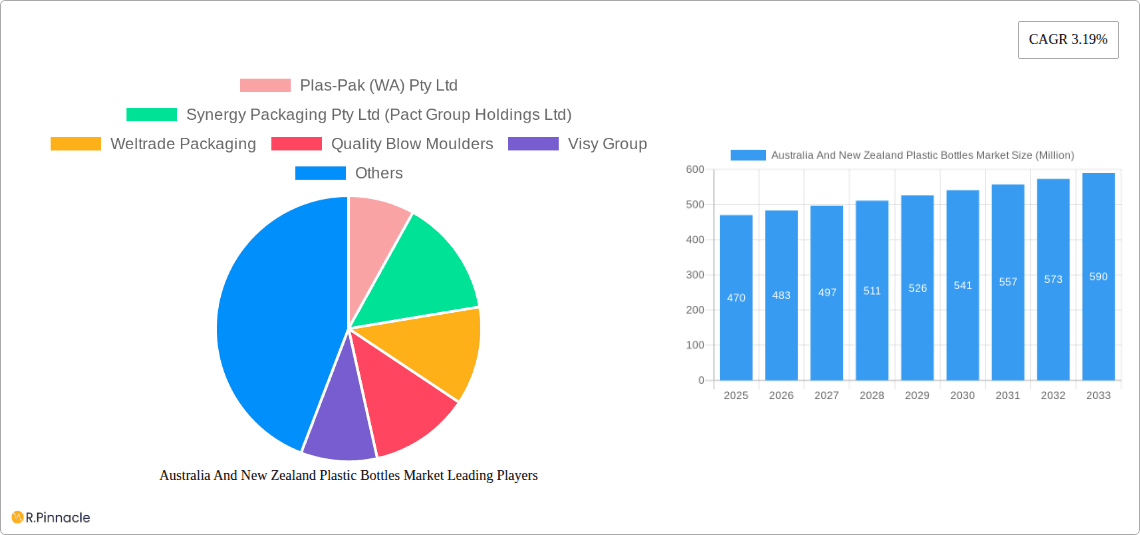

Australia And New Zealand Plastic Bottles Market Market Size (In Million)

The ongoing evolution of consumer preferences, coupled with environmental concerns and regulatory pressure, necessitates a proactive approach from market participants. Companies are likely to focus on strategies that combine cost-effectiveness with environmental responsibility. This includes investments in recycling infrastructure, research and development into biodegradable alternatives, and transparent communication about sustainability initiatives to resonate with increasingly environmentally conscious consumers. Further growth may also be stimulated through innovations that enhance product shelf life, improve product protection, and reduce the overall environmental footprint of the plastic bottles across their lifecycle. Successful strategies will involve careful consideration of the specific requirements of different market segments and proactive adaptation to changing consumer demands and environmental regulations.

Australia And New Zealand Plastic Bottles Market Company Market Share

This comprehensive report provides a detailed analysis of the Australia and New Zealand plastic bottles market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period 2019-2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth potential.

Australia And New Zealand Plastic Bottles Market Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report examines the market share held by key players such as Plas-Pak (WA) Pty Ltd, Synergy Packaging Pty Ltd (Pact Group Holdings Ltd), Weltrade Packaging, Quality Blow Moulders, Visy Group, PB Packaging, Ant Packaging Pty Ltd, TSL Plastics Ltd, Waipak NZ Ltd, LinkPlas Ltd, and Flexicon Plastics, differentiating between established and emerging players. The analysis also includes an assessment of the impact of mergers and acquisitions, with estimated deal values where available. The report considers the influence of regulatory frameworks on innovation and the adoption of sustainable packaging solutions. It also explores the impact of substitute materials and evolving consumer preferences on market dynamics.

Australia And New Zealand Plastic Bottles Market Market Dynamics & Trends

This section delves into the key factors driving market growth, including technological advancements, shifting consumer preferences, and competitive dynamics. The report quantifies market growth using Compound Annual Growth Rate (CAGR) projections for the forecast period (2025-2033). Market penetration rates for different bottle types and applications will be analyzed. The impact of technological disruptions, such as advancements in lightweighting and recyclability, on market trends will be discussed. Specific examples of consumer preferences, such as the growing demand for sustainable packaging and eco-friendly materials, are incorporated. The competitive landscape is examined, highlighting strategic actions taken by key players to maintain or gain market share. The influence of major market events, such as the Suntory Oceania collaboration (USD 1.99 Billion) is explored.

Dominant Regions & Segments in Australia And New Zealand Plastic Bottles Market

This section identifies the leading regions and segments within the Australia and New Zealand plastic bottles market. A detailed analysis will pinpoint the dominant regions based on factors such as market size, growth rate, and consumer demand. For each leading region/segment, the report identifies key drivers through bullet points:

- Economic factors: GDP growth, disposable income levels, consumer spending patterns.

- Infrastructure: Availability of manufacturing facilities, distribution networks, and supporting industries.

- Government policies: Regulations related to plastic waste, recycling initiatives, and incentives for sustainable packaging.

The dominance analysis will delve into the factors contributing to the success of the leading regions/segments, including market size, growth projections, competitive dynamics, and technological advancements.

Australia And New Zealand Plastic Bottles Market Product Innovations

This section summarizes the latest product developments in the plastic bottles market, focusing on technological trends and their market fit. It explores innovations in materials, design, and functionality, highlighting the competitive advantages offered by new products. The discussion encompasses the adoption of sustainable materials, lightweighting techniques, and improved recyclability. The impact of these innovations on market share and consumer adoption is evaluated.

Report Scope & Segmentation Analysis

This section outlines the segmentation of the Australia and New Zealand plastic bottles market. The market is segmented by:

- Material Type: PET, HDPE, PP, and others, each segment's growth projections, market sizes and competitive dynamics will be detailed.

- Bottle Type: Carbonated soft drinks, water, juices, and other beverages. Each segment will receive similar treatment.

- End-Use Industry: Food and beverages, personal care, pharmaceuticals, and others. Each segment will be analysed.

Each segment's growth projections, market size, and competitive dynamics are analyzed.

Key Drivers of Australia And New Zealand Plastic Bottles Market Growth

This section identifies the key factors driving growth in the Australia and New Zealand plastic bottles market. This includes:

- Technological advancements: Innovations in materials, manufacturing processes, and packaging design.

- Economic growth: Rising disposable incomes and increased consumer spending.

- Regulatory changes: Government initiatives promoting sustainable packaging and waste reduction.

Specific examples of each driver, such as investments in new manufacturing facilities or specific government policies, will be provided.

Challenges in the Australia And New Zealand Plastic Bottles Market Sector

This section highlights the challenges facing the Australia and New Zealand plastic bottles market. Key challenges explored include:

- Environmental concerns: Growing pressure to reduce plastic waste and improve recycling rates. This will include quantifiable impacts on the market, such as potential regulations or consumer boycotts.

- Supply chain disruptions: Vulnerabilities in raw material sourcing and logistical challenges.

- Competitive pressures: Intensity of competition from alternative packaging materials and manufacturers.

The section quantifies the impact of these challenges on market growth and profitability.

Emerging Opportunities in Australia And New Zealand Plastic Bottles Market

This section explores the emerging opportunities in the Australia and New Zealand plastic bottles market. This includes:

- Growth in specific segments: Increased demand for sustainable packaging options and specialized bottle types.

- Technological innovations: Adoption of advanced manufacturing technologies and innovative materials.

- New market penetration: Expansion into new geographic regions and consumer segments.

Specific examples are given, including the potential for growth in the sports drink segment.

Leading Players in the Australia And New Zealand Plastic Bottles Market Market

- Plas-Pak (WA) Pty Ltd

- Synergy Packaging Pty Ltd (Pact Group Holdings Ltd)

- Weltrade Packaging

- Quality Blow Moulders

- Visy Group

- PB Packaging

- Ant Packaging Pty Ltd

- TSL Plastics Ltd

- Waipak NZ Ltd

- LinkPlas Ltd

- Flexicon Plastics

A competitor analysis differentiates between established and emerging players.

Key Developments in Australia And New Zealand Plastic Bottles Market Industry

August 2024: Coca-Cola Europacific Partners (CCEP) invests USD 105.5 Million in a new Warmfill Line in Moorabbin, Victoria, Australia. This signifies a significant investment in Australian manufacturing, driven by rising demand for sports drinks within the NARTD segment.

August 2023: Beam Suntory and Frucor Suntory launch Suntory Oceania, a AUD 3 Billion (USD 1.99 Billion) multi-beverage collaboration, aiming to become the fourth-largest beverage group in Australia and New Zealand by mid-2025 (Australia) and 2026 (New Zealand).

Future Outlook for Australia And New Zealand Plastic Bottles Market Market

The future of the Australia and New Zealand plastic bottles market shows strong potential for growth, driven by continued economic growth, population increase, and the rising demand for convenient, ready-to-drink beverages. The increasing adoption of sustainable and innovative packaging solutions will shape future market trends. Strategic opportunities exist for companies that can effectively meet the evolving consumer preferences for eco-friendly and functional packaging. The significant investments made by key players indicate a positive outlook, with opportunities in sectors like sports drinks and premium beverages contributing significantly to future market expansion.

Australia And New Zealand Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Resins

-

2. End-user Industries

- 2.1. Food

-

2.2. Beverage**

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices and Energy Drinks

- 2.2.5. Other Beverages

- 2.3. Pharmaceuticals

- 2.4. Personal Care and Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints and Coatings

- 2.8. Other End-user Industries

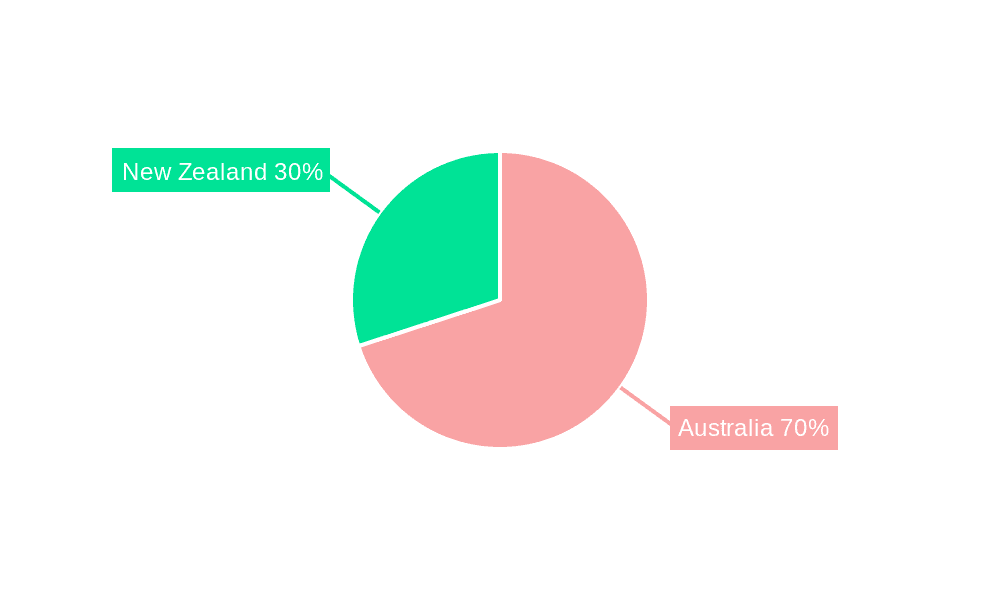

Australia And New Zealand Plastic Bottles Market Segmentation By Geography

- 1. Australia

Australia And New Zealand Plastic Bottles Market Regional Market Share

Geographic Coverage of Australia And New Zealand Plastic Bottles Market

Australia And New Zealand Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Healthy and RTD Beverages to Push the Market; Plastic Recycling Trends Set to Propel the Market

- 3.3. Market Restrains

- 3.3.1. Need for Healthy and RTD Beverages to Push the Market; Plastic Recycling Trends Set to Propel the Market

- 3.4. Market Trends

- 3.4.1. Recyclable Plastic Materials Such as Polyethylene Terephthalate (PET) To Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Food

- 5.2.2. Beverage**

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices and Energy Drinks

- 5.2.2.5. Other Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care and Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints and Coatings

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Plas-Pak (WA) Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Synergy Packaging Pty Ltd (Pact Group Holdings Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Weltrade Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Quality Blow Moulders

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Visy Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PB Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ant Packaging Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TSL Plastics Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Waipak NZ Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LinkPlas Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Flexicon Plastics7 2 Competitor Analysis - Emerging vs Established Player

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Plas-Pak (WA) Pty Ltd

List of Figures

- Figure 1: Australia And New Zealand Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia And New Zealand Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Australia And New Zealand Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Australia And New Zealand Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 3: Australia And New Zealand Plastic Bottles Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 4: Australia And New Zealand Plastic Bottles Market Volume Million Forecast, by End-user Industries 2020 & 2033

- Table 5: Australia And New Zealand Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia And New Zealand Plastic Bottles Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Australia And New Zealand Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Australia And New Zealand Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 9: Australia And New Zealand Plastic Bottles Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 10: Australia And New Zealand Plastic Bottles Market Volume Million Forecast, by End-user Industries 2020 & 2033

- Table 11: Australia And New Zealand Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia And New Zealand Plastic Bottles Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Plastic Bottles Market?

The projected CAGR is approximately 3.19%.

2. Which companies are prominent players in the Australia And New Zealand Plastic Bottles Market?

Key companies in the market include Plas-Pak (WA) Pty Ltd, Synergy Packaging Pty Ltd (Pact Group Holdings Ltd), Weltrade Packaging, Quality Blow Moulders, Visy Group, PB Packaging, Ant Packaging Pty Ltd, TSL Plastics Ltd, Waipak NZ Ltd, LinkPlas Ltd, Flexicon Plastics7 2 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Australia And New Zealand Plastic Bottles Market?

The market segments include Resin, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 453.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Healthy and RTD Beverages to Push the Market; Plastic Recycling Trends Set to Propel the Market.

6. What are the notable trends driving market growth?

Recyclable Plastic Materials Such as Polyethylene Terephthalate (PET) To Witness Growth.

7. Are there any restraints impacting market growth?

Need for Healthy and RTD Beverages to Push the Market; Plastic Recycling Trends Set to Propel the Market.

8. Can you provide examples of recent developments in the market?

August 2024 - Coca-Cola Europacific Partners (CCEP) is set to invest an additional USD 105.5 million in a new Warmfill Line at its Moorabbin plant in Victoria, Australia. This marks a significant single investment in CCEP's Australian manufacturing network, underscoring the company's commitment to efficiently delivering high-quality beverages to an expanding customer base. With a rising consumer focus on health and wellness, especially towards no-sugar variants, sports drinks are anticipated to be among the fastest-growing categories in the non-alcoholic ready-to-drink (NARTD) segment. This would push the country's market for plastic bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence