Key Insights

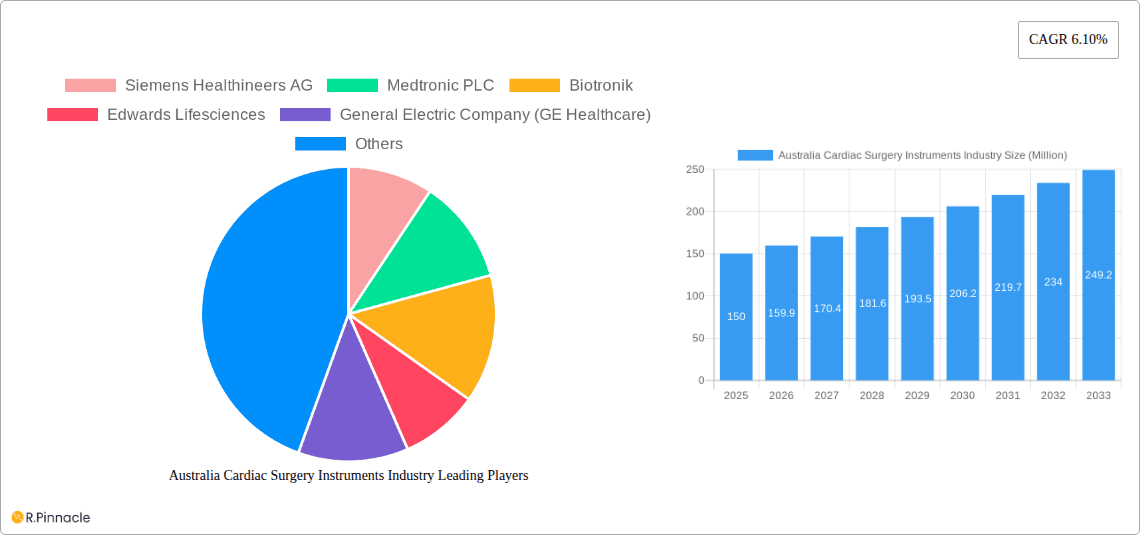

The Australian cardiac surgery instruments market, valued at approximately $150 million in 2025, is projected to experience robust growth, driven by factors such as an aging population leading to increased prevalence of cardiovascular diseases, rising demand for minimally invasive surgical procedures, technological advancements in device design and functionality, and a growing focus on improving patient outcomes. The market's Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033 indicates a significant expansion, with the market expected to surpass $250 million by 2033. This growth is further fueled by increasing government initiatives promoting healthcare infrastructure development and advancements in medical technologies. The segment comprising diagnostic and monitoring devices holds a larger market share compared to therapeutic and surgical devices, reflecting the crucial role of accurate pre- and post-operative assessment in cardiac surgeries. Key players such as Siemens Healthineers, Medtronic, and Boston Scientific are driving innovation and competition, contributing to the market's dynamic nature. However, factors such as high costs associated with advanced instruments and potential regulatory hurdles might act as restraints to some extent, influencing the market's growth trajectory.

Australia Cardiac Surgery Instruments Industry Market Size (In Million)

The market segmentation reveals a significant concentration in diagnostic and monitoring devices due to their critical role in planning and evaluating cardiac surgical procedures. This segment's dominance is likely to persist throughout the forecast period. While therapeutic and surgical devices contribute substantially, their growth rate might be slightly lower compared to the diagnostic and monitoring segment due to the higher capital investment and specialized expertise required. Geographic concentration within Australia suggests opportunities for further penetration within regional healthcare facilities, possibly through strategic partnerships and targeted marketing initiatives. Continuous technological advancements, including the integration of AI and robotics, are expected to create new opportunities and drive further market expansion. Competitive landscape analysis points to ongoing efforts by leading players to develop innovative instruments and expand market reach, signifying healthy competition and potential for market consolidation in the coming years.

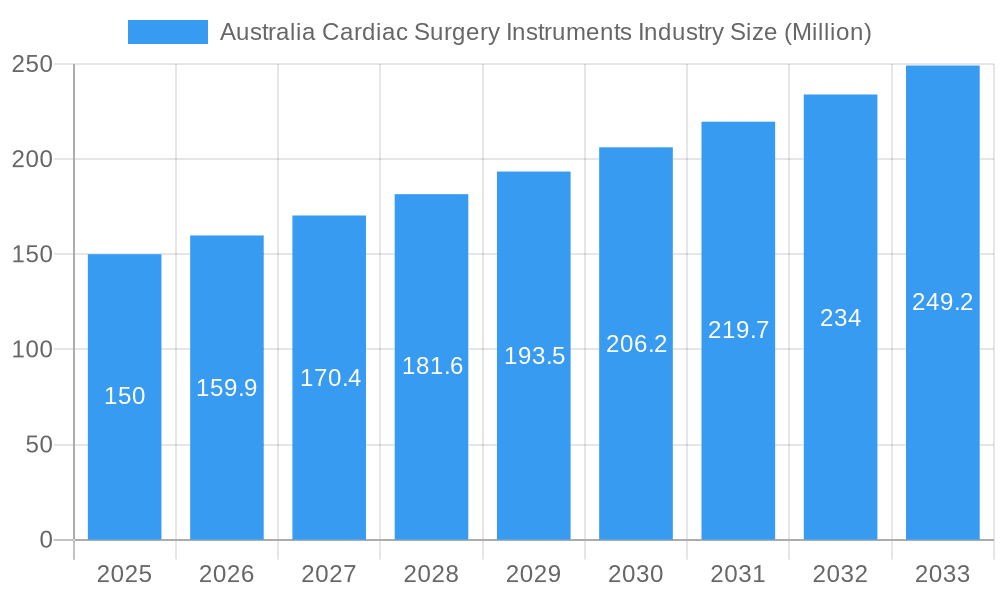

Australia Cardiac Surgery Instruments Industry Company Market Share

Australia Cardiac Surgery Instruments Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian cardiac surgery instruments market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers market structure, dynamics, leading players, innovation trends, and future growth projections, utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The market is segmented by device type: Diagnostic and Monitoring Devices and Therapeutic and Surgical Devices. The total market size is predicted to reach xx Million by 2033.

Australia Cardiac Surgery Instruments Industry Market Structure & Innovation Trends

The Australian cardiac surgery instruments market exhibits a moderately concentrated structure, with key players holding significant market share. While precise market share data for each company requires further proprietary research, industry giants like Siemens Healthineers AG, Medtronic PLC, and Edwards Lifesciences are expected to dominate. Innovation is driven by the need for minimally invasive procedures, improved patient outcomes, and technological advancements in areas like imaging and data analytics. The regulatory landscape, governed by the Therapeutic Goods Administration (TGA), influences product approvals and market entry. Substitute products are limited, primarily focusing on alternative surgical techniques. The end-user demographic consists mainly of hospitals, cardiac surgery centers, and private clinics. M&A activity has been moderate, with deal values averaging xx Million in recent years. Specific examples of M&A activity within the Australian cardiac surgery instruments sector would require deeper proprietary research.

- Market Concentration: Moderately Concentrated

- Key Innovation Drivers: Minimally invasive surgery, improved patient outcomes, technological advancements.

- Regulatory Framework: TGA (Therapeutic Goods Administration)

- M&A Activity: Moderate, average deal value xx Million (2019-2024)

Australia Cardiac Surgery Instruments Industry Market Dynamics & Trends

The Australian cardiac surgery instruments market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. Rising prevalence of cardiovascular diseases, an aging population, increasing government spending on healthcare infrastructure, and technological advancements in surgical instruments contribute to robust market growth. Technological disruptions, such as the adoption of robotics and AI-assisted surgery, are reshaping the market landscape. Consumer preferences increasingly favor minimally invasive procedures and improved patient experiences, influencing product development and market demand. Competitive dynamics are intense, with established players focusing on innovation, strategic partnerships, and market expansion. Market penetration for minimally invasive cardiac surgery instruments is expected to reach xx% by 2033.

Dominant Regions & Segments in Australia Cardiac Surgery Instruments Industry

While precise regional breakdowns require further proprietary research, the major metropolitan areas in Australia (Sydney, Melbourne, Brisbane, etc.) are expected to dominate the market due to higher concentration of specialized cardiac care facilities and higher population density. Within the segment breakdown, Therapeutic and Surgical Devices are projected to hold a larger market share than Diagnostic and Monitoring Devices, owing to the higher demand for advanced surgical instruments in complex cardiac procedures.

Key Drivers for Dominant Regions:

- Higher concentration of specialized cardiac care facilities

- Higher population density

- Increased government healthcare spending in major metropolitan areas

- Better access to advanced medical technologies and skilled professionals.

Key Drivers for Dominant Segments (Therapeutic and Surgical Devices):

- Increasing demand for minimally invasive procedures

- Technological advancements in surgical instruments leading to improved efficiency and outcomes

- Growing prevalence of complex cardiovascular diseases requiring advanced surgical interventions.

Australia Cardiac Surgery Instruments Industry Product Innovations

Recent years have witnessed significant product innovations, particularly in areas like minimally invasive surgical tools, improved imaging technologies, and data-driven surgical planning. Companies are focusing on developing devices that enhance precision, reduce surgical trauma, and improve patient recovery times. This focus reflects a market trend toward minimally invasive techniques and improved patient outcomes, providing a competitive advantage for companies that can deliver advanced, efficient, and safer products.

Report Scope & Segmentation Analysis

This report segments the Australian cardiac surgery instruments market by device type:

Diagnostic and Monitoring Devices: This segment includes instruments used for pre- and post-operative diagnosis and monitoring of cardiac patients. Market size is projected to reach xx Million by 2033, with a CAGR of xx%. Competitive dynamics are driven by technological advancements and the need for accurate, efficient diagnostic tools.

Therapeutic and Surgical Devices: This segment encompasses instruments used in cardiac surgical procedures, including minimally invasive devices and advanced surgical tools. The market size is projected to be xx Million by 2033, with a CAGR of xx%. Competition is fierce, with leading players focusing on innovation and product differentiation.

Key Drivers of Australia Cardiac Surgery Instruments Industry Growth

The Australian cardiac surgery instruments market’s growth is driven by several factors:

- Technological advancements: Innovations in minimally invasive surgery, robotic-assisted surgery, and improved imaging technologies are driving market expansion.

- Rising prevalence of cardiovascular diseases: The increasing incidence of heart conditions fuels the demand for advanced surgical instruments.

- Government healthcare initiatives: Investments in healthcare infrastructure and funding for cardiovascular research contribute to market growth. For example, the USD 17.2 Million allocated for mobile health clinics in Queensland demonstrates a commitment to expanding cardiac care access.

Challenges in the Australia Cardiac Surgery Instruments Industry Sector

Several challenges impede market growth:

- High regulatory hurdles: Strict TGA regulations can delay product approvals and increase costs for market entry.

- Supply chain disruptions: Global supply chain volatility can impact the availability and pricing of essential components.

- Intense competition: The presence of numerous established and emerging players intensifies competitive pressures, requiring continuous innovation and cost optimization.

Emerging Opportunities in Australia Cardiac Surgery Instruments Industry

Several emerging opportunities exist:

- Growing demand for minimally invasive procedures: This trend drives the need for advanced minimally invasive surgical tools.

- Adoption of AI and data analytics: Integrating AI and data analytics into surgical planning and execution presents new avenues for growth.

- Expansion into rural and remote areas: Increasing access to advanced cardiac care in underserved areas offers significant market potential.

Leading Players in the Australia Cardiac Surgery Instruments Industry Market

- Siemens Healthineers AG

- Medtronic PLC

- Biotronik

- Edwards Lifesciences

- General Electric Company (GE Healthcare)

- Canon Medical Systems Corporation

- Boston Scientific Corporation

- B Braun SE

- Abbott Laboratories

- W L Gore & Associates Inc

- Cardinal Health Inc

Key Developments in Australia Cardiac Surgery Instruments Industry

- June 2022: Teleflex Incorporated launched its Arrow Pressure Injectable Midline Catheter in Australia, enhancing patient safety and clinician efficiency.

- March 2022: The Australian government allocated USD 17.2 Million for mobile health clinics, expanding access to cardiology services.

Future Outlook for Australia Cardiac Surgery Instruments Industry Market

The Australian cardiac surgery instruments market is poised for continued growth, driven by technological advancements, increasing prevalence of cardiovascular diseases, and government initiatives. Strategic partnerships, expansion into new markets, and a focus on developing innovative, cost-effective products will be crucial for success in this dynamic market. The market’s future is bright, with the potential for significant expansion in the coming years.

Australia Cardiac Surgery Instruments Industry Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

Australia Cardiac Surgery Instruments Industry Segmentation By Geography

- 1. Australia

Australia Cardiac Surgery Instruments Industry Regional Market Share

Geographic Coverage of Australia Cardiac Surgery Instruments Industry

Australia Cardiac Surgery Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures and Technological Advancements in Cardiovascular Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Product Recalls

- 3.4. Market Trends

- 3.4.1. Electrocardiogram (ECG) Segment is Expected to Witness Growth Over The Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Cardiac Surgery Instruments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens Healthineers AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biotronik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Edwards Lifesciences

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Canon Medical Systems Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 B Braun SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abbott Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cardinal Health Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthineers AG

List of Figures

- Figure 1: Australia Cardiac Surgery Instruments Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Cardiac Surgery Instruments Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 2: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 6: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Cardiac Surgery Instruments Industry?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Australia Cardiac Surgery Instruments Industry?

Key companies in the market include Siemens Healthineers AG, Medtronic PLC, Biotronik, Edwards Lifesciences, General Electric Company (GE Healthcare), Canon Medical Systems Corporation, Boston Scientific Corporation, B Braun SE, Abbott Laboratories, W L Gore & Associates Inc, Cardinal Health Inc.

3. What are the main segments of the Australia Cardiac Surgery Instruments Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures and Technological Advancements in Cardiovascular Devices.

6. What are the notable trends driving market growth?

Electrocardiogram (ECG) Segment is Expected to Witness Growth Over The Forecast period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Product Recalls.

8. Can you provide examples of recent developments in the market?

June 2022: Teleflex Incorporated, a leading global provider of medical technologies, launched its Arrow Pressure Injectable Midline Catheter in Australia. The addition of the pressure injectable catheter further enhances the Midline portfolio to meet the expanded needs of clinicians and is designed to improve patient safety. The new 20 cm Arrow Pressure Injectable Midline with brightly colored yellow hubs and labeling will help clinicians overcome catheter identification confusion, which can lead to infusion mistakes that can harm patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Cardiac Surgery Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Cardiac Surgery Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Cardiac Surgery Instruments Industry?

To stay informed about further developments, trends, and reports in the Australia Cardiac Surgery Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence