Key Insights

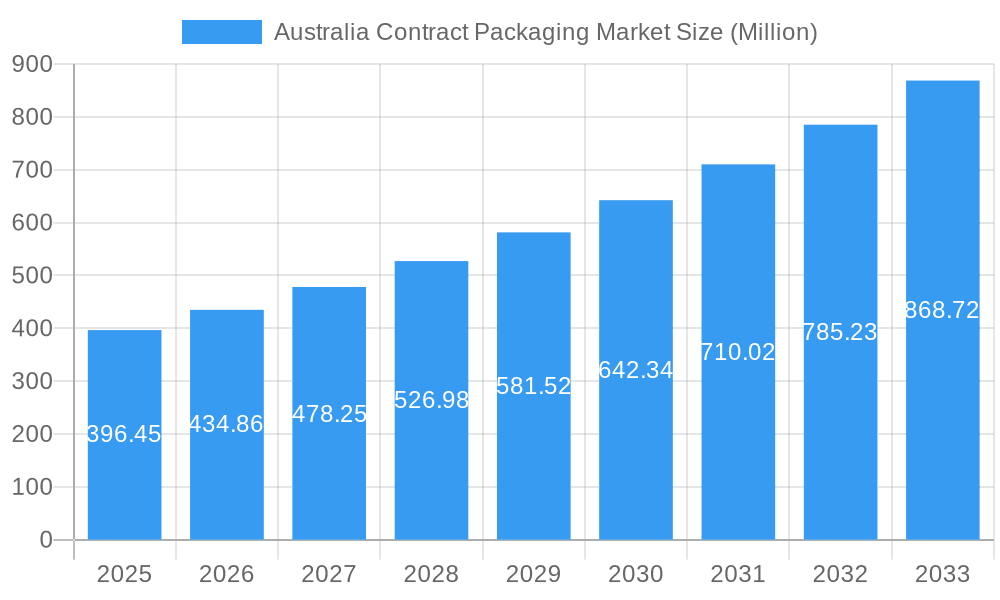

The Australian contract packaging market, valued at $396.45 million in 2025, is experiencing robust growth, projected to expand at a CAGR of 9.76% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for efficient and cost-effective packaging solutions across diverse sectors, including food, beverages, pharmaceuticals, and personal care, is a primary catalyst. Furthermore, the growing prevalence of e-commerce and the need for customized packaging solutions are significantly boosting market growth. Companies are outsourcing packaging to specialize in their core competencies, leading to increased demand for contract packaging services. The market is segmented by packaging type (primary, secondary, tertiary) and end-user type. The food and beverage sector currently dominates, followed by pharmaceuticals and personal care. However, the pharmaceutical segment is expected to witness significant growth due to stringent regulatory requirements and the rising demand for specialized packaging for pharmaceuticals and medical devices. Competitive pressures among contract packaging companies are driving innovation and efficiency improvements, further benefiting the market's growth trajectory.

Australia Contract Packaging Market Market Size (In Million)

While the market enjoys favorable conditions, certain restraints exist. Fluctuations in raw material prices and stringent environmental regulations pose challenges. However, the overall market outlook remains positive, driven by continuous innovations in packaging materials and technologies, coupled with a sustained focus on optimizing supply chains and reducing overall packaging costs for businesses in Australia. Key players like FoodPak, Multipack-LJM, and PakCo are strategically positioned to capitalize on these trends. The market's growth is expected to be consistent throughout the forecast period, supported by continued investment in automation and advanced packaging technologies. This will enhance efficiency and cater to the increasing demand for customized and sustainable packaging solutions, further propelling the Australian contract packaging market's expansion.

Australia Contract Packaging Market Company Market Share

Australia Contract Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia Contract Packaging Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, challenges, and emerging opportunities. The market is segmented by type (Primary, Secondary, Tertiary) and end-user (Food, Beverage, Pharmaceutical, Home Care & Personal Care, Other). The report values are expressed in Millions.

Australia Contract Packaging Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Australian contract packaging market, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational players and smaller specialized firms. While precise market share data for each company is unavailable for all entities, we can infer a moderately fragmented structure. Notable players include FoodPak, Multipack-LJM (Probiotec Limited), PakCo, Outsource Packaging, Chemical Solutions, UltraPak (Australia) Pty Ltd, Finishing Services Pty Ltd, HH Packaging (Probiotec Limited), Probiotec Pharma (Probiotec Limited), Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited), Tripak Pharmaceuticals, and Rapid Pak. The total market value in 2025 is estimated at xx Million.

- Market Concentration: Moderately fragmented, with no single dominant player controlling a significant share.

- Innovation Drivers: Growing demand for sustainable packaging, automation in packaging lines, and increasing focus on customized packaging solutions drive innovation.

- Regulatory Frameworks: Australian regulations concerning food safety, labeling, and environmental sustainability significantly influence packaging choices and practices.

- Product Substitutes: The market faces competition from in-house packaging solutions, although contract packaging offers scalability and cost advantages.

- End-User Demographics: Growth is driven by increasing demand from the food, beverage, pharmaceutical, and homecare & personal care sectors.

- M&A Activities: The report notes several mergers and acquisitions in the recent past, with deal values estimated at xx Million annually. Exact figures are unavailable due to private transactions.

Australia Contract Packaging Market Market Dynamics & Trends

The Australian contract packaging market exhibits strong growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%. Market penetration of contract packaging services continues to increase across various sectors, particularly within food and beverage. Technological advancements, such as automation and advanced packaging materials, are transforming the industry. Evolving consumer preferences towards sustainable and convenient packaging further fuel market expansion. Intense competition among players necessitates continuous innovation and cost optimization strategies.

Dominant Regions & Segments in Australia Contract Packaging Market

The market is geographically dispersed across Australia, with no single region dominating the market share. However, regions with strong manufacturing and industrial bases show higher demand for contract packaging services. In terms of segment dominance:

By Type: Primary packaging holds a larger market share than secondary and tertiary packaging due to the high volume of primary packaging requirements across different end-user segments.

By End-user Type: The food and beverage sector constitutes the largest segment, followed by the pharmaceutical industry. This is due to the significant volume of products requiring specialized packaging and the emphasis on hygiene and safety regulations in this area. The homecare and personal care sector also shows considerable growth potential.

Key Drivers (across regions and segments):

- Strong economic growth and rising disposable incomes.

- Favorable government policies supporting the food processing and manufacturing industries.

- Robust infrastructure facilitating efficient logistics and distribution networks.

Australia Contract Packaging Market Product Innovations

Recent product innovations include the adoption of sustainable materials like recycled plastics and biodegradable packaging. Technological advancements in automation are improving efficiency and reducing costs. The market is also witnessing increasing demand for specialized packaging tailored to the needs of specific products, such as tamper-evident seals and child-resistant closures. These innovations enhance product appeal and contribute to market growth. Overall market penetration of eco-friendly packaging is estimated to increase to xx% by 2033.

Report Scope & Segmentation Analysis

This report comprehensively segments the Australian contract packaging market:

By Type:

- Primary Packaging: This segment is projected to register significant growth due to increased demand from the food and beverage industry and a strong emphasis on product preservation and branding. Market size in 2025 is estimated at xx Million.

- Secondary Packaging: This segment displays moderate growth, driven by the demand for effective product grouping and transportation. Market size in 2025 is estimated at xx Million.

- Tertiary Packaging: This segment exhibits slower growth compared to primary and secondary packaging. Market size in 2025 is estimated at xx Million.

By End-user Type:

- Food: This is the largest segment, benefiting from the growing food processing industry and increasing consumer demand for packaged food products. Market size in 2025 is estimated at xx Million.

- Beverage: This sector showcases robust growth driven by the popularity of packaged beverages and increasing demand for convenience. Market size in 2025 is estimated at xx Million.

- Pharmaceutical: Stringent regulations and the need for tamper-evident packaging drive significant growth in this segment. Market size in 2025 is estimated at xx Million.

- Home Care & Personal Care: This segment is experiencing considerable growth due to rising consumer spending on personal care products and the need for attractive and functional packaging. Market size in 2025 is estimated at xx Million.

- Other End Users: This category includes industrial goods, electronics, and other sectors with packaging needs. Market size in 2025 is estimated at xx Million.

Key Drivers of Australia Contract Packaging Market Growth

The growth of the Australian contract packaging market is driven by several key factors. Increasing demand for customized packaging, particularly from the food and beverage sectors, significantly contributes to market expansion. Furthermore, the rising adoption of sustainable packaging solutions and technological advancements in automation are major growth enablers. Favorable government regulations promote the adoption of eco-friendly practices, boosting the demand for specialized packaging services.

Challenges in the Australia Contract Packaging Market Sector

The Australian contract packaging market faces challenges including intense competition, fluctuating raw material prices, and stringent regulatory requirements. Maintaining consistent supply chain operations and managing labor costs are other key challenges. These factors can influence profitability and overall market growth, creating pressure on businesses to operate efficiently.

Emerging Opportunities in Australia Contract Packaging Market

The market presents significant opportunities. Increasing demand for sustainable and eco-friendly packaging solutions opens avenues for specialized contract packaging services. Technological advancements like automation, robotics, and AI present opportunities for improved efficiency and cost savings. Expansion into niche markets, including pharmaceuticals and personal care, offers considerable growth potential.

Leading Players in the Australia Contract Packaging Market Market

- FoodPak

- Multipack-LJM (Probiotec Limited)

- PakCo

- Outsource Packaging

- Chemical Solutions

- UltraPak (Australia) Pty Ltd

- Finishing Services Pty Ltd

- HH Packaging (Probiotec Limited)

- Probiotec Pharma (Probiotec Limited)

- Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)

- Tripak Pharmaceuticals

- Rapid Pak

Key Developments in Australia Contract Packaging Market Industry

- August 2023: The Boxed Beverage Company partnered with Tetra-Pack to launch sustainably packaged alkaline water, Waterbox, signifying a shift towards eco-friendly solutions.

- January 2023: CEVA Logistics implemented Nulogy's cloud-based contract packaging software in Melbourne, highlighting the adoption of advanced technologies for improved efficiency in the automotive spare parts sector.

Future Outlook for Australia Contract Packaging Market Market

The future outlook for the Australian contract packaging market remains positive. Continued growth in the food and beverage sectors, coupled with the increasing adoption of sustainable packaging and technological advancements, will drive market expansion. Strategic partnerships, mergers, and acquisitions are expected to shape the competitive landscape, presenting opportunities for both established players and new entrants. The market is poised for substantial growth in the coming years, driven by innovation and a rising demand for specialized packaging solutions.

Australia Contract Packaging Market Segmentation

-

1. Type

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End User

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Home Care and Personal Care

- 2.5. Other End Users

Australia Contract Packaging Market Segmentation By Geography

- 1. Australia

Australia Contract Packaging Market Regional Market Share

Geographic Coverage of Australia Contract Packaging Market

Australia Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. FMCG Domain Remains a Key Driver for the Growth of Co-packing Services; Growing Emphasis on Outsourcing Non-core Operations By Product Manufacturers in Australia to Drive Demand

- 3.3. Market Restrains

- 3.3.1. ; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials

- 3.4. Market Trends

- 3.4.1. FMCG Domain Remains a Key Driver for Growth of Co-Packing Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Home Care and Personal Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FoodPak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Multipack-LJM (Probiotec Limited)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PakCo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Outsource Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chemical Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UltraPak (Australia) Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Finishing Services Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HH Packaging (Probiotec Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Probiotec Pharma (Probiotec Limited)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tripak Pharmaceuticals

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rapid Pak

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 FoodPak

List of Figures

- Figure 1: Australia Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Contract Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Contract Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Australia Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Contract Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Australia Contract Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Australia Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Contract Packaging Market?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the Australia Contract Packaging Market?

Key companies in the market include FoodPak, Multipack-LJM (Probiotec Limited), PakCo, Outsource Packaging, Chemical Solutions, UltraPak (Australia) Pty Ltd, Finishing Services Pty Ltd, HH Packaging (Probiotec Limited), Probiotec Pharma (Probiotec Limited), Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)*List Not Exhaustive, Tripak Pharmaceuticals, Rapid Pak.

3. What are the main segments of the Australia Contract Packaging Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.45 Million as of 2022.

5. What are some drivers contributing to market growth?

FMCG Domain Remains a Key Driver for the Growth of Co-packing Services; Growing Emphasis on Outsourcing Non-core Operations By Product Manufacturers in Australia to Drive Demand.

6. What are the notable trends driving market growth?

FMCG Domain Remains a Key Driver for Growth of Co-Packing Services.

7. Are there any restraints impacting market growth?

; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials.

8. Can you provide examples of recent developments in the market?

August 2023 - The Australian Start-up company, the Boxed Beverage Company, came into collaboration with the key packaging company Tetra-Pack to launch sustainably packaged alkaline water, Waterbox.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Australia Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence