Key Insights

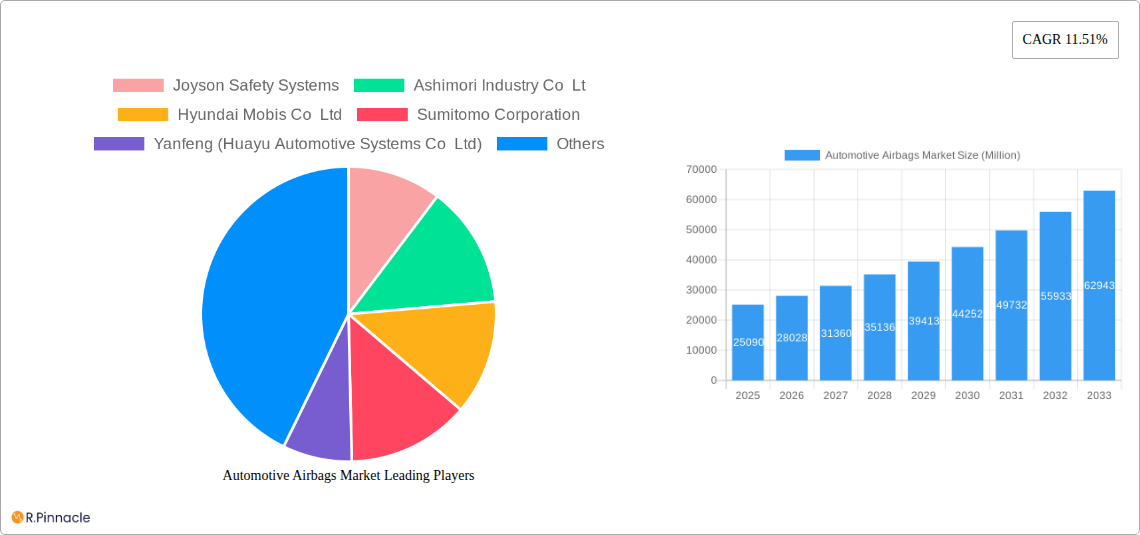

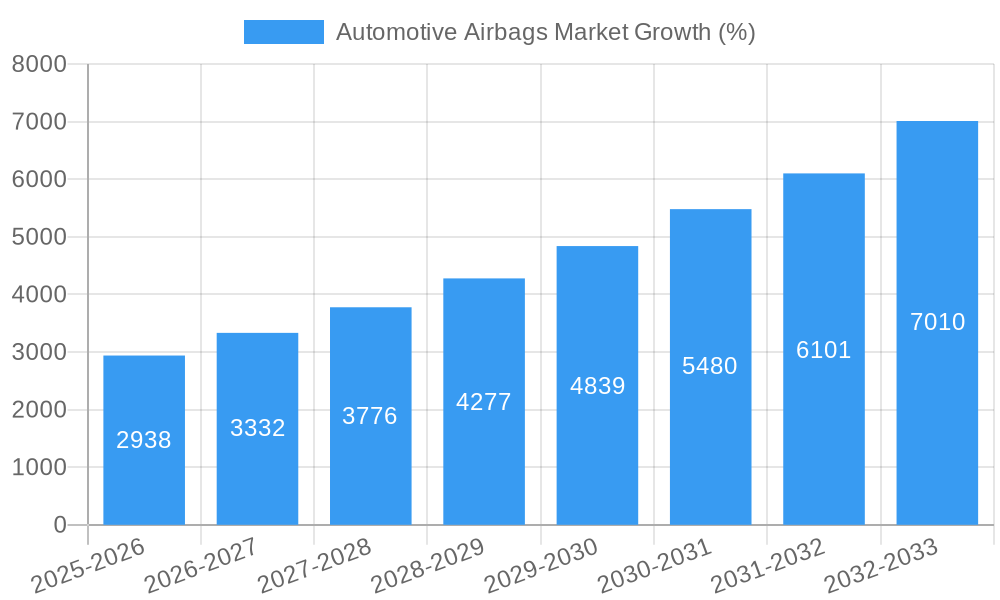

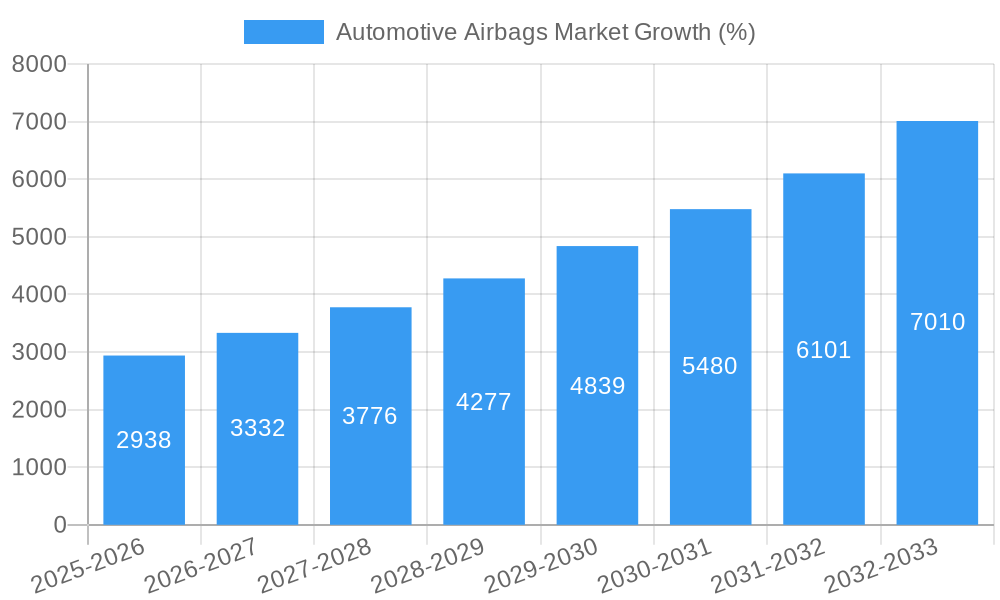

The global automotive airbags market, valued at $25.09 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 11.51% from 2025 to 2033. This expansion is fueled by several key factors. Rising vehicle production, particularly in developing economies like India and China, significantly contributes to increased demand for airbags. Furthermore, stringent government regulations mandating airbag installations in new vehicles across various regions are acting as a major catalyst. Growing consumer awareness regarding vehicle safety and a preference for advanced safety features in automobiles are further boosting market growth. The increasing integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies, which often incorporate airbags as crucial safety components, also contributes to the market's upward trajectory. Segmentation analysis reveals that passenger cars currently hold a larger market share compared to commercial vehicles, while front airbags dominate the type segment due to their mandatory installation in most vehicles. The OEM sales channel accounts for a substantial portion of market revenue, although the aftermarket segment is showing potential for growth, driven by rising vehicle parc and replacement needs.

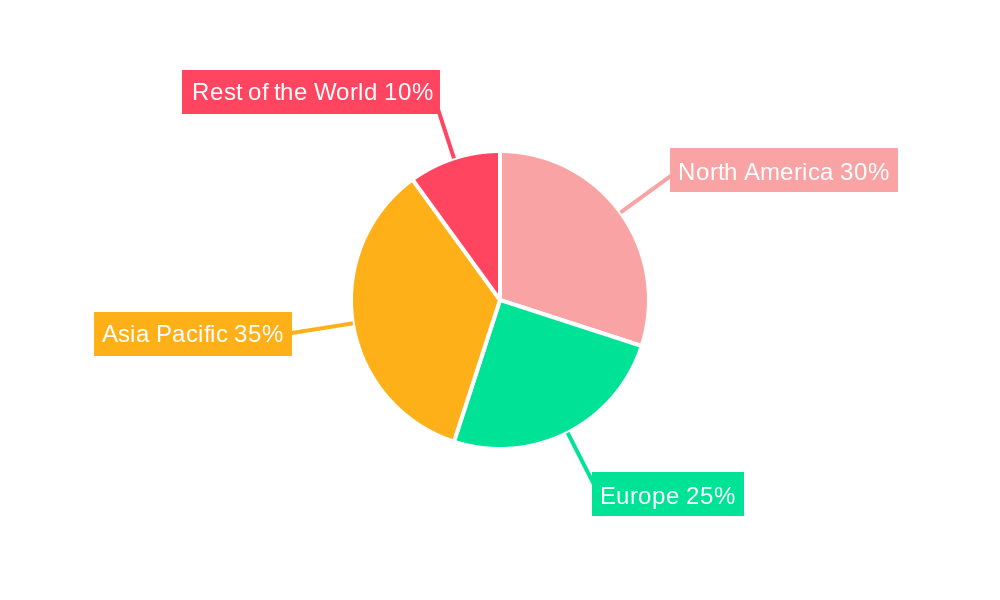

The market is segmented by vehicle type (passenger cars and commercial vehicles), airbag type (front, inflatable seat belts, curtain, side, and knee airbags), and sales channel (OEM and aftermarket). Geographic analysis indicates that North America and Europe currently represent significant market shares, owing to established automotive industries and high vehicle ownership rates. However, the Asia-Pacific region, especially China and India, is poised for substantial growth due to rapid economic development, rising disposable incomes, and increasing vehicle sales. While the market faces some restraints such as fluctuating raw material prices and supply chain disruptions, the overall positive growth trajectory is expected to continue throughout the forecast period due to the aforementioned drivers and the increasing focus on automotive safety globally. Competition within the market is intense, with major players such as Autoliv, Takata, and ZF Friedrichshafen aggressively pursuing technological advancements and expanding their global presence.

Automotive Airbags Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Automotive Airbags Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market is segmented by vehicle type (passenger cars, commercial vehicles), airbag type (front airbags, inflatable seat belts, curtain airbags, side airbags, knee airbags), and sales channel (OEM, replacement/aftermarket). Key players like Joyson Safety Systems, Ashimori Industry Co Ltd, Hyundai Mobis Co Ltd, Sumitomo Corporation, Yanfeng (Huayu Automotive Systems Co Ltd), Continental AG, Autoliv Inc, Jinzhou Jinheng Automotive Safety System Co Ltd, Toyoda Gosei Co Ltd, and ZF Friedrichshafen AG are thoroughly analyzed.

Automotive Airbags Market Structure & Innovation Trends

The automotive airbag market exhibits a moderately consolidated structure, with a few dominant players holding significant market share. Market concentration is influenced by factors such as technological advancements, economies of scale, and strategic partnerships. Innovation is driven by stringent safety regulations, increasing consumer demand for enhanced safety features, and the development of advanced driver-assistance systems (ADAS). The regulatory landscape plays a critical role, with evolving safety standards impacting product design and manufacturing processes. Product substitutes, such as advanced restraint systems, are emerging but currently hold a minor market share. The end-user demographics are largely driven by global vehicle production trends and regional safety regulations. M&A activities are prevalent, with deal values in the xx Million range, as companies seek to expand their product portfolios and geographic reach.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Deal Values (2019-2024): Averaged approximately xx Million per deal.

- Innovation Drivers: Stringent safety regulations, ADAS integration, consumer preference for enhanced safety.

- Regulatory Frameworks: Differ significantly across regions, impacting product specifications and compliance costs.

Automotive Airbags Market Dynamics & Trends

The automotive airbags market is experiencing robust growth, driven by factors such as rising vehicle production, particularly in developing economies, and increasingly stringent global safety regulations. Technological advancements, such as the integration of sensors and electronics into airbags for improved performance and functionality, are contributing significantly to market expansion. Consumer preferences for safer vehicles are fueling demand for advanced airbag systems. Competitive dynamics are shaped by technological innovation, cost competitiveness, and strategic partnerships. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration rates increasing in emerging markets. The market is also experiencing some disruptions from technological developments such as autonomous driving, potentially influencing future demand.

Dominant Regions & Segments in Automotive Airbags Market

The Asia-Pacific region currently dominates the automotive airbags market, driven by high vehicle production volumes in China, India, and other Southeast Asian countries. Within the segment breakdown:

- By Vehicle Type: Passenger cars segment holds the largest market share, owing to higher vehicle production compared to commercial vehicles.

- By Type: Front airbags constitute the largest segment, followed by side airbags and curtain airbags. However, growth in inflatable seatbelts and knee airbags is notable.

- By Sales Channel: The OEM channel holds a dominant market share.

Key Drivers (By Region):

- Asia-Pacific: High vehicle production, rising disposable incomes, stringent safety regulations.

- North America: Stringent safety standards, increasing demand for advanced safety features.

- Europe: High vehicle safety standards, increasing adoption of ADAS.

The dominance of specific regions is underpinned by a number of factors including economic growth, supportive government policies, and the establishment of robust automotive manufacturing clusters.

Automotive Airbags Market Product Innovations

Recent product innovations focus on enhancing airbag performance, safety, and integration with ADAS. Innovations such as inflatable seatbelts and advanced airbag deployment systems offer improved occupant protection. The integration of sensors and electronics allows for more precise and adaptive airbag deployment. These innovations address market needs for increased safety and improved occupant comfort. There is significant focus on reducing the overall cost of airbags while maintaining high quality standards and effective performance. The technological trends are towards more sophisticated systems with improved safety features and more tailored deployments to different crash scenarios.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the automotive airbags market, segmented by:

- By Vehicle Type: Passenger Cars (Market Size: xx Million, Growth Projection: xx%), Commercial Vehicles (Market Size: xx Million, Growth Projection: xx%). Competitive dynamics vary across these segments due to differing safety standards and cost considerations.

- By Type: Front Airbags (Market Size: xx Million, Growth Projection: xx%), Inflatable Seat Belts (Market Size: xx Million, Growth Projection: xx%), Curtain Airbags (Market Size: xx Million, Growth Projection: xx%), Side Airbags (Market Size: xx Million, Growth Projection: xx%), Knee Airbags (Market Size: xx Million, Growth Projection: xx%). The growth of each segment is largely dictated by advancements in technology, the introduction of new models that incorporate them, and changes in the legal landscape of various regions.

- By Sales Channel: Original Equipment Manufacturer (OEM) (Market Size: xx Million, Growth Projection: xx%), Replacement/Aftermarket (Market Size: xx Million, Growth Projection: xx%). The OEM segment dominates the market due to higher initial vehicle sales. However, the aftermarket segment has potential growth due to higher vehicle age and growing demand for replacement parts.

Key Drivers of Automotive Airbags Market Growth

The growth of the automotive airbags market is fueled by several factors:

- Stringent Safety Regulations: Governments worldwide are implementing stricter safety regulations, mandating the inclusion of airbags in vehicles.

- Technological Advancements: Innovations in airbag technology, such as adaptive airbags and inflatable seatbelts, are enhancing safety and driving market demand.

- Rising Vehicle Production: Increased global vehicle production, particularly in developing economies, is boosting the demand for airbags.

- Growing Consumer Awareness: Increased consumer awareness about vehicle safety is driving demand for vehicles equipped with advanced safety features, including airbags.

Challenges in the Automotive Airbags Market Sector

The automotive airbags market faces several challenges:

- Supply Chain Disruptions: Global supply chain issues can impact the availability of raw materials and components, leading to production delays and increased costs.

- Cost Pressures: Intense competition and increasing raw material prices are putting pressure on manufacturers' profit margins.

- Technological Complexity: Developing advanced airbag systems requires significant investments in research and development, adding to manufacturing costs.

- Regulatory Compliance: Meeting stringent safety and environmental regulations involves high costs and can be complex.

Emerging Opportunities in Automotive Airbags Market

Several emerging opportunities are shaping the future of the automotive airbags market:

- Autonomous Vehicles: The development of autonomous vehicles presents new opportunities for advanced airbag systems tailored to the unique safety needs of self-driving cars.

- Light Weighting: Manufacturers are increasingly seeking to reduce the weight of vehicles to improve fuel efficiency; this requires lightweight airbag materials and designs.

- Electric Vehicles: The growth of the electric vehicle market presents increased demand for airbags in this sector.

- New Market Penetration: Expanding into developing economies with increasing vehicle ownership represents a significant growth opportunity.

Leading Players in the Automotive Airbags Market Market

- Joyson Safety Systems

- Ashimori Industry Co Ltd

- Hyundai Mobis Co Ltd

- Sumitomo Corporation

- Yanfeng (Huayu Automotive Systems Co Ltd)

- Continental AG

- Autoliv Inc

- Jinzhou Jinheng Automotive Safety System Co Ltd

- Toyoda Gosei Co Ltd

- ZF Friedrichshafen AG

Key Developments in Automotive Airbags Market Industry

- July 2023: Yanfeng developed an innovative passenger seat safety solution including a hoodie and buttock airbag, enhancing safety in reclined seating positions, particularly relevant to the Chinese market.

- August 2023: Toyoda Gosei announced a 50% increase in airbag production by 2030, driven by stricter safety regulations and market growth.

- November 2023: Toyoda Gosei opened a new facility in Guangdong, China, to meet rising demand for safety systems.

- January 2024: Audi recalled 1,001 Q7 and Q8 models due to a driver-side airbag mounting fault, highlighting the importance of adherence to safety standards.

Future Outlook for Automotive Airbags Market Market

The automotive airbags market is poised for continued growth, driven by a combination of factors including rising vehicle production, particularly in emerging markets, ongoing technological advancements, and stricter safety regulations. The increasing integration of airbags with ADAS and the development of lightweight and more efficient airbag systems are creating new opportunities for innovation and growth. Strategic partnerships and mergers and acquisitions will continue to reshape the market landscape, leading to further consolidation and innovation. The market is expected to maintain a healthy growth trajectory, driven by these favorable conditions.

Automotive Airbags Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Type

- 2.1. Front Airbags

- 2.2. Inflatable Seat Belts

- 2.3. Curtain Airbags

- 2.4. Side Airbags

- 2.5. Knee Airbags

-

3. Sales Channel

- 3.1. Original Equipment Manufacturer (OEM)

- 3.2. Replacement/Aftermarket

Automotive Airbags Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Airbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Passenger and Commercial Vehicle Sales to Foster Growth

- 3.3. Market Restrains

- 3.3.1. Airbag Malfunction and Recall Deters Growth

- 3.4. Market Trends

- 3.4.1. Passengers Cars Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Front Airbags

- 5.2.2. Inflatable Seat Belts

- 5.2.3. Curtain Airbags

- 5.2.4. Side Airbags

- 5.2.5. Knee Airbags

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Original Equipment Manufacturer (OEM)

- 5.3.2. Replacement/Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Front Airbags

- 6.2.2. Inflatable Seat Belts

- 6.2.3. Curtain Airbags

- 6.2.4. Side Airbags

- 6.2.5. Knee Airbags

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Original Equipment Manufacturer (OEM)

- 6.3.2. Replacement/Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Front Airbags

- 7.2.2. Inflatable Seat Belts

- 7.2.3. Curtain Airbags

- 7.2.4. Side Airbags

- 7.2.5. Knee Airbags

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Original Equipment Manufacturer (OEM)

- 7.3.2. Replacement/Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Front Airbags

- 8.2.2. Inflatable Seat Belts

- 8.2.3. Curtain Airbags

- 8.2.4. Side Airbags

- 8.2.5. Knee Airbags

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. Original Equipment Manufacturer (OEM)

- 8.3.2. Replacement/Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Front Airbags

- 9.2.2. Inflatable Seat Belts

- 9.2.3. Curtain Airbags

- 9.2.4. Side Airbags

- 9.2.5. Knee Airbags

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. Original Equipment Manufacturer (OEM)

- 9.3.2. Replacement/Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. North America Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Airbags Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Joyson Safety Systems

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Ashimori Industry Co Lt

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Hyundai Mobis Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Sumitomo Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Yanfeng (Huayu Automotive Systems Co Ltd)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Continental AG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Autoliv Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Jinzhou Jinheng Automotive Safety System Co Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Toyoda Gosei Co Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 ZF Friedrichshafen AG

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Joyson Safety Systems

List of Figures

- Figure 1: Global Automotive Airbags Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Airbags Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 11: North America Automotive Airbags Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 12: North America Automotive Airbags Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Automotive Airbags Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Automotive Airbags Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 15: North America Automotive Airbags Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 16: North America Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Airbags Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: Europe Automotive Airbags Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: Europe Automotive Airbags Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Automotive Airbags Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Automotive Airbags Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 23: Europe Automotive Airbags Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 24: Europe Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Airbags Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 27: Asia Pacific Automotive Airbags Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 28: Asia Pacific Automotive Airbags Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Airbags Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Airbags Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Asia Pacific Automotive Airbags Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Asia Pacific Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Airbags Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Rest of the World Automotive Airbags Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Rest of the World Automotive Airbags Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Rest of the World Automotive Airbags Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Rest of the World Automotive Airbags Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 39: Rest of the World Automotive Airbags Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 40: Rest of the World Automotive Airbags Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Airbags Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Airbags Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Automotive Airbags Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: Global Automotive Airbags Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: South America Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 26: Global Automotive Airbags Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 33: Global Automotive Airbags Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 35: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Spain Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 42: Global Automotive Airbags Market Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 44: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Automotive Airbags Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 51: Global Automotive Airbags Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Automotive Airbags Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 53: Global Automotive Airbags Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: South America Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Middle East and Africa Automotive Airbags Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Airbags Market?

The projected CAGR is approximately 11.51%.

2. Which companies are prominent players in the Automotive Airbags Market?

Key companies in the market include Joyson Safety Systems, Ashimori Industry Co Lt, Hyundai Mobis Co Ltd, Sumitomo Corporation, Yanfeng (Huayu Automotive Systems Co Ltd), Continental AG, Autoliv Inc, Jinzhou Jinheng Automotive Safety System Co Ltd, Toyoda Gosei Co Ltd, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Airbags Market?

The market segments include Vehicle Type, Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Passenger and Commercial Vehicle Sales to Foster Growth.

6. What are the notable trends driving market growth?

Passengers Cars Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Airbag Malfunction and Recall Deters Growth.

8. Can you provide examples of recent developments in the market?

January 2024: Audi reported that a total of 1,001 units of Q7 and Q8 models would need to be returned to dealerships in the United States because of a driver seat-side airbag fault, which was not properly mounted in the seatback frame. Due to the failure to comply with Federal Motor Vehicle Standards, the company alerted the owners of the impacted vehicles to return their models to dealerships by February 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Airbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Airbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Airbags Market?

To stay informed about further developments, trends, and reports in the Automotive Airbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence