Key Insights

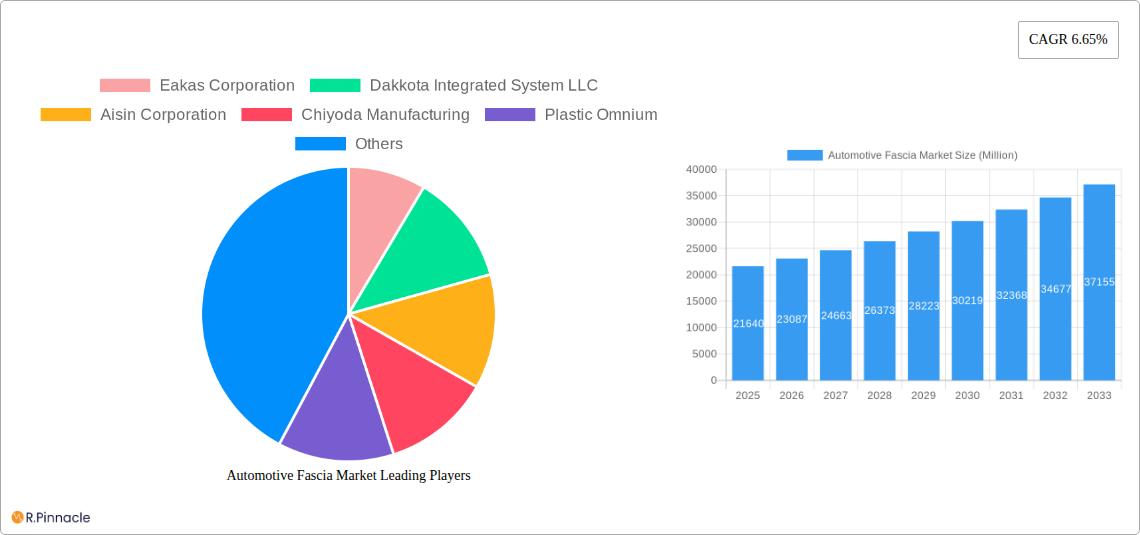

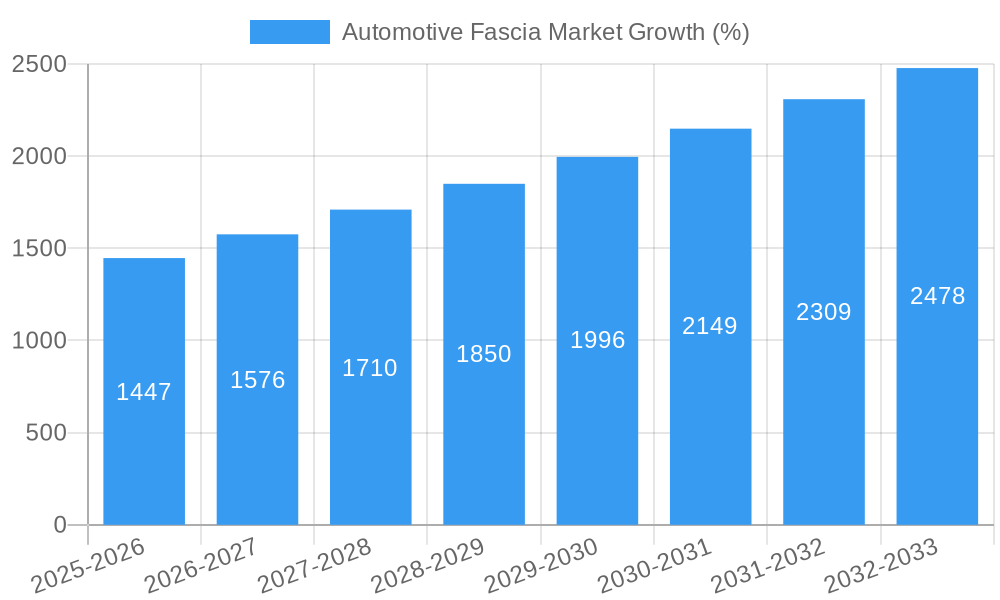

The global automotive fascia market, valued at $21.64 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production, particularly in the Asia-Pacific region. The market's Compound Annual Growth Rate (CAGR) of 6.65% from 2025 to 2033 signifies significant expansion opportunities. Key growth drivers include the rising demand for aesthetically pleasing and functional vehicle exteriors, the increasing adoption of advanced driver-assistance systems (ADAS) requiring sophisticated fascia designs for sensor integration, and the shift towards lightweight materials like plastic-covered aluminum to improve fuel efficiency. Segment-wise, passenger cars dominate the market share, followed by commercial vehicles. The OEM (Original Equipment Manufacturer) sales channel currently holds the largest share, but the aftermarket segment is expected to witness considerable growth driven by the rising trend of vehicle customization and replacement parts demand. Material-wise, plastic-covered styrofoam remains a dominant material owing to its cost-effectiveness; however, the adoption of plastic-covered aluminum is steadily increasing due to its superior durability and lightweight properties. Competitive landscape analysis reveals a mix of established global players and regional manufacturers vying for market share, resulting in a dynamic competitive environment with continuous innovation and technological advancements in material science and manufacturing processes.

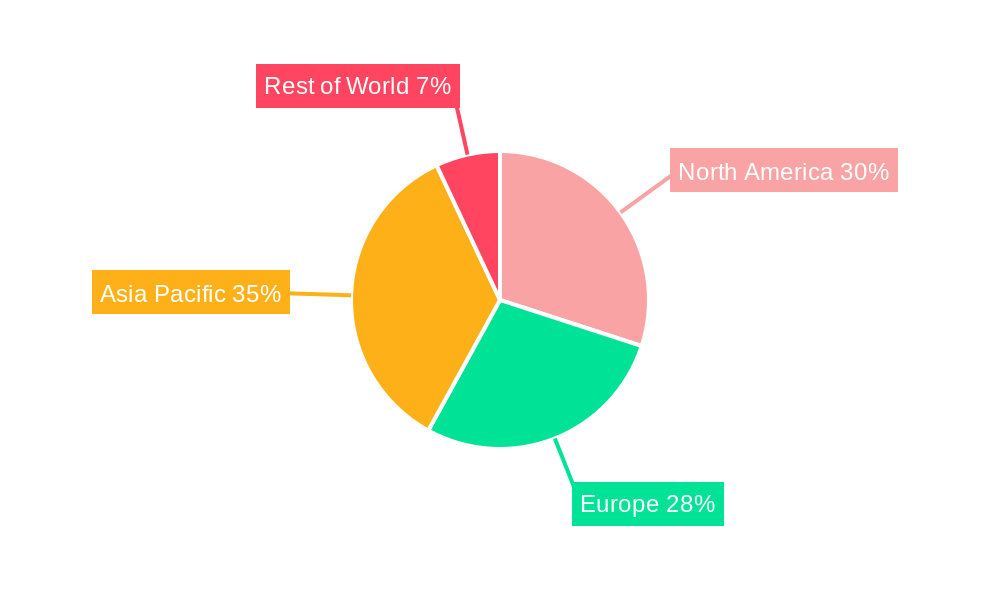

The geographical distribution of the market shows significant growth potential in developing economies, especially in Asia-Pacific regions like China and India, fueled by rapid urbanization and rising disposable incomes. North America and Europe are expected to maintain substantial market shares, driven by established automotive industries and technological advancements. However, increasing environmental regulations globally may necessitate the adoption of more sustainable materials, presenting both challenges and opportunities for market players. The continuous evolution of vehicle designs, influenced by changing consumer preferences and technological innovations, will continue to shape the automotive fascia market, necessitating adaptability and innovation from companies to maintain competitiveness in this dynamic sector. The forecast period (2025-2033) promises substantial market expansion, presenting lucrative investment opportunities for stakeholders across the value chain.

Automotive Fascia Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Fascia Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a detailed examination spanning the period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils key market trends, growth drivers, and challenges shaping the future of automotive fascia design and manufacturing. The market is projected to reach xx Million by 2033, exhibiting a notable CAGR of xx% during the forecast period.

Automotive Fascia Market Structure & Innovation Trends

The Automotive Fascia Market is characterized by a moderately concentrated landscape, with key players such as Eakas Corporation, Dakkota Integrated System LLC, Aisin Corporation, and others vying for market share. Market concentration is estimated at xx% in 2025, with the top 5 players holding approximately xx% of the market. Innovation is driven by advancements in lightweight materials, the integration of advanced lighting technologies (LED, DRLs), and the increasing demand for aesthetically pleasing and functional designs. Stringent safety regulations and evolving consumer preferences are also significant drivers.

- Market Share Dynamics: The report analyzes the market share of leading players, highlighting competitive strategies and market positioning. Several companies have engaged in strategic partnerships and mergers & acquisitions (M&A) to expand their market footprint. The estimated total value of M&A deals within the Automotive Fascia Market during 2019-2024 is estimated at xx Million.

- Regulatory Landscape: The report details the impact of international and regional regulations on the market, examining standards related to safety, emissions, and material usage.

- Product Substitutes: Analysis of potential substitutes and their impact on market growth is provided.

- End-User Demographics: The report offers insights into changing consumer preferences and their influence on fascia design and material choices.

Automotive Fascia Market Dynamics & Trends

The Automotive Fascia Market is experiencing robust growth, driven by factors such as the rising demand for vehicles globally, increased adoption of advanced driver-assistance systems (ADAS), and the growing preference for enhanced vehicle aesthetics. Technological disruptions, such as the integration of sensors and lighting systems within fascia components, are further accelerating market expansion. Consumer preferences are shifting towards more personalized and technologically advanced vehicles, leading to innovative fascia designs. Competitive dynamics are intensified by the ongoing innovation and strategic alliances among major players.

The market is segmented by vehicle type (Passenger Cars and Commercial Vehicles), material (Plastic Covered Styrofoam, Plastic Covered Aluminum, Other Materials), position (Front and Rear Fascia), and sales channel (OEM and Aftermarket). The Passenger Car segment is currently the largest, holding approximately xx% of the market share, and is expected to maintain its dominance through 2033. Technological advancements, such as the use of lightweight materials and advanced manufacturing processes, are pushing the market toward higher efficiency and cost-effectiveness.

Dominant Regions & Segments in Automotive Fascia Market

The Automotive Fascia Market exhibits strong regional variations. North America and Asia Pacific are currently the dominant regions, driven by high vehicle production volumes and robust automotive industries.

Key Drivers by Region:

- North America: Strong OEM presence, high consumer demand for advanced features, and supportive government policies.

- Asia Pacific: Rapid economic growth, increasing vehicle production, and rising disposable incomes.

- Europe: Stricter emission standards and focus on sustainable materials are shaping market dynamics.

Dominant Segments:

- By Position Type: The Front Fascia segment dominates, accounting for approximately xx% of the market due to its high visibility and integration with safety features.

- By Material: Plastic Covered Styrofoam currently holds the largest market share because of its cost-effectiveness and lightweight properties. However, Plastic Covered Aluminum and other materials (steel, rubber) are gaining traction due to enhanced durability and design flexibility.

- By Vehicle Type: Passenger cars constitute the majority of market share, and the Commercial Vehicles segment is expected to witness moderate growth.

- By Sales Channel: The OEM segment is significantly larger due to the high volume of vehicle production.

Automotive Fascia Market Product Innovations

Recent innovations focus on the integration of active safety features, advanced lighting systems (LED, adaptive headlights), and the use of lightweight, sustainable materials. These innovations enhance vehicle safety, improve aesthetics, and contribute to fuel efficiency. The adoption of sensors within fascia components for ADAS is rapidly gaining traction, leading to more sophisticated and integrated automotive designs.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Automotive Fascia Market, including:

- By Position Type: Front Fascia and Rear Fascia, with growth projections showing xx% and xx% CAGR respectively over the forecast period.

- By Material: Plastic Covered Styrofoam, Plastic Covered Aluminum, and Other Materials (Steel, Rubber etc.), with Plastic Covered Styrofoam maintaining a dominant share.

- By Vehicle Type: Passenger Cars and Commercial Vehicles, showing a higher CAGR for Commercial Vehicles due to growth in the logistics and transportation sectors.

- By Sales Channel: Original Equipment Manufacturer (OEM) and Aftermarket, with OEM holding a larger portion of the market.

Key Drivers of Automotive Fascia Market Growth

Technological advancements in lighting, material science, and manufacturing processes are key drivers, alongside increasing consumer demand for aesthetically pleasing and functional fascia designs. Stringent government regulations mandating advanced safety features further propel market expansion. The rising global vehicle production and economic growth in developing countries also contribute to market growth.

Challenges in the Automotive Fascia Market Sector

The Automotive Fascia Market faces challenges including supply chain disruptions, fluctuating raw material prices, and intense competition among established players and new entrants. Stringent environmental regulations and increasing pressure to adopt sustainable manufacturing practices also pose challenges. The estimated impact of supply chain disruptions on market growth in 2024 was a reduction of approximately xx Million in revenue.

Emerging Opportunities in Automotive Fascia Market

Emerging opportunities lie in the integration of advanced lighting technologies (e.g., OLED, micro-LED) for personalized illumination, the use of lightweight and sustainable materials (e.g., recycled plastics, bio-based composites), and expansion into developing markets with high growth potential. The increasing adoption of electric and autonomous vehicles also creates opportunities for innovative fascia designs.

Leading Players in the Automotive Fascia Market Market

- Eakas Corporation

- Dakkota Integrated System LLC

- Aisin Corporation

- Chiyoda Manufacturing

- Plastic Omnium

- MRC Manufacturing

- Guardian Industries

- Samvardhana Motherson

- Flex-N-Gate Corporation

- Sanko GOSEI

- Magna International

- Dongfeng Electronic Technology Co Ltd

- Revere Plastics System

- Toyoda Gosei

- Inhance Technologies

- Gestamp Automocion

Key Developments in Automotive Fascia Market Industry

- November 2022: MG India tested the MG Hector facelift with an improved front fascia design.

- January 2023: Plasman supplied spoilers and front grilles to Honda for its new CR-V model.

- February 2023: BMW patented a light-emitting kidney grille design.

- April 2023: Skoda developed a car grille with safety signals for pedestrians.

Future Outlook for Automotive Fascia Market Market

The Automotive Fascia Market is poised for continued growth, driven by technological innovation, increasing vehicle production, and evolving consumer preferences. Strategic partnerships, investments in R&D, and expansion into new markets will play a crucial role in shaping the future of this dynamic sector. The market is expected to witness significant growth over the coming years, with opportunities for players to leverage advancements in materials science, design, and manufacturing to establish a strong market presence.

Automotive Fascia Market Segmentation

-

1. Position Type

- 1.1. Front Fascia

- 1.2. Rear Fascia

-

2. Material

- 2.1. Plastic Covered Styrofoam

- 2.2. Plastic Covered Aluminum

- 2.3. Other Materials (Steel, Rubber etc.)

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commerical Vehicles

-

4. Sales Channel

- 4.1. Original Equipment Manufacturer (OEM)

- 4.2. Aftermarket

Automotive Fascia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Fascia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Sales; Others

- 3.3. Market Restrains

- 3.3.1. High Maintenance and Replacement Cost

- 3.4. Market Trends

- 3.4.1. Passenger Cars Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Position Type

- 5.1.1. Front Fascia

- 5.1.2. Rear Fascia

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Plastic Covered Styrofoam

- 5.2.2. Plastic Covered Aluminum

- 5.2.3. Other Materials (Steel, Rubber etc.)

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commerical Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Original Equipment Manufacturer (OEM)

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Position Type

- 6. North America Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Position Type

- 6.1.1. Front Fascia

- 6.1.2. Rear Fascia

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Plastic Covered Styrofoam

- 6.2.2. Plastic Covered Aluminum

- 6.2.3. Other Materials (Steel, Rubber etc.)

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commerical Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. Original Equipment Manufacturer (OEM)

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Position Type

- 7. Europe Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Position Type

- 7.1.1. Front Fascia

- 7.1.2. Rear Fascia

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Plastic Covered Styrofoam

- 7.2.2. Plastic Covered Aluminum

- 7.2.3. Other Materials (Steel, Rubber etc.)

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commerical Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. Original Equipment Manufacturer (OEM)

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Position Type

- 8. Asia Pacific Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Position Type

- 8.1.1. Front Fascia

- 8.1.2. Rear Fascia

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Plastic Covered Styrofoam

- 8.2.2. Plastic Covered Aluminum

- 8.2.3. Other Materials (Steel, Rubber etc.)

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commerical Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. Original Equipment Manufacturer (OEM)

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Position Type

- 9. Rest of the World Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Position Type

- 9.1.1. Front Fascia

- 9.1.2. Rear Fascia

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Plastic Covered Styrofoam

- 9.2.2. Plastic Covered Aluminum

- 9.2.3. Other Materials (Steel, Rubber etc.)

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commerical Vehicles

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. Original Equipment Manufacturer (OEM)

- 9.4.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Position Type

- 10. North America Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Kingdom

- 11.1.2 Germany

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Fascia Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Eakas Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Dakkota Integrated System LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Aisin Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Chiyoda Manufacturing

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Plastic Omnium

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 MRC Manufacturing

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Guardian Industries

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Samvardhana Motherson

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Flex-N-Gate Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Sanko GOSEI

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Magna International

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Dongfeng Electronic Technology Co Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Revere Plastics System

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Toyoda Gose

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Inhance Technologies

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 Gestamp Automocion

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 Eakas Corporation

List of Figures

- Figure 1: Global Automotive Fascia Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Fascia Market Revenue (Million), by Position Type 2024 & 2032

- Figure 11: North America Automotive Fascia Market Revenue Share (%), by Position Type 2024 & 2032

- Figure 12: North America Automotive Fascia Market Revenue (Million), by Material 2024 & 2032

- Figure 13: North America Automotive Fascia Market Revenue Share (%), by Material 2024 & 2032

- Figure 14: North America Automotive Fascia Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: North America Automotive Fascia Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: North America Automotive Fascia Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 17: North America Automotive Fascia Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 18: North America Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Automotive Fascia Market Revenue (Million), by Position Type 2024 & 2032

- Figure 21: Europe Automotive Fascia Market Revenue Share (%), by Position Type 2024 & 2032

- Figure 22: Europe Automotive Fascia Market Revenue (Million), by Material 2024 & 2032

- Figure 23: Europe Automotive Fascia Market Revenue Share (%), by Material 2024 & 2032

- Figure 24: Europe Automotive Fascia Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe Automotive Fascia Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe Automotive Fascia Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 27: Europe Automotive Fascia Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 28: Europe Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Automotive Fascia Market Revenue (Million), by Position Type 2024 & 2032

- Figure 31: Asia Pacific Automotive Fascia Market Revenue Share (%), by Position Type 2024 & 2032

- Figure 32: Asia Pacific Automotive Fascia Market Revenue (Million), by Material 2024 & 2032

- Figure 33: Asia Pacific Automotive Fascia Market Revenue Share (%), by Material 2024 & 2032

- Figure 34: Asia Pacific Automotive Fascia Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Asia Pacific Automotive Fascia Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Asia Pacific Automotive Fascia Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 37: Asia Pacific Automotive Fascia Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 38: Asia Pacific Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Automotive Fascia Market Revenue (Million), by Position Type 2024 & 2032

- Figure 41: Rest of the World Automotive Fascia Market Revenue Share (%), by Position Type 2024 & 2032

- Figure 42: Rest of the World Automotive Fascia Market Revenue (Million), by Material 2024 & 2032

- Figure 43: Rest of the World Automotive Fascia Market Revenue Share (%), by Material 2024 & 2032

- Figure 44: Rest of the World Automotive Fascia Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 45: Rest of the World Automotive Fascia Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Rest of the World Automotive Fascia Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 47: Rest of the World Automotive Fascia Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 48: Rest of the World Automotive Fascia Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Automotive Fascia Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Fascia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Fascia Market Revenue Million Forecast, by Position Type 2019 & 2032

- Table 3: Global Automotive Fascia Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Global Automotive Fascia Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global Automotive Fascia Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Global Automotive Fascia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Automotive Fascia Market Revenue Million Forecast, by Position Type 2019 & 2032

- Table 27: Global Automotive Fascia Market Revenue Million Forecast, by Material 2019 & 2032

- Table 28: Global Automotive Fascia Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 29: Global Automotive Fascia Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 30: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of North America Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Automotive Fascia Market Revenue Million Forecast, by Position Type 2019 & 2032

- Table 35: Global Automotive Fascia Market Revenue Million Forecast, by Material 2019 & 2032

- Table 36: Global Automotive Fascia Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 37: Global Automotive Fascia Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 38: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Germany Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: France Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Automotive Fascia Market Revenue Million Forecast, by Position Type 2019 & 2032

- Table 45: Global Automotive Fascia Market Revenue Million Forecast, by Material 2019 & 2032

- Table 46: Global Automotive Fascia Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 47: Global Automotive Fascia Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 48: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Automotive Fascia Market Revenue Million Forecast, by Position Type 2019 & 2032

- Table 55: Global Automotive Fascia Market Revenue Million Forecast, by Material 2019 & 2032

- Table 56: Global Automotive Fascia Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 57: Global Automotive Fascia Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 58: Global Automotive Fascia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: South America Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Middle East and Africa Automotive Fascia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fascia Market?

The projected CAGR is approximately 6.65%.

2. Which companies are prominent players in the Automotive Fascia Market?

Key companies in the market include Eakas Corporation, Dakkota Integrated System LLC, Aisin Corporation, Chiyoda Manufacturing, Plastic Omnium, MRC Manufacturing, Guardian Industries, Samvardhana Motherson, Flex-N-Gate Corporation, Sanko GOSEI, Magna International, Dongfeng Electronic Technology Co Ltd, Revere Plastics System, Toyoda Gose, Inhance Technologies, Gestamp Automocion.

3. What are the main segments of the Automotive Fascia Market?

The market segments include Position Type, Material, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Sales; Others.

6. What are the notable trends driving market growth?

Passenger Cars Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Maintenance and Replacement Cost.

8. Can you provide examples of recent developments in the market?

April 2023: Skoda announced the ongoing development of an advanced technology that will involve its car grille, which forms a part of the automotive fascia, to give out safety signals to pedestrians, including green arrows and green figures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Fascia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Fascia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Fascia Market?

To stay informed about further developments, trends, and reports in the Automotive Fascia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence