Key Insights

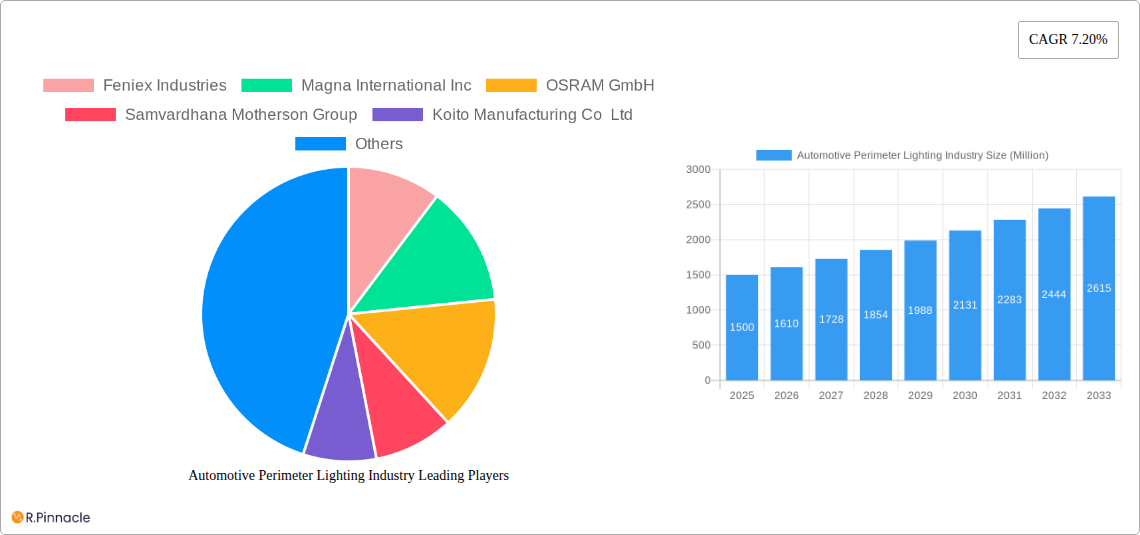

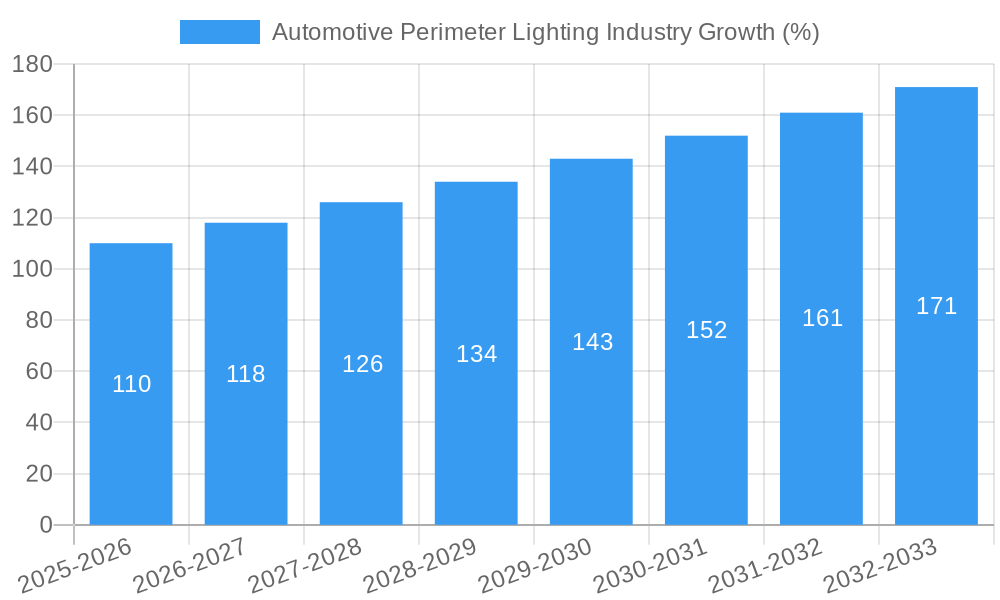

The automotive perimeter lighting market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to reach $YY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.20%. This expansion is driven by several key factors. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies necessitates more sophisticated and reliable lighting solutions, boosting demand for LED and other advanced lighting technologies. Furthermore, stringent safety regulations worldwide are mandating improved vehicle visibility, fueling the market's growth. The shift towards aesthetically pleasing and customizable lighting designs is another significant driver, particularly in the passenger car segment. While the OEM segment currently dominates, the aftermarket segment is showing promising growth potential, fueled by the rising demand for vehicle personalization and after-market upgrades. The LED segment is expected to continue its dominance due to its energy efficiency, longer lifespan, and design flexibility compared to traditional halogen and xenon options. Geographical growth is anticipated to be driven by rapid automotive production in Asia-Pacific, particularly in China and India, followed by North America and Europe. However, challenges remain, including the high initial investment costs associated with advanced lighting technologies and potential supply chain disruptions.

Despite the overall positive outlook, certain restraints could hinder market growth. Fluctuations in raw material prices, particularly for rare earth elements used in LED manufacturing, pose a risk. Furthermore, technological advancements in lighting technology could lead to rapid obsolescence and require continuous investment in research and development. Competition among established players and new entrants is also intensifying, potentially leading to price pressure. Nevertheless, the long-term outlook for the automotive perimeter lighting market remains optimistic, with continuous innovation and increasing demand for enhanced vehicle safety and aesthetics driving significant expansion throughout the forecast period. The market is segmented by sales channel (OEM and Aftermarket), vehicle type (passenger cars and commercial vehicles), and light type (halogen, xenon, LED, and others). Key players in this competitive landscape include Feniex Industries, Magna International Inc., OSRAM GmbH, Samvardhana Motherson Group, Koito Manufacturing Co Ltd, Gentex Corporation, HELLA GmbH & Co KGaA, Marelli Holdings Co Ltd, and Setina Manufacturing. These companies are actively investing in R&D to develop innovative lighting solutions and expand their market share.

Automotive Perimeter Lighting Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the global Automotive Perimeter Lighting Industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state, future trajectory, and key players shaping its evolution. The market is valued at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%.

Automotive Perimeter Lighting Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences within the Automotive Perimeter Lighting market. The industry exhibits a moderately concentrated structure, with key players like Feniex Industries, Magna International Inc, OSRAM GmbH, and HELLA GmbH & Co KGaA holding significant market share. However, the presence of several smaller, specialized players fosters innovation and competition.

Market Concentration: The top five players account for approximately xx% of the global market share in 2025. This indicates a moderately consolidated market with opportunities for both established players and new entrants.

Innovation Drivers: The primary drivers of innovation are advancements in LED technology, increasing demand for enhanced safety features, and stricter regulations on vehicle lighting standards. The shift towards energy-efficient and aesthetically pleasing lighting solutions further fuels innovation.

Regulatory Frameworks: Stringent safety and environmental regulations globally significantly influence the market. Compliance with these regulations necessitates continuous innovation in materials, design, and manufacturing processes.

Product Substitutes: While LED technology dominates, the market includes halogen and Xenon lighting, but these are being gradually phased out.

M&A Activities: The Automotive Perimeter Lighting market has witnessed significant M&A activity in recent years. For example, Magna International Inc.'s joint venture with LAN Manufacturing in February 2022, demonstrates a strategic move towards expanding their presence in the automotive seating and related components sectors. The value of this deal is estimated at $xx Million. The overall value of M&A deals in this sector from 2019-2024 is estimated to be $xx Million.

Automotive Perimeter Lighting Industry Market Dynamics & Trends

The Automotive Perimeter Lighting market is experiencing robust growth, driven by several factors. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles necessitates more sophisticated and integrated lighting systems. Consumer preference for enhanced vehicle aesthetics and safety features also drives demand. Technological advancements, particularly in LED technology, are leading to lighter, more energy-efficient, and cost-effective lighting solutions, further boosting market growth. The competitive landscape is characterized by intense rivalry among established players and emerging companies, leading to continuous product innovation and improved performance. Market penetration of LED lighting is growing rapidly, surpassing xx% in 2025.

Dominant Regions & Segments in Automotive Perimeter Lighting Industry

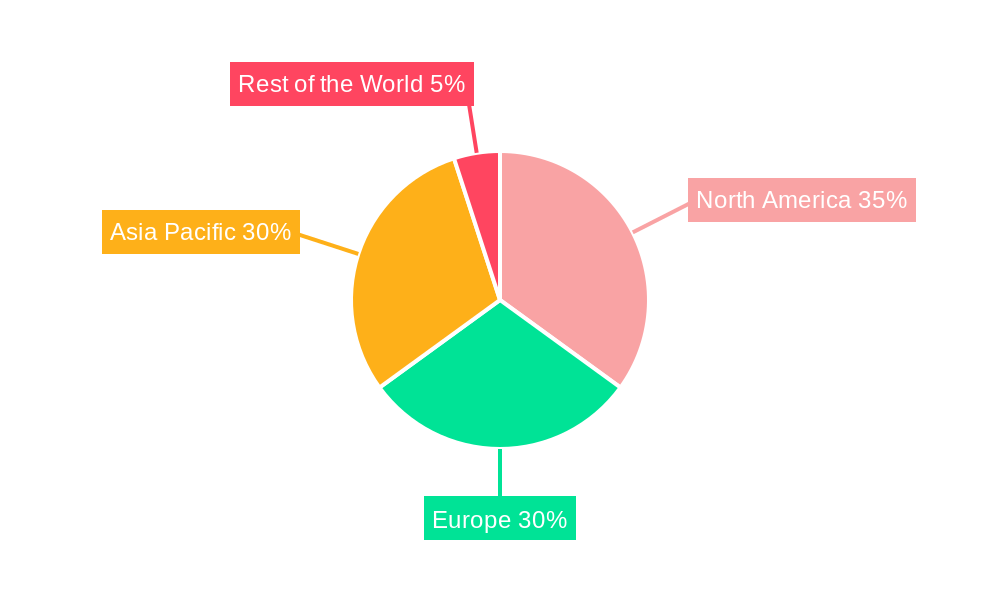

The Automotive Perimeter Lighting market is geographically diverse, with significant presence across North America, Europe, and Asia-Pacific. However, Asia-Pacific is expected to dominate the market owing to its robust automotive production and increasing vehicle sales in developing economies.

By Sales Channel:

- OEM: This segment holds the largest market share, driven by the integration of perimeter lighting into new vehicles. Growth is linked to the expansion of the automotive industry.

- Aftermarket: This segment is experiencing steady growth, fueled by the increasing demand for vehicle customization and aftermarket upgrades.

By Vehicle Type:

- Passenger Cars: This segment currently dominates, owing to the high volume of passenger car production globally.

- Commercial Vehicles: This segment is experiencing significant growth, driven by rising demand for enhanced safety features in trucks and buses.

By Light Type:

- LED: This is the fastest-growing segment, driven by its energy efficiency, durability, and design flexibility.

- Halogen & Xenon: These are gradually declining due to the superior performance and cost-effectiveness of LEDs.

- Others: This includes emerging technologies like OLED and laser lighting.

Key Drivers for Dominant Regions:

- Asia-Pacific: Rapid economic growth, expanding automotive manufacturing base, and increasing vehicle sales are driving market dominance.

- North America: Stringent safety regulations and high demand for advanced lighting systems contribute to significant growth.

- Europe: High adoption of LED technology and stringent environmental regulations fuel market expansion.

Automotive Perimeter Lighting Industry Product Innovations

Recent product innovations focus on enhancing lighting performance, safety, and aesthetics. The introduction of adaptive lighting systems, intelligent lighting controls, and innovative designs are key trends. Manufacturers are emphasizing energy efficiency, reduced weight, and improved durability through advancements in LED technology and materials science. The market fit for these innovations is excellent due to increasing consumer demand for sophisticated and stylish vehicle lighting solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Automotive Perimeter Lighting market, segmented by sales channel (OEM and aftermarket), vehicle type (passenger cars and commercial vehicles), and light type (halogen, xenon, LED, and others). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The LED segment is projected to exhibit the highest growth rate, driven by its advantages over traditional lighting technologies. The OEM channel accounts for a larger market share compared to the aftermarket segment.

Key Drivers of Automotive Perimeter Lighting Industry Growth

Several factors drive the growth of the Automotive Perimeter Lighting market. Technological advancements, particularly in LED technology, offer improved efficiency, durability, and aesthetics. Stringent safety regulations globally mandate the adoption of advanced lighting systems, while rising consumer demand for enhanced safety and aesthetic features boosts market growth. Economic growth in key regions also positively impacts the market.

Challenges in the Automotive Perimeter Lighting Industry Sector

The Automotive Perimeter Lighting industry faces challenges such as stringent regulatory compliance, supply chain disruptions (especially the impact of global events), and intense competition from both established and emerging players. Fluctuations in raw material prices and the complexity of integrating advanced lighting systems into vehicles also pose challenges.

Emerging Opportunities in Automotive Perimeter Lighting Industry

Emerging trends present significant opportunities, such as the increasing adoption of ADAS and autonomous vehicles demanding advanced lighting systems for enhanced safety and functionality. The rise of connected car technologies opens avenues for smart lighting solutions that can interact with other vehicle systems. Furthermore, the growing focus on sustainability creates opportunities for energy-efficient and environmentally friendly lighting technologies.

Leading Players in the Automotive Perimeter Lighting Industry Market

- Feniex Industries

- Magna International Inc

- OSRAM GmbH

- Samvardhana Motherson Group

- Koito Manufacturing Co Ltd

- Gentex Corporation

- HELLA GmbH & Co KGaA

- Marelli Holdings Co Lt

- Setina Manufacturing

Key Developments in Automotive Perimeter Lighting Industry

- January 2022: HELLA GmbH & Co KGaA launched the new Black Magic LED series, designed for off-road applications. This expands their product portfolio and targets a niche market segment.

- January 2022: Gentex Corporation partnered with eSight to develop mobile electronic eyewear for visually impaired individuals. This is a strategic diversification into a related technology area.

- February 2022: Magna International Inc. entered a joint venture with LAN Manufacturing to assemble seats for Ford Motor Company. This strengthens Magna's position in the automotive supply chain.

Future Outlook for Automotive Perimeter Lighting Industry Market

The Automotive Perimeter Lighting market is poised for continued growth, driven by technological advancements, increasing vehicle production, and the rising adoption of advanced safety features. The shift towards electric and autonomous vehicles presents significant opportunities for innovation and market expansion. Strategic partnerships, product diversification, and technological advancements will be crucial for players to maintain competitiveness and capture market share.

Automotive Perimeter Lighting Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Light Type

- 2.1. Halogen

- 2.2. Xenon

- 2.3. LED

- 2.4. Others

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

Automotive Perimeter Lighting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Perimeter Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Automotive Production; Growing Demand For Advanced Safety Features

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand from End User is Likely to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Light Type

- 5.2.1. Halogen

- 5.2.2. Xenon

- 5.2.3. LED

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Light Type

- 6.2.1. Halogen

- 6.2.2. Xenon

- 6.2.3. LED

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Light Type

- 7.2.1. Halogen

- 7.2.2. Xenon

- 7.2.3. LED

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Light Type

- 8.2.1. Halogen

- 8.2.2. Xenon

- 8.2.3. LED

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Light Type

- 9.2.1. Halogen

- 9.2.2. Xenon

- 9.2.3. LED

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. North America Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Perimeter Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Feniex Industries

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Magna International Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 OSRAM GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Samvardhana Motherson Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Koito Manufacturing Co Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Gentex Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 HELLA GmbH & Co KGaA

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Marelli Holdings Co Lt

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Setina Manufacturing

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 Feniex Industries

List of Figures

- Figure 1: Global Automotive Perimeter Lighting Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Perimeter Lighting Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 11: North America Automotive Perimeter Lighting Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 12: North America Automotive Perimeter Lighting Industry Revenue (Million), by Light Type 2024 & 2032

- Figure 13: North America Automotive Perimeter Lighting Industry Revenue Share (%), by Light Type 2024 & 2032

- Figure 14: North America Automotive Perimeter Lighting Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 15: North America Automotive Perimeter Lighting Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 16: North America Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Perimeter Lighting Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: Europe Automotive Perimeter Lighting Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: Europe Automotive Perimeter Lighting Industry Revenue (Million), by Light Type 2024 & 2032

- Figure 21: Europe Automotive Perimeter Lighting Industry Revenue Share (%), by Light Type 2024 & 2032

- Figure 22: Europe Automotive Perimeter Lighting Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 23: Europe Automotive Perimeter Lighting Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 24: Europe Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 27: Asia Pacific Automotive Perimeter Lighting Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 28: Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million), by Light Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Perimeter Lighting Industry Revenue Share (%), by Light Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Asia Pacific Automotive Perimeter Lighting Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Perimeter Lighting Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Rest of the World Automotive Perimeter Lighting Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Rest of the World Automotive Perimeter Lighting Industry Revenue (Million), by Light Type 2024 & 2032

- Figure 37: Rest of the World Automotive Perimeter Lighting Industry Revenue Share (%), by Light Type 2024 & 2032

- Figure 38: Rest of the World Automotive Perimeter Lighting Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 39: Rest of the World Automotive Perimeter Lighting Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 40: Rest of the World Automotive Perimeter Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Perimeter Lighting Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Light Type 2019 & 2032

- Table 4: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Light Type 2019 & 2032

- Table 28: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 29: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 34: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Light Type 2019 & 2032

- Table 35: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 36: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 44: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Light Type 2019 & 2032

- Table 45: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 46: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: India Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: China Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 53: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Light Type 2019 & 2032

- Table 54: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 55: Global Automotive Perimeter Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South America Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Middle East and Africa Automotive Perimeter Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Perimeter Lighting Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Automotive Perimeter Lighting Industry?

Key companies in the market include Feniex Industries, Magna International Inc, OSRAM GmbH, Samvardhana Motherson Group, Koito Manufacturing Co Ltd, Gentex Corporation, HELLA GmbH & Co KGaA, Marelli Holdings Co Lt, Setina Manufacturing.

3. What are the main segments of the Automotive Perimeter Lighting Industry?

The market segments include Vehicle Type, Light Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Automotive Production; Growing Demand For Advanced Safety Features.

6. What are the notable trends driving market growth?

Increasing Demand from End User is Likely to Drive the Market.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

February 2022: Magna announced it has entered into a joint venture with LAN Manufacturing, a minority-owned automotive supplier based in Michigan. The JV, to be called LM Manufacturing, will assemble complete seats for various trucks and SUVs for Ford Motor Company operating from a 296,000-square-foot leased facility in Detroit, Michigan. Magna will own a 49% stake.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Perimeter Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Perimeter Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Perimeter Lighting Industry?

To stay informed about further developments, trends, and reports in the Automotive Perimeter Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence