Key Insights

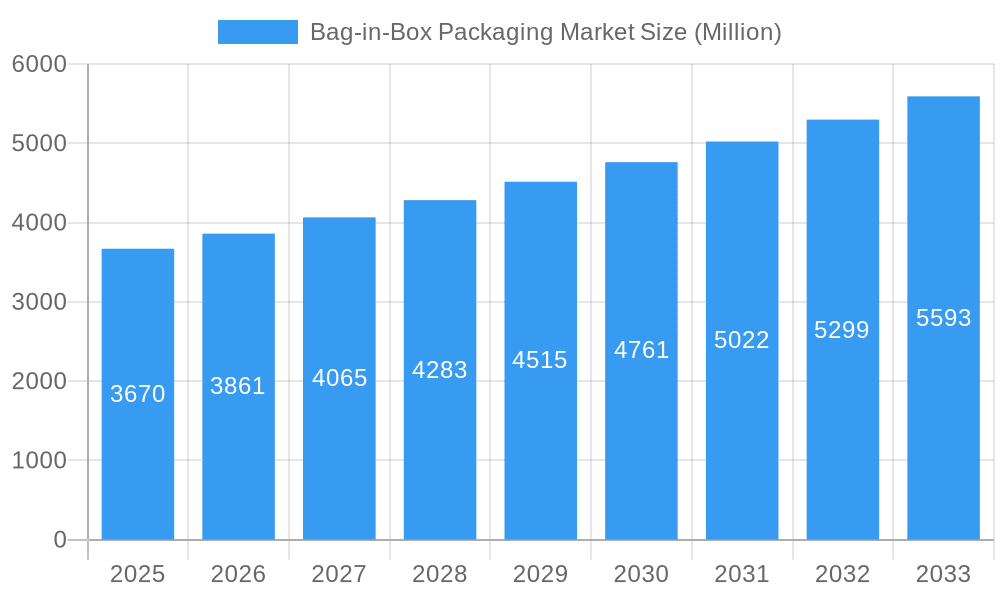

The Bag-in-Box (BIB) packaging market, valued at $3.67 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising demand for convenient, sustainable, and cost-effective packaging solutions across diverse industries, including food and beverages, pharmaceuticals, and personal care, is a primary driver. The increasing adoption of BIB packaging for extending product shelf life and reducing waste contributes significantly to market expansion. Furthermore, advancements in BIB packaging technology, such as improved barrier films and dispensing systems, are enhancing its appeal to manufacturers seeking to protect product quality and improve consumer experience. The growth is also fueled by the expanding e-commerce sector, which requires efficient and tamper-evident packaging solutions. Geographic expansion into emerging markets with growing consumption of packaged goods presents substantial opportunities. While potential constraints such as fluctuating raw material prices and the availability of skilled labor exist, the overall market outlook remains positive.

Bag-in-Box Packaging Market Market Size (In Billion)

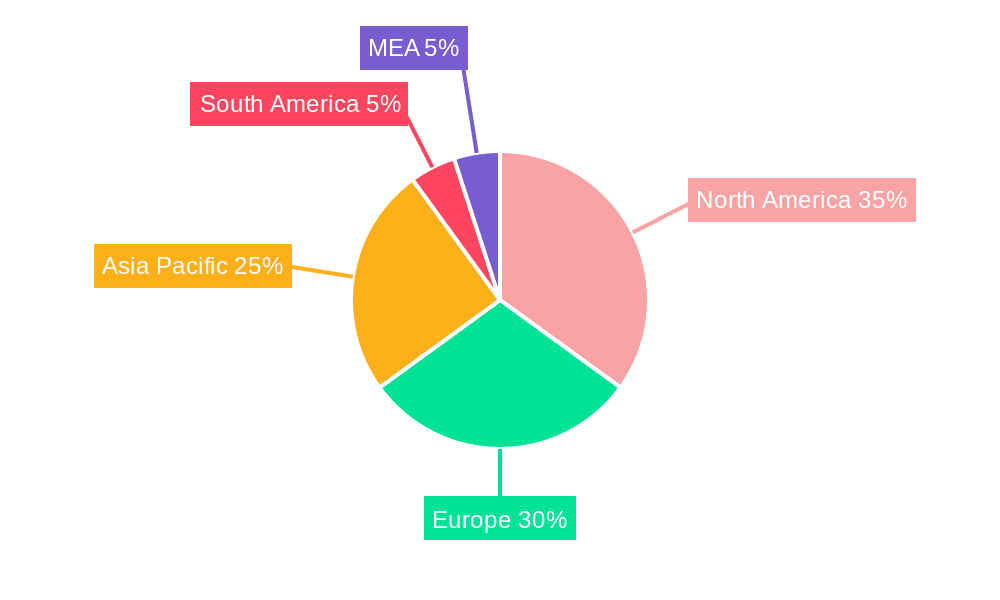

The market is segmented by capacity (0-5 liters, 5-10 liters, >10 liters) and end-user industry (beverage, non-alcoholic drinks, food, pharmaceutical, industrial, personal care). The beverage segment, including both alcoholic and non-alcoholic drinks, currently holds the largest market share due to the widespread adoption of BIBs for wine, juice, and other liquid products. However, growth in the food and pharmaceutical sectors is expected to be significant, driven by the increasing demand for extended shelf life and safe packaging for sensitive products. Regionally, North America and Europe currently dominate the market due to established industries and high consumer awareness of sustainable packaging. However, the Asia-Pacific region is anticipated to witness the fastest growth rate due to rising disposable incomes, increasing urbanization, and a growing preference for convenient packaging options. Key players like Aran Group, Liqui-Box, and Amcor are leading the market through innovations and strategic expansions. The forecast period of 2025-2033 presents significant opportunities for market expansion.

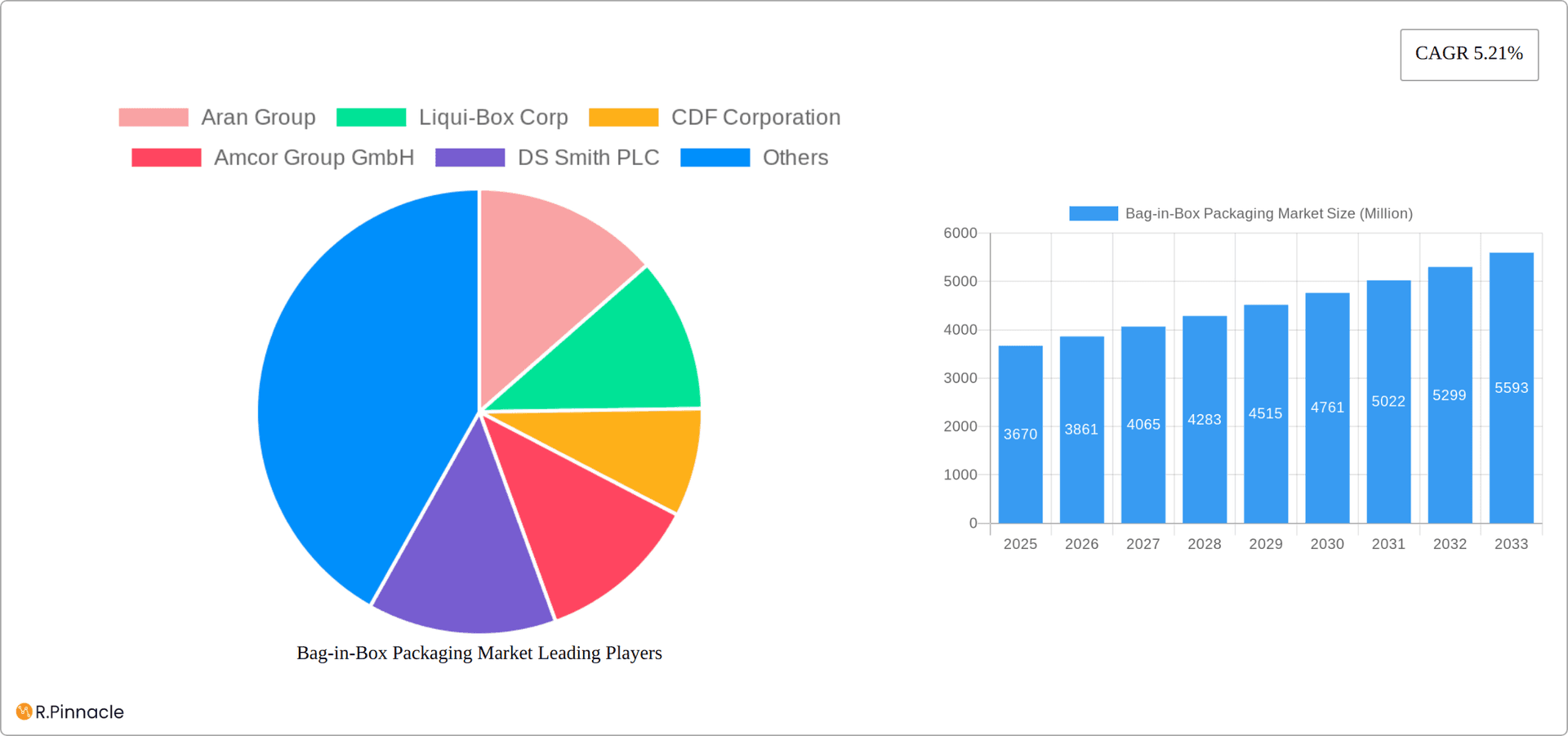

Bag-in-Box Packaging Market Company Market Share

Bag-in-Box Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Bag-in-Box Packaging Market, offering actionable insights for industry professionals. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, key players, emerging trends, and future growth potential. The global Bag-in-Box Packaging Market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Bag-in-Box Packaging Market Market Structure & Innovation Trends

The Bag-in-Box packaging market presents a moderately concentrated competitive landscape, with several key players holding significant, albeit undisclosed, market share. Prominent companies shaping this market include Aran Group, Liqui-Box Corp, CDF Corporation, Amcor Group GmbH, DS Smith PLC, Fujimori Kogyo Co Ltd (Zacros Cubitainer), Scholle IPN Corp, AstraPouch (Vine Valley Ventures LLC), Goglio SpA, and Smurfit Kappa. While precise market share data remains unavailable, the competitive dynamics are influenced by a confluence of factors including innovation, regulatory pressures, and strategic mergers and acquisitions (M&A).

- Innovation Drivers: Sustainability is a paramount concern, driving the development of eco-friendly materials and designs. Advancements in barrier film technology and dispensing systems are crucial for extending product shelf life and enhancing user convenience. This includes exploring biodegradable and compostable materials, and optimizing packaging designs for reduced material usage.

- Regulatory Frameworks: Stringent government regulations concerning food safety and material recyclability are significantly impacting product development and manufacturing processes. Companies are increasingly focusing on compliance with evolving standards for both material composition and packaging disposal.

- Product Substitutes: The market faces competition from alternative packaging formats such as rigid containers (bottles, cans) and flexible pouches. This necessitates continuous innovation to highlight the unique advantages of bag-in-box packaging, such as cost-effectiveness and reduced waste.

- End-User Demographics: The growing consumer preference for convenient and sustainable packaging solutions is a major growth catalyst across diverse end-user industries. This trend favors bag-in-box packaging due to its inherent benefits of portability, extended shelf-life, and reduced environmental impact.

- M&A Activities: While specific financial details remain undisclosed, recent M&A activity suggests a moderate level of consolidation. These strategic acquisitions primarily aim to bolster production capacity, broaden geographic reach, and integrate complementary technologies.

Bag-in-Box Packaging Market Market Dynamics & Trends

This section delves into the key market dynamics driving growth in the Bag-in-Box Packaging Market. Strong growth is fueled by several factors:

- Rising Consumer Demand: Growing consumer preference for convenience, portability, and sustainability is a major growth driver. Bag-in-box packaging offers significant advantages over traditional packaging formats in terms of cost-effectiveness, reduced waste, and extended shelf life.

- Technological Advancements: Innovations in barrier film technology are improving oxygen and moisture barrier properties, leading to longer shelf life for sensitive products. New dispensing systems further enhance product usability and convenience.

- E-commerce Growth: The rise of e-commerce is driving demand for robust and easily shippable packaging solutions, benefiting bag-in-box packaging.

- Sustainability Concerns: Increasing environmental awareness is pushing brands towards sustainable packaging options, with bag-in-box packaging's reduced material usage and ease of recycling proving advantageous.

- Competitive Dynamics: The market is characterized by both intense competition and opportunities for strategic partnerships and collaborations.

Dominant Regions & Segments in Bag-in-Box Packaging Market

This section highlights the leading regions and segments within the Bag-in-Box Packaging Market. While precise market share data is unavailable at this time (xx), it is predicted that North America and Europe will remain dominant regions. Within capacity segments, the 5-10 Liter segment is predicted to be the largest, followed by the >10 Liter segment. The beverage industry is projected to be the largest end-user industry segment.

Key Drivers by Segment:

- By Capacity:

- 0-5 Liter: Driven by increasing demand for single-serving and smaller-sized products.

- 5-10 Liter: Dominated by household consumption and small-scale commercial use.

- Greater than 10 Liter: Driven by bulk purchases and large-scale commercial operations.

- By End-User Industry:

- Beverage: High growth fueled by the rising popularity of wine, juice, and other beverages packaged in bag-in-box formats.

- Non-alcoholic Drinks: Strong growth predicted due to expanding consumer preference for convenient, shelf-stable, and sustainable packaging solutions.

- Food: Expanding utilization in sectors such as sauces, oils, and other food products.

- Pharmaceutical and Medicine: Steady growth, driven by the requirement of tamper-evident and shelf-stable packaging.

- Industrial (Chemical, Paintings and Coatings): Driven by a need for robust and cost-effective solutions for storing and distributing industrial liquids.

- Personal Care and Homecare: Growing adoption for dispensing liquid products like shampoos and cleaning solutions.

Bag-in-Box Packaging Market Product Innovations

Recent innovations center on improved barrier films with enhanced oxygen and moisture protection, resulting in extended product shelf life. New dispensing systems are enhancing convenience and reducing waste. Sustainable materials are also gaining prominence, aligning with growing environmental concerns. These innovations address key market needs for improved product preservation and sustainability.

Report Scope & Segmentation Analysis

This report segments the Bag-in-Box Packaging Market by capacity (0-5 Liter, 5-10 Liter, >10 Liter) and end-user industry (Beverage, Non-alcoholic Drinks, Food, Pharmaceutical and Medicine, Industrial, Personal Care and Homecare). Each segment's growth is analyzed, considering market size, growth projections, and competitive dynamics. The report provides detailed information on the market size and growth rates of each segment for the study period (2019-2033). Market size data for 2025 is provided (xx Million for each segment).

Key Drivers of Bag-in-Box Packaging Market Growth

Several factors drive the growth of the Bag-in-Box Packaging Market. These include the increasing demand for convenient and sustainable packaging solutions, technological advancements in barrier film technology and dispensing systems, growing e-commerce sales, and rising consumer awareness of environmental issues. Government regulations promoting sustainable packaging also contribute to market expansion.

Challenges in the Bag-in-Box Packaging Market Sector

Challenges include the competition from alternative packaging formats, fluctuating raw material prices, and the need to comply with evolving regulations. Supply chain disruptions can also impact production and delivery timelines. These challenges present opportunities for innovation and strategic adaptation within the industry.

Emerging Opportunities in Bag-in-Box Packaging Market

Emerging opportunities lie in developing sustainable and recyclable materials, expanding into new end-user industries, and exploring innovative dispensing technologies. Focus on customized packaging solutions and personalized branding options for enhanced consumer appeal is also beneficial.

Leading Players in the Bag-in-Box Packaging Market Market

- Aran Group

- Liqui-Box Corp

- CDF Corporation

- Amcor Group GmbH

- DS Smith PLC

- Fujimori Kogyo Co Ltd (Zacros Cubitainer)

- Scholle IPN Corp

- AstraPouch (Vine Valley Ventures LLC)

- Goglio SpA

- Smurfit Kappa

Key Developments in Bag-in-Box Packaging Market Industry

- November 2023: Campo Viejo launched its Winemakers’ Blend in a bag-in-box format, highlighting the growing acceptance of this packaging type for premium products.

- April 2024: Peak Packaging invested over USD 1.08 Million in its UK facility, increasing its bag-in-box production capacity to over 60 Million bags annually. This demonstrates significant investment in the sector and highlights expansion plans.

Future Outlook for Bag-in-Box Packaging Market Market

The Bag-in-Box Packaging Market is poised for continued growth, driven by ongoing innovation in materials and dispensing technologies, as well as increasing consumer demand for sustainable and convenient packaging. Strategic partnerships and investments in production capacity will further shape market dynamics. The market is predicted to experience robust expansion throughout the forecast period.

Bag-in-Box Packaging Market Segmentation

-

1. Capacity

- 1.1. 0-5 Liter

- 1.2. 5-10 Liter

- 1.3. Greater than 10 Liter

-

2. End-User Industry

-

2.1. Beverage

- 2.1.1. Alcoholic Drinks

- 2.1.2. Non-alcoholic Drinks

- 2.2. Food

- 2.3. Pharmaceutical and Medicine

- 2.4. Industrial (Chemical, Paintings and Coatings)

- 2.5. Perosnal Care and Homecare

-

2.1. Beverage

Bag-in-Box Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Bag-in-Box Packaging Market Regional Market Share

Geographic Coverage of Bag-in-Box Packaging Market

Bag-in-Box Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Demand for BIB Packaging Format Among Beverage Manufacturers; The Rising Need for Convenience and Eco-friendly Packaging in E-commerce

- 3.3. Market Restrains

- 3.3.1. Restrictions on Using Plastic Retail Bags

- 3.4. Market Trends

- 3.4.1. The Rising Demand From Beverage Sector Aids Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. 0-5 Liter

- 5.1.2. 5-10 Liter

- 5.1.3. Greater than 10 Liter

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Beverage

- 5.2.1.1. Alcoholic Drinks

- 5.2.1.2. Non-alcoholic Drinks

- 5.2.2. Food

- 5.2.3. Pharmaceutical and Medicine

- 5.2.4. Industrial (Chemical, Paintings and Coatings)

- 5.2.5. Perosnal Care and Homecare

- 5.2.1. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North America Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. 0-5 Liter

- 6.1.2. 5-10 Liter

- 6.1.3. Greater than 10 Liter

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Beverage

- 6.2.1.1. Alcoholic Drinks

- 6.2.1.2. Non-alcoholic Drinks

- 6.2.2. Food

- 6.2.3. Pharmaceutical and Medicine

- 6.2.4. Industrial (Chemical, Paintings and Coatings)

- 6.2.5. Perosnal Care and Homecare

- 6.2.1. Beverage

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Europe Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. 0-5 Liter

- 7.1.2. 5-10 Liter

- 7.1.3. Greater than 10 Liter

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Beverage

- 7.2.1.1. Alcoholic Drinks

- 7.2.1.2. Non-alcoholic Drinks

- 7.2.2. Food

- 7.2.3. Pharmaceutical and Medicine

- 7.2.4. Industrial (Chemical, Paintings and Coatings)

- 7.2.5. Perosnal Care and Homecare

- 7.2.1. Beverage

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Asia Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. 0-5 Liter

- 8.1.2. 5-10 Liter

- 8.1.3. Greater than 10 Liter

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Beverage

- 8.2.1.1. Alcoholic Drinks

- 8.2.1.2. Non-alcoholic Drinks

- 8.2.2. Food

- 8.2.3. Pharmaceutical and Medicine

- 8.2.4. Industrial (Chemical, Paintings and Coatings)

- 8.2.5. Perosnal Care and Homecare

- 8.2.1. Beverage

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Latin America Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. 0-5 Liter

- 9.1.2. 5-10 Liter

- 9.1.3. Greater than 10 Liter

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Beverage

- 9.2.1.1. Alcoholic Drinks

- 9.2.1.2. Non-alcoholic Drinks

- 9.2.2. Food

- 9.2.3. Pharmaceutical and Medicine

- 9.2.4. Industrial (Chemical, Paintings and Coatings)

- 9.2.5. Perosnal Care and Homecare

- 9.2.1. Beverage

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Middle East and Africa Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. 0-5 Liter

- 10.1.2. 5-10 Liter

- 10.1.3. Greater than 10 Liter

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Beverage

- 10.2.1.1. Alcoholic Drinks

- 10.2.1.2. Non-alcoholic Drinks

- 10.2.2. Food

- 10.2.3. Pharmaceutical and Medicine

- 10.2.4. Industrial (Chemical, Paintings and Coatings)

- 10.2.5. Perosnal Care and Homecare

- 10.2.1. Beverage

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aran Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Liqui-Box Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CDF Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amcor Group GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujimori Kogyo Co Ltd (Zacros Cubitainer)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Scholle IPN Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AstraPouch (Vine Valley Ventures LLC)*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Goglio SpA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Smurfit Kappa

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Aran Group

List of Figures

- Figure 1: Global Bag-in-Box Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 3: North America Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 4: North America Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 9: Europe Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 10: Europe Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 15: Asia Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 16: Asia Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 21: Latin America Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 22: Latin America Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Latin America Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Latin America Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 27: Middle East and Africa Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 28: Middle East and Africa Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 2: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 5: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 10: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 17: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia and New Zealand Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 24: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 25: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Brazil Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Mexico Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 29: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 30: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Arab Emirates Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Saudi Arabia Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: South Africa Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bag-in-Box Packaging Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the Bag-in-Box Packaging Market?

Key companies in the market include Aran Group, Liqui-Box Corp, CDF Corporation, Amcor Group GmbH, DS Smith PLC, Fujimori Kogyo Co Ltd (Zacros Cubitainer), Scholle IPN Corp, AstraPouch (Vine Valley Ventures LLC)*List Not Exhaustive, Goglio SpA, Smurfit Kappa.

3. What are the main segments of the Bag-in-Box Packaging Market?

The market segments include Capacity, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Demand for BIB Packaging Format Among Beverage Manufacturers; The Rising Need for Convenience and Eco-friendly Packaging in E-commerce.

6. What are the notable trends driving market growth?

The Rising Demand From Beverage Sector Aids Market Growth.

7. Are there any restraints impacting market growth?

Restrictions on Using Plastic Retail Bags.

8. Can you provide examples of recent developments in the market?

April 2024: Peak Packaging, a specialist in liquid packaging, announced an investment exceeding USD 1.08 million in its UK facility. The move is set to bolster its bag-in-box production capabilities, with the goal of ramping up capacity to over 60 million bags annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bag-in-Box Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bag-in-Box Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bag-in-Box Packaging Market?

To stay informed about further developments, trends, and reports in the Bag-in-Box Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence