Key Insights

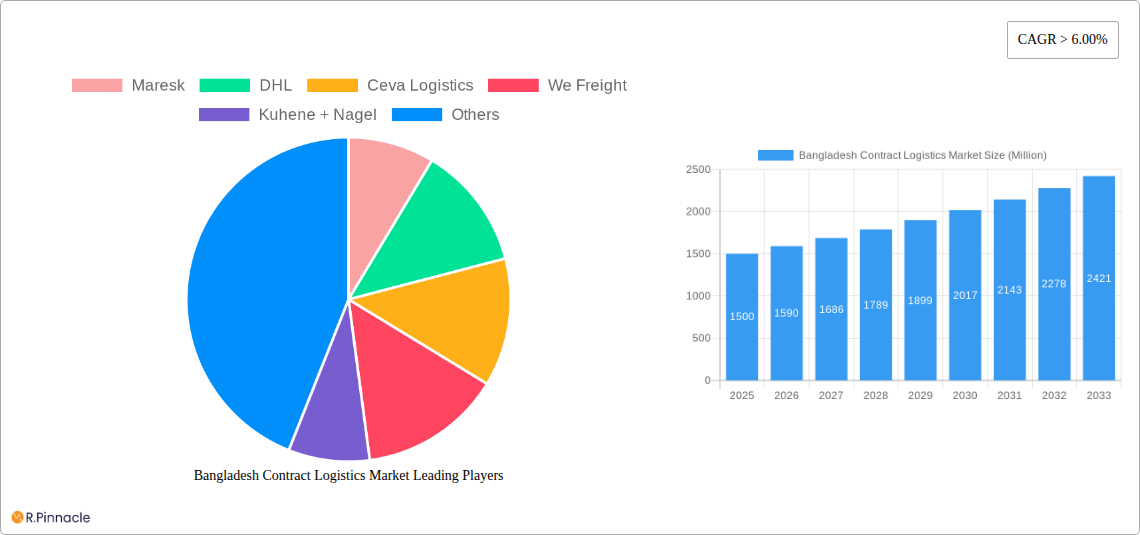

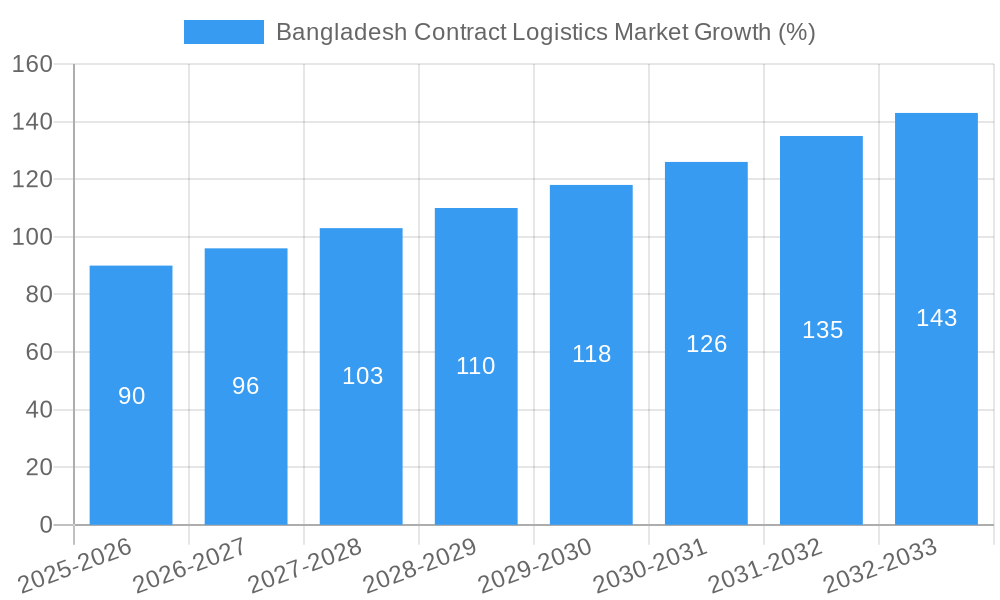

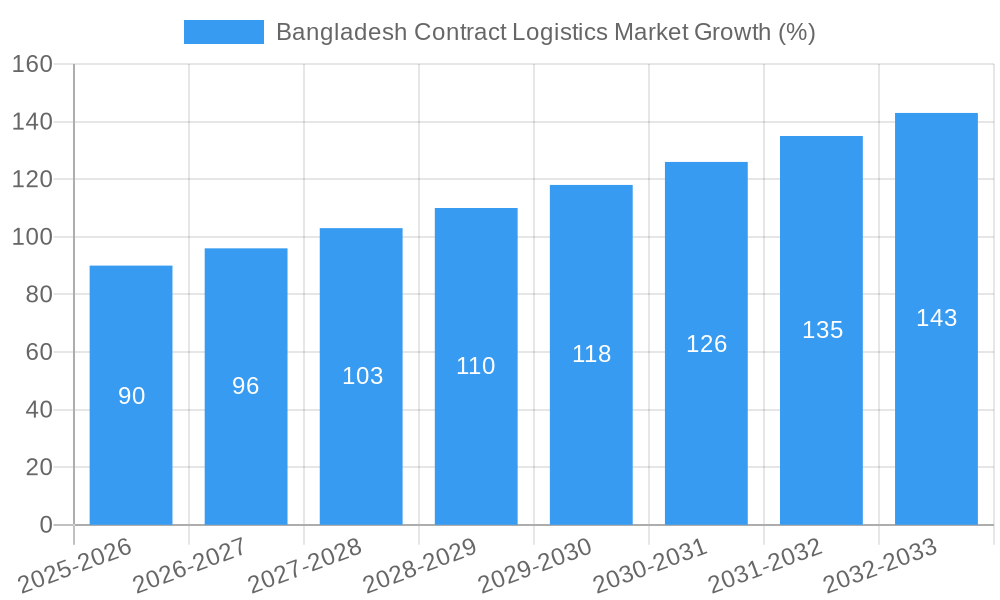

The Bangladesh contract logistics market exhibits robust growth potential, driven by the country's burgeoning manufacturing and export-oriented industries, particularly in the ready-made garment (RMG) sector. A CAGR exceeding 6% from 2019-2033 indicates a significant expansion, fueled by increasing e-commerce adoption, a growing need for supply chain efficiency, and foreign direct investment (FDI) inflows stimulating industrial growth. The market is segmented by type (insourced vs. outsourced) and end-user (manufacturing & automotive, consumer goods & retail, high-tech, healthcare & pharmaceuticals, and others). Outsourced contract logistics is expected to dominate, given the complexities of global supply chains and the expertise offered by specialized 3PL providers. Key players like Maersk, DHL, and local providers like Navana Logistics and SARVAM Logistics are vying for market share, leveraging their established networks and technological capabilities. While infrastructure limitations and skilled labor shortages pose challenges, government initiatives aimed at improving logistics infrastructure and streamlining regulations are expected to mitigate these restraints.

The forecast for the Bangladesh contract logistics market projects substantial growth through 2033. The RMG sector, a major contributor to the nation's GDP, requires efficient logistics solutions for timely delivery to international markets. Furthermore, the expanding consumer goods and retail sectors, coupled with increasing e-commerce activity, are creating significant demand for warehousing, transportation, and value-added services. While the high-tech and pharmaceutical sectors represent smaller market segments currently, their anticipated growth trajectory positions them as significant contributors to market expansion in the coming years. The competitive landscape is characterized by a blend of global logistics giants and established domestic players, resulting in a dynamic market with various service offerings and pricing strategies. Sustained economic growth and favorable government policies should further propel the market's upward trajectory.

Bangladesh Contract Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bangladesh contract logistics market, offering valuable insights for industry professionals, investors, and stakeholders. With a focus on market dynamics, key players, and future trends, this report is an essential resource for understanding and navigating this rapidly evolving sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Bangladesh Contract Logistics Market Market Structure & Innovation Trends

The Bangladesh contract logistics market exhibits a moderately concentrated structure, with both multinational giants and local players vying for market share. Key players like Maersk, DHL, and others hold significant portions of the market, though the exact figures vary by segment. Innovation is driven primarily by the need to improve efficiency, reduce costs, and meet the demands of a growing and diversifying economy. The regulatory framework, while evolving, presents both opportunities and challenges. The limited number of Container Freight Stations (CFSs) in the country presents a significant constraint, but investments are being made to address this. Product substitutes, including in-house logistics solutions, exist but are often less efficient for larger businesses. M&A activity has been moderate, with deal values in the range of xx Million in recent years.

- Market Concentration: Moderately concentrated, with top players holding significant but not dominant shares.

- Innovation Drivers: Efficiency improvements, cost reduction, and meeting growing market demands.

- Regulatory Framework: Evolving, presenting both opportunities and challenges.

- M&A Activity: Moderate, with deal values totaling xx Million in recent years.

Bangladesh Contract Logistics Market Market Dynamics & Trends

The Bangladesh contract logistics market is experiencing robust growth, driven by the expansion of the ready-made garment (RMG) industry, increasing e-commerce penetration, and improving infrastructure. The CAGR for the period 2025-2033 is projected to be xx%, reflecting strong growth momentum. Technological disruptions, such as the adoption of automation and digitalization, are transforming the sector, improving efficiency and transparency. Consumer preferences are shifting towards faster and more reliable delivery services, putting pressure on logistics providers to adapt. Competitive dynamics are characterized by intense rivalry among both multinational and local players, leading to price competition and innovation. Market penetration of outsourced logistics services is steadily rising and is predicted to reach xx% by 2033.

Dominant Regions & Segments in Bangladesh Contract Logistics Market

The Chattogram region dominates the Bangladesh contract logistics market due to its strategic location near the Chattogram Port, the country’s primary seaport. The RMG sector is the largest end-user segment, driving significant demand for contract logistics services. Outsourced logistics is the fastest growing segment, reflecting companies' preference for specialization and efficiency gains.

Key Drivers for Chattogram Region Dominance: Proximity to Chattogram Port, improved infrastructure (e.g., Karnaphuly Tunnel).

Key Drivers for RMG Segment Dominance: Significant export volumes, strong growth in the garment industry.

Key Drivers for Outsourced Segment Growth: Cost efficiencies, specialized expertise, and scalability.

Manufacturing and Automotive: The automotive sector is also a significant driver of contract logistics, with increasing demand for efficient supply chains.

Consumer Goods and Retail: The rising middle class and growth in e-commerce have increased demand for reliable and fast delivery services within this segment.

High-tech: This segment experiences increasing demand, driven by the growth of technology companies and the need for precise, secure logistics.

Healthcare and Pharmaceuticals: This sector demands highly specialized logistics solutions and stringent regulatory compliance.

Bangladesh Contract Logistics Market Product Innovations

Recent product innovations focus on enhancing efficiency, transparency, and visibility across the supply chain. Technological trends like real-time tracking, blockchain technology, and automated warehousing systems are being adopted to improve service quality and reduce costs. These innovations are proving crucial for market success, particularly in meeting demands for speed and transparency.

Report Scope & Segmentation Analysis

This report segments the Bangladesh contract logistics market by type (insourced and outsourced) and end-user (Manufacturing and Automotive, Consumer Goods and Retail, High-tech, Healthcare and Pharmaceuticals, and Other End-Users). Each segment’s growth projections, market sizes, and competitive dynamics are meticulously analyzed, providing a granular understanding of the market landscape.

- By Type: The Outsourced segment is expected to show stronger growth than the Insourced segment.

- By End-User: The Manufacturing and Automotive sector is currently the largest segment and is projected to continue its dominance.

Key Drivers of Bangladesh Contract Logistics Market Growth

The growth of the Bangladesh contract logistics market is fueled by several key factors: the expanding RMG industry, increasing foreign direct investment (FDI), government initiatives to improve infrastructure, and the burgeoning e-commerce sector. These factors collectively create a strong demand for efficient and reliable logistics services.

Challenges in the Bangladesh Contract Logistics Market Sector

Challenges include infrastructural limitations (e.g., inadequate road networks in certain areas), bureaucratic hurdles, and a shortage of skilled labor. These factors can lead to increased costs and delays, hindering the growth of the sector. The impact of these challenges on market growth is projected at xx% annually.

Emerging Opportunities in Bangladesh Contract Logistics Market

Emerging opportunities include the growth of e-commerce, the increasing adoption of technology solutions (e.g., automation, AI), and the expansion of the cold chain logistics sector. These trends offer significant potential for market expansion and innovation.

Leading Players in the Bangladesh Contract Logistics Market Market

- Maersk (Maersk)

- DHL (DHL)

- Ceva Logistics (Ceva Logistics)

- We Freight

- Kuhene + Nagel (Kühne + Nagel)

- Bolloré Logistics (Bolloré Logistics)

- GEODIS (GEODIS)

- XPO Logistics (XPO Logistics)

- Agility Logistics Pvt Ltd

- Navana Logistics

- SARVAM Logistics

- 3i Logistics

- DB Schenker (DB Schenker)

- DSV (DSV)

Key Developments in Bangladesh Contract Logistics Market Industry

- May 2023: DHL invests over €2 Million to expand CFS capacity to support the RMG sector.

- November 2022: Maersk opens a new 100,000 sq ft warehouse facility in Chattogram.

- July 2022: xx

Future Outlook for Bangladesh Contract Logistics Market Market

The Bangladesh contract logistics market is poised for continued growth, driven by strong economic expansion and ongoing infrastructure development. Strategic investments in technology and capacity expansion will play a key role in shaping the future of the sector, offering significant opportunities for both established players and new entrants.

Bangladesh Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

Bangladesh Contract Logistics Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 SAG'S Increased Focus Toward Transportation Infrastructure

- 3.2.2 Including Railways

- 3.2.3 Airports

- 3.2.4 And Seaports; Establishment Of Special Economic Zones

- 3.3. Market Restrains

- 3.3.1. Limited Visible of Shipments; Increasing Transportation

- 3.4. Market Trends

- 3.4.1. Pharmaceutical and healthcare spending is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Maresk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 We Freight

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuhene + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolloré Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GEODIS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 XPO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agility Logistics Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Navana Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SARVAM Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3i Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DB Schenkar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DSV

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Maresk

List of Figures

- Figure 1: Bangladesh Contract Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Contract Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Contract Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Bangladesh Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Bangladesh Contract Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bangladesh Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bangladesh Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Bangladesh Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Bangladesh Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Contract Logistics Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Bangladesh Contract Logistics Market?

Key companies in the market include Maresk, DHL, Ceva Logistics, We Freight, Kuhene + Nagel, Bolloré Logistics, GEODIS, XPO Logistics, Agility Logistics Pvt Ltd, Navana Logistics, SARVAM Logistics, 3i Logistics, DB Schenkar, DSV.

3. What are the main segments of the Bangladesh Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

SAG'S Increased Focus Toward Transportation Infrastructure. Including Railways. Airports. And Seaports; Establishment Of Special Economic Zones.

6. What are the notable trends driving market growth?

Pharmaceutical and healthcare spending is driving the market.

7. Are there any restraints impacting market growth?

Limited Visible of Shipments; Increasing Transportation.

8. Can you provide examples of recent developments in the market?

May 2023: To serve Bangladesh's ever-expanding readymade garments (RMG) industry, DHL Global Forwarding, the freight-specializing division of Deutsche Post DHL Group, recently committed more than 2 million euros to extend its specialized Container Freight Station (CFS) capacity. Less than 20 CFSs are present in the entire nation of Bangladesh, making CFSs rare. These facilities assist in gathering products from various sources, combining them into a single container, and then transporting the container to the desired location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Bangladesh Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence