Key Insights

Germany's contract logistics market is poised for substantial growth, projected to reach €30.43 billion by 2025, with a compound annual growth rate (CAGR) of 2.18%. This expansion is primarily driven by the accelerating e-commerce sector, which demands sophisticated warehousing and delivery infrastructure. The increasing intricacy of global supply chains also fuels demand for specialized contract logistics outsourcing. Furthermore, Germany's robust manufacturing prowess, particularly in automotive, industrial, and technology sectors, sustains a consistent need for contract logistics services. The adoption of automation and digitalization is enhancing operational efficiency and transparency, further contributing to market momentum. Key challenges include volatile fuel prices, a persistent shortage of skilled labor, and escalating regulatory compliance costs.

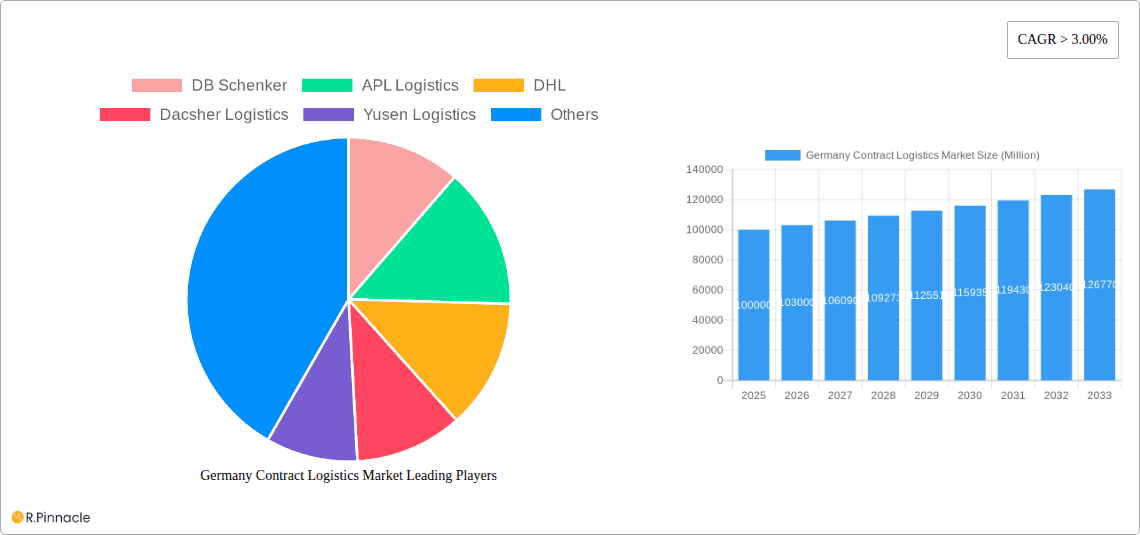

Germany Contract Logistics Market Market Size (In Billion)

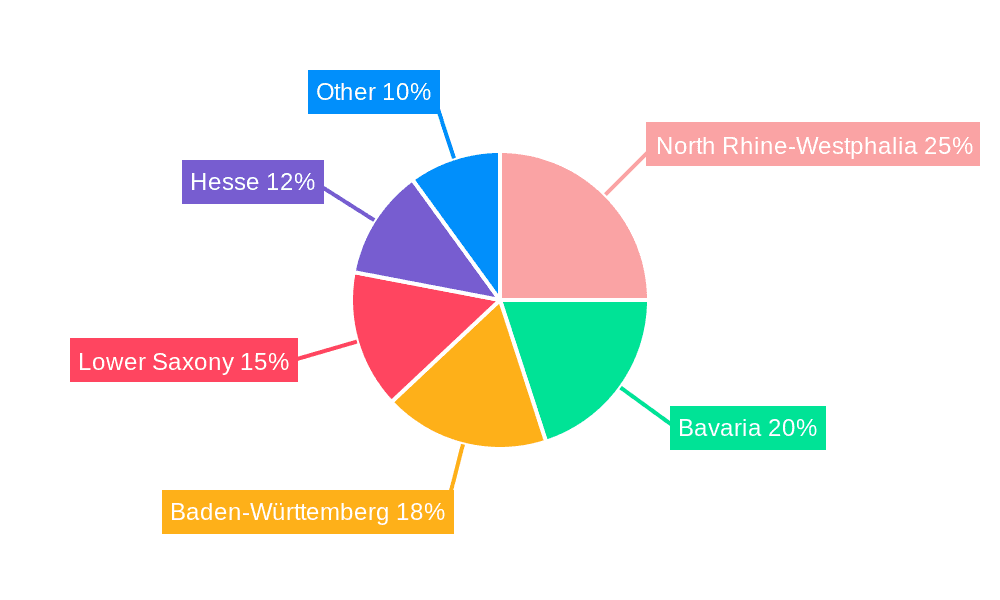

Market segmentation highlights robust contributions from both insourced and outsourced logistics. The automotive, consumer & retail, and technology sectors are prominent end-users driving demand. Contract logistics activity is concentrated in Germany's economically vital regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, owing to their industrial clusters, advanced infrastructure, and skilled workforce. The forecast period (2025-2033) anticipates sustained growth, propelled by continued e-commerce expansion and the adoption of advanced logistics technologies. This outlook solidifies Germany's position as a significant player in the European contract logistics arena. The competitive environment features established global entities such as DB Schenker and DHL, alongside numerous specialized providers, indicating a vibrant and evolving market.

Germany Contract Logistics Market Company Market Share

Germany Contract Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany contract logistics market, offering valuable insights for industry professionals, investors, and strategic planners. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to deliver actionable intelligence, supporting informed decision-making within this dynamic sector.

Germany Contract Logistics Market Structure & Innovation Trends

The German contract logistics market is characterized by a moderately concentrated landscape, with key players including DB Schenker, DHL, APL Logistics, Dacsher Logistics, Yusen Logistics, Hellman Worldwide Logistics, CEVA Logistics, BLG Logistics, Feige, and Agility Logistics. However, the market also features numerous smaller, specialized providers. Market share analysis reveals that the top five players collectively hold approximately xx% of the market, indicating significant opportunities for both established players and emerging entrants. Innovation is driven by advancements in technology, such as automation, AI, and blockchain, leading to improved efficiency and transparency within supply chains. The regulatory framework, including environmental regulations and data privacy laws, significantly impacts operational strategies. While limited direct product substitutes exist, competitors constantly seek to differentiate their offerings through specialized services and technological integration. Mergers and acquisitions (M&A) activity has been moderate in recent years, with total deal values reaching approximately €xx Million in 2024. The automotive, consumer & retail, and industrial & aerospace sectors are major drivers of M&A activity, as companies seek to expand their market reach and service capabilities.

Germany Contract Logistics Market Market Dynamics & Trends

The German contract logistics market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several key factors. The increasing complexity of global supply chains necessitates outsourcing of logistical functions, thereby driving demand for contract logistics services. E-commerce expansion continues to stimulate growth, demanding efficient and reliable delivery networks. Technological advancements, particularly in automation and data analytics, significantly enhance efficiency and reduce costs within the sector. Consumer preferences for faster and more transparent delivery processes influence the market. The competitive dynamics are characterized by intense rivalry amongst established players and the emergence of innovative service providers leveraging technology. Market penetration of advanced logistics technologies is gradually increasing, with xx% of companies currently adopting automation solutions. Government initiatives promoting digitalization and sustainable logistics are also shaping market trends.

Dominant Regions & Segments in Germany Contract Logistics Market

While data on specific regional dominance within Germany is limited, the proximity to major European transportation hubs and industrial centers suggests that regions with high concentrations of manufacturing and distribution activities likely dominate the market.

By Type:

- Outsourced: This segment currently holds the largest market share, driven by companies' desire to focus on core competencies and benefit from the cost efficiencies and expertise offered by specialized logistics providers.

- Insourced: This segment retains a significant share, primarily amongst larger companies with extensive in-house logistics capabilities.

By End-User:

- Automotive: This sector is a major driver of market growth due to the complexity of automotive supply chains and the need for efficient logistics management. Strong economic growth in the automotive industry, supported by government policies promoting sustainable manufacturing, fuels demand.

- Consumer & Retail: E-commerce growth is significantly boosting this segment. The increasing demand for faster delivery times and enhanced transparency is influencing service providers to adapt their strategies and invest in new technologies.

- Industrial & Aerospace: This segment exhibits steady growth driven by the high value and specialized nature of goods requiring tailored logistics solutions. Well-developed infrastructure and access to skilled labor contribute to its robust growth.

- Other End Users: This sector exhibits moderate growth, influenced by the varied needs and operational models of different industries.

Detailed analysis reveals the automotive sector as the currently dominant end-user segment, followed closely by consumer & retail. However, the Industrial & Aerospace sector is projected to experience the fastest growth during the forecast period.

Germany Contract Logistics Market Product Innovations

Recent product innovations within the German contract logistics market center around the adoption of advanced technologies, such as AI-powered route optimization software, automated warehousing systems, and blockchain for enhanced supply chain transparency and traceability. These technological advancements are improving efficiency, reducing costs, and enhancing customer satisfaction. The market fit of these innovations is strong, as companies increasingly seek to leverage technology to gain a competitive edge.

Report Scope & Segmentation Analysis

This report segments the Germany contract logistics market by type (Insourced, Outsourced) and by end-user (Automotive, Consumer & Retail, Energy, Healthcare, Industrial & Aerospace, Technology, Other End Users). The Outsourced segment is projected to witness faster growth compared to the Insourced segment. Within end-users, the Automotive and Consumer & Retail segments are anticipated to dominate the market, showcasing substantial growth opportunities. Each segment's analysis considers market size, growth projections, and competitive dynamics.

Key Drivers of Germany Contract Logistics Market Growth

The German contract logistics market is driven by the increasing complexity of global supply chains, the rapid expansion of e-commerce, advancements in technology (automation, AI, blockchain), government initiatives promoting digitalization and sustainable logistics, and the strong manufacturing base in Germany. These factors contribute to high demand for efficient and reliable logistics services.

Challenges in the Germany Contract Logistics Market Sector

Challenges include rising labor costs, increasing fuel prices, stringent environmental regulations, supply chain disruptions (e.g., port congestion), and intense competition amongst service providers. These factors impact profitability and operational efficiency. The shortage of skilled labor is a particularly significant challenge impacting the market’s growth.

Emerging Opportunities in Germany Contract Logistics Market

Emerging opportunities include the expansion of e-commerce and last-mile delivery solutions, the growing adoption of sustainable logistics practices, the integration of advanced technologies like AI and IoT, and the increasing demand for specialized logistics services in niche sectors like healthcare and technology.

Leading Players in the Germany Contract Logistics Market Market

- DB Schenker

- APL Logistics

- DHL

- Dacsher Logistics

- Yusen Logistics

- Hellman Worldwide Logistics

- CEVA Logistics

- BLG Logistics

- Feige

- Agility Logistics

Key Developments in Germany Contract Logistics Market Industry

- 2024 Q4: DHL announces expansion of its automated warehousing facilities in Germany.

- 2023 Q3: DB Schenker invests in a new rail freight terminal to improve intermodal connectivity.

- 2022 Q1: A significant merger occurs between two mid-sized contract logistics providers. (Details unavailable)

Future Outlook for Germany Contract Logistics Market Market

The German contract logistics market is poised for continued growth, driven by technological innovation, increasing demand from key sectors, and a focus on sustainability. Strategic opportunities lie in adopting advanced technologies, expanding service offerings, and focusing on niche markets. The market's future potential is substantial, particularly with the ongoing digital transformation of supply chains.

Germany Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Automotive

- 2.2. Consumer & Retail

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Industrial & Aerospace

- 2.6. Technology

- 2.7. Other End Users

Germany Contract Logistics Market Segmentation By Geography

- 1. Germany

Germany Contract Logistics Market Regional Market Share

Geographic Coverage of Germany Contract Logistics Market

Germany Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trade Activities

- 3.3. Market Restrains

- 3.3.1. Truck Drivers Protest

- 3.4. Market Trends

- 3.4.1. Climate Protection and Green Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Consumer & Retail

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Industrial & Aerospace

- 5.2.6. Technology

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 APL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dacsher Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hellman Worldwide Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BLG Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Feige

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agility Logistics*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Contract Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Contract Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Germany Contract Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Contract Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Germany Contract Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Contract Logistics Market?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the Germany Contract Logistics Market?

Key companies in the market include DB Schenker, APL Logistics, DHL, Dacsher Logistics, Yusen Logistics, Hellman Worldwide Logistics, CEVA Logistics, BLG Logistics, Feige, Agility Logistics*List Not Exhaustive.

3. What are the main segments of the Germany Contract Logistics Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trade Activities.

6. What are the notable trends driving market growth?

Climate Protection and Green Logistics.

7. Are there any restraints impacting market growth?

Truck Drivers Protest.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Germany Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence